444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany haying and forage machinery market represents a critical component of the nation’s agricultural infrastructure, serving as the backbone for livestock feed production and grassland management. German farmers increasingly rely on advanced haying equipment to optimize their forage harvesting operations, driven by the need for enhanced efficiency and quality feed production. The market encompasses a comprehensive range of equipment including mowers, tedders, rakes, balers, and forage harvesters that collectively support the country’s robust dairy and livestock sectors.

Market dynamics indicate substantial growth potential, with the sector experiencing a 6.2% annual growth rate in equipment adoption over recent years. Technological advancement continues to reshape the landscape, as manufacturers integrate precision agriculture technologies, GPS guidance systems, and automated controls into traditional haying machinery. The German market benefits from strong domestic manufacturing capabilities, with several world-renowned equipment producers maintaining significant operations within the country.

Regional distribution shows concentrated activity in Bavaria, Lower Saxony, and North Rhine-Westphalia, where extensive grasslands and high livestock densities drive consistent demand for forage machinery. Sustainability initiatives increasingly influence purchasing decisions, with farmers seeking equipment that reduces fuel consumption, minimizes soil compaction, and supports environmentally responsible farming practices.

The Germany haying and forage machinery market refers to the comprehensive ecosystem of agricultural equipment specifically designed for cutting, processing, and harvesting grass crops and other forage materials used in livestock feed production. This specialized market encompasses various machine categories including disc mowers, drum mowers, rotary rakes, tedders, round balers, square balers, and self-propelled forage harvesters that enable efficient conversion of grassland resources into high-quality animal feed.

Forage machinery serves multiple critical functions within German agriculture, from initial grass cutting and conditioning to final baling and storage preparation. These machines enable farmers to optimize harvest timing, preserve nutritional content, and achieve consistent feed quality essential for maintaining productive livestock operations. The market includes both self-propelled and tractor-mounted implements, offering solutions for operations ranging from small family farms to large commercial enterprises.

Modern haying equipment incorporates sophisticated technologies such as crop conditioning systems, moisture monitoring, and automated bale handling to maximize operational efficiency while minimizing labor requirements. The German market particularly emphasizes precision and reliability, reflecting the country’s reputation for engineering excellence and agricultural innovation.

Germany’s haying and forage machinery sector demonstrates remarkable resilience and growth potential, supported by the country’s strong agricultural foundation and commitment to technological innovation. The market benefits from robust domestic demand driven by extensive livestock operations, particularly in dairy farming where high-quality forage represents a critical input for maintaining milk production standards.

Key market drivers include increasing farm mechanization rates, with 78% of German farms now utilizing some form of automated haying equipment compared to traditional manual methods. Precision agriculture adoption continues accelerating, as farmers recognize the value of data-driven decision making in optimizing harvest timing and feed quality. The integration of IoT sensors and GPS technology enables real-time monitoring of crop conditions and equipment performance.

Competitive dynamics feature both established German manufacturers and international players competing across various market segments. Innovation focus centers on developing more efficient, environmentally sustainable equipment that reduces operational costs while improving forage quality. The market shows particular strength in premium equipment segments, where German engineering expertise commands significant market share.

Future prospects appear highly favorable, with continued modernization of German agriculture expected to drive sustained demand for advanced haying machinery. Sustainability regulations and environmental consciousness increasingly influence purchasing decisions, creating opportunities for manufacturers developing eco-friendly solutions.

Strategic analysis reveals several fundamental insights shaping the German haying and forage machinery landscape:

Market maturity varies across different equipment categories, with traditional mowing and raking equipment showing steady replacement demand while advanced forage processing systems experience rapid growth. Customer preferences increasingly favor multi-functional equipment that can perform multiple operations, reducing overall machinery investment requirements.

Primary growth drivers propelling the German haying and forage machinery market include several interconnected factors that collectively create favorable conditions for sustained expansion.

Agricultural modernization represents the most significant driver, as German farmers continue investing in advanced machinery to improve operational efficiency and reduce labor costs. The ongoing transition from traditional farming methods to mechanized operations creates consistent demand for modern haying equipment. Labor shortage concerns particularly motivate farmers to adopt automated solutions that can maintain productivity levels with reduced workforce requirements.

Livestock sector growth provides fundamental demand support, as expanding dairy and beef operations require reliable sources of high-quality forage. The German dairy industry’s emphasis on maintaining consistent milk production standards drives investment in equipment capable of producing premium feed materials. Feed quality requirements continue becoming more stringent, necessitating advanced machinery with precise cutting and conditioning capabilities.

Environmental regulations increasingly influence equipment selection, as farmers seek machinery that supports sustainable farming practices. Carbon footprint reduction initiatives encourage adoption of fuel-efficient equipment and precision agriculture technologies that optimize resource utilization. Government incentives for environmentally friendly farming practices provide additional motivation for equipment upgrades.

Technological advancement creates opportunities for improved productivity and operational precision. Smart farming integration enables farmers to optimize harvest timing, monitor crop conditions, and maximize feed quality through data-driven decision making. The availability of advanced features at competitive prices makes technology adoption increasingly attractive to farmers across all operation sizes.

Significant challenges constrain growth potential within the German haying and forage machinery market, requiring strategic responses from manufacturers and stakeholders.

High capital investment requirements represent the primary barrier for many potential customers, particularly smaller farming operations with limited financial resources. Advanced haying machinery often requires substantial upfront investment, creating affordability challenges that may delay purchase decisions or limit market penetration. Financing constraints become particularly acute during periods of agricultural commodity price volatility when farm income uncertainty affects equipment purchasing power.

Market saturation in certain equipment categories limits growth opportunities, as many German farms already possess adequate machinery for basic haying operations. The replacement cycle for durable agricultural equipment typically spans many years, reducing the frequency of new purchases. Equipment longevity means that well-maintained machinery can remain productive for decades, extending replacement intervals and limiting market expansion.

Seasonal demand patterns create operational challenges for manufacturers and dealers, as haying equipment purchases concentrate in specific periods related to farming seasons. This seasonality complicates inventory management, production planning, and cash flow optimization. Weather dependency affects both equipment utilization and replacement timing, as favorable or adverse conditions influence farmers’ financial capacity for new investments.

Regulatory complexity surrounding agricultural equipment standards, emissions requirements, and safety regulations increases compliance costs and development timelines. Certification processes for new technologies can be lengthy and expensive, potentially delaying market introduction of innovative solutions. International trade considerations and tariff policies may also impact equipment pricing and availability.

Emerging opportunities within the German haying and forage machinery market present significant potential for growth and innovation across multiple dimensions.

Precision agriculture expansion offers substantial opportunities for manufacturers developing smart haying equipment with integrated sensors, GPS guidance, and data analytics capabilities. Digital transformation in agriculture creates demand for machinery that can seamlessly integrate with farm management systems, providing real-time operational data and performance optimization recommendations. The growing acceptance of technology-driven farming practices supports premium pricing for advanced equipment features.

Sustainability initiatives create market opportunities for environmentally friendly machinery that reduces fuel consumption, minimizes soil impact, and supports carbon sequestration efforts. Electric and hybrid powertrains represent emerging technology areas with significant growth potential as battery technology improves and charging infrastructure expands. Manufacturers developing low-emission solutions position themselves advantageously for future regulatory requirements.

Service sector expansion presents opportunities for comprehensive maintenance, training, and support services that enhance customer relationships and create recurring revenue streams. Equipment-as-a-Service models may appeal to farmers seeking to reduce capital investment while accessing latest technology. Custom harvesting services using advanced machinery can serve smaller farms unable to justify equipment ownership.

Export market development leverages German engineering reputation to expand into international markets seeking high-quality agricultural equipment. Emerging economies with developing agricultural sectors represent potential growth markets for German manufacturers. Technology transfer and partnership opportunities may facilitate market entry while supporting local agricultural development.

Complex interactions between various market forces shape the competitive landscape and growth trajectory of Germany’s haying and forage machinery sector.

Supply chain dynamics significantly influence market conditions, as manufacturers navigate component availability, raw material costs, and logistics challenges. The integration of global supply networks with local manufacturing capabilities creates both opportunities and vulnerabilities. Component sourcing strategies increasingly emphasize supply security and cost optimization while maintaining quality standards essential for German market acceptance.

Customer behavior evolution reflects changing priorities as farmers balance traditional requirements with modern expectations for technology integration and environmental responsibility. Decision-making processes increasingly involve multiple stakeholders and extended evaluation periods as equipment investments represent significant financial commitments. The growing influence of younger farmers brings different perspectives on technology adoption and sustainability priorities.

Competitive intensity varies across different market segments, with premium equipment categories showing strong differentiation opportunities while commodity segments face price pressure. Innovation cycles accelerate as manufacturers compete to introduce advanced features and improved performance capabilities. Strategic partnerships between equipment manufacturers and technology providers enable rapid development of smart farming solutions.

Regulatory evolution continues shaping market requirements, with environmental standards, safety regulations, and agricultural policies influencing equipment design and market acceptance. Policy support for sustainable farming practices creates favorable conditions for advanced machinery adoption. The alignment of market trends with government priorities supports long-term growth prospects.

Comprehensive research approach employed for analyzing the German haying and forage machinery market incorporates multiple data sources and analytical methodologies to ensure accuracy and reliability of findings.

Primary research activities included extensive interviews with key market participants including equipment manufacturers, dealers, farmers, and industry associations. Survey methodologies captured quantitative data on equipment usage patterns, purchase intentions, and technology preferences across different farm sizes and regional locations. Direct engagement with end-users provided valuable insights into operational challenges and equipment performance requirements.

Secondary research utilized comprehensive analysis of industry publications, government statistics, trade association reports, and company financial disclosures. Market intelligence gathering incorporated monitoring of patent filings, technology developments, and competitive activities to identify emerging trends and innovation directions. Historical data analysis enabled identification of market cycles and growth patterns.

Data validation processes ensured information accuracy through cross-referencing multiple sources and expert verification. Statistical analysis employed appropriate methodologies for market sizing, trend analysis, and forecasting while accounting for seasonal variations and economic cycles. Quality control measures maintained research integrity throughout the analytical process.

MarkWide Research analytical frameworks provided structured approaches for market segmentation, competitive analysis, and opportunity assessment. The research methodology emphasizes actionable insights that support strategic decision-making for market participants across the value chain.

Geographic distribution of the German haying and forage machinery market reveals distinct regional characteristics influenced by agricultural practices, farm structures, and economic conditions.

Bavaria represents the largest regional market, accounting for approximately 28% of national equipment demand, driven by extensive grassland areas and high livestock densities. The region’s traditional dairy farming emphasis creates consistent demand for high-quality forage equipment. Bavarian farmers typically prioritize equipment reliability and precision, supporting premium market segments. The presence of major agricultural machinery manufacturers in the region facilitates close customer relationships and rapid service support.

Lower Saxony constitutes another major market region with 22% market share, characterized by larger farm operations and intensive agricultural production systems. The region’s flat terrain and extensive grasslands favor efficient large-scale haying operations using advanced machinery. Technology adoption rates in Lower Saxony exceed national averages, particularly for GPS-guided equipment and automated systems.

North Rhine-Westphalia demonstrates strong market presence with diverse agricultural operations ranging from dairy farming to mixed crop production. The region’s proximity to major industrial centers supports robust equipment dealer networks and service infrastructure. Environmental consciousness among farmers in this region drives demand for sustainable machinery solutions.

Eastern German states show rapid growth potential as agricultural modernization continues following reunification. Farm consolidation in these regions creates opportunities for large-scale equipment sales as operations achieve economies of scale. Government support programs facilitate equipment upgrades and technology adoption.

Market leadership in Germany’s haying and forage machinery sector features a combination of established domestic manufacturers and international competitors, each leveraging distinct competitive advantages.

Competitive strategies emphasize technology differentiation, service excellence, and comprehensive solution provision. Innovation leadership becomes increasingly important as customers seek advanced features and improved operational efficiency. Strategic partnerships between equipment manufacturers and technology providers enable rapid development of smart farming capabilities.

Market positioning varies significantly across competitors, with some focusing on premium segments while others target cost-conscious customers. Brand loyalty remains strong in the German market, where equipment reliability and service quality significantly influence purchasing decisions.

Market segmentation analysis reveals distinct categories within the German haying and forage machinery market, each characterized by specific customer requirements and competitive dynamics.

By Equipment Type:

By Power Source:

By Farm Size:

By Technology Level:

Detailed analysis of individual equipment categories reveals specific market dynamics and growth opportunities within the German haying and forage machinery sector.

Mowing Equipment Category: This fundamental segment shows steady demand driven by regular replacement cycles and technology upgrades. Disc mower adoption continues expanding due to superior cutting quality and reduced maintenance requirements compared to traditional systems. Conditioning integration becomes increasingly popular as farmers seek to optimize crop drying through combined cutting and conditioning operations. The category benefits from 42% market penetration of GPS-guided systems that ensure precise cutting patterns and field efficiency.

Baling Equipment Category: Round balers dominate the German market due to their versatility and weather resistance advantages. Variable chamber technology enables optimization of bale density and size according to specific crop conditions and storage requirements. Automation features such as automatic twine cutting and bale ejection reduce operator workload while improving consistency. The integration of moisture monitoring systems helps farmers achieve optimal baling conditions and preserve feed quality.

Forage Harvester Category: Self-propelled forage harvesters represent the premium market segment, with 85% of units now featuring advanced crop processing systems and precision chop length control. Kernel processing capabilities become standard expectations for corn silage applications. The category shows strong growth in telematics integration, enabling remote monitoring and predictive maintenance capabilities.

Tedding and Raking Category: These crop conditioning implements show increasing sophistication with hydraulic adjustments and automated ground following systems. Rotor design improvements enhance crop handling while minimizing leaf loss and maintaining forage quality. The category benefits from growing demand for wider working widths that improve field efficiency in larger operations.

Comprehensive value creation within the German haying and forage machinery market generates significant benefits for various stakeholders across the agricultural value chain.

For Farmers:

For Equipment Manufacturers:

For Dealers and Distributors:

For the Agricultural Sector:

Strategic assessment of the German haying and forage machinery market reveals key internal and external factors influencing competitive positioning and growth prospects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the German haying and forage machinery market reflect broader changes in agricultural practices, technology adoption, and environmental consciousness.

Precision Agriculture Integration: The convergence of GPS technology, sensors, and data analytics revolutionizes traditional haying operations. Smart machinery now provides real-time crop monitoring, optimal cutting height adjustment, and yield mapping capabilities. Data-driven decision making enables farmers to optimize harvest timing, minimize crop losses, and maximize feed quality through precise operational control.

Automation Advancement: Increasing levels of automation reduce operator workload while improving operational consistency and efficiency. Autonomous functions such as automatic steering, implement control, and field pattern optimization become standard features in premium equipment segments. Remote monitoring capabilities allow farmers to oversee multiple machines simultaneously and respond quickly to operational issues.

Sustainability Emphasis: Environmental considerations increasingly influence equipment design and customer purchasing decisions. Fuel efficiency improvements of 20-25% compared to previous generation equipment reflect manufacturer focus on reducing operational costs and environmental impact. Soil health protection features such as low ground pressure systems and controlled traffic patterns support sustainable farming practices.

Electrification Emergence: Battery-powered and hybrid equipment represents an emerging trend with significant long-term potential. Electric powertrains offer advantages in noise reduction, emissions elimination, and operational cost reduction, particularly for smaller implements and specialized applications. Charging infrastructure development and battery technology improvements support gradual market adoption.

Service Integration: Comprehensive service offerings become critical differentiators as customers seek complete solutions rather than standalone equipment. Predictive maintenance using IoT sensors and data analytics helps prevent unexpected breakdowns and optimize equipment uptime. Training programs ensure operators maximize equipment potential and maintain safety standards.

Significant developments within the German haying and forage machinery industry demonstrate the dynamic nature of technological advancement and market evolution.

Technology Partnerships: Major equipment manufacturers increasingly collaborate with technology companies to accelerate smart farming solution development. Strategic alliances between traditional machinery producers and software developers enable rapid integration of advanced analytics, machine learning, and IoT capabilities. These partnerships facilitate faster time-to-market for innovative features while leveraging specialized expertise from both sectors.

Product Innovation: Recent product launches showcase significant technological advancement in crop processing, automation, and operational efficiency. Next-generation balers feature improved bale density control, integrated wrapping systems, and enhanced crop flow management. Advanced mowing systems incorporate variable cutting height adjustment, automatic obstacle detection, and optimized power management for different crop conditions.

Manufacturing Investment: German manufacturers continue investing in production facility upgrades and capacity expansion to meet growing demand for advanced equipment. Industry 4.0 implementation in manufacturing processes improves production efficiency and quality control while enabling customization capabilities. Research and development investments focus on breakthrough technologies such as artificial intelligence integration and autonomous operation capabilities.

Market Consolidation: Strategic acquisitions and mergers reshape competitive dynamics as companies seek to strengthen market positions and expand technological capabilities. Vertical integration strategies enable manufacturers to control key component supply chains and accelerate innovation cycles. Geographic expansion through acquisitions provides access to new markets and distribution networks.

Regulatory Adaptation: Industry participants actively engage with regulatory developments affecting equipment design, emissions standards, and safety requirements. Compliance initiatives ensure products meet evolving environmental standards while maintaining performance capabilities. Certification processes for new technologies facilitate market acceptance and customer confidence in innovative solutions.

Strategic recommendations for market participants reflect comprehensive analysis of current conditions, emerging trends, and future opportunities within the German haying and forage machinery sector.

For Equipment Manufacturers: Innovation investment should prioritize precision agriculture integration and automation capabilities that deliver measurable value to customers. MarkWide Research analysis indicates that farmers increasingly value equipment features that provide operational data and optimize performance automatically. Partnership strategies with technology providers can accelerate development timelines while reducing internal R&D costs. Service expansion into comprehensive support offerings creates recurring revenue opportunities and strengthens customer relationships.

For Dealers and Distributors: Technical expertise development becomes critical as equipment complexity increases and customers require sophisticated support services. Training programs for service technicians should emphasize electronic systems, software troubleshooting, and precision agriculture technologies. Inventory management strategies must balance seasonal demand patterns with customer service requirements while optimizing working capital utilization.

For Farmers and End Users: Technology adoption should focus on solutions that provide clear return on investment through improved efficiency, reduced costs, or enhanced crop quality. Equipment selection processes should consider total cost of ownership including maintenance, fuel consumption, and resale value rather than initial purchase price alone. Operator training investments ensure maximum benefit realization from advanced equipment features and capabilities.

For Industry Stakeholders: Collaboration initiatives between manufacturers, dealers, farmers, and technology providers can accelerate innovation adoption and market development. Sustainability focus aligns with regulatory trends and customer preferences while creating competitive advantages. Export market development leverages German engineering reputation to expand growth opportunities beyond domestic markets.

Long-term prospects for the German haying and forage machinery market appear highly favorable, supported by fundamental agricultural trends, technological advancement, and evolving customer requirements.

Market growth is expected to continue at a steady 5-7% annual rate over the next decade, driven by ongoing farm modernization and equipment replacement cycles. Technology integration will accelerate as precision agriculture becomes mainstream, with 90% of new equipment expected to feature some form of smart farming capability by 2030. Automation advancement will progress toward semi-autonomous and fully autonomous operation capabilities, particularly in larger farming operations.

Sustainability requirements will increasingly influence market development, with environmental regulations driving demand for low-emission, fuel-efficient equipment. Electric powertrains may achieve 15-20% market share in smaller implement categories within the next decade as battery technology improves and charging infrastructure expands. Carbon footprint reduction initiatives will create opportunities for equipment that supports climate-smart agriculture practices.

Market consolidation may continue as manufacturers seek scale advantages and technological capabilities through strategic acquisitions. Service integration will become increasingly important as customers seek comprehensive solutions rather than standalone equipment purchases. Digital transformation will enable new business models such as equipment-as-a-service and performance-based contracts.

International expansion opportunities will grow as German manufacturers leverage their technological leadership and quality reputation in emerging markets. Export growth may offset potential domestic market maturation while supporting continued innovation investment. MWR projections suggest that German haying equipment exports could increase by 35-40% over the next five years as global agricultural modernization accelerates.

The Germany haying and forage machinery market represents a dynamic and evolving sector characterized by strong fundamentals, technological innovation, and promising growth prospects. Market analysis reveals a mature but continuously advancing industry that successfully balances traditional agricultural requirements with modern technological capabilities and environmental consciousness.

Key success factors include the industry’s commitment to engineering excellence, comprehensive customer support, and continuous innovation in response to changing agricultural needs. The integration of precision agriculture technologies, automation capabilities, and sustainability features positions German manufacturers advantageously for future market development. Competitive dynamics favor companies that can effectively combine technological leadership with practical solutions that deliver measurable value to farming operations.

Future opportunities appear substantial, driven by ongoing agricultural modernization, environmental regulations, and the global reputation of German engineering quality. The market’s ability to adapt to changing customer requirements while maintaining its core strengths in reliability and performance suggests continued growth potential. Strategic positioning for long-term success requires balanced investment in innovation, service capabilities, and market development initiatives that support sustainable competitive advantages in an increasingly sophisticated agricultural equipment landscape.

What is Haying & Forage Machinery?

Haying & Forage Machinery refers to the equipment used in the agricultural sector for the harvesting, processing, and storage of hay and forage crops. This includes machinery such as mowers, rakes, tedders, and balers that facilitate efficient crop management.

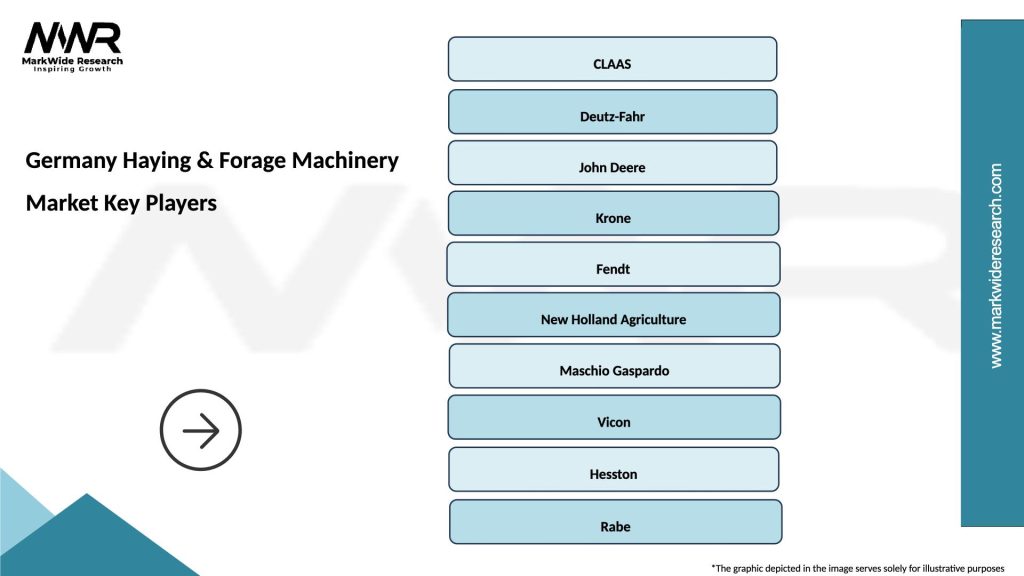

What are the key players in the Germany Haying & Forage Machinery Market?

Key players in the Germany Haying & Forage Machinery Market include companies like CLAAS, Krone, and John Deere, which are known for their innovative agricultural solutions and extensive product lines in haying and forage equipment, among others.

What are the growth factors driving the Germany Haying & Forage Machinery Market?

The growth of the Germany Haying & Forage Machinery Market is driven by increasing demand for efficient farming practices, advancements in agricultural technology, and the rising need for high-quality forage for livestock. Additionally, the trend towards sustainable farming is encouraging the adoption of modern machinery.

What challenges does the Germany Haying & Forage Machinery Market face?

The Germany Haying & Forage Machinery Market faces challenges such as high initial investment costs for advanced machinery and the need for skilled operators. Additionally, fluctuating weather conditions can impact the efficiency of hay production and forage management.

What opportunities exist in the Germany Haying & Forage Machinery Market?

Opportunities in the Germany Haying & Forage Machinery Market include the development of smart farming technologies and automation solutions that enhance productivity. There is also potential for growth in the organic farming sector, which requires specialized forage equipment.

What trends are shaping the Germany Haying & Forage Machinery Market?

Trends shaping the Germany Haying & Forage Machinery Market include the increasing integration of precision agriculture technologies, the use of data analytics for crop management, and a growing focus on sustainability and environmental impact in farming practices.

Germany Haying & Forage Machinery Market

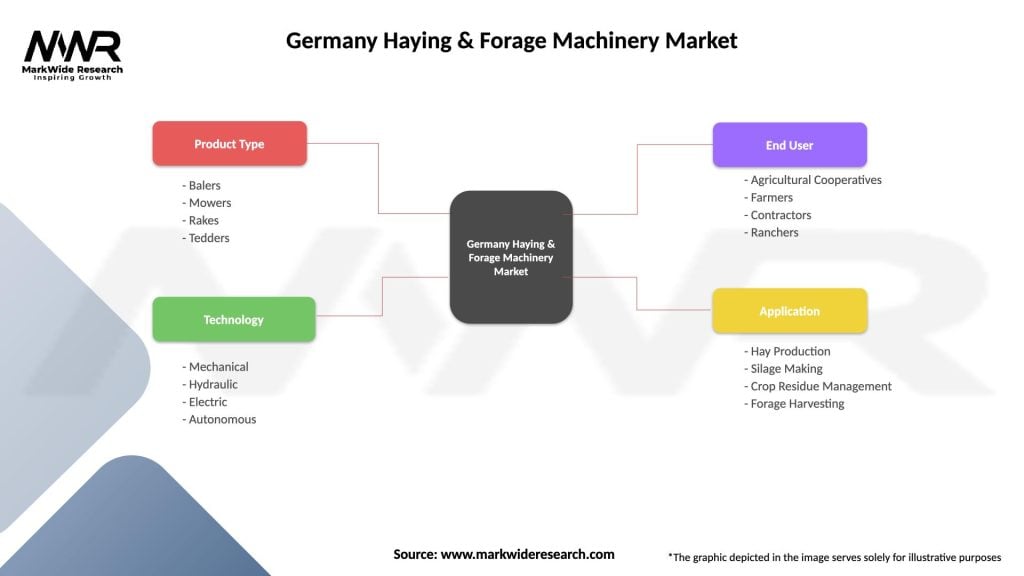

| Segmentation Details | Description |

|---|---|

| Product Type | Balers, Mowers, Rakes, Tedders |

| Technology | Mechanical, Hydraulic, Electric, Autonomous |

| End User | Agricultural Cooperatives, Farmers, Contractors, Ranchers |

| Application | Hay Production, Silage Making, Crop Residue Management, Forage Harvesting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Haying & Forage Machinery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at