444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France accommodation market represents one of Europe’s most dynamic and diverse hospitality sectors, encompassing traditional hotels, boutique properties, vacation rentals, hostels, and innovative lodging concepts. France’s position as the world’s leading tourist destination drives substantial demand across multiple accommodation categories, with the market experiencing robust growth driven by domestic tourism, international visitors, and evolving consumer preferences. The sector demonstrates remarkable resilience and adaptability, particularly following recent global challenges that reshaped travel patterns and accommodation preferences.

Market dynamics indicate strong recovery momentum, with occupancy rates reaching 78% across major metropolitan areas and coastal regions showing particularly strong performance during peak seasons. The accommodation landscape reflects France’s rich cultural heritage and geographic diversity, from luxury palace hotels in Paris to charming bed-and-breakfasts in Provence, mountain chalets in the Alps, and beachfront resorts along the Mediterranean coast. Digital transformation continues to reshape booking patterns, with online reservations accounting for 65% of total bookings across all accommodation types.

Regional distribution shows Paris and Île-de-France commanding approximately 35% market share, while coastal regions, ski destinations, and wine country collectively represent significant portions of the accommodation ecosystem. The market benefits from France’s extensive transportation infrastructure, cultural attractions, business tourism, and strong domestic travel culture that sustains year-round demand across diverse accommodation segments.

The France accommodation market refers to the comprehensive ecosystem of lodging facilities and services that provide temporary housing solutions for tourists, business travelers, and domestic visitors throughout France. This market encompasses traditional hospitality establishments including luxury hotels, mid-scale properties, budget accommodations, as well as alternative lodging options such as vacation rentals, boutique guesthouses, hostels, camping facilities, and innovative accommodation concepts that cater to evolving traveler preferences and experiences.

Market scope includes both commercial and non-commercial accommodation providers, ranging from international hotel chains and independent properties to peer-to-peer rental platforms and specialized lodging services. The sector integrates various service levels, from basic overnight stays to comprehensive hospitality experiences that include dining, entertainment, wellness, and concierge services tailored to different market segments and price points.

France’s accommodation market demonstrates exceptional diversity and resilience, supported by the country’s position as a premier global destination attracting millions of visitors annually. The sector encompasses approximately 18,000 classified hotels alongside thousands of alternative accommodation options, creating a comprehensive lodging ecosystem that serves diverse traveler needs and preferences. Market recovery has been particularly strong, with performance indicators showing sustained improvement across key metrics including occupancy rates, average daily rates, and revenue per available room.

Key market drivers include France’s rich cultural heritage, diverse geographic attractions, robust transportation infrastructure, and strong domestic tourism culture. The sector benefits from year-round demand patterns, with business tourism supporting urban markets during weekdays while leisure travel drives weekend and seasonal performance. Digital adoption has accelerated significantly, with mobile bookings representing 42% of online reservations and contactless services becoming standard across property categories.

Competitive landscape features a balanced mix of international hotel groups, domestic chains, and independent operators, with vacation rental platforms gaining substantial market share in recent years. The market shows strong adaptation to changing consumer preferences, including increased demand for sustainable accommodations, unique local experiences, and flexible booking policies that address evolving travel patterns and expectations.

Strategic market insights reveal several critical trends shaping France’s accommodation landscape:

Tourism infrastructure excellence serves as a fundamental market driver, with France’s comprehensive transportation networks, including high-speed rail connections, extensive highway systems, and major international airports, facilitating seamless access to accommodation destinations throughout the country. The nation’s cultural richness and UNESCO World Heritage sites create sustained demand for nearby lodging facilities, while diverse geographic attractions from Alpine ski resorts to Mediterranean beaches ensure year-round market activity across different regions and accommodation types.

Business tourism strength provides consistent demand, particularly in major metropolitan areas where corporate travel, conferences, and trade exhibitions drive weekday occupancy rates. France’s position as a leading business destination in Europe, combined with its hosting of international events and exhibitions, creates stable revenue streams for urban accommodation providers. Government support for tourism development through infrastructure investments, marketing initiatives, and regulatory frameworks that balance market growth with quality standards further strengthens the accommodation sector.

Digital transformation acceleration enables accommodation providers to reach global markets more effectively while improving operational efficiency through advanced booking systems, revenue management tools, and guest experience technologies. The growing importance of sustainable tourism practices aligns with France’s environmental commitments, driving demand for eco-certified accommodations and properties that demonstrate environmental responsibility through energy efficiency, waste reduction, and local sourcing initiatives.

Regulatory complexity presents ongoing challenges for accommodation providers, particularly regarding taxation, licensing requirements, and compliance with evolving health and safety standards that vary across regions and property types. Labor market constraints affect the hospitality sector significantly, with skilled workforce shortages in key positions impacting service quality and operational capacity, while rising labor costs pressure profit margins across all accommodation categories.

Seasonal demand fluctuations create revenue volatility for many properties, particularly those in tourist-dependent regions where off-season periods result in reduced occupancy rates and the need for careful cash flow management. Infrastructure limitations in some rural and emerging destinations restrict accommodation development and guest access, while urban areas face challenges related to parking availability, traffic congestion, and noise regulations that impact guest satisfaction.

Economic sensitivity affects discretionary travel spending, with accommodation bookings vulnerable to economic downturns, currency fluctuations, and geopolitical events that influence international travel patterns. Competition intensification from alternative accommodation platforms and new market entrants creates pricing pressure and requires continuous investment in property improvements, marketing, and service differentiation to maintain market position and profitability.

Sustainable tourism growth creates significant opportunities for accommodation providers to differentiate through environmental certifications, renewable energy adoption, and partnerships with local communities that enhance guest experiences while supporting regional development. Technology integration offers pathways for operational efficiency improvements, personalized guest services, and data-driven revenue optimization that can enhance profitability and competitive positioning in an increasingly digital marketplace.

Niche market development presents opportunities in specialized accommodation segments including wellness retreats, culinary tourism properties, adventure tourism lodges, and cultural immersion experiences that command premium pricing while attracting dedicated traveler segments. Regional expansion potential exists in emerging destinations and secondary cities where accommodation supply remains limited relative to growing tourism demand, particularly in areas with unique cultural or natural attractions.

Corporate partnership opportunities with businesses seeking extended-stay accommodations for remote workers, project teams, and relocated employees create new revenue streams and occupancy stability. Experience economy alignment enables properties to develop comprehensive packages that combine accommodation with local activities, dining experiences, and cultural programs, increasing guest spending and satisfaction while building brand loyalty and repeat visitation patterns.

Supply and demand equilibrium varies significantly across French regions, with major tourist destinations experiencing capacity constraints during peak seasons while emerging areas offer growth potential for new accommodation development. Pricing dynamics reflect complex interactions between location desirability, seasonal patterns, competitive positioning, and service quality levels, with successful properties implementing sophisticated revenue management strategies that optimize rates based on real-time market conditions and booking patterns.

Consumer behavior evolution drives accommodation providers to adapt service offerings, with travelers increasingly seeking authentic local experiences, flexible booking terms, and personalized services that reflect individual preferences and travel purposes. Distribution channel dynamics continue evolving as online travel agencies, direct booking platforms, and social media influence booking decisions, requiring properties to maintain multi-channel strategies while managing commission costs and customer relationships.

Competitive intensity varies by market segment and location, with luxury properties competing on service excellence and unique experiences while budget accommodations focus on value proposition and convenience factors. Market consolidation trends see larger hospitality groups acquiring independent properties and regional chains, while simultaneously, boutique and specialty accommodations gain market share by offering distinctive experiences that differentiate from standardized chain offerings.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into France’s accommodation market dynamics. Primary research includes structured interviews with accommodation operators, industry associations, tourism boards, and hospitality professionals across different property types and geographic regions, providing firsthand insights into market conditions, operational challenges, and growth opportunities.

Secondary research incorporates analysis of industry reports, government tourism statistics, trade publications, and academic studies that provide historical context and trend analysis for the accommodation sector. Quantitative analysis utilizes occupancy data, pricing information, booking patterns, and performance metrics collected from industry databases, property management systems, and market intelligence platforms to identify statistical trends and market patterns.

Market segmentation analysis examines accommodation categories by property type, price point, location, and target market to understand competitive dynamics and growth opportunities within specific market niches. Regional analysis considers geographic variations in demand patterns, supply characteristics, and market development potential across France’s diverse tourism destinations and metropolitan areas.

Paris and Île-de-France region dominates the accommodation market with approximately 35% of total room inventory and the highest concentration of luxury and business hotels. The capital region benefits from consistent year-round demand driven by business travel, international tourism, and cultural attractions, maintaining average occupancy rates above 75% annually. Premium positioning allows Paris properties to command higher average daily rates while facing intense competition and high operational costs.

Provence-Alpes-Côte d’Azur region represents a significant market segment focused on leisure tourism, with coastal properties experiencing peak demand during summer months and achieving occupancy rates exceeding 85% during high season. The region’s diverse accommodation offerings range from luxury resort properties to boutique hotels and vacation rentals that capitalize on Mediterranean climate, cultural attractions, and lifestyle appeal.

Auvergne-Rhône-Alpes region benefits from both winter sports tourism and summer mountain activities, with ski resort accommodations achieving strong seasonal performance and year-round properties serving business travelers in major cities like Lyon. Alpine destinations demonstrate particular strength in luxury chalet rentals and mountain resort properties that cater to international visitors seeking premium mountain experiences.

Nouvelle-Aquitaine region shows growing accommodation demand driven by wine tourism, coastal attractions, and cultural heritage sites, with properties in Bordeaux and Atlantic coast destinations experiencing steady growth in both domestic and international visitation. Regional development focuses on sustainable tourism practices and authentic local experiences that differentiate the area from more established tourist destinations.

Market leadership features a diverse competitive environment with multiple player categories competing across different segments and price points:

Competitive differentiation strategies include brand positioning, service quality, location advantages, pricing strategies, and unique experience offerings that appeal to specific traveler segments and preferences.

By Property Type:

By Location:

By Target Market:

Luxury accommodation segment demonstrates resilience and growth potential, with high-end properties benefiting from increased demand for premium experiences and personalized services. Luxury hotels in Paris and resort destinations maintain strong pricing power while investing in spa facilities, fine dining, and exclusive experiences that justify premium rates and attract affluent travelers seeking exceptional accommodations.

Mid-scale properties represent the largest accommodation category by room count, serving diverse traveler needs with balanced service levels and moderate pricing. These properties focus on operational efficiency and guest satisfaction while competing on location, amenities, and value proposition in highly competitive markets across urban and suburban locations.

Budget accommodation segment shows strong growth driven by price-conscious travelers and the expansion of economy hotel chains that offer standardized accommodations at competitive rates. Economy properties emphasize operational simplicity, technology integration, and strategic locations that provide convenient access to transportation and attractions while maintaining cost-effective operations.

Alternative accommodations including vacation rentals and boutique properties gain market share by offering unique experiences, local authenticity, and flexible arrangements that appeal to travelers seeking alternatives to traditional hotel stays. Vacation rental platforms particularly benefit from family travel, extended stays, and group bookings that value space, privacy, and home-like amenities.

Accommodation operators benefit from France’s strong tourism fundamentals, diverse market segments, and year-round demand patterns that support revenue stability and growth opportunities. Investment opportunities exist across property types and locations, with particular potential in emerging destinations, sustainable accommodations, and technology-enhanced properties that meet evolving guest expectations and operational requirements.

Tourism stakeholders including destination marketing organizations, local governments, and community businesses benefit from accommodation sector growth through increased visitor spending, job creation, and economic development that supports local communities and preserves cultural heritage. Collaborative partnerships between accommodations and local attractions, restaurants, and service providers create comprehensive tourism experiences that enhance visitor satisfaction and extend length of stay.

Technology providers find significant opportunities in hospitality technology solutions including property management systems, booking platforms, guest experience applications, and operational efficiency tools that help accommodation providers improve service delivery and financial performance. Service suppliers including linen services, food and beverage providers, and maintenance companies benefit from steady demand and opportunities for specialized hospitality services.

Financial institutions and investors recognize accommodation properties as valuable real estate assets with income-generating potential, while hospitality management companies find opportunities for brand expansion, management contracts, and franchise development across diverse market segments and geographic regions throughout France.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with accommodation providers implementing environmental certifications, renewable energy systems, and waste reduction programs that appeal to environmentally conscious travelers while reducing operational costs. Green building standards and eco-friendly amenities become competitive differentiators, particularly among younger travelers and corporate clients with sustainability mandates.

Technology advancement transforms guest experiences through mobile check-in systems, keyless entry, voice-activated room controls, and personalized service recommendations based on guest preferences and behavior patterns. Artificial intelligence and machine learning applications optimize pricing strategies, predict demand patterns, and enhance operational efficiency while improving guest satisfaction through personalized interactions.

Experience-centric offerings shift focus from basic accommodation to comprehensive lifestyle experiences, with properties developing unique programs including culinary classes, cultural tours, wellness retreats, and adventure activities that create memorable stays and justify premium pricing. Local partnership development enables accommodations to offer authentic regional experiences while supporting community businesses and cultural preservation.

Flexible accommodation models respond to changing work and travel patterns, with properties offering extended-stay options, co-working spaces, and hybrid arrangements that accommodate remote workers, digital nomads, and travelers seeking longer-term accommodations with residential amenities and community features.

Digital transformation acceleration has revolutionized accommodation operations, with properties implementing comprehensive technology suites that integrate booking management, guest services, housekeeping coordination, and revenue optimization. Contactless service delivery becomes standard practice, with mobile applications enabling guests to manage their entire stay experience from reservation through checkout without traditional front desk interactions.

Sustainability certifications gain prominence as accommodation providers pursue environmental accreditations including Green Key, EU Ecolabel, and local sustainability programs that demonstrate environmental commitment while attracting eco-conscious travelers. Energy efficiency investments in LED lighting, smart HVAC systems, and renewable energy sources reduce operational costs while supporting environmental goals.

Market consolidation activities see major hospitality groups acquiring independent properties and regional chains to expand market presence, while simultaneously, boutique and specialty accommodations gain market share through unique positioning and personalized service offerings. Franchise development enables brand expansion while allowing local ownership and management that maintains regional character and community connections.

Health and safety protocol enhancement establishes new operational standards including advanced cleaning procedures, air filtration systems, and health monitoring capabilities that address guest concerns while ensuring compliance with evolving health regulations and industry best practices.

MarkWide Research analysis indicates that accommodation providers should prioritize technology integration and sustainability initiatives to maintain competitive positioning in an evolving market landscape. Investment focus should emphasize guest experience enhancement through personalized services, mobile technology adoption, and unique local experiences that differentiate properties from standardized offerings and create lasting guest loyalty.

Regional expansion strategies should consider emerging destinations and secondary cities where accommodation supply remains limited relative to growing tourism demand, particularly in areas with unique cultural or natural attractions that can support premium positioning. Partnership development with local businesses, attractions, and service providers creates comprehensive guest experiences while supporting community economic development and cultural preservation.

Revenue optimization requires sophisticated pricing strategies that leverage real-time market data, booking patterns, and competitive intelligence to maximize profitability while maintaining occupancy targets. Operational efficiency improvements through technology adoption, staff training, and process optimization can reduce costs while enhancing service quality and guest satisfaction levels.

Market positioning should emphasize unique value propositions that resonate with target market segments, whether focusing on luxury experiences, sustainable practices, local authenticity, or value-oriented accommodations that meet specific traveler needs and preferences in an increasingly competitive marketplace.

Market growth prospects remain positive, with the France accommodation sector expected to benefit from continued tourism recovery, domestic travel strength, and evolving consumer preferences that favor experiential travel and authentic local experiences. Performance indicators suggest sustained improvement in occupancy rates, with projections indicating potential growth of 6-8% annually in key performance metrics over the medium term.

Technology integration will continue reshaping accommodation operations and guest experiences, with artificial intelligence, Internet of Things applications, and advanced data analytics becoming standard tools for revenue optimization, operational efficiency, and personalized service delivery. Sustainability requirements will intensify, with environmental certifications and carbon neutrality commitments becoming essential for competitive positioning and regulatory compliance.

Market segmentation evolution will see continued growth in alternative accommodations, boutique properties, and specialized lodging concepts that cater to niche markets and unique traveler preferences. Regional development opportunities will emerge in secondary destinations and rural areas where tourism infrastructure development supports new accommodation projects and market expansion.

MWR projections indicate that successful accommodation providers will be those that effectively balance technology adoption with personalized service delivery, environmental responsibility with operational efficiency, and global brand standards with local authenticity to create compelling value propositions for increasingly sophisticated travelers.

France’s accommodation market demonstrates remarkable resilience and adaptability, supported by the country’s enduring appeal as a premier global destination and its diverse portfolio of attractions that sustain year-round demand across multiple market segments. The sector’s strength lies in its comprehensive range of accommodation options, from luxury palace hotels to innovative alternative lodging concepts, all benefiting from France’s excellent tourism infrastructure and rich cultural heritage that continues attracting millions of visitors annually.

Market evolution toward sustainability, technology integration, and experience-centric offerings positions the accommodation sector for continued growth and development. Properties that successfully adapt to changing consumer preferences while maintaining operational efficiency and service excellence will capture the greatest opportunities in this dynamic marketplace. The sector’s ability to balance tradition with innovation, global standards with local authenticity, and premium experiences with accessible pricing ensures its continued relevance and competitiveness in the global hospitality landscape.

Future success will depend on accommodation providers’ ability to leverage technology for operational efficiency and guest experience enhancement while maintaining the personal service and cultural authenticity that distinguish French hospitality. The market’s diverse regional opportunities, strong domestic tourism culture, and position as a leading international destination provide a solid foundation for sustained growth and development across all accommodation categories and market segments throughout France.

What is Accommodation?

Accommodation refers to the provision of lodging or housing for travelers and residents, including hotels, hostels, vacation rentals, and serviced apartments.

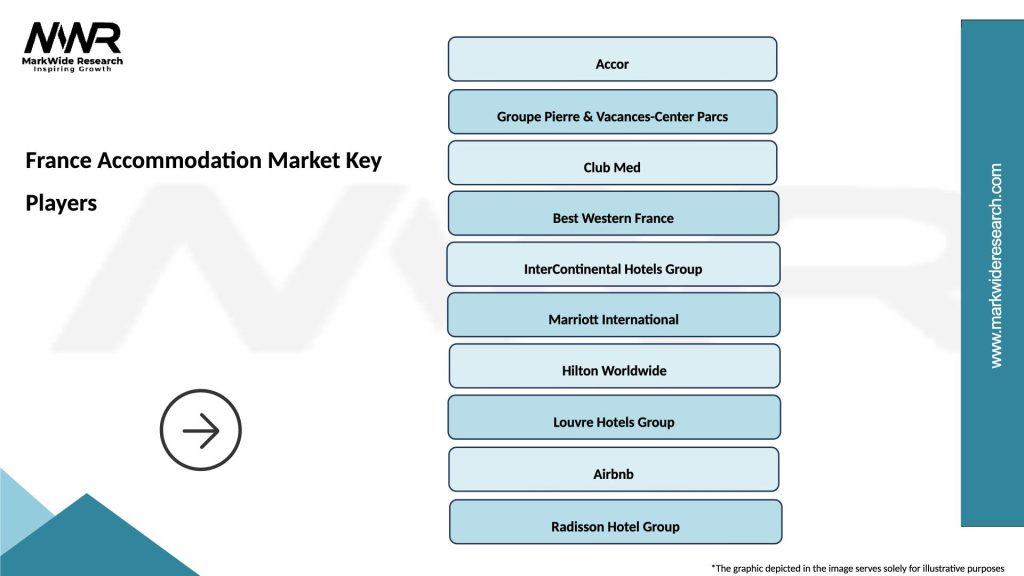

What are the key players in the France Accommodation Market?

Key players in the France Accommodation Market include AccorHotels, Pierre & Vacances, and Club Med, among others.

What are the growth factors driving the France Accommodation Market?

The France Accommodation Market is driven by factors such as increasing tourism, a growing number of international events, and the rise of online booking platforms.

What challenges does the France Accommodation Market face?

Challenges in the France Accommodation Market include regulatory hurdles, competition from alternative lodging options like Airbnb, and fluctuating demand due to economic conditions.

What opportunities exist in the France Accommodation Market?

Opportunities in the France Accommodation Market include the expansion of eco-friendly accommodations, the rise of digital nomadism, and the potential for luxury travel experiences.

What trends are shaping the France Accommodation Market?

Trends in the France Accommodation Market include the increasing popularity of boutique hotels, the integration of technology in guest services, and a focus on sustainability in hospitality practices.

France Accommodation Market

| Segmentation Details | Description |

|---|---|

| Accommodation Type | Hotels, Hostels, Bed & Breakfasts, Vacation Rentals |

| Price Tier | Luxury, Mid-Range, Budget, Economy |

| Booking Channel | Online Travel Agencies, Direct Booking, Travel Agents, Mobile Apps |

| Customer Type | Business Travelers, Tourists, Families, Solo Travelers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at