444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Turkey mattress market represents a dynamic and rapidly evolving sector within the country’s furniture and bedding industry. Market dynamics indicate substantial growth driven by increasing consumer awareness about sleep quality, rising disposable incomes, and evolving lifestyle preferences. The Turkish mattress industry has experienced significant transformation over recent years, with manufacturers adopting advanced technologies and innovative materials to meet diverse consumer demands.

Consumer preferences in Turkey have shifted toward premium comfort solutions, memory foam technologies, and eco-friendly materials. The market demonstrates robust expansion with a projected CAGR of 6.2% through the forecast period, reflecting strong domestic demand and export potential. Urban development and housing sector growth contribute significantly to market expansion, particularly in major metropolitan areas including Istanbul, Ankara, and Izmir.

Manufacturing capabilities within Turkey have strengthened considerably, with local producers investing in state-of-the-art production facilities and quality control systems. The market benefits from Turkey’s strategic geographical position, serving as a bridge between European and Asian markets, facilitating both domestic consumption and international trade opportunities.

The Turkey mattress market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of sleeping mattresses within Turkish borders. This market includes various mattress types such as innerspring, memory foam, latex, hybrid, and specialty orthopedic mattresses designed to meet diverse consumer sleep requirements and preferences.

Market scope extends beyond traditional retail channels to include online platforms, specialty bedding stores, furniture retailers, and direct-to-consumer sales models. The Turkish mattress industry encompasses both domestic manufacturing and imported products, creating a competitive landscape that drives innovation and quality improvements across all market segments.

Industry definition covers the entire value chain from raw material sourcing and manufacturing processes to final consumer sales and after-sales services. The market includes both residential and commercial segments, serving individual consumers, hotels, hospitals, dormitories, and other institutional buyers requiring quality sleep solutions.

Strategic analysis reveals the Turkey mattress market as a thriving sector characterized by strong growth fundamentals and increasing consumer sophistication. The market demonstrates resilience despite economic fluctuations, supported by essential nature of sleep products and growing health consciousness among Turkish consumers.

Key growth drivers include urbanization trends, rising middle-class population, and increased awareness of sleep’s impact on health and productivity. The market benefits from 65% urban population concentration, creating substantial demand for quality mattresses in residential developments and commercial establishments.

Competitive landscape features both established Turkish manufacturers and international brands, fostering innovation and competitive pricing strategies. The market shows strong potential for premium segment growth, with consumers increasingly willing to invest in high-quality sleep solutions that offer superior comfort and durability.

Future prospects indicate continued expansion driven by demographic trends, technological advancements, and evolving consumer preferences toward personalized sleep solutions. The market is positioned for sustained growth with opportunities in both domestic and export markets.

Market intelligence reveals several critical insights shaping the Turkey mattress industry landscape:

Primary growth catalysts propelling the Turkey mattress market include demographic shifts, economic development, and changing lifestyle patterns. The country’s young population profile, with 42% under age 35, creates sustained demand for new household formations and mattress purchases.

Urbanization trends significantly impact market growth, as city dwellers typically invest more in home comfort and quality sleep solutions. Rising disposable incomes enable consumers to upgrade from basic mattresses to premium options featuring advanced materials and technologies.

Health awareness campaigns and medical research highlighting sleep’s importance drive consumer investment in quality mattresses. Healthcare professionals increasingly recommend proper sleep surfaces for addressing back pain, sleep disorders, and overall wellness improvement.

Housing market development creates consistent demand for new mattresses, particularly in growing metropolitan areas experiencing residential construction booms. Government housing initiatives and urban renewal projects contribute to market expansion through increased household formation rates.

Tourism industry growth generates substantial commercial mattress demand from hotels, resorts, and hospitality establishments seeking to enhance guest comfort and satisfaction levels.

Economic volatility poses challenges for the Turkey mattress market, as currency fluctuations and inflation impact both production costs and consumer purchasing power. Raw material price volatility, particularly for imported components, affects manufacturer profitability and pricing strategies.

Import dependencies for certain specialized materials and components create supply chain vulnerabilities and cost pressures. International trade tensions and tariff changes can disrupt established sourcing patterns and increase production expenses.

Intense competition from both domestic and international brands creates pricing pressures, particularly in the mid-market segment where consumers are price-sensitive. Market saturation in certain segments limits growth opportunities for new entrants.

Consumer durability expectations mean mattress replacement cycles are relatively long, typically 8-12 years, limiting repeat purchase frequency. This durability factor requires manufacturers to focus on market share growth rather than replacement sales.

Regulatory compliance requirements for safety standards, environmental regulations, and quality certifications increase operational costs and complexity for manufacturers, particularly smaller producers with limited resources.

Export market expansion presents significant opportunities for Turkish mattress manufacturers, leveraging the country’s competitive manufacturing costs and strategic location. Regional markets in the Middle East, North Africa, and Eastern Europe offer substantial growth potential.

E-commerce channel development creates opportunities for direct-to-consumer sales models, reducing distribution costs and enabling better customer relationships. Online platforms allow manufacturers to reach previously underserved rural and remote markets.

Premium segment growth offers higher margin opportunities as Turkish consumers increasingly prioritize sleep quality and are willing to invest in advanced mattress technologies. Memory foam, hybrid, and smart mattress categories show particular promise.

Sustainability initiatives create opportunities for eco-friendly mattress development using organic materials, recyclable components, and environmentally responsible manufacturing processes. Green certifications can command premium pricing and appeal to environmentally conscious consumers.

Healthcare partnerships present opportunities for specialized orthopedic and therapeutic mattresses designed for medical applications. Collaborations with healthcare providers can open institutional sales channels and enhance product credibility.

Supply chain dynamics in the Turkey mattress market reflect both local manufacturing strengths and international sourcing requirements. Domestic producers benefit from established textile and foam manufacturing capabilities, while specialized components often require international procurement.

Competitive dynamics feature intense rivalry between established Turkish brands and international players, driving continuous innovation and competitive pricing. Market leaders maintain positions through brand recognition, distribution networks, and product quality, while new entrants compete on price and niche positioning.

Consumer behavior dynamics show evolving preferences toward online research and purchasing, with 38% of consumers now researching mattresses online before making purchase decisions. Social media influence and online reviews significantly impact brand perception and purchase decisions.

Technology adoption dynamics accelerate as manufacturers integrate smart features, advanced materials, and customization capabilities. Innovation cycles shorten as companies race to introduce new technologies and maintain competitive advantages.

Distribution channel dynamics evolve with traditional retail maintaining importance while online channels gain market share. Omnichannel strategies become essential for reaching diverse consumer segments and providing comprehensive customer experiences.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Turkey mattress market. Primary research includes extensive surveys, interviews, and focus groups with industry stakeholders, consumers, and retail partners.

Data collection methods encompass both quantitative and qualitative approaches, utilizing structured questionnaires for statistical analysis and in-depth interviews for nuanced market understanding. Consumer behavior studies provide insights into purchasing patterns, preferences, and decision-making factors.

Secondary research incorporates industry reports, government statistics, trade association data, and company financial information to validate primary findings and provide comprehensive market context. Economic indicators and demographic data support market sizing and forecasting activities.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify growth opportunities. Cross-validation methods ensure data accuracy and reliability across multiple sources.

Expert consultation with industry professionals, retail executives, and market specialists provides additional validation and insights into market trends, competitive dynamics, and future developments affecting the Turkey mattress industry.

Geographic distribution across Turkey reveals significant regional variations in mattress market dynamics, with major metropolitan areas driving the majority of market activity. Istanbul region commands approximately 28% market share, reflecting its economic importance and population density.

Marmara Region demonstrates the highest market concentration, benefiting from industrial development, higher incomes, and urbanization rates. This region shows strong preference for premium mattresses and advanced sleep technologies, with consumers willing to invest in quality sleep solutions.

Aegean and Mediterranean regions show growing market potential, driven by tourism industry development and increasing residential construction. These coastal areas demonstrate rising demand for both residential and commercial mattresses, particularly in hospitality applications.

Central Anatolia represents emerging market opportunities, with Ankara serving as a key growth center. Government employment and educational institutions create steady demand for quality mattresses, while industrial development supports market expansion.

Eastern regions present developing market potential, though economic factors and lower urbanization rates currently limit market penetration. However, infrastructure development and economic growth initiatives suggest future expansion opportunities in these areas.

Market leadership in the Turkey mattress industry features a mix of established domestic manufacturers and international brands, creating a dynamic competitive environment that drives innovation and quality improvements.

Competitive strategies focus on product differentiation, brand building, distribution expansion, and pricing optimization. Companies invest heavily in research and development to introduce innovative materials and technologies that address evolving consumer preferences.

Product type segmentation reveals diverse consumer preferences across different mattress categories:

By Material Type:

By Size Category:

By End-User:

Premium mattress category demonstrates the strongest growth trajectory, with consumers increasingly prioritizing sleep quality over price considerations. This segment benefits from rising health awareness and willingness to invest in long-term comfort solutions.

Memory foam segment shows exceptional growth potential, driven by consumer education about pressure relief benefits and improved sleep quality. Turkish manufacturers are investing in memory foam production capabilities to meet growing domestic demand and export opportunities.

Eco-friendly mattress category emerges as a significant trend, with 23% of consumers expressing interest in sustainable and organic mattress options. This category appeals particularly to younger demographics and environmentally conscious buyers.

Smart mattress technology represents an emerging category with substantial future potential. Integration of sleep tracking, temperature control, and connectivity features appeals to tech-savvy consumers seeking personalized sleep optimization.

Orthopedic mattress segment maintains steady growth, supported by aging population demographics and increased awareness of sleep’s impact on back health and overall wellness. Healthcare professional recommendations drive demand in this specialized category.

Manufacturers benefit from growing market demand, opportunities for product innovation, and potential for export expansion. The Turkish mattress industry offers competitive manufacturing costs, skilled workforce, and strategic geographic advantages for serving regional markets.

Retailers gain from increasing consumer spending on sleep products, opportunities for premium product sales, and growing e-commerce channels. Multi-channel distribution strategies enable retailers to reach diverse consumer segments and maximize market penetration.

Consumers enjoy expanding product choices, improved quality standards, competitive pricing, and enhanced sleep comfort options. Market competition drives continuous innovation and better value propositions across all price segments.

Suppliers benefit from growing demand for raw materials, components, and manufacturing equipment. The expanding mattress industry creates opportunities for textile manufacturers, foam producers, and specialty component suppliers.

Investors find attractive opportunities in a growing market with strong fundamentals, export potential, and increasing consumer sophistication. The mattress industry offers relatively stable demand patterns and opportunities for value creation through operational improvements and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation reshapes the Turkey mattress market as consumers increasingly research and purchase mattresses online. E-commerce platforms enable direct-to-consumer sales models, reducing distribution costs and enabling better customer relationships.

Sustainability focus drives demand for eco-friendly mattresses made from organic materials, recyclable components, and environmentally responsible manufacturing processes. Consumers show growing interest in products with environmental certifications and sustainable credentials.

Customization trends reflect consumer desire for personalized sleep solutions tailored to individual preferences, body types, and sleep patterns. Manufacturers invest in technologies enabling mass customization and personalized product offerings.

Health and wellness emphasis influences mattress purchasing decisions as consumers recognize sleep’s impact on overall health. Medical endorsements, orthopedic features, and therapeutic benefits become important selling points.

Smart technology integration introduces connected mattresses with sleep tracking, temperature control, and smartphone connectivity. These innovations appeal to tech-savvy consumers seeking data-driven sleep optimization solutions.

Manufacturing investments by leading Turkish mattress companies include facility expansions, technology upgrades, and capacity increases to meet growing domestic and export demand. These investments strengthen Turkey’s position as a regional manufacturing hub.

Strategic partnerships between Turkish manufacturers and international technology providers enable access to advanced materials, manufacturing processes, and product innovations. These collaborations accelerate technology transfer and market development.

Retail channel expansion includes new showroom openings, e-commerce platform launches, and omnichannel strategy implementations. Companies invest in customer experience improvements and multi-channel distribution capabilities.

Product innovation initiatives focus on developing new mattress technologies, materials, and features that address evolving consumer preferences. Research and development investments drive competitive differentiation and market positioning.

Export market development efforts include international trade show participation, distributor network expansion, and market entry strategies for regional markets. Turkish manufacturers actively pursue growth opportunities beyond domestic borders.

MarkWide Research analysis suggests Turkish mattress manufacturers should prioritize export market development to diversify revenue sources and reduce dependence on domestic market fluctuations. Regional markets offer substantial growth potential with less competitive intensity than mature Western markets.

Investment recommendations include technology upgrades for smart mattress production capabilities, sustainable manufacturing processes, and e-commerce platform development. These investments position companies for future growth and changing consumer preferences.

Market positioning strategies should emphasize quality, innovation, and value propositions that differentiate Turkish products from international competitors. Brand building investments and marketing initiatives can enhance market presence and consumer recognition.

Partnership opportunities with healthcare providers, hospitality chains, and retail networks can expand market reach and create new sales channels. Strategic alliances enable access to specialized markets and customer segments.

Consumer education initiatives about sleep health benefits and mattress technology can drive premium segment growth and increase overall market value. Educational marketing approaches build brand credibility and justify premium pricing.

Long-term projections for the Turkey mattress market indicate sustained growth driven by demographic trends, urbanization, and increasing consumer sophistication. The market is expected to maintain a healthy CAGR of 6.2% through the forecast period, supported by both domestic demand and export opportunities.

Technology evolution will continue shaping market dynamics as smart mattresses, advanced materials, and customization capabilities become mainstream. Manufacturers investing in innovation and technology adoption will gain competitive advantages and market share.

Export market expansion presents the most significant growth opportunity, with Turkish manufacturers well-positioned to serve regional markets in the Middle East, North Africa, and Eastern Europe. Strategic geographic location and competitive manufacturing costs support export growth initiatives.

Premium segment development offers substantial value creation opportunities as Turkish consumers increasingly prioritize sleep quality and health benefits. Market premiumization trends suggest continued growth in higher-margin product categories.

MWR projections indicate the Turkish mattress market will continue evolving toward greater sophistication, with consumers demanding better quality, innovative features, and personalized solutions. Companies adapting to these trends will achieve sustainable competitive advantages and market leadership positions.

Market assessment reveals the Turkey mattress market as a dynamic and growing sector with strong fundamentals and promising future prospects. The combination of domestic demand growth, export opportunities, and technological advancement creates a favorable environment for industry participants and stakeholders.

Strategic positioning in this market requires focus on quality, innovation, and customer satisfaction while building capabilities for both domestic and international market success. Companies that invest in technology, sustainability, and brand building will be best positioned for long-term growth and profitability.

Future success in the Turkey mattress market will depend on adaptability to changing consumer preferences, technological innovation, and strategic market expansion. The industry’s evolution toward premium products, sustainable solutions, and smart technologies presents both challenges and opportunities for market participants seeking sustainable competitive advantages.

What is a mattress?

A mattress is a large, rectangular pad used for supporting the body during sleep. It is typically made of materials such as foam, latex, or innerspring coils, and is designed to provide comfort and support for various sleeping positions.

What are the key players in the Turkey Mattress Market?

Key players in the Turkey Mattress Market include companies like Yatsan, Aydın Yatak, and İstikbal, which are known for their diverse range of mattress products catering to different consumer needs and preferences, among others.

What are the growth factors driving the Turkey Mattress Market?

The Turkey Mattress Market is driven by factors such as increasing consumer awareness about sleep health, rising disposable incomes, and a growing trend towards online shopping for home furnishings.

What challenges does the Turkey Mattress Market face?

Challenges in the Turkey Mattress Market include intense competition among manufacturers, fluctuating raw material prices, and changing consumer preferences towards sustainable and eco-friendly products.

What opportunities exist in the Turkey Mattress Market?

Opportunities in the Turkey Mattress Market include the potential for innovation in materials and designs, the expansion of e-commerce platforms, and the increasing demand for customized mattress solutions.

What trends are shaping the Turkey Mattress Market?

Trends in the Turkey Mattress Market include the rise of smart mattresses with integrated technology, a focus on health and wellness features, and the growing popularity of organic and natural materials in mattress production.

Turkey Mattress Market

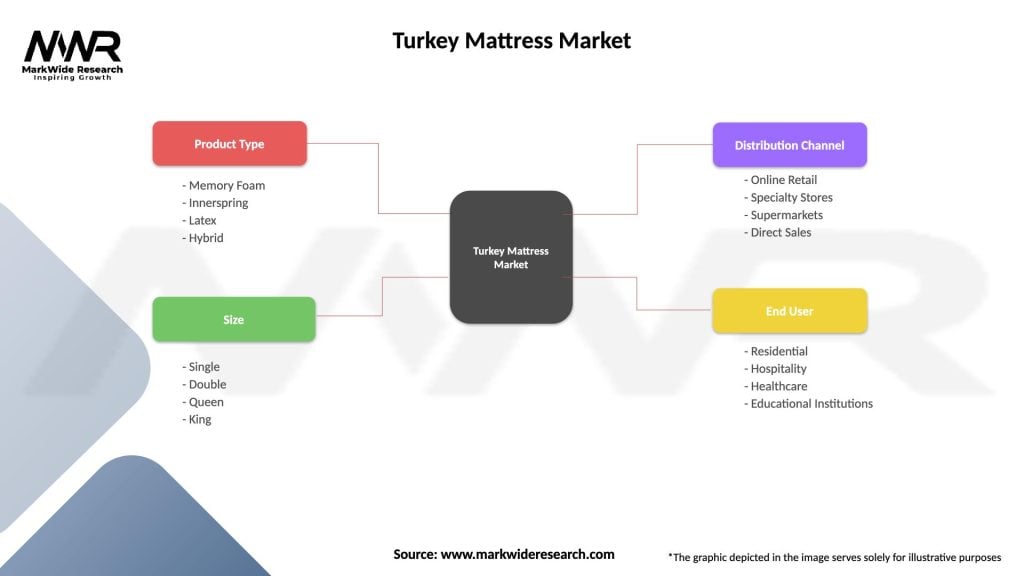

| Segmentation Details | Description |

|---|---|

| Product Type | Memory Foam, Innerspring, Latex, Hybrid |

| Size | Single, Double, Queen, King |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

| End User | Residential, Hospitality, Healthcare, Educational Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Turkey Mattress Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at