444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Display LSI IC (Large-Scale Integration Integrated Circuit) market is a thriving sector in the electronics industry. It encompasses the production, distribution, and utilization of integrated circuits specifically designed for display applications. Display LSI ICs are essential components in various electronic devices, including smartphones, televisions, laptops, tablets, and automotive displays. These ICs enable the efficient processing, control, and enhancement of visual content, leading to improved display quality, performance, and functionality.

Meaning

Display LSI ICs, also known as display driver ICs, are semiconductor devices responsible for managing and controlling the operation of displays. They provide crucial functionalities such as signal amplification, voltage regulation, color management, and pixel control. Display LSI ICs integrate multiple electronic components onto a single chip, allowing for compact design, improved power efficiency, and cost-effective manufacturing.

Executive Summary

The Display LSI IC market has experienced significant growth over the years, driven by the increasing demand for high-quality displays in consumer electronics and automotive applications. The market has witnessed advancements in technology, leading to the development of advanced display driver ICs with features like high-resolution support, low power consumption, and compatibility with emerging display technologies. The market is highly competitive, with several key players competing to innovate and capture a significant market share.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Resolution-Driven Complexity: The shift from Full HD to 4K/8K and high-refresh-rate panels necessitates DDICs with greater I/O bandwidth (up to 10 Gbps per channel) and more sophisticated TCON architectures.

OLED & Flexible Displays: OLED and AMOLED technologies dominate high-end smartphones and are entering laptops and TVs, boosting demand for dedicated source-driver ICs with compensation algorithms to address burn-in and non-uniform aging.

Automotive Growth: The automotive display segment is forecast to grow at over 8% CAGR, requiring LSI ICs that meet AEC-Q100 automotive-grade reliability standards and support functional safety (ISO 26262).

Energy Efficiency: Low-power display ICs with dynamic refresh-rate scaling (DRR) and variable backlight control reduce panel power consumption by up to 30%, critical for battery-operated devices and green data-center signage.

Supply Chain Dynamics: Concentration of panel fabs in East Asia (China, Korea, Japan) has led to co-development partnerships between display fabs and LSI suppliers, accelerating customization but also creating regional dependencies.

Market Drivers

Consumer Electronics Innovation: Rapid turnover of smartphones, tablets, and wearables with ever-improving display specs drives continuous IC development.

Automotive Electrification: Electric and autonomous vehicles adopt larger, multi-screen cockpits and HUDs, requiring diverse LSI solutions.

Industrial & Medical Displays: Rugged, high-brightness panels for outdoor signage, medical imaging, and aerospace find uses for specialized display drivers.

IoT & Smart Home: Smart appliances and home-automation hubs increasingly feature touchscreens, spawning demand for integrated touch-controller/display-driver combos.

Gaming & AR/VR: High-refresh, low-latency displays in gaming monitors and AR/VR headsets necessitate timing controllers with ultra-low frame delay.

Market Restraints

Design Complexity: Developing ICs for bespoke form factors (foldable, stretchable, transparent) increases R&D cycles and NRE costs.

High Entry Barriers: Leading-edge process nodes and packaging technologies require significant capital expenditure, limiting competition.

Panel Vendor Consolidation: Vertical integration by panel makers into LSI supply reduces available market for independent IC suppliers.

Price Pressure: Downward pricing trends in commodity LCD panels compress margins for LSI ICs unless value-added features are offered.

Supply Constraints: Occasional shortages of wafers and lead-time fluctuations can delay both IC production and panel assembly schedules.

Market Opportunities

MicroLED Integration: As microLED displays mature, new driver-array ICs and multiplexing controllers will open green-field markets.

SiP & Co-Packaging: Combining display LSI with PMICs or RF front-ends in a single package improves board integration and system performance.

Open-Source RISC-V: Adoption of RISC-V cores in timing controllers may lower IP licensing costs and foster customizable architectures.

Edge AI Displays: Embedding simple AI accelerators into TCONs for real-time HDR adjustment, eye-tracking backlight control, and content recognition.

Emerging Regions: Growing demand for large-screen TVs and smartphones in India, Southeast Asia, and Latin America presents untapped volume potential.

Market Dynamics

Co-Development Models: Joint design agreements between panel fabs and LSI IC vendors accelerate feature alignment but intensify IP negotiation.

Consolidation & Alliances: Strategic acquisitions (e.g., MediaTek’s purchase of MStar) and alliances expand portfolios across display, touch, and power-management ICs.

Process-Node Evolution: Migration to 12 nm FinFET and below enables higher integration but raises design complexity and mask costs.

Software Ecosystems: Provision of comprehensive firmware stacks, display-driver libraries, and calibration tools is increasingly a differentiator.

Regulatory Compliance: Automotive functional-safety and environmental directives (RoHS, REACH) mandate rigorous component-level testing and documentation.

Regional Analysis

Asia-Pacific: Dominates both production and consumption, with strong ecosystems in China, Taiwan, Korea, and Japan — home to major panel and IC fabs.

North America: Focus on high-end gaming, professional graphics monitors, and emerging AR/VR; significant R&D centers for novel display IC architectures.

Europe: Premium automotive and industrial-display markets, supported by regional OEMs; emphasis on functional safety and local design services.

Latin America & MEA: Growing smartphone and TV adoption drives entry-level LSI IC demand; digital signage uptake supports mid-range timing-controller shipments.

Competitive Landscape

Leading Companies in the Display LSI IC Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

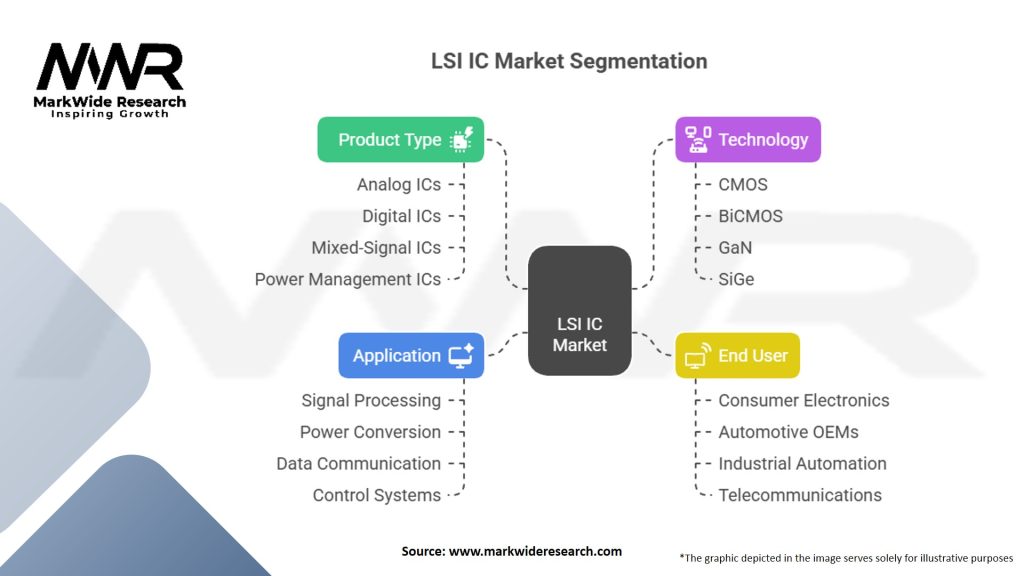

Segmentation

The Display LSI IC market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Display LSI IC market. While the initial outbreak disrupted the global supply chain and manufacturing activities, the market gradually recovered due to the increased demand for display devices for remote work, online learning, and entertainment purposes. The pandemic also accelerated the adoption of touchless and contactless display technologies, driving the need for advanced display driver ICs to support these functionalities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Display LSI IC market is expected to witness steady growth in the coming years. Advancements in display technologies, the rising demand for high-resolution displays, and the increasing adoption of smart devices will be key drivers for market expansion. The integration of advanced displays in automotive applications and the development of flexible and transparent display technologies will also present new opportunities for market players. However, intense competition, cost pressures, and the need for continuous innovation will remain challenges in the dynamic display driver IC landscape.

Conclusion

The Display LSI IC market plays a critical role in enabling high-quality and visually immersive displays across a wide range of consumer electronics and automotive applications. With the continuous evolution of display technologies and the increasing demand for enhanced visual experiences, the market offers significant opportunities for industry participants. By focusing on innovation, collaboration, and market expansion, companies can navigate the competitive landscape, address customer requirements, and capitalize on the growing demand for advanced display driver ICs.

What is Display LSI IC?

Display LSI IC refers to large-scale integration circuits specifically designed for display applications, including LCDs, OLEDs, and other visual technologies. These integrated circuits manage the processing and control of images and video signals in various electronic devices.

What are the key players in the Display LSI IC Market?

Key players in the Display LSI IC Market include companies like Samsung Electronics, Texas Instruments, and NXP Semiconductors, which are known for their innovative solutions in display technology. These companies focus on enhancing image quality and energy efficiency in display systems, among others.

What are the growth factors driving the Display LSI IC Market?

The Display LSI IC Market is driven by the increasing demand for high-resolution displays in consumer electronics, the rise of smart devices, and advancements in display technologies such as OLED and microLED. Additionally, the growing trend of automation in industries is boosting the need for sophisticated display solutions.

What challenges does the Display LSI IC Market face?

Challenges in the Display LSI IC Market include rapid technological changes that require constant innovation, high manufacturing costs, and competition from alternative display technologies. These factors can hinder market growth and affect profit margins for manufacturers.

What opportunities exist in the Display LSI IC Market?

Opportunities in the Display LSI IC Market include the expansion of the automotive sector with advanced display systems, the growth of augmented and virtual reality applications, and the increasing adoption of smart home devices. These trends are expected to create new avenues for innovation and market expansion.

What trends are shaping the Display LSI IC Market?

Current trends in the Display LSI IC Market include the shift towards flexible and foldable displays, the integration of artificial intelligence for enhanced user experiences, and the development of energy-efficient display technologies. These trends are influencing product design and consumer preferences.

Display LSI IC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Analog ICs, Digital ICs, Mixed-Signal ICs, Power Management ICs |

| Technology | CMOS, BiCMOS, GaN, SiGe |

| End User | Consumer Electronics, Automotive OEMs, Industrial Automation, Telecommunications |

| Application | Signal Processing, Power Conversion, Data Communication, Control Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Display LSI IC Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at