444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Morocco automotive industry market represents one of Africa’s most dynamic and rapidly evolving automotive manufacturing hubs. Strategic positioning between Europe and Africa has transformed Morocco into a critical automotive production center, attracting major international manufacturers and suppliers. The country’s automotive sector has experienced remarkable growth with production volumes increasing by 12.5% annually over recent years, establishing Morocco as the continent’s leading automotive exporter.

Manufacturing excellence defines Morocco’s automotive landscape, with world-class facilities producing vehicles for both domestic consumption and international export markets. The industry encompasses vehicle assembly, automotive components manufacturing, and supporting services, creating a comprehensive automotive ecosystem. Government initiatives and strategic investments have positioned Morocco as a preferred destination for automotive manufacturers seeking cost-effective production capabilities with proximity to European markets.

Export performance demonstrates the industry’s global competitiveness, with 85% of production destined for international markets, primarily Europe. This export-oriented approach has driven continuous improvements in quality standards, technological capabilities, and operational efficiency throughout the Moroccan automotive supply chain.

The Morocco automotive industry market refers to the comprehensive ecosystem of vehicle manufacturing, automotive component production, and related services operating within Morocco’s borders. This market encompasses original equipment manufacturers, tier-one suppliers, component manufacturers, and supporting industries that collectively contribute to Morocco’s position as a leading automotive production hub in Africa and the Mediterranean region.

Industrial transformation characterizes this market, representing Morocco’s evolution from a traditional economy to a modern manufacturing powerhouse. The automotive industry serves as a catalyst for economic diversification, technology transfer, and skills development, creating employment opportunities and fostering industrial expertise across multiple sectors.

Strategic importance defines Morocco’s automotive industry as a cornerstone of the country’s economic development strategy. The sector has attracted substantial foreign direct investment, established world-class manufacturing facilities, and created extensive supply chain networks that support both domestic and international automotive production requirements.

Production capabilities have expanded significantly, with Morocco now ranking among the top automotive manufacturing countries in Africa. The industry benefits from competitive labor costs, strategic geographic location, and comprehensive government support through industrial policies and infrastructure development initiatives.

Market dynamics indicate continued growth potential, driven by increasing demand for vehicles in African markets, ongoing expansion of manufacturing capacity, and Morocco’s integration into global automotive supply chains. The industry’s focus on quality improvement and technological advancement positions it for sustained competitiveness in international markets.

Manufacturing excellence drives Morocco’s automotive industry success, with several key insights highlighting the market’s distinctive characteristics:

Economic diversification serves as a primary driver for Morocco’s automotive industry development, with the government actively promoting manufacturing as a key pillar of economic growth. This strategic focus has resulted in comprehensive support mechanisms, including industrial zones, tax incentives, and infrastructure development that collectively enhance the sector’s competitiveness.

Cost competitiveness represents another significant driver, with Morocco offering attractive labor costs compared to European manufacturing locations while maintaining quality standards. The country’s competitive cost structure, combined with proximity to major markets, creates compelling value propositions for international automotive manufacturers seeking efficient production alternatives.

Free trade agreements provide crucial market access advantages, enabling Moroccan automotive manufacturers to export products with preferential terms to multiple regions. These agreements facilitate integration into global supply chains and support the industry’s export-oriented growth strategy.

Infrastructure development continues driving industry expansion, with ongoing investments in transportation networks, port facilities, and industrial infrastructure. Modern logistics capabilities ensure efficient movement of raw materials, components, and finished products, supporting the industry’s operational efficiency and competitiveness.

Skills shortage presents ongoing challenges for Morocco’s automotive industry, particularly in specialized technical areas requiring advanced manufacturing expertise. While training programs exist, the rapid pace of industry growth sometimes outpaces workforce development initiatives, creating temporary capacity constraints.

Supply chain dependencies create vulnerabilities, as many critical components and raw materials must be imported from international suppliers. These dependencies can result in supply disruptions, cost fluctuations, and logistical challenges that impact production schedules and operational efficiency.

Technology gaps in certain advanced manufacturing areas require continued investment and knowledge transfer to maintain competitiveness with established automotive manufacturing regions. Bridging these gaps demands ongoing collaboration with international partners and sustained investment in research and development capabilities.

Market concentration risks arise from heavy dependence on a limited number of major manufacturers and export markets. This concentration creates potential vulnerabilities to changes in global automotive demand patterns or shifts in manufacturer production strategies.

African market expansion presents substantial opportunities for Morocco’s automotive industry, as growing economies across the continent increase demand for vehicles and automotive components. Morocco’s established manufacturing capabilities position it advantageously to serve these emerging markets with cost-effective, quality products.

Electric vehicle transition offers opportunities for Morocco to establish leadership in next-generation automotive technologies. The country’s renewable energy resources and strategic positioning could support development of electric vehicle manufacturing capabilities and associated supply chains.

Value chain integration opportunities exist for developing more sophisticated automotive components and systems within Morocco. Moving up the value chain through advanced manufacturing capabilities could increase profitability and strengthen the industry’s competitive position.

Regional hub development potential allows Morocco to serve as a comprehensive automotive manufacturing and distribution center for the broader North African and West African regions. This expansion could leverage existing infrastructure and expertise to capture additional market opportunities.

Competitive positioning within Morocco’s automotive industry reflects dynamic interactions between global manufacturers, local suppliers, and government policies. The market demonstrates strong momentum driven by continuous capacity expansion, technology upgrades, and supply chain optimization initiatives that enhance overall competitiveness.

Investment flows continue supporting industry growth, with both foreign direct investment and domestic capital contributing to facility expansion, technology advancement, and workforce development. These investments demonstrate confidence in Morocco’s long-term potential as an automotive manufacturing hub.

Quality improvements represent ongoing market dynamics, with manufacturers implementing advanced quality management systems and achieving international certifications. These efforts support the industry’s reputation for reliability and help secure long-term contracts with global automotive brands.

Innovation adoption characterizes the industry’s evolution, with increasing integration of digital technologies, automation systems, and sustainable manufacturing practices. According to MarkWide Research analysis, these technological advances contribute to 15% productivity improvements across major manufacturing facilities.

Comprehensive analysis of Morocco’s automotive industry market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry executives, government officials, and key stakeholders throughout the automotive value chain.

Data collection encompasses both quantitative and qualitative research approaches, incorporating production statistics, trade data, investment figures, and market performance indicators. Secondary research draws from government publications, industry reports, and international trade organizations to provide comprehensive market context.

Market validation processes ensure data accuracy through cross-referencing multiple sources and conducting follow-up interviews with key market participants. This rigorous approach provides reliable foundations for market analysis and strategic recommendations.

Analytical frameworks apply established industry analysis methodologies, including value chain analysis, competitive positioning assessment, and market dynamics evaluation. These frameworks enable systematic examination of market forces and identification of key trends shaping industry development.

Casablanca-Settat region dominates Morocco’s automotive manufacturing landscape, hosting major production facilities and supporting infrastructure. This region benefits from proximity to ports, established industrial zones, and comprehensive logistics networks that facilitate efficient operations and export activities.

Tangier-Tetouan-Al Hoceima region represents the fastest-growing automotive manufacturing area, with 40% of total production capacity located in this northern region. Strategic proximity to Europe and modern port facilities make this region particularly attractive for export-oriented manufacturing operations.

Rabat-Salé-Kénitra region contributes significantly to automotive component manufacturing and research activities. Government presence and educational institutions in this region support policy development and workforce training initiatives that benefit the broader automotive industry.

Regional distribution of automotive activities reflects strategic considerations including logistics efficiency, labor availability, and infrastructure quality. MWR data indicates that 75% of automotive exports originate from coastal regions, highlighting the importance of port access for international market reach.

International manufacturers dominate Morocco’s automotive industry landscape, bringing global expertise, advanced technologies, and established market relationships. The competitive environment reflects a mix of established automotive giants and emerging players seeking to capitalize on Morocco’s strategic advantages.

Major players in Morocco’s automotive market include:

Competitive strategies focus on cost optimization, quality enhancement, and supply chain efficiency. Companies leverage Morocco’s strategic location and competitive advantages to serve both regional and global markets effectively.

By Vehicle Type:

By Manufacturing Activity:

By Market Destination:

Passenger vehicle manufacturing represents the cornerstone of Morocco’s automotive industry, with established production lines serving both domestic and international markets. This category benefits from economies of scale, established supply chains, and strong export performance that drives continued investment and expansion.

Automotive components sector demonstrates remarkable growth potential, with increasing sophistication in manufacturing capabilities and product offerings. Component manufacturers serve both local assembly operations and international customers, creating diversified revenue streams and reducing market concentration risks.

Wire harness production has emerged as a particular strength for Morocco’s automotive industry, with the country becoming a major global supplier in this specialized segment. Advanced manufacturing capabilities and cost competitiveness have established Morocco as a preferred sourcing destination for major automotive manufacturers worldwide.

Commercial vehicle segment shows promising development prospects, driven by growing demand for transportation solutions across African markets. This segment offers opportunities for market diversification and reduced dependence on passenger car production.

Manufacturers benefit from Morocco’s competitive cost structure, strategic location, and comprehensive government support. Access to skilled workforce, modern infrastructure, and preferential trade agreements creates compelling value propositions for automotive production operations.

Suppliers gain access to growing automotive market with opportunities for long-term partnerships and capacity expansion. The industry’s growth trajectory provides sustainable business opportunities and potential for value chain integration.

Government stakeholders realize economic diversification objectives through job creation, export revenue generation, and technology transfer. The automotive industry contributes significantly to Morocco’s industrial development and economic modernization goals.

Local communities benefit from employment opportunities, skills development programs, and economic activity generated by automotive manufacturing operations. The industry’s growth supports broader socioeconomic development in manufacturing regions.

International partners access cost-effective manufacturing capabilities with quality standards meeting global requirements. Morocco’s automotive industry provides reliable production alternatives with strategic market access advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization adoption represents a major trend transforming Morocco’s automotive industry, with manufacturers implementing advanced digital technologies to enhance operational efficiency and product quality. Industry 4.0 principles are increasingly integrated into production processes, creating smarter, more responsive manufacturing operations.

Sustainability initiatives gain prominence as automotive manufacturers prioritize environmental responsibility and resource efficiency. These efforts include energy optimization, waste reduction, and sustainable supply chain practices that align with global automotive industry trends.

Local content development emerges as a strategic priority, with efforts to increase domestic value-added content in automotive production. This trend supports economic development objectives while reducing supply chain dependencies and enhancing competitiveness.

Skills development programs expand to address workforce requirements for advanced manufacturing technologies. Collaboration between industry, government, and educational institutions creates comprehensive training initiatives supporting long-term industry growth.

Supply chain optimization continues as manufacturers seek greater efficiency and resilience in their operations. These efforts include supplier development, logistics improvements, and risk management strategies that enhance overall competitiveness.

Capacity expansion projects demonstrate continued confidence in Morocco’s automotive industry potential, with major manufacturers announcing significant investments in new facilities and production line upgrades. These developments reflect long-term commitment to Morocco as a strategic manufacturing location.

Technology partnerships between international companies and Moroccan institutions foster knowledge transfer and capability development. These collaborations support the industry’s evolution toward more sophisticated manufacturing processes and product offerings.

Infrastructure improvements continue enhancing the industry’s operational environment, with investments in transportation networks, port facilities, and industrial zones. These developments strengthen Morocco’s competitive position and support continued industry growth.

Regulatory developments create supportive frameworks for automotive industry operations, including streamlined procedures, investment incentives, and quality standards alignment with international requirements. These regulatory improvements enhance the business environment for automotive manufacturers.

Strategic positioning recommendations emphasize the importance of continued investment in advanced manufacturing capabilities and workforce development. Morocco should leverage its current advantages while building capabilities for next-generation automotive technologies to maintain long-term competitiveness.

Market diversification strategies should focus on expanding presence in African markets while maintaining strong European relationships. This approach reduces concentration risks and capitalizes on growing demand in emerging markets across the continent.

Value chain enhancement initiatives should prioritize development of higher-value manufacturing activities and increased local content. Moving up the value chain strengthens the industry’s competitive position and increases profitability potential.

Innovation investment in research and development capabilities supports long-term industry sustainability. Collaboration with international partners and educational institutions can accelerate technology transfer and capability development.

Supply chain resilience improvements should address current dependencies through supplier development and alternative sourcing strategies. Building more robust supply chains enhances operational stability and reduces vulnerability to external disruptions.

Growth trajectory for Morocco’s automotive industry remains positive, with continued expansion expected across multiple segments and markets. The industry’s strong fundamentals, government support, and strategic positioning create favorable conditions for sustained development over the coming years.

Technology evolution will drive significant changes in manufacturing processes and product offerings, with increasing integration of digital technologies, automation, and sustainable practices. Morocco’s ability to adapt to these changes will determine its long-term competitiveness in global automotive markets.

Market expansion opportunities in African and Middle Eastern regions present substantial growth potential for Moroccan automotive manufacturers. MarkWide Research projections indicate that regional market penetration could increase by 25% over the next five years, driven by economic growth and increasing vehicle demand.

Investment continuation from international manufacturers demonstrates confidence in Morocco’s automotive industry future. Ongoing capacity expansion, technology upgrades, and supply chain development support optimistic growth projections and market leadership potential.

Competitive positioning improvements through continued focus on quality, efficiency, and innovation will strengthen Morocco’s position as a preferred automotive manufacturing destination. The industry’s evolution toward higher-value activities and advanced technologies supports long-term sustainability and growth prospects.

Morocco’s automotive industry market represents a remarkable success story of strategic economic development and industrial transformation. The sector’s evolution from modest beginnings to becoming Africa’s leading automotive manufacturing hub demonstrates the power of coordinated government policy, international investment, and strategic positioning.

Sustained growth potential characterizes the industry’s future prospects, supported by strong fundamentals including competitive costs, strategic location, quality capabilities, and comprehensive government support. The sector’s export orientation and integration into global supply chains provide solid foundations for continued expansion and development.

Strategic advantages position Morocco favorably for capitalizing on emerging opportunities in electric vehicles, African market expansion, and value chain integration. The industry’s ability to adapt to changing global automotive trends while maintaining its competitive strengths will determine long-term success and market leadership potential in the evolving automotive landscape.

What is Morocco Automotive?

Morocco Automotive refers to the sector involved in the manufacturing, assembly, and distribution of vehicles and automotive components within Morocco. This includes passenger cars, commercial vehicles, and automotive parts, contributing significantly to the country’s economy.

What are the key players in the Morocco Automotive Industry Market?

Key players in the Morocco Automotive Industry Market include Renault, Peugeot, and Volkswagen, which have established manufacturing plants in the country. These companies are pivotal in driving local production and employment, among others.

What are the growth factors for the Morocco Automotive Industry Market?

The growth of the Morocco Automotive Industry Market is driven by factors such as government incentives for foreign investment, a strategic geographic location for exports, and a growing domestic market for vehicles. Additionally, the development of local supply chains enhances competitiveness.

What challenges does the Morocco Automotive Industry Market face?

The Morocco Automotive Industry Market faces challenges such as fluctuating global demand, competition from other emerging markets, and the need for skilled labor. These factors can impact production efficiency and market stability.

What opportunities exist in the Morocco Automotive Industry Market?

Opportunities in the Morocco Automotive Industry Market include the potential for electric vehicle production, expansion of local manufacturing capabilities, and increased investment in research and development. These factors can position Morocco as a key player in the automotive sector.

What trends are shaping the Morocco Automotive Industry Market?

Trends shaping the Morocco Automotive Industry Market include the shift towards electric and hybrid vehicles, advancements in automotive technology, and a focus on sustainability. These trends are influencing consumer preferences and manufacturing practices.

Morocco Automotive Industry Market

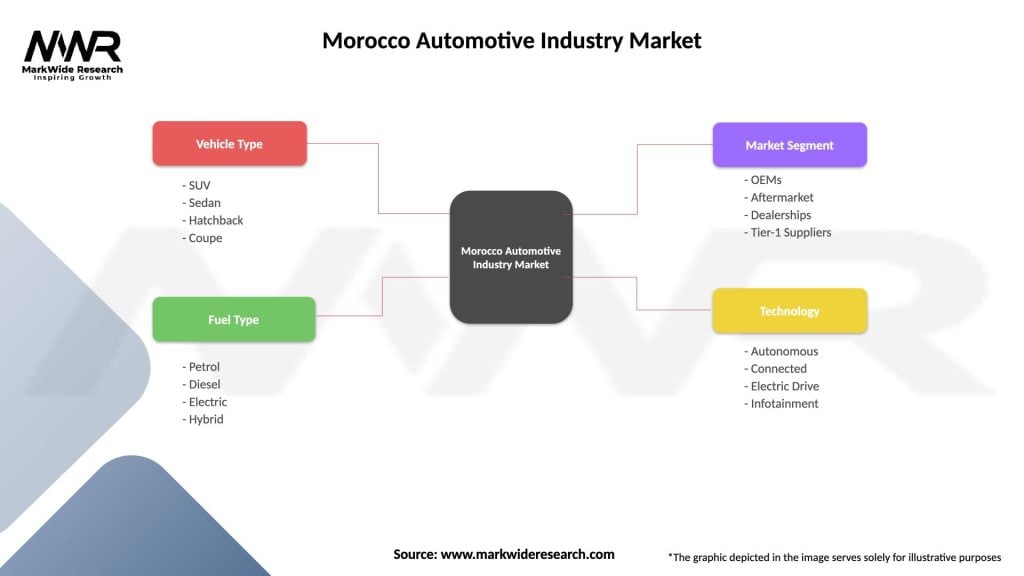

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Market Segment | OEMs, Aftermarket, Dealerships, Tier-1 Suppliers |

| Technology | Autonomous, Connected, Electric Drive, Infotainment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Morocco Automotive Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at