444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US material handling equipment leasing market represents a dynamic and rapidly evolving sector that has become increasingly vital to American businesses across multiple industries. This comprehensive market encompasses the rental and leasing of essential equipment including forklifts, conveyor systems, automated guided vehicles, cranes, and warehouse automation solutions. Market dynamics indicate robust growth driven by the increasing preference for operational flexibility and capital preservation among businesses of all sizes.

Industry transformation has accelerated significantly as companies recognize the strategic advantages of leasing over purchasing material handling equipment. The market demonstrates strong resilience with growth rates consistently exceeding 8.5% annually, reflecting the fundamental shift in how businesses approach equipment acquisition and fleet management. E-commerce expansion and supply chain modernization initiatives continue to fuel demand for flexible leasing solutions.

Regional distribution shows concentrated activity in major industrial corridors, with the Midwest accounting for approximately 35% of total leasing activity, followed by the Southeast at 28% and the West Coast at 22%. This geographic concentration aligns with manufacturing density and distribution center locations, creating sustainable demand patterns for equipment leasing services.

The US material handling equipment leasing market refers to the comprehensive ecosystem of financial services and equipment rental solutions that enable businesses to access essential material handling equipment without the substantial capital investment required for outright purchase. This market encompasses short-term rentals, long-term leases, lease-to-own arrangements, and flexible financing options for a wide range of industrial equipment.

Core components of this market include traditional forklift leasing, which represents the largest segment, alongside emerging categories such as automated material handling systems, robotics leasing, and integrated warehouse solution packages. The market serves diverse industries including manufacturing, warehousing, distribution, retail, construction, and logistics, providing tailored solutions that match specific operational requirements and financial constraints.

Service models within this market range from basic equipment rental with maintenance included to comprehensive managed services that encompass equipment selection, deployment, maintenance, operator training, and performance optimization. This evolution toward service-oriented offerings reflects the market’s maturation and increasing sophistication of customer requirements.

Market leadership in the US material handling equipment leasing sector is characterized by strong competitive dynamics and continuous innovation in service delivery models. The market has demonstrated exceptional resilience through economic cycles, with leasing penetration rates reaching approximately 42% of total material handling equipment deployments across key industrial sectors.

Technology integration has emerged as a primary differentiator, with leading leasing companies incorporating IoT sensors, predictive maintenance capabilities, and fleet management software into their service offerings. This technological advancement has resulted in improved equipment utilization rates and reduced total cost of ownership for customers, driving increased adoption of leasing solutions.

Financial performance indicators show robust health across the sector, with average lease utilization rates exceeding 78% and customer retention rates maintaining levels above 85%. These metrics reflect the market’s ability to deliver consistent value propositions while adapting to evolving customer needs and technological advancements.

Strategic positioning within the broader industrial equipment ecosystem has strengthened considerably, with material handling equipment leasing now recognized as an essential component of modern supply chain optimization strategies. This recognition has attracted significant investment in fleet expansion and service capability enhancement across major market participants.

Operational flexibility has emerged as the primary driver for businesses choosing leasing over purchasing, with companies citing the ability to scale equipment fleets according to seasonal demands and business cycles as the most valuable benefit. This flexibility becomes particularly crucial during periods of economic uncertainty or rapid business growth.

E-commerce growth continues to serve as a fundamental catalyst for material handling equipment leasing demand, with online retail expansion requiring rapid deployment of warehouse and distribution capabilities. The need for flexible equipment solutions that can adapt to fluctuating order volumes and seasonal peaks has made leasing an attractive option for e-commerce fulfillment operations.

Supply chain modernization initiatives across American industries have accelerated the adoption of advanced material handling technologies, many of which are accessed through leasing arrangements due to their high initial costs and rapid technological evolution. Companies are increasingly leveraging leasing to pilot new technologies before making long-term commitments.

Capital preservation strategies have gained prominence as businesses focus on maintaining financial flexibility in uncertain economic environments. Leasing enables companies to access necessary equipment while preserving capital for strategic investments, research and development, and market expansion opportunities.

Regulatory compliance requirements, particularly in industries such as food and beverage, pharmaceuticals, and chemicals, drive demand for regularly updated equipment that meets evolving safety and environmental standards. Leasing arrangements ensure access to compliant equipment without the burden of managing obsolescence and upgrade cycles.

Total cost considerations present challenges for some businesses, as long-term leasing arrangements may result in higher total costs compared to equipment purchases, particularly for businesses with stable, long-term equipment needs. This cost differential becomes more pronounced for companies with strong balance sheets and access to low-cost capital.

Equipment customization limitations can restrict businesses that require highly specialized or modified equipment configurations. Standard leasing fleets may not accommodate unique operational requirements, forcing some companies to pursue purchase options or accept suboptimal equipment specifications.

Dependency relationships with leasing providers can create operational vulnerabilities, particularly regarding equipment availability during peak demand periods or service disruptions. This dependency requires careful vendor selection and relationship management to ensure business continuity.

Contract complexity and lease term restrictions may limit operational flexibility for some businesses, particularly those with unpredictable equipment needs or rapidly changing operational requirements. Complex lease agreements can also create administrative burdens and potential compliance challenges.

Automation integration presents significant expansion opportunities as businesses increasingly adopt automated material handling solutions. The high capital requirements and technological complexity of automation systems make them ideal candidates for leasing arrangements, creating new market segments for specialized providers.

Small and medium enterprise penetration offers substantial growth potential, as SMEs increasingly recognize the benefits of equipment leasing for accessing advanced material handling technologies previously available only to large corporations. Tailored financing solutions and simplified lease structures can unlock this underserved market segment.

Sustainability initiatives create opportunities for leasing providers to offer environmentally friendly equipment options and circular economy solutions. Electric forklifts, energy-efficient conveyor systems, and equipment refurbishment programs align with corporate sustainability goals while providing competitive advantages.

Technology-as-a-Service models represent emerging opportunities where material handling equipment is bundled with software, analytics, and managed services. These comprehensive solutions address the growing demand for integrated operational optimization and data-driven decision making capabilities.

Competitive intensity within the material handling equipment leasing market has increased significantly as traditional equipment manufacturers expand their leasing capabilities while specialized leasing companies enhance their service offerings. This competition has resulted in improved customer value propositions and innovative financing structures.

Technology disruption continues to reshape market dynamics, with IoT-enabled equipment, predictive maintenance systems, and fleet management platforms becoming standard offerings. These technological enhancements have improved equipment utilization rates by approximately 15-20% while reducing maintenance costs and downtime.

Customer expectations have evolved toward comprehensive service solutions that extend beyond basic equipment provision. Modern leasing arrangements increasingly include operator training, performance monitoring, maintenance management, and optimization consulting services, creating higher barriers to entry but also greater customer loyalty.

Economic sensitivity influences market dynamics through cyclical demand patterns, with leasing activity typically increasing during economic uncertainty as businesses seek to preserve capital and maintain operational flexibility. This counter-cyclical characteristic provides stability during economic downturns while enabling rapid growth during expansion periods.

Comprehensive analysis of the US material handling equipment leasing market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, leasing company representatives, equipment manufacturers, and end-user customers across diverse industry sectors.

Data collection processes encompass both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, focus groups, and observational studies of equipment deployment and utilization patterns. This multi-faceted approach ensures comprehensive understanding of market dynamics and customer behavior patterns.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, trade publications, and academic studies to provide context and validation for primary research findings. Cross-referencing multiple data sources ensures reliability and accuracy of market assessments.

Analytical frameworks include statistical modeling, trend analysis, competitive benchmarking, and scenario planning to develop robust market projections and strategic insights. These analytical tools enable identification of emerging opportunities and potential market disruptions.

Midwest dominance in the US material handling equipment leasing market reflects the region’s concentration of manufacturing facilities and distribution centers. States including Illinois, Ohio, Michigan, and Indiana account for approximately 35% of total market activity, driven by automotive manufacturing, food processing, and logistics operations.

Southeast expansion has accelerated significantly, with states such as Georgia, North Carolina, Tennessee, and Florida capturing 28% of market share. This growth is fueled by manufacturing reshoring initiatives, port expansion projects, and the region’s emergence as a major e-commerce fulfillment hub.

West Coast markets demonstrate strong demand for advanced material handling solutions, representing 22% of total leasing activity. California’s technology sector and the region’s international trade activities drive demand for sophisticated automation and high-capacity equipment solutions.

Northeast markets show steady demand patterns focused on urban distribution and last-mile delivery solutions, accounting for 15% of market activity. Dense population centers and space constraints create unique equipment requirements that favor flexible leasing arrangements over equipment ownership.

Market leadership is distributed among several categories of providers, each bringing distinct competitive advantages and service capabilities to the material handling equipment leasing sector.

Competitive differentiation increasingly focuses on service quality, technology integration, and comprehensive fleet management capabilities rather than purely on equipment availability or pricing. Leading providers invest heavily in digital platforms, predictive maintenance systems, and customer support infrastructure.

Equipment type segmentation reveals distinct market characteristics and growth patterns across different categories of material handling equipment available through leasing arrangements.

By Equipment Type:

By Industry Application:

Forklift leasing maintains its position as the cornerstone of the material handling equipment leasing market, with electric models experiencing particularly strong growth due to environmental considerations and operational cost advantages. Battery technology improvements have enhanced the attractiveness of electric forklift leasing by extending operating times and reducing charging requirements.

Automation equipment leasing represents the fastest-growing category, driven by labor shortages and the need for operational efficiency improvements. Automated guided vehicles and robotic systems are increasingly accessed through leasing arrangements due to their high capital costs and rapid technological evolution.

Specialized equipment categories including clean room material handling, hazardous material equipment, and temperature-controlled systems demonstrate strong leasing adoption rates due to their specialized nature and compliance requirements. These niche segments often command premium lease rates while providing stable, long-term customer relationships.

Integrated system leasing has emerged as a significant trend, with customers increasingly seeking comprehensive material handling solutions that combine multiple equipment types with software, maintenance, and optimization services. This approach simplifies procurement while ensuring system compatibility and performance optimization.

Equipment manufacturers benefit from leasing programs through expanded market reach, recurring revenue streams, and stronger customer relationships. Leasing enables manufacturers to serve price-sensitive customers while maintaining equipment quality standards and brand positioning.

Leasing companies capitalize on growing demand for flexible equipment access while building sustainable business models based on asset utilization and service delivery. The recurring revenue nature of leasing provides financial stability and predictable cash flows.

End-user customers gain access to advanced material handling technologies without large capital investments, while benefiting from professional maintenance, regular equipment updates, and operational flexibility. This access democratizes advanced technology adoption across businesses of all sizes.

Financial institutions participate in the material handling equipment leasing market through equipment financing and portfolio investments, benefiting from secured asset backing and diversified risk profiles. The essential nature of material handling equipment provides stability for financial stakeholders.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration continues to reshape the material handling equipment landscape, with electric forklifts and automated systems gaining market share due to environmental regulations and operational cost advantages. Battery technology improvements have addressed traditional limitations while reducing total cost of ownership.

Automation integration has become a dominant trend, with businesses increasingly adopting automated guided vehicles, robotic systems, and intelligent conveyor solutions through leasing arrangements. This trend is driven by labor shortages and the need for consistent operational performance.

Service-oriented models are evolving beyond basic equipment provision to include comprehensive operational support, performance optimization, and data analytics services. These integrated offerings create stronger customer relationships while generating additional revenue streams.

Digital transformation initiatives within leasing companies focus on customer experience enhancement through online platforms, mobile applications, and real-time equipment monitoring systems. These digital capabilities improve operational efficiency while providing customers with greater visibility and control.

Sustainability emphasis influences equipment selection and leasing program design, with customers increasingly prioritizing energy-efficient equipment and circular economy principles. This trend creates opportunities for equipment refurbishment and lifecycle extension programs.

Strategic partnerships between equipment manufacturers and technology companies have accelerated the development of smart material handling solutions with integrated IoT capabilities and predictive maintenance systems. These collaborations enhance equipment value propositions while creating new service opportunities.

Fleet expansion initiatives by major leasing providers reflect confidence in market growth prospects and the need to meet increasing customer demand. Recent investments focus on electric equipment, automation systems, and specialized application solutions.

Acquisition activity has intensified as companies seek to expand geographic coverage, enhance service capabilities, and access new customer segments. Consolidation trends create larger, more capable service providers while potentially reducing competition in some markets.

Technology investments in fleet management platforms, customer portals, and predictive analytics capabilities demonstrate the industry’s commitment to digital transformation and operational excellence. These investments improve asset utilization while enhancing customer experience.

Regulatory compliance initiatives address evolving safety standards and environmental requirements, with leasing companies investing in equipment updates and certification programs to ensure customer compliance and operational safety.

MarkWide Research analysis indicates that companies should prioritize technology integration and service capability development to maintain competitive advantages in the evolving material handling equipment leasing market. Investment in digital platforms and predictive maintenance capabilities will become essential for long-term success.

Market positioning strategies should focus on specific industry verticals or equipment specializations rather than broad-based approaches. Specialized expertise and tailored solutions command premium pricing while creating stronger customer relationships and higher barriers to competition.

Partnership development with technology providers, equipment manufacturers, and service companies can enhance value propositions while reducing investment requirements. Strategic alliances enable access to advanced capabilities and expanded market reach without full vertical integration.

Customer relationship management investments should emphasize long-term value creation through comprehensive service offerings and performance optimization support. Retention strategies become increasingly important as customer acquisition costs rise and competition intensifies.

Geographic expansion opportunities exist in underserved markets and emerging industrial regions, particularly in the Southeast and Southwest United States. Careful market selection and local partnership strategies can accelerate growth while minimizing investment risks.

Growth trajectory for the US material handling equipment leasing market remains strongly positive, with projected annual growth rates of 8-10% driven by continued e-commerce expansion, supply chain modernization, and increasing adoption of automation technologies. MWR projections indicate sustained demand across all major equipment categories and industry applications.

Technology evolution will continue to reshape market dynamics, with artificial intelligence, machine learning, and advanced robotics becoming standard features in material handling equipment. These technological advances will create new leasing opportunities while potentially disrupting traditional equipment categories.

Market consolidation trends are expected to continue as companies seek scale advantages and enhanced service capabilities. Larger, more sophisticated providers will likely capture increasing market share while smaller, specialized companies may find niche opportunities in specific applications or regions.

Sustainability initiatives will become increasingly important, with electric equipment adoption rates projected to reach 60-70% of new leasing activity within the next five years. Environmental considerations will influence equipment selection, lease terms, and end-of-life management practices.

Service integration will deepen as customers seek comprehensive operational solutions rather than simple equipment access. This trend will create opportunities for value-added services while requiring significant investments in service capabilities and technical expertise.

The US material handling equipment leasing market represents a dynamic and essential component of American industrial infrastructure, providing businesses with flexible access to critical equipment while enabling operational optimization and capital preservation. Market fundamentals remain strong, supported by e-commerce growth, supply chain modernization, and increasing adoption of automation technologies.

Competitive dynamics continue to evolve as traditional boundaries blur between equipment manufacturers, leasing companies, and service providers. Success in this market increasingly depends on comprehensive service capabilities, technology integration, and deep understanding of customer operational requirements rather than simple equipment availability.

Future prospects appear highly favorable, with multiple growth drivers supporting sustained market expansion and evolution. The increasing sophistication of customer requirements creates opportunities for innovative service providers while rewarding companies that invest in technology, service capabilities, and customer relationship management. As businesses continue to prioritize operational flexibility and capital efficiency, the material handling equipment leasing market is positioned to play an increasingly vital role in American industrial operations.

What is Material Handling Equipment?

Material Handling Equipment refers to a range of tools and machinery used to facilitate the movement, protection, storage, and control of materials and products throughout the manufacturing, warehousing, distribution, and consumption stages. This includes equipment such as forklifts, conveyors, and pallet jacks.

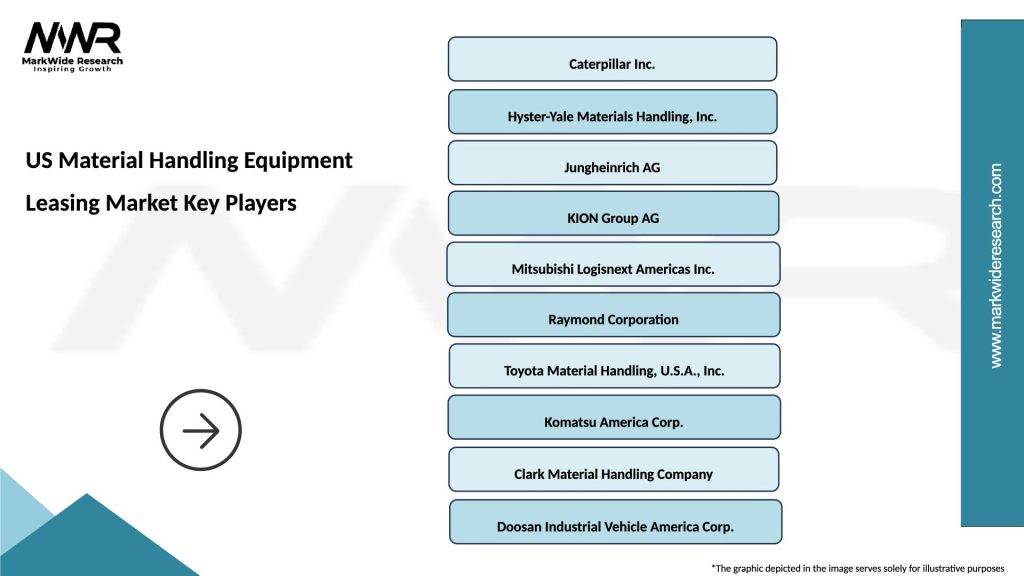

What are the key players in the US Material Handling Equipment Leasing Market?

Key players in the US Material Handling Equipment Leasing Market include companies like United Rentals, Sunbelt Rentals, and Herc Rentals, which provide a variety of leasing options for equipment used in logistics and warehousing, among others.

What are the growth factors driving the US Material Handling Equipment Leasing Market?

The growth of the US Material Handling Equipment Leasing Market is driven by the increasing demand for automation in warehouses, the rise of e-commerce, and the need for efficient supply chain management. These factors lead to a greater reliance on advanced material handling solutions.

What challenges does the US Material Handling Equipment Leasing Market face?

Challenges in the US Material Handling Equipment Leasing Market include the high initial costs of equipment, fluctuating demand based on economic conditions, and the need for regular maintenance and updates to technology. These factors can impact leasing decisions for businesses.

What opportunities exist in the US Material Handling Equipment Leasing Market?

Opportunities in the US Material Handling Equipment Leasing Market include the expansion of e-commerce logistics, advancements in automation technology, and the growing trend of sustainability in supply chain practices. These trends encourage businesses to invest in modern material handling solutions.

What trends are shaping the US Material Handling Equipment Leasing Market?

Trends shaping the US Material Handling Equipment Leasing Market include the increasing adoption of robotics and automation, the integration of IoT technology for real-time tracking, and a shift towards more flexible leasing options. These innovations are enhancing operational efficiency in various industries.

US Material Handling Equipment Leasing Market

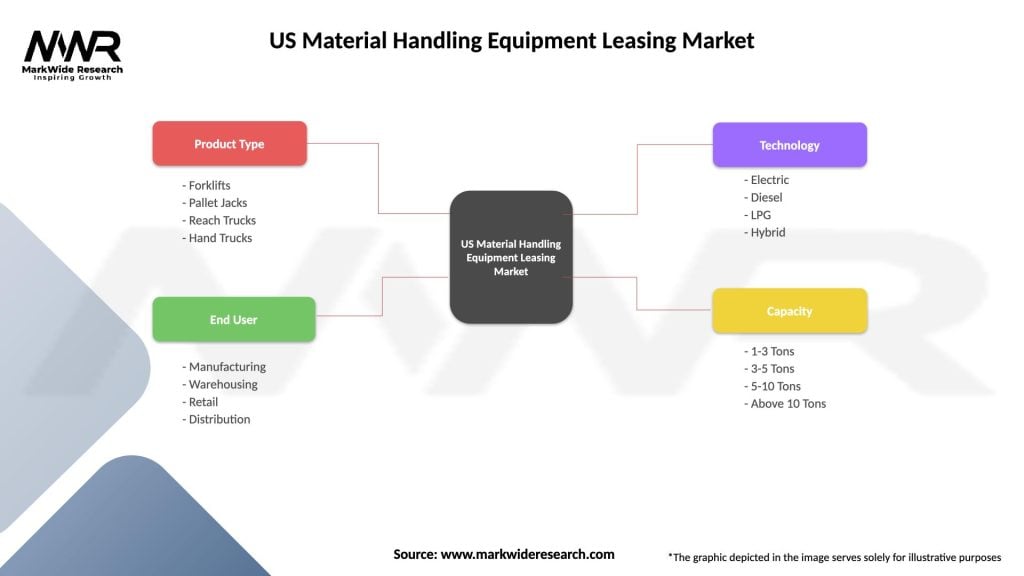

| Segmentation Details | Description |

|---|---|

| Product Type | Forklifts, Pallet Jacks, Reach Trucks, Hand Trucks |

| End User | Manufacturing, Warehousing, Retail, Distribution |

| Technology | Electric, Diesel, LPG, Hybrid |

| Capacity | 1-3 Tons, 3-5 Tons, 5-10 Tons, Above 10 Tons |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Material Handling Equipment Leasing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at