444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America Safety Instrumented Systems market represents a critical component of industrial safety infrastructure across manufacturing, oil and gas, chemical processing, and power generation sectors. Safety Instrumented Systems (SIS) serve as the final line of defense against catastrophic industrial accidents, automatically initiating protective actions when dangerous conditions are detected. The market demonstrates robust expansion driven by stringent regulatory requirements, increasing industrial automation, and growing emphasis on worker safety protocols.

Market dynamics indicate substantial growth momentum with the sector experiencing a compound annual growth rate of 8.2% across the forecast period. The United States dominates regional market share, accounting for approximately 72% of North American SIS installations, while Canada contributes significantly through its expanding oil sands operations and manufacturing base. Technological advancement in wireless safety systems, cybersecurity integration, and predictive maintenance capabilities continues reshaping market landscapes.

Industrial sectors increasingly recognize Safety Instrumented Systems as essential investments rather than regulatory compliance costs. The integration of Industry 4.0 technologies with traditional safety systems creates new opportunities for enhanced monitoring, diagnostics, and system optimization. Process industries particularly drive demand as they face heightened scrutiny regarding environmental protection and operational safety standards.

The Safety Instrumented Systems market refers to the comprehensive ecosystem of hardware, software, and services designed to automatically detect hazardous conditions and initiate predetermined safety actions to prevent or mitigate industrial accidents. SIS technology encompasses sensors, logic solvers, final control elements, and associated engineering services that work together to achieve specific Safety Integrity Levels (SIL) as defined by international standards.

Functional safety represents the core principle underlying Safety Instrumented Systems, ensuring that safety-related systems perform their intended functions correctly in response to inputs or fail in a predictable manner. These systems operate independently from basic process control systems, providing redundant protection layers that activate when primary control systems fail or when process conditions exceed safe operating parameters.

Market participants include system integrators, hardware manufacturers, software developers, and specialized engineering consultants who collaborate to deliver comprehensive safety solutions. The market encompasses both greenfield installations in new facilities and brownfield upgrades of existing industrial plants seeking enhanced safety performance and regulatory compliance.

Strategic market analysis reveals the North America Safety Instrumented Systems market positioned for sustained growth driven by regulatory mandates, technological innovation, and increasing industrial safety awareness. Key market drivers include mandatory compliance with IEC 61508 and IEC 61511 standards, rising insurance costs for industrial accidents, and growing adoption of wireless safety technologies that offer 35% reduction in installation costs compared to traditional wired systems.

Competitive landscape features established players leveraging advanced technologies to differentiate their offerings while emerging companies focus on specialized applications and innovative solutions. The market benefits from strong collaboration between technology providers and end-users, resulting in customized safety solutions that address specific industry requirements and operational challenges.

Regional distribution shows concentrated activity in industrial corridors along the Gulf Coast, Great Lakes region, and Western Canada, where heavy process industries require sophisticated safety systems. Market penetration continues expanding into smaller manufacturing facilities as system costs decrease and awareness of safety benefits increases throughout industrial sectors.

Market intelligence indicates several critical insights shaping the North America Safety Instrumented Systems landscape:

Regulatory requirements serve as the primary market driver, with organizations mandated to implement Safety Instrumented Systems meeting specific Safety Integrity Levels. OSHA regulations and industry-specific standards create consistent demand for compliant safety solutions across manufacturing, chemical processing, and energy sectors. The Process Safety Management standard particularly influences market growth by requiring comprehensive safety system documentation and performance verification.

Industrial accidents and their associated costs continue driving SIS adoption as companies recognize the financial and reputational risks of inadequate safety systems. Insurance companies increasingly offer premium reductions for facilities demonstrating robust safety instrumented system implementations, creating additional economic incentives for market participation.

Technological advancement enables more sophisticated and cost-effective safety solutions, expanding market accessibility to smaller industrial facilities previously unable to justify SIS investments. Wireless technologies particularly reduce installation complexity and costs while maintaining safety integrity levels required by regulatory standards.

Aging infrastructure across North American industrial facilities creates substantial modernization opportunities as existing safety systems require updates to meet current standards and performance expectations. Digital transformation initiatives further accelerate SIS adoption as companies integrate safety systems with broader industrial automation and data analytics platforms.

High implementation costs represent the most significant market restraint, particularly for smaller industrial facilities with limited capital budgets. Initial investment requirements for comprehensive Safety Instrumented Systems can be substantial, including hardware, software, engineering services, and ongoing maintenance costs that may deter some potential adopters.

Technical complexity associated with SIS design, installation, and maintenance requires specialized expertise that may not be readily available in all geographic regions or industrial sectors. Skills shortage in functional safety engineering creates project delays and increases implementation costs, potentially limiting market growth in certain applications.

Legacy system integration challenges complicate SIS implementation in existing facilities where new safety systems must interface with older process control equipment and infrastructure. Compatibility issues between different technology generations can increase project complexity and costs while extending implementation timelines.

Cybersecurity concerns increasingly influence SIS adoption decisions as organizations balance safety system connectivity benefits against potential security vulnerabilities. Risk assessment requirements for networked safety systems add complexity to project planning and may slow adoption in security-sensitive applications.

Wireless safety technology presents significant market expansion opportunities by reducing installation costs and complexity while maintaining required safety integrity levels. Wireless SIS solutions enable safety system implementation in previously inaccessible locations and facilitate rapid deployment in temporary or mobile applications.

Predictive maintenance capabilities integrated with Safety Instrumented Systems create new service revenue opportunities while improving system reliability and performance. Advanced diagnostics and condition monitoring enable proactive maintenance strategies that reduce unplanned downtime and extend system lifecycles.

Small and medium enterprises represent an underserved market segment with growing safety awareness and regulatory compliance requirements. Standardized SIS solutions designed for smaller facilities can expand market reach while reducing engineering and implementation costs through economies of scale.

Cybersecurity integration offers opportunities for specialized service providers and technology companies to develop security-enhanced safety systems addressing growing industrial cybersecurity concerns. Secure safety networks become increasingly important as industrial facilities adopt connected technologies and remote monitoring capabilities.

Supply chain dynamics within the North America Safety Instrumented Systems market reflect complex interactions between technology providers, system integrators, and end-users. Vendor consolidation trends create opportunities for comprehensive solution providers while potentially limiting technology diversity and competitive pricing pressures.

Technology evolution continuously reshapes market dynamics as new capabilities emerge and existing solutions become obsolete. Digital transformation initiatives drive demand for connected safety systems while creating new requirements for cybersecurity and data management capabilities.

Customer expectations evolve toward integrated solutions that combine safety functionality with operational optimization and predictive maintenance capabilities. Total cost of ownership considerations increasingly influence purchasing decisions as organizations seek maximum value from safety system investments.

Regulatory landscape changes impact market dynamics through updated standards and enforcement priorities that may accelerate or redirect market demand. International harmonization of safety standards creates opportunities for global technology providers while potentially disadvantaging regional specialists.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes structured interviews with industry executives, safety engineers, system integrators, and regulatory officials to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technical standards to establish market context and identify key trends. MarkWide Research utilizes proprietary databases and analytical frameworks to synthesize information from diverse sources into coherent market intelligence.

Quantitative analysis incorporates statistical modeling and trend analysis to project market growth patterns and identify significant market drivers and restraints. Qualitative assessment provides context for quantitative findings through expert opinions and industry case studies that illuminate market dynamics and competitive positioning.

Data validation processes ensure research accuracy through cross-referencing multiple sources and expert review of preliminary findings. Continuous monitoring of market developments enables regular updates to research conclusions and market projections as new information becomes available.

United States market dominates North American Safety Instrumented Systems adoption, representing approximately 72% of regional installations driven by extensive industrial infrastructure and stringent regulatory enforcement. Gulf Coast region shows particularly strong demand due to concentrated petrochemical and refining operations requiring sophisticated safety systems.

Texas and Louisiana lead state-level SIS adoption with their extensive process industries and regulatory compliance requirements. California demonstrates growing market activity driven by environmental regulations and industrial modernization initiatives, while Midwest manufacturing centers contribute steady demand for safety system upgrades and new installations.

Canada represents approximately 23% of regional market share, with Alberta oil sands operations driving significant SIS demand for upstream and downstream facilities. Ontario manufacturing sector contributes substantial market activity through automotive and chemical processing applications requiring advanced safety systems.

Mexico accounts for the remaining 5% of North American market share, with growing industrial development and foreign investment driving increased safety system adoption. Manufacturing expansion along the US-Mexico border creates opportunities for SIS providers serving multinational companies implementing consistent safety standards across facilities.

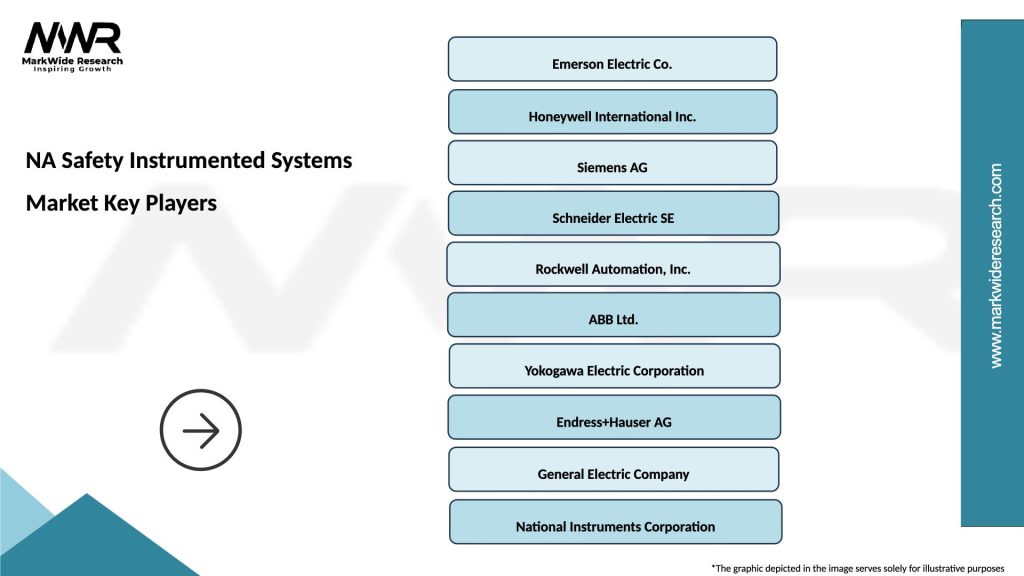

Market leadership features established industrial automation companies leveraging their technology portfolios and customer relationships to maintain competitive advantages in Safety Instrumented Systems markets:

Competitive strategies emphasize technology differentiation, comprehensive service offerings, and strategic partnerships with system integrators and engineering consultants. Market consolidation continues as larger companies acquire specialized safety system providers to expand their technology portfolios and market reach.

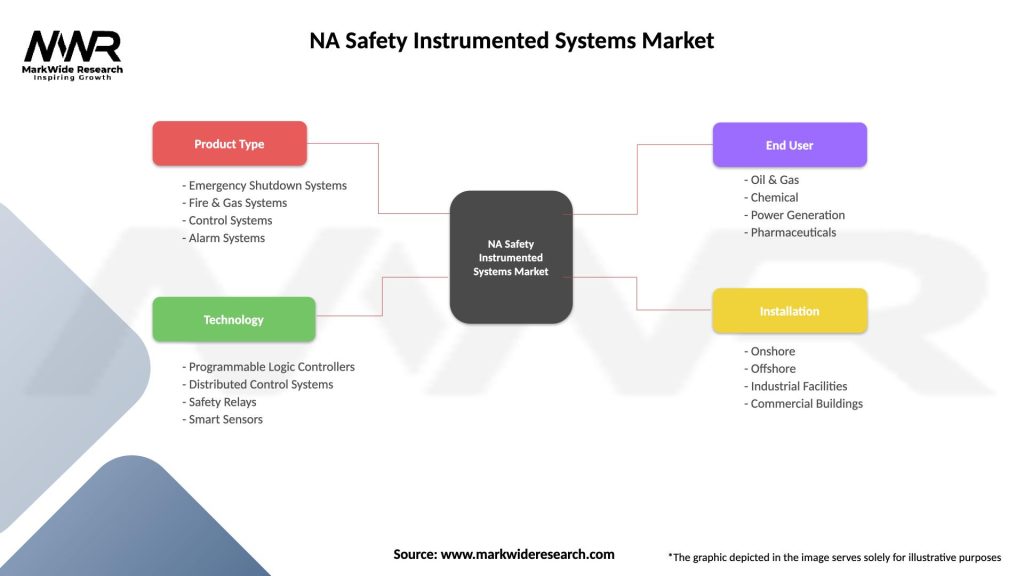

Technology segmentation reveals diverse approaches to Safety Instrumented Systems implementation across North American industrial markets:

By System Type:

By Component:

By Industry Vertical:

Emergency Shutdown Systems dominate market share due to their critical role in process safety and regulatory compliance requirements. ESD systems experience steady demand growth driven by expanding process industries and aging infrastructure modernization needs. Advanced diagnostics capabilities increasingly differentiate ESD offerings as operators seek improved system reliability and maintenance optimization.

Fire and Gas Systems show robust growth in hydrocarbon processing applications where detection speed and accuracy directly impact facility safety and environmental protection. Wireless detection technologies gain traction in this segment due to installation flexibility and reduced infrastructure requirements in hazardous environments.

Safety Controllers represent the technological heart of Safety Instrumented Systems, with market demand driven by increasing system complexity and integration requirements. Cybersecurity features become essential differentiators as industrial facilities adopt connected technologies while maintaining safety system integrity.

Oil and Gas sector leads industry adoption with approximately 45% of North American SIS installations, driven by regulatory requirements and operational safety priorities. Downstream refining operations particularly emphasize comprehensive safety systems due to process complexity and environmental sensitivity.

End-user organizations benefit from Safety Instrumented Systems through reduced accident risks, regulatory compliance assurance, and potential insurance premium reductions. Operational efficiency improvements result from integrated safety and process control systems that optimize plant performance while maintaining safety integrity.

Technology providers gain access to stable, regulation-driven demand with opportunities for long-term service relationships and system lifecycle management. Innovation opportunities in wireless technologies, cybersecurity, and predictive maintenance create competitive differentiation and premium pricing potential.

System integrators benefit from complex project requirements that demand specialized expertise and comprehensive service capabilities. Recurring revenue opportunities through maintenance, upgrades, and consulting services provide business stability and growth potential.

Regulatory agencies achieve improved industrial safety outcomes through mandatory SIS implementation and performance standards. Public safety benefits result from reduced industrial accident risks and environmental protection improvements.

Insurance companies experience reduced claim exposure through improved industrial safety performance and can offer premium incentives for facilities with robust safety systems. Risk assessment capabilities improve through better safety system data and performance monitoring.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless safety technology emerges as a transformative trend, offering 35% reduction in installation costs while maintaining required safety integrity levels. Wireless SIS solutions enable safety system deployment in previously inaccessible locations and facilitate rapid installation in temporary applications.

Cybersecurity integration becomes increasingly critical as Safety Instrumented Systems adopt connected technologies and remote monitoring capabilities. Security-by-design approaches influence system architecture decisions while specialized cybersecurity services emerge to address industrial safety system vulnerabilities.

Predictive maintenance capabilities transform safety system lifecycle management through advanced diagnostics and condition monitoring. Data analytics enable proactive maintenance strategies that improve system reliability while reducing operational costs and unplanned downtime.

Standardization initiatives drive market efficiency through common platforms and interoperable solutions that reduce engineering costs and implementation complexity. Modular system designs enable scalable safety solutions suitable for diverse industrial applications and facility sizes.

Cloud-based services expand market reach through remote monitoring, diagnostics, and support capabilities that reduce on-site expertise requirements. Software-as-a-Service models provide cost-effective access to advanced safety system capabilities for smaller industrial facilities.

Technology advancement continues reshaping the Safety Instrumented Systems landscape through innovative solutions addressing evolving market requirements. Artificial intelligence integration enables advanced pattern recognition and predictive capabilities that enhance safety system performance and reliability.

Strategic partnerships between technology providers and system integrators create comprehensive solution offerings that address complete project lifecycles from design through maintenance. Collaborative relationships enable specialized expertise sharing and market expansion into new geographic regions and industry sectors.

Regulatory updates influence market development through revised standards and enforcement priorities that may accelerate adoption in specific applications or industry sectors. International harmonization efforts create opportunities for global technology providers while potentially challenging regional specialists.

Acquisition activity continues as larger industrial automation companies seek to expand their safety system capabilities through strategic purchases of specialized providers. Market consolidation creates opportunities for comprehensive solution providers while potentially reducing technology diversity.

Research and development investments focus on next-generation safety technologies including advanced sensors, wireless communications, and integrated cybersecurity capabilities. Innovation initiatives address emerging market requirements while maintaining compatibility with existing industrial infrastructure.

Market participants should prioritize cybersecurity capabilities in their Safety Instrumented Systems offerings as industrial facilities increasingly adopt connected technologies. Security-enhanced solutions will become essential differentiators in competitive markets where safety and security requirements converge.

Technology providers should invest in wireless safety system development to capitalize on growing demand for cost-effective installation solutions. Wireless SIS technologies offer significant market expansion opportunities while addressing key customer pain points related to implementation costs and complexity.

System integrators should develop specialized expertise in predictive maintenance and advanced diagnostics to capture emerging service revenue opportunities. Lifecycle management services provide recurring revenue streams while strengthening customer relationships through ongoing value delivery.

End-user organizations should consider total cost of ownership when evaluating Safety Instrumented Systems, including long-term maintenance, upgrade, and training costs. Strategic planning for safety system modernization can optimize investment timing and technology selection decisions.

MarkWide Research recommends that market participants focus on standardized solutions and modular architectures that can address diverse customer requirements while achieving economies of scale in development and manufacturing.

Market trajectory indicates sustained growth driven by regulatory requirements, technological advancement, and increasing industrial safety awareness. Compound annual growth rate projections suggest continued expansion at 8.2% through the forecast period, with wireless technologies and predictive maintenance capabilities driving incremental demand.

Technology evolution will continue reshaping market dynamics as artificial intelligence, machine learning, and advanced analytics become integrated with traditional safety system functions. Smart safety systems will provide enhanced diagnostic capabilities and predictive maintenance features that improve system reliability while reducing operational costs.

Market expansion into small and medium enterprises represents significant growth potential as standardized solutions and cloud-based services reduce implementation barriers. Accessibility improvements through cost-effective technologies and simplified installation procedures will broaden market participation across industrial sectors.

Regulatory landscape evolution will continue influencing market development through updated standards and enforcement priorities that may accelerate adoption in specific applications. International harmonization efforts create opportunities for global solution providers while potentially challenging regional specialists.

Competitive dynamics will favor companies offering comprehensive solutions combining safety functionality with operational optimization and cybersecurity capabilities. Integration trends suggest market consolidation around platform providers capable of addressing complete customer requirements through single-source solutions.

North America Safety Instrumented Systems market demonstrates robust growth potential driven by regulatory mandates, technological innovation, and increasing industrial safety awareness. Market fundamentals remain strong with consistent demand from process industries and expanding adoption in manufacturing sectors seeking enhanced safety performance.

Technology trends toward wireless systems, predictive maintenance, and cybersecurity integration create new opportunities for market participants while addressing evolving customer requirements. Competitive landscape evolution favors comprehensive solution providers capable of delivering integrated safety and operational optimization capabilities.

Future success in this market will depend on companies’ ability to balance safety integrity requirements with cost-effectiveness, technological advancement, and customer service excellence. Strategic positioning around emerging technologies and underserved market segments will determine long-term competitive advantages in this essential industrial safety market.

What is Safety Instrumented Systems?

Safety Instrumented Systems (SIS) are engineered systems designed to prevent hazardous events by automatically taking control actions when predetermined conditions are met. They are critical in industries such as oil and gas, chemical processing, and manufacturing to ensure operational safety.

What are the key players in the NA Safety Instrumented Systems Market?

Key players in the NA Safety Instrumented Systems Market include Honeywell International Inc., Siemens AG, and Emerson Electric Co. These companies are known for their advanced safety solutions and technologies in various industrial applications, among others.

What are the main drivers of growth in the NA Safety Instrumented Systems Market?

The main drivers of growth in the NA Safety Instrumented Systems Market include increasing regulatory compliance requirements, the rising need for operational safety in hazardous industries, and advancements in technology that enhance system reliability and performance.

What challenges does the NA Safety Instrumented Systems Market face?

Challenges in the NA Safety Instrumented Systems Market include the high costs associated with system implementation and maintenance, the complexity of integrating SIS with existing infrastructure, and the need for skilled personnel to manage these systems effectively.

What opportunities exist in the NA Safety Instrumented Systems Market?

Opportunities in the NA Safety Instrumented Systems Market include the growing adoption of Industry Four Point Zero technologies, the increasing focus on process safety management, and the potential for expansion into emerging markets with developing industrial sectors.

What trends are shaping the NA Safety Instrumented Systems Market?

Trends shaping the NA Safety Instrumented Systems Market include the integration of IoT technologies for real-time monitoring, the use of artificial intelligence for predictive maintenance, and the shift towards more automated safety solutions to enhance operational efficiency.

NA Safety Instrumented Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Emergency Shutdown Systems, Fire & Gas Systems, Control Systems, Alarm Systems |

| Technology | Programmable Logic Controllers, Distributed Control Systems, Safety Relays, Smart Sensors |

| End User | Oil & Gas, Chemical, Power Generation, Pharmaceuticals |

| Installation | Onshore, Offshore, Industrial Facilities, Commercial Buildings |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the NA Safety Instrumented Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at