444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Singapore data center water consumption market represents a critical intersection of digital infrastructure development and sustainable resource management in one of Asia’s most technologically advanced nations. As Singapore continues to establish itself as a regional hub for cloud computing, artificial intelligence, and digital services, the water consumption patterns of data centers have become increasingly significant for both environmental sustainability and operational efficiency.

Data center operators in Singapore are experiencing unprecedented demand for cooling solutions, with water consumption representing approximately 40% of total operational resource usage across major facilities. The tropical climate and high humidity levels create unique challenges for thermal management, making water-based cooling systems essential for maintaining optimal server performance and preventing equipment failures.

Government initiatives and regulatory frameworks have intensified focus on water efficiency metrics, driving innovation in cooling technologies and water recycling systems. The Singapore government’s commitment to carbon neutrality by 2050 has created additional pressure for data center operators to optimize their water consumption patterns while maintaining service reliability and performance standards.

Market dynamics indicate a growing emphasis on advanced cooling technologies, including liquid cooling systems, evaporative cooling, and hybrid approaches that combine multiple cooling methodologies. These technological advances are enabling data centers to achieve significant water efficiency improvements of up to 35% compared to traditional air-cooling systems.

The Singapore data center water consumption market refers to the comprehensive ecosystem of water usage patterns, efficiency technologies, monitoring systems, and regulatory compliance measures implemented across data center facilities throughout Singapore. This market encompasses the study of water consumption metrics, cooling system optimization, sustainability initiatives, and resource management strategies employed by data center operators to balance operational requirements with environmental responsibility.

Water consumption analysis in this context includes direct cooling water usage, indirect consumption through evaporation, water recycling and treatment processes, and the implementation of water-efficient technologies. The market also encompasses consulting services, monitoring equipment, water treatment solutions, and regulatory compliance systems that support sustainable data center operations.

Stakeholders in this market include data center operators, cooling system manufacturers, water treatment technology providers, environmental consultants, government regulatory bodies, and sustainability monitoring organizations that collectively work to optimize water usage while maintaining operational excellence.

Singapore’s data center water consumption market is experiencing rapid evolution driven by increasing digital infrastructure demands and stringent environmental regulations. The market is characterized by growing adoption of water-efficient cooling technologies, enhanced monitoring systems, and comprehensive sustainability reporting frameworks that align with Singapore’s national water security objectives.

Key market drivers include the expansion of hyperscale data centers, implementation of artificial intelligence and machine learning workloads requiring intensive cooling, and government mandates for improved water efficiency. Data centers in Singapore are achieving water usage effectiveness improvements of approximately 25% through advanced cooling system implementations and operational optimization strategies.

Technology adoption trends show increasing preference for liquid cooling solutions, closed-loop water systems, and hybrid cooling approaches that combine air and water-based methods. These technologies are enabling data centers to reduce water consumption while maintaining optimal operating temperatures for high-performance computing equipment.

Regulatory compliance requirements are driving investment in water monitoring systems, treatment technologies, and reporting mechanisms that ensure adherence to Singapore’s water conservation standards and environmental protection guidelines.

Critical insights from Singapore’s data center water consumption market reveal several transformative trends shaping the industry landscape:

Primary market drivers propelling Singapore’s data center water consumption market include the rapid expansion of digital infrastructure requirements and increasing focus on environmental sustainability. The growth of cloud computing services, artificial intelligence applications, and edge computing deployments is creating unprecedented demand for efficient cooling solutions that balance performance requirements with water conservation objectives.

Government initiatives supporting Singapore’s Smart Nation vision are driving investment in advanced data center technologies and sustainable operational practices. Regulatory frameworks requiring detailed water usage reporting and efficiency improvements are compelling data center operators to implement comprehensive water management strategies and invest in monitoring technologies.

Climate considerations unique to Singapore’s tropical environment are necessitating specialized cooling approaches that optimize water usage while maintaining equipment reliability. The consistent high temperatures and humidity levels create ongoing cooling demands that require sophisticated water management systems and efficient heat dissipation technologies.

Economic factors including rising water costs and increasing emphasis on operational efficiency are motivating data center operators to invest in water-saving technologies and optimization strategies. The potential for significant cost savings through improved water efficiency is driving adoption of advanced cooling systems and monitoring solutions.

Significant market restraints affecting Singapore’s data center water consumption market include the high capital investment requirements for advanced cooling system implementations and the technical complexity of integrating water-efficient technologies with existing infrastructure. Many data center operators face challenges in justifying the upfront costs of comprehensive cooling system upgrades despite long-term operational benefits.

Technical limitations in retrofitting existing facilities with advanced water management systems create barriers to market adoption. Legacy data center infrastructure often requires extensive modifications to accommodate modern cooling technologies, resulting in operational disruptions and substantial implementation costs.

Regulatory complexity surrounding water usage reporting and compliance requirements can create administrative burdens for data center operators, particularly smaller facilities that may lack dedicated environmental management resources. The need for specialized expertise in water management and regulatory compliance can limit market participation.

Water quality considerations in Singapore’s urban environment require sophisticated treatment systems that add complexity and cost to water-based cooling implementations. The need for consistent water quality standards to prevent equipment damage or performance degradation creates ongoing operational challenges.

Substantial market opportunities exist in Singapore’s data center water consumption market through the development of innovative cooling technologies and comprehensive water management solutions. The growing demand for hyperscale data centers and edge computing facilities creates opportunities for specialized cooling system providers and water efficiency consultants.

Technology innovation opportunities include the development of climate-specific cooling solutions optimized for Singapore’s tropical conditions, advanced water recycling systems, and integrated monitoring platforms that provide comprehensive water usage analytics. These innovations can address the unique challenges of operating data centers in high-temperature, high-humidity environments.

Service sector opportunities encompass water management consulting, regulatory compliance services, and ongoing optimization support for data center operators seeking to improve their water efficiency metrics. The complexity of water management in data center environments creates demand for specialized expertise and ongoing support services.

Partnership opportunities between cooling technology providers, water treatment companies, and data center operators can drive innovation in integrated solutions that address multiple aspects of water consumption optimization. Collaborative approaches can accelerate technology adoption and improve overall market efficiency.

Market dynamics in Singapore’s data center water consumption sector are characterized by the interplay between technological advancement, regulatory requirements, and operational efficiency demands. The market is experiencing rapid evolution as data center operators seek to balance increasing computational demands with water conservation objectives and regulatory compliance requirements.

Supply chain dynamics involve cooling system manufacturers, water treatment technology providers, monitoring equipment suppliers, and specialized service providers working together to deliver comprehensive water management solutions. The integration of these various components requires sophisticated coordination and technical expertise to ensure optimal system performance.

Competitive dynamics are driving innovation in cooling technologies and water management approaches as providers seek to differentiate their offerings through superior efficiency, reliability, and cost-effectiveness. The market is witnessing increased collaboration between technology providers and data center operators to develop customized solutions that address specific operational requirements.

Regulatory dynamics continue to shape market development through evolving water usage standards, reporting requirements, and sustainability mandates. Data center operators must navigate complex regulatory frameworks while maintaining operational efficiency and service reliability, creating ongoing demand for compliance support and monitoring solutions.

Comprehensive research methodology employed in analyzing Singapore’s data center water consumption market incorporates multiple data collection approaches and analytical frameworks to ensure accurate and actionable insights. The research methodology combines quantitative analysis of water consumption patterns with qualitative assessment of market trends, regulatory impacts, and technology adoption patterns.

Primary research activities include structured interviews with data center operators, cooling system providers, regulatory officials, and industry experts to gather firsthand insights into market dynamics, challenges, and opportunities. These interviews provide valuable perspectives on operational practices, technology preferences, and future market directions.

Secondary research components encompass analysis of government reports, industry publications, regulatory documents, and technology specifications to establish comprehensive market context and validate primary research findings. This approach ensures thorough coverage of market factors and trends affecting water consumption patterns.

Data validation processes include cross-referencing multiple information sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to identify significant trends and patterns. The methodology ensures research accuracy and reliability while providing actionable insights for market participants.

Singapore’s unique position as a city-state creates distinct regional characteristics that influence data center water consumption patterns and market dynamics. The concentration of data center facilities within a limited geographic area enables efficient resource sharing and coordinated sustainability initiatives while creating specific challenges related to water resource management and heat dissipation.

Geographic distribution of data centers across Singapore shows concentration in specific zones optimized for digital infrastructure, with approximately 65% of facilities located in designated technology parks that provide enhanced cooling infrastructure and water management capabilities. These concentrated locations enable shared resource utilization and coordinated environmental management approaches.

Climate impact analysis reveals that Singapore’s tropical conditions create consistent cooling demands throughout the year, with minimal seasonal variation in water consumption patterns. This consistency enables predictable resource planning but requires robust cooling systems capable of handling sustained high-temperature operations.

Infrastructure considerations include Singapore’s advanced water treatment and distribution systems that support data center operations, while water scarcity concerns drive emphasis on efficiency and recycling technologies. The integration of data center water management with Singapore’s broader water security strategy creates unique opportunities for innovation and collaboration.

The competitive landscape in Singapore’s data center water consumption market features a diverse ecosystem of technology providers, service companies, and specialized consultants working to address the complex challenges of water-efficient data center operations. Market participants range from global cooling system manufacturers to local water management specialists.

Key market participants include:

Competitive strategies focus on technology innovation, water efficiency optimization, and comprehensive service offerings that address the full spectrum of data center cooling requirements. Companies are investing in research and development to create solutions specifically adapted to Singapore’s climate conditions and regulatory requirements.

Market segmentation in Singapore’s data center water consumption market reflects the diverse cooling requirements and operational approaches across different facility types and applications. Segmentation enables targeted analysis of water consumption patterns and optimization opportunities across various data center configurations.

By Facility Type:

By Cooling Technology:

By Application:

Hyperscale data centers represent the largest category in terms of absolute water consumption, with these facilities typically consuming significant volumes representing approximately 45% of total market consumption. These facilities are leading adoption of advanced cooling technologies and comprehensive water recycling systems due to their scale and operational requirements.

Colocation facilities demonstrate strong potential for water efficiency optimization through shared cooling infrastructure and coordinated management approaches. These facilities are achieving water efficiency improvements of up to 30% through optimized cooling system designs and comprehensive monitoring implementations.

Enterprise data centers show varying water consumption patterns based on specific operational requirements and technology implementations. Many enterprise facilities are investing in cooling system upgrades to achieve compliance with corporate sustainability objectives and regulatory requirements.

Edge computing centers represent an emerging category with unique water consumption characteristics due to their distributed nature and smaller scale. These facilities are driving demand for compact, efficient cooling solutions that minimize water usage while maintaining reliable operations.

Technology category analysis reveals that liquid cooling systems are experiencing rapid adoption growth, with implementation rates increasing by approximately 40% annually as data center operators seek to optimize thermal management efficiency and reduce overall water consumption.

Data center operators benefit from comprehensive water consumption analysis through improved operational efficiency, reduced resource costs, and enhanced regulatory compliance capabilities. Understanding water usage patterns enables operators to optimize cooling system performance while meeting sustainability objectives and maintaining service reliability.

Technology providers gain valuable market insights that inform product development strategies and enable targeted solution offerings that address specific water consumption challenges. Market analysis helps providers identify opportunities for innovation and differentiation in cooling technologies and water management systems.

Regulatory bodies benefit from detailed water consumption data that supports policy development and enforcement activities. Comprehensive market analysis enables regulators to establish appropriate standards and incentives that promote water conservation while supporting continued digital infrastructure development.

Environmental consultants and sustainability professionals gain access to detailed consumption patterns and efficiency metrics that support client advisory services and sustainability reporting requirements. This information enables consultants to provide targeted recommendations for water consumption optimization and regulatory compliance.

Investment community benefits from market analysis that provides insights into technology adoption trends, regulatory impacts, and growth opportunities in the water management sector. This information supports investment decisions and risk assessment for data center and cooling technology investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Liquid cooling adoption represents the most significant trend in Singapore’s data center water consumption market, with facilities increasingly implementing direct-to-chip cooling and immersion cooling technologies that provide superior thermal management efficiency. This trend is driven by the need to support high-density computing workloads while optimizing water usage patterns.

Smart monitoring integration is transforming water consumption management through IoT-enabled sensors, real-time analytics, and predictive maintenance capabilities that enable proactive optimization of cooling system performance. These technologies are providing data center operators with unprecedented visibility into water usage patterns and efficiency opportunities.

Sustainability reporting enhancement is driving implementation of comprehensive water consumption tracking and documentation systems that support environmental, social, and governance reporting requirements. Data center operators are investing in detailed monitoring capabilities to demonstrate compliance with sustainability objectives and regulatory requirements.

Hybrid cooling system development combines multiple cooling technologies to optimize water usage while maintaining operational flexibility and reliability. These systems enable data centers to adapt cooling approaches based on workload requirements, environmental conditions, and water availability constraints.

Water recycling advancement includes implementation of sophisticated treatment and purification systems that enable high levels of water reuse within data center cooling operations. According to MarkWide Research analysis, advanced recycling systems are enabling water reuse rates of up to 80% in optimal configurations.

Recent industry developments in Singapore’s data center water consumption market include significant investments in advanced cooling technologies and comprehensive water management systems. Major data center operators are implementing pilot programs for immersion cooling and direct liquid cooling systems that promise substantial reductions in overall water consumption.

Regulatory developments include enhanced water usage reporting requirements and new efficiency standards that are driving investment in monitoring and optimization technologies. The Singapore government has introduced incentive programs for data centers that achieve superior water efficiency metrics and implement innovative conservation technologies.

Technology partnerships between cooling system manufacturers and data center operators are accelerating development of customized solutions that address Singapore’s specific climate conditions and operational requirements. These collaborations are resulting in innovative cooling approaches that optimize water usage while maintaining equipment reliability.

Infrastructure investments include development of shared cooling facilities and district cooling systems that enable multiple data centers to benefit from centralized, efficient water management systems. These initiatives are creating opportunities for coordinated resource optimization and enhanced operational efficiency.

Research initiatives supported by Singapore’s government and academic institutions are advancing understanding of tropical climate cooling optimization and developing new technologies specifically designed for high-temperature, high-humidity environments.

Strategic recommendations for data center operators include prioritizing investment in liquid cooling technologies and comprehensive water monitoring systems that provide detailed consumption analytics and optimization opportunities. Operators should focus on implementing scalable solutions that can adapt to changing workload requirements and regulatory standards.

Technology adoption strategies should emphasize hybrid cooling approaches that combine multiple technologies to optimize water usage while maintaining operational flexibility. Data center operators should consider phased implementation approaches that enable gradual transition to more water-efficient cooling systems without disrupting ongoing operations.

Regulatory compliance planning should include investment in comprehensive monitoring and reporting systems that exceed current requirements and provide flexibility for future regulatory changes. Operators should engage proactively with regulatory bodies to understand evolving standards and contribute to policy development processes.

Partnership development opportunities exist for collaboration between data center operators, cooling technology providers, and water management specialists to develop integrated solutions that address multiple aspects of water consumption optimization. These partnerships can accelerate technology adoption and improve overall market efficiency.

Investment priorities should focus on technologies and systems that provide measurable water efficiency improvements while supporting long-term operational objectives. Operators should evaluate total cost of ownership including water costs, energy consumption, and maintenance requirements when making technology investment decisions.

Future market development in Singapore’s data center water consumption sector will be characterized by continued technology innovation, enhanced regulatory requirements, and growing emphasis on sustainability metrics. The market is expected to experience sustained growth in demand for water-efficient cooling solutions and comprehensive monitoring systems.

Technology evolution will focus on development of climate-specific cooling solutions optimized for tropical conditions, advanced water recycling systems, and integrated monitoring platforms that provide comprehensive water usage analytics. These innovations will enable data centers to achieve water efficiency improvements of up to 50% compared to current baseline systems.

Regulatory development is expected to include more stringent water usage standards, enhanced reporting requirements, and incentive programs for facilities that achieve superior efficiency metrics. Data center operators will need to invest in advanced monitoring and optimization technologies to maintain compliance and competitive positioning.

Market expansion will be driven by continued growth in digital infrastructure requirements, increasing adoption of artificial intelligence and machine learning applications, and expansion of edge computing deployments. These trends will create sustained demand for efficient cooling solutions and water management technologies.

Innovation opportunities will emerge in areas including predictive cooling optimization, automated water management systems, and integration of renewable energy sources with cooling operations. MWR projections indicate that these innovations will enable the market to achieve comprehensive efficiency improvements exceeding 40% over the next five years.

Singapore’s data center water consumption market represents a dynamic and rapidly evolving sector that balances the growing demands of digital infrastructure with critical water conservation objectives. The market is characterized by increasing adoption of advanced cooling technologies, comprehensive monitoring systems, and innovative water management approaches that optimize resource utilization while maintaining operational excellence.

Key market drivers including regulatory requirements, sustainability objectives, and operational efficiency demands are creating sustained opportunities for technology providers, service companies, and data center operators. The unique challenges of Singapore’s tropical climate and water resource constraints are driving innovation in cooling technologies and water management systems specifically adapted to local conditions.

Future market development will be shaped by continued technology advancement, evolving regulatory frameworks, and growing emphasis on environmental sustainability. Data center operators that invest in comprehensive water management strategies and advanced cooling technologies will be best positioned to capitalize on market opportunities while meeting regulatory requirements and sustainability objectives.

The Singapore data center water consumption market offers significant potential for stakeholders who can navigate the complex interplay of technology, regulation, and operational requirements while delivering solutions that optimize water usage and support sustainable digital infrastructure development.

What is Data Center Water Consumption?

Data Center Water Consumption refers to the amount of water used by data centers for cooling and other operational processes. This includes water used in cooling towers, chillers, and other systems that manage heat generated by servers and equipment.

What are the key players in the Singapore Study Of Data Center Water Consumption Market?

Key players in the Singapore Study Of Data Center Water Consumption Market include companies like ST Telemedia, Keppel Data Centres, and Equinix, among others. These companies are involved in optimizing water usage and implementing sustainable practices in their data center operations.

What are the growth factors driving the Singapore Study Of Data Center Water Consumption Market?

The growth of the Singapore Study Of Data Center Water Consumption Market is driven by the increasing demand for data processing, the expansion of cloud services, and the need for efficient cooling solutions. Additionally, regulatory pressures for sustainability are pushing data centers to adopt water-efficient technologies.

What challenges does the Singapore Study Of Data Center Water Consumption Market face?

Challenges in the Singapore Study Of Data Center Water Consumption Market include the high cost of implementing water-efficient technologies and the potential for water scarcity in urban areas. Furthermore, balancing operational efficiency with environmental sustainability remains a significant hurdle.

What opportunities exist in the Singapore Study Of Data Center Water Consumption Market?

Opportunities in the Singapore Study Of Data Center Water Consumption Market include the development of innovative cooling technologies and the integration of recycled water systems. As companies strive for sustainability, there is a growing market for solutions that reduce water usage while maintaining performance.

What trends are shaping the Singapore Study Of Data Center Water Consumption Market?

Trends in the Singapore Study Of Data Center Water Consumption Market include the adoption of advanced cooling techniques such as liquid cooling and the use of AI for optimizing water usage. Additionally, there is a shift towards more sustainable practices, including the use of rainwater harvesting systems.

Singapore Study Of Data Center Water Consumption Market

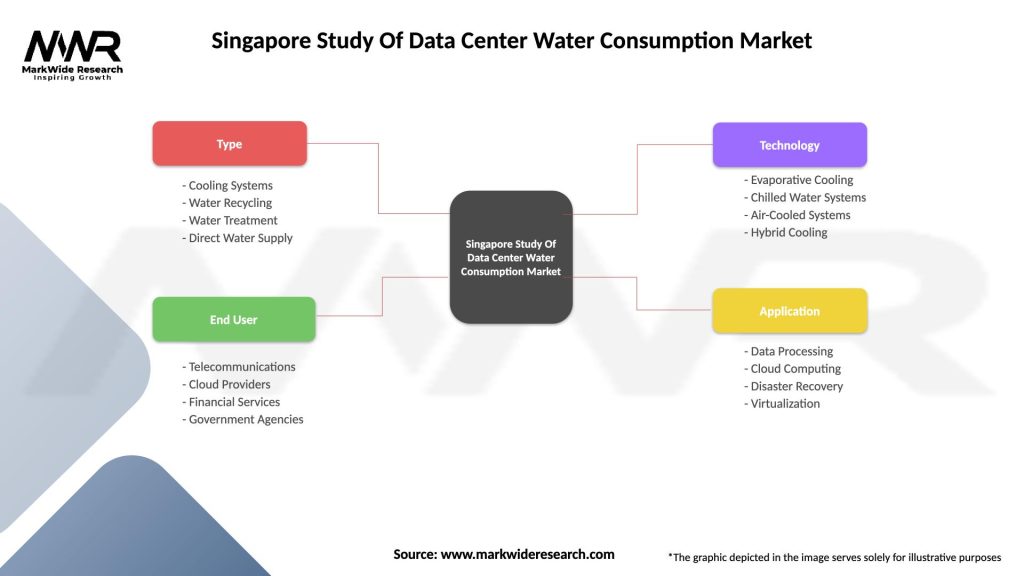

| Segmentation Details | Description |

|---|---|

| Type | Cooling Systems, Water Recycling, Water Treatment, Direct Water Supply |

| End User | Telecommunications, Cloud Providers, Financial Services, Government Agencies |

| Technology | Evaporative Cooling, Chilled Water Systems, Air-Cooled Systems, Hybrid Cooling |

| Application | Data Processing, Cloud Computing, Disaster Recovery, Virtualization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore Study Of Data Center Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at