444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan commercial construction market represents a dynamic and evolving sector that continues to drive economic growth and urban development across the nation. Commercial construction in Japan encompasses a diverse range of projects including office buildings, retail complexes, hospitality facilities, healthcare institutions, and mixed-use developments. The market has demonstrated remarkable resilience and adaptability, particularly in response to changing business needs, technological advancements, and evolving consumer preferences.

Market dynamics indicate sustained growth driven by urbanization trends, infrastructure modernization initiatives, and increasing demand for sustainable building solutions. The sector has experienced significant transformation with the integration of smart building technologies, energy-efficient systems, and innovative construction methodologies. Growth projections suggest the market will expand at a compound annual growth rate of 4.2% over the forecast period, supported by robust investment in commercial real estate and government infrastructure programs.

Key market characteristics include the dominance of major metropolitan areas, particularly Tokyo, Osaka, and Nagoya, which account for approximately 68% of total commercial construction activity. The market benefits from Japan’s advanced construction technologies, stringent quality standards, and emphasis on disaster-resistant building designs. Technological innovation continues to reshape the industry with increased adoption of Building Information Modeling (BIM), prefabrication techniques, and automated construction processes.

The Japan commercial construction market refers to the comprehensive sector encompassing the planning, design, development, and construction of non-residential buildings intended for business, commercial, and institutional purposes. This market includes various project types such as office complexes, shopping centers, hotels, restaurants, warehouses, healthcare facilities, educational institutions, and mixed-use developments that combine commercial and residential elements.

Commercial construction differs from residential construction in its scale, complexity, regulatory requirements, and intended use. These projects typically involve larger investments, longer development timelines, and more sophisticated building systems including advanced HVAC, electrical, and security infrastructure. The market encompasses both new construction projects and major renovation or expansion of existing commercial properties.

Market participants include general contractors, specialty subcontractors, architects, engineers, developers, investors, and various service providers. The sector plays a crucial role in Japan’s economy by creating employment opportunities, supporting related industries, and contributing to urban development and modernization efforts across the country.

Japan’s commercial construction market continues to demonstrate steady growth momentum driven by urbanization, technological advancement, and evolving business requirements. The market has successfully adapted to post-pandemic challenges while embracing new construction technologies and sustainable building practices. Key growth drivers include increasing demand for flexible office spaces, expansion of e-commerce fulfillment centers, and growing investment in healthcare and hospitality infrastructure.

Market segmentation reveals diverse opportunities across multiple building types, with office construction maintaining the largest market share at approximately 35% of total activity. Retail and mixed-use developments represent significant growth segments, while industrial and logistics facilities experience robust demand driven by supply chain modernization. The market benefits from Japan’s stable economic environment, advanced construction capabilities, and strong regulatory framework.

Competitive landscape features both established Japanese construction giants and international players seeking market opportunities. Innovation remains a key differentiator, with companies investing heavily in digital construction technologies, sustainable building solutions, and efficient project delivery methods. Future prospects appear positive, supported by ongoing urbanization trends, infrastructure investment, and the country’s commitment to carbon neutrality goals.

Strategic market insights reveal several critical trends shaping Japan’s commercial construction landscape:

Market maturity is evidenced by sophisticated construction capabilities, established supply chains, and comprehensive regulatory frameworks. The sector continues to evolve with changing demographics, business practices, and environmental considerations driving new development patterns and construction approaches.

Primary market drivers propelling growth in Japan’s commercial construction sector include urbanization acceleration, technological advancement, and evolving business space requirements. Urban population concentration continues to increase, with metropolitan areas experiencing sustained demand for modern commercial facilities that support diverse business activities and economic growth.

Economic stability and low interest rates create favorable conditions for commercial real estate investment and development projects. Government infrastructure initiatives and urban renewal programs provide additional momentum, particularly in areas targeted for redevelopment and modernization. Tourism recovery following pandemic restrictions drives demand for hospitality and retail construction projects.

Technological innovation serves as a significant driver, with businesses seeking modern facilities equipped with advanced building systems, high-speed connectivity, and smart building features. The shift toward sustainable business practices creates demand for environmentally friendly buildings with energy-efficient systems and green certifications. Supply chain evolution drives construction of modern logistics and distribution facilities to support e-commerce growth and improved inventory management.

Demographic changes including aging population and changing work patterns influence commercial space design and functionality requirements. Healthcare facility expansion addresses growing medical service needs, while educational institution modernization supports evolving learning environments and research capabilities.

Market constraints affecting Japan’s commercial construction sector include labor shortages, regulatory complexity, and economic uncertainties. Skilled labor availability remains a persistent challenge, with an aging workforce and limited new entrants creating capacity constraints for construction projects. This situation drives increased labor costs and potential project delays.

Regulatory requirements while ensuring quality and safety, can create complexity and extend project timelines. Building code compliance, environmental regulations, and permit processes require significant time and resources, particularly for large-scale commercial developments. Land availability in prime urban locations presents challenges, with limited developable sites driving up land costs and creating competition among developers.

Material cost volatility affects project economics, with fluctuating prices for steel, concrete, and other construction materials impacting profit margins and project feasibility. Global supply chain disruptions can cause material shortages and delivery delays, affecting construction schedules and costs.

Economic uncertainties including potential recession risks, inflation concerns, and changing business conditions can impact commercial real estate demand and investment decisions. Environmental regulations while promoting sustainability, may increase construction costs and complexity, particularly for projects requiring advanced green building technologies and certifications.

Significant opportunities exist within Japan’s commercial construction market, driven by technological advancement, sustainability trends, and evolving business needs. Smart building integration presents substantial growth potential as businesses seek facilities with advanced automation, energy management, and connectivity features that enhance operational efficiency and occupant experience.

Sustainable construction offers expanding opportunities as organizations prioritize environmental responsibility and energy efficiency. Green building certifications, renewable energy integration, and carbon-neutral construction methods create new market segments and competitive advantages for forward-thinking contractors and developers.

Urban redevelopment projects provide opportunities for large-scale commercial construction as cities modernize aging infrastructure and create mixed-use developments. Healthcare facility expansion represents a growing market segment driven by demographic changes and increasing medical service demand, requiring specialized construction expertise and advanced building systems.

Industrial and logistics construction experiences robust growth driven by e-commerce expansion and supply chain optimization needs. Modern distribution centers, automated warehouses, and last-mile delivery facilities require sophisticated construction approaches and advanced building technologies. Hospitality sector recovery creates opportunities for hotel, resort, and entertainment facility construction as tourism rebounds and business travel resumes.

Renovation and modernization of existing commercial properties presents substantial market potential as building owners seek to upgrade facilities, improve energy efficiency, and adapt spaces for changing business requirements.

Market dynamics in Japan’s commercial construction sector reflect the interplay of economic, technological, and social factors shaping industry development. Supply and demand balance varies by region and building type, with metropolitan areas experiencing stronger demand while rural regions face different market conditions and development patterns.

Competitive intensity remains high among construction companies, driving innovation in project delivery methods, cost management, and value-added services. Companies differentiate through technological capabilities, sustainability expertise, and specialized construction knowledge. Client expectations continue to evolve, with increasing emphasis on project quality, delivery speed, and long-term building performance.

Technology adoption rates accelerate across the industry, with approximately 72% of major contractors implementing digital construction technologies to improve efficiency and project outcomes. Collaboration patterns between architects, engineers, contractors, and technology providers become increasingly integrated, supporting more efficient project delivery and better building performance.

Investment flows from both domestic and international sources support market growth, with institutional investors seeking stable returns from commercial real estate development. Risk management becomes increasingly sophisticated, with companies implementing advanced project management systems and comprehensive insurance strategies to mitigate construction and market risks.

Regulatory environment continues to evolve, with updated building codes promoting innovation while maintaining safety standards. Environmental regulations drive adoption of sustainable construction practices and green building technologies throughout the industry.

Comprehensive research methodology employed for analyzing Japan’s commercial construction market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, construction professionals, developers, and government officials to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government statistics, industry reports, company financial statements, and regulatory documents to establish market baselines and identify key trends. Data triangulation methods verify findings across multiple sources to ensure consistency and accuracy in market assessments and projections.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth, segment performance, and regional development patterns. Qualitative assessment incorporates expert opinions, industry surveys, and stakeholder feedback to understand market dynamics and competitive positioning.

Market segmentation analysis examines various building types, construction methods, and regional markets to identify growth opportunities and competitive landscapes. Competitive intelligence gathering includes analysis of major market participants, their strategies, capabilities, and market positioning.

Validation processes include peer review, expert consultation, and cross-referencing with established industry benchmarks to ensure research quality and reliability. Regular updates incorporate new data and market developments to maintain current and relevant market intelligence.

Regional market distribution across Japan reveals significant concentration in major metropolitan areas, with distinct development patterns and growth opportunities in different regions. Tokyo metropolitan area dominates commercial construction activity, accounting for approximately 42% of total market volume, driven by corporate headquarters, financial services, and international business presence.

Kansai region including Osaka and Kyoto represents the second-largest market, contributing roughly 23% of national construction activity. This region benefits from manufacturing industry presence, tourism development, and ongoing urban renewal projects. Chubu region centered around Nagoya accounts for approximately 15% of market activity, supported by automotive industry concentration and industrial facility development.

Northern regions including Hokkaido experience moderate growth driven by tourism infrastructure and agricultural facility modernization. Southern regions including Kyushu benefit from technology industry development and international trade facility construction.

Urban versus rural dynamics show contrasting development patterns, with cities focusing on high-rise and mixed-use projects while rural areas emphasize industrial and logistics facilities. Regional specialization emerges based on local economic strengths, with technology hubs, manufacturing centers, and tourism destinations driving specific types of commercial construction.

Infrastructure connectivity influences regional development patterns, with areas served by high-speed rail and major airports experiencing stronger commercial construction demand. Government regional development initiatives support balanced growth across different areas of the country.

Competitive environment in Japan’s commercial construction market features established domestic leaders alongside international competitors seeking market opportunities. Market leadership is characterized by companies with strong financial resources, advanced technical capabilities, and comprehensive project management expertise.

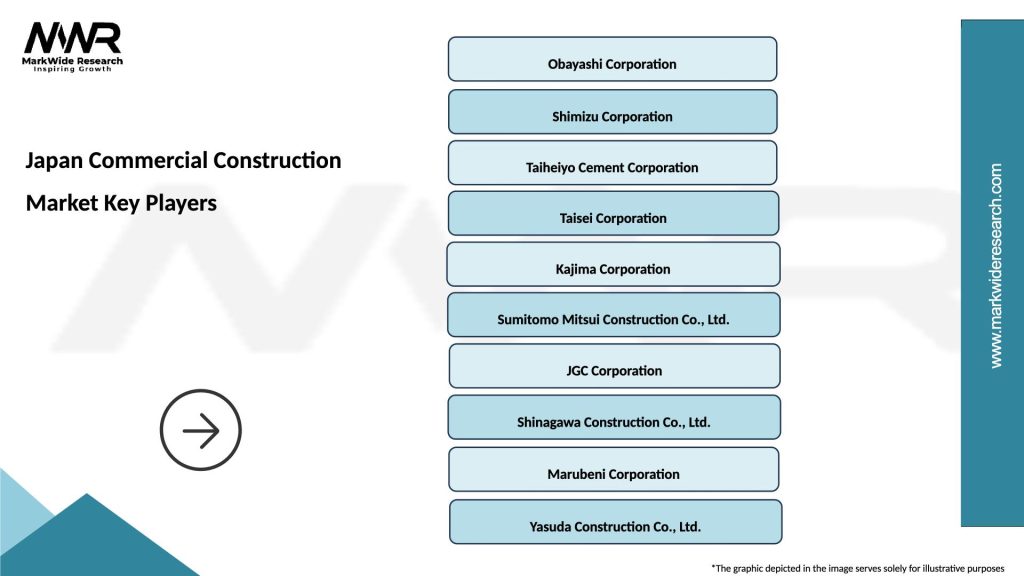

Major market participants include:

Competitive strategies focus on technological innovation, sustainability leadership, and specialized expertise in specific building types or construction methods. Companies invest heavily in research and development, digital construction technologies, and workforce development to maintain competitive advantages.

Market consolidation trends include strategic partnerships, joint ventures, and acquisitions as companies seek to expand capabilities and market reach. International collaboration brings global expertise and technologies to the Japanese market while providing local companies with overseas expansion opportunities.

Market segmentation analysis reveals diverse opportunities across multiple dimensions including building type, construction method, end-user industry, and project scale. By building type, the market encompasses several key categories with distinct characteristics and growth patterns.

Office Buildings: Representing the largest segment with approximately 35% market share, including corporate headquarters, business centers, and flexible workspace facilities. This segment benefits from ongoing demand for modern office environments and smart building technologies.

Retail and Commercial: Accounting for roughly 22% of market activity, encompassing shopping centers, department stores, restaurants, and entertainment facilities. E-commerce impact drives demand for experiential retail spaces and omnichannel fulfillment centers.

Industrial and Logistics: Representing approximately 18% of construction volume, including warehouses, distribution centers, manufacturing facilities, and data centers. Growth driven by supply chain modernization and digital infrastructure needs.

Healthcare Facilities: Contributing about 12% of market activity, including hospitals, clinics, medical research facilities, and senior care centers. Demographic trends and medical technology advancement drive continued expansion.

Hospitality and Tourism: Accounting for roughly 8% of construction activity, encompassing hotels, resorts, conference centers, and cultural facilities. Recovery from pandemic impacts supports renewed investment in tourism infrastructure.

Educational and Institutional: Representing approximately 5% of market volume, including universities, training centers, government buildings, and research facilities.

Office construction category continues to evolve with changing workplace requirements, emphasizing flexible layouts, collaboration spaces, and health-conscious design features. Hybrid work models influence space planning with increased focus on technology integration and adaptable environments that support both in-person and remote collaboration.

Retail construction adapts to omnichannel commerce trends, with projects incorporating fulfillment capabilities, experiential elements, and flexible spaces that can accommodate changing retail formats. Mixed-use developments gain popularity by combining retail, office, and residential components in integrated communities.

Industrial construction emphasizes automation-ready facilities with advanced material handling systems, climate control, and connectivity infrastructure. Logistics facilities incorporate sophisticated sorting systems, robotics integration, and last-mile delivery capabilities to support modern supply chain requirements.

Healthcare construction focuses on patient-centered design, infection control measures, and advanced medical technology integration. Specialized facilities including research laboratories and treatment centers require sophisticated building systems and regulatory compliance expertise.

Hospitality construction emphasizes guest experience enhancement through smart room technologies, sustainable design features, and flexible event spaces. Wellness-focused amenities and contactless service capabilities become standard requirements in modern hospitality facilities.

Educational construction incorporates technology-enhanced learning environments, collaborative spaces, and sustainable design principles that support modern educational methodologies and environmental responsibility.

Industry participants in Japan’s commercial construction market benefit from numerous advantages including stable economic environment, advanced technology infrastructure, and sophisticated regulatory frameworks that support quality construction and long-term asset value.

Construction companies benefit from:

Developers and investors gain advantages through:

End users and tenants benefit from modern facilities with advanced building systems, energy efficiency, and flexible spaces that support business operations and employee satisfaction. Economic impact extends to related industries including materials suppliers, equipment manufacturers, and professional services providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping Japan’s commercial construction market reflect technological advancement, sustainability priorities, and evolving business requirements. Digital construction adoption accelerates with Building Information Modeling (BIM) implementation reaching approximately 78% among major contractors, improving project coordination and reducing construction errors.

Sustainable construction practices gain momentum with increasing demand for green building certifications and energy-efficient designs. Carbon neutrality goals drive adoption of renewable energy systems, sustainable materials, and construction methods that minimize environmental impact throughout building lifecycles.

Modular and prefabricated construction methods expand to address labor shortages and improve construction efficiency. Off-site manufacturing of building components reduces on-site construction time and improves quality control while addressing skilled labor availability challenges.

Smart building integration becomes standard practice with IoT sensors, automated systems, and data analytics enhancing building operations and occupant experiences. Health and wellness features including improved air quality systems, natural lighting, and biophilic design elements gain importance in commercial building design.

Flexible space design responds to changing work patterns with adaptable layouts that can accommodate various business functions and hybrid work models. Technology infrastructure requirements expand with high-speed connectivity, cloud computing support, and cybersecurity features becoming essential building components.

Resilience planning incorporates disaster preparedness and business continuity considerations into building design and construction methods, reflecting Japan’s experience with natural disasters and emergency preparedness requirements.

Recent industry developments demonstrate continued innovation and adaptation within Japan’s commercial construction sector. Technology partnerships between construction companies and technology providers accelerate implementation of advanced building systems and digital construction methods.

Sustainability initiatives include major contractors committing to carbon-neutral construction goals and implementing comprehensive environmental management systems. Green building certifications become increasingly common with LEED, BREEAM, and local sustainability standards driving design and construction decisions.

Workforce development programs address labor shortages through training initiatives, apprenticeship programs, and technology-assisted construction methods that improve productivity and attract new workers to the industry. International collaboration brings global expertise and best practices to Japanese construction projects.

Regulatory updates include revised building codes that promote innovation while maintaining safety standards, and new environmental regulations that encourage sustainable construction practices. Government infrastructure investment supports market growth through public-private partnerships and urban development initiatives.

Digital transformation accelerates with cloud-based project management systems, virtual reality design tools, and artificial intelligence applications improving construction planning and execution. Supply chain innovation includes development of new materials, construction methods, and logistics systems that enhance project efficiency and quality.

Market consolidation continues through strategic mergers, acquisitions, and partnerships that create larger, more capable construction organizations with enhanced technical and financial resources.

Strategic recommendations for market participants focus on technology adoption, sustainability leadership, and operational efficiency improvements. MarkWide Research analysis suggests that companies should prioritize digital transformation initiatives including BIM implementation, project management system upgrades, and workforce training programs to maintain competitive advantages.

Technology investment should emphasize solutions that address labor shortages, improve project efficiency, and enhance building performance. Automation technologies including robotics, prefabrication systems, and AI-powered project management tools offer significant potential for improving construction productivity and quality.

Sustainability positioning becomes increasingly important as clients prioritize environmental responsibility and energy efficiency. Companies should develop expertise in green building certifications, sustainable materials, and carbon-neutral construction methods to capture growing market demand.

Market diversification strategies should consider emerging segments including healthcare facilities, logistics centers, and mixed-use developments that offer growth opportunities. Geographic expansion within Japan can provide access to regional markets with specific development needs and growth potential.

Partnership development with technology providers, international contractors, and specialized consultants can enhance capabilities and market reach. Workforce development initiatives including training programs, technology adoption, and retention strategies address critical labor challenges while improving operational efficiency.

Risk management strategies should address material cost volatility, regulatory changes, and economic uncertainties through comprehensive planning and flexible business models that can adapt to changing market conditions.

Future prospects for Japan’s commercial construction market appear positive, supported by continued urbanization, technological advancement, and infrastructure investment. Market growth is expected to continue at a steady pace with projected expansion driven by modernization needs, sustainability requirements, and evolving business space demands.

Technology integration will accelerate with advanced construction methods, smart building systems, and digital project management becoming standard industry practices. Artificial intelligence and machine learning applications will enhance project planning, risk management, and building operations, creating more efficient and responsive construction processes.

Sustainability focus will intensify with carbon neutrality goals driving adoption of renewable energy systems, sustainable materials, and circular economy principles in construction practices. Green building standards will become more stringent, requiring advanced environmental performance and lifecycle sustainability considerations.

Demographic changes including aging population and urbanization trends will influence building design and functionality requirements. Healthcare construction will expand significantly to address growing medical service needs, while office and retail spaces will continue evolving to support changing work and consumer patterns.

Regional development initiatives will create opportunities beyond major metropolitan areas, with government infrastructure investment supporting balanced economic growth across different regions. International collaboration will bring global expertise and investment to Japanese construction projects while providing domestic companies with overseas expansion opportunities.

Innovation acceleration will continue with emerging technologies including 3D printing, advanced materials, and autonomous construction equipment transforming industry capabilities and project delivery methods.

Japan’s commercial construction market demonstrates remarkable resilience and adaptability, positioning itself for continued growth through technological innovation, sustainability leadership, and responsive adaptation to changing business needs. The market benefits from strong economic fundamentals, advanced construction capabilities, and comprehensive regulatory frameworks that support quality development and long-term asset value.

Key success factors include embracing digital transformation, developing sustainable construction expertise, and addressing workforce challenges through technology adoption and training initiatives. Market opportunities span multiple segments including smart buildings, healthcare facilities, logistics centers, and urban redevelopment projects that offer substantial growth potential.

Competitive advantages will increasingly depend on technological capabilities, sustainability expertise, and ability to deliver complex projects efficiently and cost-effectively. Companies that invest in innovation, workforce development, and strategic partnerships will be best positioned to capitalize on market opportunities and navigate industry challenges.

Future market evolution will be shaped by continued urbanization, demographic changes, and technological advancement that create new requirements for commercial building design and construction methods. Sustainability imperatives and smart building technologies will become standard requirements rather than competitive differentiators, requiring industry-wide adaptation and capability development.

The Japan commercial construction market outlook remains positive with steady growth prospects supported by ongoing modernization needs, infrastructure investment, and evolving business space requirements that will drive continued demand for innovative construction solutions and high-quality commercial facilities.

What is Commercial Construction?

Commercial construction refers to the building and renovation of structures intended for commercial use, such as offices, retail spaces, and warehouses. This sector plays a crucial role in the economy by providing infrastructure for businesses and services.

What are the key players in the Japan Commercial Construction Market?

Key players in the Japan Commercial Construction Market include Shimizu Corporation, Obayashi Corporation, and Taisei Corporation, among others. These companies are involved in various projects ranging from large-scale commercial buildings to infrastructure development.

What are the main drivers of the Japan Commercial Construction Market?

The main drivers of the Japan Commercial Construction Market include urbanization, increased demand for commercial spaces, and government investments in infrastructure. Additionally, the growth of e-commerce is leading to a rise in logistics and distribution centers.

What challenges does the Japan Commercial Construction Market face?

The Japan Commercial Construction Market faces challenges such as labor shortages, rising material costs, and regulatory hurdles. These factors can impact project timelines and overall profitability for construction firms.

What opportunities exist in the Japan Commercial Construction Market?

Opportunities in the Japan Commercial Construction Market include the development of smart buildings and sustainable construction practices. The increasing focus on energy efficiency and green building certifications is driving innovation in construction methods.

What trends are shaping the Japan Commercial Construction Market?

Trends shaping the Japan Commercial Construction Market include the adoption of advanced construction technologies, such as Building Information Modeling (BIM) and modular construction. Additionally, there is a growing emphasis on sustainability and eco-friendly materials in new projects.

Japan Commercial Construction Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concrete, Steel, Wood, Glass |

| End User | Commercial, Institutional, Industrial, Infrastructure |

| Technology | Modular Construction, Prefabrication, Green Building, Smart Building |

| Application | Office Buildings, Retail Spaces, Warehouses, Educational Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Commercial Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at