444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The subsea production and processing components market represents a critical segment of the offshore oil and gas industry, encompassing sophisticated equipment designed to extract, process, and transport hydrocarbons from underwater reservoirs. This specialized market has experienced remarkable transformation as energy companies venture into deeper waters and more challenging environments to meet global energy demands. Technological advancements in subsea systems have enabled operations at depths exceeding 3,000 meters, with some installations reaching unprecedented depths of over 10,000 feet below sea level.

Market dynamics indicate robust growth driven by increasing offshore exploration activities, particularly in regions such as the Gulf of Mexico, North Sea, and offshore Brazil. The industry has witnessed a 12.5% annual increase in deepwater project sanctions over the past three years, reflecting renewed confidence in subsea developments. Component reliability has become paramount as operators seek to maximize production uptime and minimize costly intervention operations in challenging subsea environments.

Innovation trends are reshaping the market landscape, with manufacturers focusing on developing more efficient, durable, and cost-effective solutions. The integration of digital technologies, artificial intelligence, and advanced materials has enhanced the performance and longevity of subsea components. Environmental considerations are also driving market evolution, as companies prioritize sustainable practices and reduced carbon footprints in their subsea operations.

The subsea production and processing components market refers to the comprehensive ecosystem of specialized equipment, systems, and technologies designed for underwater oil and gas extraction, processing, and transportation operations. This market encompasses a wide range of critical components including subsea trees, manifolds, control systems, umbilicals, risers, and processing equipment that enable hydrocarbon production from seabed reservoirs.

Subsea components are engineered to withstand extreme underwater conditions including high pressure, corrosive environments, and temperature variations while maintaining operational integrity for extended periods. These systems represent the interface between subsea wells and surface facilities, facilitating the safe and efficient extraction of oil and gas from offshore reservoirs. Processing capabilities have evolved to include separation, compression, and treatment functions performed directly on the seabed, reducing the need for topside facilities and enhancing project economics.

Market fundamentals demonstrate strong growth potential driven by increasing global energy demand and the depletion of shallow-water reserves. The subsea production and processing components market has emerged as a vital enabler of deepwater and ultra-deepwater developments, with operators increasingly relying on advanced subsea technologies to access previously uneconomical reserves. Investment patterns show a 18% increase in subsea project commitments, reflecting industry confidence in technological capabilities and economic viability.

Technological evolution continues to drive market expansion, with manufacturers developing more sophisticated and reliable components capable of operating in increasingly challenging environments. The integration of digital technologies, remote monitoring capabilities, and predictive maintenance systems has enhanced operational efficiency and reduced lifecycle costs. Regional development varies significantly, with mature markets like the North Sea focusing on life extension and enhanced recovery, while emerging regions emphasize new field developments and infrastructure expansion.

Competitive dynamics are characterized by intense innovation competition among established players and emerging technology providers. The market structure includes major oilfield service companies, specialized subsea equipment manufacturers, and technology innovators developing next-generation solutions. Strategic partnerships and collaborative development programs have become increasingly important for addressing complex technical challenges and sharing development costs.

Strategic insights reveal several critical factors shaping the subsea production and processing components market landscape:

Primary drivers propelling the subsea production and processing components market include the fundamental shift toward deepwater and ultra-deepwater exploration as conventional reserves decline. Energy security concerns have intensified focus on developing domestic offshore resources, particularly in regions with significant continental shelf areas. The economic attractiveness of subsea developments has improved substantially due to technological advances that have reduced development costs and enhanced recovery rates.

Technological innovation serves as a crucial market driver, with continuous improvements in component reliability, durability, and performance capabilities. Advanced materials, enhanced sealing technologies, and improved manufacturing processes have extended equipment lifecycles and reduced maintenance requirements. Digital transformation initiatives are driving demand for smart subsea systems capable of autonomous operation and real-time performance optimization.

Regulatory frameworks supporting offshore development and environmental protection are creating opportunities for advanced subsea technologies. Government policies promoting energy independence and offshore resource development have stimulated investment in subsea infrastructure. Climate considerations are paradoxically driving both renewable energy adoption and more efficient hydrocarbon extraction methods, with subsea processing offering reduced surface footprint and lower emissions profiles.

Significant challenges constraining market growth include the substantial capital investment requirements associated with subsea developments. High upfront costs for subsea components and systems can create barriers to project sanctioning, particularly during periods of commodity price volatility. The complexity of subsea operations requires specialized expertise and sophisticated support infrastructure, limiting market accessibility for smaller operators and emerging regions.

Technical risks associated with deepwater operations present ongoing challenges, including equipment failure, intervention difficulties, and environmental hazards. Harsh operating conditions in subsea environments place extreme demands on component reliability and durability, requiring extensive testing and qualification processes that increase development timelines and costs. The remote nature of subsea installations complicates maintenance and repair operations, necessitating highly reliable components and comprehensive contingency planning.

Regulatory complexity and environmental concerns create additional constraints, with stringent approval processes and compliance requirements potentially delaying project implementation. Market cyclicality linked to oil and gas price fluctuations can result in project deferrals and reduced capital allocation to subsea developments. Skills shortages and aging workforce demographics in the offshore industry pose long-term challenges for market growth and technology development.

Emerging opportunities in the subsea production and processing components market are driven by technological breakthroughs enabling access to previously uneconomical reserves. Frontier regions including offshore Africa, South America, and Asia-Pacific present substantial growth potential as exploration activities intensify and infrastructure develops. The 35% increase in exploration licensing rounds globally indicates renewed industry optimism and investment appetite.

Technology convergence creates opportunities for innovative solutions combining traditional subsea expertise with digital technologies, artificial intelligence, and advanced materials. Subsea processing capabilities are expanding beyond traditional separation to include compression, water treatment, and enhanced oil recovery applications. The development of all-electric subsea systems offers improved efficiency, reduced environmental impact, and enhanced control capabilities.

Life extension projects in mature offshore fields represent significant opportunities for component upgrades, retrofits, and enhanced recovery systems. Decommissioning activities are creating new market segments for specialized removal and recycling services. The growing focus on carbon capture and storage applications presents opportunities for adapting subsea technologies to support climate change mitigation efforts.

Market dynamics in the subsea production and processing components sector are characterized by complex interactions between technological advancement, economic factors, and regulatory influences. Cyclical patterns linked to commodity prices continue to impact investment decisions, though the industry has demonstrated increased resilience through cost optimization and efficiency improvements. The average project breakeven has decreased by approximately 25% over the past five years due to technological advances and operational improvements.

Supply chain evolution has become increasingly sophisticated, with manufacturers developing global networks to support project execution and aftermarket services. Digitalization trends are transforming traditional business models, enabling remote monitoring, predictive maintenance, and performance optimization services. The integration of artificial intelligence and machine learning technologies is enhancing decision-making processes and operational efficiency.

Competitive intensity remains high, with established players investing heavily in research and development while new entrants bring innovative technologies and business models. Strategic consolidation through mergers and acquisitions is reshaping the competitive landscape, creating larger, more integrated service providers. Customer relationships are evolving toward long-term partnerships and integrated service delivery models rather than traditional transactional approaches.

Comprehensive analysis of the subsea production and processing components market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, technical specialists, and market participants across the value chain. Direct engagement with equipment manufacturers, service providers, operators, and regulatory bodies provides firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, technical publications, regulatory filings, and company financial statements. Data triangulation methods validate findings across multiple sources, ensuring consistency and reliability of market intelligence. Quantitative analysis includes statistical modeling, trend analysis, and correlation studies to identify patterns and relationships within market data.

Expert validation processes involve review and verification of findings by industry specialists and technical experts. Market modeling incorporates various scenarios and sensitivity analyses to account for uncertainty and variability in market conditions. The research methodology emphasizes both current market conditions and forward-looking projections based on identified trends and drivers.

North America maintains a dominant position in the subsea production and processing components market, driven by extensive Gulf of Mexico developments and technological leadership. The region accounts for approximately 42% of global subsea installations, with continued investment in deepwater projects and infrastructure expansion. Technological innovation centers in Houston and other energy hubs contribute to advanced component development and testing capabilities.

Europe represents a mature but evolving market, with the North Sea serving as a testing ground for advanced subsea technologies and life extension solutions. Norway and the United Kingdom lead regional development, with increasing focus on enhanced recovery, electrification, and environmental compliance. The region’s 28% market share reflects its established infrastructure and continued investment in offshore developments.

Asia-Pacific emerges as a high-growth region, with countries like Australia, Malaysia, and Indonesia expanding offshore exploration and production activities. Regional content requirements are driving local manufacturing capabilities and technology transfer initiatives. South America shows strong potential, particularly offshore Brazil, where pre-salt developments require advanced subsea technologies and specialized components.

Africa and Middle East regions present significant opportunities, with deepwater developments offshore West Africa and continued expansion in the Persian Gulf. Local capacity building initiatives are creating opportunities for regional suppliers and service providers.

Market leadership in the subsea production and processing components sector is characterized by a mix of large integrated service companies and specialized technology providers. The competitive landscape features several key categories of participants:

Competitive strategies focus on technological differentiation, cost optimization, and integrated service delivery. Innovation investments continue to drive product development and market positioning, with companies allocating significant resources to research and development activities.

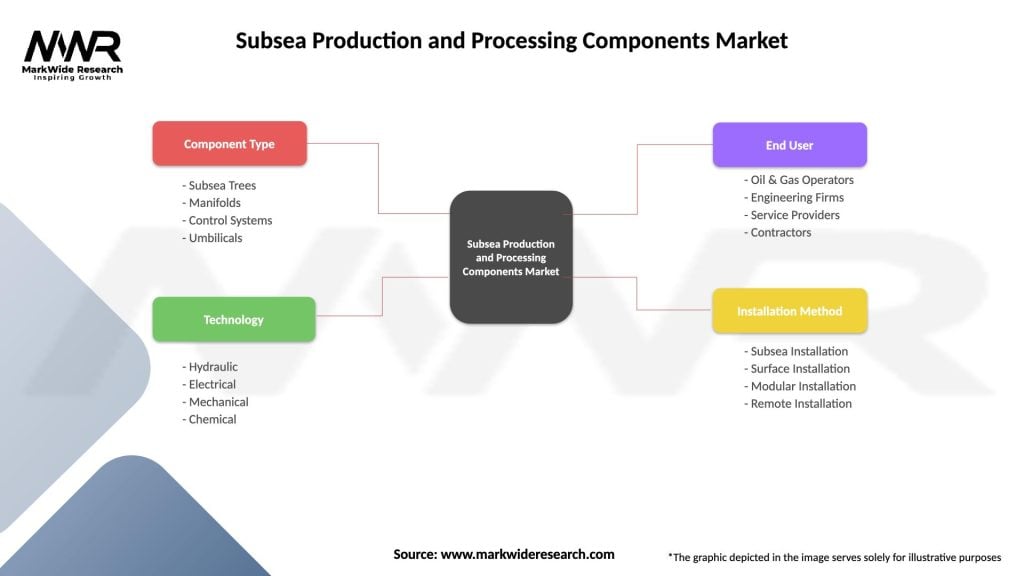

Market segmentation analysis reveals distinct categories based on component type, application, and water depth requirements:

By Component Type:

By Application:

By Water Depth:

Subsea trees represent the largest component category, accounting for approximately 32% of market demand due to their critical role in well control and production management. Technological advances in tree design focus on improved reliability, reduced intervention requirements, and enhanced flow capacity. Standardization initiatives are driving cost reductions and improved interoperability across different field developments.

Control systems are experiencing rapid evolution with the integration of digital technologies and advanced monitoring capabilities. All-electric systems are gaining traction due to their improved efficiency, reduced maintenance requirements, and enhanced control precision. The shift toward intelligent completion systems is driving demand for sophisticated control and monitoring equipment.

Processing equipment represents the fastest-growing category, with 22% annual growth driven by increasing adoption of subsea processing technologies. Separation systems enable early water removal and enhanced production efficiency, while compression technologies extend field life and improve recovery rates. The development of subsea factories integrating multiple processing functions is creating new market opportunities.

Umbilicals and risers benefit from advances in materials technology and manufacturing processes, enabling longer lengths and improved performance in harsh environments. Steel tube umbilicals are gaining preference for high-pressure applications, while thermoplastic composite risers offer weight and corrosion advantages.

Operators benefit from advanced subsea production and processing components through improved production efficiency, reduced operational costs, and enhanced reservoir recovery. Technological capabilities enable access to previously uneconomical reserves while minimizing surface footprint and environmental impact. The 15% improvement in production efficiency achieved through modern subsea systems demonstrates tangible value creation for field operators.

Service companies gain competitive advantages through technological differentiation and integrated service delivery capabilities. Long-term contracts and life-of-field services provide stable revenue streams and deeper customer relationships. The evolution toward digital services creates new revenue opportunities and higher-margin business models.

Equipment manufacturers benefit from increasing demand for specialized components and the opportunity to develop innovative solutions for challenging applications. Standardization initiatives enable economies of scale and reduced manufacturing costs while maintaining technical performance. Aftermarket services provide ongoing revenue streams and customer engagement opportunities.

Regional stakeholders including governments and local suppliers benefit from job creation, technology transfer, and economic development associated with offshore projects. Local content requirements create opportunities for domestic manufacturing and service capabilities while supporting regional economic development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration represents the most significant trend transforming the subsea production and processing components market. Smart subsea systems incorporating sensors, connectivity, and analytics capabilities are becoming standard requirements for new developments. The integration of artificial intelligence and machine learning technologies enables predictive maintenance, performance optimization, and autonomous operation capabilities.

Electrification initiatives are driving the development of all-electric subsea systems, eliminating hydraulic fluid requirements and improving environmental compliance. Power distribution technologies are advancing to support high-power subsea processing equipment and enhanced oil recovery systems. According to MarkWide Research analysis, electric systems demonstrate 20% higher efficiency compared to traditional hydraulic alternatives.

Standardization efforts continue to gain momentum, with industry organizations developing common interfaces and specifications to reduce costs and improve interoperability. Modular design approaches enable faster deployment and easier maintenance while reducing total cost of ownership. Subsea factories integrating multiple processing functions are becoming more prevalent, particularly in deepwater developments where surface facilities are not economically viable.

Environmental sustainability considerations are influencing component design and material selection, with emphasis on reduced emissions, improved containment, and end-of-life recyclability. Leak detection and monitoring technologies are becoming more sophisticated, providing early warning capabilities and environmental protection.

Recent developments in the subsea production and processing components market demonstrate continued innovation and market evolution. Major contract awards for deepwater projects in Brazil, Gulf of Mexico, and West Africa indicate renewed operator confidence and investment commitment. The successful deployment of next-generation subsea processing systems has validated technology capabilities and commercial viability.

Strategic partnerships between equipment manufacturers and technology companies are accelerating digital transformation initiatives. Collaborative development programs focus on advancing subsea processing capabilities, all-electric systems, and enhanced monitoring technologies. Qualification programs for new materials and components continue to expand operational envelopes and improve performance capabilities.

Regulatory approvals for advanced subsea technologies are facilitating broader commercial adoption and market penetration. Industry standards development continues to progress, with new specifications addressing digital interfaces, cybersecurity, and environmental performance requirements. Investment announcements in manufacturing capabilities and research facilities indicate continued industry commitment to technology advancement.

Market consolidation activities including mergers and acquisitions are reshaping the competitive landscape and creating larger, more integrated service providers. Technology licensing agreements are facilitating broader access to advanced capabilities while enabling specialized companies to focus on core competencies.

Strategic recommendations for market participants emphasize the importance of continued investment in digital technologies and advanced manufacturing capabilities. Technology differentiation will become increasingly critical as the market matures and competition intensifies. Companies should focus on developing integrated solutions that combine hardware, software, and services to create comprehensive value propositions for customers.

Geographic diversification strategies should prioritize emerging markets with significant offshore potential while maintaining strong positions in established regions. Local partnerships and joint ventures can facilitate market entry and compliance with local content requirements. MWR analysis suggests that companies with strong regional presence achieve 30% higher market penetration rates compared to purely international players.

Investment priorities should focus on sustainability technologies, digital capabilities, and advanced materials that address evolving customer requirements and regulatory expectations. Workforce development initiatives are essential to address skills shortages and support technology advancement. Supply chain resilience strategies should emphasize diversification and local sourcing capabilities to mitigate disruption risks.

Customer engagement approaches should evolve toward long-term partnerships and outcome-based service models rather than traditional transactional relationships. Data monetization opportunities through digital services and analytics capabilities represent significant value creation potential for forward-thinking companies.

Long-term prospects for the subsea production and processing components market remain positive despite near-term uncertainties related to energy transition and economic volatility. Technological advancement will continue to drive market evolution, with digital technologies, advanced materials, and processing capabilities expanding the addressable market and improving project economics. The industry is projected to achieve sustained growth of approximately 8.5% annually over the next decade.

Market transformation will be characterized by increasing integration of digital technologies, greater emphasis on environmental sustainability, and evolution toward more autonomous subsea systems. Processing capabilities will expand significantly, with subsea factories becoming more common and sophisticated. Electrification trends will accelerate, driven by efficiency improvements and environmental compliance requirements.

Regional development patterns will shift toward emerging markets, particularly in Asia-Pacific and Africa, while mature regions focus on life extension and enhanced recovery applications. Technology convergence will create new opportunities at the intersection of traditional subsea expertise and emerging technologies such as artificial intelligence, robotics, and advanced materials.

Industry structure will continue to evolve through consolidation and strategic partnerships, creating larger, more integrated service providers capable of delivering comprehensive solutions. Sustainability considerations will become increasingly important, driving innovation in environmental protection, emissions reduction, and circular economy principles.

The subsea production and processing components market stands at a critical juncture, with technological innovation and market dynamics creating both opportunities and challenges for industry participants. Digital transformation and advanced processing capabilities are reshaping the competitive landscape while enabling access to previously uneconomical reserves. The market’s resilience through recent commodity cycles demonstrates the fundamental value proposition of subsea technologies in enabling efficient offshore hydrocarbon development.

Strategic success in this evolving market will require continued investment in technology development, geographic diversification, and customer-centric service delivery models. Sustainability considerations and environmental compliance will become increasingly important differentiators, while digital capabilities will enable new service models and value creation opportunities. Companies that successfully navigate these trends while maintaining operational excellence will be well-positioned for long-term growth and market leadership in the dynamic subsea production and processing components market.

What is Subsea Production and Processing Components?

Subsea Production and Processing Components refer to the equipment and systems used in underwater oil and gas extraction and processing. This includes subsea trees, manifolds, and control systems that facilitate the efficient recovery of hydrocarbons from beneath the ocean floor.

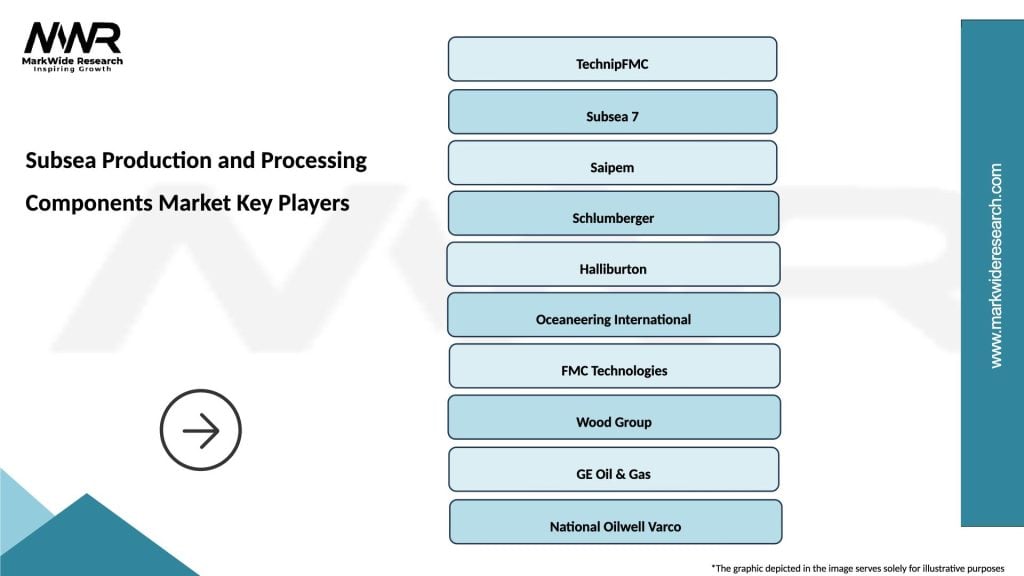

What are the key players in the Subsea Production and Processing Components Market?

Key players in the Subsea Production and Processing Components Market include companies like TechnipFMC, Aker Solutions, and Subsea 7, which provide innovative solutions for subsea engineering and project management, among others.

What are the growth factors driving the Subsea Production and Processing Components Market?

The Subsea Production and Processing Components Market is driven by the increasing demand for energy, advancements in subsea technology, and the need for efficient extraction methods in deepwater oil and gas fields. Additionally, the push for sustainable energy solutions is influencing market growth.

What challenges does the Subsea Production and Processing Components Market face?

Challenges in the Subsea Production and Processing Components Market include high operational costs, technical complexities associated with deepwater projects, and environmental concerns related to subsea operations. These factors can hinder project feasibility and investment.

What opportunities exist in the Subsea Production and Processing Components Market?

Opportunities in the Subsea Production and Processing Components Market include the development of new technologies for enhanced oil recovery, the expansion of offshore wind energy projects, and the increasing focus on reducing carbon emissions in subsea operations.

What trends are shaping the Subsea Production and Processing Components Market?

Trends in the Subsea Production and Processing Components Market include the integration of digital technologies for monitoring and control, the rise of autonomous underwater vehicles for inspection and maintenance, and the growing emphasis on sustainability and environmental protection in subsea projects.

Subsea Production and Processing Components Market

| Segmentation Details | Description |

|---|---|

| Component Type | Subsea Trees, Manifolds, Control Systems, Umbilicals |

| Technology | Hydraulic, Electrical, Mechanical, Chemical |

| End User | Oil & Gas Operators, Engineering Firms, Service Providers, Contractors |

| Installation Method | Subsea Installation, Surface Installation, Modular Installation, Remote Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Subsea Production and Processing Components Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at