444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America halal food and beverages market represents a rapidly expanding sector driven by increasing Muslim population, growing awareness of halal certification benefits, and rising demand for ethically sourced food products. Market dynamics indicate significant growth potential across key countries including Brazil, Argentina, Colombia, and Chile, where halal products are gaining mainstream acceptance beyond traditional Muslim consumers.

Regional expansion has been particularly notable in Brazil, which accounts for approximately 68% of the South American halal market share, followed by Argentina with 15% market penetration. The market encompasses diverse product categories including processed foods, beverages, dairy products, meat and poultry, confectionery, and personal care items that comply with Islamic dietary laws and ethical standards.

Consumer awareness regarding halal certification has increased substantially, with 42% of non-Muslim consumers now recognizing halal products as premium quality options. This trend reflects growing interest in clean label products, ethical sourcing, and religious dietary compliance across diverse demographic segments throughout South America.

The South America halal food and beverages market refers to the comprehensive ecosystem of food products, beverages, and related items that comply with Islamic dietary laws (halal) and are produced, processed, distributed, and consumed across South American countries. This market encompasses all stages from raw material sourcing to final consumer purchase, ensuring adherence to strict halal certification standards.

Halal compliance involves rigorous oversight of ingredients, processing methods, storage, transportation, and retail practices to maintain product integrity according to Islamic principles. The market includes both locally produced items and imported products that meet regional halal certification requirements established by recognized Islamic authorities and certification bodies.

Market scope extends beyond traditional food categories to include beverages, supplements, cosmetics, pharmaceuticals, and personal care products that align with halal standards. This comprehensive approach reflects the growing sophistication of halal consumer demands and the market’s evolution toward complete lifestyle integration.

Strategic analysis reveals the South America halal food and beverages market experiencing robust expansion driven by demographic shifts, increased religious awareness, and growing consumer preference for ethically certified products. The market demonstrates strong growth momentum with projected expansion at a compound annual growth rate of 8.2% through the forecast period.

Key market drivers include rising Muslim population, increased disposable income, expanding retail distribution networks, and growing acceptance of halal products among non-Muslim consumers seeking premium quality options. Brazil leads regional market development, followed by significant growth opportunities in Argentina, Colombia, and Peru.

Competitive landscape features both international halal food manufacturers and emerging local producers investing in certification processes and market expansion strategies. The market benefits from improving regulatory frameworks, enhanced certification processes, and increasing consumer education about halal product benefits and availability.

Market intelligence indicates several critical insights shaping the South America halal food and beverages sector:

Primary growth drivers propelling the South America halal food and beverages market include fundamental demographic, economic, and social factors that create sustained demand for halal-certified products across the region.

Population dynamics represent the most significant driver, with Muslim communities experiencing steady growth rates and increasing urbanization patterns. This demographic expansion creates expanding consumer bases in major metropolitan areas including São Paulo, Buenos Aires, Bogotá, and Lima, where halal product availability and variety continue improving.

Economic prosperity among Muslim households has increased disposable income available for premium halal products, while growing middle-class segments demonstrate willingness to pay premium prices for certified halal options. This economic empowerment enables greater market participation and drives demand for diverse product categories.

Religious awareness and adherence to Islamic dietary principles have strengthened among younger Muslim generations, creating sustained demand for properly certified halal products. Educational initiatives and community outreach programs have enhanced understanding of halal requirements and benefits among both Muslim and non-Muslim consumers.

Mainstream acceptance of halal products has expanded significantly, with non-Muslim consumers increasingly recognizing halal certification as indicators of quality, cleanliness, and ethical production practices. This crossover appeal substantially enlarges the addressable market beyond traditional Muslim consumer segments.

Market constraints affecting the South America halal food and beverages sector include regulatory, economic, and infrastructure challenges that may limit growth potential and market development across certain regions and product categories.

Certification complexity presents ongoing challenges, with varying halal standards and certification bodies creating confusion among producers and consumers. Inconsistent certification processes across different countries and regions can complicate market entry strategies and product distribution efforts.

Supply chain limitations affect product availability and pricing, particularly in smaller markets where halal-certified ingredients and processing facilities may be limited. These constraints can result in higher production costs and reduced product variety compared to conventional food markets.

Consumer education remains insufficient in many areas, with limited awareness of halal product benefits and availability among potential consumers. This knowledge gap restricts market expansion and limits cross-cultural adoption of halal products.

Economic volatility in certain South American countries can impact consumer purchasing power and discretionary spending on premium halal products. Currency fluctuations and inflation pressures may affect import costs and overall market accessibility for price-sensitive consumer segments.

Emerging opportunities within the South America halal food and beverages market present significant potential for growth expansion, market penetration, and strategic development across multiple dimensions and geographic regions.

Export market development offers substantial opportunities for South American halal producers to access global markets, particularly in the Middle East, Southeast Asia, and North America where demand for certified halal products continues growing rapidly.

E-commerce expansion creates new distribution channels and market access opportunities, enabling halal product manufacturers to reach dispersed consumer populations and underserved geographic areas through digital platforms and direct-to-consumer sales models.

Product innovation opportunities exist in developing region-specific halal products that incorporate local flavors, ingredients, and culinary traditions while maintaining strict halal compliance. This approach can create competitive advantages and strengthen market positioning.

Partnership development with mainstream retailers, food service operators, and distribution networks can significantly expand market reach and product availability. Strategic alliances can accelerate market penetration and reduce barriers to consumer access.

Tourism integration presents opportunities to serve growing numbers of Muslim travelers and expatriate communities seeking familiar halal food options during travel and temporary residence in South American countries.

Market dynamics within the South America halal food and beverages sector reflect complex interactions between supply-side factors, demand-side influences, regulatory environments, and competitive forces that shape overall market evolution and growth trajectories.

Supply chain evolution demonstrates increasing sophistication as producers invest in halal-certified processing facilities, improved cold chain logistics, and enhanced quality control systems. These improvements enable better product quality, extended shelf life, and expanded distribution capabilities across regional markets.

Demand patterns show increasing diversification beyond traditional staple products toward premium categories including organic halal foods, functional beverages, and specialty items. Consumer preferences increasingly favor products that combine halal certification with additional attributes such as sustainability, health benefits, and local sourcing.

Regulatory landscape continues evolving with governments implementing clearer halal certification standards and import/export requirements. These regulatory improvements create more predictable business environments while ensuring consumer protection and market integrity.

Competitive intensity has increased as both international and domestic players recognize market opportunities and invest in halal product development. This competition drives innovation, improves product quality, and enhances consumer choice while potentially pressuring profit margins.

Research approach for analyzing the South America halal food and beverages market employed comprehensive methodologies combining primary research, secondary data analysis, industry expert consultations, and market observation techniques to ensure accurate and reliable market intelligence.

Primary research included structured interviews with key industry stakeholders including halal food manufacturers, distributors, retailers, certification bodies, and consumer focus groups across major South American markets. These interactions provided direct insights into market conditions, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, trade publications, government statistics, certification body data, and academic studies related to halal food markets, consumer behavior, and regional economic conditions. This comprehensive data review ensured thorough market understanding.

Market observation involved retail audits, product availability assessments, pricing analysis, and competitive positioning studies across key urban markets. These observational techniques provided real-world validation of market trends and consumer preferences.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market findings and projections presented in this comprehensive market analysis.

Regional market distribution across South America reveals significant variations in halal food and beverages market development, with Brazil dominating regional market share while other countries demonstrate emerging growth potential and unique market characteristics.

Brazil maintains market leadership with approximately 68% of regional market share, driven by the largest Muslim population, established halal certification infrastructure, and well-developed retail distribution networks. Major cities including São Paulo, Rio de Janeiro, and Brasília serve as primary consumption centers with growing product variety and availability.

Argentina represents the second-largest market with 15% regional market share, characterized by concentrated Muslim populations in Buenos Aires and Córdoba. The market benefits from strong meat processing capabilities and growing export opportunities to Middle Eastern markets.

Colombia demonstrates rapid growth potential with 8% market share and increasing Muslim population in Bogotá, Medellín, and Cali. The market shows particular strength in beverages and processed foods categories with expanding retail presence.

Other markets including Chile, Peru, Ecuador, and Venezuela collectively account for 9% of regional market share but demonstrate significant growth potential as Muslim communities expand and consumer awareness increases. These markets benefit from improving economic conditions and enhanced product availability.

Competitive environment within the South America halal food and beverages market features diverse participants ranging from multinational corporations to specialized regional producers, each contributing unique strengths and market positioning strategies.

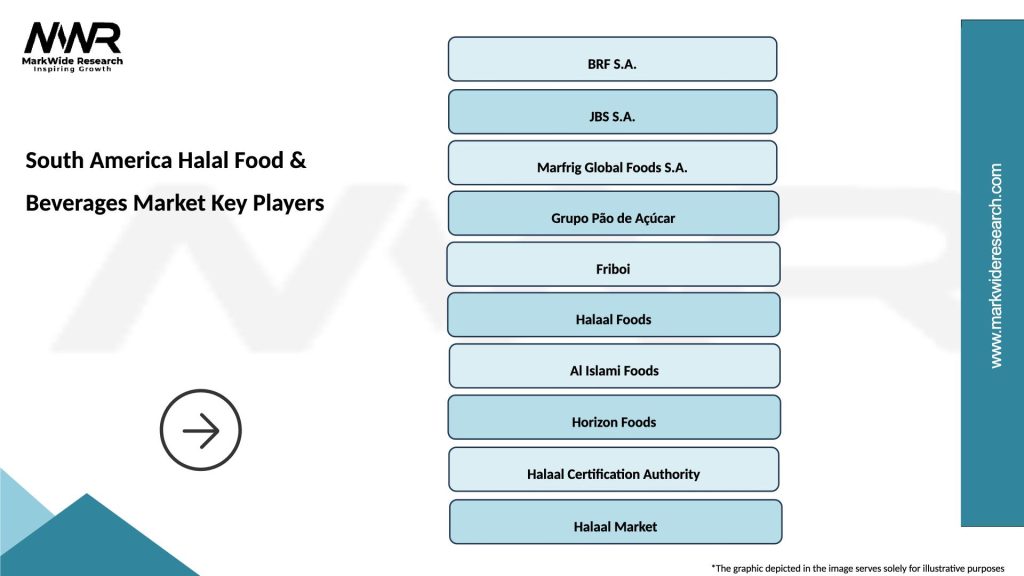

Leading market participants include:

Competitive strategies focus on product innovation, certification expansion, distribution network development, and strategic partnerships with local retailers and food service operators. Companies increasingly invest in consumer education and brand awareness initiatives to build market recognition and loyalty.

Market segmentation analysis reveals diverse categorization approaches that help understand consumer preferences, distribution patterns, and growth opportunities across different product types, price points, and consumer demographics within the South America halal food and beverages market.

By Product Type:

By Distribution Channel:

Category analysis provides detailed understanding of performance variations across different product segments within the South America halal food and beverages market, revealing unique growth patterns, consumer preferences, and market opportunities.

Meat and Poultry Category dominates market share due to fundamental importance in Islamic dietary practices and strong local production capabilities. Brazil and Argentina lead this segment with established halal slaughterhouses and processing facilities serving both domestic and export markets. Growth rates remain steady with increasing quality standards and certification improvements.

Beverages Segment demonstrates rapid expansion as consumer preferences shift toward premium and functional drinks. Non-alcoholic beverages including energy drinks, fruit juices, and specialty teas show particular strength. Innovation opportunities exist in developing region-specific flavors and health-focused formulations.

Processed Foods Category benefits from busy lifestyles and increasing urbanization patterns. Ready-to-eat meals, snack foods, and convenience products show strong growth potential. Market development focuses on combining halal certification with local taste preferences and nutritional requirements.

Dairy Products Segment experiences steady growth driven by health consciousness and protein consumption trends. Premium dairy products including organic and specialty items demonstrate particular consumer appeal. Supply chain development remains critical for maintaining product quality and availability.

Industry participants and stakeholders within the South America halal food and beverages market can realize significant benefits through strategic engagement, proper positioning, and comprehensive understanding of market dynamics and consumer requirements.

Manufacturers benefit from access to expanding consumer bases, premium pricing opportunities, and potential export market development. Halal certification can differentiate products in competitive markets while opening new distribution channels and consumer segments previously inaccessible.

Retailers gain competitive advantages through halal product offerings that attract diverse customer bases and increase store traffic. Dedicated halal sections can enhance store differentiation while building loyalty among Muslim consumers and quality-conscious shoppers.

Distributors can develop specialized expertise and relationships within halal supply chains, creating sustainable competitive advantages and growth opportunities. Specialized halal distribution capabilities command premium service fees and enable market expansion.

Investors can access growing market segments with strong demographic fundamentals and increasing consumer spending power. The halal market offers diversification opportunities with defensive characteristics during economic downturns.

Certification Bodies benefit from increasing demand for halal certification services and can expand service offerings to include training, consulting, and market development support for manufacturers and retailers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the South America halal food and beverages market reflect evolving consumer preferences, technological advances, and market maturation processes that shape future development directions and strategic opportunities.

Health and Wellness Integration represents a significant trend as consumers increasingly seek halal products that also offer health benefits, organic certification, and functional ingredients. This convergence creates premium product categories combining religious compliance with nutritional advantages.

Digital Transformation accelerates market development through e-commerce platforms, mobile applications, and digital marketing strategies that enhance product discovery and consumer education. Technology adoption enables better supply chain transparency and certification verification processes.

Sustainability Focus emerges as consumers demand environmentally responsible production practices alongside halal certification. This trend drives innovation in packaging, sourcing, and manufacturing processes that align with both Islamic principles and environmental stewardship.

Premium Product Development continues expanding as affluent Muslim consumers seek high-quality, artisanal, and specialty halal products. This trend supports higher profit margins and brand differentiation opportunities for manufacturers and retailers.

Cross-Cultural Appeal grows as halal products gain acceptance among non-Muslim consumers attracted to quality assurance, ethical production practices, and clean label attributes associated with halal certification standards.

Recent industry developments demonstrate the dynamic nature of the South America halal food and beverages market, with significant investments, partnerships, and strategic initiatives shaping market evolution and competitive positioning.

Certification Infrastructure Expansion has accelerated with new halal certification bodies establishing operations across South American countries. These developments improve certification accessibility, reduce compliance costs, and enhance consumer confidence in halal product authenticity.

Retail Partnership Agreements between halal food manufacturers and major supermarket chains have expanded product availability and market reach. These partnerships include dedicated halal sections, promotional support, and consumer education initiatives that drive market growth.

Technology Integration Projects focus on blockchain-based certification tracking, mobile applications for halal product identification, and digital platforms connecting producers with consumers. These technological advances enhance market transparency and consumer trust.

Export Market Initiatives have gained momentum with South American halal producers establishing distribution partnerships in Middle Eastern, Southeast Asian, and North American markets. These developments create new revenue streams and market diversification opportunities.

Investment Activities include facility expansions, equipment upgrades, and new production line installations dedicated to halal food processing. These investments demonstrate industry confidence in long-term market growth potential and consumer demand sustainability.

Strategic recommendations for market participants seeking to optimize their position within the South America halal food and beverages market focus on sustainable growth strategies, competitive differentiation, and market expansion opportunities.

MarkWide Research analysis suggests that companies should prioritize comprehensive halal certification strategies that encompass entire supply chains rather than individual products. This approach builds stronger consumer trust and creates sustainable competitive advantages in increasingly competitive markets.

Market entry strategies should emphasize partnership development with established local distributors and retailers who understand regional consumer preferences and regulatory requirements. These partnerships can accelerate market penetration while reducing entry risks and investment requirements.

Product development initiatives should focus on combining halal certification with additional consumer-valued attributes such as organic ingredients, health benefits, and sustainability credentials. This multi-attribute approach can justify premium pricing and expand addressable market segments.

Consumer education investments remain critical for market development, particularly in regions with limited halal product awareness. Educational initiatives should target both Muslim and non-Muslim consumers, emphasizing quality, safety, and ethical production benefits associated with halal certification.

Digital marketing strategies should leverage social media platforms, influencer partnerships, and content marketing to build brand awareness and consumer engagement. These approaches can cost-effectively reach dispersed target audiences and build community around halal lifestyle choices.

Future prospects for the South America halal food and beverages market indicate sustained growth momentum driven by favorable demographic trends, increasing consumer awareness, and expanding product availability across diverse distribution channels.

Market expansion is projected to continue at robust rates with compound annual growth exceeding 8% through the forecast period. This growth trajectory reflects strengthening fundamentals including population growth, economic development, and increasing mainstream acceptance of halal products.

Geographic expansion will likely extend beyond current major markets as Muslim communities grow in secondary cities and rural areas. This expansion creates opportunities for targeted product development and distribution strategies tailored to local preferences and economic conditions.

Product innovation will accelerate as manufacturers develop region-specific formulations, premium product lines, and multi-attribute offerings that combine halal certification with health, sustainability, and convenience benefits. These innovations will drive market differentiation and consumer loyalty.

Export opportunities will expand significantly as South American halal producers gain recognition in global markets and develop distribution partnerships with international retailers and food service operators. This international expansion will diversify revenue sources and reduce dependence on domestic markets.

MWR projections indicate that technology integration will transform market operations through improved supply chain transparency, enhanced consumer engagement, and streamlined certification processes. These technological advances will reduce operational costs while improving market efficiency and consumer satisfaction.

The South America halal food and beverages market presents compelling growth opportunities driven by favorable demographic trends, increasing consumer awareness, and expanding product availability across diverse distribution channels. Market fundamentals remain strong with sustained demand growth, improving regulatory frameworks, and increasing mainstream acceptance of halal products.

Strategic positioning within this market requires comprehensive understanding of regional variations, consumer preferences, and certification requirements that ensure product authenticity and market acceptance. Companies that invest in proper halal certification, consumer education, and distribution network development will be best positioned to capture emerging opportunities.

Long-term success depends on maintaining product quality, building consumer trust, and adapting to evolving market conditions while preserving the religious and ethical principles that define halal products. The market’s evolution toward mainstream acceptance creates significant opportunities for growth while maintaining the specialized characteristics that differentiate halal products from conventional alternatives.

What is Halal Food & Beverages?

Halal Food & Beverages refer to products that comply with Islamic dietary laws, which dictate what is permissible for Muslims to consume. This includes specific guidelines on the sourcing, processing, and preparation of food and drinks.

What are the key players in the South America Halal Food & Beverages Market?

Key players in the South America Halal Food & Beverages Market include companies like BRF S.A., JBS S.A., and Al Islami Foods, among others. These companies are involved in the production and distribution of halal-certified products across various segments.

What are the growth factors driving the South America Halal Food & Beverages Market?

The growth of the South America Halal Food & Beverages Market is driven by increasing Muslim population, rising awareness of halal dietary practices, and growing demand for ethically sourced food products. Additionally, the expansion of retail channels is facilitating access to halal options.

What challenges does the South America Halal Food & Beverages Market face?

Challenges in the South America Halal Food & Beverages Market include the lack of standardized certification processes, which can lead to consumer confusion, and competition from non-halal products. Additionally, cultural differences in food preferences can impact market penetration.

What opportunities exist in the South America Halal Food & Beverages Market?

Opportunities in the South America Halal Food & Beverages Market include the potential for product innovation, such as plant-based halal options, and the expansion into non-Muslim consumer segments interested in halal products for their perceived quality and ethical sourcing.

What trends are shaping the South America Halal Food & Beverages Market?

Trends in the South America Halal Food & Beverages Market include the increasing popularity of online shopping for halal products, the rise of health-conscious consumers seeking organic and natural halal options, and the growing interest in sustainable and ethically produced food items.

South America Halal Food & Beverages Market

| Segmentation Details | Description |

|---|---|

| Product Type | Meat, Dairy, Beverages, Snacks |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Specialty Stores |

| End User | Households, Restaurants, Catering Services, Food Manufacturers |

| Certification | Halal, Organic, Non-GMO, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Halal Food & Beverages Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at