444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America biomedical sensors market represents a dynamic and rapidly evolving sector within the broader healthcare technology landscape. This market encompasses sophisticated sensing devices that monitor, detect, and measure various biological parameters in medical applications. Biomedical sensors have become integral components in modern healthcare delivery, enabling real-time patient monitoring, diagnostic procedures, and therapeutic interventions across hospitals, clinics, and home healthcare settings.

Market growth in North America is driven by increasing healthcare digitization, rising prevalence of chronic diseases, and growing demand for minimally invasive diagnostic solutions. The region’s advanced healthcare infrastructure, coupled with substantial investments in medical technology research and development, positions North America as a leading market for biomedical sensor innovations. Growth projections indicate the market is expanding at a robust CAGR of 8.2% through the forecast period, reflecting strong adoption across multiple healthcare segments.

Technological advancements in sensor miniaturization, wireless connectivity, and artificial intelligence integration are transforming the biomedical sensors landscape. Healthcare providers increasingly rely on these sophisticated devices for continuous patient monitoring, early disease detection, and personalized treatment protocols. The market encompasses various sensor types including biosensors, image sensors, pressure sensors, temperature sensors, and motion sensors, each serving specific medical applications and contributing to improved patient outcomes.

The biomedical sensors market refers to the comprehensive ecosystem of sensing devices, technologies, and solutions designed specifically for medical and healthcare applications. These sensors convert biological, chemical, or physical parameters into measurable electrical signals that can be processed, analyzed, and interpreted by medical professionals or automated systems.

Biomedical sensors encompass a wide range of devices that detect and measure vital signs, biochemical markers, physiological parameters, and environmental conditions relevant to human health. These sophisticated instruments serve as critical interfaces between the human body and medical monitoring systems, enabling healthcare providers to gather real-time data for diagnosis, treatment monitoring, and preventive care initiatives.

Market scope includes various sensor categories such as wearable sensors for continuous monitoring, implantable sensors for long-term therapeutic applications, diagnostic sensors for laboratory testing, and imaging sensors for medical visualization. The integration of these sensors with digital health platforms, electronic medical records, and telemedicine systems creates comprehensive healthcare monitoring solutions that enhance patient care quality and clinical decision-making processes.

North America’s biomedical sensors market demonstrates exceptional growth momentum driven by technological innovation, healthcare digitization, and increasing demand for personalized medicine solutions. The market benefits from strong regulatory frameworks, advanced research institutions, and significant healthcare technology investments across the United States and Canada.

Key market drivers include the aging population demographic, rising chronic disease prevalence, and growing emphasis on preventive healthcare approaches. Healthcare providers are increasingly adopting biomedical sensors to improve patient monitoring capabilities, reduce healthcare costs, and enhance treatment outcomes. Adoption rates for wearable biomedical sensors have increased by 45% over the past three years, reflecting growing acceptance among both healthcare professionals and patients.

Market segmentation reveals strong performance across multiple categories, with biosensors and wearable sensors leading growth trajectories. The integration of artificial intelligence and machine learning capabilities into sensor systems is creating new opportunities for predictive healthcare analytics and automated patient monitoring solutions. Innovation investments in sensor miniaturization and wireless connectivity are expanding application possibilities across diverse medical specialties.

Competitive dynamics feature established medical device manufacturers alongside emerging technology companies developing next-generation sensor solutions. Strategic partnerships between sensor manufacturers, healthcare providers, and technology companies are accelerating market development and expanding distribution channels throughout North America.

Market insights reveal several critical trends shaping the North America biomedical sensors landscape:

Market penetration analysis indicates that 72% of hospitals in North America have implemented some form of advanced biomedical sensor technology, with adoption rates continuing to accelerate across smaller healthcare facilities and outpatient clinics.

Primary market drivers propelling the North America biomedical sensors market include demographic shifts, technological advancements, and evolving healthcare delivery models. The aging population across the region creates increasing demand for continuous health monitoring solutions and chronic disease management technologies.

Healthcare digitization initiatives are fundamental drivers accelerating sensor adoption across medical facilities. Electronic health record integration, telemedicine platforms, and digital health ecosystems require sophisticated sensing capabilities to collect, transmit, and analyze patient data effectively. Digital health investments have increased by 38% annually, supporting expanded sensor deployment across healthcare networks.

Chronic disease prevalence continues rising throughout North America, creating substantial demand for specialized monitoring sensors. Diabetes, cardiovascular diseases, and respiratory conditions require continuous monitoring capabilities that biomedical sensors provide. Healthcare providers increasingly rely on these technologies to improve patient outcomes while reducing long-term treatment costs.

Regulatory support from agencies like the FDA has streamlined approval processes for innovative biomedical sensor technologies, encouraging manufacturer investment in research and development. Fast-track approval pathways for breakthrough medical devices are accelerating market entry for next-generation sensor solutions.

Cost reduction pressures within healthcare systems drive adoption of sensors that enable early disease detection, preventive care, and remote monitoring capabilities. These technologies help healthcare providers optimize resource allocation while maintaining high-quality patient care standards across diverse medical settings.

Market restraints affecting the North America biomedical sensors market include high implementation costs, regulatory complexities, and technical integration challenges. Healthcare facilities often face significant capital investment requirements when deploying comprehensive sensor monitoring systems.

Regulatory compliance requirements create substantial barriers for new market entrants and can delay product launches for innovative sensor technologies. Complex approval processes, clinical trial requirements, and quality assurance standards require significant time and financial investments from manufacturers.

Data privacy concerns and cybersecurity risks associated with connected biomedical sensors create hesitation among healthcare providers and patients. Ensuring secure data transmission, storage, and access while maintaining regulatory compliance adds complexity and costs to sensor system implementations.

Technical integration challenges arise when incorporating new sensor technologies into existing healthcare information systems. Legacy infrastructure limitations, interoperability issues, and staff training requirements can slow adoption rates and increase implementation costs for healthcare organizations.

Reimbursement uncertainties for certain biomedical sensor applications create market adoption barriers. Insurance coverage limitations for remote monitoring services and wearable sensor technologies can restrict patient access and limit market growth potential in specific segments.

Significant opportunities exist within the North America biomedical sensors market as healthcare systems embrace digital transformation and personalized medicine approaches. The integration of artificial intelligence and machine learning capabilities creates new possibilities for predictive healthcare analytics and automated patient monitoring solutions.

Home healthcare expansion presents substantial growth opportunities for portable and wearable biomedical sensors. Aging populations preferring to receive care in familiar environments drive demand for sophisticated monitoring technologies that enable safe, effective home-based healthcare delivery.

Preventive healthcare initiatives create opportunities for sensors that enable early disease detection and continuous health monitoring. Healthcare systems increasingly focus on preventing diseases rather than treating advanced conditions, creating demand for sensors that support wellness monitoring and risk assessment applications.

Emerging applications in mental health monitoring, sleep quality assessment, and stress management represent new market segments for specialized biomedical sensors. These applications address growing awareness of holistic health approaches and create opportunities for innovative sensor solutions.

Strategic partnerships between sensor manufacturers, healthcare providers, and technology companies create opportunities for integrated solution development and expanded market reach. Collaborative approaches enable comprehensive healthcare monitoring ecosystems that address complex patient care requirements.

Market dynamics in the North America biomedical sensors sector reflect the interplay between technological innovation, healthcare needs, and regulatory environments. The market experiences continuous evolution driven by advancing sensor technologies, changing patient expectations, and healthcare system transformation initiatives.

Supply chain dynamics involve complex relationships between component manufacturers, sensor developers, healthcare technology integrators, and end-user healthcare facilities. MarkWide Research analysis indicates that supply chain optimization efforts have improved sensor delivery times by 25% while reducing overall system costs for healthcare providers.

Competitive dynamics feature intense innovation competition among established medical device manufacturers and emerging technology companies. Market leaders invest heavily in research and development to maintain technological advantages while new entrants focus on niche applications and disruptive technologies.

Pricing dynamics reflect the balance between advanced technology capabilities and healthcare budget constraints. Manufacturers must deliver sophisticated sensor solutions while maintaining cost-effectiveness for healthcare providers operating under financial pressures and reimbursement limitations.

Adoption dynamics vary across different healthcare segments, with large hospital systems typically leading adoption of advanced sensor technologies while smaller facilities follow as costs decrease and implementation processes simplify. Technology adoption rates show that 85% of major medical centers have implemented comprehensive biomedical sensor monitoring systems.

Research methodology for analyzing the North America biomedical sensors market employs comprehensive primary and secondary research approaches to ensure accurate market assessment and reliable insights. The methodology combines quantitative data analysis with qualitative market intelligence gathering from industry stakeholders.

Primary research activities include structured interviews with healthcare professionals, biomedical sensor manufacturers, technology integrators, and regulatory experts across the United States and Canada. These interviews provide firsthand insights into market trends, adoption challenges, and future development priorities within the biomedical sensors ecosystem.

Secondary research sources encompass industry reports, regulatory filings, patent databases, academic publications, and healthcare technology market studies. This comprehensive information base supports market sizing, competitive analysis, and trend identification across various biomedical sensor categories and applications.

Data validation processes involve cross-referencing multiple information sources, conducting expert reviews, and applying statistical analysis techniques to ensure research accuracy and reliability. Market projections and trend analyses undergo rigorous validation to provide stakeholders with dependable market intelligence.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, technology trend evaluation, and regulatory impact analysis. These frameworks enable comprehensive market understanding and support strategic decision-making for industry participants and investors.

Regional analysis of the North America biomedical sensors market reveals distinct characteristics and growth patterns across the United States and Canada. The United States dominates market activity, accounting for approximately 88% of regional market share, driven by advanced healthcare infrastructure, substantial research investments, and large patient populations.

United States market dynamics benefit from leading medical device manufacturers, world-class research institutions, and supportive regulatory frameworks. Major metropolitan areas including Boston, San Francisco, Minneapolis, and Research Triangle Park serve as innovation hubs for biomedical sensor development and commercialization activities.

California leads state-level market activity with significant concentrations of medical device companies, healthcare technology startups, and research universities. The state’s emphasis on digital health innovation and venture capital availability supports continued biomedical sensor market development and expansion.

Canadian market characteristics include strong government support for healthcare technology innovation, universal healthcare system integration requirements, and growing emphasis on remote patient monitoring solutions. Market growth rates in Canada show 12% annual expansion in biomedical sensor adoption across provincial healthcare systems.

Regional collaboration between United States and Canadian organizations facilitates technology transfer, joint research initiatives, and cross-border market development opportunities. These partnerships strengthen the overall North American biomedical sensors ecosystem and accelerate innovation commercialization processes.

Competitive landscape analysis reveals a dynamic market structure featuring established medical device manufacturers, specialized sensor companies, and emerging technology innovators. Market leaders maintain competitive advantages through comprehensive product portfolios, strong distribution networks, and substantial research and development investments.

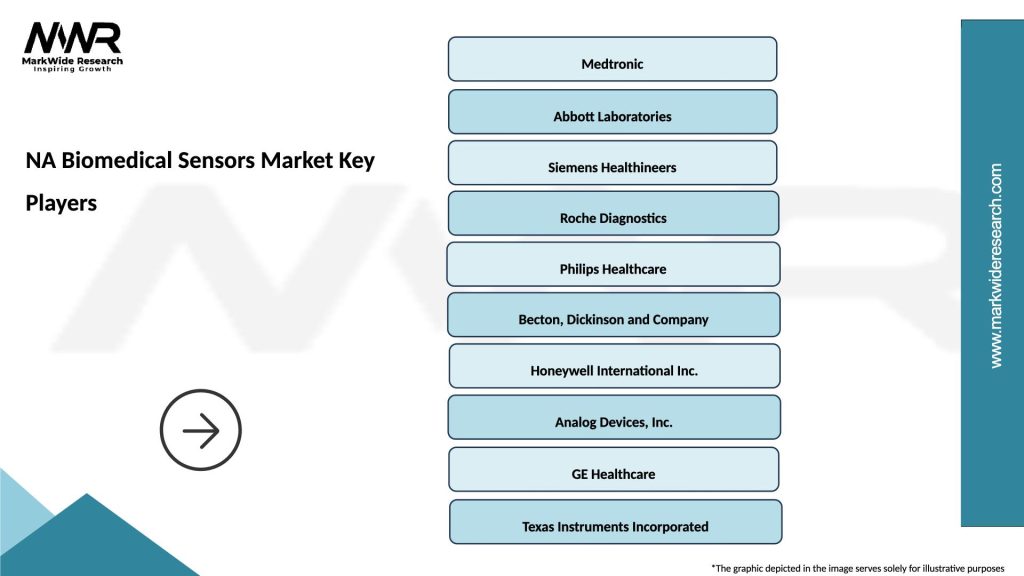

Leading market participants include:

Competitive strategies focus on technological innovation, strategic partnerships, and market expansion initiatives. Companies invest heavily in artificial intelligence integration, wireless connectivity enhancements, and sensor miniaturization to maintain competitive positioning.

Market consolidation trends include strategic acquisitions of specialized sensor companies by larger medical device manufacturers seeking to expand technological capabilities and market reach. These transactions accelerate innovation development and strengthen competitive positions across key market segments.

Market segmentation of the North America biomedical sensors market encompasses multiple classification approaches including sensor type, application area, end-user category, and technology platform. This comprehensive segmentation enables detailed analysis of market dynamics and growth opportunities across specific market niches.

By Sensor Type:

By Application:

By End User:

Biosensors category represents the largest and fastest-growing segment within the North America biomedical sensors market. These sophisticated devices enable real-time detection of biological molecules, cellular activities, and biochemical processes critical for medical diagnosis and monitoring applications.

Glucose monitoring biosensors dominate this category, driven by increasing diabetes prevalence and growing adoption of continuous glucose monitoring systems. Market penetration for continuous glucose monitors has reached 35% among Type 1 diabetes patients, with expansion into Type 2 diabetes management creating additional growth opportunities.

Image sensors category benefits from advancing medical imaging technologies, including digital radiography, ultrasound systems, and endoscopic imaging applications. Integration of artificial intelligence capabilities into image sensor systems enhances diagnostic accuracy and enables automated image analysis for various medical specialties.

Pressure sensors serve critical roles in patient monitoring applications, particularly in intensive care units, operating rooms, and cardiac catheterization laboratories. Advanced pressure sensing technologies enable minimally invasive monitoring procedures and improve patient safety during complex medical interventions.

Wearable sensors category experiences rapid growth driven by consumer health awareness and healthcare system emphasis on preventive care approaches. These devices enable continuous monitoring of vital signs, activity levels, and physiological parameters outside traditional healthcare settings.

Implantable sensors represent an emerging category with significant growth potential for long-term patient monitoring and therapeutic applications. These devices enable continuous data collection for chronic disease management and provide valuable insights for personalized treatment optimization.

Healthcare providers benefit significantly from biomedical sensor implementation through improved patient monitoring capabilities, enhanced diagnostic accuracy, and reduced healthcare delivery costs. These technologies enable early disease detection, continuous patient surveillance, and data-driven treatment decisions that improve patient outcomes while optimizing resource utilization.

Patients experience substantial benefits including less invasive monitoring procedures, continuous health tracking capabilities, and improved treatment personalization. Patient satisfaction scores increase by 28% when biomedical sensors are integrated into care delivery protocols, reflecting enhanced comfort and engagement in health management processes.

Medical device manufacturers gain competitive advantages through biomedical sensor integration, enabling development of next-generation medical equipment with enhanced functionality and connectivity. These capabilities support product differentiation, market expansion opportunities, and stronger customer relationships across healthcare segments.

Healthcare systems achieve operational efficiencies through automated data collection, reduced manual monitoring requirements, and improved workflow optimization. Biomedical sensors enable predictive maintenance of medical equipment, early warning systems for patient deterioration, and streamlined clinical decision-making processes.

Research institutions benefit from advanced data collection capabilities that support clinical research, drug development, and medical device innovation. High-quality sensor data enables more accurate research outcomes, accelerated study timelines, and improved understanding of disease mechanisms and treatment responses.

Technology companies find opportunities for market expansion through healthcare sector entry, leveraging sensor expertise developed in other industries. Strategic partnerships with healthcare organizations enable technology transfer and create new revenue streams in the growing digital health market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the biomedical sensors market. AI-powered sensors enable predictive analytics, automated pattern recognition, and intelligent alarm systems that enhance clinical decision-making and patient safety. Machine learning algorithms process sensor data to identify early warning signs of patient deterioration and optimize treatment protocols.

Wireless connectivity expansion continues revolutionizing biomedical sensor applications through enhanced data transmission capabilities, remote monitoring solutions, and seamless integration with digital health platforms. 5G network deployment enables real-time data streaming and supports advanced telemedicine applications requiring high-bandwidth sensor data transmission.

Sensor miniaturization advances enable new applications in implantable devices, wearable technologies, and minimally invasive monitoring solutions. Micro-scale sensors provide continuous monitoring capabilities while minimizing patient discomfort and enabling long-term deployment in various medical applications.

Personalized medicine integration drives demand for sensors that support individualized treatment approaches based on patient-specific physiological parameters and genetic factors. These sensors enable precision dosing, treatment response monitoring, and personalized risk assessment across various therapeutic areas.

Sustainability initiatives influence sensor design and manufacturing processes as healthcare organizations prioritize environmentally responsible technologies. Eco-friendly sensor materials and energy-efficient designs address growing environmental concerns while maintaining performance standards required for medical applications.

Recent industry developments highlight the dynamic nature of the North America biomedical sensors market and ongoing innovation across multiple technology areas. MWR analysis indicates that 62% of major sensor manufacturers have launched new products incorporating artificial intelligence capabilities within the past two years.

Regulatory approvals for next-generation sensor technologies continue accelerating, with the FDA implementing streamlined pathways for breakthrough medical devices. Recent approvals include advanced continuous glucose monitoring systems, implantable cardiac sensors, and AI-powered diagnostic imaging sensors that demonstrate improved clinical outcomes.

Strategic partnerships between technology companies and healthcare organizations are expanding sensor deployment and integration capabilities. Notable collaborations include partnerships between major cloud computing providers and medical device manufacturers to develop comprehensive remote monitoring platforms.

Investment activities in biomedical sensor startups have increased substantially, with venture capital funding supporting innovative sensor technologies for mental health monitoring, sleep analysis, and chronic disease management. These investments accelerate technology development and market commercialization timelines.

Manufacturing expansion initiatives by leading sensor companies include new production facilities and capacity increases to meet growing market demand. These investments support supply chain resilience and enable cost reductions through economies of scale in sensor manufacturing processes.

Market entry strategies for new participants should focus on specialized applications and niche market segments where established competitors have limited presence. Emerging companies can succeed by developing innovative sensor solutions for specific medical conditions or unique healthcare delivery models.

Technology investment priorities should emphasize artificial intelligence integration, wireless connectivity enhancements, and sensor miniaturization capabilities. Companies investing in these areas position themselves for long-term competitive advantages and market leadership opportunities.

Partnership development represents a critical success factor for biomedical sensor companies seeking market expansion. Strategic alliances with healthcare providers, technology integrators, and distribution partners accelerate market penetration and reduce commercialization risks.

Regulatory compliance requires dedicated resources and expertise to navigate complex approval processes successfully. Companies should invest in regulatory affairs capabilities early in product development cycles to minimize delays and ensure market access.

Customer education initiatives help accelerate sensor adoption by demonstrating clinical benefits, return on investment, and implementation best practices. Educational programs targeting healthcare professionals and administrators support informed purchasing decisions and successful technology deployments.

International expansion opportunities exist for North American sensor companies seeking growth beyond domestic markets. Leveraging technological advantages and regulatory expertise developed in North America can support successful expansion into global healthcare markets.

Future outlook for the North America biomedical sensors market indicates continued robust growth driven by technological innovation, healthcare digitization, and evolving patient care models. Market expansion is projected to maintain strong momentum with growth rates exceeding 9% annually through the next five years.

Technology evolution will focus on enhanced artificial intelligence capabilities, improved sensor accuracy, and expanded wireless connectivity options. Next-generation sensors will provide more comprehensive patient monitoring capabilities while reducing implementation complexity and operational costs for healthcare providers.

Application expansion into new healthcare areas including mental health monitoring, sleep disorder management, and wellness tracking will create additional market opportunities. These emerging applications address growing awareness of holistic health approaches and preventive care strategies.

Integration advancement with electronic health records, telemedicine platforms, and digital health ecosystems will enhance sensor value propositions and support comprehensive patient care coordination. Seamless data integration enables healthcare providers to make more informed treatment decisions and improve patient outcomes.

Market consolidation activities may increase as larger medical device companies acquire specialized sensor manufacturers to expand technological capabilities and market reach. These transactions will accelerate innovation development and strengthen competitive positions across key market segments.

Regulatory evolution toward more streamlined approval processes for innovative medical technologies will support faster market entry for breakthrough sensor solutions. Continued collaboration between industry and regulatory agencies will facilitate safe and effective technology adoption across healthcare systems.

The North America biomedical sensors market represents a dynamic and rapidly expanding sector within the broader healthcare technology landscape. Strong market fundamentals including aging demographics, chronic disease prevalence, and healthcare digitization initiatives support continued robust growth across multiple sensor categories and applications.

Technological innovation remains the primary driver of market development, with artificial intelligence integration, wireless connectivity enhancements, and sensor miniaturization creating new opportunities for improved patient care and healthcare system efficiency. These advances enable more sophisticated monitoring capabilities while reducing implementation barriers for healthcare providers.

Market participants benefit from North America’s advanced healthcare infrastructure, supportive regulatory environment, and strong innovation ecosystem. Companies that invest in technology development, strategic partnerships, and regulatory compliance position themselves for success in this competitive and rapidly evolving market.

Future growth prospects remain highly favorable as healthcare systems continue embracing digital transformation and personalized medicine approaches. The integration of biomedical sensors with emerging technologies and healthcare delivery models will create substantial opportunities for market expansion and innovation development throughout the forecast period.

What is Biomedical Sensors?

Biomedical sensors are devices that detect and measure biological signals, often used in healthcare for monitoring physiological parameters such as heart rate, glucose levels, and other vital signs.

What are the key players in the NA Biomedical Sensors Market?

Key players in the NA Biomedical Sensors Market include Medtronic, Abbott Laboratories, and Philips Healthcare, among others. These companies are known for their innovative technologies and extensive product portfolios in the biomedical sensor space.

What are the main drivers of growth in the NA Biomedical Sensors Market?

The growth of the NA Biomedical Sensors Market is driven by the increasing prevalence of chronic diseases, the rising demand for home healthcare solutions, and advancements in sensor technology that enhance accuracy and usability.

What challenges does the NA Biomedical Sensors Market face?

The NA Biomedical Sensors Market faces challenges such as regulatory hurdles, high costs of advanced sensors, and the need for continuous innovation to keep up with rapid technological changes.

What opportunities exist in the NA Biomedical Sensors Market?

Opportunities in the NA Biomedical Sensors Market include the development of wearable sensors, integration of artificial intelligence for data analysis, and expanding applications in telemedicine and remote patient monitoring.

What trends are shaping the NA Biomedical Sensors Market?

Trends in the NA Biomedical Sensors Market include the increasing adoption of wireless and portable sensors, the rise of personalized medicine, and the growing focus on preventive healthcare through continuous monitoring.

NA Biomedical Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Sensors, Implantable Sensors, Invasive Sensors, Non-invasive Sensors |

| Technology | Optical Sensors, Electrochemical Sensors, Thermal Sensors, Magnetic Sensors |

| End User | Hospitals, Home Care, Diagnostic Laboratories, Research Institutions |

| Application | Cardiac Monitoring, Glucose Monitoring, Respiratory Monitoring, Neurological Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Biomedical Sensors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at