444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China automotive microcontrollers market represents one of the most dynamic and rapidly evolving segments within the global semiconductor industry. As China continues to establish itself as a dominant force in automotive manufacturing and electric vehicle production, the demand for sophisticated automotive microcontrollers has reached unprecedented levels. These critical components serve as the brain of modern vehicles, controlling everything from engine management systems to advanced driver assistance systems (ADAS) and infotainment platforms.

Market dynamics in China are particularly compelling due to the country’s aggressive push toward electrification and autonomous driving technologies. The automotive microcontroller landscape is experiencing robust growth, driven by increasing vehicle production, rising consumer demand for smart features, and stringent government regulations promoting vehicle safety and emissions control. Growth projections indicate the market is expanding at a 12.5% CAGR through the forecast period, significantly outpacing global averages.

Technological advancement remains at the forefront of market development, with Chinese automotive manufacturers increasingly adopting 32-bit and 64-bit microcontrollers to support complex automotive applications. The integration of artificial intelligence, machine learning capabilities, and enhanced connectivity features has created substantial opportunities for microcontroller suppliers. Electric vehicle adoption rates in China have reached 28% of total vehicle sales, directly correlating with increased demand for specialized automotive microcontrollers designed for battery management, power conversion, and thermal control systems.

The China automotive microcontrollers market refers to the comprehensive ecosystem of semiconductor devices specifically designed and manufactured for automotive applications within the Chinese market. These microcontrollers are specialized computing units that manage and control various electronic systems in vehicles, ranging from basic engine control units to sophisticated autonomous driving processors.

Automotive microcontrollers in the Chinese context encompass a wide range of products including 8-bit, 16-bit, 32-bit, and emerging 64-bit processors that meet stringent automotive quality standards such as AEC-Q100 certification. These devices are engineered to withstand extreme temperatures, vibrations, and electromagnetic interference commonly encountered in automotive environments while maintaining reliable performance throughout the vehicle’s operational lifetime.

Market scope includes microcontrollers used in powertrain systems, body electronics, safety systems, infotainment platforms, and emerging applications in electric and autonomous vehicles. The Chinese market is characterized by both domestic production capabilities and international supplier partnerships, creating a complex but robust supply chain ecosystem that serves both local and global automotive manufacturers.

China’s automotive microcontrollers market stands as a cornerstone of the country’s automotive electronics revolution, driven by unprecedented growth in electric vehicle production and smart automotive technologies. The market demonstrates exceptional resilience and innovation capacity, with domestic manufacturers increasingly developing competitive solutions alongside established international suppliers.

Key market drivers include the rapid electrification of China’s vehicle fleet, government mandates for advanced safety systems, and the growing consumer preference for connected and autonomous vehicle features. Electric vehicle penetration has accelerated demand for specialized microcontrollers, with power management applications representing 35% of total microcontroller demand in the automotive sector.

Competitive landscape features a mix of global semiconductor leaders and emerging Chinese companies, creating a dynamic environment that fosters innovation and cost optimization. The market benefits from China’s comprehensive automotive supply chain, advanced manufacturing capabilities, and substantial government support for semiconductor development. Domestic production capacity has increased significantly, with Chinese manufacturers now supplying 42% of automotive microcontrollers used in locally produced vehicles.

Future prospects remain highly favorable, with autonomous driving technologies, vehicle-to-everything (V2X) communication, and advanced infotainment systems driving sustained demand growth. The market is positioned to benefit from China’s leadership in electric vehicle adoption and its ambitious goals for autonomous vehicle deployment.

Strategic market insights reveal several critical trends shaping the China automotive microcontrollers landscape. The following key observations provide essential understanding of market dynamics:

Market intelligence indicates that Chinese automotive manufacturers are increasingly prioritizing microcontroller suppliers who can provide comprehensive solutions including software development tools, technical support, and long-term supply guarantees. This trend reflects the growing sophistication of China’s automotive electronics ecosystem and the critical importance of reliable semiconductor partnerships.

Electric vehicle proliferation serves as the primary catalyst driving China’s automotive microcontrollers market expansion. The country’s commitment to achieving carbon neutrality by 2060 has accelerated electric vehicle adoption, creating substantial demand for specialized microcontrollers that manage battery systems, power conversion, and thermal management. EV sales growth of 83% year-over-year has directly translated into increased microcontroller consumption across multiple vehicle systems.

Government regulations mandating advanced safety features have significantly boosted demand for automotive microcontrollers. New vehicle safety standards require implementation of electronic stability control, anti-lock braking systems, and advanced driver assistance features, all of which rely heavily on sophisticated microcontroller solutions. These regulatory requirements have created a stable, long-term demand foundation for the market.

Consumer expectations for connected and intelligent vehicles continue to drive market growth. Chinese consumers increasingly demand advanced infotainment systems, smartphone integration, voice recognition, and over-the-air update capabilities. These features require powerful microcontrollers capable of handling complex software applications and real-time data processing.

Autonomous driving development represents a significant growth driver, with Chinese companies investing heavily in self-driving technologies. The computational requirements for autonomous vehicles necessitate high-performance microcontrollers capable of processing sensor data, making real-time decisions, and ensuring fail-safe operation. Autonomous vehicle testing programs have expanded to cover over 15 major cities, indicating strong market momentum.

Supply chain vulnerabilities pose significant challenges to the China automotive microcontrollers market, particularly regarding dependence on international semiconductor suppliers for advanced manufacturing processes. Global chip shortages have highlighted the risks associated with complex supply chains and have prompted increased focus on domestic production capabilities, though building such capabilities requires substantial time and investment.

Technical complexity and stringent automotive qualification requirements create barriers for new market entrants and increase development costs for existing suppliers. Automotive microcontrollers must meet rigorous reliability, safety, and performance standards while operating in harsh environmental conditions. The lengthy qualification processes can delay product launches and increase time-to-market pressures.

Cost pressures from automotive manufacturers seeking to maintain competitive pricing while incorporating advanced features create ongoing challenges for microcontroller suppliers. The need to balance performance, reliability, and cost-effectiveness requires continuous innovation and efficient manufacturing processes. Price competition has intensified as more suppliers enter the market, potentially impacting profit margins.

Cybersecurity concerns related to connected vehicles have introduced new complexity and compliance requirements for automotive microcontrollers. Ensuring robust security features while maintaining performance and cost targets requires specialized expertise and additional development resources. The evolving nature of cybersecurity threats necessitates ongoing updates and enhancements to microcontroller security capabilities.

Autonomous driving advancement presents unprecedented opportunities for automotive microcontroller suppliers in China. The development of Level 4 and Level 5 autonomous vehicles requires sophisticated computing platforms capable of processing massive amounts of sensor data in real-time. Investment in autonomous driving technologies has reached significant levels, creating substantial market opportunities for high-performance microcontroller solutions.

Vehicle electrification expansion beyond passenger cars into commercial vehicles, buses, and specialty vehicles opens new market segments for microcontroller suppliers. Electric commercial vehicles require specialized power management systems, battery monitoring capabilities, and charging infrastructure integration, all of which depend on advanced microcontroller technologies.

Smart city integration initiatives across China create opportunities for vehicle-to-infrastructure (V2I) communication systems that rely on sophisticated microcontrollers. These systems enable traffic optimization, emergency response coordination, and environmental monitoring, representing a growing market segment with substantial government support.

Domestic semiconductor development programs offer opportunities for Chinese microcontroller manufacturers to capture increased market share through government support, favorable policies, and strategic partnerships with automotive manufacturers. The emphasis on supply chain security and technological independence creates a supportive environment for domestic suppliers to expand their capabilities and market presence.

Competitive dynamics in the China automotive microcontrollers market reflect a complex interplay between established international suppliers and emerging domestic manufacturers. Global semiconductor companies maintain technological leadership in high-performance applications, while Chinese companies are rapidly developing capabilities in mainstream automotive applications and gaining market share through competitive pricing and localized support.

Technology evolution continues to reshape market dynamics, with the transition from traditional automotive applications to software-defined vehicles requiring new approaches to microcontroller design and integration. The increasing importance of over-the-air updates, artificial intelligence processing, and real-time communication capabilities is driving demand for more powerful and flexible microcontroller solutions.

Supply chain dynamics have become increasingly important following global semiconductor shortages, with automotive manufacturers seeking to diversify supplier bases and reduce dependency on single sources. This trend has created opportunities for alternative suppliers while emphasizing the importance of supply chain resilience and flexibility.

Innovation cycles in the automotive industry are accelerating, requiring microcontroller suppliers to develop products more quickly while maintaining quality and reliability standards. The traditional automotive development timeline of several years is being compressed to meet rapidly evolving market demands and technological capabilities. Product development cycles have shortened by 25% on average, reflecting the industry’s need for faster innovation.

Comprehensive market analysis for the China automotive microcontrollers market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data analysis, qualitative insights from industry experts, and trend analysis to provide accurate market intelligence and forecasting.

Primary research activities include structured interviews with key stakeholders across the automotive microcontroller value chain, including semiconductor manufacturers, automotive OEMs, tier-1 suppliers, and technology integrators. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the industry landscape.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, regulatory documents, and technical publications. This comprehensive data collection approach ensures thorough coverage of market developments, technological advances, and regulatory changes affecting the automotive microcontroller sector.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market insights. The research methodology emphasizes objectivity and transparency while providing actionable intelligence for market participants and stakeholders.

Eastern China dominates the automotive microcontrollers market, accounting for 45% of total demand, driven by the concentration of major automotive manufacturing hubs in Shanghai, Jiangsu, and Zhejiang provinces. This region benefits from established automotive supply chains, advanced manufacturing capabilities, and proximity to key semiconductor suppliers. The presence of leading electric vehicle manufacturers and automotive electronics companies creates a robust ecosystem supporting microcontroller demand.

Southern China represents a rapidly growing market segment, particularly in Guangdong province, where automotive electronics manufacturing and electric vehicle production are expanding significantly. The region’s strength in electronics manufacturing and component assembly provides advantages for automotive microcontroller integration and testing. Regional growth rates exceed 15% annually, reflecting strong industrial development and government support.

Northern China maintains importance through traditional automotive manufacturing centers in Beijing, Tianjin, and surrounding areas. While growth rates are more moderate compared to other regions, the area remains significant for commercial vehicle applications and government fleet electrification initiatives. The region’s focus on autonomous driving testing and smart city development creates specialized demand for advanced microcontroller solutions.

Central and Western China represent emerging markets with increasing automotive production and growing demand for microcontroller solutions. Government initiatives to develop inland automotive manufacturing capabilities and support for electric vehicle adoption are driving market expansion in these regions. Infrastructure investment and industrial development programs are expected to accelerate growth in these areas over the forecast period.

Market leadership in China’s automotive microcontrollers sector is characterized by intense competition between global semiconductor giants and rapidly advancing domestic manufacturers. The competitive environment fosters innovation while driving cost optimization and localization efforts.

Competitive strategies include technology partnerships with Chinese automotive manufacturers, establishment of local design and manufacturing facilities, and development of China-specific product variants. International suppliers are increasingly collaborating with domestic partners to enhance market access and supply chain resilience.

Innovation focus areas include artificial intelligence integration, cybersecurity enhancement, and energy efficiency optimization. Companies are investing heavily in research and development to maintain technological leadership while adapting to China’s unique market requirements and regulatory environment.

By Product Type:

By Application:

By Vehicle Type:

32-bit microcontrollers represent the fastest-growing category, driven by increasing computational requirements for advanced automotive applications. These devices offer optimal balance between performance, power consumption, and cost, making them ideal for mainstream automotive electronics. Market adoption of 32-bit solutions has reached 68% of total automotive microcontroller volume, reflecting their versatility and capability.

Electric vehicle applications demonstrate unique requirements for specialized microcontrollers capable of managing high-voltage systems, battery monitoring, and thermal management. These applications demand enhanced safety features, real-time processing capabilities, and robust communication interfaces. The growing complexity of electric vehicle systems is driving demand for more sophisticated microcontroller solutions.

Safety-critical applications require microcontrollers meeting the highest automotive safety standards (ASIL-D) and demonstrating exceptional reliability under all operating conditions. These applications include airbag systems, electronic braking, and steering control, where failure could result in serious safety consequences. Safety system penetration continues to expand, with mandatory safety features now required in 95% of new vehicles.

Infotainment systems represent a rapidly evolving category requiring microcontrollers with advanced graphics processing, connectivity capabilities, and multimedia support. Consumer expectations for smartphone-like experiences in vehicles are driving demand for more powerful and feature-rich microcontroller solutions. The integration of artificial intelligence and voice recognition capabilities is creating new requirements for processing power and memory capacity.

Automotive manufacturers benefit from the expanding microcontroller market through access to advanced technologies that enable differentiated vehicle features and improved performance. The availability of diverse microcontroller solutions allows manufacturers to optimize cost-performance trade-offs while meeting regulatory requirements and consumer expectations. System integration capabilities provided by modern microcontrollers reduce development complexity and time-to-market.

Semiconductor suppliers gain access to a large and growing market with stable, long-term demand driven by increasing vehicle electronics content. The automotive market provides opportunities for premium pricing due to stringent quality requirements and the critical nature of automotive applications. Successful suppliers can establish long-term partnerships with automotive manufacturers, providing predictable revenue streams.

Technology integrators and tier-1 suppliers benefit from the availability of advanced microcontroller solutions that enable them to develop sophisticated automotive systems and maintain competitive advantages. Access to cutting-edge microcontroller technologies allows these companies to offer innovative solutions and expand their market presence.

Consumers ultimately benefit from improved vehicle safety, enhanced features, better fuel efficiency, and more reliable automotive systems enabled by advanced microcontroller technologies. The ongoing evolution of automotive microcontrollers contributes to the development of smarter, more connected, and more sustainable vehicles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined vehicles represent a fundamental shift in automotive architecture, requiring microcontrollers with enhanced processing power, memory capacity, and over-the-air update capabilities. This trend is transforming traditional automotive electronics from hardware-centric to software-centric systems, creating new requirements for microcontroller flexibility and performance.

Artificial intelligence integration is becoming increasingly important in automotive applications, driving demand for microcontrollers with AI acceleration capabilities. Edge computing requirements for autonomous driving, predictive maintenance, and personalized user experiences are creating new market opportunities for specialized AI-enabled microcontrollers.

Cybersecurity enhancement has emerged as a critical trend, with automotive microcontrollers requiring built-in security features to protect against cyber threats. Hardware security modules, secure boot capabilities, and encrypted communication interfaces are becoming standard requirements for automotive microcontroller solutions.

Energy efficiency optimization continues to drive microcontroller development, particularly for electric vehicle applications where power consumption directly impacts driving range. Advanced power management features, sleep modes, and energy harvesting capabilities are becoming increasingly important for automotive microcontroller design.

Connectivity expansion through 5G, V2X communication, and IoT integration is creating demand for microcontrollers with advanced wireless communication capabilities. According to MarkWide Research analysis, connected vehicle features are expected to be present in 78% of new vehicles by 2027, driving sustained demand for communication-enabled microcontrollers.

Strategic partnerships between international semiconductor companies and Chinese automotive manufacturers have accelerated technology transfer and localization efforts. These collaborations are enabling faster development of China-specific microcontroller solutions while building local supply chain capabilities and technical expertise.

Manufacturing capacity expansion by both domestic and international suppliers reflects confidence in China’s automotive microcontroller market growth potential. New fabrication facilities and assembly plants are being established to serve the growing demand while reducing supply chain risks and improving delivery times.

Technology acquisitions and joint ventures are reshaping the competitive landscape, with companies seeking to acquire specialized capabilities in automotive microcontroller design, AI processing, and cybersecurity. These strategic moves are accelerating innovation and market consolidation.

Regulatory developments including new automotive safety standards and cybersecurity requirements are driving innovation in microcontroller design and creating new market opportunities for compliant solutions. Government initiatives supporting domestic semiconductor development are also influencing market dynamics and competitive positioning.

Research and development investments in next-generation automotive technologies are creating demand for advanced microcontroller solutions. MWR data indicates that automotive R&D spending in China has increased by 22% annually, reflecting the industry’s commitment to innovation and technological advancement.

Supply chain diversification should be a priority for automotive manufacturers to reduce dependency on single suppliers and geographic regions. Developing relationships with multiple microcontroller suppliers, including domestic Chinese companies, can improve supply security and cost competitiveness while supporting local industry development.

Technology roadmap alignment between automotive manufacturers and microcontroller suppliers is essential for successful product development and market success. Early collaboration on future vehicle architectures and feature requirements can ensure optimal microcontroller selection and integration while reducing development risks and costs.

Investment in local capabilities including design centers, technical support, and manufacturing facilities can provide competitive advantages for international microcontroller suppliers operating in China. Understanding local market requirements and building relationships with Chinese partners are critical success factors.

Focus on emerging applications such as autonomous driving, vehicle-to-everything communication, and advanced infotainment systems can provide growth opportunities and competitive differentiation. Companies should invest in developing specialized microcontroller solutions for these high-growth market segments.

Cybersecurity integration should be considered a fundamental requirement rather than an optional feature for automotive microcontrollers. Developing robust security capabilities and obtaining relevant certifications will be essential for market success as cybersecurity becomes increasingly important in connected vehicles.

Long-term growth prospects for China’s automotive microcontrollers market remain highly favorable, driven by continued vehicle electrification, autonomous driving development, and increasing electronics content per vehicle. The market is expected to maintain robust growth rates as China solidifies its position as a global leader in automotive innovation and manufacturing.

Technology evolution will continue to drive market expansion, with next-generation microcontrollers featuring enhanced AI capabilities, improved energy efficiency, and advanced connectivity features. The transition to software-defined vehicles will create new opportunities for flexible, high-performance microcontroller solutions capable of supporting over-the-air updates and feature additions.

Market consolidation is likely to occur as the industry matures, with successful companies gaining market share through technological leadership, cost competitiveness, and strong customer relationships. Partnerships between international suppliers and Chinese companies may become increasingly important for market success.

Regulatory influence will continue to shape market development, with new safety standards, cybersecurity requirements, and environmental regulations driving demand for advanced microcontroller solutions. Government support for domestic semiconductor development may alter competitive dynamics and create new market opportunities.

Global integration of China’s automotive microcontroller industry is expected to increase, with Chinese suppliers potentially expanding into international markets while continuing to serve domestic demand. The development of world-class domestic capabilities could position China as a major global supplier of automotive microcontrollers, fundamentally changing the industry landscape.

China’s automotive microcontrollers market represents a dynamic and rapidly evolving sector that stands at the intersection of automotive innovation and semiconductor advancement. The market’s robust growth trajectory, driven by electric vehicle adoption, autonomous driving development, and increasing vehicle electronics content, positions it as one of the most attractive segments within the global automotive electronics industry.

Market fundamentals remain strong, supported by China’s position as the world’s largest automotive market, substantial government support for industry development, and growing domestic semiconductor capabilities. The combination of established international suppliers and emerging Chinese companies creates a competitive environment that fosters innovation while driving cost optimization and technological advancement.

Future success in this market will depend on companies’ ability to navigate complex supply chain dynamics, meet evolving technical requirements, and adapt to changing regulatory environments. The transition toward software-defined vehicles, artificial intelligence integration, and enhanced cybersecurity will create new opportunities for companies that can deliver innovative, reliable, and cost-effective microcontroller solutions. As China continues to lead global automotive electrification and smart vehicle development, the automotive microcontrollers market will remain a critical enabler of the industry’s technological transformation and sustainable growth.

What is Automotive Microcontrollers?

Automotive microcontrollers are integrated circuits designed to control various functions in vehicles, including engine management, safety systems, and infotainment. They play a crucial role in enhancing vehicle performance and safety features.

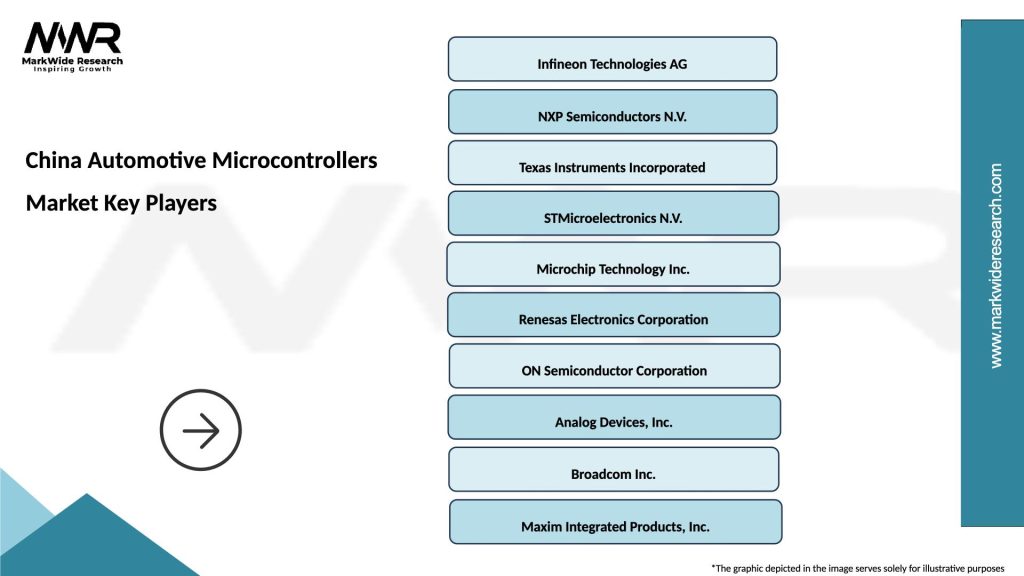

What are the key players in the China Automotive Microcontrollers Market?

Key players in the China Automotive Microcontrollers Market include NXP Semiconductors, Infineon Technologies, STMicroelectronics, and Texas Instruments, among others.

What are the growth factors driving the China Automotive Microcontrollers Market?

The growth of the China Automotive Microcontrollers Market is driven by the increasing demand for advanced driver-assistance systems (ADAS), the rise of electric vehicles, and the growing emphasis on vehicle safety and automation.

What challenges does the China Automotive Microcontrollers Market face?

Challenges in the China Automotive Microcontrollers Market include the complexity of automotive software development, the need for stringent safety standards, and the rapid pace of technological advancements that require continuous innovation.

What opportunities exist in the China Automotive Microcontrollers Market?

Opportunities in the China Automotive Microcontrollers Market include the expansion of smart vehicle technologies, the integration of Internet of Things (IoT) capabilities, and the increasing focus on sustainable automotive solutions.

What trends are shaping the China Automotive Microcontrollers Market?

Trends shaping the China Automotive Microcontrollers Market include the shift towards electrification of vehicles, the adoption of artificial intelligence in automotive applications, and the growing importance of cybersecurity in vehicle systems.

China Automotive Microcontrollers Market

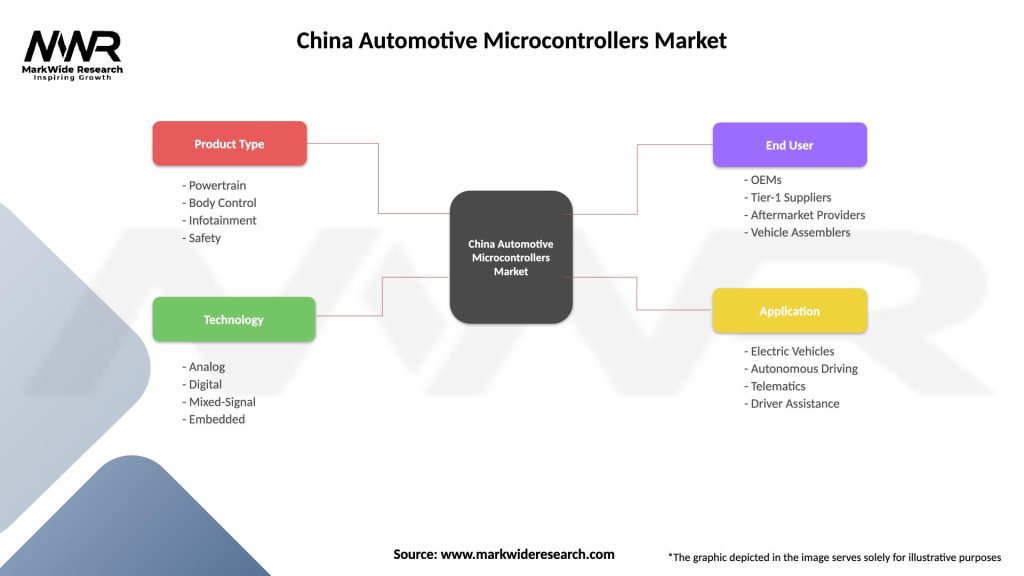

| Segmentation Details | Description |

|---|---|

| Product Type | Powertrain, Body Control, Infotainment, Safety |

| Technology | Analog, Digital, Mixed-Signal, Embedded |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Electric Vehicles, Autonomous Driving, Telematics, Driver Assistance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Automotive Microcontrollers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at