444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States automotive collision avoidance systems industry represents a transformative segment within the broader automotive safety technology landscape. This rapidly expanding market encompasses advanced driver assistance systems (ADAS), autonomous emergency braking, lane departure warning systems, and sophisticated sensor technologies designed to prevent vehicular accidents. Market dynamics indicate robust growth driven by stringent federal safety regulations, increasing consumer awareness of vehicle safety features, and technological advancements in artificial intelligence and sensor integration.

Industry participants are witnessing unprecedented demand for collision avoidance technologies as automotive manufacturers integrate these systems as standard equipment rather than optional features. The market demonstrates strong momentum with projected growth rates of 12.8% CAGR through the forecast period, reflecting the critical importance of safety technology in modern vehicle design. Key stakeholders include automotive OEMs, tier-1 suppliers, semiconductor manufacturers, and technology companies specializing in radar, lidar, and camera-based detection systems.

Technological evolution continues to drive market expansion as systems become more sophisticated, incorporating machine learning algorithms and real-time data processing capabilities. The integration of 5G connectivity and vehicle-to-everything (V2X) communication protocols further enhances system effectiveness, creating new opportunities for market participants and establishing the foundation for fully autonomous vehicle deployment.

The automotive collision avoidance systems market refers to the comprehensive ecosystem of technologies, components, and integrated solutions designed to detect potential collision scenarios and automatically intervene to prevent or mitigate vehicular accidents. These systems utilize advanced sensor technologies including radar, lidar, cameras, and ultrasonic sensors combined with sophisticated algorithms to monitor vehicle surroundings and execute preventive actions when collision risks are identified.

Core functionalities encompass automatic emergency braking, forward collision warning, blind spot detection, lane keeping assistance, and adaptive cruise control. Modern systems integrate multiple sensor modalities to create comprehensive situational awareness, enabling vehicles to respond to various collision scenarios including pedestrian detection, cyclist recognition, and multi-vehicle accident prevention.

System architecture typically includes sensor arrays, electronic control units (ECUs), actuators for braking and steering intervention, and human-machine interfaces that provide driver alerts and feedback. The technology represents a critical bridge between traditional passive safety systems and fully autonomous vehicle capabilities, establishing the foundation for next-generation transportation safety.

Market leadership in the United States automotive collision avoidance systems industry is characterized by intense competition among established automotive suppliers and emerging technology companies. The sector demonstrates exceptional growth potential driven by regulatory mandates, consumer demand for enhanced safety features, and continuous technological innovation. Federal regulations requiring automatic emergency braking systems on new vehicles by 2022 have accelerated market adoption, with 85% of new vehicles now equipped with some form of collision avoidance technology.

Investment trends reveal significant capital allocation toward research and development, particularly in artificial intelligence, sensor fusion, and edge computing capabilities. Major automotive manufacturers are establishing strategic partnerships with technology companies to accelerate innovation and reduce time-to-market for advanced safety systems. Supply chain dynamics indicate growing importance of semiconductor availability and advanced manufacturing capabilities for sensor production.

Consumer acceptance has reached unprecedented levels, with safety features ranking among the top purchasing criteria for vehicle buyers. Insurance industry support through premium reductions for vehicles equipped with collision avoidance systems further drives market adoption. Future projections indicate continued expansion as systems become more sophisticated and integrate with emerging connected vehicle technologies.

Strategic insights reveal several critical factors shaping the United States automotive collision avoidance systems industry:

Primary growth drivers propelling the United States automotive collision avoidance systems market include comprehensive regulatory frameworks established by the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS). These organizations have implemented stringent safety standards requiring collision avoidance capabilities across vehicle categories, creating mandatory demand for advanced safety technologies.

Consumer awareness of vehicle safety features has reached critical mass, with collision avoidance systems ranking among the most desired automotive technologies. Growing understanding of system benefits, supported by extensive safety testing and real-world accident prevention data, drives purchasing decisions across demographic segments. Insurance industry support through premium reductions for vehicles equipped with collision avoidance systems provides additional financial incentives for consumer adoption.

Technological advancement continues accelerating market growth through improved system reliability, reduced false positive rates, and enhanced detection capabilities. Integration of artificial intelligence and machine learning algorithms enables systems to adapt to diverse driving conditions and improve performance over time. Manufacturing scale economies achieved through increased production volumes are reducing system costs, making advanced safety technologies accessible across broader vehicle price ranges and market segments.

Cost considerations remain a significant constraint for widespread collision avoidance system adoption, particularly in entry-level vehicle segments where price sensitivity limits advanced technology integration. High-performance sensor technologies, sophisticated processing units, and complex software development require substantial investment, creating challenges for cost-conscious manufacturers and consumers.

Technical limitations of current collision avoidance systems include performance degradation in adverse weather conditions, challenges with detecting certain object types, and occasional false positive activations that can frustrate drivers. System reliability concerns, particularly in complex urban environments with multiple moving objects and unpredictable scenarios, continue to limit consumer confidence in fully autonomous collision avoidance capabilities.

Infrastructure dependencies constrain system effectiveness in areas lacking adequate road markings, signage, or connected vehicle communication networks. Rural and older urban areas may not provide optimal operating conditions for advanced collision avoidance systems, limiting their effectiveness and potentially creating safety disparities across geographic regions. Regulatory complexity across different states and jurisdictions can create compliance challenges for manufacturers developing systems for national deployment.

Emerging opportunities within the United States automotive collision avoidance systems market include integration with smart city infrastructure and vehicle-to-everything (V2X) communication networks. These technologies enable enhanced situational awareness through real-time data sharing between vehicles, infrastructure, and traffic management systems, creating opportunities for more sophisticated collision avoidance capabilities.

Aftermarket potential represents substantial growth opportunities as millions of existing vehicles lack advanced collision avoidance systems. Development of retrofit solutions and portable collision avoidance devices could address this market segment, particularly for commercial fleet operators seeking to enhance safety across existing vehicle inventories. Insurance partnerships create opportunities for innovative business models combining collision avoidance technology with usage-based insurance programs.

Commercial vehicle applications offer significant expansion opportunities given the higher accident costs and regulatory scrutiny associated with trucks, buses, and delivery vehicles. Advanced collision avoidance systems specifically designed for commercial applications could address unique challenges including longer stopping distances, blind spot coverage, and pedestrian detection in urban delivery scenarios. International expansion opportunities exist as United States companies leverage technological expertise to serve growing global markets for automotive safety systems.

Competitive dynamics within the United States automotive collision avoidance systems market reflect intense rivalry among established automotive suppliers, technology companies, and emerging startups. Traditional tier-1 suppliers leverage existing automotive industry relationships and manufacturing capabilities, while technology companies contribute advanced algorithms, sensor technologies, and software development expertise.

Innovation cycles are accelerating as companies invest heavily in research and development to maintain competitive advantages. Patent portfolios have become critical strategic assets, with companies building extensive intellectual property protection around key technologies including sensor fusion algorithms, object recognition systems, and predictive collision modeling. Collaboration strategies between automotive manufacturers and technology companies are becoming increasingly common to combine domain expertise and accelerate innovation timelines.

Supply chain dynamics reveal growing importance of semiconductor availability and advanced manufacturing capabilities. Companies are establishing strategic partnerships with chip manufacturers and investing in vertical integration to ensure component availability for critical safety systems. Market consolidation trends indicate potential for mergers and acquisitions as companies seek to acquire complementary technologies and expand market reach. According to MarkWide Research analysis, the competitive landscape is evolving rapidly with new entrants challenging established players through innovative approaches to collision avoidance technology.

Comprehensive analysis of the United States automotive collision avoidance systems market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, automotive engineers, regulatory officials, and technology developers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, patent filings, regulatory documents, and financial statements from publicly traded companies. Government databases including NHTSA crash statistics, vehicle registration data, and safety testing results provide quantitative foundation for market analysis. Technical literature review covers academic research, engineering publications, and technology development reports to understand innovation trends and future capabilities.

Market modeling utilizes statistical analysis of historical data, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Cross-validation of findings through multiple data sources and analytical approaches ensures robustness of conclusions. Expert validation involves review of findings by industry specialists and academic researchers to confirm accuracy and relevance of market insights and projections.

Geographic distribution of the United States automotive collision avoidance systems market reveals significant regional variations driven by regulatory requirements, consumer preferences, and infrastructure development. California leads market adoption with 42% regional market share, driven by stringent state emissions and safety regulations, high consumer income levels, and concentration of technology companies developing advanced automotive systems.

Northeast corridor states including New York, Massachusetts, and Connecticut demonstrate strong market penetration due to dense urban environments where collision avoidance systems provide significant safety benefits. High vehicle insurance costs in these regions create additional incentives for collision avoidance system adoption through insurance premium reductions. Texas and Florida represent rapidly growing markets with 28% combined regional share, driven by large vehicle populations and increasing safety awareness among consumers.

Midwest automotive manufacturing centers including Michigan, Ohio, and Indiana serve as development and testing hubs for collision avoidance technologies. These regions benefit from proximity to automotive OEMs and supplier networks, facilitating rapid technology deployment and market penetration. Rural markets across the Mountain West and Plains states show slower adoption rates due to lower population density, reduced traffic congestion, and cost sensitivity among consumers, though growth is accelerating as system costs decline.

Market leadership in the United States automotive collision avoidance systems industry is distributed among several key categories of companies, each bringing distinct capabilities and competitive advantages:

Competitive strategies include vertical integration of sensor manufacturing, strategic partnerships with automotive OEMs, and aggressive investment in artificial intelligence and machine learning capabilities. Companies are differentiating through system reliability, cost optimization, and integration with broader vehicle electronic architectures.

Technology segmentation of the United States automotive collision avoidance systems market reveals distinct categories based on sensor types and system capabilities:

By Sensor Technology:

By Vehicle Type:

By System Type:

Radar-based systems dominate the collision avoidance market due to their reliability in diverse weather conditions and cost-effectiveness for mass market applications. These systems demonstrate 78% market penetration in new vehicles, driven by proven performance and regulatory acceptance. Millimeter-wave radar technology provides excellent range detection capabilities while maintaining reasonable cost structures for automotive applications.

Camera-based systems are experiencing rapid growth due to advances in computer vision and machine learning algorithms. Integration with artificial intelligence enables sophisticated object recognition including pedestrian detection, traffic sign recognition, and lane marking identification. Stereo camera configurations provide depth perception capabilities that enhance system accuracy and reduce false positive rates.

Sensor fusion approaches represent the future direction of collision avoidance technology, combining radar, camera, and lidar inputs to create comprehensive situational awareness. These systems demonstrate 95% accuracy rates in controlled testing environments and provide redundancy that enhances safety and reliability. Edge computing integration enables real-time processing of multiple sensor inputs while minimizing latency and improving system response times.

Commercial vehicle applications require specialized collision avoidance systems addressing unique operational challenges including longer stopping distances, larger blind spots, and diverse loading configurations. Fleet operators are driving adoption through safety programs and insurance requirements, creating opportunities for specialized system development and aftermarket installation services.

Automotive manufacturers benefit from collision avoidance system integration through enhanced vehicle safety ratings, competitive differentiation, and compliance with federal safety regulations. These systems enable manufacturers to achieve higher safety scores in NHTSA and IIHS testing programs, supporting premium pricing strategies and brand positioning. Regulatory compliance benefits include meeting mandatory safety requirements while potentially exceeding standards to gain competitive advantages.

Consumers realize significant benefits including enhanced personal safety, reduced accident risk, and potential insurance premium reductions. Advanced collision avoidance systems provide peace of mind for drivers and passengers while reducing the likelihood of costly vehicle damage and personal injury. Long-term value includes reduced maintenance costs, higher vehicle resale values, and improved overall driving experience through reduced stress and fatigue.

Insurance companies benefit from reduced claim frequency and severity as collision avoidance systems prevent accidents and minimize damage when collisions occur. These systems enable development of usage-based insurance programs and risk-based pricing models that reward safe driving behavior. Fleet operators achieve reduced liability exposure, lower insurance costs, and improved driver safety records through systematic deployment of collision avoidance technologies.

Technology suppliers benefit from growing market demand, opportunities for innovation, and potential for long-term partnerships with automotive manufacturers. The expanding market creates opportunities for specialized companies to develop niche technologies and establish market positions in rapidly growing segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the collision avoidance systems market, with machine learning algorithms enabling systems to improve performance through real-world experience. Deep learning models are enhancing object recognition capabilities, reducing false positive rates, and enabling more sophisticated prediction of collision scenarios. This trend is driving 35% improvement in system accuracy over traditional rule-based approaches.

Sensor fusion advancement continues accelerating as manufacturers combine radar, lidar, and camera technologies to create more reliable and comprehensive detection capabilities. Multi-modal sensing approaches provide redundancy and enhanced performance across diverse operating conditions, addressing previous limitations of single-sensor systems. Integration of solid-state lidar technology is reducing costs while improving reliability and performance.

Edge computing deployment is enabling real-time processing of sensor data within vehicles, reducing latency and improving system response times. Advanced processing capabilities allow for more sophisticated algorithms and enhanced decision-making without dependence on external connectivity. 5G connectivity integration supports enhanced vehicle-to-everything communication, enabling collision avoidance systems to benefit from real-time traffic and hazard information.

Predictive analytics are emerging as collision avoidance systems incorporate historical data and behavioral patterns to anticipate potential collision scenarios before they develop. MWR research indicates that predictive capabilities could improve collision prevention rates by 25% compared to reactive systems, representing a significant advancement in automotive safety technology.

Recent technological breakthroughs include development of advanced radar systems operating at higher frequencies with improved resolution and detection capabilities. 77-81 GHz radar systems provide enhanced performance for automotive applications while meeting regulatory requirements for spectrum allocation. These systems demonstrate improved detection of small objects and better performance in challenging weather conditions.

Strategic partnerships between automotive manufacturers and technology companies are accelerating innovation and market deployment. Major collaborations include joint development programs for next-generation collision avoidance systems, shared research initiatives, and technology licensing agreements. Vertical integration strategies are emerging as companies seek to control critical technology components and ensure supply chain security.

Regulatory developments include expanded NHTSA requirements for collision avoidance systems and new testing protocols for system validation. Updated safety standards address emerging technologies and establish performance criteria for advanced driver assistance systems. International harmonization efforts are creating opportunities for global technology deployment and standardization.

Investment activity remains robust with significant venture capital and corporate investment in collision avoidance technology companies. Acquisition activity includes major automotive suppliers acquiring specialized technology companies to expand capabilities and market reach. Government research funding supports continued innovation in automotive safety technologies through various federal programs and initiatives.

Strategic recommendations for industry participants include prioritizing investment in artificial intelligence and machine learning capabilities to maintain competitive advantages in rapidly evolving collision avoidance technology. Companies should focus on developing comprehensive sensor fusion solutions that combine multiple detection modalities for enhanced reliability and performance across diverse operating conditions.

Market positioning strategies should emphasize system reliability, cost optimization, and integration with broader vehicle electronic architectures. Partnership development with automotive manufacturers, technology companies, and research institutions can accelerate innovation and market penetration while sharing development costs and risks. Companies should consider vertical integration of critical components to ensure supply chain security and technology control.

Technology development priorities should include edge computing capabilities, predictive analytics, and integration with connected vehicle infrastructure. Regulatory engagement is essential to influence safety standards development and ensure technology compatibility with evolving requirements. Companies should invest in comprehensive testing and validation programs to demonstrate system effectiveness and build consumer confidence.

Market expansion opportunities include aftermarket applications, commercial vehicle specialization, and international market development. MarkWide Research analysis suggests that companies focusing on these growth areas while maintaining technology leadership in core markets will achieve the strongest competitive positions and financial performance in the evolving collision avoidance systems industry.

Long-term projections for the United States automotive collision avoidance systems market indicate continued robust growth driven by technological advancement, regulatory expansion, and increasing consumer demand for vehicle safety features. Market evolution will be characterized by integration with autonomous vehicle technologies, enhanced connectivity capabilities, and improved artificial intelligence algorithms that enable more sophisticated collision prediction and prevention.

Technology roadmaps suggest significant improvements in sensor performance, cost reduction, and system integration over the next decade. Solid-state lidar deployment will accelerate as costs decline and reliability improves, enabling more comprehensive environmental sensing capabilities. Integration with 5G networks and smart city infrastructure will create opportunities for enhanced collision avoidance through real-time data sharing and coordinated traffic management.

Regulatory evolution will likely expand collision avoidance system requirements to additional vehicle categories and operational scenarios. Performance standards will become more stringent as technology capabilities improve, driving continued innovation and system enhancement. International harmonization of safety standards will create opportunities for global technology deployment and market expansion.

Market maturation will be characterized by consolidation among technology suppliers, standardization of key technologies, and integration with broader automotive electronic systems. Consumer expectations will continue rising, driving demand for more sophisticated and reliable collision avoidance capabilities. The market is projected to achieve near-universal adoption in new vehicles by 2030, with significant growth in aftermarket and retrofit applications for existing vehicle populations.

The United States automotive collision avoidance systems industry represents a dynamic and rapidly expanding market driven by regulatory requirements, technological innovation, and growing consumer demand for enhanced vehicle safety. Market fundamentals remain strong with projected growth rates exceeding broader automotive industry averages, reflecting the critical importance of safety technology in modern vehicle design and consumer purchasing decisions.

Competitive dynamics favor companies that can successfully integrate advanced sensor technologies, artificial intelligence capabilities, and comprehensive system solutions while maintaining cost competitiveness and regulatory compliance. Technology trends including sensor fusion, edge computing, and predictive analytics are reshaping the industry landscape and creating new opportunities for innovation and market differentiation.

Future success in this market will depend on companies’ ability to navigate complex regulatory requirements, develop reliable and cost-effective technologies, and establish strategic partnerships across the automotive value chain. The transition toward connected and autonomous vehicles creates additional opportunities for collision avoidance system integration and enhanced capabilities. Industry participants that can successfully balance innovation, cost management, and market positioning will be best positioned to capitalize on the significant growth opportunities in the United States automotive collision avoidance systems market.

What is Automotive Collision Avoidance Systems?

Automotive Collision Avoidance Systems refer to technologies designed to prevent accidents by detecting potential collisions and taking corrective actions. These systems include features such as automatic braking, lane departure warnings, and adaptive cruise control.

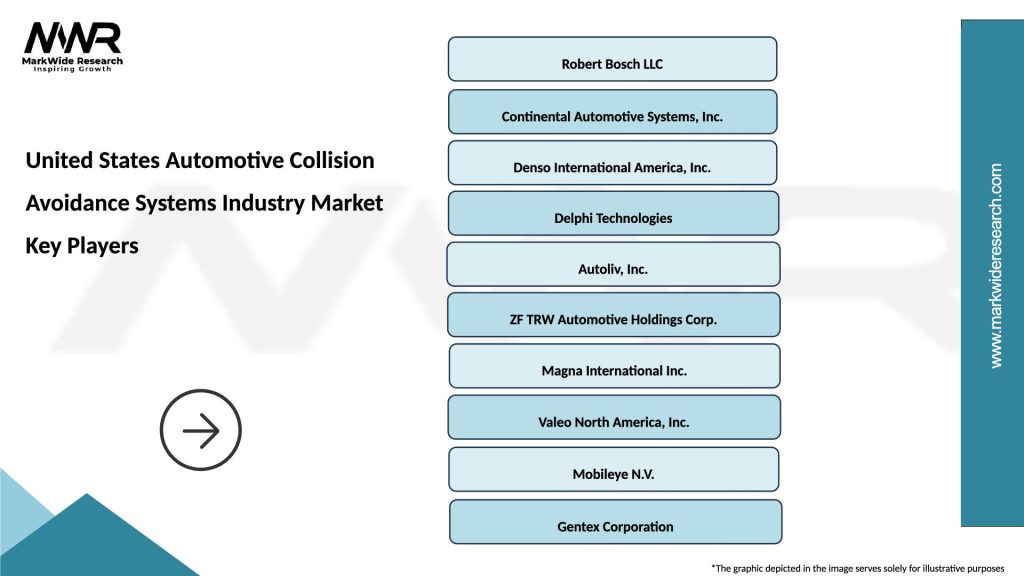

What are the key players in the United States Automotive Collision Avoidance Systems Industry Market?

Key players in the United States Automotive Collision Avoidance Systems Industry Market include companies like Mobileye, Bosch, and Continental. These companies are known for their innovative technologies and contributions to enhancing vehicle safety, among others.

What are the growth factors driving the United States Automotive Collision Avoidance Systems Industry Market?

The growth of the United States Automotive Collision Avoidance Systems Industry Market is driven by increasing road safety regulations, rising consumer demand for advanced safety features, and technological advancements in sensor and camera systems. These factors contribute to the widespread adoption of collision avoidance technologies.

What challenges does the United States Automotive Collision Avoidance Systems Industry Market face?

Challenges in the United States Automotive Collision Avoidance Systems Industry Market include high development costs, integration complexities with existing vehicle systems, and varying regulatory standards across states. These factors can hinder the rapid deployment of new technologies.

What opportunities exist in the United States Automotive Collision Avoidance Systems Industry Market?

Opportunities in the United States Automotive Collision Avoidance Systems Industry Market include the growing trend of autonomous vehicles, advancements in artificial intelligence for better decision-making, and increasing partnerships between automotive manufacturers and technology firms. These trends are likely to shape the future of vehicle safety.

What trends are shaping the United States Automotive Collision Avoidance Systems Industry Market?

Trends shaping the United States Automotive Collision Avoidance Systems Industry Market include the integration of machine learning algorithms for improved predictive capabilities, the rise of connected vehicle technologies, and a focus on user-friendly interfaces. These innovations are enhancing the effectiveness of collision avoidance systems.

United States Automotive Collision Avoidance Systems Industry Market

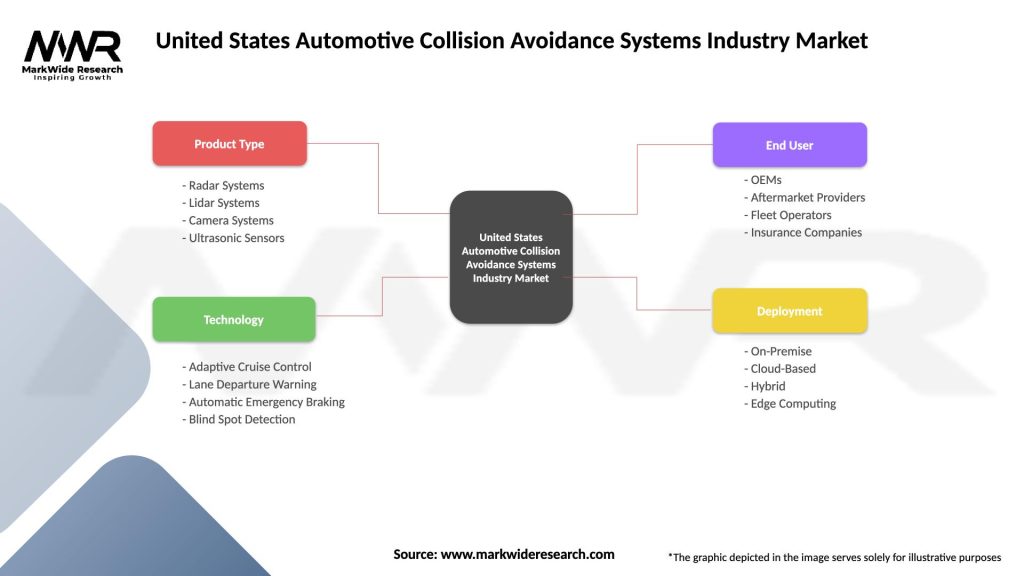

| Segmentation Details | Description |

|---|---|

| Product Type | Radar Systems, Lidar Systems, Camera Systems, Ultrasonic Sensors |

| Technology | Adaptive Cruise Control, Lane Departure Warning, Automatic Emergency Braking, Blind Spot Detection |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Insurance Companies |

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Automotive Collision Avoidance Systems Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at