444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK mobile payments market represents one of Europe’s most dynamic and rapidly evolving digital payment ecosystems, characterized by widespread consumer adoption and innovative technological solutions. Mobile payment systems have fundamentally transformed how British consumers conduct financial transactions, from contactless purchases to peer-to-peer transfers and online commerce. The market demonstrates exceptional growth momentum, with adoption rates reaching 78% among smartphone users and continuing to expand across diverse demographic segments.

Digital transformation initiatives across the United Kingdom have accelerated mobile payment integration, supported by robust financial infrastructure and progressive regulatory frameworks. Major financial institutions, fintech startups, and technology giants compete intensively to capture market share in this lucrative sector. The market encompasses various payment methods including Near Field Communication (NFC) contactless payments, mobile wallets, Quick Response (QR) code transactions, and in-app payment solutions.

Consumer behavior patterns indicate strong preference for convenience, security, and speed in payment processing, driving continuous innovation in mobile payment technologies. The market benefits from high smartphone penetration rates exceeding 85% of the adult population and widespread acceptance of digital payment methods across retail, hospitality, and service sectors. MarkWide Research analysis reveals that mobile payment adoption continues accelerating, particularly among younger demographics and urban populations.

The UK mobile payments market refers to the comprehensive ecosystem of financial transaction services conducted through mobile devices, including smartphones and tablets, within the United Kingdom’s economic landscape. This market encompasses various payment methodologies, technological platforms, and service providers that enable consumers and businesses to execute monetary transactions using mobile applications, contactless technologies, and digital wallet solutions.

Mobile payment systems integrate multiple technologies including NFC, biometric authentication, tokenization, and cloud-based processing to facilitate secure, convenient, and efficient financial transactions. The market includes traditional banking institutions offering mobile banking services, specialized fintech companies developing innovative payment solutions, and technology corporations providing comprehensive digital wallet platforms.

Market dynamics in the UK mobile payments sector demonstrate exceptional growth potential driven by technological advancement, changing consumer preferences, and supportive regulatory environments. The market exhibits strong competitive intensity with established financial institutions, emerging fintech companies, and international technology giants vying for market leadership through innovative service offerings and strategic partnerships.

Key growth drivers include increasing smartphone adoption, enhanced security features, government digitalization initiatives, and evolving consumer expectations for seamless payment experiences. The market benefits from 92% contactless payment acceptance among UK retailers and growing merchant adoption of mobile payment technologies across various industry sectors.

Technological innovation continues reshaping the competitive landscape, with artificial intelligence, machine learning, and blockchain technologies enhancing payment security, fraud detection, and transaction processing capabilities. The market demonstrates resilience and adaptability, particularly evident during the COVID-19 pandemic when contactless payment adoption accelerated significantly.

Strategic market insights reveal several critical trends shaping the UK mobile payments landscape:

Technological advancement serves as the primary catalyst driving UK mobile payments market expansion, with continuous improvements in payment processing speed, security protocols, and user interface design. Enhanced smartphone capabilities, including advanced biometric sensors, improved processing power, and sophisticated security features, enable more secure and convenient payment experiences that attract consumer adoption.

Consumer lifestyle changes significantly influence market growth, particularly the increasing demand for contactless, quick, and seamless payment solutions. Modern consumers prioritize convenience, speed, and security in their payment preferences, driving adoption of mobile payment technologies that offer superior user experiences compared to traditional payment methods.

Regulatory support from UK financial authorities, including the Financial Conduct Authority and Payment Systems Regulator, creates favorable conditions for mobile payment innovation and adoption. Progressive regulatory frameworks encourage competition, ensure consumer protection, and facilitate technological advancement while maintaining financial system stability and security standards.

Merchant adoption initiatives accelerate market growth as retailers, restaurants, and service providers recognize the benefits of accepting mobile payments, including reduced transaction costs, improved customer satisfaction, and enhanced operational efficiency. Government digitalization programs and small business support initiatives further encourage merchant adoption of mobile payment technologies.

Security concerns represent significant challenges for mobile payment market expansion, despite continuous technological improvements. Consumer apprehensions about data privacy, fraud risks, and cybersecurity threats can limit adoption rates, particularly among older demographic segments and security-conscious users who prefer traditional payment methods.

Technical infrastructure limitations in certain geographic areas or among specific merchant categories can restrict mobile payment accessibility and functionality. Network connectivity issues, outdated point-of-sale systems, and insufficient technical support capabilities may hinder seamless mobile payment experiences and limit market penetration.

Regulatory compliance complexities create operational challenges for mobile payment service providers, requiring substantial investments in compliance systems, security protocols, and regulatory reporting capabilities. Evolving regulatory requirements and international compliance standards can increase operational costs and complexity for market participants.

Market fragmentation resulting from multiple competing platforms, payment standards, and technological approaches can create confusion among consumers and merchants, potentially slowing adoption rates and limiting market efficiency. Interoperability challenges between different mobile payment systems may restrict user convenience and merchant acceptance.

Emerging technology integration presents substantial opportunities for mobile payment market expansion, particularly through artificial intelligence, machine learning, and blockchain implementations that enhance security, personalization, and transaction efficiency. These technologies enable advanced fraud detection, predictive analytics, and automated customer service capabilities that improve overall payment experiences.

Untapped demographic segments offer significant growth potential, especially among older adults, rural populations, and small business owners who have not yet fully adopted mobile payment technologies. Targeted education programs, simplified user interfaces, and specialized service offerings can expand market reach into these underserved segments.

Cross-industry partnerships create opportunities for mobile payment integration across diverse sectors including healthcare, transportation, government services, and entertainment. Strategic collaborations between payment providers, technology companies, and industry-specific organizations can develop specialized solutions that address unique sector requirements.

International expansion capabilities enable UK-based mobile payment companies to leverage their domestic expertise and technological capabilities in global markets, particularly in emerging economies with growing smartphone adoption and developing digital payment infrastructure.

Competitive intensity within the UK mobile payments market drives continuous innovation and service improvement as established financial institutions compete with agile fintech startups and international technology giants. This competitive environment benefits consumers through improved features, reduced costs, and enhanced security measures while challenging companies to differentiate their offerings.

Consumer behavior evolution significantly influences market dynamics, with changing preferences for digital-first experiences, personalized services, and integrated financial management tools. Mobile payment providers must adapt their strategies to meet evolving consumer expectations while maintaining security and regulatory compliance standards.

Technological convergence creates dynamic market conditions as mobile payments integrate with other digital services including e-commerce, social media, gaming, and Internet of Things applications. This convergence enables new business models and revenue streams while creating complex competitive relationships between traditional and non-traditional market participants.

Regulatory evolution continues shaping market dynamics through new compliance requirements, consumer protection measures, and innovation-friendly policies that balance market development with financial system stability and security considerations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UK mobile payments market landscape. Primary research includes extensive surveys of consumers, merchants, and industry professionals to understand adoption patterns, preferences, and challenges in mobile payment usage and acceptance.

Secondary research components encompass analysis of industry reports, regulatory publications, financial statements, and technology trend assessments from authoritative sources. This approach provides comprehensive market understanding through quantitative data analysis and qualitative insight development.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert interviews, and statistical verification methods. Market sizing and growth projections utilize established economic modeling techniques and industry-specific analytical frameworks to provide reliable market intelligence.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market insights. This ongoing research approach enables identification of emerging trends and market opportunities as they develop.

London metropolitan area dominates the UK mobile payments market, accounting for approximately 35% of total transaction volume due to high population density, advanced technological infrastructure, and concentrated financial services sector presence. The capital region demonstrates the highest adoption rates across all demographic segments and serves as the primary testing ground for new mobile payment innovations.

Northern England regions including Manchester, Leeds, and Liverpool show strong mobile payment adoption with 68% smartphone user participation rates, driven by young professional populations and growing fintech sector presence. These areas benefit from government digitalization initiatives and increasing merchant acceptance of mobile payment technologies.

Scotland and Wales demonstrate growing mobile payment adoption, particularly in urban centers like Edinburgh, Glasgow, and Cardiff, where adoption rates reach 61% among adult populations. Rural areas in these regions show increasing acceptance as network infrastructure improvements and targeted education programs expand market accessibility.

Southern England regions outside London, including Brighton, Bristol, and Oxford, exhibit high mobile payment penetration rates driven by technology-savvy populations and strong economic conditions. These areas serve as important secondary markets for mobile payment service providers expanding beyond the London metropolitan area.

Market leadership in the UK mobile payments sector involves intense competition among diverse player categories, each leveraging unique strengths and strategic approaches:

Strategic partnerships and acquisitions continue reshaping the competitive landscape as companies seek to enhance their technological capabilities, expand market reach, and improve customer value propositions through collaborative approaches.

Technology-based segmentation reveals distinct market categories with varying growth trajectories and consumer preferences:

User demographic segmentation shows distinct adoption patterns and preferences across different population groups:

Retail sector applications demonstrate the strongest mobile payment adoption with comprehensive integration across grocery stores, fashion retailers, and specialty shops. Contactless payment acceptance reaches nearly universal levels among major retail chains, while small independent retailers show increasing adoption driven by cost-effective mobile payment solutions and customer demand.

Food and beverage industry shows exceptional mobile payment growth, particularly in quick-service restaurants, coffee shops, and food delivery services. Mobile ordering integration with payment systems creates seamless customer experiences that drive adoption and increase transaction values through enhanced convenience and personalization features.

Transportation sector integration includes public transit systems, ride-sharing services, and parking applications that leverage mobile payments for improved user convenience and operational efficiency. MWR data indicates that transportation-related mobile payments show consistent growth across urban and suburban markets.

Healthcare and professional services represent emerging categories with growing mobile payment adoption for appointment scheduling, service payments, and insurance processing. These sectors benefit from improved patient/client experiences and reduced administrative costs through mobile payment integration.

Consumer advantages include enhanced convenience through faster transaction processing, improved security via biometric authentication and tokenization, and better financial management through integrated spending tracking and budgeting tools. Mobile payments enable seamless experiences across online and offline channels while providing greater control over personal financial information.

Merchant benefits encompass reduced transaction costs compared to traditional card processing, faster payment settlement, and improved customer insights through transaction data analytics. Mobile payment acceptance can increase sales through impulse purchases, reduce cash handling costs, and enhance customer satisfaction through streamlined checkout processes.

Financial institution opportunities include expanded customer engagement through mobile banking integration, reduced operational costs through digital transaction processing, and enhanced data analytics capabilities for risk management and product development. Mobile payments enable banks to maintain customer relationships in increasingly digital financial ecosystems.

Technology provider advantages involve new revenue streams through payment processing fees, platform licensing, and value-added services. Mobile payment platforms create opportunities for cross-selling additional financial services and developing innovative solutions that address evolving market needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Biometric authentication integration represents a fundamental trend reshaping mobile payment security and user experience. Advanced fingerprint, facial recognition, and voice authentication technologies enhance security while simplifying payment processes, driving increased consumer confidence and adoption rates across all demographic segments.

Artificial intelligence implementation enables personalized payment experiences through predictive analytics, fraud detection, and automated financial management features. AI-powered systems provide real-time spending insights, budget recommendations, and customized offers that enhance user engagement and payment platform value propositions.

Cross-platform integration creates seamless payment experiences across multiple devices, applications, and service providers. Universal payment standards and API development enable interoperability between different mobile payment systems, improving user convenience and merchant acceptance capabilities.

Sustainable payment initiatives address growing consumer environmental consciousness through digital receipt systems, carbon footprint tracking, and eco-friendly transaction processing. These features appeal to environmentally aware consumers while supporting corporate sustainability objectives.

Social commerce integration combines social media platforms with mobile payment capabilities, enabling direct purchases through social applications and peer-to-peer payment sharing. This trend particularly appeals to younger demographics who integrate social interaction with shopping and payment activities.

Open banking implementation has revolutionized the UK mobile payments landscape by enabling third-party payment providers to access bank account information with customer consent. This regulatory development has fostered innovation, increased competition, and improved consumer choice while maintaining security and privacy standards through standardized APIs and authentication protocols.

Central Bank Digital Currency (CBDC) exploration by the Bank of England represents a significant development that could reshape the entire mobile payments ecosystem. Digital pound initiatives aim to combine the benefits of digital payments with the stability and trust of central bank-issued currency, potentially creating new opportunities and challenges for existing market participants.

5G network deployment enhances mobile payment capabilities through improved connectivity, reduced latency, and enhanced security features. Advanced network infrastructure enables real-time transaction processing, improved user experiences, and new payment applications including Internet of Things integration and augmented reality shopping experiences.

Cryptocurrency integration initiatives by major payment platforms expand consumer choice and address growing interest in digital assets. While regulatory frameworks continue evolving, early cryptocurrency payment implementations demonstrate market demand for alternative payment methods and blockchain-based transaction processing.

Strategic focus recommendations for mobile payment providers emphasize the importance of user experience optimization, security enhancement, and cross-platform compatibility development. Companies should prioritize seamless integration across multiple touchpoints while maintaining robust security protocols that address evolving cybersecurity threats and consumer privacy concerns.

Market expansion strategies should target underserved demographic segments through tailored education programs, simplified user interfaces, and specialized customer support services. Particular attention should focus on older adult populations and small business owners who represent significant untapped market potential with specific needs and preferences.

Technology investment priorities should emphasize artificial intelligence, machine learning, and blockchain implementations that enhance payment security, personalization, and operational efficiency. Companies should also invest in interoperability solutions that enable seamless integration with existing financial systems and emerging payment technologies.

Partnership development initiatives should focus on strategic collaborations with retailers, financial institutions, and technology providers that expand market reach and enhance service capabilities. Cross-industry partnerships can create innovative solutions that address specific sector requirements while leveraging complementary strengths and resources.

Market evolution projections indicate continued robust growth in the UK mobile payments sector, driven by technological advancement, changing consumer behaviors, and supportive regulatory environments. MarkWide Research analysis suggests that mobile payment adoption will continue expanding across all demographic segments, with particular growth expected in rural areas and among older adult populations as infrastructure and education initiatives improve accessibility.

Technology integration trends will likely accelerate, with artificial intelligence, blockchain, and Internet of Things technologies becoming standard features in mobile payment platforms. These technological advances will enable more sophisticated fraud detection, personalized financial services, and seamless integration with smart devices and automated systems.

Regulatory developments are expected to continue supporting innovation while strengthening consumer protection and financial system stability. Future regulations may address cryptocurrency integration, cross-border payment facilitation, and data privacy enhancement while maintaining competitive market conditions that encourage technological advancement.

Competitive landscape evolution will likely see increased consolidation among smaller players while major technology companies and financial institutions expand their mobile payment capabilities through strategic acquisitions and partnership development. This evolution may create more comprehensive payment ecosystems that integrate multiple financial services and enhance customer value propositions.

The UK mobile payments market represents a dynamic and rapidly evolving sector that has fundamentally transformed how consumers and businesses conduct financial transactions. With strong growth momentum, widespread consumer adoption, and continuous technological innovation, the market demonstrates exceptional potential for continued expansion across diverse demographic and geographic segments.

Key success factors for market participants include maintaining robust security protocols, delivering superior user experiences, and developing strategic partnerships that enhance service capabilities and market reach. Companies that effectively balance innovation with security, convenience with compliance, and growth with sustainability will be best positioned to capture emerging opportunities in this competitive landscape.

Future market development will be shaped by technological advancement, regulatory evolution, and changing consumer expectations that demand increasingly sophisticated, secure, and convenient payment solutions. The integration of emerging technologies, expansion into underserved segments, and development of cross-industry applications will continue driving market growth and creating new opportunities for innovation and value creation in the UK mobile payments ecosystem.

What is UK Mobile Payments?

UK Mobile Payments refer to the use of mobile devices to make financial transactions, including purchases and money transfers, through applications or mobile wallets. This method has gained popularity due to its convenience and speed, allowing users to complete transactions without physical cash or cards.

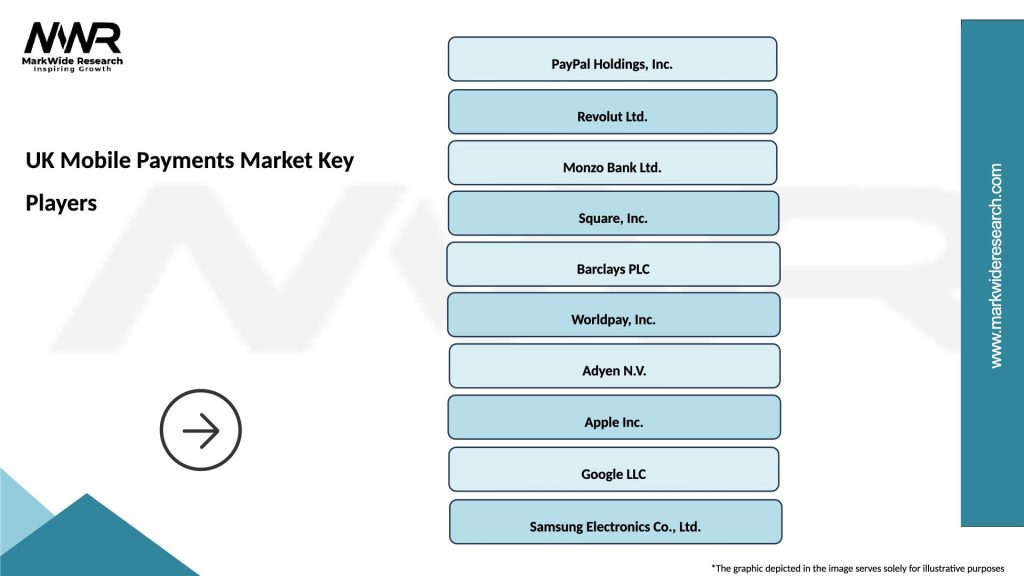

What are the key players in the UK Mobile Payments Market?

Key players in the UK Mobile Payments Market include companies like PayPal, Apple Pay, and Google Pay, which offer various mobile payment solutions. Additionally, traditional banks and fintech startups are also significant contributors to this evolving landscape, among others.

What are the main drivers of growth in the UK Mobile Payments Market?

The growth of the UK Mobile Payments Market is driven by increasing smartphone penetration, the rise of e-commerce, and consumer demand for convenient payment solutions. Additionally, advancements in mobile technology and security features have further encouraged adoption.

What challenges does the UK Mobile Payments Market face?

The UK Mobile Payments Market faces challenges such as security concerns, regulatory compliance, and the need for widespread merchant acceptance. Additionally, consumer trust in mobile payment systems remains a critical factor for growth.

What opportunities exist in the UK Mobile Payments Market?

Opportunities in the UK Mobile Payments Market include the expansion of contactless payment options and the integration of mobile payments with loyalty programs. Furthermore, the increasing adoption of digital currencies presents new avenues for innovation.

What trends are shaping the UK Mobile Payments Market?

Trends in the UK Mobile Payments Market include the rise of biometric authentication, the growth of peer-to-peer payment platforms, and the increasing use of mobile wallets for everyday transactions. These trends reflect a shift towards more secure and user-friendly payment methods.

UK Mobile Payments Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Wallets, Contactless Cards, QR Code Payments, In-App Payments |

| Customer Type | Retail Consumers, Small Businesses, Large Enterprises, E-commerce Platforms |

| Technology | NFC, Blockchain, Biometrics, Cloud-Based Solutions |

| End User | Retail, Hospitality, Transportation, Entertainment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Mobile Payments Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at