444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US mammography market represents a critical component of the nation’s healthcare infrastructure, serving as the primary screening method for breast cancer detection. This specialized medical imaging sector encompasses digital mammography systems, 3D tomosynthesis technology, and advanced screening solutions that have revolutionized early breast cancer detection capabilities. Market dynamics indicate robust growth driven by increasing awareness of preventive healthcare, technological advancements, and expanding screening programs across healthcare facilities.

Healthcare providers across the United States are increasingly adopting advanced mammography technologies to enhance diagnostic accuracy and improve patient outcomes. The market demonstrates significant momentum with digital mammography systems experiencing widespread adoption rates of approximately 85% across major healthcare facilities. Technological evolution continues to shape the landscape, with 3D mammography (tomosynthesis) showing remarkable growth in implementation, achieving penetration rates exceeding 60% in leading medical centers.

Regional distribution varies significantly across the United States, with metropolitan areas and established healthcare networks leading in advanced technology adoption. The market benefits from strong regulatory support, comprehensive insurance coverage, and growing emphasis on preventive care strategies. Innovation drivers include artificial intelligence integration, improved image quality, reduced radiation exposure, and enhanced patient comfort features that collectively contribute to market expansion.

The US mammography market refers to the comprehensive ecosystem of medical imaging technologies, equipment, services, and solutions specifically designed for breast cancer screening and diagnostic imaging within the United States healthcare system. This market encompasses various mammography modalities including traditional 2D digital mammography, advanced 3D tomosynthesis systems, and emerging technologies that support early detection and accurate diagnosis of breast abnormalities.

Market scope includes mammography equipment manufacturers, healthcare facilities, imaging centers, mobile screening units, and supporting technologies such as computer-aided detection systems and artificial intelligence-enhanced diagnostic tools. The definition extends to encompass service components including maintenance, training, software updates, and comprehensive imaging solutions that enable healthcare providers to deliver effective breast cancer screening programs.

Healthcare integration represents a fundamental aspect of this market, connecting mammography services with broader cancer care pathways, electronic health records, and population health management systems. The market serves diverse healthcare settings from large hospital systems and specialized breast centers to community clinics and mobile screening programs, ensuring comprehensive coverage across various patient populations and geographic regions.

Strategic analysis reveals the US mammography market as a mature yet dynamically evolving sector characterized by continuous technological advancement and expanding accessibility. The market demonstrates resilience through consistent demand driven by aging demographics, increased health awareness, and comprehensive screening guidelines that recommend regular mammography examinations for women over 40 years of age.

Technology transformation represents the primary growth catalyst, with 3D mammography systems showing exceptional adoption rates of approximately 12% annual growth as healthcare facilities upgrade from traditional 2D systems. Artificial intelligence integration emerges as a significant trend, with AI-powered diagnostic tools being implemented in over 35% of major imaging centers to enhance detection accuracy and reduce interpretation time.

Market consolidation continues among equipment manufacturers, while healthcare providers focus on expanding access through mobile screening programs and community outreach initiatives. The sector benefits from strong reimbursement frameworks, government support for preventive care, and increasing emphasis on value-based healthcare delivery models that prioritize early detection and improved patient outcomes.

Technological advancement drives market evolution with several key insights shaping the competitive landscape:

Market maturation reflects in the sophisticated technology adoption patterns and comprehensive service offerings available across diverse healthcare settings. Innovation cycles continue to introduce enhanced imaging capabilities, improved patient comfort features, and advanced diagnostic tools that support more accurate and efficient breast cancer screening programs.

Demographic trends represent the primary driver for mammography market growth, with an aging female population requiring increased screening services. The expanding population of women in the 40-70 age demographic, combined with extended life expectancy, creates sustained demand for regular mammography examinations. Healthcare awareness campaigns and educational initiatives have significantly increased participation in screening programs, contributing to market expansion.

Technological innovation serves as a crucial growth driver, with advanced mammography systems offering superior image quality, reduced radiation exposure, and enhanced diagnostic capabilities. The transition to 3D mammography technology demonstrates clear clinical benefits including improved cancer detection rates and reduced false positive results. AI-powered solutions are increasingly being integrated to support radiologists in image interpretation and workflow optimization.

Regulatory support through comprehensive screening guidelines and quality standards ensures consistent market demand. Government initiatives promoting preventive healthcare, insurance coverage mandates for mammography screening, and quality assurance programs create a supportive environment for market growth. Healthcare infrastructure expansion, including new imaging centers and mobile screening programs, further drives market development by improving access to mammography services across diverse geographic regions.

High capital costs associated with advanced mammography equipment represent a significant market restraint, particularly for smaller healthcare facilities and independent imaging centers. The substantial investment required for 3D mammography systems, ongoing maintenance costs, and regular technology upgrades can limit adoption rates among cost-sensitive healthcare providers. Budget constraints in healthcare systems may delay equipment replacement cycles and slow the adoption of newer technologies.

Workforce challenges including radiologist shortages and the need for specialized training on advanced mammography systems create operational constraints. The requirement for certified mammography technologists and ongoing professional development adds complexity to staffing requirements. Regulatory compliance demands, while necessary for quality assurance, can create administrative burden and additional costs for healthcare facilities.

Patient concerns regarding radiation exposure, examination discomfort, and anxiety related to screening procedures can impact participation rates in mammography programs. Geographic disparities in healthcare access, particularly in rural and underserved areas, limit market penetration and create challenges for comprehensive screening coverage. Insurance coverage variations and patient cost-sharing requirements may also influence screening utilization patterns.

Artificial intelligence integration presents substantial opportunities for market expansion through enhanced diagnostic accuracy, automated workflow optimization, and improved radiologist productivity. AI-powered tools can support image analysis, risk assessment, and clinical decision-making processes. Personalized screening approaches based on individual risk factors and genetic markers offer opportunities for targeted mammography programs and precision medicine applications.

Mobile mammography expansion represents a significant growth opportunity, particularly for reaching underserved populations and improving screening accessibility. Advanced mobile units equipped with state-of-the-art technology can extend services to rural areas, workplace screening programs, and community outreach initiatives. Telemammography solutions enable remote image interpretation and consultation services, expanding access to specialized expertise.

Technology convergence opportunities include integration with other imaging modalities, molecular imaging applications, and comprehensive breast health platforms. Value-based care models create opportunities for outcome-focused service delivery, population health management, and comprehensive screening programs that demonstrate measurable health improvements and cost-effectiveness.

Competitive dynamics within the US mammography market reflect a balance between established equipment manufacturers and emerging technology innovators. Major players focus on technological differentiation through advanced imaging capabilities, AI integration, and comprehensive service offerings. Market competition drives continuous innovation in image quality, patient comfort, and workflow efficiency.

Healthcare consolidation trends influence purchasing decisions as larger health systems seek standardized equipment platforms and comprehensive service agreements. Technology adoption patterns vary by facility size and geographic location, with academic medical centers and large hospital systems typically leading in advanced technology implementation. Smaller facilities often focus on cost-effective solutions that provide reliable performance and strong return on investment.

Regulatory evolution continues to shape market dynamics through updated quality standards, accreditation requirements, and safety guidelines. Reimbursement policies significantly impact market demand, with comprehensive coverage for screening mammography supporting consistent utilization. The shift toward value-based healthcare models influences equipment selection criteria and service delivery approaches, emphasizing outcomes measurement and cost-effectiveness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US mammography market. Primary research includes extensive interviews with healthcare administrators, radiologists, mammography technologists, and equipment manufacturers to gather firsthand perspectives on market trends, challenges, and opportunities. Industry surveys conducted across diverse healthcare settings provide quantitative data on technology adoption, purchasing patterns, and operational preferences.

Secondary research encompasses analysis of industry reports, regulatory filings, clinical studies, and healthcare statistics from authoritative sources including the American College of Radiology, FDA databases, and professional medical associations. Market intelligence gathering includes monitoring of equipment launches, technology developments, and competitive activities across the mammography sector.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. MarkWide Research methodology incorporates both quantitative metrics and qualitative insights to provide comprehensive market understanding. Trend analysis utilizes historical data patterns, current market indicators, and forward-looking projections to identify growth opportunities and potential challenges facing the US mammography market.

Geographic distribution across the United States reveals significant regional variations in mammography market characteristics, technology adoption, and service accessibility. The Northeast region demonstrates high market maturity with extensive healthcare infrastructure, advanced technology adoption rates, and comprehensive screening programs. Major metropolitan areas including New York, Boston, and Philadelphia show technology penetration rates exceeding 75% for 3D mammography systems.

West Coast markets including California, Washington, and Oregon exhibit strong growth in innovative mammography technologies, with Silicon Valley and Seattle areas leading in AI integration and digital health solutions. The region benefits from proximity to technology companies and research institutions that drive innovation in medical imaging. Southern states show expanding market opportunities with growing healthcare infrastructure and increasing emphasis on preventive care programs.

Midwest regions demonstrate steady market growth supported by established healthcare systems and strong insurance coverage. Rural areas across all regions present both challenges and opportunities, with mobile mammography programs showing utilization growth rates of 18% annually. Market concentration remains highest in urban areas, while rural and underserved regions represent significant expansion opportunities for mobile and telemammography services.

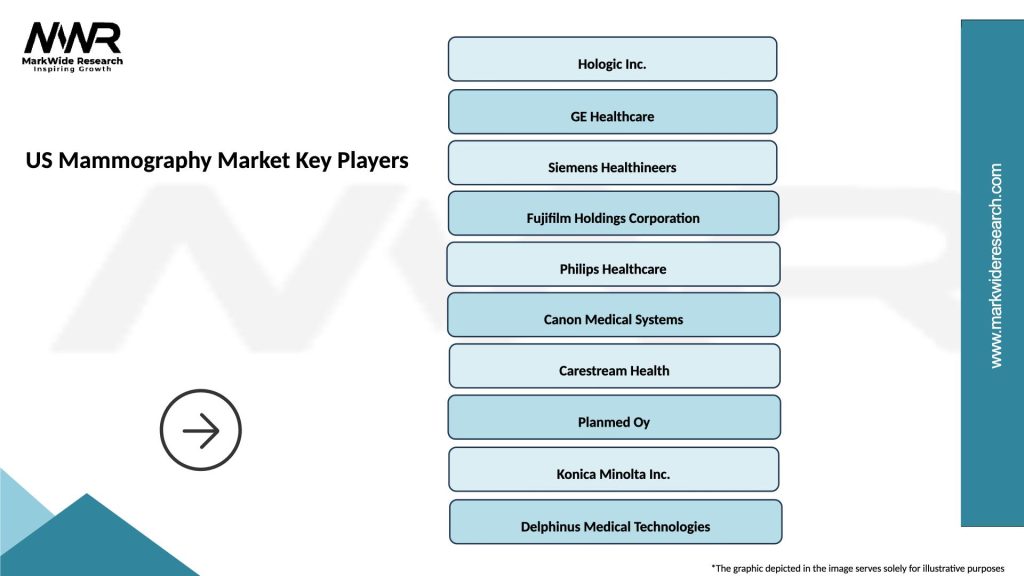

Market leadership in the US mammography sector is characterized by several key players offering comprehensive imaging solutions:

Competitive strategies emphasize technological differentiation, comprehensive service offerings, and strategic partnerships with healthcare providers. Innovation focus areas include AI integration, dose optimization, image quality enhancement, and patient experience improvements. Market players increasingly offer integrated solutions combining equipment, software, and services to provide comprehensive mammography programs.

Technology segmentation divides the US mammography market into distinct categories based on imaging capabilities and technical specifications:

By Technology:

By End User:

By Application:

3D Mammography segment demonstrates exceptional growth potential with superior clinical outcomes compared to traditional 2D systems. This technology category shows adoption rates increasing by 20% annually as healthcare facilities recognize the benefits of improved cancer detection and reduced callback rates. Clinical evidence supporting 3D mammography effectiveness drives continued investment in this technology segment.

AI-Enhanced Systems represent an emerging category with significant growth prospects. These solutions integrate artificial intelligence algorithms to support radiologist interpretation, automate workflow processes, and improve diagnostic accuracy. Early adopters report substantial improvements in efficiency and diagnostic confidence, leading to broader market acceptance.

Mobile Mammography category addresses critical access challenges in underserved communities and rural areas. This segment benefits from increasing recognition of health equity issues and the need for comprehensive screening coverage. Utilization patterns show strong growth in workplace screening programs, community health initiatives, and targeted outreach efforts to improve screening participation rates among diverse populations.

Healthcare Providers benefit from advanced mammography technologies through improved diagnostic capabilities, enhanced workflow efficiency, and better patient outcomes. Modern systems offer superior image quality, reduced examination time, and comprehensive integration with existing healthcare IT infrastructure. Operational advantages include automated quality assurance, streamlined reporting processes, and enhanced patient comfort features that improve overall service delivery.

Patients experience significant benefits including more accurate screening results, reduced radiation exposure, and improved comfort during examinations. Advanced mammography systems provide faster examination times, better image quality, and reduced need for repeat examinations. Early detection capabilities enable timely intervention and improved treatment outcomes for breast cancer patients.

Equipment Manufacturers benefit from sustained market demand driven by technology advancement cycles, regulatory requirements, and expanding healthcare infrastructure. Innovation opportunities in AI integration, workflow optimization, and patient experience enhancement create competitive advantages and market differentiation. Strategic partnerships with healthcare providers enable collaborative development of solutions that address specific clinical and operational needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming mammography practice. AI-powered tools are being deployed to assist radiologists in image interpretation, automate quality assurance processes, and optimize workflow efficiency. Machine learning algorithms demonstrate capability to identify subtle abnormalities and support clinical decision-making processes.

3D Mammography Standardization continues as healthcare facilities transition from 2D to tomosynthesis systems. This trend reflects clinical evidence demonstrating improved cancer detection rates and reduced false positive results. Technology adoption patterns show accelerating implementation across diverse healthcare settings, from large hospital systems to community imaging centers.

Patient-Centered Design emerges as a key trend focusing on comfort, convenience, and anxiety reduction during mammography examinations. Equipment manufacturers are incorporating ergonomic improvements, automated positioning features, and enhanced patient communication systems. Experience optimization includes reduced compression force, faster examination times, and improved facility design to create more welcoming environments for patients.

Technology Advancements in mammography continue with introduction of next-generation imaging systems featuring enhanced resolution, improved contrast sensitivity, and advanced image processing capabilities. Recent developments include spectral mammography systems, contrast-enhanced imaging techniques, and integrated ultrasound capabilities that expand diagnostic options for healthcare providers.

Regulatory Updates from the FDA include revised mammography quality standards, updated equipment performance requirements, and enhanced patient notification protocols. These developments ensure continued improvement in service quality while maintaining safety standards. Quality assurance programs are being enhanced with digital monitoring systems and automated compliance tracking.

Partnership Initiatives between equipment manufacturers and healthcare providers are creating innovative service delivery models. MWR analysis indicates increasing collaboration in developing integrated solutions that combine equipment, software, and services to optimize mammography programs. Strategic alliances focus on improving access, enhancing quality, and reducing costs through comprehensive service agreements.

Technology Investment strategies should prioritize 3D mammography systems and AI-enhanced solutions that demonstrate clear clinical and operational benefits. Healthcare facilities should evaluate total cost of ownership including equipment, maintenance, training, and ongoing support requirements. Implementation planning should consider workflow integration, staff training needs, and patient communication strategies to maximize technology benefits.

Access Expansion initiatives should focus on mobile mammography programs and telemammography solutions to reach underserved populations. Community partnerships with employers, community organizations, and public health agencies can enhance screening participation rates and improve population health outcomes. Strategic planning should address geographic coverage gaps and demographic-specific outreach needs.

Quality Optimization efforts should emphasize continuous improvement in diagnostic accuracy, patient experience, and operational efficiency. Healthcare providers should implement comprehensive quality assurance programs, regular performance monitoring, and patient feedback systems. Best practice sharing across healthcare networks can accelerate improvement initiatives and standardize high-quality care delivery.

Market evolution over the next five years will be characterized by continued technology advancement, expanded access initiatives, and enhanced integration with broader healthcare systems. Growth projections indicate sustained demand driven by demographic trends, technology adoption, and increasing emphasis on preventive healthcare. The market is expected to maintain steady growth rates of 6-8% annually across key technology segments.

Innovation trajectories point toward increased AI integration, personalized screening protocols, and comprehensive breast health platforms that combine multiple imaging modalities. MarkWide Research projects significant advancement in automated workflow systems, risk assessment tools, and patient engagement technologies that will transform mammography service delivery.

Healthcare integration trends suggest deeper connectivity between mammography services and electronic health records, population health management systems, and precision medicine applications. Future developments will likely include enhanced interoperability, real-time quality monitoring, and outcome-based service delivery models that demonstrate measurable health improvements and cost-effectiveness in breast cancer screening programs.

The US mammography market represents a mature yet dynamically evolving healthcare sector positioned for continued growth through technological innovation and expanded access initiatives. The market demonstrates resilience through consistent demand driven by demographic trends, regulatory support, and increasing emphasis on preventive healthcare delivery. Technology advancement remains the primary catalyst for market evolution, with 3D mammography and AI integration leading transformation efforts across healthcare facilities.

Strategic opportunities exist in mobile mammography expansion, AI-enhanced diagnostic solutions, and comprehensive breast health platforms that address both clinical and operational needs. Healthcare providers, equipment manufacturers, and technology innovators must collaborate to address access challenges, optimize service delivery, and improve patient outcomes. Market sustainability depends on continued investment in technology advancement, workforce development, and quality assurance programs that maintain high standards of care while expanding service accessibility across diverse populations and geographic regions throughout the United States.

What is Mammography?

Mammography is a specialized medical imaging technique that uses low-energy X-rays to examine the human breast. It is primarily used for early detection and diagnosis of breast diseases, particularly breast cancer.

What are the key players in the US Mammography Market?

Key players in the US Mammography Market include Hologic, Inc., Siemens Healthineers, and GE Healthcare, among others. These companies are known for their advanced imaging technologies and innovative solutions in breast cancer screening.

What are the main drivers of growth in the US Mammography Market?

The main drivers of growth in the US Mammography Market include the increasing prevalence of breast cancer, rising awareness about early detection, and advancements in mammography technology. Additionally, government initiatives promoting regular screenings contribute to market expansion.

What challenges does the US Mammography Market face?

The US Mammography Market faces challenges such as high costs associated with advanced imaging technologies and disparities in access to screening services. Furthermore, there are concerns regarding false positives and the psychological impact on patients.

What opportunities exist in the US Mammography Market?

Opportunities in the US Mammography Market include the development of digital mammography and tomosynthesis technologies, which enhance diagnostic accuracy. Additionally, increasing investments in healthcare infrastructure and telemedicine solutions present avenues for growth.

What trends are shaping the US Mammography Market?

Trends shaping the US Mammography Market include the integration of artificial intelligence in image analysis, personalized screening protocols, and a shift towards more patient-centered care. These innovations aim to improve detection rates and patient outcomes.

US Mammography Market

| Segmentation Details | Description |

|---|---|

| Product Type | Analog Mammography, Digital Mammography, 3D Mammography, Breast MRI |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Technology | Computed Tomography, Ultrasound, Stereotactic Biopsy, Contrast-Enhanced Mammography |

| Application | Screening, Diagnosis, Treatment Planning, Follow-Up |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Mammography Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at