444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa payment market represents one of the most dynamic and rapidly evolving financial technology landscapes globally. This region has witnessed unprecedented transformation in payment systems, driven by increasing smartphone penetration, government digitization initiatives, and a growing young population embracing digital financial services. The market encompasses traditional banking solutions, mobile payment platforms, digital wallets, cryptocurrency exchanges, and innovative fintech applications that cater to diverse consumer needs across multiple countries.

Digital payment adoption has accelerated significantly, with the region experiencing growth rates of approximately 12.5% CAGR in digital transaction volumes. Countries like the United Arab Emirates, Saudi Arabia, South Africa, and Kenya have emerged as key drivers of payment innovation, implementing advanced infrastructure and regulatory frameworks that support seamless financial transactions. The market benefits from substantial investments in financial technology, strategic partnerships between traditional banks and fintech companies, and increasing consumer confidence in digital payment solutions.

mobile payment solutions dominate the landscape, particularly in Africa where mobile money services have revolutionized financial inclusion. The region’s unique demographic profile, characterized by a large unbanked population and high mobile phone usage, has created fertile ground for innovative payment solutions that bypass traditional banking infrastructure. This has resulted in the development of sophisticated payment ecosystems that serve both urban and rural populations effectively.

The Middle East and Africa payment market refers to the comprehensive ecosystem of financial transaction services, technologies, and platforms that facilitate the exchange of monetary value across the Middle East and African regions. This market encompasses various payment methods including traditional card-based transactions, mobile payments, digital wallets, peer-to-peer transfers, merchant payment solutions, and emerging technologies such as blockchain-based payment systems.

Payment infrastructure in this context includes point-of-sale terminals, automated teller machines, online payment gateways, mobile payment applications, and the underlying technological framework that supports secure financial transactions. The market serves diverse stakeholders including consumers, merchants, financial institutions, payment service providers, and government entities, each requiring tailored solutions that address specific regional needs and regulatory requirements.

Financial inclusion represents a core component of this market definition, as payment solutions in the Middle East and Africa often serve as primary access points to formal financial services for previously unbanked populations. This includes microfinance solutions, remittance services, and basic banking functionalities delivered through mobile and digital channels.

Market dynamics in the Middle East and Africa payment sector reflect a rapidly maturing ecosystem characterized by technological innovation, regulatory evolution, and increasing consumer adoption. The region has experienced remarkable growth in digital payment penetration, with mobile payment adoption rates reaching approximately 68% in key markets such as Kenya and the UAE. This transformation has been supported by strategic government initiatives, substantial private sector investments, and the emergence of local fintech champions.

Key market drivers include the region’s young demographic profile, increasing smartphone penetration rates exceeding 75% in urban areas, and supportive regulatory frameworks that encourage financial innovation. Traditional banking institutions have embraced digital transformation, partnering with fintech companies to deliver comprehensive payment solutions that serve both banked and unbanked populations effectively.

Competitive landscape features a mix of global payment giants, regional financial institutions, and innovative local startups that have developed solutions specifically tailored to Middle Eastern and African market needs. The market has attracted significant venture capital investment, with fintech funding growing by approximately 45% annually over the past three years, indicating strong investor confidence in the region’s payment sector potential.

Strategic insights reveal several critical trends shaping the Middle East and Africa payment market landscape:

Consumer behavior patterns indicate strong preference for convenient, secure, and cost-effective payment solutions that integrate seamlessly with daily activities. The market demonstrates particular strength in peer-to-peer transfers, bill payments, and merchant transactions, with consumers showing increasing comfort with digital-only financial interactions.

Demographic advantages represent the primary driver of payment market growth in the Middle East and Africa. The region’s young population, with median ages below 30 years in many countries, demonstrates high receptivity to digital payment solutions and mobile-first financial services. This demographic dividend creates sustained demand for innovative payment platforms that offer convenience, speed, and accessibility.

Government digitization initiatives across the region have accelerated payment market development through supportive policies, infrastructure investments, and regulatory frameworks that encourage financial innovation. Countries like the UAE, Saudi Arabia, and South Africa have implemented comprehensive digital transformation strategies that prioritize cashless payment adoption and financial inclusion objectives.

Smartphone penetration growth continues to fuel market expansion, with mobile device adoption rates exceeding 85% in major urban centers. This technological foundation enables widespread deployment of mobile payment solutions, digital wallets, and application-based financial services that serve diverse consumer segments effectively.

Economic diversification efforts in oil-dependent economies have prioritized fintech sector development as part of broader strategies to reduce reliance on traditional industries. These initiatives include regulatory sandboxes, fintech incubators, and strategic partnerships that foster payment innovation and entrepreneurship.

Infrastructure limitations in certain regions continue to challenge payment market expansion, particularly in rural areas where internet connectivity and mobile network coverage remain inconsistent. These technological gaps create barriers to widespread digital payment adoption and limit the reach of innovative financial services to underserved populations.

Regulatory complexity across multiple jurisdictions creates compliance challenges for payment service providers seeking to operate across the Middle East and Africa region. Varying regulatory requirements, licensing procedures, and operational standards increase costs and complexity for companies attempting to scale their services regionally.

Cybersecurity concerns represent significant restraints as increasing digitization of financial services creates new vulnerability vectors for fraud and data breaches. Consumer trust in digital payment solutions depends heavily on robust security measures, and high-profile security incidents can significantly impact market confidence and adoption rates.

Financial literacy gaps in certain populations limit the effective utilization of advanced payment solutions, particularly among older demographics and rural communities. Educational initiatives and user-friendly interface design become critical factors in overcoming these adoption barriers and achieving inclusive financial service delivery.

Cross-border payment solutions present substantial opportunities as regional trade volumes increase and diaspora communities seek efficient remittance services. The development of seamless, cost-effective international payment platforms could capture significant market share while supporting economic integration across the Middle East and Africa region.

Small business digitization offers extensive growth potential as micro, small, and medium enterprises increasingly recognize the benefits of digital payment acceptance. Payment service providers can develop tailored solutions that address the specific needs of small businesses, including inventory management integration, customer relationship tools, and financial analytics capabilities.

Islamic finance integration represents a unique opportunity to serve the large Muslim population across the region with Sharia-compliant payment solutions. This includes developing payment platforms that incorporate Islamic banking principles, halal certification processes, and religious compliance features that appeal to faith-conscious consumers.

Agricultural payment solutions could revolutionize rural economies by providing farmers and agricultural businesses with access to digital financial services, crop insurance payments, and supply chain financing. These specialized solutions address the unique seasonal and geographical challenges faced by agricultural communities while promoting financial inclusion in rural areas.

Competitive intensity in the Middle East and Africa payment market has increased significantly as global payment giants compete with regional champions and innovative local startups. This competitive environment drives continuous innovation, improved service quality, and competitive pricing strategies that benefit consumers and merchants across the region.

Partnership ecosystems have emerged as critical success factors, with payment companies forming strategic alliances with banks, telecommunications providers, retailers, and technology companies. These partnerships enable comprehensive service delivery, expanded market reach, and integrated solutions that address multiple customer needs through single platforms.

Regulatory evolution continues to shape market dynamics as governments balance innovation encouragement with consumer protection and financial stability objectives. Recent regulatory developments have generally favored market growth while implementing appropriate safeguards for data protection, anti-money laundering, and cybersecurity requirements.

Technology advancement drives market evolution through the integration of artificial intelligence, machine learning, blockchain technology, and biometric authentication systems. These technological improvements enhance security, reduce transaction costs, and enable new service capabilities that differentiate payment providers in competitive markets.

Comprehensive market analysis for the Middle East and Africa payment market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes structured interviews with industry executives, payment service providers, financial institutions, merchants, and consumers across key markets in the region.

Secondary research incorporates analysis of regulatory filings, company financial reports, industry publications, government statistics, and academic research papers that provide quantitative and qualitative insights into market trends, competitive dynamics, and growth drivers. This approach ensures comprehensive coverage of market developments and emerging trends.

Data validation processes include cross-referencing multiple sources, conducting expert interviews, and utilizing proprietary databases to verify market statistics and trend analysis. MarkWide Research employs rigorous quality control procedures to ensure the reliability and accuracy of all market intelligence presented in this analysis.

Regional segmentation analysis covers major markets including the United Arab Emirates, Saudi Arabia, Egypt, South Africa, Kenya, Nigeria, and other significant economies across the Middle East and Africa region. This geographic approach provides detailed insights into local market conditions, regulatory environments, and consumer preferences that influence payment market development.

Gulf Cooperation Council countries lead the Middle East payment market with advanced infrastructure, high smartphone penetration, and supportive government policies that encourage digital payment adoption. The UAE and Saudi Arabia demonstrate particularly strong market development, with digital payment penetration rates exceeding 78% among urban populations. These markets benefit from substantial fintech investments, regulatory sandboxes, and strategic initiatives that position them as regional payment innovation hubs.

North African markets including Egypt, Morocco, and Tunisia show significant growth potential driven by large populations, increasing internet connectivity, and government digitization programs. Egypt represents the largest market opportunity in North Africa, with growing consumer acceptance of mobile payment solutions and expanding merchant adoption of digital payment acceptance capabilities.

Sub-Saharan Africa demonstrates remarkable payment innovation, particularly in mobile money services that have achieved global recognition for their effectiveness in promoting financial inclusion. Kenya leads this segment with mobile payment adoption rates approaching 85% of the adult population, while countries like Ghana, Tanzania, and Uganda show strong growth trajectories in digital payment utilization.

South Africa maintains its position as the most developed payment market in Africa, with sophisticated banking infrastructure, high card payment penetration, and growing adoption of contactless and mobile payment solutions. The market benefits from established regulatory frameworks, competitive banking sector, and increasing consumer comfort with digital financial services.

Market leadership in the Middle East and Africa payment sector features a diverse mix of global technology companies, regional financial institutions, and innovative local fintech startups. The competitive landscape reflects the region’s unique characteristics, with different players achieving success in various market segments and geographic areas.

Global payment providers have established significant presence across major markets:

Regional champions have developed specialized solutions tailored to local market needs:

By Payment Type: The Middle East and Africa payment market segments into multiple categories based on transaction methods and technologies. Card-based payments maintain significant market share in developed economies, while mobile payments dominate in markets with high smartphone penetration and limited traditional banking infrastructure.

By End User: Market segmentation reflects diverse user categories with distinct needs and preferences:

Mobile Payment Category demonstrates the strongest growth trajectory across the Middle East and Africa region, driven by high smartphone adoption and innovative service delivery models. This category benefits from lower infrastructure requirements compared to traditional banking, enabling rapid deployment in underserved markets. Mobile payment solutions have achieved particular success in peer-to-peer transfers, bill payments, and small merchant transactions.

Digital Wallet Segment shows increasing sophistication with multi-service platforms that integrate payment capabilities with loyalty programs, merchant offers, and financial management tools. Leading digital wallets in the region have expanded beyond basic payment functionality to offer comprehensive financial ecosystems that serve diverse consumer needs through single applications.

Cross-Border Payment Category represents significant opportunity as regional trade increases and diaspora communities seek efficient remittance solutions. This segment faces regulatory complexity but offers substantial revenue potential for providers that can navigate compliance requirements while delivering cost-effective international transfer services.

Merchant Payment Solutions continue evolving to serve the diverse needs of businesses ranging from street vendors to large retailers. Point-of-sale technology advancement, including contactless payment acceptance and integrated inventory management, drives adoption among merchants seeking to improve customer experience and operational efficiency.

Financial Institutions benefit from payment market participation through expanded customer reach, increased transaction volumes, and opportunities to offer comprehensive digital banking services. Banks can leverage payment platforms to acquire new customers, particularly among previously unbanked populations, while reducing operational costs through digital service delivery.

Merchants and Retailers gain access to broader customer bases, improved cash flow management, and enhanced customer experience through digital payment acceptance. Small businesses particularly benefit from affordable payment solutions that enable them to compete effectively with larger enterprises while accessing valuable transaction data for business optimization.

Consumers experience increased convenience, enhanced security, and access to financial services that were previously unavailable or difficult to obtain. Digital payment solutions provide 24/7 accessibility, reduced transaction costs, and integration with other financial services such as savings, credit, and insurance products.

Government Entities achieve improved tax collection efficiency, reduced cash handling costs, and enhanced ability to deliver citizen services through digital channels. Payment digitization supports broader economic development objectives including financial inclusion, economic transparency, and reduced informal economy participation.

Technology Providers access rapidly growing markets with substantial revenue potential while contributing to financial inclusion and economic development objectives. The region’s payment market offers opportunities for innovation, partnership development, and scaling of successful solutions across multiple countries and market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless Payment Adoption has accelerated significantly across the Middle East and Africa, driven by hygiene concerns and convenience preferences. Near-field communication technology integration in smartphones and payment cards enables tap-to-pay functionality that appeals to consumers seeking quick and secure transaction methods. Merchant adoption of contactless acceptance technology has grown by approximately 55% annually in major urban markets.

Biometric Authentication Integration represents a major trend as payment providers implement fingerprint, facial recognition, and voice authentication technologies to enhance security while improving user experience. These advanced authentication methods address security concerns while enabling seamless payment authorization that appeals to tech-savvy consumers across the region.

Super App Development shows payment companies expanding beyond basic transaction services to offer comprehensive digital ecosystems that include messaging, e-commerce, transportation, and financial services. This trend reflects consumer preference for integrated platforms that address multiple daily needs through single applications.

Blockchain and Cryptocurrency Exploration indicates growing interest in distributed ledger technologies for enhanced security, transparency, and cost reduction in payment processing. While regulatory frameworks continue evolving, several countries have initiated pilot programs and regulatory sandboxes to explore blockchain-based payment solutions.

Artificial Intelligence Implementation enables advanced fraud detection, personalized service delivery, and predictive analytics that improve payment platform performance and user experience. AI-powered systems help payment providers identify suspicious transactions, optimize routing, and deliver customized financial products to individual users.

Regulatory Sandbox Programs have been established across multiple countries including the UAE, Saudi Arabia, and South Africa, enabling fintech companies to test innovative payment solutions in controlled environments. These programs accelerate innovation while ensuring appropriate consumer protection and regulatory compliance.

Central Bank Digital Currency initiatives are advancing in several countries, with pilot programs exploring the potential for government-issued digital currencies that could transform payment landscapes. The Central Bank of Nigeria has launched its eNaira digital currency, while other regional central banks conduct research and development programs.

Strategic Partnerships between traditional banks and fintech companies have increased significantly, combining established financial institution credibility with innovative technology capabilities. These partnerships enable rapid deployment of advanced payment solutions while leveraging existing customer relationships and regulatory compliance frameworks.

Infrastructure Investments in fiber optic networks, 5G telecommunications, and data center facilities support the technological foundation required for advanced payment services. Government and private sector investments in digital infrastructure enable broader deployment of sophisticated payment platforms across urban and rural areas.

Cross-Border Integration Projects aim to harmonize payment systems across regional economic communities, facilitating seamless transactions between countries and supporting increased trade volumes. The African Continental Free Trade Area agreement has accelerated discussions about integrated payment systems that could serve the entire continent.

Market Entry Strategy recommendations for payment companies include partnering with established local institutions, understanding regulatory requirements thoroughly, and developing solutions that address specific regional needs rather than adapting global products. MarkWide Research analysis indicates that successful market entrants typically invest significant time in understanding local consumer behavior and regulatory environments.

Technology Investment Priorities should focus on mobile-first platform development, robust security infrastructure, and scalable architecture that can accommodate rapid user growth. Companies should prioritize user experience design that addresses varying levels of digital literacy while maintaining advanced functionality for sophisticated users.

Partnership Development represents a critical success factor, with recommendations to establish relationships with telecommunications providers, banks, merchants, and government entities. These partnerships enable market access, regulatory compliance, and comprehensive service delivery that addresses diverse stakeholder needs.

Regulatory Compliance requires dedicated resources and expertise to navigate complex and evolving regulatory landscapes across multiple jurisdictions. Companies should invest in compliance infrastructure early and maintain ongoing dialogue with regulatory authorities to ensure alignment with policy developments.

Customer Education initiatives should accompany product launches to address financial literacy gaps and build consumer confidence in digital payment solutions. Educational programs that demonstrate security features, cost benefits, and convenience advantages help accelerate adoption among hesitant user segments.

Growth Trajectory for the Middle East and Africa payment market remains strongly positive, with digital payment adoption expected to continue expanding at approximately 14.2% CAGR over the next five years. This growth will be driven by continued smartphone penetration, supportive government policies, and increasing consumer comfort with digital financial services.

Technology Evolution will likely include widespread adoption of artificial intelligence, blockchain integration, and advanced biometric authentication systems that enhance security while improving user experience. The integration of Internet of Things devices and voice-activated payment systems may create new transaction channels and use cases.

Market Consolidation is expected as successful payment platforms acquire smaller competitors and expand their service offerings to create comprehensive financial ecosystems. This consolidation will likely result in a smaller number of dominant platforms that serve multiple countries and offer diverse financial services.

Regulatory Harmonization efforts across regional economic communities may simplify compliance requirements and enable more efficient cross-border payment solutions. Standardized regulatory frameworks could accelerate market development while maintaining appropriate consumer protection and financial stability safeguards.

Financial Inclusion Achievement represents a key long-term objective, with payment platforms serving as primary access points to formal financial services for currently unbanked populations. Success in this area could significantly impact economic development and poverty reduction across the region.

The Middle East and Africa payment market stands at a pivotal moment of transformation, characterized by unprecedented growth opportunities, technological innovation, and increasing consumer adoption of digital financial services. The region’s unique demographic advantages, including young populations and high mobile penetration, create ideal conditions for continued payment market expansion and financial inclusion advancement.

Market dynamics indicate sustained growth potential driven by supportive government policies, strategic private sector investments, and evolving consumer preferences that favor convenient and secure digital payment solutions. The competitive landscape continues evolving as global payment giants compete with innovative local companies that understand regional market nuances and consumer needs.

Success factors for payment market participants include deep understanding of local regulations, strategic partnership development, robust technology infrastructure, and commitment to financial inclusion objectives. Companies that can navigate regulatory complexity while delivering user-friendly solutions tailored to regional preferences are positioned for significant market success.

The future outlook remains optimistic as technological advancement, regulatory support, and demographic trends align to support continued payment market growth across the Middle East and Africa region. This market represents one of the most promising opportunities in global financial technology, with potential to drive economic development and improve financial access for millions of consumers and businesses.

What is Middle East and Africa Payment?

Middle East and Africa Payment refers to the systems and methods used for financial transactions in the region, including digital wallets, mobile payments, and traditional banking services. This sector is rapidly evolving with the adoption of technology and changing consumer preferences.

What are the key players in the Middle East and Africa Payment Market?

Key players in the Middle East and Africa Payment Market include companies like PayU, Flutterwave, and Fawry. These companies are leading the way in providing innovative payment solutions and services tailored to the unique needs of the region, among others.

What are the main drivers of growth in the Middle East and Africa Payment Market?

The main drivers of growth in the Middle East and Africa Payment Market include the increasing smartphone penetration, the rise of e-commerce, and the growing demand for cashless transactions. Additionally, government initiatives to promote digital payments are also contributing to this growth.

What challenges does the Middle East and Africa Payment Market face?

The Middle East and Africa Payment Market faces challenges such as regulatory hurdles, cybersecurity threats, and a lack of infrastructure in certain areas. These factors can hinder the adoption of advanced payment technologies and services.

What opportunities exist in the Middle East and Africa Payment Market?

Opportunities in the Middle East and Africa Payment Market include the expansion of fintech solutions, the potential for cross-border payments, and the increasing interest in blockchain technology. These factors can lead to enhanced financial inclusion and improved transaction efficiency.

What trends are shaping the Middle East and Africa Payment Market?

Trends shaping the Middle East and Africa Payment Market include the rise of contactless payments, the integration of artificial intelligence in fraud detection, and the growth of peer-to-peer payment platforms. These trends are transforming how consumers and businesses engage in financial transactions.

Middle East and Africa Payment Market

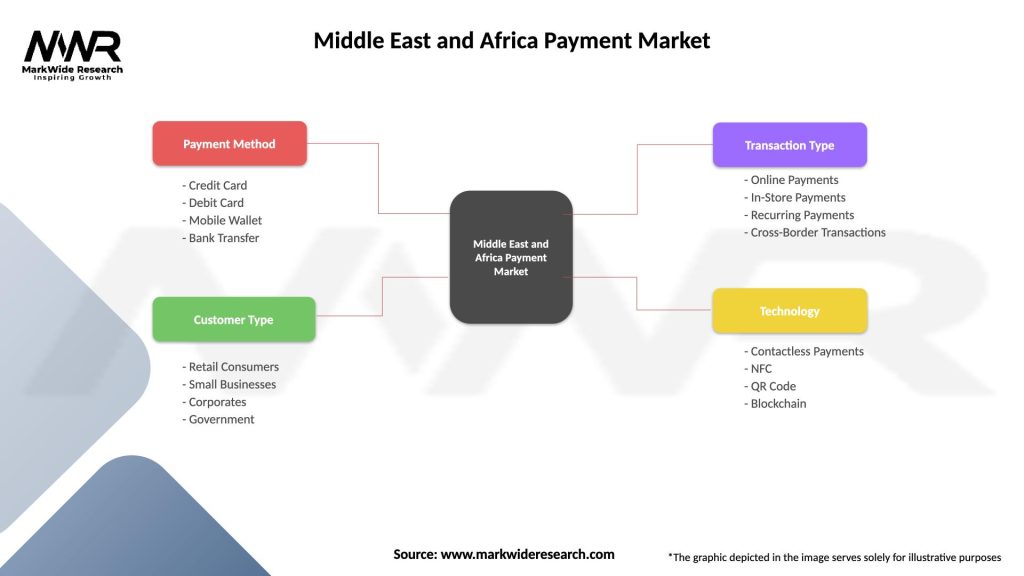

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| Customer Type | Retail Consumers, Small Businesses, Corporates, Government |

| Transaction Type | Online Payments, In-Store Payments, Recurring Payments, Cross-Border Transactions |

| Technology | Contactless Payments, NFC, QR Code, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Payment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at