444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global pharmaceutical contract manufacturing and research services market represents a rapidly expanding sector that has become integral to modern drug development and production strategies. This comprehensive market encompasses a wide range of services including contract research organization (CRO) activities, contract development and manufacturing organization (CDMO) services, and specialized pharmaceutical outsourcing solutions. Pharmaceutical companies increasingly rely on these external partnerships to accelerate drug development timelines, reduce operational costs, and access specialized expertise that may not be available in-house.

Market dynamics indicate robust growth driven by the increasing complexity of drug development processes, rising research and development costs, and the growing demand for specialized manufacturing capabilities. The market has experienced significant expansion, with growth rates reaching approximately 8.2% CAGR over recent years. Contract manufacturing organizations and research service providers have evolved to offer comprehensive solutions spanning from early-stage drug discovery through commercial manufacturing and post-market surveillance activities.

Geographic distribution shows strong market presence across North America, Europe, and Asia-Pacific regions, with emerging markets contributing increasingly to overall market expansion. The sector benefits from regulatory harmonization efforts, technological advancements in pharmaceutical manufacturing, and the growing trend toward outsourcing non-core activities among pharmaceutical and biotechnology companies.

The pharmaceutical contract manufacturing and research services market refers to the comprehensive ecosystem of external service providers that support pharmaceutical and biotechnology companies throughout the entire drug development and manufacturing lifecycle. This market encompasses specialized organizations that offer contract research services, development support, manufacturing capabilities, and regulatory compliance assistance to help bring pharmaceutical products from concept to market.

Contract research organizations provide clinical trial management, regulatory affairs support, data management, and biostatistical analysis services. Contract development and manufacturing organizations offer integrated services combining process development, analytical testing, and commercial-scale manufacturing capabilities. These services enable pharmaceutical companies to access specialized expertise, reduce capital investments, and accelerate time-to-market for new therapeutic products.

Service categories within this market include preclinical research, clinical trial services, regulatory consulting, analytical testing, process development, API manufacturing, finished dosage form production, packaging services, and supply chain management. The market serves various therapeutic areas including oncology, cardiovascular diseases, central nervous system disorders, and emerging fields such as gene therapy and personalized medicine.

Market expansion in the pharmaceutical contract manufacturing and research services sector reflects the fundamental transformation of how pharmaceutical companies approach drug development and production. The industry has witnessed substantial growth as companies increasingly recognize the strategic advantages of outsourcing specialized functions to expert service providers. Cost optimization remains a primary driver, with outsourcing enabling pharmaceutical companies to reduce operational expenses by approximately 25-30% compared to maintaining in-house capabilities.

Service diversification has become a key trend, with leading contract organizations expanding their offerings to provide end-to-end solutions. This integrated approach allows pharmaceutical clients to work with fewer vendors while accessing comprehensive expertise across the drug development continuum. Technological advancement plays a crucial role, with contract service providers investing heavily in advanced manufacturing technologies, digital platforms, and automation systems to enhance efficiency and quality.

Regional dynamics show North America maintaining market leadership, while Asia-Pacific regions demonstrate the highest growth rates due to cost advantages and expanding manufacturing capabilities. The market benefits from increasing regulatory acceptance of contract manufacturing, growing complexity of pharmaceutical products, and the rising number of small and mid-sized biotechnology companies that rely heavily on external service providers.

Strategic partnerships between pharmaceutical companies and contract service providers have evolved beyond traditional vendor relationships to become integral components of drug development strategies. The following key insights highlight the market’s current dynamics:

Cost pressures within the pharmaceutical industry continue to drive increased adoption of contract manufacturing and research services. Pharmaceutical companies face mounting pressure to reduce development costs while maintaining high-quality standards and accelerating time-to-market for new products. Outsourcing strategies enable companies to convert fixed costs into variable costs, providing greater financial flexibility and improved return on investment.

Regulatory complexity has increased significantly across global markets, creating demand for specialized regulatory expertise that many pharmaceutical companies cannot efficiently maintain in-house. Contract research organizations offer deep regulatory knowledge and established relationships with regulatory agencies, helping pharmaceutical companies navigate approval processes more effectively. The growing number of regulatory pathways for different product types and therapeutic areas further amplifies this driver.

Technological advancement requirements in pharmaceutical manufacturing and research have become increasingly sophisticated, requiring substantial capital investments and specialized expertise. Contract service providers can spread these investments across multiple clients, making advanced technologies more accessible to pharmaceutical companies of all sizes. Innovation acceleration through access to cutting-edge capabilities enables pharmaceutical companies to remain competitive without massive internal investments.

Market access considerations drive pharmaceutical companies to partner with contract organizations that have established presence in key geographic markets. Global expansion strategies benefit from local manufacturing capabilities, regulatory expertise, and market knowledge that contract partners can provide more efficiently than establishing internal operations.

Quality control concerns represent a significant restraint in the pharmaceutical contract manufacturing and research services market. Pharmaceutical companies must maintain strict quality standards and regulatory compliance, which can be challenging when working with external service providers. Regulatory scrutiny of contract manufacturing facilities has intensified, with regulatory agencies conducting more frequent inspections and imposing stricter requirements for quality management systems.

Intellectual property protection issues create hesitation among pharmaceutical companies when considering outsourcing arrangements. Confidentiality concerns regarding proprietary formulations, manufacturing processes, and clinical data can limit the scope of services that companies are willing to outsource. The risk of technology transfer and potential competitive disadvantages must be carefully managed through comprehensive contractual arrangements.

Supply chain vulnerabilities have become more apparent, particularly following global disruptions that highlighted the risks of over-reliance on external service providers. Dependency risks associated with critical manufacturing processes or specialized services can create potential bottlenecks in drug supply chains. Pharmaceutical companies must balance cost savings with supply security considerations.

Communication challenges can arise when working with contract service providers, particularly in complex development projects requiring close collaboration between multiple stakeholders. Project management complexity increases when coordinating activities across different organizations, potentially leading to delays or quality issues if not properly managed.

Emerging markets present substantial growth opportunities for pharmaceutical contract manufacturing and research services. Asia-Pacific regions offer significant cost advantages combined with improving quality standards and regulatory frameworks. Countries such as India, China, and South Korea have developed sophisticated pharmaceutical manufacturing capabilities while maintaining competitive cost structures, attracting increasing outsourcing activities from global pharmaceutical companies.

Specialized therapeutics represent high-growth opportunities within the contract services market. Biologics manufacturing, cell and gene therapy production, and personalized medicine services require specialized expertise and facilities that many pharmaceutical companies prefer to access through contract partnerships. The complexity and capital requirements for these advanced therapeutic modalities create natural opportunities for specialized contract service providers.

Digital transformation initiatives across the pharmaceutical industry create opportunities for contract service providers to differentiate themselves through advanced digital capabilities. Data analytics, artificial intelligence applications, and digital quality management systems can enhance service delivery and provide additional value to pharmaceutical clients. Integration of digital technologies throughout the drug development and manufacturing process represents a significant growth opportunity.

Regulatory harmonization efforts across global markets are creating opportunities for contract service providers to leverage their expertise across multiple jurisdictions. Streamlined approval processes and mutual recognition agreements enable contract organizations to provide more efficient global services, reducing duplication of efforts and accelerating market access for pharmaceutical products.

Competitive intensity within the pharmaceutical contract manufacturing and research services market has increased significantly as more organizations recognize the growth potential in this sector. Market consolidation through mergers and acquisitions has created larger, more comprehensive service providers capable of offering integrated solutions across the entire drug development lifecycle. This consolidation trend has resulted in approximately 15-20% market share concentration among the top service providers.

Service evolution continues to drive market dynamics, with contract organizations expanding their capabilities to meet changing client needs. Value-added services such as regulatory consulting, supply chain management, and commercial manufacturing support have become increasingly important differentiators. The shift toward outcome-based pricing models and risk-sharing arrangements is reshaping traditional service delivery approaches.

Technology integration across contract service operations is enhancing efficiency and quality while reducing costs. Automation systems, continuous manufacturing processes, and advanced analytical capabilities are being implemented to improve service delivery and meet evolving client expectations. Digital platforms for project management and data sharing are becoming standard requirements for competitive contract service providers.

Client relationship management has evolved from transactional interactions to strategic partnerships. Long-term agreements and preferred provider relationships are becoming more common, providing stability for both pharmaceutical companies and contract service providers. These strategic partnerships often include capacity reservations, technology sharing arrangements, and collaborative development programs.

Comprehensive analysis of the pharmaceutical contract manufacturing and research services market employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, contract service providers, pharmaceutical companies, and regulatory experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses extensive analysis of industry reports, regulatory filings, company financial statements, and academic publications to validate primary research findings and identify emerging trends. Data triangulation methods are employed to cross-verify information from multiple sources and ensure consistency in market analysis and projections.

Market modeling techniques incorporate various analytical approaches including trend analysis, regression modeling, and scenario planning to develop robust market forecasts. Quantitative analysis focuses on market sizing, growth rate calculations, and segmentation analysis, while qualitative research provides insights into market dynamics, competitive positioning, and strategic implications.

Industry validation processes involve review of research findings with industry experts and key stakeholders to ensure accuracy and relevance of conclusions. Continuous monitoring of market developments, regulatory changes, and competitive activities ensures that research findings remain current and actionable for market participants.

North America maintains its position as the leading market for pharmaceutical contract manufacturing and research services, accounting for approximately 45% of global market share. The region benefits from a well-established pharmaceutical industry, advanced regulatory framework, and strong presence of leading contract service providers. United States dominates the regional market with its large pharmaceutical companies, robust clinical trial infrastructure, and favorable regulatory environment for contract manufacturing.

Europe represents the second-largest market, with approximately 30% market share, driven by strong pharmaceutical industries in Germany, Switzerland, United Kingdom, and France. Regulatory harmonization within the European Union has facilitated cross-border contract manufacturing activities and created opportunities for service providers to serve multiple markets efficiently. The region’s emphasis on quality standards and regulatory compliance aligns well with pharmaceutical industry requirements.

Asia-Pacific demonstrates the highest growth rates in the contract services market, with expansion rates exceeding 12% annually in several key markets. China and India lead regional growth due to cost advantages, improving quality standards, and expanding manufacturing capabilities. The region’s growing pharmaceutical industry and increasing investment in research and development activities create substantial opportunities for contract service providers.

Latin America and other emerging markets show promising growth potential, particularly in generic pharmaceutical manufacturing and clinical trial services. Market development in these regions is supported by improving regulatory frameworks, growing healthcare access, and increasing pharmaceutical industry investment.

Market leadership in the pharmaceutical contract manufacturing and research services sector is characterized by a mix of large integrated service providers and specialized niche players. The competitive landscape continues to evolve through strategic acquisitions, capacity expansions, and service diversification initiatives.

Competitive strategies focus on service integration, geographic expansion, and technology advancement to differentiate offerings and capture market share. Strategic partnerships and long-term client relationships have become increasingly important for maintaining competitive positioning in this dynamic market.

Service type segmentation reveals diverse market opportunities across different functional areas of pharmaceutical development and manufacturing. Contract research services represent the largest segment, encompassing clinical trial management, regulatory affairs, and data management services. This segment benefits from increasing clinical trial complexity and growing demand for specialized expertise in regulatory compliance.

By Service Category:

By Therapeutic Area:

By Company Size:

Contract research services continue to dominate market activity, driven by increasing clinical trial complexity and regulatory requirements. Clinical trial outsourcing has become standard practice for pharmaceutical companies seeking to access specialized expertise and global trial capabilities. The segment benefits from growing clinical trial volumes, with approximately 75% of pharmaceutical companies now outsourcing significant portions of their clinical development activities.

Contract manufacturing services show strong growth across both small molecule and biologics production. API manufacturing represents a mature segment with established service providers and well-defined quality standards. Finished dosage form manufacturing continues to expand as pharmaceutical companies seek to optimize their manufacturing footprints and access specialized production capabilities.

Biologics manufacturing represents the highest growth category within contract services, driven by the increasing number of biologic drug approvals and the complexity of biologics production. Cell and gene therapy manufacturing requires highly specialized facilities and expertise, creating opportunities for contract service providers to develop niche capabilities in these emerging therapeutic areas.

Regulatory services have become increasingly important as pharmaceutical companies navigate complex global regulatory requirements. Regulatory consulting and submission support services help pharmaceutical companies accelerate approval timelines and ensure compliance across multiple jurisdictions. The growing importance of regulatory strategy in drug development has elevated the value of specialized regulatory expertise.

Pharmaceutical companies realize substantial benefits from partnering with contract manufacturing and research service providers. Cost reduction remains a primary advantage, with companies typically achieving operational cost savings while accessing specialized expertise and advanced technologies. The ability to convert fixed costs to variable costs provides greater financial flexibility and improved resource allocation.

Risk mitigation benefits include reduced capital investment requirements, shared regulatory compliance responsibilities, and access to backup manufacturing capabilities. Speed to market advantages result from leveraging established infrastructure and expertise rather than building internal capabilities. Contract service providers often have pre-approved facilities and established regulatory relationships that can accelerate development timelines.

Access to expertise represents a critical benefit, particularly for specialized therapeutic areas or advanced manufacturing technologies. Global reach capabilities enable pharmaceutical companies to access international markets more efficiently through contract partners with local presence and regulatory knowledge.

Contract service providers benefit from stable revenue streams, opportunities for capacity utilization optimization, and the ability to leverage investments across multiple clients. Technology advancement becomes more feasible when costs can be shared across a broader client base, enabling contract organizations to maintain competitive capabilities.

Patients and healthcare systems ultimately benefit from improved drug access, reduced development costs that can translate to lower drug prices, and accelerated availability of new therapeutic options through more efficient development processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Service integration has emerged as a dominant trend, with contract organizations expanding their capabilities to offer comprehensive end-to-end solutions. One-stop shopping approaches reduce vendor management complexity for pharmaceutical companies while enabling contract service providers to capture larger portions of client spending. This trend toward integrated service delivery is reshaping competitive dynamics and client relationships.

Digital transformation is revolutionizing contract service delivery through implementation of advanced technologies. Artificial intelligence applications in drug discovery, data analytics for clinical trial optimization, and digital quality management systems are becoming standard capabilities. Cloud-based platforms enable real-time collaboration and data sharing between pharmaceutical companies and their contract service providers.

Specialized capabilities development focuses on high-growth therapeutic areas and advanced manufacturing technologies. Personalized medicine services, including companion diagnostics and targeted therapy development, represent emerging opportunities. Advanced therapy medicinal products require specialized manufacturing capabilities that many contract organizations are developing to serve this growing market segment.

Geographic diversification strategies are expanding as contract service providers establish global networks to serve multinational pharmaceutical clients. Near-shoring and regionalization trends are influencing facility location decisions to balance cost advantages with supply chain security and regulatory requirements. Emerging market expansion continues as these regions develop pharmaceutical manufacturing capabilities and regulatory frameworks.

Regulatory evolution continues to shape industry development with new guidelines for contract manufacturing oversight and quality management. FDA guidance on contract manufacturing arrangements has clarified expectations for pharmaceutical companies and their service providers, leading to enhanced quality systems and compliance programs. International harmonization efforts are creating more consistent regulatory requirements across global markets.

Technology advancement in pharmaceutical manufacturing is driving significant industry developments. Continuous manufacturing implementation is expanding beyond pilot programs to commercial-scale operations, offering improved efficiency and quality control. Process analytical technology integration enables real-time monitoring and control of manufacturing processes, enhancing product quality and regulatory compliance.

Market consolidation through strategic acquisitions continues to reshape the competitive landscape. MarkWide Research analysis indicates that merger and acquisition activity has intensified as companies seek to expand service capabilities and geographic reach. These consolidation activities are creating larger, more comprehensive service providers capable of supporting global pharmaceutical companies’ diverse needs.

Capacity expansion investments are being made across key therapeutic areas and geographic markets. Biologics manufacturing capacity additions are particularly significant as demand for biologic drugs continues to grow. Specialized facilities for cell and gene therapy production are being developed to support the emerging advanced therapy market segment.

Strategic partnership development should focus on long-term relationships rather than transactional arrangements. Pharmaceutical companies should evaluate contract service providers based on their ability to support long-term strategic objectives, not just immediate cost savings. Risk assessment capabilities and business continuity planning should be key evaluation criteria when selecting contract partners.

Technology investment priorities should align with emerging industry trends and client requirements. Contract service providers should focus on digital capabilities, advanced manufacturing technologies, and specialized therapeutic area expertise to maintain competitive positioning. Continuous improvement programs should be implemented to enhance operational efficiency and service quality.

Geographic expansion strategies should consider both cost advantages and strategic market access requirements. Emerging markets offer significant growth opportunities, but service providers must ensure adequate quality standards and regulatory compliance capabilities. Regional expertise development is essential for successful expansion into new geographic markets.

Quality management systems should be continuously enhanced to meet evolving regulatory requirements and client expectations. Investment in quality infrastructure and personnel is essential for maintaining competitive positioning and avoiding regulatory issues that could impact multiple clients. Proactive compliance approaches should be implemented to anticipate and address regulatory changes.

Market expansion is expected to continue at robust rates, driven by increasing pharmaceutical industry outsourcing and growing demand for specialized services. Growth projections indicate the market will maintain expansion rates of approximately 8-10% annually over the next five years, with particular strength in biologics manufacturing and emerging therapeutic areas.

Service evolution will continue toward more integrated and comprehensive offerings. End-to-end solutions spanning from drug discovery through commercial manufacturing will become increasingly common as pharmaceutical companies seek to simplify vendor relationships and improve project coordination. Outcome-based pricing models and risk-sharing arrangements are expected to become more prevalent.

Technology integration will accelerate across all aspects of contract service delivery. Artificial intelligence and machine learning applications will enhance drug discovery, clinical trial design, and manufacturing optimization. Digital platforms will become essential for client collaboration and project management, enabling more efficient service delivery and improved communication.

Geographic shifts in manufacturing and research activities will continue as companies optimize their global footprints. Asia-Pacific markets are expected to capture increasing market share due to cost advantages and improving capabilities. MWR analysis suggests that approximately 35% of new contract manufacturing capacity additions will be located in emerging markets over the next five years.

Regulatory developments will continue to influence market dynamics, with increasing emphasis on quality management systems and supply chain transparency. Harmonization efforts across global regulatory agencies will create opportunities for more efficient international service delivery while maintaining high quality standards.

The global pharmaceutical contract manufacturing and research services market represents a dynamic and rapidly expanding sector that has become integral to modern pharmaceutical industry operations. Market growth continues to be driven by cost optimization pressures, increasing regulatory complexity, and the growing demand for specialized expertise across diverse therapeutic areas. The evolution from transactional relationships to strategic partnerships reflects the maturation of this market and its critical importance to pharmaceutical industry success.

Competitive dynamics continue to evolve through service integration, technology advancement, and geographic expansion initiatives. Leading service providers are differentiating themselves through comprehensive capabilities, advanced technologies, and deep therapeutic area expertise. The trend toward consolidation is creating larger, more capable organizations that can support the complex needs of global pharmaceutical companies.

Future prospects remain highly positive, with continued market expansion expected across all major service categories and geographic regions. Emerging opportunities in advanced therapeutics, digital technologies, and global market access will drive continued investment and innovation within the contract services sector. The pharmaceutical industry’s ongoing transformation toward more efficient and flexible operating models ensures sustained demand for high-quality contract manufacturing and research services, positioning this market for continued growth and evolution in the years ahead.

What is Pharmaceutical Contract Manufacturing and Research Services?

Pharmaceutical Contract Manufacturing and Research Services refer to the outsourcing of pharmaceutical production and research activities to specialized companies. These services include drug formulation, clinical trials, and regulatory compliance, allowing pharmaceutical companies to focus on core competencies.

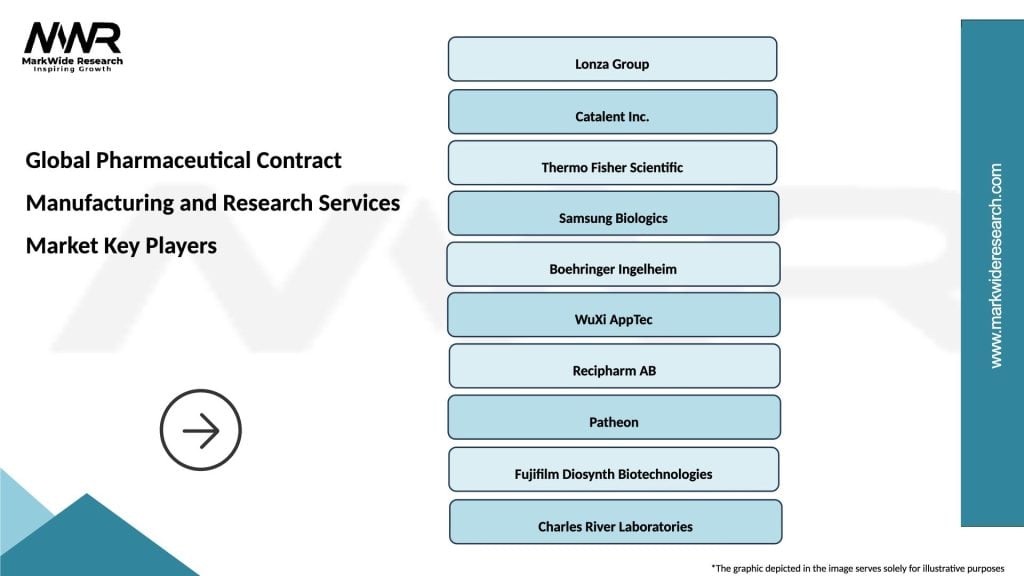

What are the key players in the Global Pharmaceutical Contract Manufacturing and Research Services Market?

Key players in the Global Pharmaceutical Contract Manufacturing and Research Services Market include Lonza Group, Catalent, and Thermo Fisher Scientific. These companies provide a range of services from drug development to manufacturing, catering to various pharmaceutical needs, among others.

What are the growth factors driving the Global Pharmaceutical Contract Manufacturing and Research Services Market?

The growth of the Global Pharmaceutical Contract Manufacturing and Research Services Market is driven by the increasing demand for cost-effective drug development, the rise in chronic diseases, and the need for faster time-to-market for new therapies. Additionally, advancements in biopharmaceuticals are contributing to market expansion.

What challenges does the Global Pharmaceutical Contract Manufacturing and Research Services Market face?

The Global Pharmaceutical Contract Manufacturing and Research Services Market faces challenges such as stringent regulatory requirements, quality control issues, and the complexity of supply chain management. These factors can hinder operational efficiency and increase costs for service providers.

What opportunities exist in the Global Pharmaceutical Contract Manufacturing and Research Services Market?

Opportunities in the Global Pharmaceutical Contract Manufacturing and Research Services Market include the growing trend of personalized medicine, the expansion of biologics, and the increasing adoption of advanced technologies like AI and automation in drug development. These trends are expected to enhance service offerings and efficiency.

What trends are shaping the Global Pharmaceutical Contract Manufacturing and Research Services Market?

Trends shaping the Global Pharmaceutical Contract Manufacturing and Research Services Market include the rise of outsourcing partnerships, increased focus on sustainability practices, and the integration of digital technologies in manufacturing processes. These trends are influencing how companies approach drug development and production.

Global Pharmaceutical Contract Manufacturing and Research Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | API Manufacturing, Formulation Development, Packaging Services, Quality Control |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Research Organizations |

| Delivery Mode | Onshore, Offshore, Hybrid, Remote |

| Therapy Area | Oncology, Cardiovascular, Neurology, Infectious Diseases |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Pharmaceutical Contract Manufacturing and Research Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at