444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The commercial paper market is a vital segment of the global financial industry, providing short-term funding options to corporations, financial institutions, and government entities. Commercial paper refers to unsecured promissory notes issued by these entities to raise funds for various purposes, including working capital requirements, debt refinancing, and capital expenditures. These short-term instruments typically have a maturity period of less than 270 days, making them attractive for investors seeking liquidity and low-risk investment opportunities.

Meaning

Commercial paper is a debt instrument that enables organizations to meet their short-term funding needs. It is an unsecured promissory note issued by corporations, financial institutions, and government entities to raise capital quickly. Investors, such as money market funds and institutional investors, purchase these notes at a discount to their face value, earning interest when the paper matures.

Executive Summary

The commercial paper market has experienced steady growth over the years, driven by its convenience, flexibility, and attractive yields. The market offers an efficient avenue for entities to access short-term financing, allowing them to manage their cash flows effectively. This executive summary provides a comprehensive overview of the commercial paper market, highlighting key insights, market drivers, restraints, opportunities, and the competitive landscape.

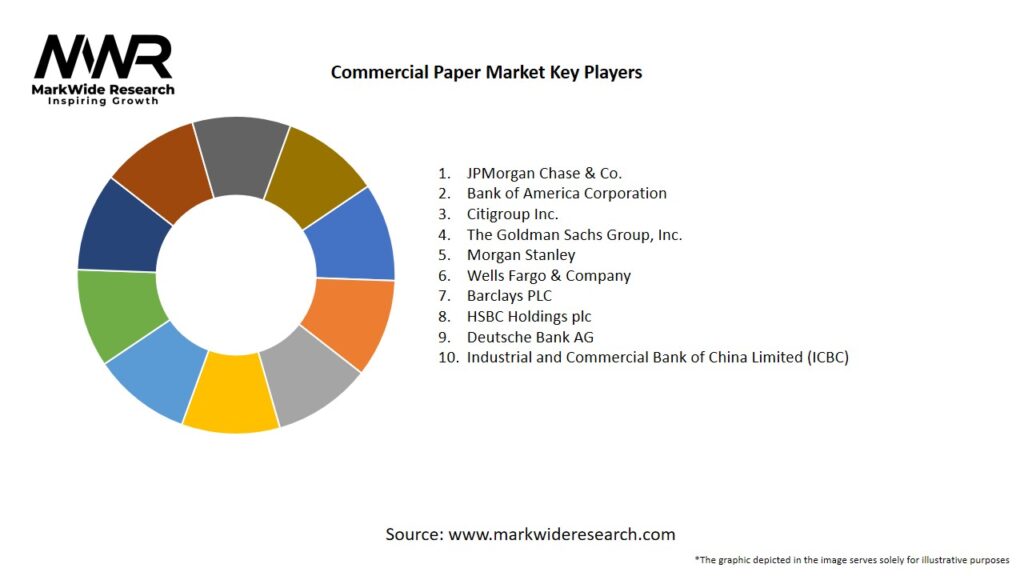

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

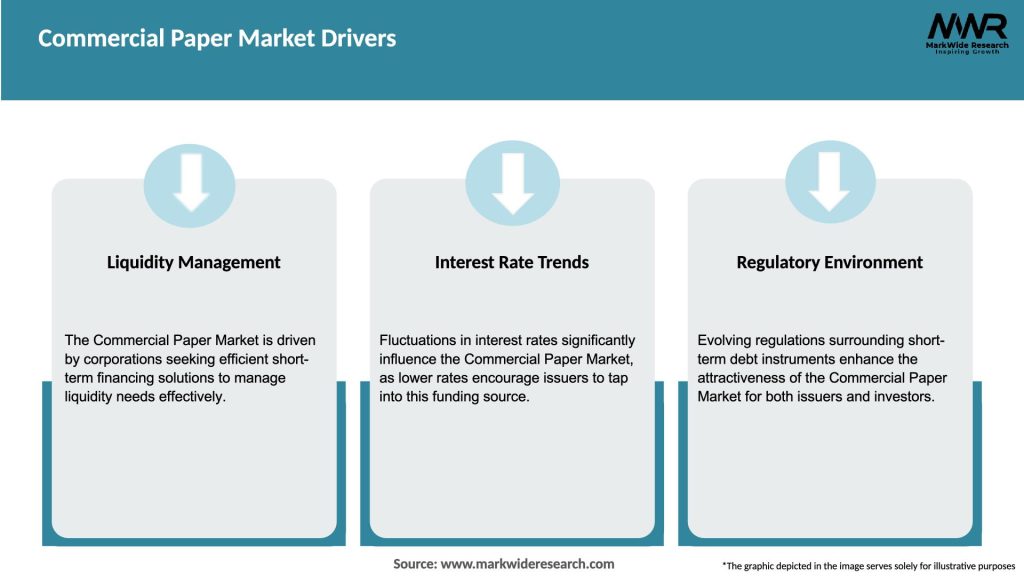

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The commercial paper market operates in a dynamic environment influenced by various factors, including economic conditions, regulatory changes, investor preferences, and market sentiment. Understanding the market dynamics is crucial for participants to make informed investment decisions and adapt to changing circumstances.

Regional Analysis

The commercial paper market exhibits regional variations based on the economic and regulatory landscape of different countries. Factors such as interest rates, credit ratings, and investor preferences can vary across regions, impacting the issuance and trading of commercial paper.

Competitive Landscape

Leading Companies in the Commercial Paper Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

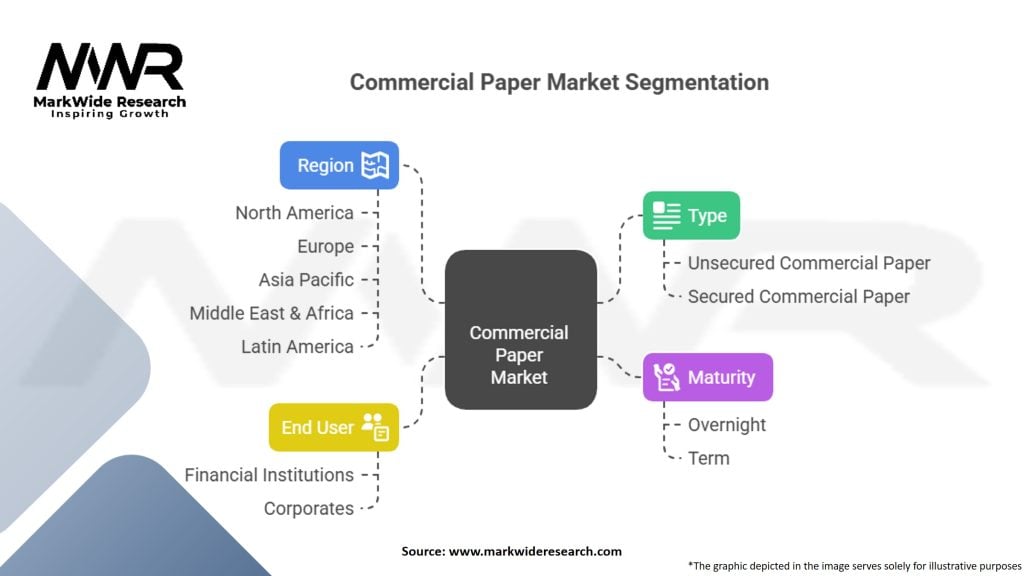

Segmentation

The commercial paper market can be segmented based on various factors, including the type of issuer, maturity period, and credit rating. Understanding the different segments of the market helps investors and issuers tailor their strategies and offerings to specific target audiences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the commercial paper market. During the initial stages of the pandemic, market participants experienced heightened uncertainties and liquidity concerns. Central banks and governments implemented measures to stabilize the market, including injecting liquidity and providing support to issuers.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the commercial paper market appears promising, with continued growth expected. Factors such as the need for short-term financing, digitalization, sustainability considerations, and emerging market opportunities are likely to drive the market’s expansion.

Conclusion

The commercial paper market serves as a crucial financing option for entities seeking short-term funding. With its convenience, flexibility, and attractive yields, commercial paper offers benefits for both issuers and investors. While the market faces challenges such as credit risk and market volatility, opportunities exist in sustainable finance and emerging markets. The market’s future outlook remains positive, driven by ongoing technological advancements and evolving investor preferences.

What is Commercial Paper?

Commercial paper is a short-term unsecured promissory note issued by corporations to raise funds for working capital and other short-term liabilities. It typically has maturities ranging from a few days to a few months and is used by companies to manage liquidity needs.

What are the key players in the Commercial Paper Market?

Key players in the Commercial Paper Market include large corporations such as General Electric, Ford Motor Company, and American Express, which issue commercial paper to finance their short-term operational needs. Additionally, financial institutions like JPMorgan Chase and Goldman Sachs play a significant role in underwriting and trading these instruments, among others.

What are the main drivers of growth in the Commercial Paper Market?

The main drivers of growth in the Commercial Paper Market include the increasing need for short-term financing among corporations, favorable interest rates, and the growing acceptance of commercial paper as a reliable funding source. Additionally, the expansion of corporate activities and economic growth contribute to the demand for these financial instruments.

What challenges does the Commercial Paper Market face?

The Commercial Paper Market faces challenges such as credit risk associated with the issuers, market volatility, and regulatory changes that can impact liquidity. Economic downturns can also lead to reduced investor confidence, affecting the issuance and demand for commercial paper.

What opportunities exist in the Commercial Paper Market?

Opportunities in the Commercial Paper Market include the potential for increased issuance by emerging market companies and the development of new financial products that cater to specific corporate financing needs. Additionally, advancements in technology may streamline the issuance process and enhance market accessibility.

What trends are shaping the Commercial Paper Market?

Trends shaping the Commercial Paper Market include a shift towards digital platforms for issuance and trading, increased focus on sustainability in financing, and the growing use of commercial paper by non-traditional issuers. These trends reflect the evolving landscape of corporate finance and investor preferences.

Commercial Paper Market

| Segmentation | Details |

|---|---|

| Type | Unsecured Commercial Paper, Secured Commercial Paper |

| Maturity | Overnight, Term |

| End User | Financial Institutions, Corporates |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Commercial Paper Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at