444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan card payments market represents one of the most sophisticated and rapidly evolving financial ecosystems in Asia-Pacific, characterized by a unique blend of traditional payment preferences and cutting-edge digital innovation. Japan’s payment landscape has undergone remarkable transformation over the past decade, driven by government initiatives, technological advancement, and changing consumer behaviors. The market demonstrates exceptional growth potential, with digital payment adoption rates increasing by approximately 23% annually as traditional cash-dependent consumers embrace electronic payment solutions.

Market dynamics in Japan reflect a fascinating convergence of cultural payment traditions and modern financial technology. While Japan historically maintained strong preferences for cash transactions, recent years have witnessed accelerated adoption of contactless payments, mobile wallets, and traditional card-based solutions. The market encompasses diverse payment methods including credit cards, debit cards, prepaid cards, and emerging digital payment platforms, each serving distinct consumer segments and use cases.

Technological infrastructure supporting Japan’s card payments ecosystem ranks among the world’s most advanced, featuring sophisticated point-of-sale systems, secure payment processing networks, and innovative mobile payment integration. The market benefits from robust regulatory frameworks, strong consumer protection measures, and continuous investment in payment security technologies. Growth projections indicate sustained expansion at approximately 8.2% CAGR through the forecast period, driven by increasing merchant acceptance, enhanced user experiences, and supportive government policies promoting cashless society initiatives.

The Japan card payments market refers to the comprehensive ecosystem encompassing all electronic payment transactions conducted through physical and digital card-based instruments within Japan’s domestic economy. This market includes traditional credit and debit card transactions, prepaid card usage, contactless payments, mobile wallet integrations, and emerging digital payment solutions that utilize card-based authentication and processing infrastructure.

Card payment systems in Japan operate through sophisticated networks connecting consumers, merchants, financial institutions, and payment processors. The market encompasses both domestic payment schemes and international card networks, facilitating seamless transactions across retail, e-commerce, transportation, and service sectors. Payment processing involves complex technological infrastructure supporting authorization, clearing, and settlement processes while maintaining stringent security standards and regulatory compliance.

Market scope extends beyond simple transaction processing to include value-added services such as loyalty programs, fraud prevention, data analytics, and integrated financial services. The ecosystem supports diverse stakeholders including card issuers, acquirers, payment processors, technology providers, and regulatory bodies, all contributing to a comprehensive payment infrastructure that serves Japan’s unique market requirements and consumer preferences.

Japan’s card payments market stands at a pivotal transformation point, transitioning from a traditionally cash-centric economy to an increasingly digital payment landscape. The market demonstrates remarkable resilience and adaptability, with contactless payment adoption reaching approximately 67% penetration among urban consumers. This shift represents fundamental changes in consumer behavior, merchant acceptance, and payment infrastructure development across the Japanese economy.

Key market drivers include government-led cashless society initiatives, increasing foreign tourism, enhanced payment security measures, and growing consumer demand for convenient payment solutions. The market benefits from strong technological foundations, widespread smartphone adoption, and robust financial services infrastructure. Credit card usage continues expanding, while emerging payment methods gain traction among younger demographics and tech-savvy consumers.

Competitive landscape features both domestic and international players, with traditional financial institutions competing alongside fintech innovators and technology companies. Market leaders focus on enhancing user experiences, expanding merchant networks, and developing integrated payment solutions that address Japan’s unique cultural and business requirements. Innovation trends emphasize seamless integration, enhanced security, and value-added services that differentiate payment offerings in an increasingly competitive environment.

Strategic insights reveal several critical factors shaping Japan’s card payments market evolution. The market demonstrates strong correlation between technological advancement and consumer adoption, with mobile payment integration driving significant growth in card-based transactions. Demographic analysis indicates varying adoption patterns across age groups, with younger consumers leading digital payment adoption while older demographics gradually embrace electronic payment solutions.

Government initiatives serve as primary catalysts driving Japan’s card payments market expansion. The Japanese government’s comprehensive cashless society promotion strategy includes targeted incentives, infrastructure development programs, and regulatory reforms designed to accelerate electronic payment adoption. Policy measures such as consumption tax incentives for cashless payments and point reward programs have significantly influenced consumer behavior and merchant acceptance rates.

Technological advancement represents another crucial driver, with continuous innovation in payment processing, security measures, and user interface design. The proliferation of smartphone technology and mobile internet connectivity has enabled seamless integration of card payments with digital platforms, creating convenient and secure payment experiences. Contactless payment technology has gained particular traction, offering speed and convenience that appeals to Japan’s efficiency-focused culture.

Demographic shifts contribute significantly to market growth, as younger generations demonstrate strong preferences for digital payment solutions. Urbanization trends and changing lifestyle patterns support increased card payment adoption, while growing international tourism creates demand for globally accepted payment methods. E-commerce expansion further drives card payment usage, as online shopping requires electronic payment solutions and builds consumer familiarity with digital transactions.

Merchant adoption has accelerated due to operational efficiency benefits, reduced cash handling costs, and enhanced customer service capabilities. Small and medium enterprises increasingly recognize card payment acceptance as essential for business competitiveness, while large retailers invest in advanced payment infrastructure to improve customer experiences and operational efficiency.

Cultural payment preferences continue presenting challenges to card payment market expansion in Japan. Despite significant progress, many consumers maintain strong preferences for cash transactions, viewing physical currency as more secure, private, and culturally appropriate. Generational differences in payment adoption create market segmentation challenges, requiring tailored approaches to address varying consumer comfort levels with electronic payment technologies.

Implementation costs represent significant barriers for smaller merchants considering card payment acceptance. Terminal equipment expenses, transaction processing fees, and ongoing maintenance costs can strain limited budgets, particularly for traditional small businesses operating on thin profit margins. Technical complexity associated with payment system integration and staff training further complicates adoption decisions for resource-constrained merchants.

Security concerns remain prominent among consumers and merchants, despite advanced fraud prevention measures and regulatory protections. Data privacy considerations and potential cybersecurity risks create hesitation among security-conscious consumers. Fraud incidents and payment disputes, while relatively rare, receive significant media attention and can negatively impact consumer confidence in electronic payment systems.

Regulatory complexity and compliance requirements create operational challenges for payment service providers and merchants. Evolving regulations require continuous adaptation and investment in compliance systems, while international payment processing involves additional regulatory considerations that can complicate cross-border transaction capabilities.

Digital transformation initiatives across Japanese businesses create substantial opportunities for card payment market expansion. Enterprise digitization programs increasingly include payment system modernization, creating demand for integrated payment solutions that support business process optimization. Industry 4.0 adoption presents opportunities for innovative payment integration with automated systems, IoT devices, and smart business applications.

Tourism recovery following global travel normalization represents significant market opportunity, as international visitors typically rely on card-based payment methods. Inbound tourism growth creates demand for globally compatible payment infrastructure and multilingual payment experiences. Olympic legacy effects continue supporting payment infrastructure development and international payment acceptance capabilities.

Financial inclusion initiatives offer opportunities to expand card payment access among underserved populations and rural communities. Digital banking expansion and mobile payment solutions can reach consumers previously excluded from traditional banking services. Senior citizen engagement programs focusing on simplified payment technologies present untapped market segments with significant growth potential.

Cross-industry partnerships enable innovative payment solution development addressing specific sector requirements. Retail integration opportunities include loyalty program enhancement, inventory management integration, and personalized customer experience development. Transportation sector collaboration supports seamless payment integration across public transit, ride-sharing, and logistics services.

Competitive dynamics in Japan’s card payments market reflect intense competition between established financial institutions, international payment networks, and emerging fintech companies. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to enhance service offerings and expand market reach. Innovation cycles accelerate as competitors introduce advanced features, improved user experiences, and integrated financial services to differentiate their offerings.

Consumer behavior evolution demonstrates increasing sophistication in payment method selection, with users choosing optimal payment solutions based on transaction context, security requirements, and reward benefits. Multi-payment adoption patterns show consumers maintaining diverse payment portfolios rather than relying on single payment methods. Usage analytics reveal growing preference for contactless payments, with adoption rates reaching approximately 72% among frequent card users.

Technological disruption continues reshaping market dynamics through artificial intelligence, blockchain technology, and advanced analytics integration. Payment processing efficiency improvements enable faster transaction authorization and settlement, while fraud detection capabilities enhance security without compromising user experience. Data analytics applications provide valuable insights for merchants and payment providers, supporting personalized services and targeted marketing initiatives.

Regulatory evolution influences market dynamics through progressive policies supporting innovation while maintaining consumer protection standards. Open banking initiatives create opportunities for new market entrants and innovative service development, while data protection regulations ensure responsible handling of sensitive payment information.

Comprehensive research approach employed for Japan card payments market analysis combines quantitative data collection with qualitative insights from industry stakeholders. Primary research methodology includes structured interviews with payment industry executives, financial institution representatives, merchant organizations, and consumer focus groups representing diverse demographic segments across Japan’s major metropolitan and rural areas.

Secondary research sources encompass government publications, central bank reports, industry association data, and regulatory filings from major payment service providers. Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification. Market sizing methodology utilizes transaction volume analysis, merchant adoption tracking, and consumer usage pattern assessment to develop comprehensive market understanding.

Analytical frameworks include competitive landscape mapping, SWOT analysis, and trend identification through longitudinal data analysis. Forecasting models incorporate historical growth patterns, regulatory impact assessment, and technological adoption curves to project market development scenarios. Regional analysis examines market variations across Japan’s prefectures, considering economic conditions, demographic factors, and infrastructure development levels.

Quality assurance measures include peer review processes, data triangulation, and continuous methodology refinement based on market feedback and emerging research best practices. Stakeholder validation ensures research findings accurately reflect market realities and provide actionable insights for industry participants and policy makers.

Tokyo metropolitan area dominates Japan’s card payments market, accounting for approximately 38% of total transaction volume and serving as the primary innovation hub for payment technology development. Urban payment adoption in Tokyo significantly exceeds national averages, with contactless payment penetration reaching 82% among regular card users. The region benefits from dense merchant networks, advanced payment infrastructure, and high consumer income levels supporting premium payment services adoption.

Osaka and Kansai region represents the second-largest market segment, characterized by strong commercial activity and growing fintech ecosystem development. Regional payment preferences show increasing alignment with national trends, though traditional payment methods maintain stronger presence compared to Tokyo. Merchant adoption rates continue expanding, particularly among small and medium enterprises recognizing competitive advantages of electronic payment acceptance.

Rural and suburban markets present significant growth opportunities despite slower adoption rates compared to major metropolitan areas. Infrastructure development programs supported by government initiatives are improving payment technology access in underserved regions. Agricultural and tourism sectors in rural areas increasingly adopt card payment solutions to serve domestic and international customers, contributing to regional market expansion.

Regional variations in payment adoption reflect local economic conditions, demographic characteristics, and cultural factors. Northern prefectures demonstrate growing interest in mobile payment integration, while southern regions show strong tourism-driven demand for international payment acceptance. Industrial centers focus on B2B payment solutions and supply chain payment integration, creating specialized market segments with unique requirements and growth potential.

Market leadership in Japan’s card payments sector reflects diverse competitive dynamics among domestic financial institutions, international payment networks, and emerging technology companies. Established players leverage extensive branch networks, customer relationships, and regulatory expertise to maintain market positions while investing heavily in digital transformation initiatives.

Competitive strategies emphasize user experience enhancement, merchant network expansion, and value-added service development. Innovation focus areas include artificial intelligence integration, blockchain technology exploration, and seamless omnichannel payment experiences. Partnership approaches involve collaboration between traditional financial institutions and technology companies to combine regulatory expertise with innovative capabilities.

Market segmentation analysis reveals distinct patterns across multiple dimensions, providing comprehensive understanding of Japan’s card payments ecosystem structure and growth opportunities. Segmentation frameworks consider payment method types, user demographics, merchant categories, and transaction contexts to identify specific market dynamics and development trends.

By Payment Method:

By User Demographics:

By Merchant Categories:

Credit card segment maintains dominant position in Japan’s card payments market, benefiting from established consumer familiarity, comprehensive reward programs, and extensive merchant acceptance networks. Premium credit cards show particular strength among high-income consumers, while standard credit offerings focus on accessibility and basic reward features. Credit card innovation emphasizes enhanced security features, mobile integration, and personalized reward programs tailored to individual spending patterns.

Debit card adoption demonstrates steady growth driven by real-time transaction processing and direct bank account integration benefits. Young consumers particularly favor debit cards for budget management and spending control capabilities. Contactless debit cards gain traction for small-value transactions, while mobile debit solutions integrate seamlessly with smartphone banking applications.

Prepaid card market serves diverse use cases including gift cards, transportation payments, and spending control applications. Corporate prepaid solutions support employee expense management and business payment processing. Digital prepaid platforms enable flexible loading and spending across multiple merchant categories, while specialized prepaid cards target specific demographics and usage scenarios.

Contactless payment category experiences rapid expansion with adoption rates increasing by approximately 34% annually among active card users. Near-field communication technology enables quick and secure transactions, particularly appealing for high-frequency, low-value purchases. Wearable payment devices and mobile contactless solutions extend contactless payment capabilities beyond traditional card formats.

Financial institutions benefit from card payments market expansion through increased transaction fee revenue, enhanced customer engagement, and valuable transaction data insights. Digital payment adoption enables banks to reduce operational costs associated with cash handling while providing opportunities for cross-selling financial products and services. Customer relationship enhancement through integrated payment solutions strengthens loyalty and increases lifetime customer value.

Merchants and retailers gain significant operational advantages through card payment acceptance, including reduced cash handling costs, improved transaction security, and enhanced customer convenience. Sales growth opportunities emerge from increased average transaction values and impulse purchase facilitation. Data analytics capabilities provide valuable customer insights supporting inventory management, marketing optimization, and business strategy development.

Consumers experience enhanced convenience, security, and financial management capabilities through card payment adoption. Reward programs and loyalty benefits provide additional value, while fraud protection measures offer security advantages over cash transactions. Digital integration enables seamless online and offline payment experiences, supporting modern lifestyle requirements and preferences.

Technology providers benefit from growing demand for payment processing infrastructure, security solutions, and innovative payment applications. Market expansion creates opportunities for specialized service development and strategic partnerships with financial institutions and merchants. Innovation drivers include artificial intelligence, blockchain technology, and mobile platform integration, supporting continuous technology advancement and market differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless payment acceleration represents the most significant trend shaping Japan’s card payments market, with tap-and-go transactions becoming standard across retail environments. Hygiene considerations and speed requirements drive consumer preference shifts toward contactless solutions, while merchants invest in compatible terminal infrastructure. Wearable payment integration extends contactless capabilities to smartwatches and fitness devices, creating seamless payment experiences for active consumers.

Mobile wallet integration demonstrates strong momentum as smartphone penetration reaches saturation levels across Japanese demographics. QR code payments gain popularity for their simplicity and low implementation costs, particularly among small merchants. Biometric authentication integration enhances security while maintaining user convenience, with fingerprint and facial recognition becoming standard features in mobile payment applications.

Artificial intelligence adoption transforms fraud detection, customer service, and personalized recommendation systems within card payment platforms. Machine learning algorithms analyze transaction patterns to identify suspicious activities and prevent fraudulent transactions in real-time. Chatbot integration provides instant customer support and transaction assistance, improving user experiences and reducing operational costs for payment service providers.

Sustainability initiatives influence payment industry development through digital receipt systems, reduced plastic card production, and environmentally conscious business practices. Carbon footprint reduction becomes competitive differentiator as environmentally aware consumers prefer sustainable payment solutions. Digital-first approaches minimize physical infrastructure requirements while supporting remote and contactless service delivery models.

Regulatory milestone achievements include the implementation of enhanced open banking frameworks enabling third-party payment service integration and innovation. Payment Services Act revisions create clearer guidelines for fintech companies while maintaining consumer protection standards. Cross-border payment regulations facilitate international transaction processing and support Japan’s growing role in global digital commerce.

Technology infrastructure upgrades across major payment networks enhance processing capacity, security measures, and real-time transaction capabilities. 5G network deployment enables faster mobile payment processing and supports advanced features such as augmented reality shopping experiences with integrated payment solutions. Cloud computing adoption improves scalability and reduces operational costs for payment service providers.

Strategic partnership formations between traditional financial institutions and technology companies accelerate innovation and market expansion. MarkWide Research analysis indicates that collaborative approaches combining banking expertise with technological innovation produce superior customer experiences and competitive advantages. International expansion initiatives by Japanese payment companies create global market opportunities and strengthen domestic market positions.

Consumer education programs launched by government agencies and industry associations improve payment security awareness and digital literacy. Merchant support initiatives provide training and technical assistance for small businesses adopting card payment systems. Financial inclusion projects target underserved populations with simplified payment solutions and accessible technology interfaces.

Strategic recommendations for market participants emphasize customer-centric innovation, security enhancement, and sustainable growth strategies. Payment service providers should prioritize user experience optimization while maintaining robust security measures and regulatory compliance. Investment priorities should focus on mobile platform development, artificial intelligence integration, and contactless payment infrastructure expansion.

Merchant engagement strategies require tailored approaches addressing specific industry requirements and business sizes. Small business support programs should include simplified onboarding processes, competitive pricing structures, and comprehensive technical support. Enterprise solutions must integrate with existing business systems while providing advanced analytics and reporting capabilities.

Consumer adoption acceleration requires targeted education campaigns, incentive programs, and gradual migration strategies respecting cultural payment preferences. Senior citizen engagement demands simplified interfaces, enhanced security communication, and patient support services. Youth market development should leverage social media integration, gamification elements, and peer-to-peer payment capabilities.

Partnership development opportunities exist across retail, transportation, hospitality, and technology sectors. Cross-industry collaboration can create integrated payment ecosystems serving multiple consumer touchpoints. International expansion should consider cultural adaptation, regulatory compliance, and local partnership strategies for sustainable market entry and growth.

Long-term market projections indicate sustained growth in Japan’s card payments sector, with digital payment adoption expected to reach approximately 85% penetration among active consumers within the next five years. Technological advancement will continue driving innovation in payment processing, security measures, and user experience design. Government support for cashless society initiatives ensures continued policy backing for market development and infrastructure investment.

Emerging technologies including blockchain, quantum computing, and advanced biometrics will reshape payment security and processing capabilities. Internet of Things integration will enable automated payments for connected devices and smart city applications. Artificial intelligence evolution will provide increasingly sophisticated fraud detection, customer service, and personalized financial services within payment platforms.

Market consolidation trends may accelerate as companies seek scale advantages and comprehensive service offerings. Fintech integration with traditional financial institutions will create hybrid business models combining innovation with regulatory expertise. International connectivity will strengthen as Japan’s payment infrastructure integrates more closely with global networks and cross-border commerce platforms.

Consumer behavior evolution will continue favoring convenient, secure, and integrated payment solutions that seamlessly connect with digital lifestyle requirements. MWR projections suggest that mobile-first payment approaches will dominate new user acquisition, while traditional card products will evolve to include advanced digital features and enhanced security measures supporting Japan’s transition toward a comprehensive cashless society.

Japan’s card payments market represents a dynamic and rapidly evolving ecosystem positioned for sustained growth and innovation. The market successfully balances respect for traditional payment preferences with embrace of cutting-edge digital technologies, creating unique opportunities for service providers, merchants, and consumers. Government support, technological advancement, and changing consumer behaviors converge to drive market expansion while maintaining high standards for security, reliability, and user experience.

Strategic success factors include customer-centric innovation, robust security measures, and adaptive business models that respond to evolving market conditions and consumer preferences. Market participants who invest in technology infrastructure, prioritize user experience, and develop comprehensive service offerings will capture the greatest opportunities in Japan’s transforming payment landscape. Collaborative approaches between traditional financial institutions and innovative technology companies will continue producing superior solutions that serve Japan’s unique market requirements while supporting broader economic digitization objectives.

What is Card Payments?

Card payments refer to transactions made using credit, debit, or prepaid cards, allowing consumers to make purchases electronically. This method is widely used in various sectors, including retail, e-commerce, and hospitality.

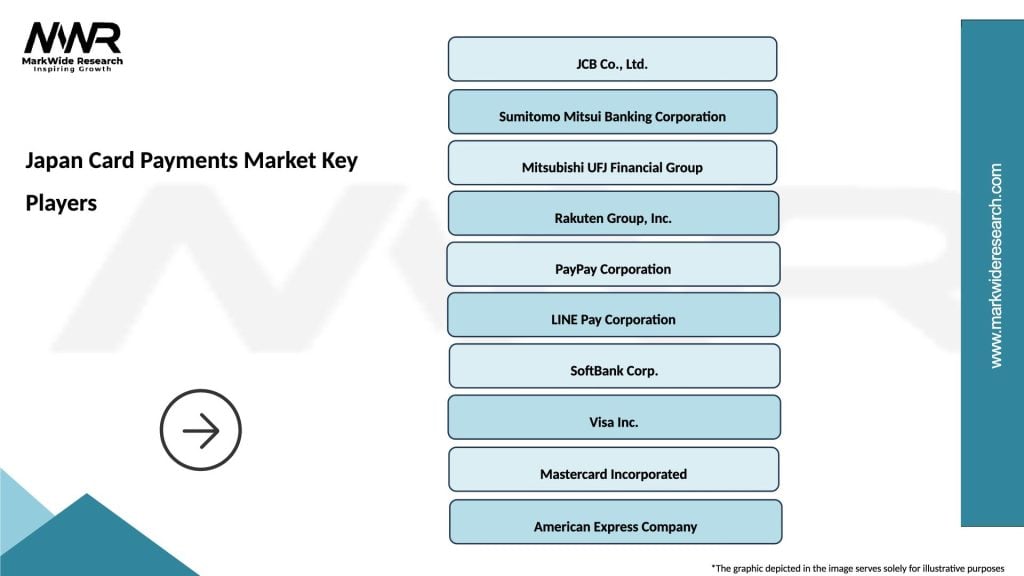

What are the key players in the Japan Card Payments Market?

Key players in the Japan Card Payments Market include companies like JCB, Rakuten, and Sumitomo Mitsui Banking Corporation, which provide various card payment solutions and services, among others.

What are the growth factors driving the Japan Card Payments Market?

The Japan Card Payments Market is driven by factors such as the increasing adoption of contactless payment technologies, the rise of e-commerce, and consumer preferences for cashless transactions.

What challenges does the Japan Card Payments Market face?

Challenges in the Japan Card Payments Market include concerns over cybersecurity, the need for regulatory compliance, and competition from alternative payment methods like mobile wallets.

What opportunities exist in the Japan Card Payments Market?

Opportunities in the Japan Card Payments Market include the expansion of digital payment platforms, the integration of advanced technologies like AI for fraud detection, and the growing demand for seamless cross-border transactions.

What trends are shaping the Japan Card Payments Market?

Trends in the Japan Card Payments Market include the increasing use of biometric authentication, the rise of subscription-based payment models, and the growing emphasis on enhancing customer experience through personalized payment solutions.

Japan Card Payments Market

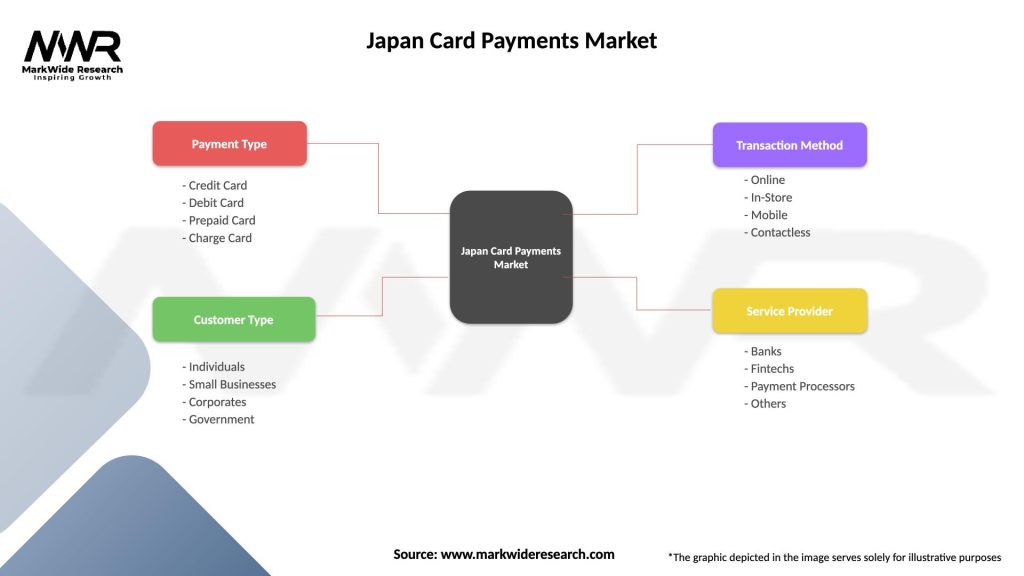

| Segmentation Details | Description |

|---|---|

| Payment Type | Credit Card, Debit Card, Prepaid Card, Charge Card |

| Customer Type | Individuals, Small Businesses, Corporates, Government |

| Transaction Method | Online, In-Store, Mobile, Contactless |

| Service Provider | Banks, Fintechs, Payment Processors, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Card Payments Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at