444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea data center water consumption market represents a critical segment within the nation’s rapidly expanding digital infrastructure landscape. As one of Asia’s most technologically advanced economies, South Korea has witnessed unprecedented growth in data center facilities, driving significant attention to water usage patterns and conservation strategies. The market encompasses comprehensive studies analyzing water consumption metrics, cooling system efficiency, and sustainable water management practices across various data center operations.

Market dynamics indicate that South Korea’s data center sector is experiencing substantial growth, with water consumption studies becoming increasingly vital for operational efficiency and environmental compliance. The country’s commitment to achieving carbon neutrality by 2050 has intensified focus on resource optimization, particularly water usage in cooling systems that typically account for approximately 40-50% of total data center water consumption.

Regional positioning shows South Korea leading the Asia-Pacific region in data center water consumption research, with government initiatives supporting comprehensive studies to establish industry benchmarks. The market benefits from strong collaboration between technology companies, research institutions, and environmental agencies, creating a robust ecosystem for water consumption analysis and optimization strategies.

The South Korea data center water consumption market refers to the comprehensive study and analysis of water usage patterns, conservation technologies, and management strategies employed by data center facilities across South Korea. This market encompasses research methodologies, monitoring systems, efficiency assessments, and sustainable water management solutions specifically designed for data center operations.

Core components include water consumption measurement technologies, cooling system optimization studies, environmental impact assessments, and regulatory compliance monitoring. The market addresses the growing need for accurate water usage data to support operational decisions, environmental reporting, and sustainability initiatives within South Korea’s expanding digital infrastructure sector.

Strategic importance lies in the market’s role in supporting South Korea’s digital transformation while maintaining environmental responsibility. As data centers consume significant water resources for cooling operations, comprehensive consumption studies enable operators to implement efficient water management practices, reduce environmental impact, and comply with increasingly stringent environmental regulations.

Market expansion in South Korea’s data center water consumption studies reflects the country’s position as a regional technology hub with growing digital infrastructure demands. The market demonstrates robust growth driven by increasing data center deployments, environmental regulations, and corporate sustainability commitments across major technology companies and cloud service providers.

Key market drivers include government initiatives promoting sustainable data center operations, rising awareness of water scarcity issues, and the need for operational cost optimization. South Korea’s advanced technology sector, combined with strong environmental policies, creates favorable conditions for comprehensive water consumption studies and innovative conservation solutions.

Technological advancement plays a crucial role in market development, with sophisticated monitoring systems, IoT-enabled sensors, and AI-powered analytics enhancing water consumption tracking capabilities. These technologies enable real-time monitoring, predictive maintenance, and optimization strategies that significantly improve water usage efficiency in data center operations.

Future prospects indicate continued market growth as South Korea expands its data center capacity to support 5G networks, cloud computing, and emerging technologies. The market is expected to benefit from increased investment in sustainable infrastructure and growing demand for comprehensive environmental impact assessments.

Primary market insights reveal several critical trends shaping South Korea’s data center water consumption study market:

Environmental regulations serve as primary market drivers, with South Korea implementing stringent policies requiring data centers to monitor and report water consumption metrics. The government’s Green New Deal initiative emphasizes sustainable infrastructure development, creating mandatory requirements for comprehensive environmental impact assessments including detailed water usage studies.

Digital transformation acceleration drives increased data center capacity requirements, necessitating thorough water consumption analysis to support sustainable growth. The rapid expansion of cloud services, 5G networks, and IoT applications creates substantial demand for new data center facilities, each requiring comprehensive water usage studies for optimal design and operation.

Corporate sustainability commitments from major technology companies and cloud service providers drive demand for detailed water consumption studies. Leading organizations are setting ambitious environmental targets, including water neutrality goals and carbon reduction commitments that require precise measurement and optimization of water usage in data center operations.

Operational cost pressures motivate data center operators to invest in comprehensive water consumption studies to identify optimization opportunities. Rising utility costs and water pricing create strong economic incentives for detailed analysis of cooling system efficiency and water usage patterns to reduce operational expenses.

Technology advancement enables more sophisticated water consumption studies through IoT sensors, AI analytics, and real-time monitoring systems. These technological capabilities make comprehensive water usage analysis more accessible and cost-effective for data center operators of all sizes.

High implementation costs represent significant market restraints, particularly for smaller data center operators seeking to conduct comprehensive water consumption studies. The investment required for advanced monitoring systems, analytical software, and specialized expertise can be substantial, limiting market participation among cost-sensitive operators.

Technical complexity in water consumption measurement and analysis creates barriers for organizations lacking specialized expertise. The sophisticated nature of modern data center cooling systems requires advanced technical knowledge to conduct accurate consumption studies and implement optimization strategies effectively.

Data standardization challenges limit market growth as different monitoring systems and measurement methodologies can produce inconsistent results. The lack of standardized protocols for water consumption studies makes it difficult to compare results across different facilities or establish industry benchmarks.

Limited skilled workforce availability constrains market expansion, as comprehensive water consumption studies require specialized expertise in data center operations, environmental engineering, and analytical technologies. The shortage of qualified professionals capable of conducting detailed water usage analysis limits market growth potential.

Regulatory uncertainty regarding future environmental requirements creates hesitation among some operators to invest in comprehensive water consumption studies. Changing regulatory frameworks and evolving compliance requirements make it challenging to determine optimal investment levels for water usage analysis capabilities.

Government incentive programs create substantial opportunities for market expansion through financial support for sustainable data center initiatives. South Korea’s commitment to environmental leadership includes funding opportunities for organizations conducting comprehensive water consumption studies and implementing conservation technologies.

International expansion opportunities emerge as South Korean companies develop expertise in data center water consumption studies that can be exported to other markets. The country’s advanced technological capabilities and environmental focus position local companies to serve growing global demand for water usage analysis services.

Technology innovation presents opportunities for developing next-generation water consumption monitoring and analysis solutions. Advances in AI, machine learning, and IoT technologies enable more sophisticated and cost-effective approaches to water usage studies in data center environments.

Partnership development with international technology companies and cloud service providers creates opportunities for expanding market reach and capabilities. Collaborative relationships can provide access to larger data center facilities and more comprehensive water consumption study requirements.

Emerging market segments including edge computing facilities and specialized data centers create new opportunities for water consumption studies. These growing segments require tailored approaches to water usage analysis that differ from traditional large-scale data center operations.

Supply-demand dynamics in South Korea’s data center water consumption study market reflect strong demand growth outpacing current supply capabilities. The rapid expansion of data center facilities creates increasing requirements for comprehensive water usage analysis, while the limited number of specialized service providers creates supply constraints that drive market opportunities.

Competitive dynamics show increasing participation from technology companies, environmental consulting firms, and research institutions. The market benefits from diverse expertise sources, including engineering firms specializing in data center design, environmental consultancies focusing on sustainability assessments, and technology companies developing monitoring solutions.

Innovation dynamics drive continuous advancement in water consumption measurement and analysis methodologies. The integration of artificial intelligence, machine learning, and advanced sensor technologies enables more accurate and comprehensive water usage studies, improving the value proposition for data center operators.

Regulatory dynamics influence market development through evolving environmental requirements and compliance standards. Government policies promoting sustainable data center operations create both opportunities and challenges, requiring market participants to adapt to changing regulatory frameworks while maintaining service quality.

Economic dynamics reflect the growing importance of operational efficiency and cost optimization in data center operations. Rising utility costs and environmental compliance expenses create strong economic incentives for comprehensive water consumption studies that can identify optimization opportunities and reduce operational costs.

Data collection methodologies employed in South Korea’s data center water consumption studies utilize multiple approaches to ensure comprehensive and accurate analysis. Primary data collection involves direct measurement through advanced metering systems, IoT sensors, and real-time monitoring technologies installed throughout data center facilities to capture detailed water usage patterns.

Analytical frameworks incorporate both quantitative and qualitative research methods to provide comprehensive insights into water consumption patterns. Statistical analysis of consumption data is combined with operational assessments, efficiency evaluations, and comparative studies to identify optimization opportunities and establish performance benchmarks.

Technology integration plays a crucial role in research methodology, with advanced monitoring systems enabling continuous data collection and analysis. Machine learning algorithms and AI-powered analytics process large datasets to identify consumption patterns, predict usage trends, and recommend optimization strategies for improved water efficiency.

Validation processes ensure research accuracy through multiple verification methods, including cross-referencing with utility records, independent measurement verification, and peer review of analytical methodologies. These validation approaches maintain research credibility and support reliable decision-making based on study results.

Reporting standards follow established protocols for environmental impact assessment and sustainability reporting, ensuring consistency and comparability across different studies. Standardized reporting formats facilitate benchmarking, regulatory compliance, and industry-wide performance comparisons.

Seoul Metropolitan Area dominates South Korea’s data center water consumption study market, accounting for approximately 60% of market activity due to the concentration of major data center facilities and technology companies. The region benefits from advanced infrastructure, skilled workforce availability, and proximity to major cloud service providers and technology corporations requiring comprehensive water usage analysis.

Busan region represents a growing market segment with approximately 15% market share, driven by increasing data center investments and government initiatives promoting the area as a technology hub. The region’s strategic location and developing digital infrastructure create opportunities for comprehensive water consumption studies supporting sustainable data center growth.

Incheon Free Economic Zone accounts for roughly 12% of market activity, benefiting from international data center investments and favorable regulatory conditions. The zone’s focus on sustainable development and environmental compliance creates strong demand for detailed water consumption studies and optimization strategies.

Daegu and surrounding areas contribute approximately 8% to market development, with growing data center facilities supporting regional digital transformation initiatives. The area’s emphasis on technology innovation and environmental sustainability drives demand for comprehensive water usage analysis and conservation strategies.

Other regional markets collectively represent the remaining 5% of market activity, including emerging data center locations and specialized facilities requiring tailored water consumption studies. These markets benefit from government support for distributed digital infrastructure development and regional economic diversification initiatives.

Market leadership in South Korea’s data center water consumption study sector includes diverse participants ranging from specialized environmental consulting firms to technology companies and research institutions. The competitive landscape reflects the multidisciplinary nature of comprehensive water usage analysis requiring expertise in engineering, environmental science, and data analytics.

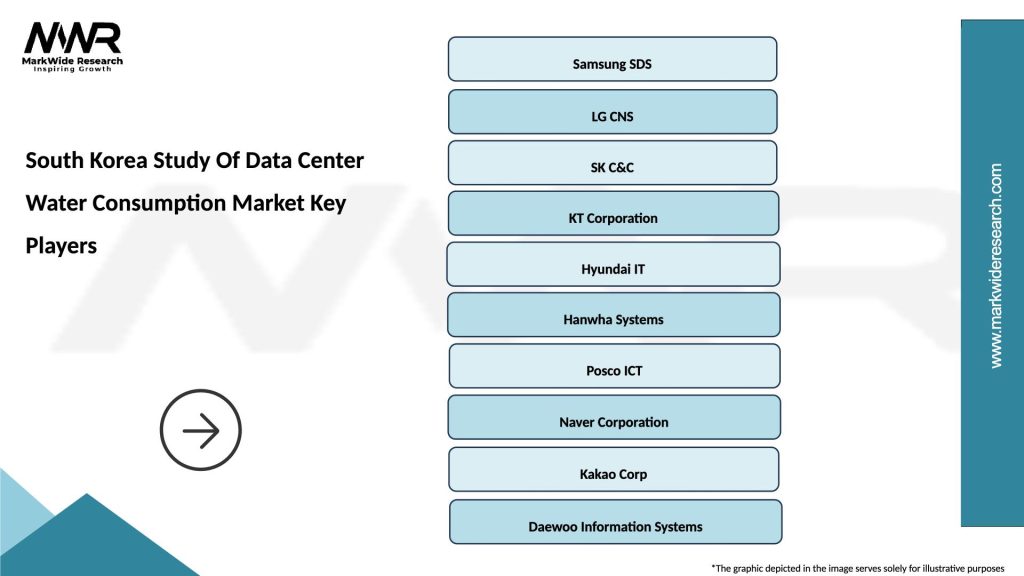

Key market participants include:

Competitive strategies focus on technology innovation, comprehensive service offerings, and strategic partnerships to enhance market position. Leading companies invest in advanced monitoring technologies, AI-powered analytics, and specialized expertise to provide superior water consumption analysis capabilities.

By facility type, the market segments into several distinct categories:

By study scope, market segmentation includes:

By technology approach, the market divides into:

Hyperscale data center studies represent the largest market category, driven by massive water consumption requirements and stringent environmental compliance needs. These facilities typically consume substantial water resources for cooling operations, making comprehensive consumption studies essential for operational efficiency and regulatory compliance. Advanced monitoring systems and sophisticated analytics are standard requirements for this category.

Enterprise data center analysis focuses on operational optimization and cost reduction opportunities, with companies seeking detailed water consumption studies to improve facility efficiency. This category benefits from growing corporate sustainability commitments and increasing awareness of environmental impact, driving demand for comprehensive water usage analysis and optimization strategies.

Colocation facility studies address unique requirements for multi-tenant environments where water consumption must be accurately measured and allocated among different customers. These studies require sophisticated metering systems and detailed analysis capabilities to support accurate billing, tenant reporting, and facility management decisions.

Edge computing water analysis represents an emerging category with specialized requirements for smaller, distributed facilities. These studies must account for different operational patterns, varying cooling requirements, and unique environmental conditions that differ significantly from traditional large-scale data center operations.

Cloud service provider assessments encompass comprehensive water consumption studies across multiple facilities, requiring standardized methodologies and consistent reporting frameworks. This category drives innovation in monitoring technologies and analytical approaches due to the scale and complexity of multi-facility water usage analysis requirements.

Data center operators benefit significantly from comprehensive water consumption studies through improved operational efficiency, reduced utility costs, and enhanced environmental compliance. Detailed analysis enables operators to identify optimization opportunities, implement conservation strategies, and demonstrate environmental responsibility to stakeholders and regulatory authorities.

Technology companies gain competitive advantages through water consumption studies that support sustainable operations and corporate environmental commitments. These studies provide essential data for environmental reporting, sustainability initiatives, and operational optimization that can reduce costs while improving environmental performance.

Government agencies benefit from comprehensive water consumption data that supports policy development, regulatory enforcement, and environmental monitoring. Detailed studies provide essential information for assessing the environmental impact of data center growth and developing appropriate regulatory frameworks for sustainable digital infrastructure development.

Environmental consultants and service providers gain market opportunities through growing demand for specialized water consumption analysis services. The expanding market creates opportunities for developing expertise, innovative methodologies, and technology solutions that address the unique requirements of data center water usage studies.

Research institutions benefit from collaboration opportunities and access to real-world data that supports academic research and technology development. Water consumption studies provide valuable datasets for advancing understanding of data center environmental impact and developing next-generation optimization technologies.

Utility companies gain insights into data center water consumption patterns that support infrastructure planning, demand forecasting, and service optimization. Comprehensive consumption studies help utilities better understand and serve the growing data center market while supporting sustainable resource management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Real-time monitoring integration represents a dominant trend in South Korea’s data center water consumption study market, with organizations increasingly adopting IoT-enabled sensors and continuous monitoring systems. This trend enables immediate identification of consumption anomalies, predictive maintenance opportunities, and real-time optimization of water usage patterns across data center operations.

AI-powered analytics adoption is transforming water consumption studies through machine learning algorithms that identify complex patterns and optimization opportunities. These advanced analytical capabilities enable more accurate consumption forecasting, automated anomaly detection, and sophisticated optimization recommendations that significantly improve water usage efficiency.

Sustainability reporting standardization drives market development as organizations seek consistent methodologies for environmental impact assessment and regulatory compliance. This trend promotes the development of standardized protocols, measurement techniques, and reporting frameworks that facilitate industry-wide benchmarking and performance comparison.

Integrated facility management approaches combine water consumption studies with broader data center optimization initiatives, creating comprehensive efficiency programs. This trend reflects growing recognition that water usage optimization must be integrated with overall facility management strategies to achieve maximum operational and environmental benefits.

Predictive maintenance integration incorporates water consumption analysis into proactive maintenance programs, enabling early identification of system inefficiencies and potential equipment failures. This trend reduces operational costs while improving water usage efficiency through optimized cooling system performance and reduced waste.

Cloud-based analysis platforms enable more accessible and cost-effective water consumption studies through software-as-a-service solutions. This trend democratizes access to sophisticated analytical capabilities, allowing smaller data center operators to conduct comprehensive water usage studies without significant upfront technology investments.

Government policy initiatives have significantly shaped market development through the introduction of comprehensive environmental regulations requiring detailed water consumption reporting from data center operators. Recent policy developments include mandatory environmental impact assessments and water usage optimization requirements that drive demand for professional consumption studies.

Technology partnerships between major data center operators and monitoring technology providers have accelerated the development of advanced water consumption analysis capabilities. These collaborations result in innovative monitoring solutions, improved analytical methodologies, and more cost-effective approaches to comprehensive water usage studies.

Research institution collaboration has produced significant advances in water consumption measurement and analysis techniques. MarkWide Research indicates that academic partnerships with industry leaders have resulted in breakthrough technologies for real-time monitoring and predictive analytics that enhance study accuracy and value.

International standard development efforts have progressed toward establishing global benchmarks for data center water consumption measurement and reporting. South Korean organizations actively participate in these standardization initiatives, contributing expertise and best practices developed through extensive domestic market experience.

Investment in monitoring infrastructure has increased substantially as data center operators recognize the value of comprehensive water consumption studies. Major facility expansions now routinely include advanced monitoring systems and analytical capabilities as standard infrastructure components rather than optional additions.

Regulatory compliance automation developments have streamlined the process of conducting water consumption studies for environmental reporting requirements. Automated data collection, analysis, and reporting systems reduce the administrative burden while improving accuracy and consistency of compliance documentation.

Investment prioritization should focus on advanced monitoring technologies and analytical capabilities that provide comprehensive water consumption insights while supporting operational optimization. Organizations should evaluate integrated solutions that combine real-time monitoring, predictive analytics, and automated reporting to maximize return on investment in water consumption studies.

Partnership development with specialized service providers and technology companies can enhance water consumption study capabilities while reducing implementation costs. Strategic collaborations enable access to advanced expertise and technologies without requiring substantial internal investment in specialized capabilities.

Standardization adoption is recommended to ensure consistency and comparability of water consumption studies across different facilities and time periods. Organizations should implement standardized measurement protocols, reporting frameworks, and analytical methodologies to support effective benchmarking and performance tracking.

Technology integration strategies should emphasize solutions that combine water consumption analysis with broader facility management and optimization initiatives. Integrated approaches provide greater value through comprehensive efficiency improvements and coordinated optimization strategies across multiple operational areas.

Regulatory preparation requires proactive investment in water consumption study capabilities to ensure compliance with evolving environmental requirements. Organizations should anticipate future regulatory developments and implement comprehensive monitoring and analysis systems that exceed current compliance requirements.

Workforce development initiatives should address the shortage of skilled professionals capable of conducting sophisticated water consumption studies. Investment in training programs, certification development, and knowledge transfer can help build the specialized expertise required for market growth and service quality improvement.

Market growth prospects remain highly positive for South Korea’s data center water consumption study market, driven by continued expansion of digital infrastructure and strengthening environmental regulations. The market is expected to experience robust growth as data center capacity increases to support 5G networks, cloud computing expansion, and emerging technologies requiring substantial computational resources.

Technology evolution will significantly enhance water consumption study capabilities through advances in IoT sensors, AI analytics, and automated monitoring systems. Future developments are expected to provide more accurate, comprehensive, and cost-effective approaches to water usage analysis, making sophisticated studies accessible to a broader range of data center operators.

Regulatory development is anticipated to strengthen requirements for water consumption monitoring and reporting, creating additional market demand for comprehensive studies. Government initiatives supporting environmental sustainability and resource conservation will likely expand mandatory reporting requirements and establish more stringent efficiency standards.

International expansion opportunities are expected to grow as South Korean expertise in data center water consumption studies gains recognition in global markets. The country’s advanced technological capabilities and comprehensive regulatory framework position local companies to serve increasing international demand for water usage analysis services.

Innovation acceleration will drive development of next-generation monitoring and analysis technologies that provide unprecedented insights into data center water consumption patterns. MWR analysis suggests that emerging technologies including quantum computing applications and advanced machine learning will revolutionize water usage optimization capabilities.

Market consolidation may occur as successful service providers expand capabilities and market reach through strategic acquisitions and partnerships. This consolidation could result in more comprehensive service offerings and improved economies of scale that benefit data center operators seeking water consumption study services.

South Korea’s data center water consumption study market represents a dynamic and rapidly evolving sector that plays a crucial role in supporting sustainable digital infrastructure development. The market benefits from strong government support, advanced technology capabilities, and growing awareness of environmental responsibility among data center operators and technology companies.

Market fundamentals remain strong, with increasing demand driven by data center expansion, regulatory requirements, and corporate sustainability commitments. The combination of technological innovation, regulatory support, and industry expertise creates favorable conditions for continued market growth and development of advanced water consumption analysis capabilities.

Future success in this market will depend on continued investment in technology innovation, workforce development, and standardization initiatives that enhance study quality and accessibility. Organizations that embrace comprehensive water consumption analysis as a strategic capability will be best positioned to capitalize on growing market opportunities while contributing to sustainable data center operations in South Korea’s digital economy.

What is Data Center Water Consumption?

Data Center Water Consumption refers to the amount of water used by data centers for cooling and other operational processes. This includes water used in cooling towers, chillers, and other systems that manage heat generated by servers and equipment.

What are the key companies in the South Korea Study Of Data Center Water Consumption Market?

Key companies in the South Korea Study Of Data Center Water Consumption Market include Samsung SDS, SK Telecom, and LG CNS, among others.

What are the growth factors driving the South Korea Study Of Data Center Water Consumption Market?

The growth of the South Korea Study Of Data Center Water Consumption Market is driven by the increasing demand for cloud services, the expansion of data centers, and the need for efficient cooling solutions to manage rising temperatures in IT infrastructure.

What challenges does the South Korea Study Of Data Center Water Consumption Market face?

Challenges in the South Korea Study Of Data Center Water Consumption Market include regulatory pressures regarding water usage, the high cost of water treatment technologies, and the environmental impact of water consumption in data center operations.

What opportunities exist in the South Korea Study Of Data Center Water Consumption Market?

Opportunities in the South Korea Study Of Data Center Water Consumption Market include the development of innovative cooling technologies, the adoption of water recycling systems, and the increasing focus on sustainability practices among data center operators.

What trends are shaping the South Korea Study Of Data Center Water Consumption Market?

Trends in the South Korea Study Of Data Center Water Consumption Market include the integration of AI for optimizing water usage, the shift towards hybrid cooling solutions, and the growing emphasis on ESG (Environmental, Social, and Governance) criteria in data center management.

South Korea Study Of Data Center Water Consumption Market

| Segmentation Details | Description |

|---|---|

| Type | Cooling Systems, Water Recycling, Water Treatment, Direct Water Supply |

| End User | Telecommunications, Cloud Providers, Financial Institutions, Government Agencies |

| Technology | Evaporative Cooling, Chilled Water Systems, Air-Cooled Systems, Hybrid Cooling |

| Application | Data Processing, Cloud Computing, Disaster Recovery, High-Performance Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Study Of Data Center Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at