444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands POS-terminals market represents a dynamic and rapidly evolving sector within the European payment technology landscape. Point-of-sale terminals have become indispensable infrastructure components for businesses across the Netherlands, facilitating seamless payment processing and enhancing customer experience. The market demonstrates remarkable resilience and adaptability, driven by the country’s progressive digital payment adoption and robust retail ecosystem.

Market dynamics in the Netherlands reflect a sophisticated payment environment where traditional cash transactions continue to decline while digital payment methods gain unprecedented traction. The market exhibits a compound annual growth rate of 8.2%, positioning it among the fastest-growing POS terminal markets in Western Europe. This growth trajectory is supported by the Netherlands’ advanced technological infrastructure and consumer preference for contactless payment solutions.

Retail transformation across various sectors has accelerated POS terminal deployment, with businesses recognizing the critical importance of modern payment acceptance capabilities. The market encompasses diverse terminal types, from traditional countertop devices to innovative mobile solutions, each serving specific merchant requirements and customer preferences. Contactless payment adoption has reached 78% penetration among Dutch consumers, driving demand for NFC-enabled terminal solutions.

Technological advancement continues to reshape the Netherlands POS terminals landscape, with emerging technologies such as biometric authentication, artificial intelligence integration, and enhanced security protocols becoming standard features. The market benefits from strong regulatory support and a business-friendly environment that encourages innovation and technological adoption across all commercial sectors.

The Netherlands POS-terminals market refers to the comprehensive ecosystem of point-of-sale payment processing devices, software solutions, and associated services operating within the Dutch commercial landscape. These terminals enable merchants to accept various payment methods including credit cards, debit cards, mobile payments, and emerging digital currencies.

POS terminals in the Netherlands context encompass a broad spectrum of payment acceptance devices, ranging from traditional fixed terminals to advanced mobile payment solutions. These systems integrate seamlessly with merchant management software, inventory systems, and financial reporting platforms, creating comprehensive business solutions that extend beyond simple payment processing capabilities.

Market definition includes hardware manufacturers, software developers, payment processors, financial institutions, and service providers that collectively deliver POS terminal solutions to Dutch businesses. The ecosystem supports various merchant categories, from small independent retailers to large multinational corporations, each requiring tailored payment acceptance solutions.

Technological integration within the Netherlands POS terminals market emphasizes interoperability, security, and user experience optimization. Modern terminals incorporate advanced features such as multi-payment method acceptance, real-time transaction processing, cloud-based management systems, and comprehensive analytics capabilities that provide merchants with valuable business insights.

Strategic market positioning of the Netherlands POS-terminals sector reflects the country’s leadership in digital payment innovation and adoption. The market demonstrates exceptional growth momentum, driven by accelerating digitalization trends, changing consumer payment preferences, and supportive regulatory frameworks that encourage technological advancement and financial inclusion.

Key market drivers include the Netherlands’ high smartphone penetration rate of 91%, widespread internet connectivity, and progressive consumer attitudes toward digital payment methods. The market benefits from strong government support for cashless society initiatives and robust banking infrastructure that facilitates seamless payment processing across all commercial sectors.

Competitive landscape features both established international players and innovative local companies, creating a dynamic environment that fosters technological advancement and service quality improvements. Market participants compete on factors including terminal functionality, pricing models, customer support quality, and integration capabilities with existing merchant systems.

Growth projections indicate sustained market expansion, with particular strength in mobile POS solutions, contactless payment terminals, and integrated business management platforms. The market’s evolution toward comprehensive merchant solutions positions POS terminals as central components of broader digital commerce ecosystems rather than standalone payment processing devices.

Market intelligence reveals several critical insights that define the Netherlands POS-terminals landscape and its future trajectory:

Market maturation indicators suggest the Netherlands POS terminals sector is transitioning from basic payment acceptance toward comprehensive business solution platforms. This evolution creates opportunities for value-added services, advanced analytics, and integrated merchant management capabilities that extend beyond traditional payment processing functions.

Primary growth drivers propelling the Netherlands POS-terminals market encompass technological, economic, and social factors that collectively create favorable conditions for sustained market expansion and innovation.

Digital transformation initiatives across Dutch businesses have accelerated POS terminal adoption as companies recognize the strategic importance of modern payment acceptance capabilities. The Netherlands’ position as a European digital leader creates strong demand for cutting-edge payment technologies that enhance customer experience and operational efficiency.

Consumer behavior evolution represents a fundamental market driver, with Dutch consumers increasingly preferring digital payment methods over traditional cash transactions. This shift has been accelerated by generational changes, urbanization trends, and the convenience factors associated with contactless and mobile payment solutions.

Regulatory support from Dutch financial authorities and European Union directives creates a favorable environment for POS terminal innovation and deployment. Payment Services Directive 2 (PSD2) and other regulatory frameworks encourage competition, innovation, and consumer protection while maintaining high security standards.

Economic factors including the Netherlands’ strong GDP growth, low unemployment rates, and robust consumer spending power create favorable conditions for retail sector expansion and consequent POS terminal demand. The country’s strategic position as a European logistics and commercial hub further drives terminal deployment across various business sectors.

Technological advancement in areas such as 5G connectivity, artificial intelligence, and blockchain technology creates opportunities for next-generation POS solutions that offer enhanced functionality, improved security, and superior user experiences for both merchants and consumers.

Market challenges facing the Netherlands POS-terminals sector include various factors that may limit growth potential or create operational difficulties for market participants and end users.

Implementation costs remain a significant barrier for smaller businesses, particularly those operating with limited capital resources. While terminal costs have decreased over time, the total cost of ownership including software licensing, maintenance, and transaction processing fees can strain budgets of micro-enterprises and startups.

Technical complexity associated with modern POS systems may overwhelm businesses lacking technical expertise or dedicated IT support. Integration challenges with existing business systems, staff training requirements, and ongoing maintenance needs can create adoption barriers for traditional merchants.

Security concerns related to payment data protection and cybersecurity threats create hesitation among some businesses, particularly those that have experienced or are aware of payment system breaches. Compliance with stringent security standards requires ongoing investment and expertise that may challenge smaller operators.

Market saturation in certain segments, particularly among established retailers and hospitality businesses, limits opportunities for dramatic growth in traditional POS terminal categories. This saturation drives intense price competition and margin pressure among terminal providers.

Regulatory compliance requirements, while generally supportive of market growth, create ongoing costs and complexity for terminal providers and merchants. Keeping pace with evolving security standards, data protection regulations, and payment industry requirements demands continuous investment and attention.

Emerging opportunities within the Netherlands POS-terminals market present significant potential for growth, innovation, and market expansion across various sectors and customer segments.

Mobile POS solutions represent a rapidly expanding opportunity as businesses seek flexible, cost-effective payment acceptance options. Food trucks, pop-up retailers, service providers, and event-based businesses increasingly require portable payment solutions that maintain full functionality while offering mobility and convenience.

Integrated business platforms that combine POS terminals with inventory management, customer relationship management, and business analytics create substantial value propositions for merchants seeking comprehensive solutions. This integration opportunity allows terminal providers to expand their service offerings and increase customer lifetime value.

Vertical market specialization offers opportunities for customized POS solutions tailored to specific industries such as healthcare, hospitality, retail, and professional services. Each sector has unique requirements that specialized terminal solutions can address more effectively than generic offerings.

Sustainability initiatives create opportunities for eco-friendly terminal solutions that appeal to environmentally conscious businesses and consumers. Energy-efficient devices, recyclable materials, and carbon-neutral operations can differentiate providers in an increasingly competitive market.

Emerging payment methods including cryptocurrency acceptance, buy-now-pay-later integration, and loyalty program connectivity create opportunities for next-generation terminals that support diverse payment ecosystems and enhance customer engagement capabilities.

Market dynamics within the Netherlands POS-terminals sector reflect complex interactions between technological advancement, competitive pressures, regulatory requirements, and evolving customer expectations that collectively shape market evolution and strategic positioning.

Competitive intensity continues to increase as traditional payment processors face competition from fintech startups, technology companies, and integrated solution providers. This competition drives innovation, improves service quality, and creates downward pressure on pricing while expanding feature sets and functionality options.

Technology convergence between POS terminals, mobile devices, and cloud-based services creates new market dynamics that blur traditional product boundaries. Terminal providers must adapt to ecosystem-based competition where success depends on platform integration capabilities rather than standalone device features.

Customer expectations for seamless, fast, and secure payment experiences drive continuous innovation in terminal design, functionality, and user interface development. Merchants demand solutions that enhance rather than complicate their operations while providing superior customer experiences.

Partnership strategies between terminal manufacturers, software developers, payment processors, and financial institutions create complex value chains that influence market dynamics. Strategic alliances and ecosystem partnerships increasingly determine competitive positioning and market access capabilities.

Regulatory evolution continues to influence market dynamics through new security requirements, data protection standards, and payment industry regulations. Market participants must balance compliance costs with innovation investments while maintaining competitive positioning in a rapidly evolving regulatory environment.

Research approach for analyzing the Netherlands POS-terminals market employed comprehensive methodologies combining primary research, secondary data analysis, and industry expert consultations to ensure accuracy, reliability, and depth of market insights.

Primary research included structured interviews with key market participants including terminal manufacturers, payment processors, merchant service providers, and end-user businesses across various sectors. These interviews provided firsthand insights into market trends, challenges, opportunities, and competitive dynamics from multiple stakeholder perspectives.

Secondary research encompassed analysis of industry reports, financial statements, regulatory documents, trade publications, and academic research to establish comprehensive market context and validate primary research findings. MarkWide Research databases provided historical market data and trend analysis that informed current market assessments.

Data validation processes included cross-referencing multiple sources, statistical analysis of quantitative data, and expert review of research findings to ensure accuracy and reliability. Market sizing methodologies employed both top-down and bottom-up approaches to validate market estimates and projections.

Analytical frameworks included SWOT analysis, Porter’s Five Forces assessment, and competitive landscape mapping to provide comprehensive market understanding. These frameworks enabled systematic evaluation of market dynamics, competitive positioning, and strategic implications for market participants.

Geographic distribution of the Netherlands POS-terminals market reveals distinct regional patterns influenced by population density, economic activity concentration, and business sector characteristics across different areas of the country.

Randstad region including Amsterdam, Rotterdam, The Hague, and Utrecht represents the largest market concentration, accounting for approximately 52% of total POS terminal installations. This dominance reflects the region’s high population density, concentrated business activity, and advanced digital infrastructure that supports sophisticated payment solutions.

Amsterdam metropolitan area leads in adoption of advanced POS technologies, particularly mobile and integrated solutions that serve the city’s dynamic retail, hospitality, and tourism sectors. The concentration of international businesses and tech-savvy consumers drives demand for cutting-edge payment acceptance capabilities.

Southern Netherlands including North Brabant and Limburg provinces shows strong growth in POS terminal adoption, driven by manufacturing sector expansion and cross-border commerce with Belgium and Germany. This region accounts for approximately 23% of market share and demonstrates particular strength in industrial and logistics applications.

Northern provinces including Groningen, Friesland, and Drenthe represent emerging markets with significant growth potential, particularly in agricultural technology integration and rural commerce applications. While currently representing 15% of market share, these regions show above-average growth rates in mobile POS adoption.

Eastern Netherlands benefits from proximity to German markets and strong manufacturing presence, creating demand for specialized POS solutions that support cross-border commerce and industrial applications. The region’s strategic logistics position drives continued market expansion and technology adoption.

Market competition within the Netherlands POS-terminals sector features a diverse mix of international technology leaders, established payment processors, and innovative local companies that collectively create a dynamic and competitive environment.

Leading market participants include:

Competitive strategies emphasize differentiation through technology innovation, service quality, pricing models, and vertical market specialization. Market leaders invest heavily in research and development, strategic partnerships, and customer support capabilities to maintain competitive advantages.

Market consolidation trends include acquisitions, strategic partnerships, and technology licensing agreements that reshape competitive dynamics and create integrated solution offerings. These developments influence pricing, innovation rates, and market access for various participant categories.

Market segmentation of the Netherlands POS-terminals sector reveals distinct categories based on technology type, deployment model, business size, and industry vertical, each with unique characteristics and growth patterns.

By Technology Type:

By Deployment Model:

By Business Size:

Retail sector represents the largest category for POS terminal deployment in the Netherlands, encompassing fashion retailers, grocery stores, electronics shops, and specialty retailers. This segment demands terminals with inventory integration, customer loyalty program support, and omnichannel capabilities that bridge online and offline commerce experiences.

Hospitality industry including restaurants, cafes, hotels, and entertainment venues requires specialized POS solutions with table management, order processing, and tip handling capabilities. The sector shows strong preference for mobile terminals that enable tableside payment processing and improve customer service efficiency.

Healthcare sector presents emerging opportunities for specialized POS terminals that handle insurance payments, co-pays, and healthcare-specific transaction types. Privacy and security requirements in this sector drive demand for terminals with enhanced data protection capabilities and regulatory compliance features.

Transportation and logistics sector utilizes POS terminals for fuel payments, parking fees, toll collection, and delivery services. This category requires ruggedized terminals capable of operating in challenging environments while maintaining reliable connectivity and transaction processing capabilities.

Professional services including legal, accounting, consulting, and personal services increasingly adopt POS terminals to streamline payment collection and improve client experience. This segment values terminals with appointment scheduling integration and professional appearance suitable for office environments.

Government and public sector applications include municipal services, licensing fees, and public facility payments. This category requires terminals with high security standards, audit capabilities, and integration with government payment systems and reporting requirements.

Merchant benefits from modern POS terminal adoption include enhanced payment acceptance capabilities, improved customer experience, and access to valuable business analytics that support informed decision-making and operational optimization.

Operational efficiency improvements include faster transaction processing, reduced cash handling requirements, automated reconciliation processes, and integrated inventory management that streamlines business operations and reduces administrative overhead.

Customer experience enhancement through contactless payments, mobile wallet acceptance, and faster checkout processes creates competitive advantages and improves customer satisfaction levels. Modern terminals support diverse payment preferences and reduce transaction friction.

Financial management benefits include real-time transaction reporting, automated bookkeeping integration, cash flow optimization, and detailed sales analytics that provide insights into business performance and customer behavior patterns.

Security advantages of modern POS terminals include EMV chip card support, tokenization technology, end-to-end encryption, and PCI DSS compliance that protect both merchants and customers from payment fraud and data breaches.

Scalability benefits enable businesses to expand payment acceptance capabilities as they grow, adding new locations, payment methods, and integration features without requiring complete system replacements or major infrastructure investments.

Technology providers benefit from recurring revenue models, expanded service opportunities, and platform-based business models that create sustainable competitive advantages and long-term customer relationships in the evolving payments ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless payment dominance continues to reshape the Netherlands POS terminals landscape, with tap-to-pay functionality becoming standard across all terminal categories. This trend accelerated significantly during the COVID-19 pandemic and shows no signs of reversing as consumers prioritize convenience and hygiene in payment interactions.

Mobile POS adoption expands rapidly among small businesses, service providers, and temporary retail operations that require flexible payment acceptance capabilities. These solutions offer cost advantages and deployment flexibility that traditional fixed terminals cannot match, driving market share gains across multiple sectors.

Integration platform evolution transforms POS terminals from standalone payment devices into comprehensive business management platforms. Modern terminals increasingly incorporate inventory management, customer relationship management, and business analytics capabilities that provide holistic merchant solutions.

Artificial intelligence integration enables predictive analytics, fraud detection, and personalized customer experiences through POS terminals. AI-powered features help merchants optimize operations, reduce risks, and enhance customer engagement while processing payments more efficiently.

Sustainability initiatives gain traction as businesses and consumers prioritize environmental responsibility. Terminal manufacturers respond with energy-efficient devices, recyclable materials, and carbon-neutral operations that appeal to environmentally conscious market segments.

Biometric authentication emerges as a security enhancement for high-value transactions and sensitive applications. Fingerprint readers, facial recognition, and other biometric technologies provide additional security layers while maintaining transaction speed and user convenience.

Cryptocurrency support begins appearing in advanced POS terminals as digital currencies gain mainstream acceptance. Early adopters in hospitality and retail sectors experiment with Bitcoin and other cryptocurrency acceptance to attract tech-savvy customers and differentiate their offerings.

Strategic partnerships between traditional payment processors and fintech companies create integrated solutions that combine established infrastructure with innovative technologies. These collaborations accelerate market evolution and expand service capabilities for merchants across all business sizes.

Regulatory compliance initiatives including PSD2 implementation and enhanced security standards drive terminal upgrades and feature enhancements across the Netherlands market. Compliance requirements create both challenges and opportunities for market participants seeking competitive differentiation.

Technology acquisitions by major payment companies consolidate market capabilities and create comprehensive solution portfolios. Recent acquisitions focus on mobile payment technologies, software platforms, and specialized vertical market solutions that enhance competitive positioning.

5G network deployment enables new POS terminal capabilities including real-time analytics, enhanced security features, and improved connectivity for mobile and remote payment applications. This infrastructure advancement supports next-generation terminal features and applications.

Open banking integration creates opportunities for POS terminals to access expanded financial services and provide enhanced merchant capabilities. Account-to-account payments, instant settlements, and integrated lending services become possible through open banking APIs and terminal integration.

Sustainability certifications and eco-friendly product launches respond to growing environmental consciousness among businesses and consumers. Terminal manufacturers invest in sustainable materials, energy efficiency, and circular economy principles to meet market demands for responsible technology solutions.

Market positioning strategies should emphasize value-added services and integrated solutions rather than competing solely on terminal hardware features or pricing. MarkWide Research analysis indicates that successful market participants focus on comprehensive merchant solutions that address broader business needs beyond payment acceptance.

Investment priorities should target mobile POS solutions, vertical market specialization, and sustainability initiatives that align with evolving market demands and customer preferences. Companies that anticipate and respond to these trends will achieve stronger competitive positions and growth opportunities.

Partnership development with software providers, system integrators, and industry specialists can accelerate market penetration and enhance solution capabilities. Strategic alliances enable market participants to offer comprehensive solutions while focusing on core competencies and competitive advantages.

Technology roadmap planning should incorporate emerging technologies such as artificial intelligence, blockchain, and biometric authentication while maintaining focus on security, reliability, and user experience. Balanced innovation approaches prevent over-engineering while ensuring competitive relevance.

Customer education initiatives can accelerate adoption of advanced POS features and justify premium pricing for sophisticated solutions. Educational programs help merchants understand value propositions and optimize their payment acceptance strategies for improved business outcomes.

Regulatory monitoring and proactive compliance strategies protect market position while identifying opportunities created by regulatory changes. Companies that anticipate and prepare for regulatory evolution maintain competitive advantages and avoid costly reactive compliance measures.

Market evolution toward integrated business platforms will continue reshaping the Netherlands POS terminals landscape, with successful solutions providing comprehensive merchant services that extend far beyond basic payment acceptance capabilities. This transformation creates opportunities for higher-value solutions and recurring revenue models.

Technology convergence between POS terminals, mobile devices, and cloud services will accelerate, creating seamless payment ecosystems that support omnichannel commerce and enhanced customer experiences. The boundaries between different payment acceptance methods will continue to blur as integration improves.

Growth projections indicate sustained market expansion with particular strength in mobile solutions, integrated platforms, and specialized vertical applications. MWR projections suggest the market will maintain robust growth rates while evolving toward more sophisticated and comprehensive merchant solutions.

Emerging payment methods including cryptocurrency, central bank digital currencies, and innovative fintech solutions will require terminal adaptability and upgrade capabilities. Market participants must balance current needs with future payment method support to maintain competitive relevance.

Sustainability requirements will become increasingly important as environmental consciousness grows among businesses and consumers. Terminal providers that prioritize eco-friendly solutions and circular economy principles will gain competitive advantages in environmentally aware market segments.

International expansion opportunities may emerge as successful Netherlands market strategies prove applicable to other European markets with similar digital payment adoption patterns and regulatory environments. Cross-border expansion can leverage proven solutions and market expertise.

The Netherlands POS-terminals market represents a dynamic and rapidly evolving sector that continues to demonstrate strong growth potential and innovation opportunities. Market success increasingly depends on providing comprehensive merchant solutions rather than standalone payment devices, reflecting the broader digital transformation occurring across Dutch businesses.

Strategic positioning for market participants requires balancing current market demands with future technology trends, regulatory requirements, and evolving customer expectations. Companies that successfully navigate this balance while maintaining focus on security, reliability, and user experience will achieve sustainable competitive advantages.

Market opportunities remain substantial across mobile POS solutions, vertical market specialization, and integrated business platforms that address comprehensive merchant needs. The Netherlands’ advanced digital infrastructure and progressive payment adoption create favorable conditions for continued innovation and market expansion.

Future success in the Netherlands POS-terminals market will require adaptability, strategic partnerships, and continuous innovation that anticipates rather than reacts to market changes. Market participants that embrace these principles while maintaining operational excellence will thrive in this competitive and dynamic environment.

What is POS-Terminals?

POS-Terminals, or Point of Sale terminals, are electronic devices used to process card payments at retail locations. They facilitate transactions by reading credit and debit cards, enabling businesses to manage sales and inventory efficiently.

What are the key players in the Netherlands POS-Terminals Market?

Key players in the Netherlands POS-Terminals Market include Ingenico, Verifone, and Adyen, which provide a range of payment solutions and technologies for various retail environments, among others.

What are the growth factors driving the Netherlands POS-Terminals Market?

The growth of the Netherlands POS-Terminals Market is driven by the increasing adoption of cashless payments, advancements in payment technology, and the rising demand for integrated payment solutions in retail and hospitality sectors.

What challenges does the Netherlands POS-Terminals Market face?

The Netherlands POS-Terminals Market faces challenges such as cybersecurity threats, the need for compliance with evolving regulations, and the high costs associated with upgrading legacy systems.

What opportunities exist in the Netherlands POS-Terminals Market?

Opportunities in the Netherlands POS-Terminals Market include the expansion of mobile payment solutions, the integration of artificial intelligence for enhanced customer experiences, and the growth of e-commerce requiring advanced payment systems.

What trends are shaping the Netherlands POS-Terminals Market?

Trends shaping the Netherlands POS-Terminals Market include the shift towards contactless payments, the rise of omnichannel retailing, and the increasing use of cloud-based POS systems for better data management and analytics.

Netherlands POS-Terminals Market

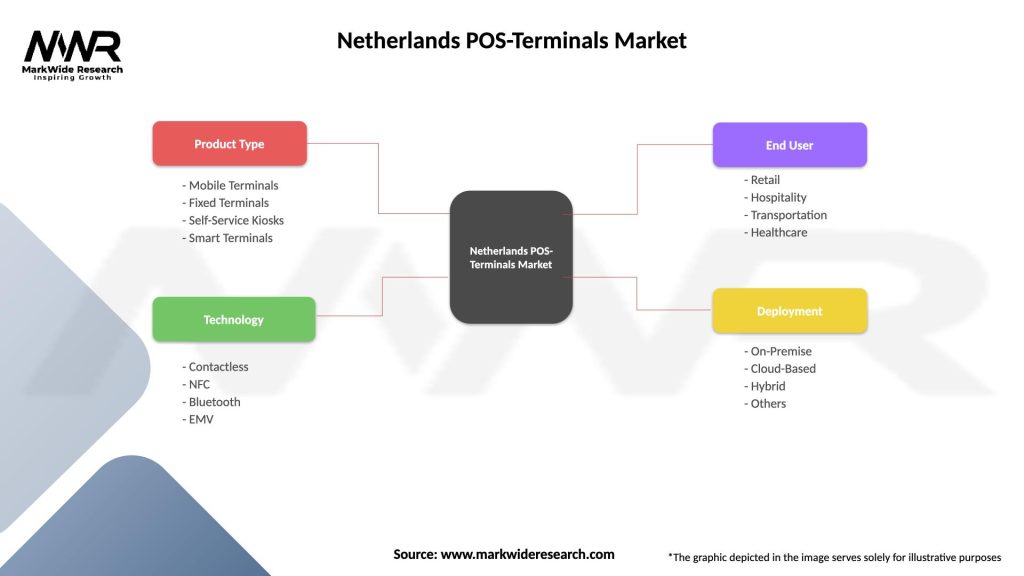

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Terminals, Fixed Terminals, Self-Service Kiosks, Smart Terminals |

| Technology | Contactless, NFC, Bluetooth, EMV |

| End User | Retail, Hospitality, Transportation, Healthcare |

| Deployment | On-Premise, Cloud-Based, Hybrid, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands POS-Terminals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at