444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China smart power distribution systems market represents a transformative segment within the nation’s rapidly evolving energy infrastructure landscape. Smart power distribution systems have emerged as critical components in China’s ambitious modernization of electrical grids, enabling enhanced efficiency, reliability, and intelligent management of power resources across urban and industrial environments. The market encompasses advanced technologies including automated switching systems, intelligent monitoring devices, predictive maintenance solutions, and integrated communication networks that collectively optimize power distribution operations.

China’s commitment to carbon neutrality by 2060 has significantly accelerated investments in smart grid technologies, with smart power distribution systems playing a pivotal role in achieving these environmental objectives. The integration of renewable energy sources, electric vehicle charging infrastructure, and industrial automation has created unprecedented demand for intelligent power distribution solutions. Market growth is driven by government initiatives, urbanization trends, and the increasing complexity of modern electrical networks requiring sophisticated management capabilities.

Regional dynamics across China’s diverse economic zones demonstrate varying adoption patterns, with tier-one cities leading implementation while emerging markets present substantial growth opportunities. The market exhibits strong momentum with projected growth rates of 8.5% CAGR through the forecast period, reflecting robust demand from multiple sectors including manufacturing, commercial real estate, data centers, and renewable energy installations.

The China smart power distribution systems market refers to the comprehensive ecosystem of intelligent electrical infrastructure solutions designed to optimize power delivery, monitoring, and management across various applications within Chinese territories. Smart power distribution systems integrate advanced sensors, communication technologies, automated controls, and data analytics to create responsive, efficient, and reliable electrical networks that can adapt to changing demand patterns and operational conditions.

These systems encompass multiple components including intelligent switchgear, automated circuit breakers, real-time monitoring devices, predictive maintenance platforms, and centralized control systems that work collectively to enhance grid performance. The technology enables utilities and facility managers to achieve improved operational efficiency, reduced downtime, enhanced safety protocols, and optimized energy consumption patterns through intelligent automation and data-driven decision making.

Market participants include equipment manufacturers, system integrators, software developers, and service providers who collaborate to deliver comprehensive smart power distribution solutions tailored to China’s unique regulatory environment, technical standards, and operational requirements across diverse industry verticals.

China’s smart power distribution systems market demonstrates exceptional growth potential driven by the nation’s comprehensive digital transformation initiatives and commitment to sustainable energy infrastructure development. The market benefits from strong government support, substantial infrastructure investments, and increasing adoption of Industry 4.0 technologies across manufacturing and commercial sectors.

Key market drivers include rapid urbanization, industrial modernization, renewable energy integration, and the growing emphasis on energy efficiency and carbon reduction. The market experiences particularly strong demand from data centers, smart cities projects, manufacturing facilities, and commercial buildings seeking to optimize their electrical infrastructure performance. Technology adoption rates show significant acceleration, with approximately 72% of new industrial facilities incorporating smart distribution technologies in their electrical systems design.

Competitive dynamics feature both international technology leaders and domestic manufacturers competing to capture market share through innovation, localization strategies, and comprehensive service offerings. The market structure supports healthy competition while encouraging technological advancement and cost optimization for end users.

Future prospects remain highly favorable, with emerging technologies such as artificial intelligence, edge computing, and advanced analytics expected to further enhance system capabilities and market growth potential throughout the forecast period.

Strategic market insights reveal several critical factors shaping the China smart power distribution systems landscape:

Market maturation patterns indicate a transition from basic automation to comprehensive intelligent systems capable of predictive analytics, autonomous operation, and seamless integration with broader energy management platforms.

Primary market drivers propelling China’s smart power distribution systems market include comprehensive government initiatives supporting electrical infrastructure modernization and digital transformation across multiple sectors. The national smart grid strategy provides substantial policy support and financial incentives for adopting advanced power distribution technologies, creating favorable conditions for market expansion.

Industrial modernization represents another significant driver, as manufacturing facilities increasingly require sophisticated power management capabilities to support automated production processes, robotics integration, and Industry 4.0 implementations. The growing complexity of industrial electrical systems necessitates intelligent monitoring, control, and optimization capabilities that traditional distribution systems cannot provide effectively.

Urbanization trends continue driving demand as expanding cities require reliable, efficient power distribution infrastructure to support growing populations and commercial developments. Smart buildings, data centers, and commercial complexes increasingly specify intelligent power distribution systems to achieve operational efficiency targets and regulatory compliance requirements.

Environmental sustainability mandates create additional market momentum, with organizations seeking to reduce carbon footprints through optimized energy consumption and improved operational efficiency. The integration of renewable energy sources requires sophisticated distribution management capabilities to handle variable power generation and maintain grid stability.

Technology advancement in areas such as artificial intelligence, machine learning, and edge computing enables more sophisticated power distribution solutions with enhanced capabilities for predictive maintenance, fault detection, and autonomous operation, driving market adoption across various applications.

Implementation complexity presents significant challenges for organizations considering smart power distribution system deployments, as these solutions require substantial technical expertise, comprehensive planning, and careful integration with existing electrical infrastructure. The complexity of system design, installation, and commissioning can create barriers for smaller organizations or those with limited technical resources.

Capital investment requirements represent another constraint, as smart power distribution systems typically involve higher upfront costs compared to conventional electrical infrastructure. Organizations must carefully evaluate return on investment calculations and may face budget constraints that delay or limit implementation scope, particularly in cost-sensitive market segments.

Technical integration challenges arise when retrofitting existing facilities with smart distribution technologies, as legacy systems may require significant modifications or replacements to achieve compatibility with modern intelligent solutions. These integration complexities can extend project timelines and increase implementation costs.

Cybersecurity concerns create additional considerations for organizations deploying connected power distribution systems, as increased connectivity introduces potential vulnerabilities that require robust security measures and ongoing monitoring capabilities. The need for comprehensive cybersecurity protocols can add complexity and cost to system implementations.

Skills shortage in specialized technical areas related to smart power distribution systems can limit implementation capabilities and increase project costs, as organizations may struggle to find qualified personnel for system design, installation, and maintenance activities.

Emerging market segments present substantial opportunities for smart power distribution system providers, particularly in rapidly developing industrial zones and new urban developments where modern electrical infrastructure can be implemented from the ground up. These greenfield projects offer optimal conditions for deploying advanced distribution technologies without legacy system constraints.

Data center expansion across China creates significant opportunities, as these facilities require highly reliable, efficient, and intelligent power distribution systems to support critical computing infrastructure. The growing demand for cloud services, edge computing, and digital transformation initiatives drives continuous data center development and associated power infrastructure requirements.

Electric vehicle infrastructure development presents emerging opportunities as charging networks require sophisticated power management capabilities to handle variable demand patterns, grid integration, and billing systems. The rapid expansion of EV adoption in China creates substantial market potential for intelligent charging infrastructure solutions.

Renewable energy integration projects offer growing opportunities as solar, wind, and other renewable installations require advanced distribution management systems to handle variable power generation, grid synchronization, and energy storage coordination. The government’s commitment to carbon neutrality drives substantial investments in renewable energy infrastructure.

Smart manufacturing initiatives create opportunities for specialized power distribution solutions designed to support automated production processes, robotics integration, and real-time monitoring capabilities required for Industry 4.0 implementations across various manufacturing sectors.

Market dynamics within China’s smart power distribution systems sector reflect the complex interplay between technological advancement, regulatory requirements, economic factors, and competitive pressures shaping industry evolution. The market demonstrates strong momentum driven by government policy support, infrastructure investment programs, and increasing recognition of intelligent power management benefits across various applications.

Supply chain dynamics show increasing localization as domestic manufacturers develop advanced capabilities and international companies establish local production facilities to serve the Chinese market more effectively. This trend supports cost optimization while ensuring compliance with local regulations and technical standards.

Technology evolution continues accelerating with regular introduction of enhanced features, improved performance capabilities, and expanded functionality in smart power distribution solutions. The integration of artificial intelligence, machine learning, and advanced analytics creates new possibilities for predictive maintenance, autonomous operation, and optimized energy management.

Customer expectations evolve toward comprehensive solutions that provide not only basic power distribution functionality but also advanced monitoring, analytics, and integration capabilities with broader facility management systems. This trend drives solution providers to develop more sophisticated, integrated offerings that address multiple operational requirements.

Competitive intensity increases as more players enter the market, driving innovation, feature enhancement, and competitive pricing strategies. Market participants focus on differentiation through technology leadership, service capabilities, and specialized solutions for specific industry verticals or applications.

Comprehensive research methodology employed for analyzing China’s smart power distribution systems market incorporates multiple data collection approaches, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include structured interviews with industry executives, technical specialists, end users, and market participants to gather firsthand insights on market trends, technology developments, competitive dynamics, and future outlook perspectives. These interviews provide qualitative insights that complement quantitative data analysis.

Secondary research encompasses analysis of industry reports, government publications, technical standards, regulatory documents, and company financial statements to establish comprehensive market understanding and validate primary research findings. This approach ensures thorough coverage of market factors and influences.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify key growth drivers, constraints, and opportunities. The modeling approach considers multiple variables including economic factors, technology adoption rates, and regulatory influences.

Data validation processes include cross-referencing multiple sources, expert review, and consistency checking to ensure research findings accurately represent market conditions and provide reliable foundation for strategic decision making by market participants and stakeholders.

Regional market dynamics across China demonstrate significant variation in smart power distribution systems adoption patterns, with tier-one cities leading implementation while emerging markets present substantial growth opportunities. Eastern coastal regions including Shanghai, Shenzhen, and Guangzhou show the highest adoption rates, with approximately 68% market penetration in new commercial and industrial developments.

Beijing and surrounding areas represent another major market concentration, driven by government initiatives, technology company headquarters, and substantial data center developments. The region benefits from strong policy support and serves as a testing ground for innovative smart grid technologies and applications.

Central China regions including Wuhan, Chengdu, and Xi’an demonstrate rapidly growing adoption rates as industrial development and urbanization accelerate. These markets offer significant growth potential with increasing infrastructure investments and manufacturing facility modernization projects.

Western regions present emerging opportunities as government development programs and infrastructure investments create demand for modern electrical systems. While current adoption rates remain lower, these markets show strong growth potential as economic development continues.

Southern manufacturing hubs including Dongguan, Foshan, and surrounding areas drive substantial demand for industrial smart power distribution solutions, with manufacturing sector adoption reaching approximately 55% penetration rates in new facility developments.

Regional preferences vary based on local regulations, technical standards, and specific industry concentrations, requiring tailored approaches for market penetration and solution deployment across different geographic areas.

Competitive landscape within China’s smart power distribution systems market features a diverse mix of international technology leaders, domestic manufacturers, and specialized solution providers competing across various market segments and applications.

Market competition intensifies as companies invest in research and development, local partnerships, and comprehensive service capabilities to differentiate their offerings and capture market share across various industry verticals and geographic regions.

Strategic partnerships between international technology providers and local companies become increasingly important for market success, enabling technology transfer, local manufacturing, and enhanced customer support capabilities.

Market segmentation analysis reveals distinct categories based on technology type, application, end-user industry, and deployment model, each presenting unique characteristics, growth patterns, and competitive dynamics within China’s smart power distribution systems market.

By Technology:

By Application:

By End-User Industry:

Industrial manufacturing represents the largest market segment, driven by extensive factory automation initiatives and Industry 4.0 implementations across China’s manufacturing base. Smart distribution systems in this category focus on reliability, integration with production systems, and real-time monitoring capabilities to support continuous operations and predictive maintenance programs.

Data center applications demonstrate the highest growth rates, with expansion rates reaching approximately 15% annually as cloud computing, edge computing, and digital transformation initiatives drive infrastructure development. These applications require the most sophisticated power distribution solutions with redundancy, high efficiency, and advanced monitoring capabilities.

Commercial building implementations focus on energy efficiency, tenant billing, and integration with building management systems. The segment benefits from green building standards and energy performance regulations that encourage adoption of intelligent power distribution technologies.

Renewable energy integration presents emerging opportunities as solar and wind installations require sophisticated distribution management to handle variable generation patterns and grid synchronization requirements. This category shows strong growth potential aligned with China’s carbon neutrality commitments.

Smart city projects create comprehensive opportunities for integrated power distribution solutions supporting public infrastructure, transportation systems, and municipal facilities. These implementations often involve large-scale deployments with standardized specifications and long-term service requirements.

Equipment manufacturers benefit from substantial market opportunities driven by China’s infrastructure modernization initiatives and growing demand for intelligent power distribution solutions across multiple industry verticals. The market provides platforms for technology innovation, product development, and revenue growth through comprehensive solution portfolios.

System integrators gain access to expanding project opportunities requiring specialized expertise in smart power distribution system design, installation, and commissioning. The complexity of modern implementations creates demand for professional services and ongoing support capabilities.

End users achieve significant operational benefits including improved energy efficiency, reduced maintenance costs, enhanced reliability, and better visibility into power consumption patterns. Efficiency improvements typically range from 15% to 25% compared to conventional distribution systems, depending on application and implementation scope.

Utility companies benefit from improved grid stability, reduced peak demand, and enhanced load management capabilities as smart distribution systems provide better demand response and grid integration features. These benefits support overall grid modernization objectives and operational efficiency improvements.

Government stakeholders achieve policy objectives related to energy efficiency, carbon reduction, and industrial modernization through widespread adoption of smart power distribution technologies. The market supports broader economic development and environmental sustainability goals.

Technology providers access opportunities for innovation, partnership development, and market expansion through participation in China’s rapidly growing smart infrastructure market, enabling long-term business growth and technology advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend, with smart power distribution systems increasingly incorporating AI-powered analytics for predictive maintenance, fault detection, and optimization algorithms. This trend enables autonomous operation capabilities and enhanced system performance through machine learning applications.

Edge computing adoption accelerates as organizations seek to process power distribution data locally for faster response times and reduced network dependencies. Edge computing capabilities enable real-time decision making and improved system responsiveness for critical applications.

Cybersecurity enhancement becomes increasingly important as connected power distribution systems require robust protection against cyber threats. Advanced security protocols, encryption technologies, and monitoring systems become standard features in modern smart distribution solutions.

Modular system design gains popularity as organizations prefer scalable solutions that can expand with growing requirements. Modular approaches enable phased implementations and reduce initial investment requirements while providing upgrade pathways for future enhancements.

Cloud-based management platforms become more prevalent, offering centralized monitoring and control capabilities across multiple facilities and locations. Cloud solutions provide scalability, remote access, and advanced analytics capabilities that enhance operational efficiency.

Sustainability focus drives demand for energy-efficient power distribution solutions that support carbon reduction objectives. Organizations increasingly prioritize systems that provide detailed energy consumption data and optimization capabilities to support environmental goals.

Major technology partnerships between international providers and Chinese companies accelerate market development through technology transfer, local manufacturing, and enhanced service capabilities. These collaborations enable faster market penetration and improved customer support across diverse geographic regions.

Government infrastructure programs continue expanding with substantial budget allocations for smart grid development and electrical infrastructure modernization. Recent initiatives include comprehensive urban power grid upgrades and industrial zone electrification projects that create significant market opportunities.

Standards development progresses with industry organizations and government agencies working to establish comprehensive technical standards for smart power distribution systems. These standards support interoperability, safety, and performance requirements across different applications and manufacturers.

Research and development investments increase as companies focus on next-generation technologies including advanced sensors, communication protocols, and analytics platforms. MarkWide Research analysis indicates that R&D spending in this sector has grown by approximately 12% annually over recent years.

Market consolidation activities include strategic acquisitions and partnerships as companies seek to expand capabilities, geographic coverage, and technology portfolios. These activities reshape competitive dynamics and create more comprehensive solution providers.

Pilot project implementations demonstrate advanced capabilities and validate new technologies across various applications, providing proof-of-concept for broader market adoption and technology refinement based on real-world performance data.

Market participants should prioritize technology innovation and comprehensive solution development to differentiate offerings in an increasingly competitive market environment. Focus on integrated platforms that combine multiple functionalities and provide seamless user experiences across various applications and industry verticals.

Investment strategies should emphasize local partnerships and manufacturing capabilities to effectively serve the Chinese market while complying with regulatory requirements and customer preferences for local support and service capabilities. Establishing strong local presence becomes critical for long-term success.

Technology development efforts should concentrate on emerging areas including artificial intelligence, edge computing, and advanced analytics that enhance system capabilities and provide competitive advantages. Early adoption of next-generation technologies creates opportunities for market leadership.

Customer engagement approaches should focus on education and demonstration of value propositions, as many potential users require comprehensive understanding of smart power distribution benefits and implementation processes. Successful market penetration requires effective communication of technology advantages and return on investment calculations.

Service capabilities development becomes increasingly important as customers seek comprehensive support throughout system lifecycles. Companies should invest in technical expertise, training programs, and service infrastructure to provide ongoing value and maintain customer relationships.

Market expansion strategies should consider geographic diversification across China’s various economic regions, as different areas present unique opportunities and requirements. Tailored approaches for specific regions and industry verticals enhance market penetration effectiveness.

Long-term market prospects remain highly favorable for China’s smart power distribution systems market, with continued growth expected throughout the forecast period driven by sustained infrastructure investment, technology advancement, and expanding application areas. The market benefits from strong fundamentals including government support, industrial modernization trends, and increasing recognition of intelligent power management benefits.

Technology evolution will continue accelerating with integration of advanced capabilities including artificial intelligence, machine learning, and autonomous operation features that enhance system performance and reduce operational requirements. MWR projections indicate that AI-enabled systems will represent approximately 40% of new installations by the end of the forecast period.

Application expansion into new market segments including electric vehicle infrastructure, renewable energy integration, and smart city projects creates additional growth opportunities beyond traditional industrial and commercial applications. These emerging segments offer substantial potential for market expansion and revenue growth.

Market maturation will drive standardization, improved interoperability, and enhanced cost-effectiveness as technologies mature and economies of scale develop. This maturation process supports broader market adoption and creates opportunities for smaller organizations to implement smart distribution solutions.

Competitive dynamics will continue evolving with increasing focus on comprehensive solutions, service capabilities, and customer relationships rather than purely technology-based competition. Successful companies will differentiate through value-added services and integrated solution portfolios.

Regulatory environment will likely become more supportive with additional incentives and requirements encouraging smart power distribution system adoption as part of broader environmental and efficiency objectives. Policy support will continue driving market growth and technology advancement.

China’s smart power distribution systems market presents exceptional opportunities for growth and innovation, driven by comprehensive government support, rapid industrial modernization, and increasing demand for intelligent infrastructure solutions. The market demonstrates strong fundamentals with sustained growth prospects throughout the forecast period, supported by technology advancement, expanding applications, and favorable regulatory environment.

Market participants who focus on technology innovation, local partnerships, and comprehensive solution development will be best positioned to capitalize on emerging opportunities across various industry verticals and geographic regions. Success requires understanding of local market dynamics, customer requirements, and regulatory considerations that shape purchasing decisions and implementation approaches.

Future success will depend on companies’ ability to adapt to evolving technology trends, customer expectations, and competitive pressures while maintaining focus on value creation and customer satisfaction. The market rewards organizations that combine technological excellence with strong service capabilities and deep market understanding, creating sustainable competitive advantages in this dynamic and rapidly growing sector.

What is Smart Power Distribution Systems?

Smart Power Distribution Systems refer to advanced electrical distribution networks that utilize digital technology to monitor and manage the flow of electricity. These systems enhance efficiency, reliability, and sustainability in power distribution, integrating renewable energy sources and smart grid technologies.

What are the key players in the China Smart Power Distribution Systems Market?

Key players in the China Smart Power Distribution Systems Market include Siemens AG, Schneider Electric, ABB Ltd., and General Electric. These companies are known for their innovative solutions and technologies in smart power distribution, among others.

What are the main drivers of the China Smart Power Distribution Systems Market?

The main drivers of the China Smart Power Distribution Systems Market include the increasing demand for reliable electricity supply, the integration of renewable energy sources, and government initiatives promoting smart grid technologies. These factors contribute to the growth and modernization of power distribution networks.

What challenges does the China Smart Power Distribution Systems Market face?

Challenges in the China Smart Power Distribution Systems Market include high initial investment costs, the complexity of integrating new technologies with existing infrastructure, and regulatory hurdles. These factors can hinder the widespread adoption of smart distribution systems.

What opportunities exist in the China Smart Power Distribution Systems Market?

Opportunities in the China Smart Power Distribution Systems Market include the growing focus on energy efficiency, advancements in IoT and AI technologies, and increasing investments in smart city projects. These trends can drive innovation and expansion in the sector.

What trends are shaping the China Smart Power Distribution Systems Market?

Trends shaping the China Smart Power Distribution Systems Market include the rise of decentralized energy systems, the adoption of advanced metering infrastructure, and the increasing use of data analytics for grid management. These trends are transforming how electricity is distributed and consumed.

China Smart Power Distribution Systems Market

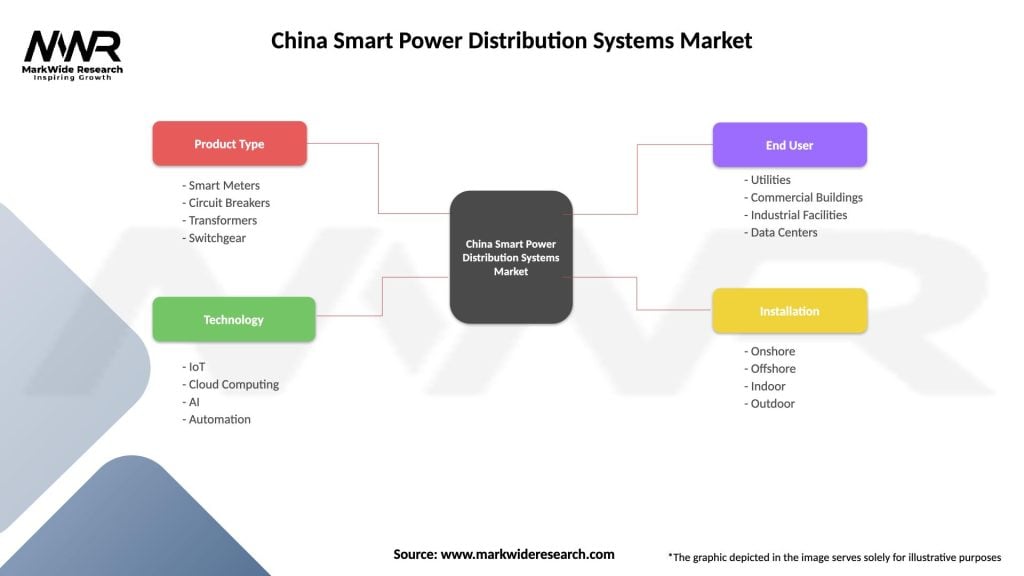

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Meters, Circuit Breakers, Transformers, Switchgear |

| Technology | IoT, Cloud Computing, AI, Automation |

| End User | Utilities, Commercial Buildings, Industrial Facilities, Data Centers |

| Installation | Onshore, Offshore, Indoor, Outdoor |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Smart Power Distribution Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at