444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China haying and forage machinery market represents a rapidly evolving sector within the nation’s agricultural equipment industry, driven by modernization initiatives and increasing demand for efficient livestock feed production. Agricultural mechanization has become a cornerstone of China’s food security strategy, with haying and forage machinery playing a crucial role in supporting the country’s expanding livestock industry. The market encompasses a comprehensive range of equipment including mowers, tedders, rakes, balers, and forage harvesters designed to optimize hay and silage production processes.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects China’s commitment to agricultural modernization and the increasing adoption of mechanized farming practices across rural regions. Government support through subsidies and policy initiatives has significantly accelerated the adoption of advanced haying and forage machinery, particularly among large-scale farming operations and agricultural cooperatives.

Regional distribution shows concentrated demand in major livestock-producing provinces, with Inner Mongolia, Xinjiang, and Heilongjiang leading adoption rates. The market benefits from China’s vast grassland resources and the growing emphasis on sustainable livestock farming practices. Technology integration has emerged as a key differentiator, with manufacturers incorporating GPS guidance systems, precision cutting mechanisms, and automated baling technologies to enhance operational efficiency and reduce labor requirements.

The China haying and forage machinery market refers to the comprehensive ecosystem of equipment, technologies, and services dedicated to the harvesting, processing, and preservation of hay and forage crops for livestock feed production within China’s agricultural sector. This market encompasses specialized machinery designed to cut, condition, rake, and bale grass crops, legumes, and other forage materials essential for supporting the country’s livestock industry.

Haying machinery specifically includes equipment for traditional hay production processes, such as disc mowers, drum mowers, tedders for hay drying, wheel rakes for windrow formation, and various types of balers for hay packaging. Forage machinery extends beyond hay production to include self-propelled forage harvesters, precision choppers, and silage-making equipment that enables farmers to preserve high-moisture crops for year-round livestock feeding.

Market significance extends beyond equipment sales to encompass maintenance services, spare parts distribution, operator training programs, and technological upgrades. The sector plays a vital role in China’s agricultural value chain, supporting dairy farming, beef production, and other livestock operations that require consistent, high-quality feed supplies throughout the year.

China’s haying and forage machinery market demonstrates exceptional growth momentum, positioning itself as a critical component of the nation’s agricultural modernization strategy. The market has experienced significant transformation over the past decade, evolving from predominantly manual harvesting methods to sophisticated mechanized operations that enhance productivity and reduce labor dependency.

Key market drivers include government agricultural subsidies covering up to 30% of machinery costs, increasing livestock production demands, and the consolidation of small farms into larger, more efficient operations. Technological advancement has emerged as a primary competitive factor, with manufacturers integrating precision agriculture technologies, IoT connectivity, and automated systems to meet evolving farmer requirements.

Market segmentation reveals diverse applications across dairy farming, beef cattle operations, sheep farming, and mixed livestock systems. Regional concentration in northern and western provinces reflects the geographic distribution of China’s grassland resources and livestock production centers. The market benefits from strong domestic manufacturing capabilities, with several Chinese companies establishing themselves as significant players alongside international brands.

Future prospects indicate continued expansion driven by agricultural policy support, increasing mechanization rates, and growing emphasis on sustainable farming practices. Market challenges include the need for operator training, maintenance infrastructure development, and adaptation to diverse regional farming conditions across China’s vast agricultural landscape.

Market penetration analysis reveals significant opportunities for growth, with mechanization rates in haying and forage operations currently at 45% in developed agricultural regions but substantially lower in traditional farming areas. This disparity presents considerable expansion potential as modernization initiatives reach smaller farming communities and cooperative organizations.

Competitive dynamics show a balanced mix of domestic and international manufacturers, with Chinese companies gaining market share through cost-competitive offerings and localized service support. Innovation trends focus on automation, precision agriculture integration, and equipment versatility to address diverse operational requirements across different farming systems.

Government policy support serves as the primary catalyst for market expansion, with China’s agricultural modernization strategy providing substantial financial incentives for machinery adoption. Subsidy programs covering equipment purchases have significantly reduced the financial barriers for farmers, particularly in designated agricultural development zones and poverty alleviation regions.

Labor shortage challenges in rural areas have accelerated the transition toward mechanized farming operations. Demographic shifts with younger populations migrating to urban centers have created urgent needs for labor-saving technologies in agricultural production. This trend has made haying and forage machinery essential for maintaining productive farming operations with reduced workforce requirements.

Livestock industry expansion continues to drive demand for efficient forage production systems. China’s growing middle class and increasing protein consumption have stimulated dairy and meat production, creating sustained demand for high-quality animal feed. Feed quality requirements have become more stringent, necessitating advanced machinery capable of producing consistent, nutritious forage products.

Land consolidation initiatives have created larger farming operations that can effectively utilize modern haying and forage machinery. Cooperative farming models enable smaller farmers to access advanced equipment through shared ownership and service arrangements, expanding the potential customer base for machinery manufacturers.

Environmental sustainability concerns have promoted the adoption of precision machinery that optimizes resource utilization and reduces waste. Sustainable farming practices supported by government environmental policies encourage the use of efficient equipment that minimizes soil compaction and preserves grassland ecosystems.

High initial investment costs continue to present significant barriers for smaller farming operations, despite government subsidy programs. Capital requirements for comprehensive haying and forage machinery systems can be substantial, particularly when including supporting equipment and infrastructure modifications necessary for efficient operations.

Technical complexity of modern machinery requires specialized knowledge and training that may not be readily available in all agricultural regions. Operator skill gaps can limit the effective utilization of advanced equipment features, reducing return on investment and potentially leading to equipment damage or suboptimal performance.

Maintenance infrastructure limitations in remote agricultural areas pose challenges for equipment servicing and repair. Spare parts availability and qualified technician access can be problematic, particularly for international brands with limited local service networks. This situation can result in extended equipment downtime during critical harvesting periods.

Fragmented land ownership patterns in many regions limit the economic viability of large-scale machinery investments. Small plot sizes and irregular field configurations may not justify the purchase of specialized haying equipment, particularly in areas where traditional farming methods remain prevalent.

Seasonal utilization patterns create challenges for equipment cost recovery, as haying and forage machinery typically experiences intensive use during limited harvest periods. Equipment idle time during off-seasons can impact the overall economic attractiveness of machinery investments for individual farmers.

Precision agriculture integration presents substantial opportunities for technology-enhanced haying and forage machinery. IoT connectivity and data analytics capabilities can provide farmers with detailed insights into crop conditions, optimal harvesting timing, and equipment performance optimization, creating premium market segments for advanced machinery solutions.

Rental and leasing services offer significant growth potential, particularly for smaller farming operations that cannot justify equipment purchases. Equipment sharing platforms and cooperative service models can expand market reach while providing sustainable revenue streams for machinery providers and service operators.

Export market development represents an emerging opportunity for Chinese manufacturers to leverage cost advantages and growing technical capabilities. Belt and Road Initiative countries with developing agricultural sectors present potential markets for Chinese-manufactured haying and forage machinery, supported by government trade promotion programs.

Aftermarket services expansion including maintenance contracts, operator training programs, and equipment upgrade services can provide recurring revenue opportunities. Digital service platforms enabling remote diagnostics, predictive maintenance, and performance monitoring can differentiate manufacturers in competitive market segments.

Sustainable technology development aligns with environmental policy priorities and can access green technology incentives. Electric and hybrid machinery development, precision application systems, and soil conservation technologies represent emerging market niches with strong growth potential supported by environmental sustainability initiatives.

Supply chain dynamics in China’s haying and forage machinery market reflect the complex interplay between domestic manufacturing capabilities, international technology partnerships, and regional distribution networks. Manufacturing concentration in industrial provinces has created efficient production clusters while challenging logistics coordination for nationwide market coverage.

Demand seasonality creates distinctive market rhythms, with peak purchasing activity concentrated around government subsidy disbursement periods and pre-harvest seasons. Inventory management becomes critical for manufacturers and dealers to balance production capacity with fluctuating demand patterns while maintaining competitive pricing structures.

Technology transfer dynamics between international manufacturers and Chinese partners have accelerated local capability development. Joint ventures and licensing agreements have enabled rapid technology adoption while fostering domestic innovation in machinery design and manufacturing processes.

Competitive intensity varies significantly across market segments, with premium technology segments dominated by international brands while cost-competitive segments show strong domestic manufacturer presence. Price competition remains intense in standard machinery categories, driving continuous efficiency improvements and cost reduction initiatives.

Regulatory dynamics influence market development through equipment standards, emission requirements, and safety regulations. Policy changes regarding agricultural subsidies, environmental compliance, and trade regulations can significantly impact market conditions and competitive positioning strategies.

Comprehensive market analysis for China’s haying and forage machinery sector employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves direct engagement with key market participants including manufacturers, distributors, farmers, agricultural cooperatives, and government officials responsible for agricultural policy implementation.

Data collection methods include structured interviews with industry executives, farmer surveys across representative agricultural regions, and participation in major agricultural trade shows and exhibitions. Field research in key agricultural provinces provides firsthand insights into equipment utilization patterns, performance requirements, and emerging technology adoption trends.

Secondary research encompasses analysis of government agricultural statistics, industry association reports, manufacturer financial disclosures, and academic research publications. Market intelligence gathering includes monitoring of patent filings, technology development announcements, and competitive product launches to identify emerging trends and innovation directions.

Quantitative analysis utilizes statistical modeling techniques to project market trends, segment growth patterns, and regional development trajectories. Qualitative assessment incorporates expert opinions, stakeholder perspectives, and policy analysis to understand market dynamics beyond numerical data points.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and continuous monitoring of market developments. MarkWide Research methodology emphasizes real-world applicability and actionable insights for industry stakeholders and investment decision-makers.

Northern China dominates the haying and forage machinery market, with Inner Mongolia accounting for approximately 28% of national demand. The region’s extensive grasslands and established livestock farming operations create ideal conditions for large-scale mechanized forage production. Heilongjiang Province shows strong adoption rates for advanced harvesting equipment, supported by large-scale farming operations and government modernization initiatives.

Western regions including Xinjiang and Qinghai demonstrate rapid market growth driven by pastoral farming expansion and infrastructure development. Xinjiang’s market share has increased to 18% of national demand, reflecting the region’s growing importance in livestock production and forage crop cultivation. Government development programs in western provinces provide substantial equipment subsidies and technical support.

Central China presents emerging opportunities as traditional crop farming areas diversify into livestock operations. Henan and Hubei provinces show increasing adoption of compact haying machinery suitable for smaller field operations and mixed farming systems. Regional preferences favor versatile equipment capable of handling multiple crop types and field conditions.

Eastern coastal provinces focus on high-technology machinery solutions despite smaller agricultural land areas. Shandong and Jiangsu markets emphasize precision equipment with advanced automation features, reflecting higher farmer income levels and intensive farming practices. These regions serve as testing grounds for innovative machinery technologies before broader market introduction.

Southern regions present unique challenges due to different climate conditions and crop varieties, requiring specialized equipment adaptations. Market penetration remains lower in southern provinces but shows potential for growth as livestock farming expands and mechanization awareness increases among local farming communities.

Market leadership in China’s haying and forage machinery sector reflects a diverse competitive environment combining established international manufacturers with rapidly growing domestic companies. Competitive positioning varies across different machinery categories and price segments, creating multiple pathways for market success.

Strategic partnerships between international and domestic manufacturers have become increasingly common, enabling technology transfer while providing market access advantages. Joint ventures allow international companies to benefit from local manufacturing cost advantages and regulatory familiarity while Chinese partners gain access to advanced technologies and global market expertise.

Innovation competition focuses on automation technologies, fuel efficiency improvements, and equipment versatility to address diverse Chinese farming conditions. Service competition has intensified with manufacturers expanding dealer networks, training programs, and spare parts availability to differentiate their offerings in competitive market segments.

By Equipment Type: The market segments into distinct categories based on specific machinery functions and applications. Mowing equipment represents the largest segment, including disc mowers, drum mowers, and flail mowers designed for different crop types and field conditions. Conditioning equipment such as tedders and rakes facilitates proper hay drying and windrow formation, essential for quality forage production.

Baling equipment encompasses round balers, square balers, and large square balers catering to different farm sizes and storage requirements. Forage harvesters include self-propelled and pull-type units for silage production, representing high-value market segments with advanced technology integration.

By Farm Size: Market segmentation reflects diverse operational scales across Chinese agriculture. Large-scale operations above 100 hectares prefer high-capacity, automated equipment with GPS guidance and precision features. Medium-scale farms between 20-100 hectares focus on versatile, reliable equipment offering good value for investment.

Small-scale operations under 20 hectares require compact, affordable machinery or access to equipment through cooperative arrangements. Cooperative segments enable shared equipment ownership and professional service provision, expanding market reach for advanced machinery categories.

By Application: Different livestock farming systems create distinct machinery requirements. Dairy farming applications emphasize high-quality forage production with consistent nutritional content. Beef cattle operations focus on cost-effective bulk forage production and storage solutions. Mixed farming systems require versatile equipment capable of handling multiple crop types and operational requirements.

Mowing Equipment Category: This segment demonstrates steady growth with adoption rates increasing by 12% annually across major agricultural regions. Disc mowers dominate sales due to their versatility and reliability in diverse crop conditions. Advanced models featuring automatic height adjustment and obstacle detection systems command premium pricing while gaining acceptance among progressive farmers.

Conditioning Equipment: Tedders and rakes show strong demand correlation with mowing equipment sales, as farmers invest in complete hay production systems. Rotary tedders have gained popularity for their gentle crop handling and efficient drying capabilities. Wheel rakes remain preferred for windrow formation due to their simplicity and cost-effectiveness.

Baling Equipment: Round balers maintain market leadership due to their suitability for Chinese farming conditions and storage practices. Variable chamber balers offer flexibility in bale size and density, appealing to farmers with diverse marketing requirements. Large square balers show growing adoption among commercial hay producers and export-oriented operations.

Forage Harvesters: Self-propelled units represent the premium market segment with advanced features including kernel processing, crop flow monitoring, and automated adjustment systems. Pull-type harvesters provide cost-effective solutions for medium-scale operations while maintaining good performance capabilities.

Specialty Equipment: Emerging categories include precision planters for forage crops, moisture meters for optimal harvesting timing, and wrapping equipment for high-moisture forage preservation. These specialized tools reflect increasing sophistication in Chinese forage production systems.

Farmers and Agricultural Operators benefit significantly from modern haying and forage machinery through enhanced operational efficiency and reduced labor requirements. Productivity improvements of up to 300% compared to manual methods enable farmers to manage larger areas with consistent quality output. Cost reduction in labor expenses and improved harvest timing flexibility contribute to better profitability and operational sustainability.

Equipment Manufacturers gain access to China’s vast agricultural market with substantial growth potential and government support for mechanization initiatives. Technology development opportunities arise from adapting international designs to local conditions while leveraging cost-effective manufacturing capabilities. Market expansion potential extends beyond domestic sales to export opportunities in developing agricultural markets.

Dealers and Service Providers benefit from recurring revenue streams through equipment sales, maintenance services, and spare parts distribution. Business diversification opportunities include operator training programs, equipment rental services, and precision agriculture consulting. Regional market development creates opportunities for specialized service providers in underserved agricultural areas.

Government and Policy Makers achieve agricultural modernization objectives while supporting rural economic development and food security goals. Technology adoption contributes to sustainable farming practices and environmental protection initiatives. Rural employment opportunities in equipment operation, maintenance, and support services help retain skilled workers in agricultural communities.

Livestock Industry benefits from consistent, high-quality feed supplies that improve animal nutrition and production efficiency. Feed cost optimization through efficient forage production and storage reduces overall livestock production expenses. Supply chain reliability ensures consistent feed availability throughout seasonal variations and market fluctuations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration represents the most significant trend shaping China’s haying and forage machinery market. GPS guidance systems and automated steering technologies are becoming standard features in premium equipment segments, enabling precise field operations and reducing operator fatigue. Sensor technologies for crop monitoring and automatic adjustment systems enhance operational efficiency while optimizing forage quality.

Precision Agriculture Adoption continues accelerating with farmers increasingly recognizing the value of data-driven farming decisions. Yield mapping and variable rate application technologies help optimize input utilization and maximize forage production efficiency. Connectivity solutions enabling remote monitoring and fleet management are gaining acceptance among large-scale operations and equipment service providers.

Sustainability Focus drives development of environmentally friendly machinery solutions. Fuel efficiency improvements and emission reduction technologies align with China’s environmental protection priorities. Soil conservation features such as reduced ground pressure systems and precision cutting mechanisms help preserve grassland ecosystems while maintaining productivity.

Service Model Evolution shows increasing emphasis on comprehensive support solutions beyond equipment sales. Equipment-as-a-Service models provide farmers access to advanced machinery without large capital investments. Digital service platforms offer remote diagnostics, predictive maintenance, and performance optimization services that enhance equipment reliability and utilization efficiency.

Customization Trends reflect diverse regional requirements and farming practices across China’s agricultural landscape. Modular equipment designs enable farmers to configure machinery for specific applications and field conditions. Regional adaptation of international designs creates opportunities for localized manufacturing and specialized equipment solutions.

Technology Partnerships between international manufacturers and Chinese companies have accelerated significantly, with several major joint ventures announced for advanced forage machinery production. MarkWide Research analysis indicates these partnerships are driving rapid technology transfer and localization of premium equipment categories previously dominated by imports.

Manufacturing Expansion initiatives include new production facilities established by both domestic and international manufacturers to serve growing market demand. Capacity investments focus on advanced manufacturing technologies and quality control systems to meet increasing performance expectations from Chinese farmers.

Government Policy Updates have expanded subsidy coverage to include precision agriculture technologies and environmental compliance features. Green machinery incentives provide additional support for equipment meeting enhanced emission standards and fuel efficiency requirements.

Innovation Launches showcase advanced features including AI-powered crop recognition systems, autonomous operation capabilities, and integrated farm management platforms. Product development increasingly focuses on addressing specific Chinese farming conditions and operational requirements.

Market Consolidation activities include strategic acquisitions and partnerships aimed at expanding product portfolios and market coverage. Distribution network expansion efforts focus on improving service accessibility in underserved agricultural regions.

Export Initiatives by Chinese manufacturers target international markets with cost-competitive solutions adapted for diverse agricultural conditions. Belt and Road countries represent primary focus areas for Chinese equipment exports supported by government trade promotion programs.

Market Entry Strategies for new participants should emphasize regional specialization and service excellence rather than attempting nationwide coverage initially. Partnership approaches with established dealers and agricultural cooperatives can provide market access advantages while reducing initial investment requirements. Technology differentiation through specialized features addressing specific Chinese farming conditions offers competitive positioning opportunities.

Investment Priorities should focus on service infrastructure development and operator training programs to support equipment adoption and customer satisfaction. Dealer network expansion in underserved regions presents significant growth opportunities, particularly with government support for rural development initiatives. Technology development investments in automation and precision agriculture capabilities will become increasingly important for competitive positioning.

Product Development recommendations emphasize versatility and adaptability to diverse Chinese farming conditions. Modular designs enabling equipment customization for specific applications and regional requirements can expand market appeal. Cost optimization without compromising quality remains essential for success in price-sensitive market segments.

Market Expansion strategies should consider the growing importance of equipment services and aftermarket support. Comprehensive service offerings including maintenance contracts, operator training, and performance optimization services can differentiate manufacturers in competitive markets. Digital platform development for remote support and fleet management represents emerging opportunities for value-added services.

Risk Management approaches should address seasonal demand fluctuations through diversified product portfolios and flexible manufacturing capabilities. Supply chain resilience becomes critical for managing component sourcing and production continuity challenges. Regulatory compliance preparation for evolving environmental and safety standards will be essential for sustained market participation.

Long-term growth prospects for China’s haying and forage machinery market remain highly positive, supported by continued agricultural modernization initiatives and expanding livestock production. Market evolution will likely accelerate toward higher technology integration and precision agriculture adoption, creating opportunities for advanced equipment manufacturers and service providers.

Technology advancement will continue driving market transformation, with automation levels expected to reach 60% in premium segments within the next five years. Artificial intelligence and machine learning applications will enhance equipment performance optimization and predictive maintenance capabilities. Connectivity solutions will enable comprehensive farm management integration and data-driven decision making.

Market consolidation trends will likely continue as successful manufacturers expand their market presence through acquisitions and strategic partnerships. Service integration will become increasingly important for competitive differentiation, with comprehensive support solutions becoming standard expectations rather than premium offerings.

Regional development patterns will show continued growth in western and northern provinces while eastern regions focus on technology upgrading and precision agriculture adoption. Export market development by Chinese manufacturers will expand significantly, supported by competitive pricing and improving technology capabilities.

Sustainability requirements will drive continued innovation in fuel efficiency, emission reduction, and environmental compliance features. MWR projections indicate that environmental considerations will become primary factors in equipment selection decisions, particularly for large-scale operations and government-supported projects.

China’s haying and forage machinery market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by agricultural modernization initiatives, government policy support, and expanding livestock industry requirements. The market demonstrates strong fundamentals with diverse opportunities across equipment categories, regional markets, and service segments.

Key success factors for market participants include technology differentiation, comprehensive service capabilities, and adaptation to diverse regional farming conditions. Strategic positioning requires balancing cost competitiveness with advanced features while building robust dealer networks and service infrastructure to support customer needs effectively.

Future market development will be characterized by increasing automation, precision agriculture integration, and sustainability focus, creating opportunities for innovative manufacturers and service providers. Market expansion potential remains substantial, particularly in underserved regions and emerging application segments supported by continued government investment in agricultural modernization.

The China haying and forage machinery market offers compelling opportunities for stakeholders willing to invest in technology development, service excellence, and long-term market development strategies aligned with China’s agricultural transformation objectives and sustainable farming initiatives.

What is Haying & Forage Machinery?

Haying & Forage Machinery refers to equipment used in the agricultural sector for the harvesting, processing, and storage of hay and forage crops. This includes machinery such as mowers, rakes, tedders, and balers that facilitate efficient crop management.

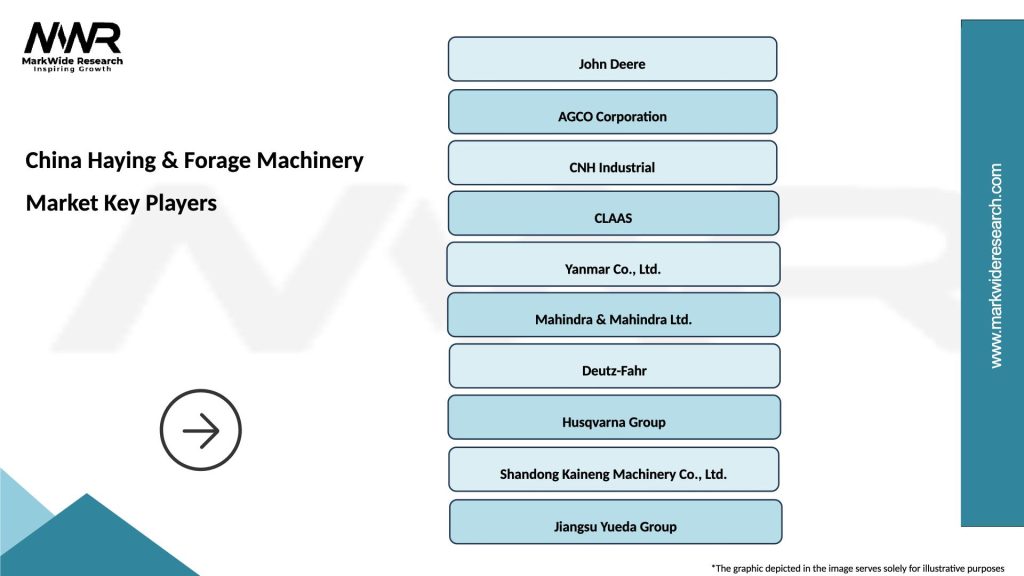

What are the key players in the China Haying & Forage Machinery Market?

Key players in the China Haying & Forage Machinery Market include companies like John Deere, AGCO Corporation, and CLAAS, which are known for their innovative agricultural solutions and extensive product lines, among others.

What are the growth factors driving the China Haying & Forage Machinery Market?

The growth of the China Haying & Forage Machinery Market is driven by increasing demand for efficient agricultural practices, rising livestock production, and advancements in machinery technology that enhance productivity and reduce labor costs.

What challenges does the China Haying & Forage Machinery Market face?

Challenges in the China Haying & Forage Machinery Market include high initial investment costs for advanced machinery, fluctuating raw material prices, and the need for skilled operators to manage sophisticated equipment.

What opportunities exist in the China Haying & Forage Machinery Market?

Opportunities in the China Haying & Forage Machinery Market include the growing trend of precision agriculture, increasing adoption of automation in farming, and the potential for export of machinery to other regions.

What trends are shaping the China Haying & Forage Machinery Market?

Trends in the China Haying & Forage Machinery Market include the integration of smart technology for data analysis, the development of eco-friendly machinery, and a shift towards more compact and versatile equipment to meet diverse farming needs.

China Haying & Forage Machinery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Balers, Mowers, Rakes, Tedders |

| Technology | Mechanical, Hydraulic, Electric, Autonomous |

| End User | Agricultural Producers, Livestock Farmers, Contractors, Cooperatives |

| Size | Small Scale, Medium Scale, Large Scale, Commercial |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Haying & Forage Machinery Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at