444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK industrial automation system integrator market represents a dynamic and rapidly evolving sector that serves as the backbone of modern manufacturing and industrial operations across the United Kingdom. System integrators play a crucial role in bridging the gap between advanced automation technologies and practical industrial applications, enabling businesses to achieve enhanced operational efficiency, reduced costs, and improved productivity. The market encompasses a diverse range of services including process automation, manufacturing execution systems, supervisory control and data acquisition (SCADA) systems, and industrial Internet of Things (IoT) implementations.

Market dynamics indicate robust growth driven by the UK’s commitment to Industry 4.0 initiatives and digital transformation across manufacturing sectors. The integration of artificial intelligence, machine learning, and advanced robotics has created unprecedented opportunities for system integrators to deliver comprehensive automation solutions. Manufacturing industries including automotive, pharmaceuticals, food and beverage, oil and gas, and chemicals are increasingly investing in sophisticated automation systems to maintain competitive advantages in global markets.

Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 8.2%, reflecting strong demand for integrated automation solutions. The market benefits from the UK’s advanced manufacturing base, skilled workforce, and supportive government policies promoting industrial digitalization. Regional distribution shows concentrated activity in industrial hubs including the Midlands, North West England, and Scotland, where major manufacturing facilities drive demand for automation integration services.

The UK industrial automation system integrator market refers to the comprehensive ecosystem of specialized companies and service providers that design, implement, and maintain integrated automation solutions for industrial facilities across the United Kingdom. System integrators serve as intermediaries between technology vendors and end-users, combining hardware, software, and services to create cohesive automation systems tailored to specific industrial requirements.

Core functions of system integrators include project management, system design and engineering, hardware and software integration, testing and commissioning, training, and ongoing maintenance support. These professionals possess deep expertise in multiple automation technologies, enabling them to select and integrate the most appropriate solutions for diverse industrial applications. Integration services span from simple control system upgrades to complex enterprise-wide automation implementations involving multiple interconnected systems.

Value proposition centers on delivering turnkey automation solutions that minimize implementation risks, reduce project timelines, and ensure optimal system performance. System integrators leverage their technical expertise, vendor relationships, and industry knowledge to provide clients with comprehensive automation strategies that align with business objectives and operational requirements.

Strategic positioning of the UK industrial automation system integrator market reflects the country’s transition toward advanced manufacturing and digital industrial ecosystems. The market demonstrates strong fundamentals supported by increasing adoption of Industry 4.0 technologies, government initiatives promoting industrial digitalization, and growing recognition of automation’s role in maintaining manufacturing competitiveness. Market participants range from large multinational system integrators to specialized regional providers, creating a diverse and competitive landscape.

Technology trends driving market evolution include the integration of artificial intelligence and machine learning capabilities, expansion of industrial IoT implementations, and growing adoption of cloud-based automation platforms. Cybersecurity considerations have become increasingly important as industrial systems become more connected, creating new service opportunities for system integrators specializing in secure automation implementations.

End-user industries demonstrate varying levels of automation maturity, with automotive and pharmaceutical sectors leading adoption while traditional industries like textiles and construction are accelerating their automation journeys. Service delivery models are evolving to include subscription-based maintenance, remote monitoring capabilities, and performance-based contracting arrangements that align integrator success with client operational outcomes.

Fundamental market insights reveal several critical factors shaping the UK industrial automation system integrator landscape:

Market maturity indicators suggest the UK market is transitioning from traditional automation implementations toward intelligent, connected systems that provide real-time insights and autonomous optimization capabilities. Competitive differentiation increasingly depends on technical expertise, industry specialization, and ability to deliver measurable business outcomes through automation investments.

Primary market drivers propelling growth in the UK industrial automation system integrator market encompass technological, economic, and regulatory factors that create compelling business cases for automation investments. Digital transformation initiatives across manufacturing sectors drive demand for comprehensive automation solutions that integrate seamlessly with existing business systems and provide actionable operational intelligence.

Labor market dynamics significantly influence automation adoption, with skills shortages in traditional manufacturing roles and aging workforce demographics creating urgency for automated solutions. Productivity imperatives drive manufacturers to seek automation systems that can deliver measurable improvements in operational efficiency, quality consistency, and production flexibility. The UK’s commitment to maintaining manufacturing competitiveness in global markets necessitates adoption of advanced automation technologies.

Regulatory compliance requirements in sectors such as pharmaceuticals, food and beverage, and chemicals create demand for automation systems that ensure consistent adherence to quality standards and regulatory mandates. Industry 4.0 adoption rates show 73% of UK manufacturers actively pursuing digital transformation initiatives, creating substantial opportunities for system integrators specializing in smart manufacturing implementations.

Cost optimization pressures encourage manufacturers to invest in automation systems that reduce operational expenses through improved efficiency, reduced waste, and optimized resource utilization. Sustainability objectives drive demand for automation solutions that support environmental goals through energy optimization, waste reduction, and improved resource management capabilities.

Significant market restraints present challenges for UK industrial automation system integrator market growth, primarily centered on implementation complexities, cost considerations, and technical barriers. Capital investment requirements for comprehensive automation systems can be substantial, particularly for small and medium-sized enterprises with limited financial resources. The complexity of modern automation systems requires significant upfront planning and design efforts, extending project timelines and increasing implementation risks.

Skills shortage challenges affect both system integrators and end-user organizations, with limited availability of qualified professionals capable of designing, implementing, and maintaining advanced automation systems. Legacy system integration presents technical challenges when connecting new automation technologies with existing industrial infrastructure, often requiring costly modifications or complete system replacements.

Cybersecurity concerns create hesitation among manufacturers regarding connected automation systems, particularly in critical infrastructure sectors where security breaches could have severe operational and safety implications. Change management resistance within organizations can slow automation adoption, as workforce concerns about job displacement and operational disruption create internal barriers to implementation.

Economic uncertainty and market volatility can delay automation investment decisions, as manufacturers prioritize short-term financial stability over long-term operational improvements. Regulatory complexity in highly regulated industries can extend project timelines and increase implementation costs, particularly when automation systems must comply with multiple overlapping regulatory frameworks.

Emerging market opportunities in the UK industrial automation system integrator sector reflect evolving industrial needs and technological capabilities that create new revenue streams and service offerings. Artificial intelligence integration presents significant opportunities for system integrators to develop predictive maintenance solutions, quality optimization systems, and autonomous production control capabilities that deliver substantial value to manufacturing clients.

Industrial IoT expansion creates opportunities for comprehensive connectivity solutions that enable real-time monitoring, remote diagnostics, and data-driven decision making across industrial operations. Edge computing implementations offer new service categories combining local processing capabilities with cloud connectivity, enabling responsive automation systems with reduced latency and improved reliability.

Sustainability-focused automation represents a growing opportunity as manufacturers seek systems that support environmental objectives through energy optimization, waste reduction, and carbon footprint monitoring. Retrofit and modernization projects provide substantial opportunities as aging industrial infrastructure requires updates to maintain competitiveness and regulatory compliance.

Service-based business models including automation-as-a-service, performance-based contracting, and subscription-based maintenance create recurring revenue opportunities while reducing client capital investment requirements. Cross-industry applications of automation technologies enable system integrators to leverage expertise across multiple sectors, expanding market reach and diversifying revenue sources.

Complex market dynamics shape the UK industrial automation system integrator landscape through interconnected technological, economic, and competitive forces. Technology evolution cycles create continuous demand for system upgrades and modernization projects, while also requiring integrators to maintain expertise across rapidly advancing technology platforms. The convergence of operational and information technologies fundamentally changes system architecture requirements and integration approaches.

Competitive pressures drive innovation in service delivery models, with system integrators developing specialized capabilities and industry expertise to differentiate their offerings. Client expectations continue to evolve toward comprehensive solutions that deliver measurable business outcomes rather than simply implementing technical systems. Partnership ecosystems become increasingly important as no single provider can deliver all components of complex automation solutions.

Economic cycles influence investment patterns, with manufacturers adjusting automation spending based on market conditions and business confidence levels. Regulatory changes create both opportunities and challenges, as new requirements drive automation demand while also increasing implementation complexity. Global supply chain considerations affect technology availability and project timelines, requiring integrators to develop flexible sourcing strategies.

Workforce dynamics continue to influence automation adoption patterns, with skills availability affecting both integrator capabilities and client implementation success. Digital transformation maturity varies significantly across industries and company sizes, creating diverse market segments with different service requirements and adoption timelines.

Comprehensive research methodology employed for analyzing the UK industrial automation system integrator market combines quantitative and qualitative research approaches to provide accurate and actionable market insights. Primary research activities include structured interviews with system integrators, end-user surveys across key industrial sectors, and expert consultations with technology vendors and industry associations.

Secondary research sources encompass industry reports, government statistics, trade association publications, and company financial disclosures to establish market baselines and validate primary research findings. Data collection methods utilize multiple channels including online surveys, telephone interviews, and in-person consultations to ensure comprehensive coverage of market participants and stakeholders.

Market segmentation analysis employs statistical modeling techniques to identify distinct market segments based on technology applications, industry verticals, company sizes, and geographic regions. Competitive landscape assessment combines public information analysis with proprietary research to evaluate market positioning, service capabilities, and strategic directions of key market participants.

Trend analysis methodologies incorporate historical data review, current market assessment, and forward-looking projections based on identified drivers and market dynamics. Validation processes include cross-referencing multiple data sources, expert review panels, and statistical verification to ensure research accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of analytical integrity.

Regional market distribution across the UK reveals distinct patterns of industrial automation system integrator activity, with concentration in established manufacturing regions and emerging growth in technology-focused areas. Greater London and Southeast England account for approximately 28% of market activity, driven by high-tech manufacturing, pharmaceutical facilities, and proximity to major airports and ports requiring sophisticated automation systems.

Midlands region represents the largest concentration of traditional manufacturing and automotive production, generating 32% of system integrator demand through established industrial base and ongoing modernization initiatives. Advanced manufacturing clusters in Birmingham, Coventry, and surrounding areas drive significant automation investment across automotive, aerospace, and general manufacturing sectors.

Northern England regions including Greater Manchester, Leeds, and Liverpool contribute 22% of market activity, with strong presence in chemicals, textiles, and food processing industries requiring specialized automation solutions. Scotland’s industrial sector generates 12% of market demand, primarily through oil and gas, whisky production, and emerging renewable energy manufacturing facilities.

Wales and Southwest England account for 6% of regional market share, with growing activity in aerospace manufacturing, automotive components, and food processing automation. Regional specialization patterns reflect local industrial strengths, with system integrators developing expertise aligned with dominant regional industries and manufacturing clusters.

Competitive market structure in the UK industrial automation system integrator sector encompasses diverse participants ranging from global multinational corporations to specialized regional providers. Market leadership is distributed among several key categories of competitors, each bringing distinct capabilities and market positioning strategies.

Competitive differentiation strategies focus on industry specialization, technology expertise, service capabilities, and geographic coverage. Market consolidation trends show larger integrators acquiring specialized firms to expand capabilities and market reach, while smaller providers focus on niche expertise and regional relationships.

Market segmentation analysis reveals distinct categories within the UK industrial automation system integrator market, each characterized by specific requirements, growth patterns, and competitive dynamics. Technology-based segmentation encompasses multiple automation categories serving different industrial applications and operational requirements.

By Technology Type:

By Industry Vertical:

By Service Type:

Process automation systems represent the largest segment within the UK industrial automation system integrator market, driven by extensive process industries including chemicals, oil and gas, pharmaceuticals, and food production. Integration complexity in process automation requires specialized expertise in regulatory compliance, safety systems, and advanced process control algorithms. Growth rates in this segment reflect ongoing modernization of aging process facilities and implementation of advanced analytics capabilities.

Discrete manufacturing automation demonstrates strong growth driven by automotive sector transformation, electronics manufacturing expansion, and general manufacturing modernization initiatives. Robotics integration within discrete manufacturing creates opportunities for system integrators with expertise in collaborative robotics, vision systems, and flexible manufacturing cells. Industry 4.0 implementations in discrete manufacturing drive demand for comprehensive integration services connecting production systems with enterprise software platforms.

Building management systems show increasing integration with industrial automation platforms, creating opportunities for system integrators to provide comprehensive facility automation solutions. Energy management focus drives demand for integrated systems that optimize both production and facility energy consumption. Smart building technologies create new service categories combining traditional building automation with advanced analytics and IoT connectivity.

Safety and security systems represent a specialized but growing segment as industrial facilities implement comprehensive cybersecurity measures and enhanced safety protocols. Regulatory requirements drive consistent demand for safety system integration, while cybersecurity concerns create new opportunities for specialized security-focused automation implementations.

Substantial benefits accrue to various stakeholders within the UK industrial automation system integrator ecosystem, creating value across the entire supply chain from technology vendors to end-user manufacturers. System integrators benefit from growing market demand, expanding service opportunities, and increasing project complexity that commands premium pricing for specialized expertise.

Manufacturing end-users realize significant operational benefits including:

Technology vendors benefit from expanded market reach through system integrator partnerships, enabling access to diverse industrial sectors and specialized applications. Regional economic benefits include job creation in high-skill technical roles, increased industrial competitiveness, and attraction of advanced manufacturing investments.

Supply chain participants including component suppliers, software providers, and service organizations benefit from increased demand driven by automation market growth. Innovation acceleration results from collaborative relationships between integrators, vendors, and end-users driving continuous technology advancement and application development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends are reshaping the UK industrial automation system integrator landscape, driven by technological advancement, changing customer expectations, and evolving industrial requirements. Artificial intelligence integration represents a fundamental shift toward intelligent automation systems capable of autonomous decision-making, predictive maintenance, and continuous optimization without human intervention.

Edge computing adoption enables distributed processing capabilities that reduce latency, improve system responsiveness, and support real-time decision-making in industrial environments. Cloud connectivity expansion facilitates remote monitoring, centralized data analytics, and scalable computing resources while maintaining local control capabilities for critical operations.

Cybersecurity integration has evolved from an afterthought to a fundamental design consideration, with system integrators developing specialized expertise in secure automation architectures and ongoing security monitoring. Modular system architectures enable flexible implementations that can adapt to changing requirements and facilitate incremental expansion of automation capabilities.

Sustainability-focused automation addresses growing environmental concerns through energy optimization, waste reduction, and carbon footprint monitoring integrated into automation systems. Human-machine collaboration trends emphasize augmenting human capabilities rather than replacing workers, creating more sophisticated integration requirements for collaborative automation systems.

Service delivery evolution toward outcome-based contracting aligns integrator success with client operational performance, driving focus on long-term value creation rather than project completion. Digital twin implementations provide virtual representations of physical systems enabling advanced simulation, optimization, and predictive maintenance capabilities.

Significant industry developments continue to shape the UK industrial automation system integrator market through technological breakthroughs, strategic partnerships, and regulatory changes. Major technology acquisitions by leading system integrators expand capabilities in artificial intelligence, cybersecurity, and specialized industry applications, creating more comprehensive solution portfolios.

Government initiatives supporting industrial digitalization include funding programs, tax incentives, and regulatory frameworks that encourage automation adoption across manufacturing sectors. Made Smarter program initiatives provide financial support and technical assistance for manufacturers implementing Industry 4.0 technologies, creating additional market opportunities for system integrators.

Partnership developments between system integrators and cloud service providers enable hybrid automation architectures combining local control with cloud-based analytics and optimization capabilities. University collaborations support research and development of advanced automation technologies while addressing skills development needs through specialized training programs.

Regulatory updates in sectors such as pharmaceuticals and food production drive demand for compliant automation systems, while cybersecurity regulations create new requirements for secure system implementations. Industry standards evolution including IEC 62443 cybersecurity standards and OPC UA communication protocols influence system architecture decisions and integration approaches.

Technology vendor developments including new product launches, capability enhancements, and strategic direction changes affect system integrator service offerings and competitive positioning. Market consolidation activities create larger, more capable system integration organizations while also generating opportunities for specialized niche providers.

Strategic recommendations for UK industrial automation system integrator market participants focus on capability development, market positioning, and service innovation to capitalize on emerging opportunities while addressing market challenges. MarkWide Research analysis suggests system integrators should prioritize development of specialized expertise in high-growth areas including artificial intelligence, cybersecurity, and sustainability-focused automation solutions.

Technology investment priorities should emphasize emerging capabilities that differentiate service offerings and create competitive advantages. Partnership strategies with technology vendors, cloud service providers, and specialized solution developers can expand capabilities without requiring extensive internal development investments. Industry specialization enables deeper expertise development and stronger client relationships within specific vertical markets.

Service model innovation including subscription-based maintenance, performance-based contracting, and automation-as-a-service offerings can create recurring revenue streams while reducing client capital investment barriers. Skills development initiatives should address critical capability gaps in emerging technologies while maintaining expertise in established automation platforms.

Market expansion strategies should consider geographic diversification, cross-industry application development, and acquisition opportunities that complement existing capabilities. Digital transformation of internal operations can improve service delivery efficiency, project management capabilities, and client communication while demonstrating automation expertise.

Risk management approaches should address cybersecurity concerns, project complexity challenges, and economic uncertainty through diversified service portfolios, robust project management processes, and flexible business models that adapt to changing market conditions.

Future market prospects for the UK industrial automation system integrator sector remain highly positive, supported by continuing digital transformation initiatives, technological advancement, and growing recognition of automation’s strategic importance for manufacturing competitiveness. Long-term growth projections indicate sustained expansion driven by Industry 4.0 adoption, sustainability requirements, and ongoing modernization of industrial infrastructure.

Technology evolution will continue to create new service opportunities as artificial intelligence, machine learning, and advanced analytics become integral components of industrial automation systems. Market maturation is expected to drive consolidation among smaller integrators while creating opportunities for specialized providers with unique capabilities or industry expertise.

Regulatory developments including enhanced cybersecurity requirements, environmental regulations, and safety standards will create consistent demand for compliant automation solutions. Skills development initiatives supported by government programs and educational institutions should help address current workforce constraints and support market growth.

International competitiveness of UK manufacturing will increasingly depend on advanced automation capabilities, creating sustained demand for system integration services. Emerging applications in renewable energy, electric vehicle manufacturing, and advanced materials processing will generate new market segments and service requirements.

Service delivery models will continue evolving toward outcome-based arrangements that align integrator success with client operational performance, requiring enhanced capabilities in performance monitoring, optimization, and continuous improvement. Market growth rates are projected to maintain momentum with annual expansion of 7-9% over the next five years, reflecting strong underlying demand drivers and expanding application opportunities.

The UK industrial automation system integrator market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by digital transformation initiatives, technological advancement, and increasing recognition of automation’s strategic importance for manufacturing competitiveness. Market fundamentals remain strong, supported by diverse industrial base, advanced technology ecosystem, and supportive regulatory environment that encourages automation adoption across multiple sectors.

Competitive landscape dynamics continue to evolve as system integrators develop specialized capabilities, expand service offerings, and adapt to changing client requirements. Technology trends including artificial intelligence integration, edge computing adoption, and cybersecurity enhancement create both opportunities and challenges that require continuous capability development and strategic adaptation.

Future success in the UK industrial automation system integrator market will depend on ability to deliver comprehensive solutions that address complex industrial requirements while providing measurable business value. Market participants that invest in emerging technologies, develop industry expertise, and innovate service delivery models are well-positioned to capitalize on substantial growth opportunities in this essential sector of the UK industrial economy.

What is Industrial Automation System Integrator?

Industrial Automation System Integrators are companies that design, implement, and maintain automated systems for various industries. They integrate hardware and software solutions to enhance operational efficiency, reduce costs, and improve productivity.

What are the key players in the UK Industrial Automation System Integrator Market?

Key players in the UK Industrial Automation System Integrator Market include Siemens, Rockwell Automation, Schneider Electric, and ABB, among others. These companies provide a range of automation solutions across sectors such as manufacturing, energy, and logistics.

What are the growth factors driving the UK Industrial Automation System Integrator Market?

The growth of the UK Industrial Automation System Integrator Market is driven by the increasing demand for operational efficiency, advancements in IoT technology, and the need for real-time data analytics. Additionally, the push for smart manufacturing and Industry Four Point Zero initiatives are significant contributors.

What challenges does the UK Industrial Automation System Integrator Market face?

Challenges in the UK Industrial Automation System Integrator Market include the high initial investment costs, a shortage of skilled labor, and the complexity of integrating new technologies with existing systems. These factors can hinder the adoption of automation solutions.

What opportunities exist in the UK Industrial Automation System Integrator Market?

Opportunities in the UK Industrial Automation System Integrator Market include the growing trend of digital transformation, the expansion of smart factories, and the increasing focus on sustainability. These trends present avenues for integrators to innovate and offer new solutions.

What trends are shaping the UK Industrial Automation System Integrator Market?

Trends shaping the UK Industrial Automation System Integrator Market include the rise of artificial intelligence and machine learning in automation processes, the integration of cloud computing, and the emphasis on cybersecurity measures. These innovations are transforming how industries approach automation.

UK Industrial Automation System Integrator Market

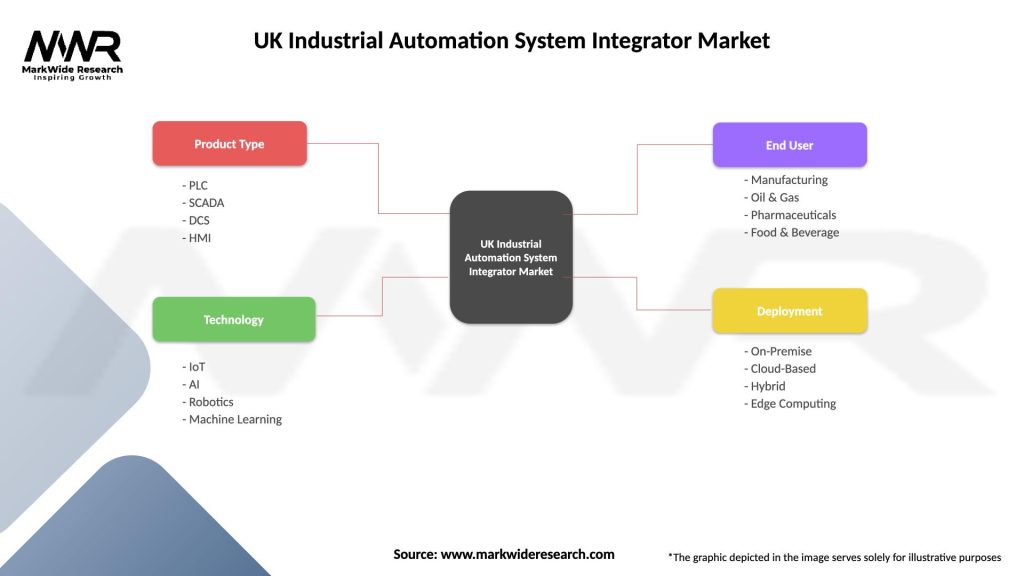

| Segmentation Details | Description |

|---|---|

| Product Type | PLC, SCADA, DCS, HMI |

| Technology | IoT, AI, Robotics, Machine Learning |

| End User | Manufacturing, Oil & Gas, Pharmaceuticals, Food & Beverage |

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Industrial Automation System Integrator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at