444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US frozen yogurt market represents a dynamic segment within the broader frozen dessert industry, characterized by evolving consumer preferences toward healthier indulgence options. Market dynamics indicate sustained growth driven by increasing health consciousness and innovative product formulations. The sector has experienced remarkable transformation over the past decade, with premium offerings and artisanal varieties gaining significant traction among diverse consumer demographics.

Consumer behavior patterns reveal a growing preference for frozen yogurt as a guilt-free alternative to traditional ice cream, with health-conscious millennials and Generation Z consumers leading adoption trends. The market demonstrates robust expansion across various distribution channels, including specialty frozen yogurt shops, grocery retail chains, and foodservice establishments. Industry projections suggest continued growth at a compound annual growth rate of 6.2% through the forecast period.

Regional distribution shows concentrated market activity in urban and suburban areas, with California, Texas, and New York representing the largest consumption markets. The sector benefits from increasing consumer awareness of probiotic benefits and protein-rich formulations, positioning frozen yogurt as both an indulgent treat and functional food product.

The US frozen yogurt market refers to the comprehensive ecosystem encompassing the production, distribution, and retail of frozen yogurt products across the United States, including traditional soft-serve varieties, packaged frozen yogurt products, and premium artisanal offerings. This market segment represents a specialized category within the broader frozen dessert industry, distinguished by its emphasis on health-conscious formulations and probiotic benefits.

Market scope includes various product formats ranging from self-serve frozen yogurt establishments to pre-packaged retail products available through grocery channels. The definition encompasses both traditional dairy-based formulations and plant-based alternatives, reflecting evolving consumer dietary preferences and lifestyle choices. Distribution channels span specialty retail locations, supermarket chains, convenience stores, and foodservice operations.

Industry classification positions frozen yogurt as a distinct category separate from ice cream and other frozen desserts, characterized by specific manufacturing processes, ingredient compositions, and regulatory standards. The market includes both franchise operations and independent retailers, creating a diverse competitive landscape with varying business models and consumer engagement strategies.

Strategic analysis of the US frozen yogurt market reveals a mature yet evolving industry experiencing steady growth driven by health-conscious consumer trends and product innovation. Market leaders continue to expand their footprint through franchise development and product diversification, while emerging brands focus on premium positioning and unique flavor profiles to capture market share.

Key growth drivers include increasing consumer awareness of gut health benefits, rising demand for low-calorie dessert alternatives, and expanding availability across multiple distribution channels. The market benefits from 45% of consumers actively seeking healthier dessert options, with frozen yogurt positioned as a preferred choice among health-conscious demographics.

Competitive dynamics showcase a fragmented market structure with numerous regional and national players competing across different price points and positioning strategies. Innovation trends focus on functional ingredients, exotic flavor combinations, and sustainable packaging solutions to differentiate offerings and attract environmentally conscious consumers.

Market challenges include seasonal demand fluctuations, increasing competition from alternative healthy desserts, and evolving consumer preferences toward plant-based options. Despite these challenges, the sector demonstrates resilience through continuous product innovation and strategic market expansion initiatives.

Consumer demographic analysis reveals that the US frozen yogurt market attracts a diverse customer base with distinct preferences and purchasing behaviors. Primary consumers include health-conscious individuals aged 25-45, families with children seeking healthier dessert alternatives, and fitness enthusiasts looking for post-workout treats with protein benefits.

Health consciousness trends represent the primary driver propelling US frozen yogurt market growth, with consumers increasingly seeking dessert options that align with wellness-focused lifestyles. Probiotic awareness has significantly increased, with 62% of consumers recognizing the digestive health benefits associated with frozen yogurt consumption, creating sustained demand for products positioned as functional foods.

Demographic shifts favor frozen yogurt adoption, particularly among millennial and Generation Z consumers who prioritize health-conscious choices without completely sacrificing indulgence. These demographics demonstrate willingness to pay premium prices for products offering clean ingredients, organic certifications, and sustainable sourcing practices.

Product innovation continues driving market expansion through development of plant-based alternatives, protein-enriched formulations, and reduced-sugar options that cater to specific dietary requirements and lifestyle preferences. Flavor creativity and seasonal offerings maintain consumer interest and encourage repeat purchases across diverse market segments.

Distribution channel expansion facilitates market growth through increased availability in grocery stores, convenience retailers, and foodservice establishments. The rise of delivery platforms and mobile ordering systems has enhanced accessibility, particularly during periods when traditional retail visits were limited.

Seasonal demand fluctuations present significant challenges for frozen yogurt operators, with consumption patterns heavily influenced by weather conditions and seasonal preferences. Winter months typically experience substantial demand decreases, requiring operators to develop strategies for maintaining revenue during off-peak periods through menu diversification and promotional activities.

Intense competition from alternative healthy dessert options, including gelato, sorbet, acai bowls, and plant-based ice creams, creates market share pressure and requires continuous differentiation efforts. Premium ice cream brands have also introduced healthier formulations that directly compete with frozen yogurt’s positioning as a guilt-free indulgence.

High operational costs associated with maintaining frozen yogurt equipment, managing inventory freshness, and staffing self-serve locations impact profitability margins. Real estate expenses in prime retail locations and franchise fees for established brands create barriers to entry for new market participants.

Consumer perception challenges arise from confusion about actual health benefits versus marketing claims, with some consumers questioning whether frozen yogurt truly offers significant nutritional advantages over other dessert options. Sugar content concerns and artificial ingredient skepticism among health-conscious consumers require transparent communication and product reformulation efforts.

Plant-based expansion represents a substantial growth opportunity as dairy-free alternatives gain mainstream acceptance among consumers with lactose intolerance, vegan lifestyles, and environmental concerns. Coconut-based, almond-based, and oat-based frozen yogurt formulations show promising market potential with 35% growth rate in the plant-based dessert segment.

Functional food positioning offers opportunities to develop frozen yogurt products with enhanced nutritional profiles, including added protein, superfruits, adaptogens, and immune-supporting ingredients. Collaboration opportunities with nutritional supplement companies and wellness brands could create innovative product lines targeting specific health objectives.

Geographic expansion into underserved markets, particularly in rural areas and smaller metropolitan regions, presents growth potential for both franchise operations and independent retailers. Mobile frozen yogurt concepts and food truck operations could effectively serve these markets while maintaining lower overhead costs.

Technology integration opportunities include development of smart dispensing systems, personalized nutrition tracking, and AI-powered flavor recommendations that enhance customer experience and operational efficiency. Subscription models and direct-to-consumer delivery services could create new revenue streams and improve customer retention rates.

Supply chain dynamics in the US frozen yogurt market reflect complex relationships between dairy suppliers, ingredient manufacturers, equipment providers, and retail operators. Vertical integration strategies among major players aim to control quality, reduce costs, and ensure consistent product availability across distribution networks.

Pricing dynamics vary significantly across market segments, with premium artisanal brands commanding higher price points while mass-market products compete primarily on value and accessibility. Self-serve models typically offer competitive pricing per ounce, while full-service establishments focus on experience and customization to justify premium pricing.

Innovation cycles drive market evolution through continuous development of new flavors, formulations, and serving formats. Seasonal product launches and limited-time offerings create consumer excitement and drive traffic during both peak and off-peak periods. Collaboration with popular brands and celebrity endorsements influence consumer preferences and market trends.

Regulatory dynamics impact product formulation, labeling requirements, and operational standards across the frozen yogurt industry. FDA guidelines for probiotic claims and nutritional labeling requirements influence marketing strategies and product development priorities. Local health department regulations affect operational procedures and equipment specifications for retail establishments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US frozen yogurt market dynamics. Primary research includes extensive surveys of consumers, industry stakeholders, and retail operators to gather firsthand perspectives on market trends, preferences, and challenges.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and financial filings from publicly traded companies operating in the frozen yogurt sector. Market intelligence gathering includes monitoring of competitor activities, product launches, pricing strategies, and expansion plans across different geographic markets.

Data validation processes ensure accuracy through cross-referencing multiple sources and conducting follow-up interviews with industry experts and market participants. Quantitative analysis utilizes statistical modeling to project market trends and identify growth opportunities across different segments and regions.

Qualitative insights emerge from in-depth interviews with franchise owners, independent operators, suppliers, and industry consultants who provide contextual understanding of market dynamics and future outlook. Consumer focus groups and taste testing sessions offer valuable feedback on product preferences and purchasing decision factors.

West Coast markets lead US frozen yogurt consumption, with California representing 28% market share due to health-conscious consumer culture and year-round favorable weather conditions. Los Angeles and San Francisco metropolitan areas show particularly strong demand for premium and artisanal frozen yogurt offerings, supporting higher price points and innovative flavor profiles.

Northeast region demonstrates steady market growth despite seasonal challenges, with New York and New Jersey markets showing resilience through strategic indoor mall locations and winter menu diversification. Urban density in major metropolitan areas supports high-traffic retail locations and delivery service viability.

Southeast markets experience robust growth driven by population expansion and increasing health consciousness among diverse demographic groups. Florida and Texas represent significant growth opportunities with favorable climate conditions and expanding suburban development supporting new retail locations.

Midwest and Mountain regions present mixed market conditions with seasonal demand variations requiring adaptive business strategies. College towns and family-oriented communities show consistent demand patterns, while rural markets remain underserved with potential for mobile and seasonal operations.

Market leadership in the US frozen yogurt sector is distributed among several key players employing different competitive strategies and market positioning approaches. Franchise models dominate the landscape, offering standardized operations and brand recognition advantages.

Independent operators compete through local market knowledge, unique product offerings, and personalized customer service. Regional chains leverage geographic concentration to build strong brand loyalty and operational efficiency within specific market areas.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer appeal. Traditional dairy-based frozen yogurt maintains the largest market share while plant-based alternatives show the fastest growth rates among health-conscious and environmentally aware consumers.

By Product Type:

By Distribution Channel:

Self-serve category dominates the US frozen yogurt market with approximately 70% market share, driven by consumer preference for customization and portion control. Interactive experience and unlimited topping options create engaging customer experiences that encourage longer visit duration and higher transaction values.

Premium artisanal segment shows strongest growth potential with double-digit expansion rates as consumers increasingly seek high-quality ingredients and unique flavor profiles. Small-batch production and locally-sourced ingredients command premium pricing while building strong customer loyalty through authenticity and craftsmanship.

Health-focused categories including low-sugar, high-protein, and probiotic-enhanced varieties attract health-conscious consumers willing to pay premium prices for functional benefits. Nutritional transparency and clean label ingredients drive purchasing decisions among educated consumer segments.

Plant-based alternatives represent the fastest-growing category with annual growth rates exceeding 25% as mainstream consumers embrace dairy-free options for health, environmental, and ethical reasons. Taste improvement and texture innovation in plant-based formulations continue expanding market appeal beyond traditional vegan demographics.

Franchise operators benefit from established brand recognition, proven business models, and comprehensive support systems that reduce operational risks and accelerate market entry. Standardized procedures and bulk purchasing power provide cost advantages while maintaining consistent quality across multiple locations.

Independent retailers enjoy flexibility in product offerings, local market adaptation, and higher profit margins through direct supplier relationships. Community connections and personalized service create competitive advantages that larger chains cannot easily replicate in local markets.

Suppliers and manufacturers benefit from growing demand for specialized ingredients, equipment upgrades, and packaging innovations that support market expansion. Long-term contracts with established operators provide revenue stability while new product development creates additional growth opportunities.

Real estate developers and property managers find frozen yogurt tenants attractive for their ability to generate consistent foot traffic and complement other retail offerings. Relatively small space requirements and flexible lease terms make frozen yogurt operations suitable for various retail environments.

Consumers benefit from increased product variety, competitive pricing, and convenient access to healthier dessert alternatives that align with wellness-focused lifestyles. Nutritional benefits and customization options provide value beyond traditional dessert experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends drive consumer willingness to pay higher prices for frozen yogurt products featuring artisanal ingredients, unique flavors, and sustainable sourcing practices. Small-batch production and locally-sourced components create authenticity that resonates with quality-conscious consumers seeking distinctive experiences.

Plant-based innovation accelerates as manufacturers develop improved formulations that closely mimic traditional dairy textures and flavors. Coconut-based, cashew-based, and oat-based alternatives gain mainstream acceptance while addressing lactose intolerance and environmental concerns among diverse consumer segments.

Functional food integration transforms frozen yogurt from simple dessert to wellness-focused product through addition of superfruits, protein supplements, adaptogens, and immune-supporting ingredients. Collaboration with nutritional brands creates innovative products targeting specific health objectives and lifestyle needs.

Technology adoption enhances customer experience through mobile ordering platforms, contactless payment systems, and personalized nutrition tracking. Social media integration and loyalty program gamification increase customer engagement while providing valuable data for targeted marketing initiatives.

Sustainability focus influences packaging choices, ingredient sourcing, and operational practices as environmentally conscious consumers prioritize brands demonstrating ecological responsibility. Compostable packaging and carbon-neutral operations become competitive differentiators in premium market segments.

Recent market developments reflect dynamic industry evolution driven by changing consumer preferences and competitive pressures. Major franchise expansions into underserved geographic markets demonstrate confidence in long-term growth potential despite seasonal challenges and competitive intensity.

Product innovation initiatives focus on clean label formulations that eliminate artificial ingredients while maintaining taste and texture quality. Probiotic enhancement and protein fortification address specific consumer health objectives while creating premium pricing opportunities for innovative brands.

Strategic partnerships between frozen yogurt operators and health food brands, fitness centers, and wellness platforms create cross-promotional opportunities that expand customer reach and reinforce health positioning. Co-branding initiatives with popular food and beverage brands generate consumer excitement and drive trial among new demographics.

Technology investments in automated dispensing systems, inventory management software, and customer relationship management platforms improve operational efficiency while enhancing customer experience. Data analytics capabilities enable personalized marketing and optimized product mix decisions based on local preferences and seasonal patterns.

Sustainability initiatives include adoption of renewable energy systems, waste reduction programs, and sustainable packaging solutions that appeal to environmentally conscious consumers while reducing operational costs over time.

Market positioning strategies should emphasize authentic health benefits while avoiding exaggerated claims that could undermine consumer trust. Transparent communication about ingredients, nutritional content, and production processes builds credibility with increasingly educated consumers who research products before purchasing.

Seasonal adaptation requires development of comprehensive year-round strategies including warm beverage offerings, comfort food flavors, and indoor experience enhancements that maintain customer engagement during colder months. Subscription models and loyalty programs can provide revenue stability during seasonal downturns.

Technology integration should focus on enhancing customer convenience and personalization rather than replacing human interaction entirely. Mobile ordering and contactless payment systems improve efficiency while personalized recommendations based on purchase history create more engaging experiences.

Geographic expansion opportunities exist in underserved suburban markets and smaller metropolitan areas where competition is less intense and real estate costs are more favorable. Mobile concepts and seasonal operations can effectively serve these markets while minimizing overhead expenses.

Product development should prioritize plant-based alternatives and functional formulations that address specific consumer needs while maintaining taste quality. Collaboration with ingredient suppliers and nutritional experts can accelerate innovation while ensuring product efficacy and safety.

Long-term market projections indicate continued growth for the US frozen yogurt market, driven by sustained consumer interest in healthier dessert alternatives and ongoing product innovation. MarkWide Research analysis suggests the market will maintain steady expansion with compound annual growth rates of 5-7% over the next five years, supported by demographic trends and health consciousness.

Emerging trends will likely focus on personalized nutrition, functional ingredients, and sustainable practices as consumers become more sophisticated in their product expectations. Plant-based segments are projected to achieve growth rates exceeding 20% annually as mainstream acceptance increases and product quality improvements continue.

Market consolidation may occur as smaller operators face increasing competition and operational challenges, creating opportunities for established brands to expand market share through strategic acquisitions. Franchise models will likely remain dominant due to their proven scalability and risk mitigation advantages.

Technology adoption will accelerate across all market segments, with artificial intelligence, predictive analytics, and automated systems becoming standard operational tools. Customer experience enhancement through technology will become a key competitive differentiator in saturated markets.

Regulatory developments may impact health claims and labeling requirements, requiring industry adaptation and potentially creating barriers for smaller operators. Sustainability regulations and environmental standards will likely influence packaging choices and operational practices across the industry.

The US frozen yogurt market demonstrates resilience and adaptability in an increasingly competitive dessert landscape, with sustained growth driven by health-conscious consumer trends and continuous product innovation. Market dynamics favor operators who successfully balance health positioning with indulgent experiences while adapting to seasonal demand variations and evolving consumer preferences.

Strategic success factors include authentic health benefits, superior customer experience, operational efficiency, and adaptive business models that respond to changing market conditions. Plant-based alternatives and functional formulations represent the most promising growth opportunities, while technology integration and sustainability initiatives will become increasingly important competitive differentiators.

Industry outlook remains positive despite challenges from alternative dessert categories and seasonal demand fluctuations. Market participants who invest in innovation, customer experience, and operational excellence are well-positioned to capitalize on continued growth opportunities in this dynamic and evolving market segment. The sector’s ability to adapt to changing consumer preferences while maintaining its core health positioning will determine long-term success in the competitive US dessert market.

What is Frozen Yogurt?

Frozen yogurt is a popular frozen dessert made from yogurt and sometimes other dairy products. It is often lower in fat than traditional ice cream and can be flavored in various ways, appealing to health-conscious consumers.

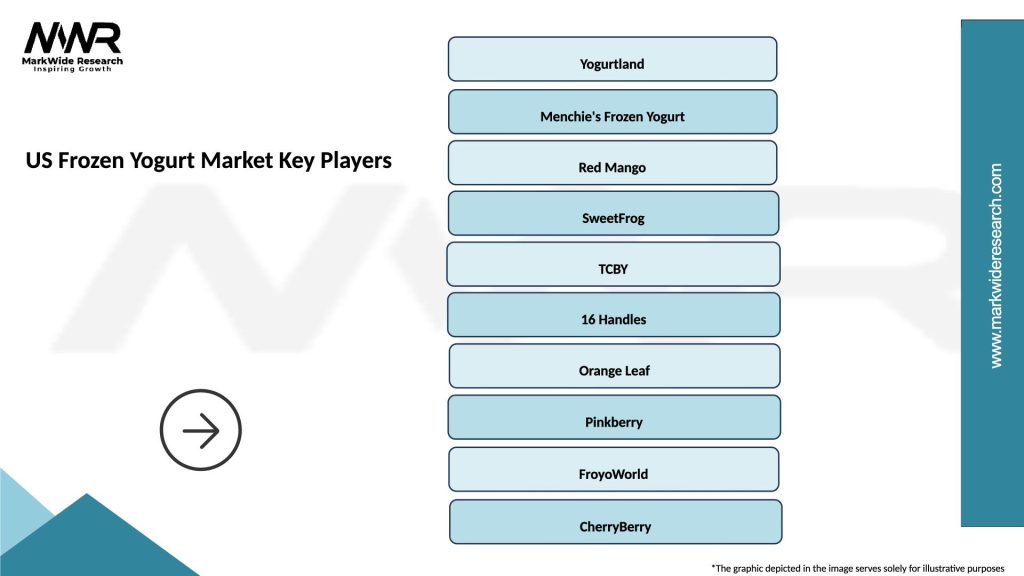

What are the key players in the US Frozen Yogurt Market?

Key players in the US Frozen Yogurt Market include companies like Pinkberry, Yogurtland, and Menchie’s, which are known for their unique flavors and customer experience. These companies compete on product variety, quality, and store ambiance, among others.

What are the growth factors driving the US Frozen Yogurt Market?

The US Frozen Yogurt Market is driven by increasing consumer demand for healthier dessert options, the popularity of customizable food experiences, and the rise of social media influencing food trends. Additionally, the growing trend of low-calorie and probiotic-rich foods contributes to market growth.

What challenges does the US Frozen Yogurt Market face?

The US Frozen Yogurt Market faces challenges such as intense competition from other frozen desserts, fluctuating dairy prices, and changing consumer preferences towards healthier options. These factors can impact profitability and market share for existing brands.

What opportunities exist in the US Frozen Yogurt Market?

Opportunities in the US Frozen Yogurt Market include expanding product lines to include dairy-free and organic options, as well as leveraging online sales and delivery services. Additionally, partnerships with health-focused brands can attract a broader customer base.

What trends are shaping the US Frozen Yogurt Market?

Trends in the US Frozen Yogurt Market include the rise of unique flavor combinations, the incorporation of superfoods, and the growth of self-serve yogurt shops. These trends reflect a shift towards personalization and health-conscious choices among consumers.

US Frozen Yogurt Market

| Segmentation Details | Description |

|---|---|

| Product Type | Regular, Low-Fat, Non-Dairy, Organic |

| Flavor Profile | Chocolate, Vanilla, Strawberry, Mango |

| Distribution Channel | Supermarkets, Specialty Stores, Online, Food Trucks |

| End User | Families, Young Adults, Health-Conscious Consumers, Students |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Frozen Yogurt Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at