444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK warehouse logistics market represents a critical component of the nation’s supply chain infrastructure, experiencing unprecedented transformation driven by e-commerce growth, technological advancement, and evolving consumer expectations. Warehouse logistics operations across the United Kingdom have witnessed substantial modernization, with facilities increasingly adopting automated systems, robotics, and data-driven management solutions to enhance operational efficiency.

Market dynamics indicate robust expansion across multiple segments, with the sector demonstrating resilience despite economic uncertainties. The integration of advanced warehouse management systems has become paramount, enabling businesses to optimize inventory control, streamline order fulfillment, and reduce operational costs. E-commerce fulfillment centers have emerged as primary growth drivers, accounting for approximately 35% of new warehouse developments across major UK metropolitan areas.

Regional distribution shows concentrated activity in strategic locations including the Midlands, Greater London periphery, and major port cities. The market exhibits strong growth momentum, with industry projections indicating a compound annual growth rate of 6.2% through the forecast period. Third-party logistics providers continue expanding their footprint, while retailers increasingly invest in dedicated distribution infrastructure to support omnichannel strategies.

The UK warehouse logistics market refers to the comprehensive ecosystem of storage, distribution, and fulfillment services that facilitate the movement of goods from manufacturers to end consumers across the United Kingdom. This market encompasses traditional warehousing facilities, automated distribution centers, cross-docking operations, and specialized storage solutions designed to support various industry verticals including retail, manufacturing, automotive, and pharmaceuticals.

Warehouse logistics operations integrate multiple functional areas including inventory management, order processing, picking and packing, transportation coordination, and returns processing. The market includes both third-party logistics providers offering outsourced services and companies operating dedicated in-house facilities. Modern warehouse logistics emphasizes technology integration, sustainability practices, and flexible capacity management to meet dynamic market demands.

Strategic market positioning reveals the UK warehouse logistics sector as a fundamental pillar supporting the nation’s economic infrastructure. The market demonstrates exceptional adaptability, with operators successfully navigating challenges including Brexit implications, labor shortages, and supply chain disruptions while maintaining operational excellence and service quality standards.

Technology adoption has accelerated significantly, with approximately 42% of warehouse facilities implementing some form of automation technology. Artificial intelligence and machine learning applications are increasingly deployed for demand forecasting, inventory optimization, and predictive maintenance. The sector benefits from substantial infrastructure investment, with new facility construction focusing on sustainability features and advanced technological capabilities.

Market consolidation trends show established logistics providers expanding through strategic acquisitions while new entrants focus on specialized service offerings. The competitive landscape emphasizes operational efficiency, customer service excellence, and technological innovation as key differentiating factors driving market success.

Fundamental market insights reveal several critical trends shaping the UK warehouse logistics landscape:

Primary growth drivers propelling the UK warehouse logistics market include the exponential expansion of e-commerce activities, which has fundamentally altered consumer shopping behaviors and delivery expectations. Online retail penetration continues accelerating, with digital commerce representing an increasingly significant portion of total retail sales, necessitating sophisticated fulfillment infrastructure capable of processing high-volume, small-parcel shipments efficiently.

Supply chain optimization initiatives drive demand for advanced warehouse logistics services as companies seek to reduce operational costs while improving service levels. Inventory management efficiency has become critical for maintaining competitive advantage, with businesses requiring flexible storage solutions that can adapt to fluctuating demand patterns and seasonal variations.

Technological advancement serves as a catalyst for market growth, with automation technologies enabling warehouse operators to achieve higher throughput rates while reducing labor dependency. Artificial intelligence applications optimize picking routes, predict maintenance requirements, and enhance inventory accuracy, contributing to overall operational excellence and cost reduction.

Urbanization trends and population concentration in major metropolitan areas create demand for strategically located distribution facilities capable of supporting last-mile delivery operations. The growing emphasis on sustainable logistics practices also drives investment in energy-efficient facilities and environmentally responsible operational procedures.

Significant market constraints include escalating real estate costs in prime logistics locations, particularly around major urban centers and transportation hubs. Land availability limitations restrict expansion opportunities, forcing operators to consider less optimal locations or invest in vertical storage solutions that may increase operational complexity and costs.

Labor shortage challenges persist across the logistics sector, with warehouse operations experiencing difficulty recruiting and retaining qualified personnel. Skills gap issues become more pronounced as facilities adopt advanced technologies requiring specialized technical expertise for operation and maintenance activities.

Regulatory compliance requirements impose additional operational burdens, particularly for facilities handling specialized products such as pharmaceuticals, hazardous materials, or food products. Brexit-related uncertainties continue affecting cross-border logistics operations, requiring additional documentation and potentially impacting operational efficiency.

Infrastructure limitations in certain regions constrain market development, with inadequate transportation networks or utility capacity restricting facility expansion possibilities. Environmental regulations increasingly influence operational practices, requiring investments in sustainable technologies and processes that may impact short-term profitability.

Emerging opportunities within the UK warehouse logistics market center on the continued expansion of e-commerce fulfillment services, with particular growth potential in specialized sectors such as healthcare, automotive parts, and industrial supplies. Same-day delivery services represent a significant opportunity for operators positioned in strategic urban locations with advanced sorting and dispatch capabilities.

Automation technology adoption presents substantial opportunities for efficiency improvements and cost reduction. Robotic process automation can address labor shortage challenges while improving operational accuracy and throughput rates. The integration of Internet of Things sensors and predictive analytics creates opportunities for proactive maintenance and optimized resource utilization.

Sustainability initiatives offer competitive differentiation opportunities, with environmentally conscious consumers and businesses increasingly prioritizing partners demonstrating strong environmental stewardship. Green logistics solutions including renewable energy adoption, waste reduction programs, and carbon-neutral operations can attract premium customers and potentially command higher service rates.

Cross-border logistics services present growth opportunities as international trade patterns evolve post-Brexit. Specialized handling capabilities for high-value, temperature-sensitive, or regulated products can command premium pricing while serving niche market segments with specific requirements.

Dynamic market forces shape the competitive landscape through continuous technological evolution, changing consumer expectations, and evolving regulatory requirements. Digital transformation initiatives drive operational modernization, with warehouse management systems becoming increasingly sophisticated and integrated with broader supply chain platforms.

Customer demand patterns exhibit increasing complexity, with businesses requiring flexible logistics solutions capable of supporting multiple sales channels simultaneously. Omnichannel fulfillment capabilities have become essential, requiring warehouse operations to efficiently process both bulk B2B shipments and individual consumer orders from the same inventory pool.

Competitive pressures intensify as market participants invest in advanced technologies and expanded service offerings. Service differentiation increasingly depends on technological capabilities, operational flexibility, and value-added services rather than purely cost-based competition. According to MarkWide Research analysis, approximately 58% of logistics providers have increased technology investments to maintain competitive positioning.

Economic factors including inflation, energy costs, and currency fluctuations impact operational expenses and pricing strategies. Supply chain resilience has gained prominence, with businesses prioritizing logistics partners capable of maintaining service continuity during disruptions.

Comprehensive research methodology employed for analyzing the UK warehouse logistics market incorporates multiple data collection approaches including primary research through industry interviews, surveys, and direct observation of operational facilities. Secondary research activities involve analysis of industry publications, government statistics, trade association reports, and company financial disclosures.

Quantitative analysis techniques include statistical modeling of market trends, correlation analysis of key performance indicators, and regression analysis to identify significant market drivers. Qualitative research methods encompass expert interviews with industry executives, facility managers, and technology providers to gain insights into operational challenges and strategic priorities.

Data validation procedures ensure accuracy and reliability through cross-referencing multiple sources, triangulation of findings, and verification with industry experts. Market segmentation analysis employs clustering techniques to identify distinct customer groups and service categories within the broader logistics market.

Forecasting methodologies combine historical trend analysis with forward-looking indicators including planned infrastructure investments, regulatory changes, and technological adoption rates. Scenario analysis evaluates potential market outcomes under different economic and regulatory conditions to provide comprehensive market outlook perspectives.

Regional market distribution across the United Kingdom reveals concentrated activity in key logistics corridors, with the Midlands region maintaining its position as the primary distribution hub due to its central location and excellent transportation connectivity. This region accounts for approximately 28% of total warehouse capacity, benefiting from proximity to major population centers and established transportation infrastructure.

Greater London periphery represents a critical market segment, with facilities in areas such as Hertfordshire, Essex, and Kent serving the capital’s substantial consumer and business markets. Last-mile distribution centers in these locations support rapid delivery services, though high real estate costs limit expansion opportunities and drive innovation in facility utilization efficiency.

Northern England demonstrates strong growth potential, particularly around Manchester and Liverpool, with these regions offering competitive real estate costs and skilled labor availability. Port-adjacent facilities in areas such as Felixstowe, Southampton, and Liverpool provide strategic advantages for import/export operations and international logistics services.

Scotland and Wales present emerging opportunities, with regional development initiatives supporting logistics infrastructure investment. Cross-border logistics operations require specialized capabilities for serving these markets efficiently while managing transportation costs and service level requirements.

Market leadership is distributed among several key categories of operators, each bringing distinct competitive advantages and service specializations:

Competitive differentiation increasingly depends on technological capabilities, operational flexibility, and specialized service offerings rather than traditional cost-based competition. Strategic partnerships between logistics providers and technology companies enable enhanced service capabilities and operational efficiency improvements.

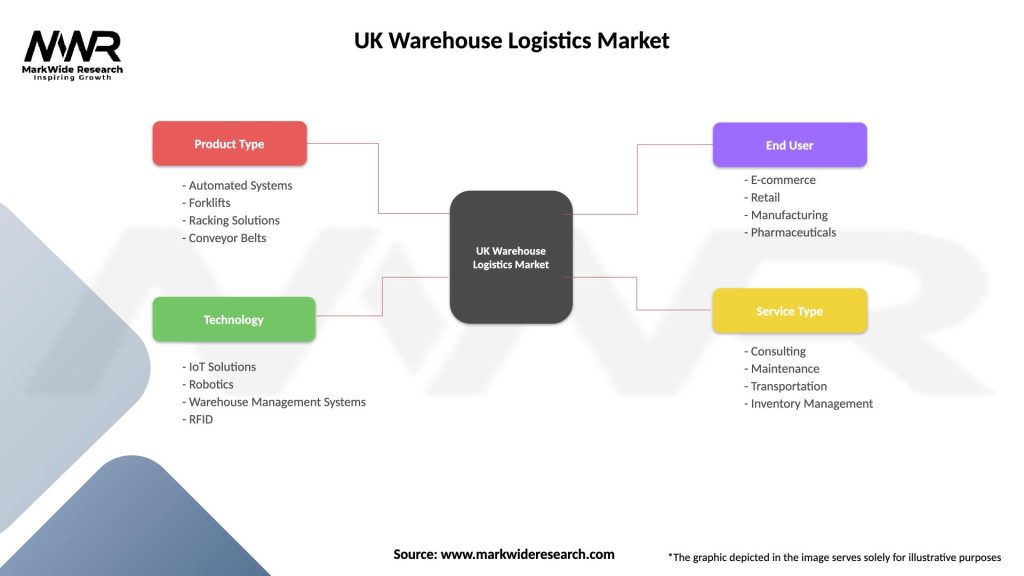

Market segmentation analysis reveals distinct categories based on multiple classification criteria:

By Service Type:

By Industry Vertical:

By Technology Level:

E-commerce fulfillment emerges as the fastest-growing category, with specialized facilities designed to handle high-volume, small-parcel processing requirements. Same-day delivery capabilities drive investment in urban micro-fulfillment centers, while returns processing becomes increasingly important for maintaining customer satisfaction and inventory accuracy.

Cold chain logistics demonstrates robust growth driven by pharmaceutical distribution requirements and fresh food delivery services. Temperature-controlled facilities command premium pricing due to specialized infrastructure requirements and regulatory compliance obligations. MWR data indicates that cold storage capacity utilization rates exceed 92% in major metropolitan areas.

Automotive logistics requires specialized handling capabilities for parts distribution, with just-in-time delivery requirements demanding precise coordination and reliable service levels. Cross-docking operations minimize inventory holding costs while ensuring rapid parts availability for manufacturing and service operations.

Healthcare logistics involves stringent regulatory compliance, with Good Distribution Practice requirements governing facility operations and staff qualifications. Serialization and track-and-trace capabilities become essential for pharmaceutical distribution, requiring advanced technology integration and process documentation.

Operational efficiency improvements represent primary benefits for warehouse logistics market participants, with advanced technologies enabling higher throughput rates, improved accuracy, and reduced operational costs. Automated systems can increase picking productivity by up to 65% compared to manual operations while reducing error rates and improving worker safety conditions.

Scalability advantages allow businesses to adjust capacity requirements based on demand fluctuations without significant capital investments. Flexible storage solutions accommodate seasonal variations and business growth while maintaining cost-effectiveness through shared resources and optimized facility utilization.

Technology integration benefits include real-time inventory visibility, predictive analytics capabilities, and seamless integration with customer systems. Data-driven insights enable proactive decision-making, demand forecasting accuracy, and continuous process optimization for enhanced competitive positioning.

Risk mitigation advantages encompass business continuity planning, disaster recovery capabilities, and compliance management support. Professional logistics providers offer expertise in regulatory requirements, insurance coverage, and operational best practices that reduce business risks and ensure service continuity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration represents the most significant trend transforming warehouse operations, with robotic systems becoming increasingly sophisticated and cost-effective. Artificial intelligence integration enables predictive maintenance, demand forecasting, and route optimization, while machine learning algorithms continuously improve operational efficiency through data analysis and process refinement.

Sustainability initiatives gain prominence as environmental consciousness influences business decisions and consumer preferences. Green building certifications, renewable energy adoption, and carbon footprint reduction programs become competitive differentiators. Circular economy principles drive innovation in packaging reduction, waste minimization, and resource optimization strategies.

Micro-fulfillment centers emerge as solutions for urban last-mile delivery challenges, with compact automated facilities positioned closer to end consumers. Dark store concepts and ghost kitchens represent specialized applications of this trend, serving specific market segments with rapid delivery requirements.

Data analytics sophistication enables advanced supply chain optimization, with predictive modeling improving demand forecasting accuracy and inventory management efficiency. Real-time visibility platforms provide comprehensive supply chain transparency, enabling proactive issue resolution and customer communication.

Technology partnerships between logistics providers and software companies accelerate innovation adoption, with collaborative development programs creating customized solutions for specific operational challenges. Strategic alliances enable smaller operators to access advanced technologies while maintaining competitive positioning against larger market participants.

Infrastructure investments focus on sustainability features and advanced automation capabilities, with new facility developments incorporating renewable energy systems, energy-efficient building designs, and state-of-the-art material handling equipment. Retrofit programs modernize existing facilities to meet current operational standards and customer expectations.

Regulatory adaptations address post-Brexit operational requirements, with customs clearance facilities and documentation processing capabilities becoming essential for international logistics operations. Compliance management systems ensure adherence to evolving regulatory standards across different industry verticals.

Workforce development initiatives address skills gaps through training programs, apprenticeships, and technology familiarization courses. Collaborative efforts between industry associations, educational institutions, and government agencies support workforce preparation for evolving job requirements in automated warehouse environments.

Strategic recommendations for market participants emphasize the importance of technology investment and operational flexibility in maintaining competitive advantage. Automation adoption should be approached systematically, with pilot programs validating technology effectiveness before full-scale implementation. Change management processes ensure successful technology integration while maintaining workforce engagement and productivity levels.

Location strategy optimization requires careful analysis of transportation costs, labor availability, and customer proximity factors. Multi-location networks provide operational resilience and service level optimization, while flexible lease arrangements enable capacity adjustments based on market conditions and business growth requirements.

Sustainability integration should be viewed as a long-term competitive advantage rather than merely a compliance requirement. Environmental performance metrics become increasingly important for customer selection criteria and regulatory compliance. MarkWide Research analysis suggests that companies with strong sustainability programs achieve 15% higher customer retention rates.

Partnership strategies enable access to specialized capabilities and market segments without significant capital investment. Technology partnerships provide access to advanced solutions, while customer partnerships create long-term revenue stability and operational efficiency through dedicated service arrangements.

Market evolution will be characterized by continued technology integration, with artificial intelligence and machine learning becoming standard operational tools rather than competitive differentiators. Autonomous vehicles and drone delivery systems will gradually integrate with warehouse operations, creating seamless end-to-end logistics solutions.

Sustainability requirements will intensify, with carbon neutrality becoming a standard expectation rather than a premium service offering. Circular economy principles will influence facility design, operational processes, and customer service offerings. Renewable energy adoption will accelerate as costs decrease and regulatory pressures increase.

Customer expectations will continue evolving toward faster delivery times, greater transparency, and enhanced service flexibility. Real-time tracking and predictive delivery notifications will become standard features, while customization capabilities will differentiate premium service providers from basic logistics operations.

Market consolidation trends will continue, with larger operators acquiring specialized service providers to expand capability portfolios. Technology companies may enter the market through strategic acquisitions or partnerships, bringing advanced automation solutions and data analytics capabilities to traditional logistics operations.

The UK warehouse logistics market stands at a transformative juncture, with technological advancement, sustainability imperatives, and evolving customer expectations reshaping operational paradigms and competitive dynamics. Market participants who successfully navigate this transformation through strategic technology investments, operational flexibility, and customer-centric service development will establish sustainable competitive advantages in an increasingly complex marketplace.

Growth opportunities remain substantial across multiple market segments, particularly in e-commerce fulfillment, specialized logistics services, and technology-enabled operations. Success factors will increasingly depend on operational excellence, technological sophistication, and environmental stewardship rather than traditional cost-based competition alone.

Future market leaders will distinguish themselves through innovative service offerings, operational resilience, and strategic partnerships that enhance capability portfolios while maintaining cost competitiveness. The UK warehouse logistics market will continue serving as a critical enabler of economic growth, supporting businesses across all sectors in meeting evolving customer demands and operational challenges.

What is Warehouse Logistics?

Warehouse logistics refers to the processes involved in managing the storage and movement of goods within a warehouse. This includes inventory management, order fulfillment, and the coordination of transportation to ensure efficient supply chain operations.

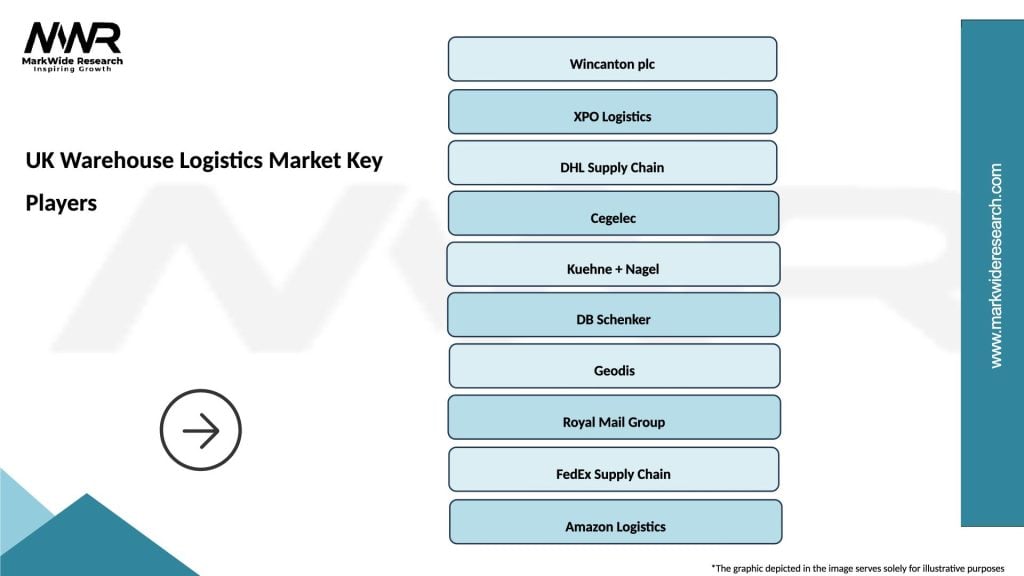

What are the key players in the UK Warehouse Logistics Market?

Key players in the UK Warehouse Logistics Market include companies like DHL Supply Chain, XPO Logistics, and Wincanton, which provide a range of logistics services including warehousing, distribution, and supply chain management, among others.

What are the main drivers of growth in the UK Warehouse Logistics Market?

The main drivers of growth in the UK Warehouse Logistics Market include the rise of e-commerce, increasing demand for efficient supply chain solutions, and advancements in technology such as automation and data analytics that enhance operational efficiency.

What challenges does the UK Warehouse Logistics Market face?

The UK Warehouse Logistics Market faces challenges such as labor shortages, rising operational costs, and the need for compliance with stringent regulations regarding safety and environmental standards.

What opportunities exist in the UK Warehouse Logistics Market?

Opportunities in the UK Warehouse Logistics Market include the expansion of e-commerce logistics, the integration of sustainable practices, and the adoption of innovative technologies like robotics and artificial intelligence to streamline operations.

What trends are shaping the UK Warehouse Logistics Market?

Trends shaping the UK Warehouse Logistics Market include the increasing use of automation and robotics, the shift towards sustainable logistics practices, and the growing importance of real-time data analytics for inventory management and supply chain optimization.

UK Warehouse Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Systems, Forklifts, Racking Solutions, Conveyor Belts |

| Technology | IoT Solutions, Robotics, Warehouse Management Systems, RFID |

| End User | E-commerce, Retail, Manufacturing, Pharmaceuticals |

| Service Type | Consulting, Maintenance, Transportation, Inventory Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Warehouse Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at