444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada gift card incentive market represents a dynamic and rapidly evolving segment within the broader rewards and recognition industry. This market encompasses digital and physical gift cards used by businesses to incentivize employees, reward customers, and drive engagement across various sectors. Canadian organizations are increasingly adopting gift card incentive programs as cost-effective alternatives to traditional cash bonuses and merchandise rewards.

Market dynamics indicate substantial growth driven by the shift toward digital transformation and the increasing preference for flexible reward options. The market benefits from Canada’s robust retail ecosystem, strong consumer spending patterns, and the growing adoption of employee recognition programs across industries. Corporate buyers particularly value gift cards for their administrative simplicity and recipient appeal.

Growth trends show the market expanding at a compound annual growth rate of 8.2%, with digital gift cards representing approximately 67% of total adoption. The integration of mobile technology and e-commerce platforms has significantly enhanced the accessibility and appeal of gift card incentive programs. Regional distribution shows Ontario and Quebec accounting for nearly 58% of market activity, reflecting their concentrated business populations and advanced digital infrastructure.

The Canada gift card incentive market refers to the comprehensive ecosystem of prepaid cards, digital vouchers, and electronic credits used by organizations to motivate, reward, and recognize individuals within business contexts. These incentive tools serve as monetary substitutes that can be redeemed at specific retailers, restaurant chains, or across broad merchant networks.

Gift card incentives function as versatile reward mechanisms that provide recipients with purchasing power while offering businesses predictable costs and simplified administration. Unlike traditional incentive programs, gift cards eliminate inventory management challenges and reduce the complexity associated with merchandise-based rewards. Digital transformation has expanded the definition to include mobile wallet integration, instant delivery capabilities, and sophisticated tracking systems.

Market participants include corporate purchasers, incentive program administrators, gift card issuers, retail partners, and technology platform providers. The ecosystem supports various use cases including employee recognition, customer loyalty programs, sales incentives, safety rewards, and promotional campaigns across industries ranging from healthcare and finance to manufacturing and retail.

Canada’s gift card incentive market demonstrates robust expansion fueled by evolving workplace dynamics and the increasing emphasis on employee engagement strategies. Organizations across sectors are recognizing the effectiveness of gift card programs in driving desired behaviors while maintaining cost control and administrative efficiency.

Key market drivers include the growing remote workforce, which has increased demand for digital reward delivery methods, and the rising focus on employee retention strategies. Approximately 73% of Canadian businesses now incorporate some form of gift card incentive into their recognition programs, representing significant growth from previous years. Digital adoption continues accelerating, with mobile-first solutions gaining particular traction among younger demographics.

Competitive landscape features established players expanding their technological capabilities alongside emerging fintech companies introducing innovative delivery mechanisms. The market benefits from strong partnerships between incentive providers and major Canadian retailers, creating comprehensive redemption networks that enhance program appeal. Regulatory compliance remains straightforward, with provincial consumer protection laws providing clear frameworks for gift card operations.

Future prospects indicate continued growth driven by artificial intelligence integration, personalized reward experiences, and expanded integration with human resources information systems. The market is positioned to benefit from ongoing digital transformation initiatives and the increasing sophistication of employee experience strategies across Canadian organizations.

Strategic analysis reveals several critical insights shaping the Canada gift card incentive market landscape. These insights provide essential understanding for stakeholders evaluating market opportunities and competitive positioning.

Primary growth drivers propelling the Canada gift card incentive market reflect fundamental shifts in workplace culture, consumer preferences, and technological capabilities. These drivers create sustained momentum for market expansion across multiple industry sectors.

Employee engagement initiatives represent the most significant driver, as Canadian organizations increasingly recognize the correlation between recognition programs and workforce retention. The competitive talent market has intensified focus on non-monetary benefits, with gift card incentives providing cost-effective solutions for regular recognition activities. Remote work adoption has further accelerated demand for digital reward delivery mechanisms that transcend geographical boundaries.

Digital transformation serves as another crucial driver, enabling sophisticated program administration and recipient experiences. Modern platforms offer instant delivery, mobile optimization, and comprehensive analytics that traditional incentive methods cannot match. Integration capabilities with existing business systems reduce administrative burden while enhancing program effectiveness.

Consumer preference evolution toward flexible reward options drives market growth, with recipients valuing choice over predetermined merchandise. Gift cards eliminate the risk of unwanted items while providing immediate gratification and personal selection freedom. Retail partnership expansion has created extensive redemption networks that enhance program appeal and utility for diverse recipient populations.

Market constraints present challenges that organizations must navigate when implementing gift card incentive programs. Understanding these limitations enables better program design and realistic expectation setting for stakeholders.

Regulatory complexity varies across provinces, creating compliance challenges for organizations operating in multiple jurisdictions. While generally straightforward, gift card regulations include expiration date restrictions, fee limitations, and disclosure requirements that require careful attention. Tax implications for both issuers and recipients can complicate program administration and require specialized expertise.

Technology integration challenges may arise when connecting gift card platforms with existing enterprise systems. Legacy infrastructure limitations can restrict functionality and require additional investment in system upgrades. Security concerns regarding digital gift card fraud and unauthorized access require robust protective measures that may increase implementation costs.

Recipient preference variations can limit program effectiveness, as some individuals prefer cash or other reward types. Cultural considerations within diverse Canadian workplaces may influence gift card acceptance and utilization rates. Additionally, economic uncertainty can impact organizational spending on discretionary programs like employee incentives, potentially constraining market growth during challenging periods.

Emerging opportunities within the Canada gift card incentive market present significant potential for growth and innovation. These opportunities align with evolving business needs and technological advancement trends.

Artificial intelligence integration offers opportunities for personalized reward recommendations based on recipient preferences and behavior patterns. Machine learning algorithms can optimize program timing, reward values, and merchant selections to maximize engagement and satisfaction. Predictive analytics capabilities enable proactive program adjustments that enhance effectiveness.

Sustainability initiatives create opportunities for environmentally conscious gift card solutions, including digital-only programs and partnerships with eco-friendly retailers. Corporate social responsibility alignment through charitable giving options and community-focused merchant partnerships appeals to socially conscious organizations and recipients.

Small business market penetration represents substantial untapped potential, as many smaller Canadian companies have yet to implement formal incentive programs. Simplified solutions designed for resource-constrained organizations can expand market reach significantly. Additionally, international expansion opportunities exist for Canadian companies seeking to extend gift card programs to global operations.

Blockchain technology presents opportunities for enhanced security, transparency, and fraud prevention in digital gift card systems. Cryptocurrency integration may appeal to tech-forward organizations and younger recipient demographics seeking innovative reward experiences.

Market dynamics within the Canada gift card incentive sector reflect the interplay between technological innovation, changing workplace expectations, and evolving consumer behaviors. These dynamics create both challenges and opportunities for market participants.

Supply chain evolution has streamlined gift card distribution through digital channels, reducing fulfillment costs and delivery timeframes. Traditional physical card distribution networks continue serving specific market segments while digital alternatives capture increasing market share. Inventory management has simplified significantly with digital solutions eliminating physical storage and shipping requirements.

Competitive intensity drives continuous innovation in platform capabilities, user experience design, and integration functionality. Market consolidation trends see larger players acquiring specialized providers to expand service offerings and market reach. Price competition remains moderate due to the value-added nature of comprehensive gift card platforms.

Customer expectations continue evolving toward more sophisticated features including real-time balance checking, mobile wallet integration, and social sharing capabilities. Instant gratification demands drive preference for immediate digital delivery over traditional mail-based distribution methods. According to MarkWide Research analysis, recipient satisfaction rates increase by approximately 34% when programs offer mobile-optimized experiences.

Comprehensive research methodology underpins the analysis of Canada’s gift card incentive market, employing multiple data collection and validation techniques to ensure accuracy and reliability. The methodology combines quantitative analysis with qualitative insights to provide holistic market understanding.

Primary research includes structured interviews with key market participants including corporate buyers, incentive program administrators, gift card issuers, and technology platform providers. Survey data collected from over 500 Canadian organizations provides quantitative insights into adoption patterns, spending behaviors, and program effectiveness metrics.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and trade association publications. Market intelligence gathering includes monitoring of competitive activities, product launches, partnership announcements, and technological developments affecting the sector.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review of findings. Triangulation methods ensure consistency between different data sources and research approaches. Market sizing and growth projections utilize conservative estimation methodologies to provide reliable forecasting.

Geographic analysis covers all Canadian provinces and territories, with particular focus on major metropolitan areas where business concentration drives market activity. Temporal analysis examines historical trends, current market conditions, and future projections to provide comprehensive market perspective.

Regional market distribution across Canada reveals significant concentration in major economic centers, with distinct characteristics and growth patterns emerging across different provinces and territories.

Ontario dominates the market with approximately 42% market share, driven by the concentration of corporate headquarters in Toronto and surrounding areas. The province’s diverse economy, including financial services, technology, and manufacturing sectors, creates substantial demand for employee incentive programs. Digital adoption rates in Ontario exceed national averages, supporting advanced gift card platform utilization.

Quebec represents roughly 23% of market activity, with unique characteristics including bilingual program requirements and distinct cultural preferences affecting gift card selection and utilization patterns. Montreal’s technology sector drives innovation in digital gift card solutions, while traditional industries maintain preference for established retail partnerships.

Western provinces collectively account for approximately 28% of market share, with Alberta leading due to its energy sector concentration and high average incomes. British Columbia shows strong growth in technology and service sectors adopting sophisticated incentive programs. Resource-based industries across western Canada utilize gift card incentives for safety recognition and retention programs.

Atlantic provinces represent emerging opportunities with growing adoption rates among small and medium enterprises. Government sector utilization in these regions drives steady demand for compliant gift card solutions. Rural market penetration remains limited but shows potential for digital-first approaches that overcome geographical constraints.

Competitive dynamics within the Canada gift card incentive market feature established players, emerging technology companies, and strategic partnerships that shape market evolution and innovation trajectories.

Market positioning varies significantly among competitors, with some focusing on enterprise clients while others target small business segments. Technology differentiation centers on integration capabilities, user interface design, and advanced features like artificial intelligence and predictive analytics.

Strategic partnerships between gift card providers and major Canadian retailers create competitive advantages through exclusive offerings and enhanced redemption networks. Innovation focus areas include mobile optimization, real-time analytics, and seamless integration with existing business systems.

Market segmentation analysis reveals distinct categories within the Canada gift card incentive market, each characterized by specific requirements, preferences, and growth patterns that inform strategic positioning and product development.

By Delivery Method:

By End-User Industry:

By Organization Size:

Category analysis provides detailed understanding of specific market segments and their unique characteristics, enabling targeted strategies and optimized solution development for different user groups.

Employee Recognition Programs represent the largest category, driven by increasing focus on workplace culture and retention strategies. These programs typically feature regular recognition cycles, milestone celebrations, and performance-based rewards. Digital delivery dominates this category due to the need for timely recognition and administrative efficiency. Integration with HR systems enables automated reward distribution based on predefined criteria.

Customer Loyalty Applications show strong growth as businesses seek alternatives to traditional points-based programs. Gift card incentives provide immediate value while encouraging repeat purchases and brand engagement. Retail partnerships are crucial for this category, with broad redemption networks enhancing program appeal and effectiveness.

Sales Incentive Programs utilize gift cards for commission supplements, contest prizes, and achievement recognition. This category values high-value options and premium presentation capabilities. Performance tracking integration enables automatic reward distribution based on sales metrics and goal achievement.

Safety and Compliance Rewards represent a specialized but growing category, particularly in industrial and healthcare settings. These programs emphasize consistent recognition for safety behaviors and compliance achievements. MWR data indicates this category shows annual growth rates of 12.4% as organizations prioritize workplace safety culture development.

Stakeholder benefits from the Canada gift card incentive market extend across multiple participant categories, creating value propositions that drive continued market growth and innovation.

For Corporate Buyers:

For Recipients:

For Technology Providers:

Strategic analysis of the Canada gift card incentive market reveals key strengths, weaknesses, opportunities, and threats that influence market dynamics and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the Canada gift card incentive market reflect evolving technology capabilities, changing workplace dynamics, and shifting consumer preferences that shape future market direction.

Mobile-First Design has become essential as recipients increasingly expect seamless mobile experiences. Modern platforms prioritize responsive design and native mobile applications that integrate with digital wallets and shopping apps. Push notifications and mobile alerts enhance engagement and redemption rates.

Personalization Technology utilizes artificial intelligence to recommend appropriate gift card options based on recipient preferences, demographics, and historical behavior. Machine learning algorithms optimize reward timing and values to maximize program effectiveness and satisfaction rates.

Real-Time Analytics provide comprehensive program performance insights including redemption patterns, recipient engagement levels, and ROI measurements. Dashboard visualization enables program administrators to make data-driven optimization decisions and demonstrate program value to stakeholders.

Integration Sophistication continues advancing with seamless connectivity to HRIS systems, performance management platforms, and customer relationship management tools. API-first architectures enable custom integrations and workflow automation that reduce administrative burden.

Sustainability Initiatives drive preference for digital-only programs that eliminate physical card production and shipping. Carbon footprint reduction appeals to environmentally conscious organizations and recipients. Some providers offer charitable giving options as alternatives to traditional retail redemption.

Recent industry developments highlight the dynamic nature of the Canada gift card incentive market, with technological innovations, strategic partnerships, and regulatory changes shaping market evolution.

Technology Platform Enhancements include the introduction of blockchain-based security measures, advanced fraud detection systems, and AI-powered personalization engines. Major providers have invested significantly in mobile optimization and user experience improvements to meet evolving recipient expectations.

Strategic Partnerships between gift card providers and major Canadian retailers have expanded redemption networks and created exclusive offering opportunities. Financial institution collaborations enable integration with existing banking relationships and payroll systems for streamlined program administration.

Regulatory Updates across provinces have strengthened consumer protections while maintaining business-friendly operational frameworks. Privacy legislation compliance has driven enhanced data protection measures and transparent privacy policies across platform providers.

Market Consolidation activities include strategic acquisitions of specialized providers by larger platforms seeking to expand service capabilities and market reach. International expansion efforts by Canadian companies demonstrate market maturity and competitive strength.

Innovation Initiatives focus on emerging technologies including cryptocurrency integration, virtual reality redemption experiences, and social gifting capabilities. Sustainability programs emphasize environmental responsibility through digital-first approaches and carbon offset partnerships.

Strategic recommendations for market participants reflect comprehensive analysis of current conditions, emerging trends, and future opportunities within the Canada gift card incentive market.

For Technology Providers: Focus investment on artificial intelligence capabilities and advanced analytics that provide measurable value to corporate buyers. Develop industry-specific solutions that address unique requirements in healthcare, financial services, and manufacturing sectors. Prioritize mobile optimization and user experience enhancements that differentiate platforms in competitive evaluations.

For Corporate Buyers: Evaluate platforms based on integration capabilities with existing systems rather than focusing solely on cost considerations. Implement pilot programs to test recipient engagement and administrative efficiency before full-scale deployment. Consider multi-vendor strategies that provide redundancy and negotiating leverage.

For Retail Partners: Develop exclusive partnerships with gift card providers to create differentiated offerings and enhanced visibility. Invest in digital infrastructure that supports seamless gift card redemption across online and physical channels. Create promotional campaigns that highlight gift card acceptance and special offers for incentive program recipients.

For New Market Entrants: Focus on underserved segments such as small businesses or specialized industries rather than competing directly with established players. Develop innovative features that address specific pain points not adequately addressed by current solutions. Consider partnership strategies that leverage existing relationships and distribution channels.

Future market prospects for the Canada gift card incentive market indicate continued growth driven by technological advancement, evolving workplace dynamics, and increasing recognition of employee engagement importance. MarkWide Research projects sustained expansion with digital solutions capturing 78% of market share within the next five years.

Technology evolution will center on artificial intelligence integration, blockchain security implementation, and enhanced personalization capabilities. Predictive analytics will enable proactive program optimization and recipient behavior forecasting. Voice-activated interfaces and conversational AI may emerge as differentiating features for next-generation platforms.

Market expansion opportunities exist in underserved sectors including small businesses, non-profit organizations, and government agencies. International growth potential for Canadian providers reflects market maturity and competitive advantages developed in the domestic market. Cross-border programs will become increasingly important for multinational organizations.

Regulatory environment is expected to remain stable with potential enhancements to consumer protection measures and privacy requirements. Sustainability regulations may favor digital-first providers and environmentally conscious program designs. Tax policy changes could impact program structures and administrative requirements.

Competitive dynamics will intensify as market growth attracts new entrants and drives innovation investment. Consolidation trends may accelerate as companies seek scale advantages and comprehensive service capabilities. Partnership strategies will become increasingly important for market positioning and competitive differentiation.

The Canada gift card incentive market represents a mature yet dynamic sector characterized by steady growth, technological innovation, and evolving stakeholder requirements. Market fundamentals remain strong, supported by widespread business adoption, regulatory clarity, and comprehensive retail partnership networks that enhance program effectiveness and recipient satisfaction.

Digital transformation continues reshaping market dynamics, with mobile-first solutions and advanced analytics becoming essential competitive requirements. The shift toward personalized experiences and seamless integration capabilities reflects broader trends in enterprise software and employee experience management. Organizations increasingly view gift card incentives as strategic tools for engagement and retention rather than simple reward mechanisms.

Growth opportunities persist across multiple dimensions including small business market penetration, international expansion, and emerging technology integration. Sustainability initiatives and corporate social responsibility alignment create additional value propositions that appeal to environmentally conscious organizations and recipients. The market’s resilience during economic uncertainty demonstrates its essential role in modern workplace culture.

Success factors for market participants include technological innovation, strategic partnerships, and deep understanding of evolving customer requirements. Companies that balance operational efficiency with recipient experience optimization are best positioned for sustained growth and competitive advantage. The Canada gift card incentive market’s future remains promising, with continued expansion expected across all major segments and geographic regions.

What is Canada Gift Card Incentive?

Canada Gift Card Incentive refers to the use of gift cards as a motivational tool in various sectors, including retail, corporate rewards, and customer loyalty programs. These incentives are designed to enhance customer engagement and drive sales.

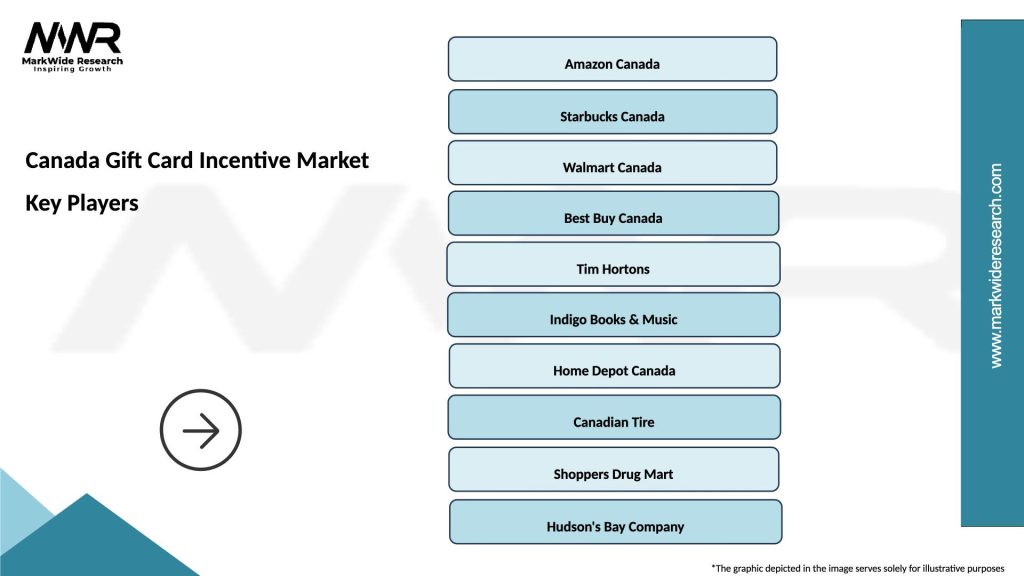

What are the key players in the Canada Gift Card Incentive Market?

Key players in the Canada Gift Card Incentive Market include companies like Blackhawk Network, InComm, and GiftCards.com, which provide a range of gift card solutions for businesses and consumers, among others.

What are the growth factors driving the Canada Gift Card Incentive Market?

The growth of the Canada Gift Card Incentive Market is driven by increasing consumer demand for flexible payment options, the rise of e-commerce, and the popularity of gift cards as corporate rewards. Additionally, advancements in digital gift card technology are enhancing user experience.

What challenges does the Canada Gift Card Incentive Market face?

Challenges in the Canada Gift Card Incentive Market include issues related to fraud and security, the need for regulatory compliance, and competition from alternative incentive programs. These factors can impact consumer trust and market growth.

What opportunities exist in the Canada Gift Card Incentive Market?

Opportunities in the Canada Gift Card Incentive Market include the expansion of digital gift card offerings, partnerships with e-commerce platforms, and the potential for personalized marketing strategies. These trends can help businesses better engage with their customers.

What trends are shaping the Canada Gift Card Incentive Market?

Trends in the Canada Gift Card Incentive Market include the increasing adoption of mobile wallets, the integration of gift cards into loyalty programs, and the growing popularity of experiential gift cards. These innovations are transforming how consumers perceive and use gift cards.

Canada Gift Card Incentive Market

| Segmentation Details | Description |

|---|---|

| Product Type | Physical Cards, Digital Cards, E-Gift Cards, Reloadable Cards |

| Customer Type | Individuals, Corporates, Non-Profits, Educational Institutions |

| Distribution Channel | Online Retailers, Brick-and-Mortar Stores, Mobile Apps, Third-Party Platforms |

| Price Tier | Low-End, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Gift Card Incentive Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at