444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada commercial construction market represents a dynamic and evolving sector that plays a crucial role in the nation’s economic development. This market encompasses the construction of office buildings, retail spaces, hotels, warehouses, and institutional facilities across Canada’s diverse provinces and territories. Market dynamics indicate robust growth driven by urbanization, technological advancement, and increasing demand for sustainable building solutions.

Commercial construction activities in Canada have experienced significant transformation in recent years, with the market demonstrating resilience despite global economic challenges. The sector benefits from strong government infrastructure investments, growing population centers, and evolving workplace requirements that demand modern, flexible commercial spaces. Construction companies are increasingly adopting innovative building technologies and sustainable practices to meet changing market demands.

Regional distribution shows concentrated activity in major metropolitan areas including Toronto, Vancouver, Montreal, and Calgary, with emerging opportunities in secondary markets. The market is characterized by a 7.2% annual growth rate in commercial construction permits, reflecting strong underlying demand for new commercial facilities. Technology integration and green building initiatives are reshaping traditional construction approaches, creating new opportunities for market participants.

The Canada commercial construction market refers to the comprehensive sector encompassing the planning, design, and construction of non-residential buildings intended for business, retail, hospitality, and institutional purposes across Canadian provinces and territories.

Commercial construction projects include office towers, shopping centers, hotels, restaurants, warehouses, distribution centers, healthcare facilities, educational institutions, and mixed-use developments. This market segment differs from residential construction by focusing on structures designed to generate revenue or serve public purposes rather than provide housing.

Market participants include general contractors, specialty subcontractors, architects, engineers, developers, and material suppliers who collaborate to deliver complex commercial projects. The sector involves sophisticated project management, regulatory compliance, and coordination of multiple stakeholders to achieve successful project completion within budget and timeline constraints.

Canada’s commercial construction market demonstrates strong fundamentals supported by economic growth, urbanization trends, and evolving business requirements. The market benefits from stable political environment, robust financial systems, and growing demand for modern commercial facilities that incorporate advanced technologies and sustainable design principles.

Key market drivers include population growth in major urban centers, business expansion activities, government infrastructure investments, and increasing focus on energy-efficient building solutions. The market shows particular strength in office construction, retail development, and logistics facilities driven by e-commerce growth and changing consumer behaviors.

Technology adoption is accelerating across the sector, with 68% of construction companies implementing digital project management tools and building information modeling systems. This technological transformation is improving project efficiency, reducing costs, and enhancing collaboration among project stakeholders. Sustainable construction practices are becoming standard requirements, with green building certifications increasingly demanded by tenants and investors.

Market challenges include skilled labor shortages, material cost volatility, regulatory complexity, and weather-related construction delays. However, these challenges are being addressed through workforce development programs, supply chain optimization, and improved project planning methodologies that account for regional climate considerations.

Market analysis reveals several critical insights that define the current state and future direction of Canada’s commercial construction sector:

Market segmentation shows office construction maintaining the largest share, followed by retail and hospitality projects. Industrial and warehouse construction is experiencing rapid growth driven by e-commerce logistics requirements and supply chain modernization initiatives.

Economic growth serves as the primary driver for Canada’s commercial construction market, with expanding businesses requiring new facilities and existing companies upgrading their physical infrastructure. GDP growth correlates strongly with commercial construction activity, as businesses invest in facilities to support operational expansion and workforce growth.

Population growth in major urban centers creates sustained demand for commercial services and facilities. Cities like Toronto, Vancouver, and Montreal are experiencing significant population increases that drive demand for retail spaces, office buildings, healthcare facilities, and educational institutions. This demographic trend supports long-term market growth prospects.

Technological advancement is reshaping workplace requirements and driving demand for modern commercial facilities equipped with advanced building systems, high-speed connectivity, and flexible space configurations. Digital transformation initiatives require businesses to upgrade their physical infrastructure to support new technologies and changing work patterns.

E-commerce growth is creating substantial demand for logistics and distribution facilities, with 45% increase in warehouse construction permits reflecting this trend. Online retail expansion requires sophisticated fulfillment centers, last-mile delivery facilities, and cold storage infrastructure to support supply chain operations.

Government infrastructure investment provides direct and indirect support for commercial construction through public facility projects and economic stimulus effects. Infrastructure spending creates positive economic conditions that encourage private sector commercial development and business expansion activities.

Skilled labor shortages represent a significant constraint on market growth, with construction companies reporting difficulty finding qualified workers across multiple trades. This shortage leads to project delays, increased labor costs, and reduced capacity to undertake new projects. Workforce development initiatives are addressing this challenge, but solutions require time to implement effectively.

Material cost volatility creates uncertainty in project planning and can impact project profitability. Fluctuating prices for steel, lumber, concrete, and other essential materials make it challenging for contractors to provide accurate project estimates and maintain profit margins. Supply chain disruptions can further exacerbate these cost pressures.

Regulatory complexity increases project development timelines and costs through lengthy approval processes, multiple permit requirements, and compliance obligations. Different provincial and municipal regulations create additional complexity for companies operating across multiple jurisdictions. Environmental regulations add layers of compliance requirements that can delay project initiation.

Weather conditions in many Canadian regions limit construction seasons and can cause significant project delays. Harsh winter conditions in northern provinces restrict outdoor construction activities and require specialized equipment and techniques that increase project costs. Climate considerations must be factored into all project planning and scheduling decisions.

Economic uncertainty can reduce business confidence and delay commercial development decisions. Market volatility, interest rate changes, and global economic conditions influence business investment decisions and can impact demand for new commercial facilities.

Sustainable construction presents significant opportunities as businesses increasingly prioritize environmental responsibility and energy efficiency. Green building technologies offer competitive advantages through reduced operating costs, improved tenant satisfaction, and enhanced property values. The growing demand for LEED-certified and other sustainable building certifications creates market opportunities for specialized contractors and suppliers.

Technology integration opportunities include building information modeling, prefabrication techniques, and smart building systems that improve construction efficiency and building performance. Digital construction tools enable better project coordination, cost control, and quality management throughout the construction process.

Infrastructure modernization creates opportunities for commercial construction companies to participate in large-scale public projects and benefit from associated private sector development. Transit-oriented development around new transportation infrastructure generates demand for mixed-use commercial projects and urban redevelopment initiatives.

Industrial construction opportunities are expanding rapidly due to supply chain reshoring, manufacturing growth, and logistics facility requirements. Advanced manufacturing facilities require specialized construction expertise and present opportunities for contractors with relevant experience and capabilities.

Healthcare and education sectors offer stable long-term opportunities driven by demographic trends and government investment priorities. These sectors require specialized construction knowledge but provide consistent project pipelines and opportunities for ongoing maintenance and renovation work.

Supply and demand dynamics in Canada’s commercial construction market are influenced by economic cycles, business confidence levels, and regional development patterns. Market equilibrium varies significantly across different provinces and metropolitan areas, with some regions experiencing high demand and limited capacity while others have more balanced conditions.

Competitive dynamics are shaped by company size, specialization areas, and geographic coverage. Large national contractors compete for major projects while regional firms focus on local markets and specialized project types. Market consolidation trends are creating larger companies with enhanced capabilities and geographic reach.

Technology adoption is creating competitive advantages for early adopters while challenging traditional construction methods. Companies investing in digital tools, automation, and innovative construction techniques are gaining 15-20% efficiency improvements compared to traditional approaches. This technology gap is influencing competitive positioning and market share distribution.

Client expectations are evolving toward greater project transparency, faster delivery timelines, and enhanced building performance. MarkWide Research analysis indicates that clients increasingly value contractors who can demonstrate proven track records with technology integration and sustainable construction practices.

Financial market conditions influence project feasibility and development timing. Interest rates, credit availability, and investor confidence directly impact commercial development decisions and market activity levels. Capital market stability supports consistent project pipelines and long-term market growth.

Primary research methodologies employed in analyzing Canada’s commercial construction market include comprehensive surveys of construction companies, developers, architects, and industry professionals. Data collection involves structured interviews with key market participants to gather insights on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government statistics, industry reports, permit data, and economic indicators that influence commercial construction activity. Statistical analysis of construction permits, employment data, and economic indicators provides quantitative foundation for market assessment and trend identification.

Market segmentation analysis examines different project types, geographic regions, and company categories to understand market structure and competitive dynamics. Comparative analysis across provinces and metropolitan areas reveals regional variations and growth patterns that influence market development.

Industry expert consultation provides qualitative insights into market dynamics, regulatory changes, and technological developments affecting the commercial construction sector. Professional associations and industry organizations contribute valuable perspectives on workforce development, safety standards, and best practices.

Trend analysis combines historical data with current market indicators to identify emerging patterns and forecast future market directions. Economic modeling incorporates multiple variables to assess market sensitivity to different economic scenarios and policy changes.

Ontario dominates Canada’s commercial construction market, accounting for approximately 42% of national construction activity. The Greater Toronto Area drives significant office, retail, and mixed-use development, supported by strong population growth and economic diversification. Toronto’s commercial market benefits from its status as Canada’s financial center and attracts major corporate headquarters and international businesses.

British Columbia represents the second-largest regional market, with 23% market share concentrated primarily in the Vancouver metropolitan area. The province benefits from Pacific Rim trade relationships, natural resource industries, and growing technology sector presence. Vancouver’s construction market is characterized by high-density development and significant foreign investment in commercial properties.

Quebec maintains a 18% market share with Montreal serving as the primary commercial construction hub. The province’s unique regulatory environment and French language requirements create distinct market characteristics. Montreal’s commercial sector benefits from aerospace industry presence, cultural institutions, and growing technology companies.

Alberta accounts for 12% of market activity, with Calgary and Edmonton driving commercial development. The province’s economy is closely tied to energy sector performance, creating cyclical patterns in commercial construction demand. Energy sector recovery is supporting renewed commercial development activity and office space absorption.

Other provinces collectively represent 5% of market activity, with growing opportunities in cities like Winnipeg, Halifax, and Saskatoon. These markets offer lower costs and emerging opportunities for companies seeking geographic diversification and growth in secondary markets.

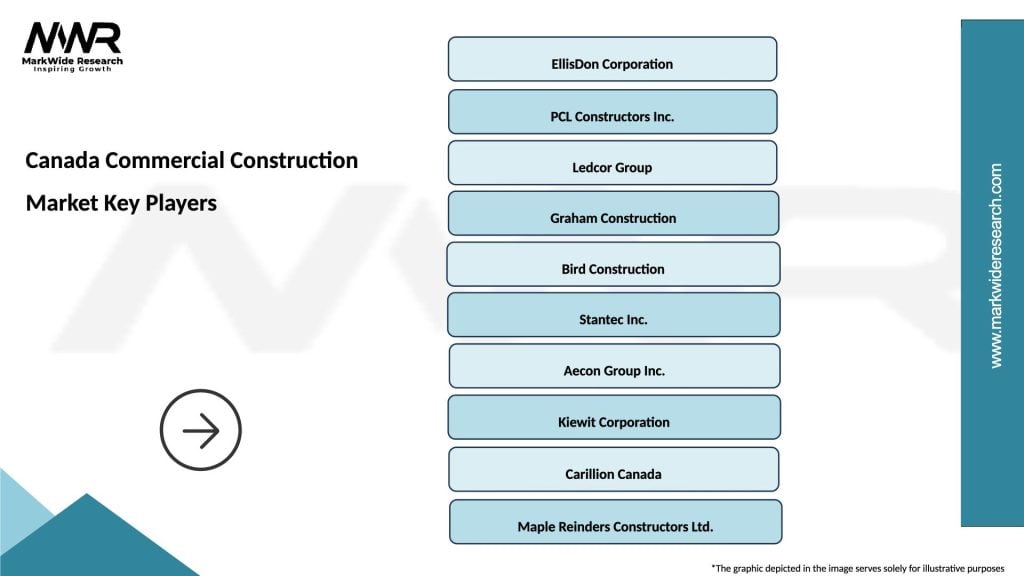

Market leadership in Canada’s commercial construction sector is distributed among several major national and regional contractors with specialized capabilities and geographic strengths:

Competitive differentiation is achieved through specialization in specific project types, geographic focus, technology adoption, and client relationship management. Market positioning strategies emphasize safety records, project delivery performance, and sustainable construction capabilities to attract clients and secure project awards.

Strategic partnerships between contractors, architects, and specialty consultants are becoming increasingly important for securing complex projects and delivering integrated solutions. Collaboration models enable companies to combine expertise and resources for large-scale commercial developments.

By Project Type:

By Construction Value:

By Geographic Region:

Office Construction remains the largest category within Canada’s commercial construction market, driven by corporate expansion, workplace modernization, and urban densification trends. Modern office buildings incorporate advanced building systems, flexible space configurations, and sustainability features that appeal to contemporary tenants and support employee productivity.

Retail Construction is adapting to changing consumer behaviors and e-commerce impacts through mixed-use developments, experiential retail concepts, and omnichannel fulfillment facilities. Shopping center renovation projects are increasing as property owners adapt existing facilities to new retail formats and consumer expectations.

Industrial Construction is experiencing rapid growth with 38% increase in warehouse and distribution facility construction driven by e-commerce logistics requirements and supply chain modernization. Advanced manufacturing facilities require specialized construction expertise and sophisticated building systems to support automated production processes.

Healthcare Construction represents a stable and growing category supported by aging population demographics and government healthcare infrastructure investments. Medical facilities require specialized construction knowledge, regulatory compliance expertise, and advanced building systems to support patient care and medical equipment.

Educational Construction benefits from enrollment growth and facility modernization requirements at both K-12 and post-secondary levels. Campus development projects often involve multiple buildings and long-term master planning that provides sustained opportunities for construction companies.

Construction Companies benefit from diverse project opportunities, stable demand patterns, and opportunities to develop specialized expertise in high-value market segments. Revenue diversification across different project types and geographic regions provides stability and growth potential for construction firms.

Skilled Trades Workers enjoy strong employment opportunities, competitive wages, and career advancement potential in a growing industry. Training programs and apprenticeship opportunities provide pathways for workers to develop specialized skills and increase earning potential.

Material Suppliers benefit from consistent demand for construction materials and opportunities to develop innovative products that meet evolving market requirements. Supply chain partnerships with major contractors provide stable revenue streams and opportunities for business growth.

Professional Services including architects, engineers, and project managers find expanding opportunities to support complex commercial projects and provide specialized expertise. Technology integration creates new service opportunities and enhances professional capabilities.

Local Communities benefit from job creation, economic development, and improved commercial infrastructure that supports business growth and quality of life improvements. Tax revenue generation from commercial construction activity supports public services and community development initiatives.

Property Investors gain access to modern commercial facilities that generate rental income and provide long-term investment returns. Sustainable buildings offer enhanced value propositions through reduced operating costs and improved tenant satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Construction Practices are becoming standard requirements rather than optional features, with clients increasingly demanding LEED certification and other green building standards. Energy efficiency measures and renewable energy integration are driving innovation in building design and construction methods.

Technology Integration is accelerating across all aspects of commercial construction, from project planning through building operations. Building Information Modeling adoption has reached 75% of major contractors, improving project coordination and reducing errors during construction.

Prefabrication and Modular Construction techniques are gaining acceptance for their ability to reduce construction timelines, improve quality control, and minimize weather-related delays. Off-site construction methods are particularly valuable for repetitive building components and standardized facility types.

Smart Building Systems are becoming standard features in new commercial construction, incorporating advanced HVAC controls, lighting systems, and security technologies. Internet of Things integration enables building operators to optimize energy consumption and maintenance schedules.

Flexible Space Design reflects changing workplace requirements and the need for adaptable commercial facilities that can accommodate evolving business needs. Multi-use spaces and convertible floor plans provide long-term value for building owners and tenants.

Health and Safety Focus has intensified following recent global health challenges, with enhanced ventilation systems, touchless technologies, and improved indoor air quality becoming priority features in commercial buildings.

Digital Transformation initiatives are reshaping construction project delivery through cloud-based project management platforms, mobile applications, and real-time collaboration tools. Construction technology investments are improving project transparency and enabling better decision-making throughout the construction process.

Workforce Development programs are addressing skilled labor shortages through partnerships between construction companies, educational institutions, and government agencies. Apprenticeship programs and skills training initiatives are attracting new workers to the construction industry and developing specialized expertise.

Sustainability Initiatives are driving innovation in construction materials, waste reduction practices, and energy-efficient building systems. Circular economy principles are being incorporated into construction practices through material recycling and waste minimization strategies.

Safety Technology adoption is improving workplace safety through wearable devices, drone inspections, and automated safety monitoring systems. Safety performance improvements are reducing insurance costs and enhancing company reputations in competitive bidding processes.

Supply Chain Innovation is addressing material cost volatility and delivery challenges through strategic partnerships, alternative sourcing strategies, and inventory management improvements. Local sourcing initiatives are reducing transportation costs and supporting regional economic development.

Technology Investment should be prioritized by construction companies seeking competitive advantages and operational efficiency improvements. MWR analysis suggests that companies investing in digital construction tools achieve significantly better project outcomes and client satisfaction ratings compared to traditional approaches.

Workforce Development strategies should focus on attracting younger workers and providing career advancement opportunities that compete with other industries. Training programs that combine traditional construction skills with technology competencies will be most effective in addressing current and future workforce needs.

Specialization Focus can provide competitive advantages in specific market segments such as healthcare, advanced manufacturing, or sustainable construction. Niche expertise enables companies to command premium pricing and develop long-term client relationships in specialized markets.

Geographic Diversification across multiple provinces and metropolitan areas can reduce market risk and provide access to different economic cycles and growth opportunities. Regional expansion strategies should consider local market conditions, regulatory requirements, and competitive landscapes.

Partnership Development with architects, engineers, and specialty contractors can enhance project capabilities and improve competitive positioning for complex commercial projects. Strategic alliances enable companies to pursue larger projects and provide integrated solutions to clients.

Sustainability Leadership positions companies advantageously as environmental requirements become more stringent and client preferences shift toward green building solutions. Early adoption of sustainable construction practices creates competitive differentiation and market leadership opportunities.

Market growth prospects for Canada’s commercial construction sector remain positive, supported by continued urbanization, business expansion, and infrastructure modernization requirements. Long-term trends indicate sustained demand for commercial facilities across multiple project categories and geographic regions.

Technology evolution will continue transforming construction practices, with artificial intelligence, robotics, and advanced materials creating new possibilities for project delivery and building performance. Digital construction adoption rates are expected to reach 85% of contractors within the next five years, driven by competitive pressures and client expectations.

Sustainability requirements will become increasingly stringent, with net-zero energy buildings and carbon-neutral construction practices becoming standard expectations rather than premium features. Regulatory evolution will support these trends through updated building codes and incentive programs.

Workforce challenges will persist but may be partially addressed through automation, prefabrication, and improved training programs that attract new workers to the construction industry. Immigration policies supporting skilled trades workers could help address labor shortages in key markets.

Regional development patterns are expected to continue favoring major metropolitan areas while creating emerging opportunities in secondary markets supported by infrastructure investments and business relocations. MarkWide Research projects that balanced regional growth will create opportunities for companies with appropriate geographic strategies.

Canada’s commercial construction market presents a dynamic and evolving landscape characterized by strong fundamentals, technological transformation, and growing emphasis on sustainability. The market benefits from stable economic conditions, diverse project opportunities, and supportive regulatory frameworks that encourage commercial development across multiple sectors.

Key success factors for market participants include technology adoption, workforce development, specialization strategies, and commitment to sustainable construction practices. Companies that effectively address these priorities while maintaining strong project delivery capabilities will be best positioned for long-term success in this competitive market.

Future market development will be shaped by continued urbanization, evolving workplace requirements, and increasing focus on environmental responsibility. The integration of advanced technologies, sustainable building practices, and innovative construction methods will define the next phase of market evolution and create new opportunities for growth and differentiation.

Strategic positioning in Canada’s commercial construction market requires understanding of regional dynamics, client expectations, and industry trends that influence project demand and competitive success. Companies that align their capabilities with market requirements while investing in future-oriented technologies and practices will achieve sustainable competitive advantages in this important economic sector.

What is Canada Commercial Construction?

Canada Commercial Construction refers to the sector involved in the building and renovation of commercial properties such as offices, retail spaces, and industrial facilities. This sector plays a crucial role in the overall economic development of the country.

What are the key players in the Canada Commercial Construction Market?

Key players in the Canada Commercial Construction Market include EllisDon, PCL Constructors, and Ledcor Group, among others. These companies are known for their significant contributions to various commercial projects across the country.

What are the main drivers of the Canada Commercial Construction Market?

The main drivers of the Canada Commercial Construction Market include urbanization, increased demand for commercial spaces, and government infrastructure investments. These factors contribute to a growing need for modern facilities and services.

What challenges does the Canada Commercial Construction Market face?

The Canada Commercial Construction Market faces challenges such as labor shortages, rising material costs, and regulatory hurdles. These issues can impact project timelines and overall profitability.

What opportunities exist in the Canada Commercial Construction Market?

Opportunities in the Canada Commercial Construction Market include the rise of sustainable building practices, advancements in construction technology, and the growing demand for mixed-use developments. These trends can lead to innovative project designs and improved efficiency.

What trends are shaping the Canada Commercial Construction Market?

Trends shaping the Canada Commercial Construction Market include the integration of smart building technologies, a focus on sustainability, and the increasing use of prefabrication methods. These trends are transforming how commercial spaces are designed and constructed.

Canada Commercial Construction Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concrete, Steel, Wood, Glass |

| End User | Government, Commercial, Institutional, Industrial |

| Technology | Building Information Modeling, Prefabrication, Green Building, Smart Construction |

| Service Type | General Contracting, Project Management, Design-Build, Renovation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Commercial Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at