444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France bakeware market represents a dynamic and evolving segment within the broader European kitchenware industry, characterized by strong consumer demand for high-quality baking solutions and innovative culinary tools. French consumers demonstrate a sophisticated appreciation for premium baking equipment, driven by the nation’s rich culinary heritage and growing home baking culture. The market encompasses a diverse range of products including cake pans, cookie sheets, muffin tins, bread loaf pans, specialty molds, and professional-grade baking accessories.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% annual growth rate as more French households embrace artisanal baking and gourmet cooking practices. The increasing popularity of baking shows, culinary education programs, and social media cooking content has significantly influenced consumer purchasing behavior, creating sustained demand for both traditional and innovative bakeware solutions.

Premium materials such as carbon steel, silicone, ceramic, and non-stick coatings dominate product preferences, reflecting French consumers’ emphasis on quality, durability, and cooking performance. The market benefits from strong domestic manufacturing capabilities alongside strategic imports of specialized baking equipment, creating a competitive landscape that serves diverse consumer segments from amateur home bakers to professional pastry chefs.

The France bakeware market refers to the comprehensive ecosystem of baking tools, pans, molds, and accessories specifically designed for bread, pastry, cake, and confectionery preparation within the French domestic and commercial sectors. This market encompasses both traditional French baking implements and modern innovative solutions that cater to evolving consumer preferences and culinary trends.

Bakeware products in this market include essential items such as tart pans, brioche molds, baguette trays, croissant forms, and specialized equipment for creating classic French pastries and breads. The market also incorporates modern conveniences like non-stick surfaces, heat-resistant silicone materials, and multi-functional designs that appeal to contemporary French cooking enthusiasts.

Market scope extends beyond basic functionality to include aesthetic considerations, ergonomic design features, and sustainability factors that align with French consumer values regarding quality craftsmanship and environmental responsibility in kitchen equipment selection.

Strategic analysis reveals the France bakeware market as a resilient and growth-oriented sector benefiting from cultural affinity for baking excellence and increasing consumer investment in premium kitchen equipment. The market demonstrates strong fundamentals supported by demographic trends, lifestyle changes, and sustained interest in culinary arts across multiple consumer segments.

Key growth drivers include the rising popularity of home baking activities, increased focus on artisanal food preparation, and growing consumer awareness of baking technique importance. Professional-grade equipment adoption among home users represents 34% of premium segment growth, indicating sophisticated consumer preferences and willingness to invest in superior baking tools.

Market segmentation reveals diverse opportunities across material types, price points, and application categories. Premium segments show particularly strong performance, with ceramic and professional-grade metal bakeware experiencing accelerated adoption rates among quality-conscious French consumers.

Competitive landscape features established European manufacturers alongside emerging innovative brands, creating dynamic market conditions that foster product innovation and competitive pricing strategies. Distribution channels continue evolving with increased emphasis on e-commerce platforms and specialty kitchenware retailers.

Consumer behavior analysis indicates several critical trends shaping the France bakeware market landscape. French consumers increasingly prioritize quality over quantity, seeking durable, versatile baking equipment that delivers consistent professional-level results in home kitchen environments.

Innovation trends emphasize smart features, improved non-stick technologies, and ergonomic designs that enhance user experience while maintaining traditional baking performance standards that French consumers expect from quality bakeware products.

Cultural heritage serves as a fundamental driver for the France bakeware market, with deep-rooted traditions of bread making, pastry creation, and culinary excellence creating sustained demand for quality baking equipment. French consumers maintain strong connections to artisanal food preparation methods, driving consistent investment in premium baking tools.

Home baking renaissance represents a significant growth catalyst, accelerated by lifestyle changes and increased time spent in home environments. This trend has expanded beyond traditional demographics to include younger consumers seeking creative outlets and stress-relief activities through baking pursuits.

Television and media influence continues driving market expansion through popular baking competitions, cooking shows, and celebrity chef endorsements that inspire consumers to upgrade their baking equipment and attempt more sophisticated recipes requiring specialized tools.

Health consciousness motivates consumers to prepare homemade baked goods using controlled ingredients, creating demand for reliable bakeware that enables consistent results in health-focused baking applications including gluten-free, organic, and reduced-sugar preparations.

Gift market dynamics contribute significantly to market growth, with quality bakeware serving as popular presents for weddings, housewarmings, and culinary enthusiasts, supporting premium segment performance and brand recognition development.

Economic sensitivity poses challenges for the France bakeware market, particularly in premium segments where high-quality materials and manufacturing processes result in elevated price points that may limit accessibility for budget-conscious consumers during economic uncertainty periods.

Storage limitations in typical French urban housing create constraints for consumers considering extensive bakeware collections, potentially limiting purchase decisions for larger or specialized items that require significant kitchen storage space.

Competition from alternatives includes ready-made bakery products and convenience foods that may reduce home baking frequency among time-constrained consumers, potentially impacting overall market demand for baking equipment.

Material concerns regarding non-stick coatings and certain manufacturing processes create consumer hesitation, particularly among health-conscious segments that prioritize natural materials and sustainable production methods in kitchen equipment selection.

Learning curve barriers may discourage novice bakers from investing in specialized or professional-grade equipment, potentially limiting market expansion among inexperienced consumers who prefer simpler, more forgiving baking tools.

E-commerce expansion presents substantial growth opportunities for the France bakeware market, enabling manufacturers and retailers to reach broader consumer bases while providing detailed product information, customer reviews, and educational content that supports informed purchasing decisions.

Sustainability initiatives offer significant market potential through development of eco-friendly materials, recyclable packaging, and manufacturing processes that align with growing French consumer environmental consciousness and corporate responsibility expectations.

Educational partnerships with culinary schools, cooking classes, and professional development programs create opportunities for bakeware manufacturers to demonstrate product capabilities while building brand loyalty among serious baking enthusiasts and aspiring professionals.

Smart technology integration represents an emerging opportunity area, with potential for temperature-monitoring capabilities, app connectivity, and other digital features that appeal to tech-savvy consumers seeking enhanced baking precision and convenience.

Export market development leverages French culinary reputation to expand into international markets, particularly targeting consumers who associate French baking traditions with quality and sophistication in kitchen equipment selection.

Supply chain evolution continues reshaping the France bakeware market through improved manufacturing efficiency, strategic sourcing partnerships, and logistics optimization that enables competitive pricing while maintaining quality standards expected by discerning French consumers.

Consumer education initiatives drive market dynamics by increasing awareness of proper baking techniques, equipment care, and product selection criteria that influence purchasing decisions and brand preferences among both novice and experienced home bakers.

Seasonal fluctuations create predictable market patterns with increased demand during holiday periods, back-to-school seasons, and spring cooking preparation times, enabling manufacturers and retailers to optimize inventory management and promotional strategies.

Innovation cycles accelerate market evolution through continuous product development, material improvements, and design enhancements that respond to changing consumer preferences and emerging baking trends within the French culinary landscape.

Regulatory influences shape market dynamics through food safety standards, material regulations, and import requirements that affect product development, manufacturing processes, and market entry strategies for both domestic and international bakeware suppliers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the France bakeware market landscape. Primary research includes consumer surveys, retailer interviews, and manufacturer consultations that provide direct market intelligence and trend identification.

Secondary research integration incorporates industry reports, trade publications, government statistics, and economic indicators that contextualize market findings within broader French retail and consumer goods sectors. This approach ensures comprehensive understanding of market forces and competitive dynamics.

Data validation processes utilize triangulation methods combining quantitative sales data, qualitative consumer feedback, and expert industry opinions to verify market insights and ensure analytical accuracy throughout the research process.

Trend analysis methodology examines historical market performance, current consumer behavior patterns, and emerging industry developments to identify growth opportunities and potential challenges facing the France bakeware market.

Segmentation analysis employs demographic, psychographic, and behavioral criteria to understand distinct consumer groups, their preferences, and purchasing patterns that influence market development and strategic planning initiatives.

Paris metropolitan region dominates the France bakeware market, accounting for approximately 35% of national sales volume due to high population density, elevated disposable income levels, and strong culinary culture that supports premium bakeware adoption among urban consumers.

Lyon and southeastern regions demonstrate robust market performance driven by culinary traditions and proximity to Italian influences that emphasize artisanal baking techniques. These areas show particular strength in traditional bakeware categories and specialty items for regional pastry preparations.

Northern France regions including Lille and surrounding areas exhibit growing market participation, with increasing consumer interest in home baking activities and investment in quality kitchen equipment that supports diverse baking applications.

Southwestern regions centered around Toulouse and Bordeaux show steady market growth supported by agricultural connections and rural baking traditions that create demand for both traditional and modern bakeware solutions.

Coastal regions demonstrate seasonal market variations with increased bakeware purchases during tourist seasons and holiday periods, creating opportunities for retailers to capitalize on temporary population increases and gift purchasing patterns.

Market leadership in the France bakeware sector features a diverse mix of established European manufacturers, innovative specialty brands, and strategic international players that compete across multiple product categories and price segments.

Competitive strategies emphasize product differentiation through material innovation, design aesthetics, and performance characteristics that appeal to specific consumer segments within the diverse French bakeware market landscape.

By Material Type:

By Product Category:

By End User:

Premium ceramic bakeware demonstrates exceptional performance in the French market, with brands like Emile Henry leading through heritage craftsmanship and innovative glazing techniques that appeal to quality-conscious consumers seeking both functionality and aesthetic appeal in their baking equipment.

Professional-grade metal bakeware shows strong growth among serious home bakers who prioritize performance characteristics such as even heat distribution, durability, and professional results. This segment benefits from increased culinary education and aspirational cooking trends.

Silicone bakeware category attracts convenience-focused consumers with easy-release properties, dishwasher compatibility, and storage flexibility. However, traditional French bakers sometimes express preferences for conventional materials that align with classical baking techniques.

Specialty molds segment maintains cultural significance in France, with traditional forms for madeleines, canelés, and other regional pastries continuing to generate steady demand despite broader market modernization trends.

Multi-functional bakeware appeals to space-conscious urban consumers who value versatility in kitchen equipment, driving innovation in convertible designs and stackable solutions that maximize utility while minimizing storage requirements.

Manufacturers benefit from the France bakeware market through opportunities to showcase premium craftsmanship, innovative materials, and design excellence that resonate with sophisticated French consumers who appreciate quality kitchen equipment and culinary heritage.

Retailers gain advantages through diverse product portfolios that serve multiple consumer segments, seasonal sales opportunities, and potential for high-margin specialty items that appeal to culinary enthusiasts and gift purchasers seeking distinctive baking equipment.

Consumers receive value through access to high-quality baking tools that enhance cooking experiences, improve baking results, and provide long-term durability that justifies investment in premium kitchen equipment for serious home baking applications.

Distributors capitalize on growing e-commerce opportunities, educational partnerships with culinary institutions, and expanding market reach through digital platforms that connect specialized bakeware products with targeted consumer segments.

Suppliers benefit from stable demand patterns, opportunities for material innovation, and partnerships with established brands that value quality components and sustainable manufacturing processes in bakeware production.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend in the France bakeware market, with consumers increasingly seeking products manufactured through environmentally responsible processes using recyclable materials and minimal packaging that aligns with broader environmental consciousness.

Professional-grade adoption continues accelerating among home bakers who desire commercial-quality results, driving demand for heavy-duty construction, superior heat distribution, and durability characteristics typically associated with professional kitchen equipment.

Multi-functional design gains prominence as urban consumers prioritize versatile equipment that serves multiple purposes while minimizing storage requirements, leading to innovative products that combine traditional baking functions with modern convenience features.

Digital integration represents an emerging trend with smart bakeware featuring temperature monitoring, app connectivity, and guided baking assistance that appeals to tech-savvy consumers seeking precision and convenience in their baking activities.

Artisanal aesthetics influence product design with consumers seeking bakeware that reflects craftsmanship values and traditional manufacturing techniques, even in modern materials and functional applications that serve contemporary baking needs.

Material innovations continue advancing the France bakeware market through development of improved non-stick coatings, enhanced ceramic formulations, and sustainable material alternatives that address consumer concerns while maintaining performance standards expected in quality baking equipment.

Manufacturing automation enables producers to achieve consistent quality while managing costs, particularly important in competitive market segments where price sensitivity influences consumer purchasing decisions without compromising product reliability.

Retail channel evolution includes expansion of specialty kitchenware stores, enhanced e-commerce platforms, and strategic partnerships with culinary education providers that create new distribution opportunities and customer engagement methods.

Brand collaborations between bakeware manufacturers and celebrity chefs, cooking show personalities, and culinary influencers create marketing opportunities that demonstrate product capabilities while building consumer confidence and brand recognition.

Regulatory developments regarding food safety standards and material certifications influence product development processes, ensuring consumer protection while potentially creating barriers for lower-quality imports that compete on price rather than performance.

MarkWide Research recommends that manufacturers focus on premium segment development through material innovation and design excellence that justifies higher price points while delivering superior performance characteristics valued by sophisticated French consumers.

Investment priorities should emphasize sustainability initiatives, digital marketing capabilities, and e-commerce platform optimization that align with evolving consumer preferences and shopping behaviors in the post-pandemic marketplace environment.

Product development strategies should balance traditional French baking requirements with modern convenience features, creating solutions that respect culinary heritage while addressing contemporary lifestyle needs and kitchen space constraints.

Market expansion opportunities exist through educational partnerships, professional endorsements, and targeted marketing campaigns that demonstrate product capabilities while building brand loyalty among serious baking enthusiasts and aspiring culinary professionals.

Competitive positioning requires clear value propositions that differentiate products through quality, performance, or unique features rather than competing solely on price in increasingly crowded market segments with diverse consumer preferences.

Long-term growth prospects for the France bakeware market remain positive, supported by cultural affinity for quality baking, increasing consumer investment in home cooking capabilities, and continued innovation in materials and design that enhance baking experiences and results.

Technology integration will likely accelerate with smart features becoming more prevalent, though traditional segments will continue serving consumers who prefer conventional baking methods and equipment that emphasizes craftsmanship over technological complexity.

Market consolidation may occur as smaller manufacturers face competitive pressures, while established brands with strong market positions and innovation capabilities are expected to capture increasing market share through strategic product development and marketing initiatives.

Sustainability requirements will become increasingly important, with MWR projecting that eco-friendly products could represent 48% of premium segment purchases within the next five years as environmental consciousness continues influencing consumer purchasing decisions.

Export opportunities leveraging French culinary reputation present significant growth potential, particularly in markets where French baking traditions and quality craftsmanship command premium positioning and consumer respect for authentic culinary equipment.

The France bakeware market represents a dynamic and resilient sector characterized by strong cultural foundations, sophisticated consumer preferences, and continuous innovation that serves diverse baking needs across multiple market segments. The combination of traditional French culinary heritage and modern lifestyle requirements creates unique opportunities for manufacturers and retailers who understand local market nuances.

Growth drivers including home baking popularity, premium quality appreciation, and sustainability consciousness support positive market outlook despite challenges from economic sensitivity and competitive pressures. The market’s ability to adapt to changing consumer preferences while maintaining quality standards positions it well for continued expansion.

Strategic success in this market requires balancing respect for traditional baking methods with innovation that addresses contemporary consumer needs, creating products that deliver superior performance while reflecting the craftsmanship values that French consumers associate with quality kitchen equipment and culinary excellence.

What is Bakeware?

Bakeware refers to a variety of kitchen tools and utensils specifically designed for baking. This includes items such as baking sheets, cake pans, muffin tins, and casserole dishes, which are essential for preparing baked goods like bread, cakes, and pastries.

What are the key players in the France Bakeware Market?

Key players in the France Bakeware Market include companies like Pyrex, Tefal, and Le Creuset, which are known for their high-quality bakeware products. These companies offer a range of items that cater to both amateur and professional bakers, among others.

What are the growth factors driving the France Bakeware Market?

The France Bakeware Market is driven by increasing consumer interest in home baking and cooking, as well as the rise of social media platforms showcasing baking trends. Additionally, the growing popularity of baking as a hobby has led to higher demand for diverse bakeware products.

What challenges does the France Bakeware Market face?

Challenges in the France Bakeware Market include intense competition among manufacturers and the need for continuous innovation to meet changing consumer preferences. Additionally, fluctuations in raw material prices can impact production costs and pricing strategies.

What opportunities exist in the France Bakeware Market?

The France Bakeware Market presents opportunities for growth through the introduction of eco-friendly and sustainable bakeware options. There is also potential for expanding online sales channels to reach a broader audience of baking enthusiasts.

What trends are shaping the France Bakeware Market?

Trends in the France Bakeware Market include the increasing popularity of non-stick and silicone bakeware, which offer convenience and ease of use. Additionally, there is a growing interest in personalized and decorative bakeware that caters to specific baking styles and occasions.

France Bakeware Market

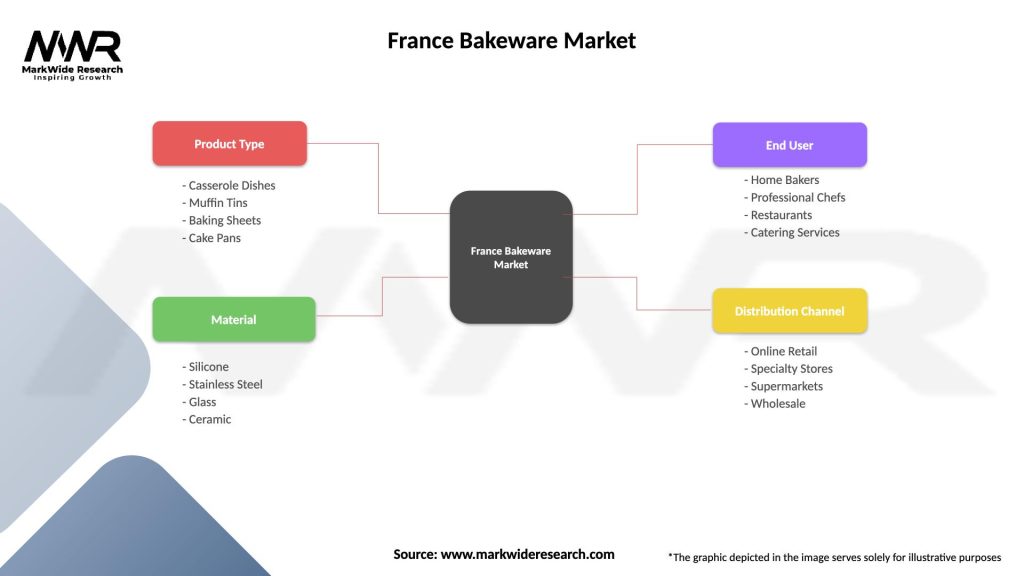

| Segmentation Details | Description |

|---|---|

| Product Type | Casserole Dishes, Muffin Tins, Baking Sheets, Cake Pans |

| Material | Silicone, Stainless Steel, Glass, Ceramic |

| End User | Home Bakers, Professional Chefs, Restaurants, Catering Services |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Bakeware Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at