444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America domestic courier, express, and parcel (CEP) market represents a rapidly evolving logistics ecosystem that has experienced unprecedented transformation in recent years. This dynamic market encompasses comprehensive delivery services across countries including Brazil, Mexico, Argentina, Colombia, Chile, and Peru, serving both business-to-business and business-to-consumer segments with increasing sophistication.

Market dynamics indicate robust growth driven by accelerating e-commerce adoption, urbanization trends, and evolving consumer expectations for faster delivery services. The region’s CEP market has demonstrated remarkable resilience, with growth rates reaching 12.5% CAGR in key segments, particularly in last-mile delivery solutions and express services.

Digital transformation has fundamentally reshaped the Latin American CEP landscape, with technology integration becoming a critical differentiator. Companies are investing heavily in route optimization, real-time tracking systems, and automated sorting facilities to enhance operational efficiency and customer satisfaction. The market has witnessed 65% adoption rate of digital tracking solutions across major urban centers.

Regional variations present both opportunities and challenges, with Brazil and Mexico leading market development while emerging economies like Colombia and Peru show accelerating growth potential. Cross-border trade facilitation and regional integration initiatives continue to drive demand for reliable CEP services throughout Latin America.

The Latin America domestic courier, express, and parcel market refers to the comprehensive ecosystem of logistics services that facilitate the collection, transportation, and delivery of packages, documents, and parcels within individual countries across the Latin American region. This market encompasses time-definite delivery services, standard parcel delivery, express courier services, and specialized logistics solutions designed to meet diverse customer requirements.

CEP services in Latin America include same-day delivery, next-day express, standard ground transportation, and specialized handling for sensitive or high-value items. The market serves various customer segments including individual consumers, small and medium enterprises, large corporations, and government entities, providing essential connectivity for commerce and communication.

Service categories within the market range from basic postal services to premium express delivery options, with increasing emphasis on technology-enabled solutions such as real-time tracking, flexible delivery windows, and integrated e-commerce fulfillment services that support the region’s growing digital economy.

Strategic market positioning reveals that the Latin America domestic CEP market has emerged as a critical infrastructure component supporting regional economic growth and digital transformation. The market demonstrates strong fundamentals with consistent expansion across all major economies, driven by e-commerce growth rates of 28% annually in key markets.

Competitive landscape features a mix of international logistics giants, regional champions, and innovative local players, each adapting their service offerings to meet specific market requirements. Technology adoption has accelerated significantly, with 75% of major operators implementing advanced tracking and route optimization systems to enhance service quality and operational efficiency.

Market segmentation shows particular strength in business-to-consumer deliveries, which now represent the fastest-growing segment, while traditional business-to-business services maintain steady demand. The integration of CEP services with e-commerce platforms has created new revenue streams and service models that are reshaping industry dynamics.

Future prospects indicate continued expansion supported by infrastructure development, regulatory improvements, and increasing consumer sophistication. The market is positioned for sustained growth as digital commerce penetration deepens and logistics networks become more sophisticated and efficient.

Primary market drivers encompass several interconnected factors that are propelling the Latin America domestic CEP market forward:

Market maturation varies significantly across the region, with Brazil and Mexico leading in service sophistication while emerging markets present substantial growth opportunities for expansion-minded operators.

E-commerce proliferation stands as the most significant driver transforming the Latin America domestic CEP market. Online retail growth has created massive demand for reliable, cost-effective delivery services, with e-commerce penetration reaching 45% in major urban markets. This digital commerce expansion has fundamentally altered consumer expectations and delivery requirements.

Urbanization acceleration continues to reshape market dynamics by concentrating delivery volumes in metropolitan areas where service efficiency and cost-effectiveness can be optimized. Major cities like São Paulo, Mexico City, and Buenos Aires have become focal points for CEP service innovation and infrastructure investment.

Technology adoption has emerged as a critical competitive differentiator, with companies investing heavily in route optimization algorithms, real-time tracking systems, and mobile applications. These technological improvements have enhanced operational efficiency while providing customers with greater visibility and control over their deliveries.

Infrastructure development across Latin America has improved the fundamental logistics environment, with better roads, expanded airport facilities, and modern distribution centers enabling more efficient and reliable service delivery. Government investments in transportation infrastructure have particularly benefited CEP operators serving secondary and tertiary markets.

Regulatory improvements have streamlined customs procedures, reduced bureaucratic barriers, and created more favorable operating environments for CEP companies. These policy changes have reduced delivery times and operational costs while improving service reliability across the region.

Infrastructure limitations continue to present significant challenges for CEP operators, particularly in rural and remote areas where road quality, telecommunications coverage, and logistics facilities remain inadequate. These constraints limit service expansion and increase operational costs for comprehensive coverage.

Security concerns represent a persistent challenge across many Latin American markets, with package theft, vehicle hijacking, and facility security issues requiring substantial investment in protective measures and insurance coverage. These security requirements add operational complexity and cost burdens for CEP providers.

Regulatory complexity varies significantly between countries and even within regions, creating compliance challenges for operators seeking to expand their service footprint. Inconsistent regulations regarding customs procedures, tax requirements, and operational licensing can impede market development and cross-border service integration.

Economic volatility in several Latin American countries has created uncertainty for long-term investment planning and service expansion. Currency fluctuations, inflation pressures, and economic instability can significantly impact operational costs and pricing strategies for CEP operators.

Labor market challenges include driver shortages, high turnover rates, and increasing wage pressures that affect service quality and operational costs. The gig economy’s growth has created both opportunities and challenges for traditional employment models in the CEP sector.

Rural market expansion presents substantial untapped potential as infrastructure improvements and technology solutions make previously uneconomical markets viable for CEP services. Companies developing innovative last-mile solutions for rural areas can capture significant market share in underserved regions.

Same-day delivery services represent a high-growth opportunity segment, particularly in major metropolitan areas where consumer willingness to pay premium prices for immediate delivery continues to increase. This segment offers attractive margins and competitive differentiation opportunities.

B2B logistics integration provides opportunities for CEP companies to expand beyond traditional parcel delivery into comprehensive supply chain solutions. Many businesses seek integrated logistics partners capable of handling warehousing, distribution, and final delivery services.

Cross-border e-commerce growth creates demand for seamless domestic distribution networks that can efficiently handle international shipments. CEP operators with strong domestic capabilities can capture increasing volumes from global e-commerce platforms entering Latin American markets.

Technology partnerships with e-commerce platforms, fintech companies, and logistics technology providers offer opportunities to develop innovative service offerings and expand market reach through integrated solutions and shared customer bases.

Sustainability initiatives are becoming increasingly important to consumers and businesses, creating opportunities for CEP companies that invest in electric vehicles, carbon-neutral delivery options, and environmentally responsible packaging solutions.

Competitive intensity has increased significantly as both international logistics companies and local operators compete for market share in the rapidly expanding Latin America CEP market. This competition has driven service innovation, pricing optimization, and operational efficiency improvements across the industry.

Customer expectations continue to evolve rapidly, with consumers demanding faster delivery times, greater flexibility, and enhanced tracking capabilities. These changing expectations are forcing CEP operators to continuously invest in service improvements and technology upgrades to maintain competitive positioning.

Technology disruption is reshaping traditional CEP business models, with artificial intelligence, machine learning, and automation technologies enabling new levels of operational efficiency and service customization. Companies that successfully integrate these technologies gain significant competitive advantages.

Market consolidation trends are evident as larger operators acquire smaller regional players to expand their geographic coverage and service capabilities. This consolidation is creating more comprehensive service networks while potentially reducing competition in some market segments.

Regulatory evolution continues to impact market dynamics as governments across Latin America update policies related to e-commerce, data protection, and logistics operations. These regulatory changes create both opportunities and challenges for market participants.

Economic integration initiatives across Latin America are facilitating greater trade flows and creating demand for more sophisticated CEP services that can support regional commerce and cross-border business activities.

Comprehensive market analysis for the Latin America domestic CEP market employed a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability. The methodology incorporated quantitative analysis of market trends, competitive positioning, and growth projections alongside qualitative insights from industry experts and market participants.

Primary research activities included structured interviews with CEP company executives, logistics managers, e-commerce platform operators, and key customers across major Latin American markets. These interviews provided valuable insights into market dynamics, operational challenges, and future development plans that inform strategic market understanding.

Secondary research encompassed analysis of industry reports, government statistics, trade publications, and company financial disclosures to establish baseline market data and validate primary research findings. This comprehensive approach ensures robust data foundation for market analysis and projections.

Data validation processes included cross-referencing multiple sources, statistical analysis of trends and patterns, and expert review of findings to ensure accuracy and reliability. The research methodology maintains high standards for data quality and analytical rigor throughout the market assessment process.

Market modeling techniques incorporated econometric analysis, trend extrapolation, and scenario planning to develop realistic growth projections and identify key market drivers and constraints affecting future development in the Latin America domestic CEP market.

Brazil dominates the Latin America domestic CEP market, accounting for approximately 42% of regional market share due to its large population, advanced e-commerce infrastructure, and sophisticated logistics networks. The Brazilian market demonstrates strong growth in urban areas while presenting expansion opportunities in interior regions.

Mexico represents the second-largest market with 28% regional market share, benefiting from proximity to the United States, strong manufacturing base, and growing e-commerce adoption. Mexican CEP operators have developed innovative cross-border solutions and urban delivery networks that serve as regional benchmarks.

Argentina maintains a significant market position with 12% regional share, despite economic challenges that have impacted growth rates. The Argentine market shows resilience in urban centers like Buenos Aires while rural areas remain underserved, presenting both challenges and opportunities for CEP operators.

Colombia has emerged as a high-growth market with 8% regional share but demonstrates the fastest expansion rates in the region. Infrastructure improvements and e-commerce growth have created favorable conditions for CEP market development, particularly in major cities like Bogotá and Medellín.

Chile and Peru together account for 6% of regional market share but show strong growth potential driven by economic stability, infrastructure development, and increasing digital commerce adoption. These markets present attractive opportunities for expansion-minded CEP operators.

Other regional markets including Ecuador, Uruguay, and Central American countries represent emerging opportunities with 4% combined market share but significant growth potential as infrastructure and economic conditions continue to improve.

Market leadership in the Latin America domestic CEP market features a diverse mix of international logistics giants, regional champions, and innovative local operators, each bringing unique strengths and market positioning strategies:

Competitive strategies increasingly focus on technology integration, service differentiation, and strategic partnerships with e-commerce platforms to capture growing digital commerce volumes and enhance customer loyalty.

Market positioning varies from cost leadership strategies targeting price-sensitive segments to premium service offerings emphasizing speed, reliability, and customer experience for higher-value market segments.

By Service Type: The Latin America domestic CEP market segments into distinct service categories, each addressing specific customer needs and market requirements:

By Customer Segment: Market segmentation reveals distinct customer categories with varying service requirements and growth patterns:

By Geographic Coverage: Service area segmentation reflects varying market maturity and infrastructure development across the region:

Express delivery services represent the highest-growth and most profitable segment within the Latin America domestic CEP market, driven by consumer willingness to pay premium prices for speed and reliability. This category has experienced 18% annual growth as e-commerce platforms and retailers compete on delivery speed to enhance customer satisfaction.

Same-day delivery has emerged as a key differentiator in major metropolitan areas, with operators investing heavily in urban fulfillment centers and optimized routing systems. This premium service category commands significantly higher margins while requiring substantial infrastructure investment and operational sophistication.

Standard parcel services continue to represent the largest volume segment, serving price-sensitive customers and businesses requiring cost-effective logistics solutions. While margins are lower, this category provides stable revenue streams and market share foundation for CEP operators.

Last-mile delivery solutions have become increasingly sophisticated, with operators implementing flexible delivery options including pickup points, locker systems, and scheduled delivery windows. These innovations address urban delivery challenges while improving customer convenience and operational efficiency.

Technology-enabled services including real-time tracking, delivery notifications, and mobile applications have become standard offerings rather than premium features. Customer expectations for digital integration continue to drive investment in technology infrastructure and service innovation.

Specialized handling services for high-value items, pharmaceuticals, and temperature-sensitive products represent growing market segments with attractive margins and specialized operational requirements that create competitive barriers for new entrants.

CEP operators benefit from expanding market opportunities driven by e-commerce growth, urbanization trends, and increasing consumer demand for convenient delivery services. The market provides multiple revenue streams through service diversification and geographic expansion opportunities.

E-commerce platforms gain competitive advantages through partnerships with reliable CEP providers, enabling faster delivery times, expanded geographic coverage, and enhanced customer satisfaction that drives repeat business and market share growth.

Small and medium enterprises access professional logistics capabilities previously available only to large corporations, enabling business expansion, improved customer service, and cost-effective distribution solutions that support growth and competitiveness.

Consumers benefit from increased convenience, faster delivery options, competitive pricing, and enhanced service reliability that improves their shopping experience and access to products from both domestic and international suppliers.

Technology providers find growing demand for logistics software, tracking systems, route optimization solutions, and mobile applications that support CEP operations and enhance service delivery capabilities.

Government entities benefit from improved logistics infrastructure that supports economic development, job creation, and enhanced connectivity between urban and rural areas, contributing to overall economic growth and social development.

Investors identify attractive opportunities in a growing market with strong fundamentals, increasing demand, and potential for consolidation and expansion that can generate substantial returns on investment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape the Latin America domestic CEP market, with companies investing heavily in artificial intelligence, machine learning, and automation technologies to optimize operations and enhance customer experience. MarkWide Research analysis indicates that 85% of major operators have implemented or are planning significant technology upgrades within the next two years.

Sustainability initiatives are gaining momentum as environmental consciousness increases among consumers and businesses. CEP operators are exploring electric vehicle fleets, carbon-neutral delivery options, and sustainable packaging solutions to meet growing demand for environmentally responsible logistics services.

Micro-fulfillment centers are becoming increasingly popular in urban areas, enabling faster delivery times and reduced transportation costs. These smaller, strategically located facilities allow CEP operators to position inventory closer to customers while maintaining operational efficiency.

Flexible delivery options including pickup points, locker systems, and scheduled delivery windows are becoming standard offerings as consumers demand greater control over their delivery experience. These options also help CEP operators optimize route efficiency and reduce failed delivery attempts.

Integration with social commerce platforms is creating new delivery channels as social media becomes an increasingly important sales channel. CEP operators are developing specialized services to support social commerce transactions and influencer-driven sales.

Cross-border e-commerce growth is driving demand for sophisticated domestic distribution networks capable of efficiently handling international shipments and providing seamless customer experiences for global online retailers entering Latin American markets.

Strategic partnerships between CEP operators and major e-commerce platforms have intensified, with companies forming exclusive or preferred provider relationships to capture growing online retail volumes. These partnerships often include technology integration, co-branded services, and shared infrastructure investments.

Infrastructure investments by both private companies and government entities have accelerated, with new sorting facilities, distribution centers, and transportation hubs being developed across major markets. These investments are improving service capabilities and expanding geographic coverage.

Technology acquisitions have become common as CEP operators seek to rapidly enhance their digital capabilities through strategic purchases of logistics technology companies, route optimization platforms, and customer experience solutions.

Regulatory modernization efforts across Latin America are streamlining customs procedures, reducing bureaucratic barriers, and creating more favorable operating environments for CEP companies. These policy improvements are facilitating market expansion and service enhancement.

Market consolidation activities have increased as larger operators acquire smaller regional players to expand their geographic footprint and service capabilities. This consolidation trend is creating more comprehensive service networks while potentially reducing competition in some segments.

Innovation initiatives including drone delivery pilots, autonomous vehicle testing, and blockchain-based tracking systems are being explored by forward-thinking CEP operators seeking competitive advantages through technological differentiation.

Technology investment should remain a top priority for CEP operators seeking to maintain competitive positioning in the rapidly evolving Latin America market. Companies should focus on customer-facing technologies that enhance service visibility and convenience while investing in backend systems that optimize operational efficiency.

Geographic expansion strategies should carefully balance market opportunity with operational complexity, prioritizing markets with strong e-commerce growth, adequate infrastructure, and favorable regulatory environments. Rural market expansion should be approached systematically with appropriate technology solutions and partnership strategies.

Service differentiation through specialized offerings, premium delivery options, and value-added services can help CEP operators avoid commoditization and maintain healthy margins in increasingly competitive markets. Focus should be on services that address specific customer pain points and unmet market needs.

Strategic partnerships with e-commerce platforms, technology providers, and complementary service companies can accelerate market expansion and enhance service capabilities without requiring substantial capital investment. These partnerships should focus on mutual value creation and long-term relationship building.

Sustainability initiatives should be integrated into long-term strategic planning as environmental concerns become increasingly important to customers and regulators. Early investment in green logistics solutions can provide competitive advantages and regulatory compliance benefits.

Risk management strategies should address security concerns, economic volatility, and regulatory changes that could impact operations. Diversification across markets, services, and customer segments can help mitigate various risk factors affecting the Latin America CEP market.

Market expansion prospects for the Latin America domestic CEP market remain highly positive, with continued growth expected across all major economies driven by sustained e-commerce expansion, urbanization trends, and infrastructure development. MWR projections indicate the market will maintain strong double-digit growth rates over the next five years.

Technology integration will accelerate significantly, with artificial intelligence, machine learning, and automation becoming standard operational tools rather than competitive differentiators. Companies that successfully implement these technologies will achieve substantial efficiency gains and service improvements.

Service evolution will continue toward greater customization, flexibility, and customer control, with same-day delivery becoming more widely available and new service models emerging to address specific market segments and customer needs.

Market consolidation is expected to continue as larger operators acquire smaller players to achieve scale advantages and expand geographic coverage. This consolidation will likely result in more comprehensive service networks and potentially higher barriers to entry for new competitors.

Regulatory harmonization across Latin America may facilitate regional service integration and cross-border expansion, creating opportunities for operators with strong domestic networks to expand their service footprint more efficiently.

Sustainability requirements will become increasingly important, with environmental regulations and customer preferences driving adoption of green logistics solutions, electric vehicle fleets, and carbon-neutral delivery options throughout the region.

The Latin America domestic CEP market represents one of the most dynamic and rapidly growing logistics sectors globally, driven by powerful trends including e-commerce expansion, urbanization, and digital transformation. The market has demonstrated remarkable resilience and adaptability, with operators successfully navigating economic challenges while capitalizing on emerging opportunities.

Strategic positioning within this market requires careful attention to technology integration, service differentiation, and geographic expansion strategies that balance growth opportunities with operational complexity. Companies that successfully combine operational excellence with customer-focused innovation are best positioned to capture market share and achieve sustainable growth.

Future success in the Latin America domestic CEP market will depend on operators’ ability to adapt to evolving customer expectations, leverage emerging technologies, and build comprehensive service networks that can efficiently serve diverse market segments across the region. The market’s continued expansion provides substantial opportunities for well-positioned companies to achieve significant growth and market leadership.

What is Domestic Courier, Express, and Parcel (CEP)?

Domestic Courier, Express, and Parcel (CEP) refers to services that facilitate the quick and efficient delivery of packages and documents within a specific country. This includes various delivery options such as same-day, next-day, and standard shipping, catering to both businesses and individual consumers.

What are the key players in the Latin America Domestic Courier, Express, and Parcel (CEP) Market?

Key players in the Latin America Domestic Courier, Express, and Parcel (CEP) Market include companies like DHL, FedEx, and Correos de México, which provide a range of delivery services tailored to local needs. These companies compete on factors such as delivery speed, reliability, and customer service, among others.

What are the main drivers of growth in the Latin America Domestic Courier, Express, and Parcel (CEP) Market?

The growth of the Latin America Domestic Courier, Express, and Parcel (CEP) Market is driven by the increasing e-commerce activities, rising consumer demand for fast delivery services, and improvements in logistics infrastructure. Additionally, the expansion of small and medium-sized enterprises is contributing to the demand for reliable courier services.

What challenges does the Latin America Domestic Courier, Express, and Parcel (CEP) Market face?

The Latin America Domestic Courier, Express, and Parcel (CEP) Market faces challenges such as regulatory hurdles, high operational costs, and infrastructure limitations in certain regions. These factors can impact service efficiency and delivery times, making it difficult for companies to meet customer expectations.

What opportunities exist in the Latin America Domestic Courier, Express, and Parcel (CEP) Market?

Opportunities in the Latin America Domestic Courier, Express, and Parcel (CEP) Market include the potential for technological advancements, such as automation and real-time tracking systems. Additionally, the growing trend of online shopping presents a significant opportunity for courier services to expand their customer base.

What trends are shaping the Latin America Domestic Courier, Express, and Parcel (CEP) Market?

Trends shaping the Latin America Domestic Courier, Express, and Parcel (CEP) Market include the rise of same-day delivery services, increased use of mobile applications for tracking shipments, and a focus on sustainability in logistics operations. These trends reflect changing consumer preferences and the need for companies to adapt to a competitive landscape.

Latin America Domestic Courier, Express, and Parcel (CEP) Market

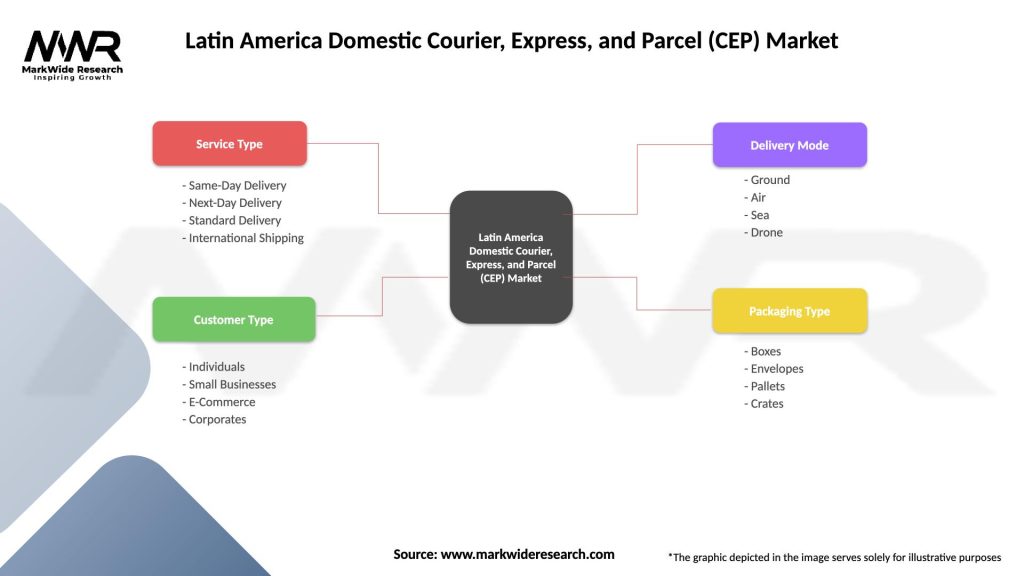

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Standard Delivery, International Shipping |

| Customer Type | Individuals, Small Businesses, E-Commerce, Corporates |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Boxes, Envelopes, Pallets, Crates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Domestic Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at