444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Bitcoin Payments Market represents a transformative shift in the financial industry, where digital currency, particularly Bitcoin, is increasingly being utilized as a medium for conducting transactions. This market has witnessed significant growth due to the increasing acceptance of cryptocurrencies as a means of payment by businesses and consumers alike.

Meaning

The Bitcoin Payments Market encompasses the use of Bitcoin, a decentralized digital currency, for making payments, conducting transactions, and settling financial obligations. Bitcoin, often referred to as a cryptocurrency, operates on a blockchain network and offers a secure and transparent alternative to traditional payment methods.

Executive Summary

The Bitcoin Payments Market is defined by its disruptive potential, enabling fast, secure, and borderless transactions. Its growth is driven by factors such as the expanding Bitcoin ecosystem, growing consumer interest, and the adoption of cryptocurrencies by businesses.

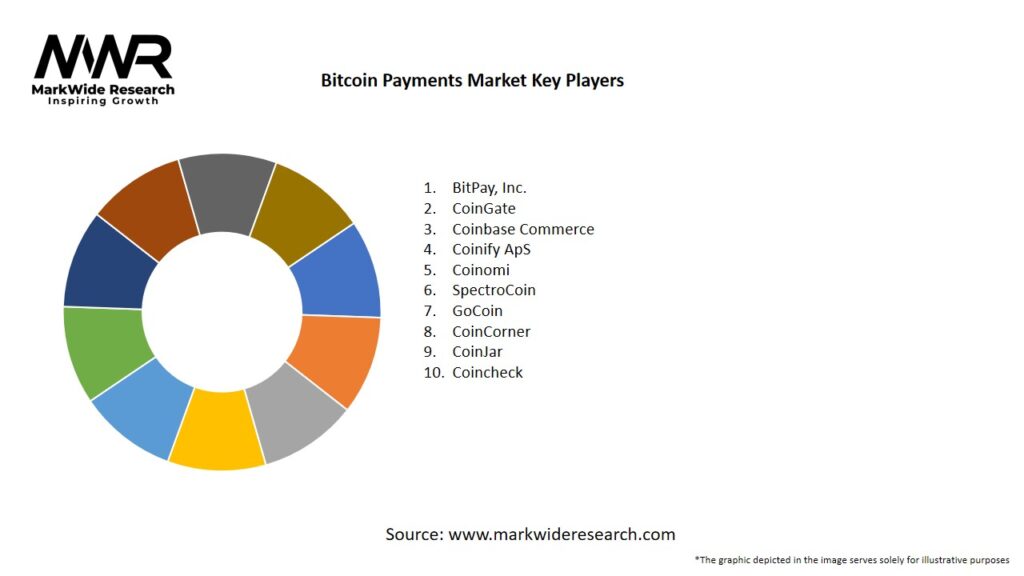

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Bitcoin Payments Market is characterized by its dynamism, influenced by factors such as market sentiment, regulatory changes, technological advancements, and macroeconomic trends. It remains at the forefront of the fintech revolution. While the market presents promising opportunities, challenges such as the complexity of global supply chains and the need for continuous technological advancements must be addressed. The competitive landscape showcases a diverse range of analytical laboratories, equipment manufacturers, and software providers, all working together to fortify the authenticity of the food we consume.

Regional Analysis

The demand for Bitcoin payments varies by region, influenced by factors such as regulatory stance, financial infrastructure, and economic conditions:

Competitive Landscape

Leading Companies in the Bitcoin Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

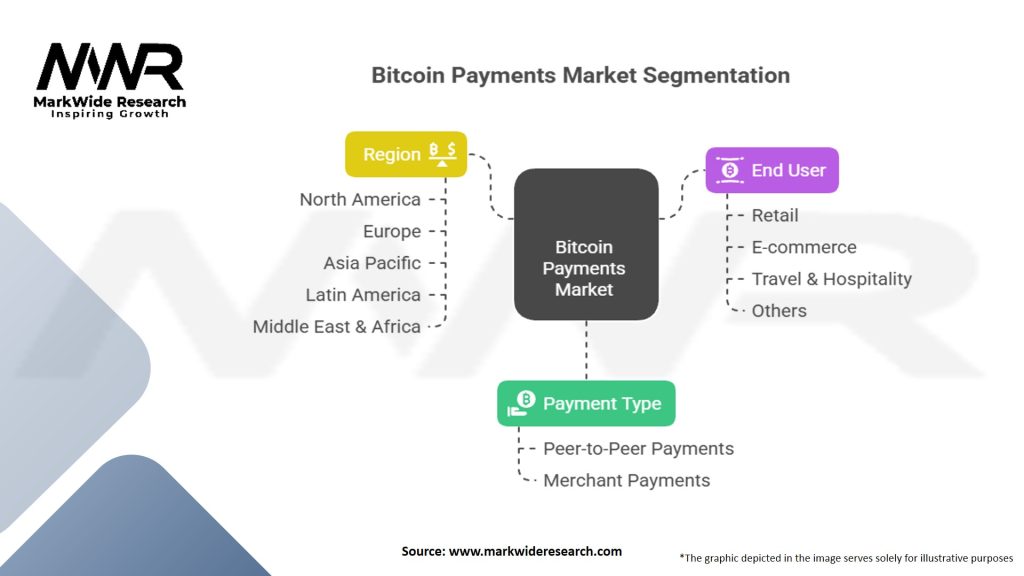

Segmentation

The Bitcoin Payments Market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Bitcoin Payments Market offers several benefits to industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had mixed effects on the Bitcoin Payments Market:

Key Industry Developments

Analyst Suggestions

As highlighted by the market drivers, the escalating concerns surrounding food fraud, consumer demand for transparency, and increasingly stringent regulatory standards drive the market’s remarkable growth. Food authenticity testing solutions have emerged as critical tools to combat food adulteration, mislabeling, and contamination. The market continues to mature and integrate with traditional financial systems, it is poised to play an increasingly vital role in global payments and financial inclusion.

Future Outlook

The Bitcoin Payments Market is poised for continued growth as cryptocurrencies gain wider acceptance and usage. Factors such as regulatory developments, technological innovations, and macroeconomic conditions will shape the market’s trajectory. While challenges like price volatility and regulatory uncertainties exist, Bitcoin’s disruptive potential and growing adoption make it a transformative force in the financial industry.

In essence, the Food Authenticity Testing Market is poised for sustained expansion, with consumers, food producers, and regulators demanding greater transparency and accountability. As the market continues to evolve, it will play a pivotal role in ensuring the quality, safety, and authenticity of the food products we rely on daily.

Conclusion

The Bitcoin Payments Market represents a paradigm shift in the way financial transactions are conducted. Its rapid evolution and adoption highlight the changing landscape of finance, with Bitcoin at the forefront of this transformation. As the market continues to mature and integrate with traditional financial systems, it is poised to play an increasingly vital role in global payments and financial inclusion.

In conclusion, the Food Authenticity Testing Market plays an indispensable role in ensuring the integrity and safety of the global food supply chain. This comprehensive guide has illuminated the market’s significance, offering insights into its key drivers, challenges, opportunities, and dynamic market dynamics.

Bitcoin Payments Market

| Segmentation Details | Details |

|---|---|

| Payment Type | Peer-to-Peer Payments, Merchant Payments |

| End User | Retail, E-commerce, Travel & Hospitality, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Bitcoin Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at