444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US bacon market represents one of the most dynamic and resilient segments within the American processed meat industry, demonstrating consistent growth patterns and evolving consumer preferences. Market dynamics indicate that bacon consumption has experienced remarkable expansion, with the industry witnessing a 4.2% annual growth rate over the past five years. This growth trajectory reflects changing dietary habits, innovative product development, and strategic marketing initiatives that have positioned bacon as a versatile culinary ingredient beyond traditional breakfast applications.

Consumer demand for premium bacon products has intensified significantly, driven by increasing disposable income and growing appreciation for artisanal food products. The market encompasses various bacon types, including traditional pork belly bacon, turkey bacon, beef bacon, and plant-based alternatives, each catering to specific consumer segments and dietary requirements. Regional preferences vary considerably across the United States, with Southern states showing particularly strong consumption patterns and Western regions demonstrating growing interest in organic and nitrate-free options.

Industry consolidation has characterized the market landscape, with major food processing companies acquiring smaller specialty producers to expand their product portfolios and market reach. This consolidation trend has facilitated improved distribution networks, enhanced production efficiency, and accelerated innovation in product development. Supply chain optimization has become increasingly important as companies strive to maintain consistent quality while managing fluctuating raw material costs and transportation challenges.

The US bacon market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and retail sale of bacon products throughout the United States. This market includes traditional pork-based bacon varieties, alternative protein bacon products, and specialty bacon formulations designed to meet diverse consumer preferences and dietary restrictions. Market participants range from large-scale industrial processors to artisanal producers, each contributing to the overall market dynamics through their unique value propositions and target market strategies.

Product categories within this market extend beyond conventional breakfast bacon to include flavored varieties, thick-cut options, pre-cooked convenience products, and innovative bacon-flavored seasonings and snacks. The market also encompasses the entire value chain from pig farming and meat processing to retail distribution and foodservice applications. Consumer segmentation plays a crucial role in market definition, with distinct categories including health-conscious consumers seeking nitrate-free options, convenience-oriented buyers preferring pre-cooked products, and premium consumers demanding artisanal quality.

Strategic analysis reveals that the US bacon market has evolved into a sophisticated industry characterized by product diversification, technological advancement, and changing consumer behaviors. The market demonstrates resilience against economic fluctuations, with bacon maintaining its position as a staple protein choice across American households. Growth drivers include expanding foodservice applications, innovative product development, and successful marketing campaigns that have elevated bacon’s cultural significance beyond traditional meal occasions.

Key market trends indicate a shift toward premium and specialty products, with consumers increasingly willing to pay higher prices for quality, taste, and perceived health benefits. The rise of alternative protein bacon products has created new market segments, attracting health-conscious consumers and those with dietary restrictions. Distribution channels have diversified significantly, with e-commerce platforms gaining importance alongside traditional grocery retail and foodservice establishments.

Competitive dynamics show established players maintaining market leadership through brand recognition and distribution advantages, while smaller specialty producers capture market share through innovation and premium positioning. The market faces challenges including raw material price volatility, regulatory compliance requirements, and evolving consumer health consciousness that demands cleaner label products.

Consumer behavior analysis reveals several critical insights that shape market dynamics and future growth potential. The following key insights demonstrate the market’s complexity and opportunity landscape:

Primary growth drivers propelling the US bacon market forward encompass both consumer-driven factors and industry innovations that create sustained demand expansion. These drivers work synergistically to maintain market momentum and create opportunities for continued growth across various market segments.

Cultural integration of bacon into American cuisine has reached unprecedented levels, with bacon appearing in diverse applications from gourmet burgers to dessert items. This culinary versatility has expanded consumption occasions beyond traditional breakfast settings, creating new demand streams and market opportunities. Social media influence has amplified bacon’s popularity, with food trends and viral content driving consumer interest and trial of new bacon-based products.

Foodservice expansion represents a significant driver, as restaurants and fast-casual establishments increasingly incorporate bacon into menu items to enhance flavor profiles and consumer appeal. The rise of bacon-centric restaurants and specialty food trucks has created dedicated market segments focused exclusively on bacon-based offerings. Innovation in processing has enabled manufacturers to develop new textures, flavors, and convenience formats that appeal to evolving consumer preferences.

Health-conscious formulations have emerged as a key driver, with manufacturers developing nitrate-free, organic, and reduced-sodium options that address consumer health concerns while maintaining taste appeal. The introduction of alternative protein bacon products has expanded the addressable market to include consumers with dietary restrictions or environmental concerns.

Significant challenges face the US bacon market, creating headwinds that industry participants must navigate to maintain growth trajectories and market position. These restraints stem from various sources including health concerns, regulatory pressures, and economic factors that impact both production costs and consumer demand.

Health consciousness trends pose the most substantial restraint, as increasing awareness of processed meat health implications influences consumer purchasing decisions. Medical studies linking processed meats to various health conditions have created consumer skepticism and driven demand for alternative protein sources. Dietary trend shifts toward plant-based eating, ketogenic diets, and clean eating philosophies challenge traditional bacon consumption patterns.

Raw material price volatility creates significant operational challenges for bacon processors, with pork belly prices fluctuating based on feed costs, disease outbreaks, and international trade dynamics. These price variations impact profit margins and force manufacturers to implement pricing strategies that may affect consumer demand. Regulatory compliance costs continue to increase as food safety standards become more stringent and labeling requirements more complex.

Supply chain disruptions have highlighted market vulnerabilities, particularly regarding processing facility capacity and transportation logistics. Labor shortages in meat processing facilities have created production bottlenecks that impact product availability and pricing. Environmental concerns related to pork production sustainability create reputational challenges and may influence future regulatory frameworks.

Emerging opportunities within the US bacon market present substantial potential for growth and market expansion, driven by evolving consumer preferences, technological advances, and innovative product development strategies. These opportunities enable market participants to differentiate their offerings and capture new consumer segments.

Premium product segments offer significant growth potential as consumers demonstrate willingness to pay higher prices for artisanal quality, unique flavors, and superior ingredients. Craft bacon producers can capitalize on this trend by developing small-batch, specialty products that command premium pricing. Organic and natural bacon products represent a rapidly expanding opportunity, with consumers increasingly seeking products free from artificial additives and preservatives.

Plant-based alternatives present substantial market expansion opportunities, allowing companies to tap into the growing vegetarian and flexitarian consumer segments. These products can attract environmentally conscious consumers while maintaining familiar bacon flavors and textures. International flavor profiles offer opportunities to introduce global cuisine influences into traditional bacon products, appealing to diverse American demographics.

E-commerce channels provide opportunities for direct-to-consumer sales, enabling specialty producers to reach national markets without traditional distribution constraints. Subscription services and meal kit integration offer additional revenue streams and customer engagement opportunities. Foodservice innovation continues to present opportunities for bacon integration into new menu categories and cuisine types.

Complex interactions between supply and demand factors, competitive forces, and external influences create dynamic market conditions that continuously reshape the US bacon industry landscape. Understanding these dynamics is crucial for market participants to develop effective strategies and maintain competitive advantages.

Supply-side dynamics are influenced by pork production cycles, processing capacity utilization, and raw material availability. Seasonal variations in pork belly supplies create price fluctuations that impact manufacturer margins and retail pricing strategies. Processing efficiency improvements through automation and technology adoption help manufacturers maintain competitiveness while managing labor costs and ensuring consistent product quality.

Demand-side factors include changing consumer preferences, economic conditions, and cultural trends that influence consumption patterns. The rise of food delivery services has created new consumption occasions and increased bacon demand in prepared foods. Cross-category competition from other breakfast proteins and snack foods creates competitive pressure that drives innovation and marketing investment.

Regulatory dynamics continue to evolve, with food safety requirements, labeling standards, and health claims regulations impacting product development and marketing strategies. Trade policies affecting pork imports and exports influence domestic supply availability and pricing. Technological advancement in processing equipment and packaging solutions enables manufacturers to improve efficiency and extend product shelf life.

Comprehensive research approaches employed in analyzing the US bacon market combine quantitative data analysis with qualitative insights to provide a complete understanding of market dynamics, consumer behavior, and industry trends. The methodology encompasses multiple data sources and analytical techniques to ensure accuracy and reliability of market assessments.

Primary research components include consumer surveys, industry expert interviews, and retail channel analysis to gather firsthand insights into market conditions and trends. Consumer focus groups provide detailed understanding of purchasing motivations, brand preferences, and product satisfaction levels. Industry stakeholder interviews with manufacturers, distributors, and retailers offer perspectives on supply chain dynamics, competitive strategies, and market challenges.

Secondary research elements encompass analysis of industry reports, government statistics, trade association data, and academic studies to establish market baselines and identify long-term trends. Sales data analysis from multiple retail channels provides quantitative insights into market size, growth rates, and segment performance. Competitive intelligence gathering through product launches, pricing analysis, and marketing campaign monitoring helps understand competitive dynamics.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis verification, and expert review of findings. Market modeling techniques help project future trends and identify potential market scenarios based on current dynamics and emerging factors.

Geographic distribution of bacon consumption across the United States reveals distinct regional patterns influenced by cultural preferences, demographic characteristics, and local culinary traditions. These regional variations create opportunities for targeted marketing strategies and product development initiatives tailored to specific market preferences.

Southern region dominance is evident in consumption data, with states like Texas, Georgia, and Tennessee showing 40% higher per-capita consumption compared to national averages. This preference stems from cultural culinary traditions that emphasize bacon in traditional dishes and breakfast preparations. Premium product adoption in Southern markets has grown significantly, with consumers showing strong preference for thick-cut and artisanal bacon varieties.

Western states demonstrate growing interest in health-conscious bacon alternatives, with California and Washington leading in organic and nitrate-free product adoption. These markets show 25% higher growth rates for alternative protein bacon products compared to traditional varieties. Urban centers in Western regions drive demand for premium and specialty bacon products, supported by higher disposable incomes and diverse culinary preferences.

Northeastern markets exhibit strong brand loyalty and preference for established national brands, while also showing increasing interest in local and artisanal producers. The region’s dense population centers support diverse distribution channels including specialty food stores and farmers’ markets. Midwestern consumption patterns reflect traditional preferences for classic bacon varieties, though premium product adoption is accelerating in metropolitan areas.

Market leadership in the US bacon industry is characterized by a mix of large-scale processors and specialty producers, each serving distinct market segments through differentiated strategies and value propositions. The competitive environment continues to evolve as companies adapt to changing consumer preferences and market dynamics.

Major industry players maintain competitive advantages through established distribution networks, brand recognition, and production scale efficiencies:

Competitive strategies vary significantly across market participants, with large processors focusing on operational efficiency and broad distribution, while specialty producers emphasize product differentiation and premium positioning. Innovation initiatives include new flavor development, packaging improvements, and alternative protein product lines to address evolving consumer demands.

Market segmentation within the US bacon industry reflects diverse consumer needs, preferences, and usage occasions that create distinct market categories with unique characteristics and growth potential. Understanding these segments enables targeted marketing strategies and product development initiatives.

By Product Type:

By Processing Method:

By Distribution Channel:

Detailed analysis of individual market categories reveals specific trends, growth patterns, and consumer behaviors that influence overall market dynamics and future development opportunities. Each category demonstrates unique characteristics that require tailored strategies and approaches.

Premium Bacon Category shows exceptional growth momentum, with consumers increasingly seeking artisanal quality and unique flavor profiles. This segment benefits from higher profit margins and strong brand loyalty, though it requires significant investment in quality ingredients and specialized processing techniques. Organic certification within this category commands substantial price premiums and attracts environmentally conscious consumers.

Convenience Bacon Products including pre-cooked and microwaveable options address busy lifestyle needs and time-constrained consumers. This category shows consistent growth as working families prioritize meal preparation efficiency. Packaging innovations in this segment focus on extended shelf life and easy preparation methods that enhance consumer convenience.

Alternative Protein Bacon represents the fastest-growing category, driven by health consciousness and dietary restrictions. Plant-based options show particular promise as manufacturers improve taste and texture to more closely resemble traditional bacon. Turkey bacon maintains steady demand among health-conscious consumers seeking lower-fat alternatives without completely abandoning meat products.

Flavored Bacon Varieties including maple, peppered, and international flavor profiles create differentiation opportunities and appeal to adventurous consumers. These products often command premium pricing and generate trial purchases that can lead to repeat consumption.

Strategic advantages available to various industry participants create value-generation opportunities across the bacon market ecosystem, from producers and processors to retailers and consumers. Understanding these benefits enables stakeholders to optimize their market participation and maximize returns.

For Manufacturers:

For Retailers:

For Consumers:

Comprehensive evaluation of the US bacon market’s internal strengths and weaknesses, along with external opportunities and threats, provides strategic insights for industry participants and stakeholders planning future initiatives and investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the US bacon market reflect evolving consumer preferences, technological advances, and industry innovations that create new opportunities and challenges for market participants. These trends influence product development, marketing strategies, and competitive positioning across the industry.

Clean Label Movement continues to gain momentum as consumers increasingly demand transparency in ingredient lists and processing methods. Manufacturers respond by developing nitrate-free, organic, and minimally processed bacon products that maintain taste while addressing health concerns. Artisanal production methods gain popularity as consumers seek authentic, small-batch products with unique flavor profiles and premium quality positioning.

Flavor Innovation drives product differentiation through unique seasoning blends, international flavor profiles, and creative smoking techniques. Manufacturers experiment with maple, bourbon, sriracha, and global spice combinations to attract adventurous consumers and create premium product categories. Texture variations including extra-thick cuts and different fat-to-meat ratios cater to specific consumer preferences and cooking applications.

Sustainability Focus influences production practices as consumers become more environmentally conscious about food choices. Companies invest in sustainable farming practices, reduced packaging materials, and carbon footprint reduction initiatives. Animal welfare considerations drive demand for humanely raised pork products and transparent supply chain practices.

Convenience Enhancement through improved packaging, pre-cooked options, and meal kit integration addresses busy lifestyle needs. Manufacturers develop resealable packaging, microwave-safe containers, and portion-controlled products that simplify meal preparation and reduce food waste.

Recent developments within the US bacon industry demonstrate the dynamic nature of market evolution and the continuous adaptation of industry participants to changing conditions and opportunities. These developments shape competitive dynamics and influence future market direction.

Technology Integration has accelerated across processing facilities, with manufacturers investing in automated slicing equipment, advanced curing systems, and quality control technologies. These investments improve production efficiency, ensure consistent product quality, and reduce labor dependency. Packaging innovations include vacuum-sealed products with extended shelf life and environmentally friendly materials that appeal to sustainability-conscious consumers.

Strategic Acquisitions continue to reshape the competitive landscape as large food companies acquire specialty bacon producers to expand their premium product portfolios. These acquisitions provide access to artisanal production techniques, established brand recognition, and specialized distribution channels. Vertical integration initiatives help companies control supply chain costs and ensure consistent raw material quality.

Product Line Extensions reflect companies’ efforts to capture growing market segments through bacon-flavored snacks, seasonings, and cooking ingredients. These extensions leverage bacon’s popular flavor profile while creating new revenue streams and market opportunities. Plant-based product launches by traditional meat companies demonstrate industry recognition of alternative protein market potential.

Regulatory Compliance initiatives address evolving food safety standards and labeling requirements, with companies investing in facility upgrades and process improvements to maintain compliance and market access.

Strategic recommendations for industry participants focus on capitalizing on market opportunities while addressing challenges and positioning for long-term success in the evolving bacon market landscape. MarkWide Research analysis suggests several key areas for strategic focus and investment.

Product Innovation Priorities should emphasize health-conscious formulations without compromising taste appeal. Companies should invest in research and development of nitrate-free processing methods, organic ingredient sourcing, and alternative protein bacon products. Flavor differentiation through unique seasoning blends and smoking techniques can create premium positioning opportunities and build brand loyalty.

Distribution Strategy Enhancement requires multi-channel approaches that include traditional retail, foodservice, and growing e-commerce opportunities. Companies should develop direct-to-consumer capabilities while maintaining strong relationships with retail partners. International expansion presents opportunities for growth, particularly in markets with growing Western food preferences and increasing disposable income.

Supply Chain Optimization becomes critical for managing cost pressures and ensuring consistent product availability. Companies should consider vertical integration opportunities, strategic supplier partnerships, and technology investments that improve efficiency and reduce dependency on volatile raw material markets. Sustainability initiatives should be integrated throughout operations to address consumer environmental concerns and potential regulatory requirements.

Brand Building Investments in marketing and consumer education can help address health concerns while promoting bacon’s culinary versatility and quality attributes. Companies should leverage social media and digital marketing channels to engage with consumers and build emotional connections to their brands.

Long-term projections for the US bacon market indicate continued growth potential despite challenges from health consciousness trends and alternative protein competition. MWR analysis suggests the market will experience transformation rather than decline, with successful companies adapting to evolving consumer preferences and market dynamics.

Growth trajectory expectations point to sustained expansion driven by product innovation, market segmentation, and international flavor integration. The market is projected to maintain a 3.8% compound annual growth rate over the next five years, supported by premium product adoption and foodservice expansion. Alternative protein segments are expected to show particularly strong growth, potentially reaching 18% of total bacon consumption within the next decade.

Technology advancement will continue to influence production efficiency, product quality, and new product development capabilities. Automation investments will help companies manage labor costs while improving consistency and food safety standards. Packaging innovations will focus on sustainability, convenience, and extended shelf life to meet evolving consumer and retailer requirements.

Market consolidation is likely to continue as companies seek scale advantages and portfolio diversification. Strategic partnerships between traditional meat companies and alternative protein specialists may emerge to capture growing market segments. International expansion opportunities will become increasingly important as domestic market growth moderates and global demand for American food products increases.

Regulatory evolution may influence production methods and labeling requirements, creating both challenges and opportunities for companies that proactively adapt to changing standards. Consumer education and transparency initiatives will become increasingly important for maintaining market position and building trust.

The US bacon market represents a dynamic and resilient industry segment that continues to evolve in response to changing consumer preferences, health consciousness trends, and technological advances. Despite challenges from processed meat health concerns and alternative protein competition, the market demonstrates remarkable adaptability and growth potential through innovation and strategic positioning.

Key success factors for industry participants include embracing product innovation, particularly in health-conscious formulations and alternative protein options, while maintaining the taste and quality attributes that drive consumer loyalty. Companies that successfully balance traditional bacon appeal with modern consumer demands for transparency, sustainability, and health benefits will capture the greatest market opportunities.

Market transformation rather than decline characterizes the industry’s future, with successful companies adapting their strategies to address evolving consumer needs while leveraging bacon’s strong cultural integration and culinary versatility. The continued expansion of foodservice applications, international flavor influences, and premium product segments provides multiple avenues for growth and differentiation.

Strategic investments in technology, supply chain optimization, and brand building will determine competitive success in an increasingly sophisticated market environment. Companies that proactively address sustainability concerns, regulatory requirements, and changing distribution channels will be best positioned for long-term success in the evolving US bacon market landscape.

What is Bacon?

Bacon is a type of salt-cured meat typically made from pork, specifically from the belly or back cuts. It is known for its rich flavor and crispy texture, making it a popular ingredient in various dishes and breakfast meals.

What are the key players in the US Bacon Market?

Key players in the US Bacon Market include Hormel Foods Corporation, Smithfield Foods, Tyson Foods, and Oscar Mayer, among others. These companies are known for their extensive product lines and significant market presence.

What are the growth factors driving the US Bacon Market?

The US Bacon Market is driven by increasing consumer demand for convenience foods, the popularity of breakfast items, and the rise of gourmet bacon products. Additionally, trends towards meat-based diets and protein-rich foods contribute to market growth.

What challenges does the US Bacon Market face?

The US Bacon Market faces challenges such as health concerns related to processed meats, fluctuating pork prices, and competition from plant-based alternatives. These factors can impact consumer preferences and market dynamics.

What opportunities exist in the US Bacon Market?

Opportunities in the US Bacon Market include the development of innovative bacon products, such as organic and nitrate-free options, and expanding into new distribution channels like online retail. Additionally, the growing trend of bacon as a gourmet ingredient presents new avenues for growth.

What trends are shaping the US Bacon Market?

Trends shaping the US Bacon Market include the rise of artisanal and specialty bacon products, increased interest in sustainable and ethically sourced meats, and the incorporation of bacon into non-traditional dishes. These trends reflect changing consumer preferences and culinary experimentation.

US Bacon Market

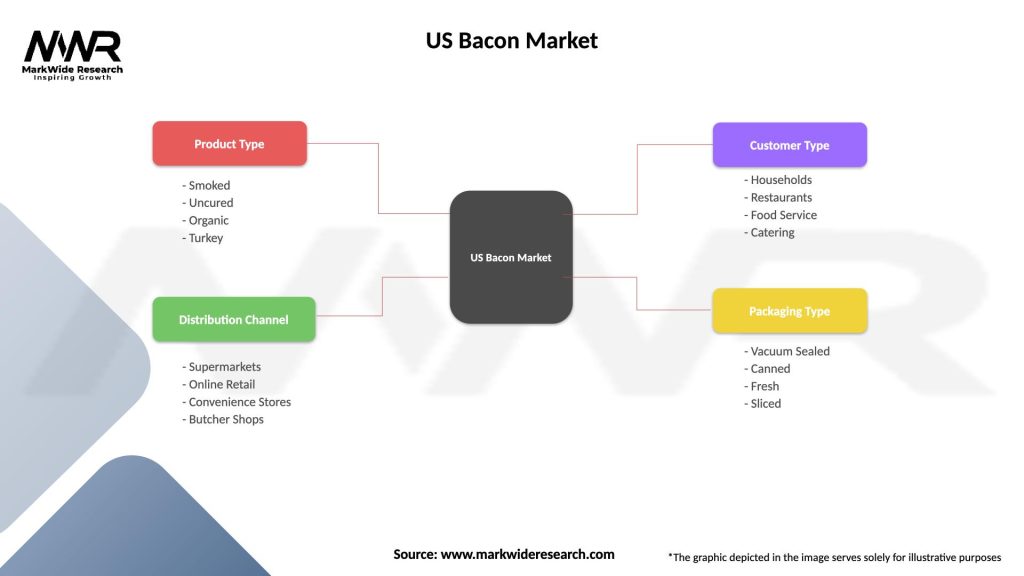

| Segmentation Details | Description |

|---|---|

| Product Type | Smoked, Uncured, Organic, Turkey |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Butcher Shops |

| Customer Type | Households, Restaurants, Food Service, Catering |

| Packaging Type | Vacuum Sealed, Canned, Fresh, Sliced |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Bacon Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at