444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK HVDC transmission systems market represents a transformative segment within the nation’s electrical infrastructure landscape, driven by the urgent need for efficient long-distance power transmission and renewable energy integration. High Voltage Direct Current (HVDC) technology has emerged as a critical enabler for the UK’s ambitious net-zero carbon emissions targets, facilitating the transmission of electricity across vast distances with minimal power losses. The market encompasses various HVDC technologies, including voltage source converters, line commutated converters, and hybrid systems designed to enhance grid stability and interconnectivity.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of approximately 8.2% as utilities and grid operators increasingly recognize the superior efficiency of HVDC systems over traditional alternating current transmission. The technology’s ability to transmit power over distances exceeding 600 kilometers with efficiency rates of up to 97% has positioned it as an indispensable component of the UK’s evolving energy infrastructure.

Strategic investments in offshore wind farms and cross-border electricity trading have further accelerated market expansion, with HVDC systems enabling seamless integration of renewable energy sources into the national grid. The technology’s capacity to provide enhanced grid stability and reduced transmission losses has attracted significant attention from both public and private sector stakeholders committed to modernizing the UK’s electrical transmission network.

The UK HVDC transmission systems market refers to the comprehensive ecosystem of high voltage direct current technologies, infrastructure, and services designed to facilitate efficient electrical power transmission across the United Kingdom’s electrical grid network. HVDC transmission systems utilize direct current technology to transport electrical energy over long distances with significantly reduced power losses compared to conventional alternating current systems, making them particularly valuable for connecting remote renewable energy generation sites to population centers and enabling international electricity trading through submarine cables.

These systems encompass converter stations, transmission cables, control systems, and associated infrastructure components that collectively enable the conversion of alternating current to direct current for transmission purposes, followed by reconversion to alternating current for distribution to end users. The market includes both point-to-point transmission links and multi-terminal HVDC networks that facilitate flexible power routing and enhanced grid reliability.

Furthermore, the market encompasses various technological configurations, including monopolar, bipolar, and back-to-back HVDC systems, each designed to address specific transmission requirements and geographical constraints while maximizing operational efficiency and grid stability.

The UK HVDC transmission systems market stands at a pivotal juncture, characterized by unprecedented growth opportunities driven by the nation’s commitment to renewable energy transition and grid modernization initiatives. Market expansion is primarily fueled by increasing offshore wind capacity installations, cross-border electricity trading requirements, and the need for enhanced grid stability in an increasingly complex energy landscape.

Key market drivers include government policies supporting renewable energy integration, with offshore wind capacity targeting 40 GW by 2030, necessitating robust HVDC transmission infrastructure to connect remote generation sites to demand centers. The technology’s superior efficiency in long-distance transmission, with power losses reduced by up to 50% compared to AC systems, has positioned HVDC as the preferred solution for major transmission projects.

Technological advancements in voltage source converter technology have enhanced system flexibility and reduced installation costs, making HVDC solutions increasingly attractive for grid operators. The market benefits from strong government support through various funding mechanisms and regulatory frameworks designed to accelerate clean energy infrastructure development.

Competitive dynamics feature established international technology providers alongside emerging domestic capabilities, creating a robust ecosystem for innovation and market growth. Strategic partnerships between utilities, technology providers, and government agencies continue to drive market expansion and technological advancement.

Strategic market insights reveal several critical factors shaping the UK HVDC transmission systems landscape, with technological innovation and regulatory support serving as primary growth catalysts. The following key insights provide comprehensive understanding of market dynamics:

Primary market drivers for UK HVDC transmission systems encompass a comprehensive range of factors that collectively create favorable conditions for sustained market growth and technological advancement. Renewable energy integration stands as the most significant driver, with the UK’s commitment to achieving net-zero carbon emissions by 2050 necessitating massive investments in clean energy infrastructure and associated transmission capabilities.

Government policy support through various initiatives, including the Contracts for Difference scheme and the Green Finance Strategy, provides substantial financial incentives for HVDC infrastructure development. The Offshore Wind Sector Deal specifically targets significant capacity expansion, requiring robust transmission infrastructure to connect remote generation sites to the national grid efficiently.

Grid modernization requirements drive demand for advanced transmission technologies capable of handling bidirectional power flows, variable renewable energy sources, and enhanced grid stability. The increasing complexity of the UK’s energy system, with distributed generation and storage systems, necessitates sophisticated transmission solutions that HVDC technology uniquely provides.

International electricity trading opportunities through interconnectors with European markets create additional demand for HVDC systems, enabling the UK to optimize energy costs and enhance supply security. The technology’s ability to facilitate asynchronous grid connections makes it indispensable for cross-border electricity commerce.

Technological advancements in converter technology, particularly voltage source converters, have improved system reliability while reducing costs, making HVDC solutions increasingly competitive with traditional AC transmission alternatives for long-distance applications.

Market restraints present significant challenges that could potentially limit the growth trajectory of the UK HVDC transmission systems market, requiring strategic mitigation approaches from industry stakeholders. High capital investment requirements represent the most substantial barrier, with HVDC converter stations requiring significant upfront costs that can impact project feasibility and financing arrangements.

Technical complexity associated with HVDC system design, installation, and maintenance demands specialized expertise that may be limited within the domestic market, potentially creating dependency on international technology providers and skilled personnel. The sophisticated nature of HVDC control systems requires extensive training and certification programs for operational staff.

Regulatory uncertainties surrounding grid access arrangements, transmission charging methodologies, and planning consent processes can create project delays and increased development risks. The evolving regulatory framework for electricity markets may impact long-term investment decisions and project viability assessments.

Grid integration challenges arise from the need to coordinate HVDC systems with existing AC infrastructure, requiring careful planning and potentially costly grid reinforcement measures. Compatibility issues between different HVDC technologies and legacy grid components can complicate system integration efforts.

Limited domestic manufacturing capacity for critical HVDC components may result in supply chain vulnerabilities and extended project delivery timelines. The reliance on international suppliers for specialized equipment could impact project costs and scheduling flexibility.

Substantial market opportunities exist within the UK HVDC transmission systems sector, driven by evolving energy market dynamics and technological innovations that create new applications and business models. Offshore wind expansion presents the most significant opportunity, with planned developments requiring extensive HVDC transmission infrastructure to connect remote generation sites to onshore grid networks efficiently.

Energy storage integration opportunities emerge as large-scale battery storage systems and other storage technologies require sophisticated transmission solutions to optimize grid services and renewable energy utilization. HVDC systems can facilitate efficient connection of storage facilities to transmission networks while providing enhanced grid stability services.

Smart grid development creates opportunities for advanced HVDC systems equipped with digital control technologies, artificial intelligence, and predictive maintenance capabilities. These intelligent transmission systems can optimize power flows, reduce operational costs, and enhance grid reliability through real-time monitoring and control.

International market expansion through additional interconnector projects with European and potentially other international markets could significantly increase demand for HVDC transmission infrastructure. The UK’s strategic geographical position makes it an ideal hub for international electricity trading.

Industrial decarbonization initiatives requiring large-scale electrification of industrial processes create demand for robust transmission infrastructure capable of handling increased electrical loads while maintaining grid stability and power quality.

Market dynamics within the UK HVDC transmission systems sector reflect a complex interplay of technological, regulatory, and economic factors that collectively shape industry evolution and competitive positioning. Supply chain dynamics are characterized by a limited number of global technology providers capable of delivering complete HVDC solutions, creating both opportunities and challenges for market participants.

Demand patterns are increasingly driven by renewable energy integration requirements, with offshore wind capacity additions accounting for approximately 75% of new HVDC transmission demand. The cyclical nature of major infrastructure projects creates periodic demand fluctuations that require strategic capacity planning from suppliers and contractors.

Competitive dynamics feature intense competition among established international players, with differentiation based on technological capabilities, project execution experience, and local partnership arrangements. The market rewards companies that can demonstrate proven track records in complex HVDC project delivery and long-term operational support.

Innovation dynamics focus on improving system efficiency, reducing costs, and enhancing operational flexibility through advanced control systems and modular designs. Research and development investments targeting next-generation HVDC technologies continue to drive market evolution and competitive advantage.

Financial dynamics involve complex project financing arrangements that require long-term commitments from multiple stakeholders, including utilities, government agencies, and private investors. The capital-intensive nature of HVDC projects necessitates innovative financing mechanisms and risk-sharing arrangements.

Comprehensive research methodology employed for analyzing the UK HVDC transmission systems market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, technology providers, utility companies, and regulatory officials to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses extensive analysis of government publications, industry reports, technical journals, and regulatory documents to establish market context and validate primary research findings. MarkWide Research analysts utilize proprietary databases and analytical tools to process and interpret market data effectively.

Data triangulation methods ensure research accuracy by cross-referencing information from multiple sources and validating findings through independent verification processes. Quantitative analysis techniques include statistical modeling, trend analysis, and comparative assessments to identify market patterns and growth trajectories.

Expert validation processes involve consultation with industry specialists and technical experts to verify research conclusions and ensure alignment with market realities. The methodology incorporates both bottom-up and top-down analytical approaches to provide comprehensive market coverage and insight depth.

Continuous monitoring of market developments, regulatory changes, and technological advancements ensures research findings remain current and relevant for strategic decision-making purposes.

Regional analysis of the UK HVDC transmission systems market reveals distinct geographical patterns driven by renewable energy resource distribution, population centers, and existing grid infrastructure characteristics. Scotland represents the most significant regional market, accounting for approximately 45% of planned HVDC capacity due to extensive offshore wind development opportunities and the need to transmit renewable energy to southern demand centers.

England’s coastal regions, particularly the North Sea coastline, demonstrate substantial growth potential for HVDC infrastructure supporting offshore wind connections and international interconnector projects. The East Anglia region specifically benefits from proximity to major offshore wind development zones and existing grid infrastructure.

Wales presents emerging opportunities for HVDC applications, particularly in connection with floating offshore wind developments and potential tidal energy projects. The region’s mountainous terrain and coastal access create unique transmission challenges that HVDC technology can address effectively.

Northern Ireland requires specialized HVDC solutions for grid interconnection with the Republic of Ireland and Great Britain, with existing and planned interconnector projects driving regional market development. The region’s isolated grid characteristics make HVDC technology particularly valuable for enhancing supply security and market access.

Cross-regional transmission corridors connecting renewable energy generation areas with major demand centers represent significant market opportunities, with HVDC systems providing efficient long-distance transmission capabilities across diverse geographical terrains.

The competitive landscape within the UK HVDC transmission systems market features a concentrated group of international technology providers with specialized capabilities in high-voltage power electronics and system integration. Market leadership is determined by technological expertise, project execution experience, and ability to deliver comprehensive HVDC solutions including equipment supply, installation, and long-term maintenance services.

Competitive differentiation focuses on technological innovation, project delivery capabilities, and local partnership arrangements with UK utilities and contractors. Companies that demonstrate proven track records in complex HVDC project execution and provide comprehensive lifecycle support services maintain competitive advantages in this specialized market.

Market segmentation analysis reveals distinct categories within the UK HVDC transmission systems market, each characterized by specific technological requirements, applications, and growth dynamics. By Technology: The market divides into voltage source converter (VSC) systems and line commutated converter (LCC) systems, with VSC technology gaining preference due to superior controllability and grid support capabilities.

By Application: Segmentation includes offshore wind connections, international interconnectors, grid reinforcement projects, and renewable energy integration applications. Offshore wind connections represent the fastest-growing segment, driven by extensive development plans and the technology’s suitability for long-distance submarine transmission.

By Voltage Rating: The market encompasses various voltage levels, including medium voltage (up to 100 kV), high voltage (100-300 kV), and extra high voltage (above 300 kV) systems. Extra high voltage systems dominate major transmission projects due to their superior efficiency and capacity characteristics.

By Configuration: Market segments include monopolar, bipolar, and back-to-back HVDC systems, each designed for specific transmission requirements and operational characteristics. Bipolar configurations are preferred for long-distance transmission due to enhanced reliability and operational flexibility.

By Component: The market includes converter stations, transmission cables, control systems, and auxiliary equipment, with converter stations representing the highest value component due to their technological complexity and critical operational role.

Offshore Wind Connections represent the most dynamic category within the UK HVDC transmission systems market, driven by ambitious renewable energy targets and the technology’s unique suitability for long-distance submarine transmission. This category benefits from government support through various incentive schemes and demonstrates the highest growth potential, with project pipeline growth of approximately 12% annually.

International Interconnectors constitute a strategically important category, enabling electricity trading with European markets and enhancing UK energy security. These projects typically involve complex regulatory coordination and substantial capital investments, but provide long-term revenue stability through capacity market mechanisms and trading opportunities.

Grid Reinforcement Applications address transmission bottlenecks and capacity constraints within the existing AC network, with HVDC systems providing enhanced power transfer capabilities and improved grid stability. This category experiences steady growth driven by increasing renewable energy penetration and evolving grid requirements.

Industrial Applications represent an emerging category as large industrial facilities seek direct connection to transmission networks for enhanced power quality and reduced costs. Data centers, steel mills, and chemical plants increasingly consider HVDC connections for their substantial and consistent power requirements.

Energy Storage Integration constitutes a developing category as large-scale storage systems require sophisticated transmission connections to optimize grid services and renewable energy utilization. This category demonstrates significant growth potential as storage deployment accelerates.

Industry participants and stakeholders derive substantial benefits from the expanding UK HVDC transmission systems market, with advantages spanning operational, financial, and strategic dimensions. Utility companies benefit from enhanced grid flexibility, reduced transmission losses, and improved ability to integrate renewable energy sources while maintaining system stability and reliability.

Technology providers gain access to a growing market with substantial project values and long-term service opportunities, enabling sustained revenue growth and technological advancement. The specialized nature of HVDC technology creates barriers to entry that protect established players while rewarding innovation and expertise.

Renewable energy developers benefit from HVDC transmission infrastructure that enables connection of remote generation sites to demand centers, expanding development opportunities and improving project economics. The technology’s efficiency advantages translate directly into enhanced project returns and reduced transmission costs.

Government agencies achieve policy objectives related to decarbonization, energy security, and economic development through HVDC infrastructure investments that enable renewable energy integration and international electricity trading. The technology supports job creation in high-value engineering and manufacturing sectors.

End consumers ultimately benefit from improved grid reliability, enhanced energy security, and potentially reduced electricity costs through more efficient transmission and increased competition from international electricity trading enabled by HVDC interconnectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend within the UK HVDC transmission systems market, with advanced control systems incorporating artificial intelligence, machine learning, and predictive analytics to optimize system performance and reduce operational costs. Smart HVDC systems enable real-time monitoring, predictive maintenance, and autonomous operation capabilities that enhance reliability while reducing lifecycle costs.

Modular system designs gain popularity as they offer enhanced flexibility for capacity expansion and reduced installation complexity. These modular approaches enable phased project development and easier system upgrades, making HVDC solutions more attractive for utilities with evolving transmission requirements.

Hybrid AC-DC networks represent an emerging trend as grid operators seek to optimize transmission efficiency by combining AC and DC technologies strategically. These hybrid approaches maximize the benefits of both technologies while addressing specific transmission challenges and grid requirements.

Environmental sustainability considerations increasingly influence HVDC system design and deployment, with focus on reduced environmental impact, recyclable materials, and minimal land use requirements. Green HVDC initiatives align with broader sustainability objectives and regulatory requirements.

Collaborative partnerships between technology providers, utilities, and research institutions drive innovation and market development, with joint ventures and strategic alliances becoming more common for major project delivery and technology advancement.

Recent industry developments demonstrate accelerating momentum within the UK HVDC transmission systems market, with major project announcements and technological breakthroughs shaping market evolution. The Eastern Green Link project represents a significant milestone, involving a 2 GW HVDC transmission system connecting Scottish renewable energy to English demand centers, showcasing the technology’s critical role in the UK’s energy transition.

Technological breakthroughs in voltage source converter technology have improved system efficiency while reducing costs, with new converter designs achieving efficiency levels exceeding 98% and enhanced grid support capabilities. These advances make HVDC solutions increasingly competitive for a broader range of applications.

International interconnector developments continue expanding, with new projects connecting the UK to European markets and enhancing electricity trading opportunities. These developments demonstrate growing confidence in HVDC technology and its strategic importance for energy security and market integration.

Research and development initiatives focus on next-generation HVDC technologies, including higher voltage ratings, improved converter designs, and advanced control systems. University partnerships and government-funded research programs support innovation and technology advancement within the sector.

Supply chain developments include efforts to establish domestic manufacturing capabilities for critical HVDC components, reducing dependence on international suppliers and supporting local economic development objectives.

Strategic recommendations for market participants emphasize the importance of positioning for long-term growth while addressing current market challenges and opportunities. Technology providers should focus on developing comprehensive service offerings that include project development, equipment supply, installation, and long-term maintenance services to differentiate themselves in a competitive market.

Investment in local capabilities represents a critical success factor, with companies that establish UK-based engineering, manufacturing, and service capabilities likely to achieve competitive advantages through reduced costs, enhanced responsiveness, and stronger stakeholder relationships. MarkWide Research analysis indicates that local presence significantly influences project selection decisions.

Partnership strategies should focus on building relationships with UK utilities, renewable energy developers, and government agencies to secure project opportunities and influence market development. Collaborative approaches that combine international expertise with local knowledge and capabilities demonstrate highest success rates.

Innovation investments in digital technologies, artificial intelligence, and advanced materials will drive future competitive positioning as the market evolves toward more sophisticated and efficient HVDC solutions. Companies that lead in technological advancement will capture premium market segments and establish long-term competitive advantages.

Risk management strategies should address supply chain vulnerabilities, regulatory uncertainties, and project execution challenges through diversified supplier networks, comprehensive insurance arrangements, and robust project management capabilities.

The future outlook for the UK HVDC transmission systems market remains exceptionally positive, driven by fundamental structural changes in the energy sector and unwavering government commitment to decarbonization objectives. Market expansion is expected to accelerate significantly over the next decade, with projected growth rates of 9-11% annually as offshore wind capacity additions and grid modernization requirements drive sustained demand for HVDC infrastructure.

Technological evolution will continue advancing HVDC capabilities, with next-generation systems offering enhanced efficiency, reduced costs, and improved operational flexibility. Digital integration will transform HVDC systems into intelligent transmission assets capable of autonomous operation and predictive maintenance, reducing lifecycle costs and improving reliability.

Market maturation will bring increased competition and standardization, potentially reducing costs while improving system interoperability and reliability. The development of domestic supply chain capabilities will enhance market resilience and reduce dependence on international suppliers.

International expansion opportunities through additional interconnector projects will create new market segments and revenue streams, positioning the UK as a major hub for international electricity trading. MWR projections indicate substantial growth potential in cross-border transmission applications.

Integration with emerging technologies including energy storage, hydrogen production, and electric vehicle charging infrastructure will create new applications and market opportunities for HVDC transmission systems, ensuring sustained relevance and growth potential throughout the energy transition period.

The UK HVDC transmission systems market stands at the forefront of the nation’s energy transformation, representing a critical enabler for achieving ambitious decarbonization objectives while enhancing grid reliability and efficiency. Market fundamentals remain exceptionally strong, supported by government policy commitments, technological advancement, and the inherent advantages of HVDC technology for long-distance transmission and renewable energy integration.

Growth prospects are underpinned by substantial offshore wind development plans, international interconnector opportunities, and evolving grid requirements that favor advanced transmission technologies. The market’s evolution toward more sophisticated, digitally-enabled HVDC systems will create new opportunities for innovation and value creation while addressing emerging challenges in grid management and optimization.

Strategic positioning for market participants requires comprehensive understanding of technological trends, regulatory developments, and stakeholder requirements, with success dependent on ability to deliver integrated solutions that address complex transmission challenges. The market rewards companies that combine technological expertise with local capabilities and strong stakeholder relationships.

Long-term market sustainability is assured by the fundamental role of HVDC technology in enabling the UK’s energy transition, with applications extending beyond traditional transmission to include energy storage integration, industrial electrification, and international electricity trading. The UK HVDC transmission systems market represents a cornerstone of the nation’s sustainable energy future, offering substantial opportunities for growth, innovation, and value creation across the entire energy ecosystem.

What is HVDC Transmission Systems?

HVDC Transmission Systems refer to high-voltage direct current technologies used for transmitting electricity over long distances. These systems are essential for connecting renewable energy sources, such as wind and solar, to the grid efficiently.

What are the key players in the UK HVDC Transmission Systems Market?

Key players in the UK HVDC Transmission Systems Market include Siemens, ABB, and General Electric. These companies are involved in the development and implementation of advanced HVDC technologies, among others.

What are the main drivers of the UK HVDC Transmission Systems Market?

The main drivers of the UK HVDC Transmission Systems Market include the increasing demand for renewable energy integration, the need for efficient long-distance power transmission, and government initiatives promoting low-carbon technologies.

What challenges does the UK HVDC Transmission Systems Market face?

Challenges in the UK HVDC Transmission Systems Market include high initial investment costs, technical complexities in system integration, and regulatory hurdles that can delay project implementation.

What opportunities exist in the UK HVDC Transmission Systems Market?

Opportunities in the UK HVDC Transmission Systems Market include the expansion of offshore wind farms, advancements in HVDC technology, and increasing investments in smart grid infrastructure.

What trends are shaping the UK HVDC Transmission Systems Market?

Trends shaping the UK HVDC Transmission Systems Market include the growing adoption of modular multilevel converters, enhanced grid stability solutions, and the integration of energy storage systems to support renewable energy sources.

UK HVDC Transmission Systems Market

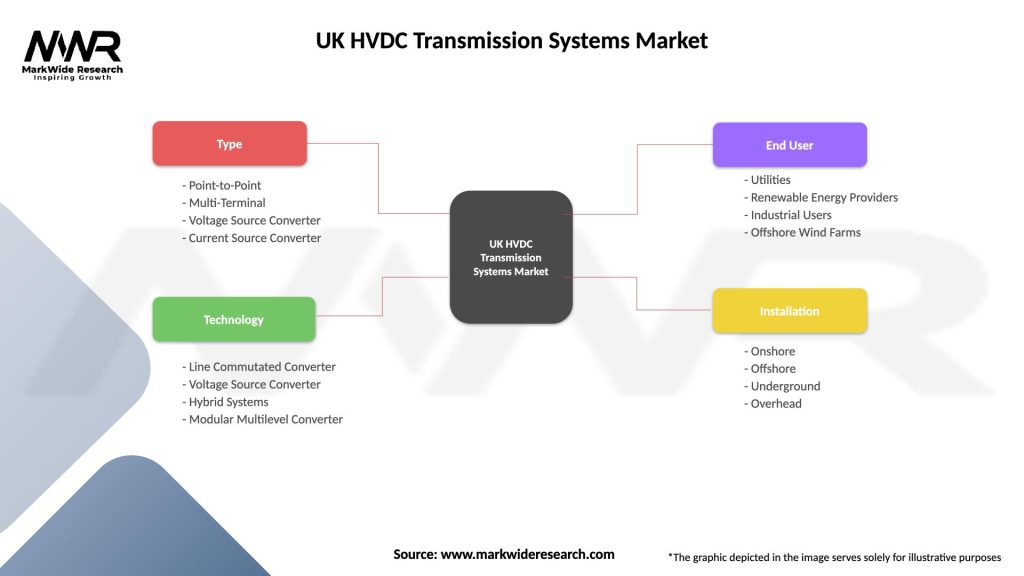

| Segmentation Details | Description |

|---|---|

| Type | Point-to-Point, Multi-Terminal, Voltage Source Converter, Current Source Converter |

| Technology | Line Commutated Converter, Voltage Source Converter, Hybrid Systems, Modular Multilevel Converter |

| End User | Utilities, Renewable Energy Providers, Industrial Users, Offshore Wind Farms |

| Installation | Onshore, Offshore, Underground, Overhead |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK HVDC Transmission Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at