444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific vitamin fortified and mineral enriched food & beverage market represents one of the most dynamic and rapidly expanding sectors in the global nutrition industry. This comprehensive market encompasses a diverse range of products including fortified cereals, enriched dairy products, vitamin-enhanced beverages, mineral-supplemented snacks, and functional foods designed to address nutritional deficiencies across the region. Market dynamics indicate robust growth driven by increasing health consciousness, rising disposable incomes, and government initiatives promoting nutritional wellness.

Regional growth patterns demonstrate significant expansion across key markets including China, India, Japan, South Korea, Australia, and Southeast Asian nations. The market exhibits a compound annual growth rate (CAGR) of 8.2% during the forecast period, reflecting strong consumer demand for nutritionally enhanced products. Consumer preferences are shifting toward products that offer convenience while delivering essential vitamins and minerals, particularly vitamin D, calcium, iron, and B-complex vitamins.

Product innovation continues to drive market expansion, with manufacturers developing sophisticated fortification technologies that maintain taste profiles while enhancing nutritional content. The market benefits from regulatory support across various countries, with governments implementing mandatory fortification programs for staple foods to combat malnutrition and micronutrient deficiencies.

The Asia-Pacific vitamin fortified and mineral enriched food & beverage market refers to the comprehensive ecosystem of nutritionally enhanced consumable products specifically designed to supplement essential vitamins and minerals in the daily diet of consumers across the Asia-Pacific region. This market encompasses products where vitamins, minerals, or both have been deliberately added during manufacturing processes to improve nutritional value and address specific dietary deficiencies prevalent in regional populations.

Fortification processes involve the addition of micronutrients to food products at levels that provide meaningful nutritional benefits without compromising taste, texture, or shelf life. Mineral enrichment specifically focuses on adding essential minerals such as iron, calcium, zinc, and magnesium to address common deficiencies identified through regional health surveys and nutritional assessments.

Market scope includes both mandatory fortification programs mandated by government health authorities and voluntary fortification initiatives undertaken by food manufacturers to meet consumer demand for healthier product options. The market serves diverse consumer segments ranging from children requiring growth-supporting nutrients to elderly populations needing bone health support.

Strategic market analysis reveals the Asia-Pacific vitamin fortified and mineral enriched food & beverage market as a high-growth sector characterized by increasing consumer awareness, technological advancement, and supportive regulatory frameworks. The market demonstrates exceptional resilience and expansion potential driven by demographic trends, urbanization patterns, and evolving lifestyle preferences across the region.

Key market drivers include rising health consciousness among consumers, increasing prevalence of lifestyle-related health conditions, and growing awareness of micronutrient deficiencies. Government initiatives promoting public health through mandatory fortification programs contribute significantly to market growth, with 65% of countries in the region implementing some form of mandatory fortification policy.

Product categories experiencing the strongest growth include fortified dairy products, vitamin-enhanced beverages, and mineral-enriched breakfast cereals. Innovation trends focus on developing products with multiple micronutrient combinations, improved bioavailability, and enhanced sensory characteristics. The market benefits from increasing penetration of modern retail channels and growing e-commerce adoption for health-focused products.

Competitive dynamics feature both multinational corporations and regional players competing through product innovation, strategic partnerships, and market expansion initiatives. Investment patterns show significant capital allocation toward research and development, manufacturing capacity expansion, and marketing initiatives targeting health-conscious consumers.

Consumer behavior analysis reveals fundamental shifts in purchasing patterns toward nutritionally enhanced products across all demographic segments. Health awareness campaigns and educational initiatives have significantly increased consumer understanding of micronutrient importance, driving demand for fortified and enriched products.

Market penetration rates vary significantly across countries, with developed markets showing higher adoption rates of 75-80% compared to emerging markets at 45-55% penetration. Product preferences demonstrate regional variations based on local dietary habits, nutritional deficiencies, and cultural food preferences.

Primary growth drivers propelling the Asia-Pacific vitamin fortified and mineral enriched food & beverage market stem from multiple interconnected factors creating a robust foundation for sustained expansion. Health consciousness evolution represents the most significant driver, with consumers increasingly recognizing the connection between nutrition and long-term health outcomes.

Nutritional deficiency awareness has reached critical levels across the region, with health organizations and government agencies highlighting widespread micronutrient deficiencies affecting population health. Iron deficiency anemia affects approximately 42% of women in reproductive age across several Asia-Pacific countries, driving demand for iron-fortified products. Vitamin D deficiency has become increasingly prevalent in urban populations, creating substantial market opportunities for fortified dairy products and beverages.

Lifestyle transformation associated with rapid urbanization and changing work patterns has created demand for convenient nutrition solutions. Busy lifestyles limit time available for meal preparation, making fortified ready-to-eat products and enhanced beverages attractive alternatives for maintaining nutritional intake. Working women represent a particularly important consumer segment driving demand for products that support family nutrition while accommodating time constraints.

Government initiatives across the region provide substantial market support through mandatory fortification programs and public health campaigns. Regulatory frameworks requiring fortification of staple foods create stable demand foundations while educational programs increase consumer awareness of nutritional benefits. Healthcare cost concerns motivate both governments and consumers to invest in preventive nutrition strategies.

Market growth limitations in the Asia-Pacific vitamin fortified and mineral enriched food & beverage sector arise from several challenging factors that companies must navigate to achieve sustained success. Cost considerations represent the most significant restraint, as fortification processes increase production costs, potentially limiting accessibility for price-sensitive consumer segments.

Technical challenges associated with fortification processes create operational complexities for manufacturers. Nutrient stability during processing, storage, and distribution requires sophisticated technology and quality control systems, increasing operational costs. Taste and texture modifications resulting from fortification can negatively impact consumer acceptance, particularly in markets where traditional flavor profiles are highly valued.

Regulatory complexities vary significantly across Asia-Pacific countries, creating challenges for companies seeking regional expansion. Approval processes for new fortified products can be lengthy and expensive, while differing standards across countries complicate product development and marketing strategies. Labeling requirements and health claim regulations add additional compliance burdens for manufacturers.

Consumer skepticism regarding processed foods and artificial additives creates resistance in certain market segments. Traditional dietary preferences and cultural resistance to modified foods can limit market penetration, particularly in rural areas where traditional food preparation methods remain prevalent. Education barriers regarding nutritional benefits require significant marketing investments to overcome consumer hesitation.

Emerging opportunities within the Asia-Pacific vitamin fortified and mineral enriched food & beverage market present substantial potential for companies positioned to capitalize on evolving consumer needs and market dynamics. Untapped rural markets represent significant expansion opportunities, with improving infrastructure and rising incomes creating access to previously underserved populations.

Product innovation opportunities continue expanding as technology advances enable more sophisticated fortification approaches. Personalized nutrition trends create opportunities for targeted products addressing specific demographic needs, such as products designed for pregnant women, elderly consumers, or athletes. Functional food integration allows companies to combine fortification with other health benefits, creating premium product categories.

E-commerce expansion provides new distribution channels and direct consumer engagement opportunities. Digital platforms enable companies to educate consumers about nutritional benefits while building brand loyalty through targeted marketing campaigns. Subscription models for regular delivery of fortified products create recurring revenue streams and improved customer retention.

Partnership opportunities with healthcare providers, educational institutions, and government agencies can accelerate market penetration and consumer education. Corporate wellness programs represent growing opportunities as employers seek to improve employee health through nutritional interventions. School nutrition programs provide stable demand for fortified products while supporting public health objectives.

Market dynamics in the Asia-Pacific vitamin fortified and mineral enriched food & beverage sector reflect complex interactions between consumer behavior, regulatory environments, technological advancement, and competitive pressures. Supply chain evolution demonstrates increasing sophistication as companies invest in advanced manufacturing technologies and quality control systems to ensure nutrient stability and product consistency.

Demand patterns show seasonal variations linked to health awareness campaigns, school programs, and cultural events promoting family health. Price sensitivity analysis reveals that while consumers are willing to pay premiums for health benefits, price remains a critical factor in purchase decisions, particularly in emerging markets. Brand loyalty dynamics indicate that consumers develop strong preferences for trusted brands that consistently deliver nutritional benefits.

Innovation cycles are accelerating as companies compete to introduce new fortification technologies and product formats. Research and development investments focus on improving nutrient bioavailability, developing natural fortification sources, and creating products with multiple health benefits. Manufacturing efficiency improvements help companies reduce costs while maintaining product quality and nutritional efficacy.

Distribution channel evolution reflects changing consumer shopping patterns, with modern retail formats accounting for 60% of fortified product sales in urban areas. Online sales growth demonstrates annual increases of 25-30% as consumers embrace digital shopping for health-focused products. Market consolidation trends show larger companies acquiring innovative smaller firms to expand product portfolios and market reach.

Comprehensive research methodology employed for analyzing the Asia-Pacific vitamin fortified and mineral enriched food & beverage market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research components include extensive surveys, in-depth interviews, and focus group discussions with industry stakeholders across the value chain.

Data collection strategies encompass surveys of consumers, manufacturers, distributors, retailers, and regulatory officials across key markets in the Asia-Pacific region. Sample sizes ensure statistical significance while representing diverse demographic segments, geographic regions, and product categories. Interview protocols focus on understanding market trends, challenges, opportunities, and future outlook from multiple stakeholder perspectives.

Secondary research methodology involves comprehensive analysis of industry reports, government publications, academic studies, company financial statements, and regulatory documents. Data validation processes cross-reference multiple sources to ensure accuracy and identify potential discrepancies requiring further investigation. Market sizing techniques employ bottom-up and top-down approaches to develop comprehensive market assessments.

Analytical frameworks include statistical analysis, trend identification, competitive benchmarking, and scenario modeling to develop actionable insights. Quality assurance protocols ensure data integrity through multiple verification stages and expert review processes. MarkWide Research methodology standards ensure consistency and reliability across all market analysis components.

Regional market dynamics across the Asia-Pacific vitamin fortified and mineral enriched food & beverage market demonstrate significant variations in growth patterns, consumer preferences, and regulatory environments. China dominates the regional market with approximately 35% market share, driven by large population, increasing health consciousness, and government support for nutrition programs.

India represents the second-largest market with 22% regional market share, characterized by rapid growth in urban areas and increasing awareness of micronutrient deficiencies. Government initiatives including mandatory iron and folic acid fortification programs create stable demand foundations while rising disposable incomes enable premium product adoption. Rural market penetration remains limited but shows promising growth potential.

Japan and South Korea collectively account for 18% of regional market share, representing mature markets with high consumer awareness and premium product preferences. Aging populations drive demand for calcium-fortified products and vitamin supplements targeting bone health and cognitive function. Innovation leadership in these markets influences product development trends across the broader region.

Southeast Asian markets including Thailand, Malaysia, Indonesia, and Philippines demonstrate rapid growth rates of 12-15% annually, driven by urbanization, rising incomes, and increasing health awareness. Government fortification programs targeting malnutrition create substantial opportunities for manufacturers. Australia and New Zealand represent premium markets with sophisticated regulatory frameworks and high consumer expectations for product quality and transparency.

Competitive dynamics in the Asia-Pacific vitamin fortified and mineral enriched food & beverage market feature intense competition among multinational corporations, regional leaders, and emerging innovative companies. Market leadership is distributed among several key players, each leveraging distinct competitive advantages and strategic positioning.

Strategic initiatives among leading companies include product portfolio expansion, manufacturing capacity investments, and strategic partnerships with local distributors. Innovation focus emphasizes developing products with improved taste profiles, enhanced nutrient bioavailability, and multiple health benefits. Market expansion strategies target underserved rural markets and emerging consumer segments through tailored product offerings and pricing strategies.

Market segmentation analysis reveals distinct categories within the Asia-Pacific vitamin fortified and mineral enriched food & beverage market, each characterized by unique growth patterns, consumer preferences, and competitive dynamics. Product-based segmentation provides insights into category-specific trends and opportunities.

By Product Type:

By Nutrient Type:

By Consumer Segment:

Category performance analysis demonstrates varying growth trajectories and market dynamics across different product segments within the Asia-Pacific vitamin fortified and mineral enriched food & beverage market. Fortified dairy products maintain market leadership with consistent growth driven by widespread consumer acceptance and government support for calcium and vitamin D supplementation programs.

Enriched breakfast cereals show strong performance in urban markets where convenience and nutrition combine to meet busy lifestyle demands. Innovation trends in this category focus on developing products with reduced sugar content while maintaining nutritional enhancement and taste appeal. Market penetration rates vary significantly between developed and emerging markets, with urban adoption rates of 70-80% compared to rural rates of 25-35%.

Vitamin-enhanced beverages represent the fastest-growing category, benefiting from increasing consumer preference for functional drinks and convenient nutrition delivery. Product innovation emphasizes natural ingredients, reduced artificial additives, and multiple health benefits beyond basic vitamin supplementation. Sports and energy drinks with vitamin enhancement show particularly strong growth among younger demographics.

Fortified infant nutrition maintains premium positioning with parents willing to invest in products supporting child development. Regulatory requirements for infant products create high barriers to entry while ensuring product quality and safety. Market expansion focuses on developing products addressing specific nutritional needs identified through pediatric health research.

Functional snacks emerge as a high-growth category combining convenience with nutritional benefits. Consumer trends toward healthy snacking drive demand for products that provide sustained energy while delivering essential micronutrients. MarkWide Research analysis indicates this category shows annual growth rates of 15-18% across key regional markets.

Industry participants in the Asia-Pacific vitamin fortified and mineral enriched food & beverage market realize substantial benefits through strategic positioning in this high-growth sector. Manufacturers benefit from premium pricing opportunities, as consumers demonstrate willingness to pay higher prices for nutritionally enhanced products compared to conventional alternatives.

Revenue diversification opportunities enable companies to reduce dependence on traditional product categories while building stronger relationships with health-conscious consumers. Brand differentiation through nutritional enhancement creates competitive advantages and supports marketing campaigns emphasizing health benefits and quality positioning.

Retailers benefit from higher profit margins on fortified products while meeting growing consumer demand for health-focused options. Category management opportunities include creating dedicated health and wellness sections that drive increased basket sizes and customer loyalty. Private label development in fortified products enables retailers to capture additional value while serving price-conscious consumers.

Suppliers and ingredient companies realize growth opportunities through partnerships with food manufacturers seeking specialized fortification solutions. Technology providers benefit from increasing demand for advanced fortification equipment and quality control systems. Distributors gain access to high-value product categories with strong growth potential and stable demand patterns.

Healthcare stakeholders including hospitals, clinics, and nutrition professionals benefit from improved population health outcomes through increased availability of fortified products. Government agencies achieve public health objectives while supporting economic development through industry growth and job creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the Asia-Pacific vitamin fortified and mineral enriched food & beverage market reflect evolving consumer preferences, technological advancement, and changing lifestyle patterns. Natural fortification represents a significant trend as consumers increasingly prefer products enhanced with naturally-derived vitamins and minerals rather than synthetic alternatives.

Personalized nutrition gains momentum as companies develop products targeting specific demographic groups, health conditions, and lifestyle requirements. Age-specific formulations address unique nutritional needs of different life stages, while gender-specific products target distinct physiological requirements. Condition-specific fortification addresses health concerns such as bone health, immune support, and cognitive function.

Clean label movement influences product development as consumers demand transparency in ingredient lists and manufacturing processes. Organic fortification combines organic food trends with nutritional enhancement, creating premium product categories. Minimal processing approaches maintain nutritional integrity while meeting consumer preferences for less processed foods.

Functional food integration combines fortification with other health benefits such as probiotics, prebiotics, and antioxidants. Plant-based fortification addresses growing demand for vegetarian and vegan nutritional options. Sustainability focus influences packaging choices, ingredient sourcing, and manufacturing processes as companies respond to environmental consciousness.

Digital engagement trends include QR codes providing nutritional information, mobile apps for tracking nutrient intake, and social media campaigns educating consumers about health benefits. Subscription services for regular delivery of fortified products gain popularity among health-conscious consumers seeking convenience.

Recent industry developments demonstrate the dynamic nature of the Asia-Pacific vitamin fortified and mineral enriched food & beverage market, with companies continuously innovating to meet evolving consumer needs and regulatory requirements. Manufacturing investments across the region reflect confidence in long-term growth prospects and commitment to serving expanding markets.

Technology partnerships between food manufacturers and nutrition research institutions accelerate product development and improve fortification efficacy. Bioavailability research leads to improved formulations that enhance nutrient absorption and utilization by the human body. Microencapsulation technologies protect sensitive vitamins during processing and storage while improving taste profiles.

Regulatory developments include updated fortification standards, expanded mandatory programs, and streamlined approval processes for new products. International harmonization efforts aim to reduce regulatory complexity and facilitate cross-border trade. Quality assurance standards continue evolving to ensure product safety and nutritional efficacy.

Market consolidation activities include strategic acquisitions, joint ventures, and licensing agreements that strengthen market positions and expand product portfolios. Startup investments in innovative fortification technologies and novel product concepts attract venture capital and corporate funding. Supply chain partnerships improve ingredient sourcing, manufacturing efficiency, and distribution capabilities.

Sustainability initiatives focus on reducing environmental impact through improved packaging, energy-efficient manufacturing, and responsible ingredient sourcing. Social responsibility programs support nutrition education and access to fortified products in underserved communities.

Strategic recommendations for companies operating in the Asia-Pacific vitamin fortified and mineral enriched food & beverage market emphasize the importance of balanced growth strategies that address both immediate opportunities and long-term market evolution. Market entry strategies should prioritize countries with supportive regulatory environments and growing health consciousness among consumers.

Product development focus should emphasize natural fortification sources, improved taste profiles, and multiple health benefits to differentiate from competitors. Innovation investments in bioavailability enhancement and personalized nutrition solutions will create sustainable competitive advantages. Quality assurance systems must meet the highest international standards to build consumer trust and regulatory compliance.

Distribution strategy optimization should leverage both traditional retail channels and emerging e-commerce platforms to maximize market reach. Rural market penetration requires tailored approaches including appropriate pricing, packaging sizes, and distribution partnerships. Urban market development should focus on premium positioning and convenience-oriented products.

Partnership strategies with healthcare providers, educational institutions, and government agencies can accelerate market penetration and consumer education. Supply chain optimization should ensure reliable ingredient sourcing while maintaining cost competitiveness. Brand building investments in consumer education and health benefit communication will drive long-term market success.

MWR analysis suggests that companies should maintain flexibility in product portfolios to adapt to changing consumer preferences and regulatory requirements. Technology investments in advanced fortification methods and quality control systems will become increasingly important for maintaining market leadership positions.

Future market projections for the Asia-Pacific vitamin fortified and mineral enriched food & beverage market indicate sustained growth driven by demographic trends, increasing health awareness, and technological advancement. Long-term growth prospects remain highly positive with expanding consumer base, rising incomes, and supportive government policies creating favorable market conditions.

Demographic transitions including aging populations and urbanization will continue driving demand for specialized nutritional products. Health consciousness evolution suggests consumers will increasingly prioritize preventive nutrition, creating opportunities for innovative product development. Technology advancement will enable more sophisticated fortification approaches and improved product quality.

Market expansion patterns indicate strongest growth potential in emerging markets where infrastructure development and income growth create new consumer opportunities. Product category evolution will likely favor functional foods combining multiple health benefits with convenient consumption formats. Premium segment growth reflects consumer willingness to invest in high-quality nutritional products.

Innovation trajectories point toward personalized nutrition solutions, natural fortification sources, and enhanced bioavailability formulations. Regulatory evolution will likely support market growth through streamlined approval processes and expanded mandatory fortification programs. Sustainability integration will become increasingly important for long-term market success.

Market maturation in developed countries will drive companies to focus on emerging markets and innovative product categories. Competitive dynamics will intensify as more companies recognize growth opportunities, requiring continuous innovation and strategic positioning. MarkWide Research projects the market will maintain robust growth rates above 8% annually through the forecast period, supported by fundamental demographic and economic trends.

The Asia-Pacific vitamin fortified and mineral enriched food & beverage market represents a compelling growth opportunity characterized by strong fundamentals, supportive trends, and expanding consumer demand. Market dynamics reflect the convergence of health consciousness, demographic transitions, and technological advancement creating sustainable growth drivers across the region.

Strategic positioning in this market requires comprehensive understanding of regional variations, consumer preferences, and regulatory environments. Success factors include product innovation, quality assurance, effective distribution, and consumer education initiatives that build trust and drive adoption. Companies that invest in advanced fortification technologies, develop targeted product portfolios, and build strong market presence will capture the greatest opportunities.

Long-term outlook remains highly positive with demographic trends, economic development, and health awareness evolution supporting sustained market expansion. The Asia-Pacific vitamin fortified and mineral enriched food & beverage market will continue serving as a critical component of regional nutrition strategies while providing substantial commercial opportunities for industry participants committed to improving population health through innovative nutritional solutions.

What is Vitamin Fortified and Mineral Enriched Food & Beverage?

Vitamin Fortified and Mineral Enriched Food & Beverage refers to products that have added vitamins and minerals to enhance their nutritional value. These products are designed to improve health outcomes and are commonly found in various segments such as dairy, snacks, and beverages.

What are the key players in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Key players in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market include Nestlé, Danone, and Abbott, among others. These companies are known for their innovative product offerings and strong market presence in the region.

What are the growth factors driving the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market?

The growth of the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market is driven by increasing health awareness among consumers, rising disposable incomes, and a growing demand for convenient and nutritious food options. Additionally, the aging population is contributing to the demand for fortified products.

What challenges does the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market face?

Challenges in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market include regulatory hurdles, consumer skepticism regarding health claims, and competition from unfortified products. These factors can hinder market growth and product acceptance.

What opportunities exist in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Opportunities in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market include the development of innovative products targeting specific health concerns, such as immunity and digestive health. Additionally, expanding e-commerce channels present new avenues for reaching consumers.

What trends are shaping the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market?

Trends in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market include a growing preference for plant-based fortified products, increased transparency in labeling, and the incorporation of functional ingredients. These trends reflect changing consumer preferences towards health and wellness.

Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market

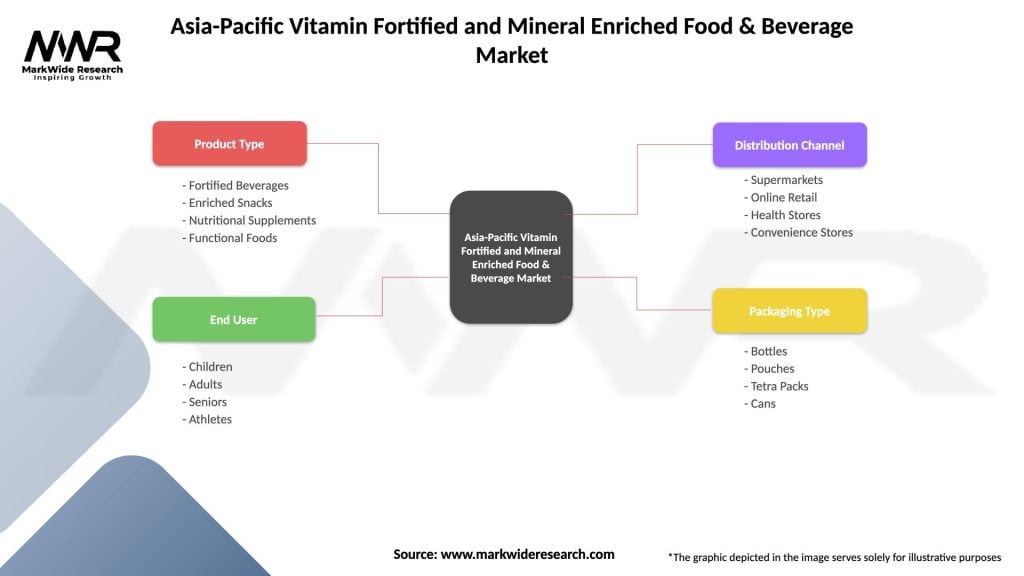

| Segmentation Details | Description |

|---|---|

| Product Type | Fortified Beverages, Enriched Snacks, Nutritional Supplements, Functional Foods |

| End User | Children, Adults, Seniors, Athletes |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Convenience Stores |

| Packaging Type | Bottles, Pouches, Tetra Packs, Cans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Vitamin Fortified and Mineral Enriched Food & Beverage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at