444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The LA LED packaging market represents a rapidly evolving segment within the global semiconductor and lighting industry, characterized by advanced packaging technologies that enhance light extraction efficiency and thermal management. LA LED packaging solutions have emerged as critical components in high-performance lighting applications, automotive lighting systems, and display technologies. The market demonstrates robust growth potential driven by increasing demand for energy-efficient lighting solutions and the continuous advancement of LED technology.

Market dynamics indicate substantial expansion opportunities across various application sectors, with the automotive industry leading adoption rates at approximately 35% market share. The integration of advanced materials and innovative packaging designs has positioned LA LED packaging as a preferred choice for manufacturers seeking superior optical performance and reliability. Regional distribution shows North America and Asia-Pacific as dominant markets, collectively accounting for over 70% of global adoption.

Technology advancement continues to drive market evolution, with manufacturers investing heavily in research and development to improve packaging efficiency and reduce manufacturing costs. The market exhibits strong growth momentum with projected expansion rates of 8.2% CAGR over the forecast period, supported by increasing penetration in emerging applications and continuous innovation in packaging materials.

The LA LED packaging market refers to the specialized segment focused on advanced packaging technologies for light-emitting diodes that optimize light extraction, thermal management, and overall performance through innovative design and material integration approaches.

LA LED packaging encompasses various packaging methodologies including chip-on-board (COB), surface-mount device (SMD), and advanced multi-chip packages that enhance luminous efficacy and operational reliability. These packaging solutions integrate sophisticated thermal management systems, optical enhancement features, and protective encapsulation to maximize LED performance across diverse applications.

Key characteristics of LA LED packaging include superior heat dissipation capabilities, enhanced light extraction efficiency, improved color consistency, and extended operational lifespan. The packaging technologies incorporate advanced materials such as high-thermal-conductivity substrates, specialized phosphor coatings, and protective encapsulants that ensure optimal performance under various operating conditions.

Application scope extends across multiple industries including automotive lighting, general illumination, display backlighting, architectural lighting, and specialty applications requiring high-performance LED solutions. The packaging technologies enable manufacturers to achieve specific performance targets while maintaining cost-effectiveness and manufacturing scalability.

Market positioning of LA LED packaging demonstrates strong competitive advantages through advanced technology integration and superior performance characteristics. The market benefits from increasing demand for energy-efficient lighting solutions and the growing adoption of LED technology across various application sectors. Growth drivers include technological advancement, regulatory support for energy-efficient lighting, and expanding applications in automotive and display industries.

Regional analysis reveals Asia-Pacific as the leading market with approximately 42% market share, driven by strong manufacturing capabilities and increasing domestic demand. North America follows with significant market presence, particularly in automotive and specialty lighting applications. European markets demonstrate steady growth supported by stringent energy efficiency regulations and increasing adoption of advanced lighting technologies.

Competitive landscape features established players focusing on innovation and strategic partnerships to maintain market position. Key market participants invest heavily in research and development to introduce next-generation packaging solutions that address evolving customer requirements and emerging application needs.

Future outlook indicates continued market expansion driven by technological advancement, increasing application diversity, and growing emphasis on energy efficiency. The market is expected to benefit from emerging opportunities in smart lighting, Internet of Things (IoT) integration, and advanced automotive lighting systems.

Technology evolution drives continuous improvement in LA LED packaging performance, with manufacturers achieving significant efficiency gains through advanced materials and innovative design approaches. The market demonstrates strong innovation momentum with regular introduction of enhanced packaging solutions that address specific application requirements.

Market segmentation reveals diverse application requirements driving specialized packaging solutions. Automotive applications demand high reliability and temperature resistance, while general lighting applications prioritize cost-effectiveness and manufacturing scalability. Display applications require precise color control and compact form factors.

Energy efficiency regulations worldwide continue to drive adoption of LED lighting solutions, creating substantial demand for advanced packaging technologies. Government initiatives promoting energy-efficient lighting systems provide strong market support, with many regions implementing phase-out programs for traditional lighting technologies.

Automotive industry transformation represents a significant growth driver as vehicle manufacturers increasingly adopt LED lighting for headlights, taillights, and interior applications. The shift toward electric vehicles further accelerates LED adoption due to energy efficiency requirements and design flexibility advantages.

Technological advancement in packaging materials and manufacturing processes enables continuous performance improvement and cost reduction. Innovations in thermal management, optical enhancement, and reliability testing drive market expansion by addressing evolving customer requirements and enabling new applications.

Smart lighting integration creates new opportunities for LA LED packaging as connected lighting systems require advanced performance characteristics and reliability. The Internet of Things (IoT) integration drives demand for sophisticated packaging solutions that support sensor integration and communication capabilities.

High initial investment requirements for advanced packaging equipment and materials can limit market entry for smaller manufacturers. The capital-intensive nature of packaging technology development creates barriers for companies seeking to establish market presence or expand production capabilities.

Technical complexity associated with advanced packaging processes requires specialized expertise and sophisticated manufacturing capabilities. The learning curve for implementing new packaging technologies can be substantial, potentially delaying market adoption and increasing development costs.

Supply chain challenges affect material availability and pricing stability, particularly for specialized substrates and advanced encapsulation materials. Global supply chain disruptions can impact production schedules and increase manufacturing costs, affecting market competitiveness.

Standardization challenges across different application sectors create complexity in product development and manufacturing processes. The lack of universal standards for packaging specifications can limit interoperability and increase development costs for manufacturers serving multiple market segments.

Emerging applications in smart cities, connected infrastructure, and advanced automotive systems create substantial growth opportunities for LA LED packaging technologies. The integration of LED lighting with IoT systems and smart controls drives demand for sophisticated packaging solutions with enhanced functionality.

Geographic expansion into developing markets presents significant opportunities as infrastructure development and urbanization drive lighting system upgrades. Emerging economies demonstrate increasing adoption of LED technology, creating demand for cost-effective packaging solutions that maintain performance standards.

Technology convergence with other semiconductor technologies opens new application possibilities and market segments. The integration of sensors, communication modules, and advanced control systems with LED packaging creates opportunities for value-added solutions and differentiated products.

Sustainability initiatives drive demand for environmentally friendly packaging materials and manufacturing processes. The focus on circular economy principles creates opportunities for recyclable packaging solutions and reduced environmental impact manufacturing approaches.

Supply and demand balance in the LA LED packaging market reflects strong growth momentum driven by expanding applications and technological advancement. Market dynamics demonstrate increasing demand across multiple sectors, with supply capabilities expanding to meet growing requirements through capacity investments and manufacturing optimization.

Price trends show gradual stabilization as manufacturing processes mature and economies of scale improve cost structures. The market benefits from continuous cost reduction efforts while maintaining quality standards and performance improvements. Competitive pricing strategies drive market penetration and volume growth across various application segments.

Innovation cycles accelerate as manufacturers invest in research and development to maintain competitive advantages and address evolving customer requirements. The rapid pace of technological advancement creates opportunities for differentiation while requiring continuous investment in development capabilities.

Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to strengthen market position and expand technological capabilities. Vertical integration strategies enable better control over supply chains and cost structures while improving product quality and reliability.

Customer requirements continue to evolve toward higher performance, improved reliability, and enhanced functionality. The market responds through continuous innovation and customization capabilities that address specific application needs and performance targets.

Comprehensive market analysis employs multiple research methodologies including primary research, secondary data analysis, and industry expert consultations to ensure accurate and reliable market insights. The research approach combines quantitative analysis with qualitative assessment to provide complete market understanding.

Primary research involves direct engagement with industry participants including manufacturers, suppliers, distributors, and end-users to gather firsthand market intelligence. Structured interviews and surveys provide insights into market trends, challenges, opportunities, and future outlook from key stakeholders.

Secondary research encompasses analysis of industry reports, company publications, regulatory documents, and technical literature to validate primary findings and provide comprehensive market context. Data triangulation ensures accuracy and reliability of market assessments and projections.

Data validation processes ensure accuracy and reliability through cross-verification of information sources and expert review. The methodology incorporates statistical analysis and trend modeling to provide robust market projections and strategic insights for stakeholders.

Asia-Pacific region dominates the LA LED packaging market with approximately 42% market share, driven by strong manufacturing capabilities, growing domestic demand, and significant investments in LED technology development. Countries including China, Japan, and South Korea lead regional market growth through advanced manufacturing infrastructure and technological innovation.

North American market demonstrates substantial growth potential with focus on automotive applications and specialty lighting solutions. The region benefits from strong research and development capabilities, advanced automotive industry, and increasing adoption of smart lighting systems. Market share reaches approximately 28% of global volume.

European markets show steady expansion supported by stringent energy efficiency regulations and increasing emphasis on sustainable lighting solutions. The region’s focus on environmental sustainability and advanced automotive technologies drives demand for high-performance LED packaging solutions.

Emerging markets in Latin America, Middle East, and Africa present growth opportunities as infrastructure development and urbanization drive LED adoption. These regions demonstrate increasing interest in energy-efficient lighting solutions and modern infrastructure development projects.

Market leadership is characterized by established players with strong technological capabilities and comprehensive product portfolios. The competitive environment emphasizes innovation, quality, and customer service as key differentiation factors in market positioning and growth strategies.

Strategic initiatives include research and development investments, strategic partnerships, and capacity expansion to strengthen market position and address growing demand. Companies focus on technological advancement and customer relationship development to maintain competitive advantages.

Innovation focus drives continuous product development and performance improvement across the competitive landscape. Market participants invest significantly in advanced materials research, manufacturing process optimization, and application-specific solution development to differentiate their offerings.

By Technology: The market segments into multiple packaging technologies including chip-on-board (COB), surface-mount device (SMD), chip-scale package (CSP), and advanced multi-chip modules. Each technology offers specific advantages for different applications and performance requirements.

By Application: Market segmentation covers automotive lighting, general illumination, display backlighting, architectural lighting, and specialty applications. Automotive applications represent the largest segment with approximately 35% market share, driven by increasing LED adoption in vehicle lighting systems.

By Power Rating: Segmentation includes low-power (less than 1W), mid-power (1-3W), and high-power (above 3W) packages. High-power segments demonstrate strong growth driven by automotive and architectural lighting applications requiring superior performance characteristics.

By End-User Industry: Market segmentation includes automotive, consumer electronics, architectural, industrial, and specialty applications. Each industry segment has specific requirements for performance, reliability, and cost-effectiveness that drive packaging technology selection and development.

Automotive segment demonstrates the strongest growth momentum with increasing LED adoption across all vehicle lighting applications. The segment benefits from automotive industry transformation toward electric vehicles and advanced lighting systems that require high-performance packaging solutions with superior reliability and thermal management.

General illumination category represents substantial market volume with focus on cost-effective packaging solutions that maintain quality and performance standards. The segment drives manufacturing scale and process optimization while supporting market expansion through broad application adoption.

Display backlighting requires specialized packaging approaches that deliver precise color control and compact form factors. The segment demonstrates steady growth driven by consumer electronics advancement and increasing display quality requirements across various device categories.

Architectural lighting category emphasizes design flexibility and performance consistency for building integration applications. The segment requires packaging solutions that support various form factors and installation requirements while maintaining long-term reliability and performance stability.

Manufacturers benefit from advanced packaging technologies through improved product performance, enhanced reliability, and expanded application opportunities. The technologies enable differentiation in competitive markets while supporting cost optimization through manufacturing efficiency improvements and economies of scale.

End-users gain significant advantages including improved energy efficiency, extended operational lifespan, and enhanced performance characteristics. LA LED packaging solutions deliver superior light quality, reduced maintenance requirements, and better total cost of ownership compared to conventional lighting technologies.

Supply chain participants benefit from market growth through increased demand for specialized materials, components, and manufacturing equipment. The expanding market creates opportunities for suppliers to develop innovative materials and solutions that support packaging technology advancement.

Investment opportunities emerge across the value chain as market expansion creates demand for manufacturing capacity, research and development capabilities, and specialized expertise. Stakeholders can capitalize on growth trends through strategic investments in technology development and market expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trend drives development of compact packaging solutions that deliver high performance in smaller form factors. The trend supports integration into space-constrained applications while maintaining thermal management and optical performance requirements.

Smart integration represents a significant trend as LED packaging incorporates sensors, communication capabilities, and advanced control systems. This convergence creates opportunities for value-added solutions that support IoT integration and intelligent lighting systems.

Sustainability focus influences packaging material selection and manufacturing processes toward environmentally friendly approaches. The trend includes recyclable materials, reduced environmental impact manufacturing, and lifecycle optimization for sustainable product development.

Customization trend drives development of application-specific packaging solutions that address unique performance requirements and installation constraints. According to MarkWide Research analysis, customized solutions represent approximately 22% of market demand and continue growing as applications become more specialized.

Technology advancement continues through significant investments in research and development across the industry. Major manufacturers introduce next-generation packaging solutions with improved performance characteristics, enhanced reliability, and expanded application capabilities on regular basis.

Strategic partnerships emerge between packaging manufacturers and end-user industries to develop customized solutions and accelerate technology adoption. These collaborations enable better understanding of application requirements and faster development of optimized packaging approaches.

Manufacturing expansion occurs globally as companies invest in production capacity to meet growing demand. New facilities incorporate advanced manufacturing technologies and automation systems to improve efficiency, quality, and cost competitiveness.

Regulatory developments influence industry standards and requirements, driving adoption of advanced packaging technologies that meet evolving performance and safety standards. Industry participants actively engage in standards development to ensure compatibility and market acceptance of new technologies.

Investment focus should prioritize advanced manufacturing capabilities and research and development to maintain competitive position in the rapidly evolving market. Companies should consider strategic investments in automation, quality control systems, and specialized expertise to support growth and differentiation.

Market expansion strategies should target emerging applications and geographic markets where growth potential remains strong. MWR data suggests that emerging markets could contribute 18-20% additional growth over the next five years through infrastructure development and LED adoption acceleration.

Technology development should emphasize sustainability, performance enhancement, and cost optimization to address evolving market requirements. Focus areas include advanced materials research, thermal management improvement, and manufacturing process optimization for better competitiveness.

Risk management should address supply chain vulnerabilities, technology disruption risks, and competitive pressures through diversification strategies and contingency planning. Companies should develop robust supply chain relationships and maintain flexibility in manufacturing and product development approaches.

Market growth trajectory indicates continued expansion driven by technology advancement, application diversification, and geographic market development. The outlook remains positive with projected growth rates of 8.2% CAGR supported by strong demand fundamentals and continuous innovation in packaging technologies.

Technology evolution will continue advancing packaging performance through materials innovation, design optimization, and manufacturing process improvement. Future developments will focus on enhanced efficiency, improved reliability, and expanded functionality to support emerging applications and requirements.

Application expansion into smart cities, connected infrastructure, and advanced automotive systems will drive substantial growth opportunities. The integration of LED packaging with IoT systems and intelligent controls creates potential for value-added solutions and market differentiation.

Geographic development in emerging markets presents significant opportunities as infrastructure modernization and urbanization drive LED adoption. These markets demonstrate increasing acceptance of advanced lighting technologies and growing investment in modern infrastructure projects.

Sustainability initiatives will increasingly influence packaging design and manufacturing approaches, creating opportunities for environmentally friendly solutions and circular economy principles. The focus on reduced environmental impact will drive innovation in materials and processes while supporting market growth through regulatory compliance and customer preference alignment.

The LA LED packaging market demonstrates strong growth potential driven by technological advancement, expanding applications, and increasing adoption of energy-efficient lighting solutions. Market dynamics indicate robust demand across automotive, general illumination, and specialty applications, supported by continuous innovation and performance improvement in packaging technologies.

Key success factors include investment in advanced manufacturing capabilities, focus on research and development, and strategic positioning in high-growth application segments. Companies that maintain technology leadership while optimizing cost structures and expanding market reach will be best positioned to capitalize on growth opportunities.

Future prospects remain positive with expanding applications, geographic market development, and technology convergence creating substantial opportunities for market participants. The emphasis on sustainability, smart integration, and performance enhancement will continue driving innovation and market expansion in the years ahead.

What is LA LED Packaging?

LA LED Packaging refers to the various methods and materials used to encase and protect light-emitting diodes (LEDs) for applications in lighting, displays, and other electronic devices. This packaging is crucial for ensuring the performance, durability, and efficiency of LED products.

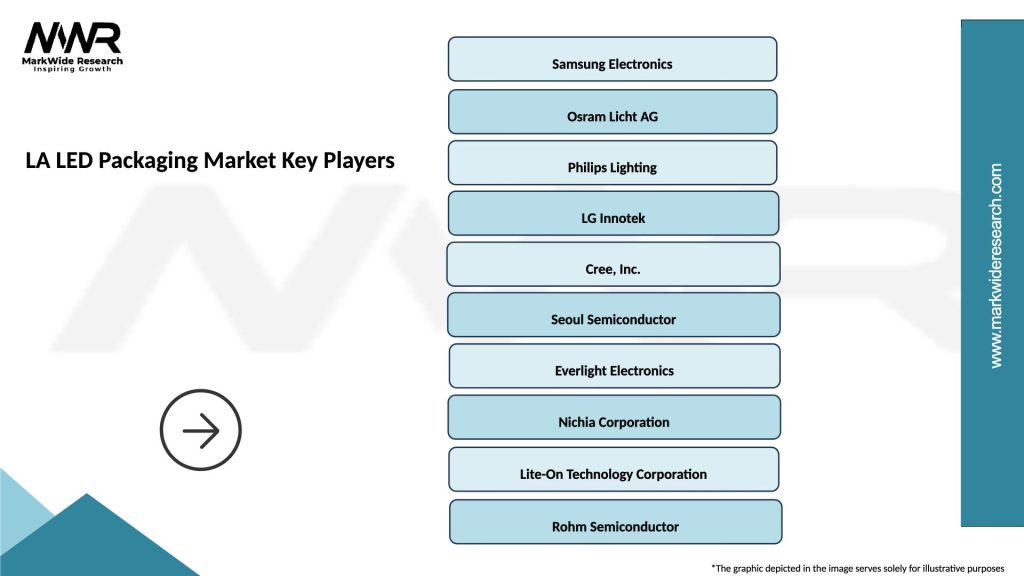

What are the key companies in the LA LED Packaging Market?

Key companies in the LA LED Packaging Market include Osram, Nichia, and Cree, which are known for their innovative LED packaging solutions. These companies focus on enhancing the efficiency and reliability of LED products, among others.

What are the main drivers of growth in the LA LED Packaging Market?

The main drivers of growth in the LA LED Packaging Market include the increasing demand for energy-efficient lighting solutions, the rise in smart lighting applications, and advancements in LED technology. These factors contribute to the expanding adoption of LED packaging across various sectors.

What challenges does the LA LED Packaging Market face?

The LA LED Packaging Market faces challenges such as high manufacturing costs and the need for continuous innovation to meet evolving consumer demands. Additionally, competition from alternative lighting technologies can hinder market growth.

What opportunities exist in the LA LED Packaging Market?

Opportunities in the LA LED Packaging Market include the growing trend of smart cities and the integration of LED technology in automotive lighting. Furthermore, the increasing focus on sustainability and eco-friendly packaging solutions presents new avenues for growth.

What trends are shaping the LA LED Packaging Market?

Trends shaping the LA LED Packaging Market include the development of miniaturized packaging solutions and the use of advanced materials to enhance thermal management. Additionally, the shift towards human-centric lighting is influencing design and functionality in LED packaging.

LA LED Packaging Market

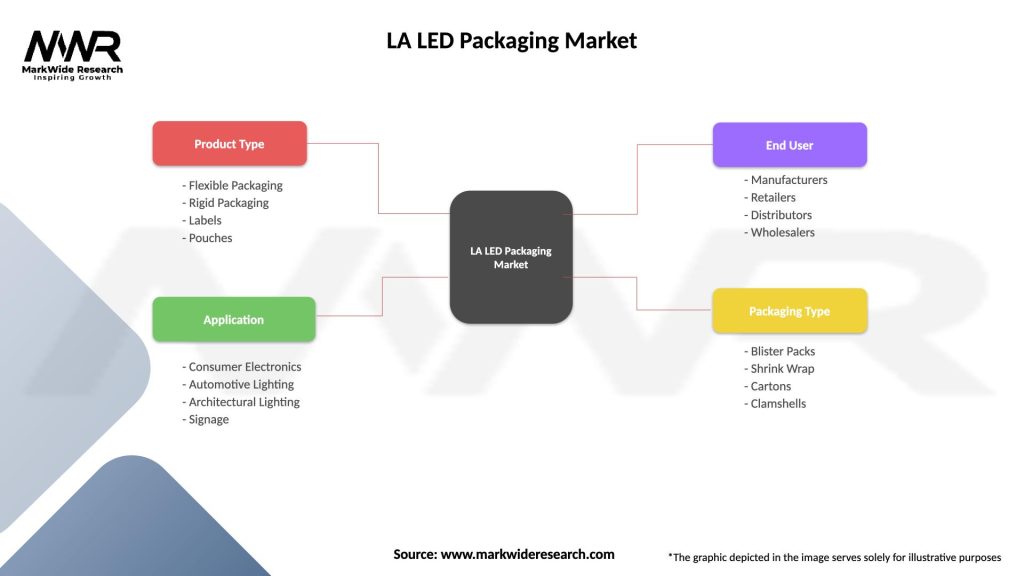

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Packaging, Rigid Packaging, Labels, Pouches |

| Application | Consumer Electronics, Automotive Lighting, Architectural Lighting, Signage |

| End User | Manufacturers, Retailers, Distributors, Wholesalers |

| Packaging Type | Blister Packs, Shrink Wrap, Cartons, Clamshells |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the LA LED Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at