444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Avocado, scientifically known as Persea americana, is a versatile and nutritious fruit that has gained immense popularity in the global market. The avocado market has experienced significant growth in recent years due to increasing consumer awareness about the health benefits associated with avocado consumption. This comprehensive analysis aims to provide valuable insights into the avocado market, including its meaning, key market insights, market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Avocado, often referred to as the “alligator pear,” is a tropical fruit native to Central and South America. It is characterized by its unique pear-shaped appearance, creamy texture, and rich, buttery flavor. Avocados are considered a superfood due to their high nutritional value, containing essential vitamins, minerals, healthy fats, and dietary fiber. They have become a staple ingredient in various cuisines worldwide, renowned for their versatility in salads, dips, smoothies, and even desserts.

Executive Summary

The avocado market has witnessed remarkable growth in recent years, driven by increasing consumer demand for healthy and natural food products. Avocados are not only known for their nutritional benefits but also for their potential applications in the beauty and personal care industry. This executive summary provides a concise overview of the avocado market, highlighting key market insights, drivers, restraints, opportunities, and market dynamics.

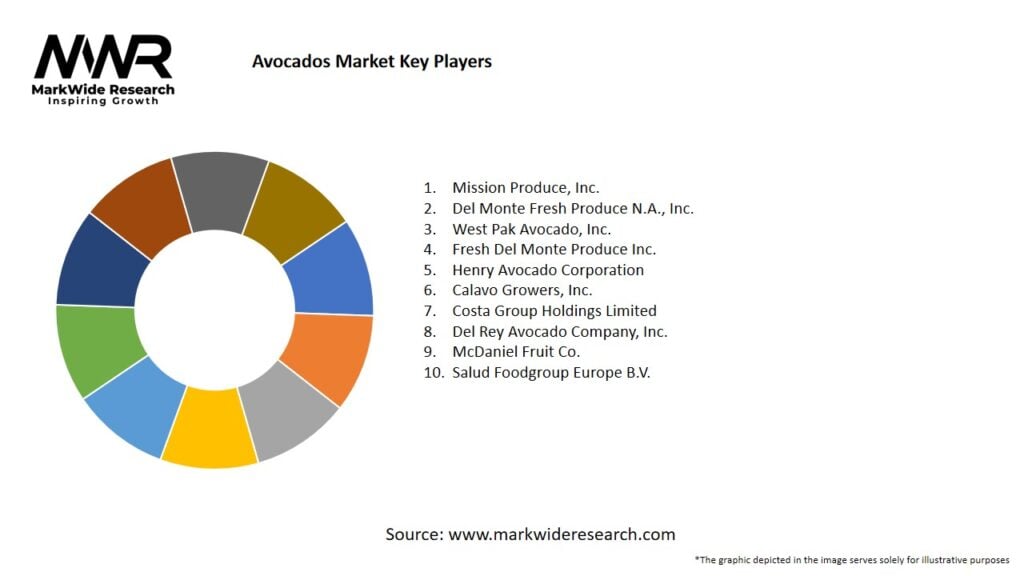

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors have been driving the growth of the avocado market:

Market Restraints

Despite the overall growth of the avocado market, certain factors pose challenges to its expansion:

Market Opportunities

The avocado market presents several opportunities for industry players and stakeholders:

Market Dynamics

The avocado market is dynamic and influenced by various factors, including consumer preferences, changing dietary habits, market trends, and government regulations. Understanding the market dynamics is crucial for industry players to adapt their strategies and capitalize on emerging opportunities.

Regional Analysis

The avocado market exhibits regional variations influenced by factors such as climate suitability, availability of arable land, and cultural preferences. This section provides a comprehensive analysis of the avocado market across key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa, highlighting consumption patterns, production trends, import/export dynamics, and market growth potential.

Competitive Landscape

Leading Companies in the Avocados Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

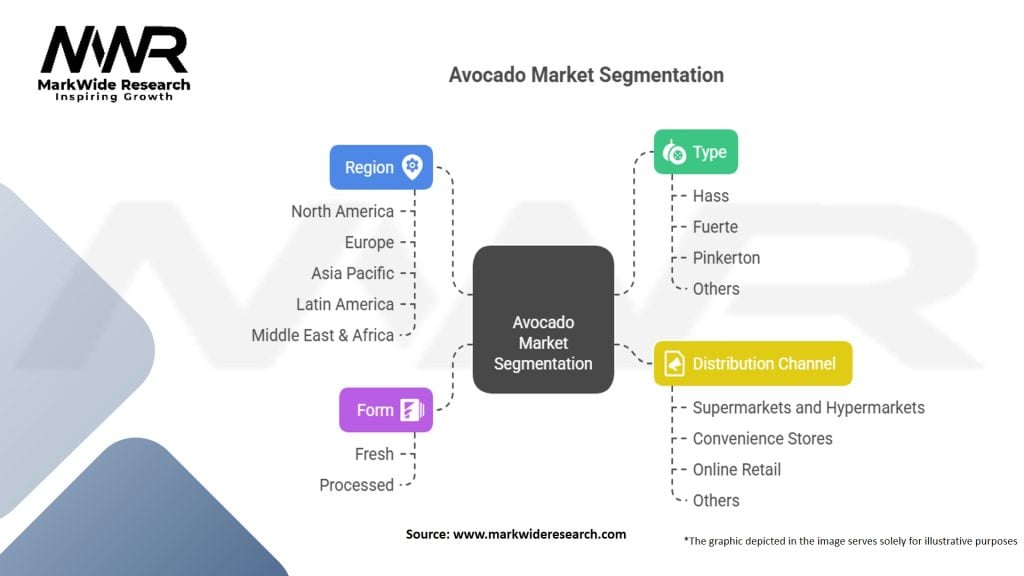

Segmentation

The avocado market can be segmented based on various factors such as product type, form, distribution channel, and end-use applications. This segmentation allows for a deeper understanding of consumer preferences and market dynamics within each segment, aiding businesses in targeted marketing and product development.

Category-wise Insights

This section delves into specific categories within the avocado market, such as organic avocados, Hass avocados, and specialty avocados. It provides insights into the demand, consumption patterns, market trends, and growth prospects for each category, enabling stakeholders to make informed business decisions.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders can benefit from the avocado market in several ways, including:

SWOT Analysis

A comprehensive SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the avocado market offers insights into the internal and external factors that impact market growth. This analysis aids in strategic decision-making and allows businesses to capitalize on strengths, address weaknesses, exploit opportunities, and mitigate threats.

Market Key Trends

This section highlights the key trends shaping the avocado market, such as the increasing demand for organic avocados, innovative avocado-based products, and sustainable farming practices. Staying informed about these trends enables industry players to stay ahead of the curve and adapt their strategies accordingly.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the global food industry, including the avocado market. This section assesses the effects of the pandemic on avocado production, supply chain disruptions, consumer behavior, and market dynamics. It also explores the measures taken by industry players to adapt to the changing landscape and ensure business continuity.

Key Industry Developments

This section highlights recent industry developments, including mergers and acquisitions, product launches, partnerships, and collaborations. These developments reflect the evolving nature of the avocado market and the strategies adopted by industry players to gain a competitive edge.

Analyst Suggestions

Based on extensive research and analysis, industry analysts provide valuable suggestions for businesses operating in the avocado market. These suggestions cover areas such as market entry strategies, product innovation, supply chain optimization, and marketing techniques. Implementing these suggestions can help businesses navigate challenges and maximize growth opportunities.

Future Outlook

The future outlook of the avocado market appears promising, with continued growth expected. Factors such as increasing consumer awareness about health and wellness, the rise of plant-based diets, and the expanding applications of avocados in various industries contribute to a positive market outlook. However, industry players should remain vigilant, continuously monitor market trends, and adapt their strategies to stay competitive.

Conclusion

In conclusion, the avocado market has experienced significant growth driven by factors such as increasing health consciousness, culinary versatility, and the popularity of plant-based diets. While challenges such as seasonal availability and post-harvest handling exist, opportunities in product diversification and emerging markets offer avenues for market expansion. By understanding market dynamics, leveraging key trends, and embracing sustainable practices, industry players can capitalize on the growing demand for avocados and secure a prosperous future in the market.

What is Aviation Transaction Blockchain?

Aviation Transaction Blockchain refers to the use of blockchain technology to facilitate and secure transactions within the aviation industry. This includes applications such as aircraft maintenance records, supply chain management, and ticketing systems.

What are the key players in the Aviation Transaction Blockchain Market?

Key players in the Aviation Transaction Blockchain Market include IBM, Honeywell, and Boeing, which are actively developing blockchain solutions for various aviation applications, among others.

What are the growth factors driving the Aviation Transaction Blockchain Market?

The growth of the Aviation Transaction Blockchain Market is driven by the need for enhanced security in transactions, increased efficiency in operations, and the demand for transparency in supply chains. These factors are crucial for improving trust and reducing fraud in the aviation sector.

What challenges does the Aviation Transaction Blockchain Market face?

Challenges in the Aviation Transaction Blockchain Market include regulatory compliance issues, the need for industry-wide standardization, and the integration of blockchain with existing systems. These hurdles can slow down the adoption of blockchain technology in aviation.

What opportunities exist in the Aviation Transaction Blockchain Market?

The Aviation Transaction Blockchain Market presents opportunities for innovation in areas such as smart contracts for aircraft leasing, real-time tracking of parts and maintenance, and improved passenger experience through secure ticketing solutions. These advancements can significantly enhance operational efficiency.

What trends are shaping the Aviation Transaction Blockchain Market?

Trends in the Aviation Transaction Blockchain Market include the increasing collaboration between airlines and technology providers, the rise of decentralized applications for aviation logistics, and the growing focus on sustainability through transparent supply chains. These trends are expected to influence the future landscape of the industry.

Aviation Transaction Blockchain Market:

| Segmentation | Details |

|---|---|

| Type | Public Blockchain, Private Blockchain, Consortium Blockchain |

| Application | Airline Ticketing, Aircraft Leasing, Loyalty Programs, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Aviation Transaction Blockchain Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at