444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK water enhancer market represents a dynamic and rapidly evolving segment within the broader beverage industry, characterized by innovative formulations and changing consumer preferences. Water enhancers have transformed the traditional hydration landscape by offering convenient, customizable flavor solutions that appeal to health-conscious consumers seeking alternatives to sugary beverages. The market encompasses liquid concentrates, powder sachets, and tablet formats designed to enhance plain water with flavors, vitamins, and functional ingredients.

Market dynamics indicate robust growth driven by increasing health awareness and the shift toward sugar-free alternatives. The UK market has experienced significant expansion with a compound annual growth rate (CAGR) of 8.2% over recent years, reflecting strong consumer adoption across diverse demographic segments. Premium positioning and innovative product development have enabled brands to capture substantial market share while addressing evolving consumer demands for functional hydration solutions.

Consumer behavior patterns demonstrate growing preference for personalized hydration experiences, with 67% of UK consumers actively seeking healthier beverage alternatives. The market benefits from strong retail distribution networks, strategic brand partnerships, and increasing penetration in both traditional and online channels. Product innovation continues to drive market expansion through enhanced formulations incorporating natural ingredients, electrolytes, and specialized nutritional components.

The UK water enhancer market refers to the commercial segment encompassing flavored liquid concentrates, powders, and tablets designed to transform plain water into flavored, often functional beverages. These products typically contain artificial or natural flavoring agents, sweeteners, vitamins, minerals, and other nutritional supplements that dissolve or mix with water to create customized drinking experiences.

Water enhancers serve as convenient alternatives to traditional flavored beverages, offering portion control, reduced sugar content, and enhanced nutritional value. The market includes various product categories ranging from basic flavor enhancers to sophisticated formulations containing electrolytes, caffeine, vitamins, and specialized functional ingredients targeting specific health and wellness objectives.

Market participants include established beverage companies, specialized nutrition brands, and emerging startups developing innovative formulations. The sector encompasses both mass-market products available in mainstream retail channels and premium offerings distributed through specialized health and wellness outlets, creating diverse market segments serving varied consumer preferences and price points.

Strategic market analysis reveals the UK water enhancer market as a high-growth segment driven by fundamental shifts in consumer beverage preferences and health consciousness. The market demonstrates strong momentum across multiple product categories, with liquid concentrates maintaining dominant market share while powder and tablet formats gain increasing traction among specific consumer segments.

Key growth drivers include rising health awareness, sugar reduction initiatives, convenience factors, and innovative product development. The market benefits from favorable regulatory environment supporting functional beverage categories and increasing consumer acceptance of artificial sweeteners and natural flavor alternatives. Distribution expansion through both traditional retail channels and e-commerce platforms has significantly enhanced market accessibility.

Competitive landscape features established multinational brands competing alongside specialized nutrition companies and emerging direct-to-consumer brands. Market leaders leverage strong brand recognition, extensive distribution networks, and continuous product innovation to maintain competitive advantages. Premium segment growth of 12.4% annually indicates increasing consumer willingness to pay higher prices for enhanced functionality and superior ingredients.

Future market trajectory appears highly favorable, supported by demographic trends, lifestyle changes, and ongoing product innovation. The market is expected to benefit from increasing focus on personalized nutrition, sustainable packaging solutions, and expanded functional ingredient incorporation addressing specific health and wellness objectives.

Consumer preference analysis reveals several critical insights shaping market development and competitive dynamics:

Market segmentation insights indicate distinct consumer clusters with varying preferences, usage patterns, and price sensitivity levels. Demographic analysis shows particularly strong adoption among millennials and Gen Z consumers, who represent the primary growth drivers for premium and innovative product categories.

Health consciousness trends represent the primary driver propelling UK water enhancer market expansion. Increasing awareness of sugar-related health risks and obesity concerns has motivated consumers to seek healthier beverage alternatives that maintain taste appeal while reducing caloric intake. Government initiatives promoting sugar reduction and healthy lifestyle choices have created favorable market conditions for water enhancer adoption.

Convenience factors significantly influence market growth as busy lifestyles drive demand for portable, easy-to-use hydration solutions. Water enhancers offer practical advantages including extended shelf life, compact packaging, and customizable serving sizes that appeal to on-the-go consumers. Workplace hydration initiatives and fitness culture expansion have further accelerated market adoption across diverse consumer segments.

Product innovation momentum continues driving market expansion through enhanced formulations incorporating functional ingredients, natural flavors, and specialized nutritional components. Technological advancement in flavor delivery systems, sweetener technologies, and packaging solutions has enabled manufacturers to develop superior products meeting evolving consumer expectations.

Distribution channel expansion through both traditional retail networks and digital platforms has significantly improved market accessibility and consumer awareness. E-commerce growth particularly benefits niche and premium brands seeking direct consumer engagement and specialized market positioning.

Consumer skepticism regarding artificial ingredients and chemical additives represents a significant market restraint, particularly among health-conscious segments seeking natural alternatives. Ingredient transparency concerns and negative perceptions of artificial sweeteners continue challenging market acceptance despite improved formulations and regulatory approvals.

Price sensitivity factors limit market penetration among budget-conscious consumers who may perceive water enhancers as unnecessary luxury items compared to plain water or traditional beverages. Economic pressures and household budget constraints can negatively impact discretionary spending on premium hydration products.

Regulatory compliance challenges related to health claims, ingredient approvals, and labeling requirements create barriers for new market entrants and product innovation initiatives. Changing regulations regarding artificial sweeteners, functional ingredients, and nutritional claims require ongoing compliance investments and potential product reformulations.

Market saturation risks in certain product categories may limit growth opportunities as increasing competition intensifies price pressure and reduces profit margins. Brand differentiation challenges become more pronounced as the market matures and consumer choice expands significantly.

Functional ingredient integration presents substantial growth opportunities as consumers increasingly seek products delivering specific health benefits beyond basic hydration and flavor enhancement. Adaptogenic ingredients, probiotics, collagen, and specialized vitamins offer differentiation potential and premium positioning opportunities for innovative brands.

Sustainable packaging solutions represent emerging opportunities as environmental consciousness drives consumer preference for eco-friendly alternatives. Biodegradable packaging, refillable systems, and reduced plastic usage can provide competitive advantages and appeal to environmentally conscious consumer segments.

Personalized nutrition trends create opportunities for customized formulations targeting specific demographic groups, health conditions, or lifestyle requirements. Direct-to-consumer models enable brands to offer personalized products based on individual preferences, health goals, and consumption patterns.

International expansion potential offers growth opportunities for successful UK brands seeking to leverage proven formulations and marketing strategies in global markets. Export opportunities particularly exist in markets with similar consumer preferences and regulatory frameworks supporting functional beverage categories.

Competitive intensity continues escalating as established beverage companies, specialized nutrition brands, and emerging startups compete for market share through product innovation, pricing strategies, and distribution expansion. Market consolidation trends may emerge as larger companies acquire successful smaller brands to expand product portfolios and market reach.

Consumer education initiatives play crucial roles in market development as brands invest in awareness campaigns highlighting product benefits, usage instructions, and health advantages. Social media marketing and influencer partnerships have become essential components of successful market penetration strategies.

Supply chain optimization becomes increasingly important as market growth creates demand for efficient manufacturing, distribution, and inventory management systems. Raw material sourcing challenges related to natural ingredients and specialized functional components require strategic supplier relationships and quality assurance protocols.

Technological integration opportunities include smart packaging solutions, mobile app connectivity, and personalized recommendation systems that enhance consumer engagement and brand loyalty. Data analytics applications enable better understanding of consumer preferences and consumption patterns for improved product development and marketing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes consumer surveys, focus groups, and in-depth interviews with industry stakeholders including manufacturers, distributors, retailers, and end consumers across diverse demographic segments.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and academic studies related to beverage industry trends, consumer behavior patterns, and regulatory developments. Market data validation through multiple sources ensures accuracy and reliability of quantitative findings and trend analysis.

Quantitative analysis includes statistical modeling, trend analysis, and forecasting methodologies applied to historical market data and current performance indicators. Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis of competitive dynamics and market positioning factors.

Data collection protocols ensure representative sampling across geographic regions, demographic segments, and product categories to provide comprehensive market understanding. Analytical frameworks incorporate both traditional market research methodologies and innovative approaches addressing digital consumer behavior and e-commerce trends.

Geographic distribution across the UK reveals distinct regional preferences and consumption patterns influenced by demographic factors, lifestyle differences, and local market conditions. London and Southeast England demonstrate the highest market penetration rates, accounting for approximately 34% of total market consumption, driven by higher disposable incomes, health consciousness, and early adoption of innovative products.

Northern England regions show strong growth potential with increasing health awareness and expanding retail distribution networks. Scotland and Wales represent emerging markets with growing consumer acceptance and improving product availability through both traditional and online channels.

Urban versus rural dynamics reveal higher adoption rates in metropolitan areas where convenience factors and health consciousness drive stronger market acceptance. Rural market penetration continues expanding through improved distribution networks and increasing consumer awareness of product benefits.

Regional retail partnerships play crucial roles in market development as local preferences and shopping patterns influence distribution strategies and product positioning approaches. E-commerce penetration varies significantly across regions, with higher online adoption rates in urban areas and among younger demographic segments.

Market leadership is characterized by intense competition among established beverage companies and specialized nutrition brands leveraging different competitive strategies and market positioning approaches:

Competitive strategies include product innovation, brand building, distribution expansion, and strategic partnerships with retailers and health-focused organizations. Market differentiation occurs through ingredient quality, flavor variety, packaging innovation, and specialized formulations targeting specific consumer needs.

Product type segmentation reveals distinct market categories with varying growth rates and consumer preferences:

Distribution channel segmentation includes:

Consumer demographic segmentation identifies key target groups including health-conscious millennials, fitness enthusiasts, busy professionals, and families seeking healthier beverage alternatives for children and adults.

Flavor category analysis reveals consumer preferences and market opportunities across different taste profiles:

Functional category insights demonstrate growing consumer interest in enhanced formulations:

Packaging format preferences vary across consumer segments with single-serve options gaining popularity for portion control and convenience while bulk formats appeal to value-conscious families and frequent users.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and brand differentiation possibilities through innovative product development and functional ingredient integration. Production efficiency advantages include concentrated formulations requiring minimal storage space and extended shelf life reducing inventory management costs.

Retailers gain from high-margin product categories, strong consumer demand, and compact shelf space requirements that maximize profitability per square foot. Cross-merchandising opportunities with bottled water and health products create additional revenue streams and enhanced customer shopping experiences.

Consumers receive convenient, customizable hydration solutions offering health benefits, flavor variety, and cost-effectiveness compared to ready-to-drink alternatives. Portion control advantages enable personalized consumption levels and reduced waste compared to traditional flavored beverages.

Health professionals can recommend water enhancers as tools for increasing daily water intake among patients struggling with plain water consumption. Nutritional benefits from vitamin and mineral fortification support dietary supplementation goals and wellness objectives.

Environmental stakeholders benefit from reduced packaging waste, lower transportation costs due to concentrated formulations, and decreased plastic bottle consumption compared to ready-to-drink alternatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient migration represents a fundamental trend as consumers increasingly prefer products with recognizable, plant-based components over artificial alternatives. Clean label initiatives drive manufacturers to reformulate products using natural flavors, colors, and sweeteners while maintaining taste appeal and functionality.

Functional enhancement trends include incorporation of adaptogens, nootropics, and specialized vitamins targeting specific health objectives such as stress reduction, cognitive performance, and immune system support. Personalized nutrition approaches enable customized formulations based on individual health profiles and lifestyle requirements.

Sustainability focus encompasses eco-friendly packaging solutions, carbon footprint reduction, and ethical sourcing practices that appeal to environmentally conscious consumers. Circular economy principles influence product development and packaging design decisions across leading market participants.

Digital integration trends include smart packaging technologies, mobile app connectivity, and subscription-based delivery models that enhance consumer engagement and brand loyalty. Social media influence continues shaping product development and marketing strategies through influencer partnerships and user-generated content campaigns.

Premium positioning trends reflect consumer willingness to pay higher prices for superior ingredients, specialized formulations, and enhanced functionality. Artisanal and craft approaches to product development create differentiation opportunities and niche market segments.

Product innovation acceleration has resulted in numerous breakthrough formulations incorporating cutting-edge ingredients and delivery systems. Recent launches include collagen-enhanced formulations, probiotic-containing variants, and specialized sports nutrition products targeting specific athletic performance objectives.

Strategic partnerships between water enhancer manufacturers and health-focused organizations have created co-branded products and educational initiatives promoting hydration awareness. Retail collaborations include exclusive product lines and private label developments for major supermarket chains.

Manufacturing investments in advanced production facilities and quality control systems have enhanced product consistency and enabled scaled production of specialized formulations. Technology adoption includes automated packaging systems and precision dosing equipment improving efficiency and reducing costs.

Regulatory approvals for new functional ingredients and health claims have expanded product development possibilities and marketing opportunities. International certifications including organic, non-GMO, and specialized dietary compliance have opened new market segments and distribution channels.

Acquisition activity among industry participants has consolidated market positions and expanded product portfolios through strategic brand acquisitions and technology transfers. Investment flows from private equity and venture capital sources have supported emerging brand development and market expansion initiatives.

MarkWide Research analysis indicates that successful market participants should prioritize natural ingredient formulations and transparent labeling practices to address growing consumer concerns about artificial additives. Investment priorities should focus on research and development capabilities enabling rapid response to emerging consumer trends and regulatory requirements.

Distribution strategy optimization requires balanced approach between traditional retail expansion and digital channel development to capture diverse consumer shopping preferences. E-commerce capabilities become increasingly critical for direct consumer engagement and subscription-based revenue models.

Brand differentiation strategies should emphasize unique functional benefits, superior ingredient quality, and specialized formulations targeting specific consumer segments rather than competing solely on price or flavor variety. Premium positioning opportunities exist for brands successfully communicating value propositions and health benefits.

International expansion planning should consider markets with similar regulatory frameworks and consumer preferences while adapting products to local taste preferences and cultural factors. Export strategies require careful market research and regulatory compliance planning to ensure successful market entry.

Sustainability initiatives should encompass entire value chain from ingredient sourcing through packaging and distribution to appeal to environmentally conscious consumers and meet corporate responsibility objectives. Innovation investments in sustainable packaging solutions and carbon footprint reduction create competitive advantages and brand differentiation opportunities.

Market trajectory analysis indicates continued strong growth driven by fundamental consumer behavior shifts toward healthier beverage choices and functional nutrition products. Long-term prospects remain highly favorable as demographic trends, lifestyle changes, and health consciousness continue supporting market expansion across diverse consumer segments.

Innovation pipeline developments suggest exciting opportunities in personalized nutrition, advanced functional ingredients, and smart packaging technologies that will drive next-generation product categories. Technological advancement in flavor delivery systems and ingredient stability will enable more sophisticated formulations and enhanced consumer experiences.

Market maturation patterns indicate potential consolidation among smaller players while creating opportunities for specialized brands focusing on niche segments and premium positioning. Competitive dynamics will likely favor companies with strong innovation capabilities, established distribution networks, and effective brand building strategies.

Regulatory environment evolution may create both opportunities and challenges as health claim regulations develop and ingredient approval processes evolve. MWR projections suggest that companies maintaining regulatory compliance leadership will gain significant competitive advantages in product development and marketing capabilities.

Global expansion potential offers substantial growth opportunities for successful UK brands seeking to leverage proven formulations and marketing strategies in international markets with similar consumer preferences and regulatory frameworks. Export market development represents a key growth driver for established market participants with strong brand recognition and production capabilities.

The UK water enhancer market represents a dynamic and rapidly expanding segment within the broader beverage industry, driven by fundamental shifts in consumer preferences toward healthier, more convenient hydration solutions. Market analysis reveals strong growth momentum supported by increasing health consciousness, product innovation, and expanding distribution networks across both traditional and digital channels.

Key success factors include continuous product innovation, natural ingredient integration, effective brand building, and strategic distribution partnerships that enable market penetration across diverse consumer segments. Competitive advantages will increasingly depend on companies’ abilities to develop differentiated formulations, maintain regulatory compliance, and effectively communicate value propositions to health-conscious consumers.

Future market development appears highly promising, with substantial opportunities in functional ingredient integration, sustainable packaging solutions, personalized nutrition approaches, and international market expansion. Industry participants that successfully navigate evolving consumer preferences, regulatory requirements, and competitive dynamics will be well-positioned to capture significant market share and achieve sustainable growth in this expanding market segment.

What is Water Enhancer?

Water enhancers are concentrated liquid or powdered products designed to add flavor, nutrients, or other functional benefits to water. They are popular among consumers looking for healthier beverage options and can include vitamins, electrolytes, and natural flavors.

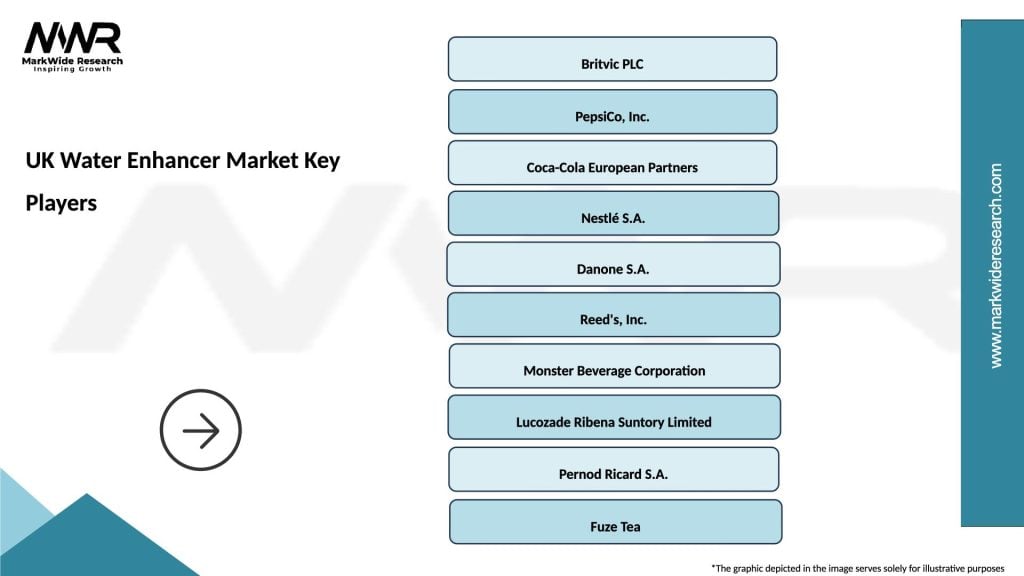

What are the key players in the UK Water Enhancer Market?

Key players in the UK Water Enhancer Market include brands like MiO, Stur, and AquaHydrate, which offer a variety of flavored water enhancers. These companies focus on innovation and catering to health-conscious consumers, among others.

What are the growth factors driving the UK Water Enhancer Market?

The UK Water Enhancer Market is driven by increasing health awareness among consumers, a growing demand for low-calorie beverage options, and the convenience of portable flavoring solutions. Additionally, the rise in fitness and wellness trends contributes to market growth.

What challenges does the UK Water Enhancer Market face?

Challenges in the UK Water Enhancer Market include competition from traditional beverages, potential regulatory scrutiny regarding health claims, and consumer skepticism about artificial ingredients. These factors can impact market penetration and brand loyalty.

What opportunities exist in the UK Water Enhancer Market?

Opportunities in the UK Water Enhancer Market include the development of organic and natural flavor options, expansion into new distribution channels, and targeting niche consumer segments such as athletes and health enthusiasts. These trends can enhance market reach.

What trends are shaping the UK Water Enhancer Market?

Trends in the UK Water Enhancer Market include the growing popularity of plant-based ingredients, the introduction of functional enhancers that provide additional health benefits, and the rise of eco-friendly packaging solutions. These trends reflect changing consumer preferences.

UK Water Enhancer Market

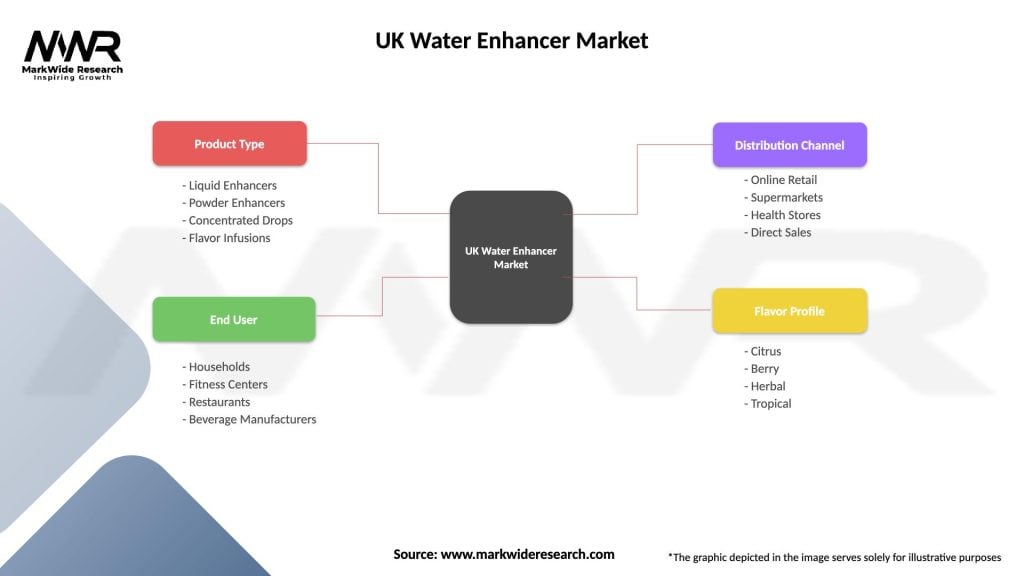

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Enhancers, Powder Enhancers, Concentrated Drops, Flavor Infusions |

| End User | Households, Fitness Centers, Restaurants, Beverage Manufacturers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Direct Sales |

| Flavor Profile | Citrus, Berry, Herbal, Tropical |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Water Enhancer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at