444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China animal health market represents one of the most dynamic and rapidly expanding sectors within the global veterinary industry. China’s agricultural transformation has fundamentally reshaped the landscape for animal healthcare products and services, driven by increasing livestock production, rising pet ownership, and enhanced awareness of animal welfare standards. The market encompasses a comprehensive range of products including vaccines, pharmaceuticals, feed additives, and diagnostic tools designed to maintain and improve animal health across various species.

Market growth in China’s animal health sector is experiencing unprecedented momentum, with the industry expanding at a robust CAGR of 8.2% over recent years. This growth trajectory reflects the country’s evolving agricultural practices, modernization of livestock farming operations, and the increasing adoption of preventive healthcare measures for both production animals and companion pets. Government initiatives supporting food safety and animal welfare have further accelerated market development, creating substantial opportunities for both domestic and international players.

Regional dynamics within China show significant variation, with eastern provinces leading in market adoption due to higher economic development and more advanced farming practices. The market’s expansion is particularly notable in the swine and poultry sectors, which account for approximately 65% of total market demand. Additionally, the companion animal segment is witnessing remarkable growth, driven by urbanization and changing consumer attitudes toward pet care and wellness.

The China animal health market refers to the comprehensive ecosystem of products, services, and technologies designed to prevent, diagnose, and treat diseases in animals while promoting overall animal welfare and productivity. This market encompasses veterinary pharmaceuticals, biologics, vaccines, feed additives, diagnostic equipment, and related services across multiple animal categories including livestock, poultry, aquaculture, and companion animals.

Market scope extends beyond traditional veterinary medicines to include innovative solutions such as precision livestock farming technologies, digital health monitoring systems, and advanced nutritional supplements. The sector plays a crucial role in ensuring food security, supporting agricultural productivity, and maintaining public health through the prevention of zoonotic diseases. Regulatory frameworks governing this market are continuously evolving to align with international standards while addressing China’s specific agricultural and economic needs.

Industry significance is amplified by China’s position as the world’s largest producer of pork and poultry, making animal health solutions essential for maintaining production efficiency and meeting domestic and export quality requirements. The market also reflects broader societal changes, including the growing importance of companion animals and the increasing sophistication of veterinary care standards across the country.

China’s animal health market stands at the forefront of global industry transformation, characterized by rapid technological advancement, regulatory modernization, and shifting consumer demands. The market demonstrates exceptional resilience and growth potential, supported by fundamental drivers including population growth, rising protein consumption, and evolving animal welfare standards. Key market segments show varying growth patterns, with companion animal care experiencing the highest growth rates while livestock applications maintain the largest market share.

Competitive dynamics reveal a landscape where international pharmaceutical companies collaborate with domestic manufacturers to capture market opportunities. The market benefits from increasing research and development investments, with innovation spending growing at approximately 12% annually across major market participants. Digital transformation is reshaping traditional business models, with technology-enabled solutions gaining significant traction among progressive farmers and veterinary professionals.

Strategic implications for market participants include the need for localized product development, enhanced distribution networks, and compliance with evolving regulatory requirements. The market’s future trajectory appears highly favorable, supported by government policies promoting sustainable agriculture, food safety initiatives, and the continued modernization of China’s agricultural sector. Investment opportunities are particularly attractive in segments addressing emerging diseases, precision farming applications, and companion animal healthcare solutions.

Market intelligence reveals several critical insights that define the current and future state of China’s animal health industry. The sector demonstrates remarkable adaptability to changing market conditions, regulatory updates, and technological innovations. Consumer behavior patterns show increasing sophistication in animal care decisions, with both commercial farmers and pet owners seeking more advanced healthcare solutions for their animals.

Primary market drivers propelling China’s animal health sector forward encompass both structural and cyclical factors that create sustained demand for innovative animal healthcare solutions. The fundamental driver remains China’s position as a global agricultural powerhouse, requiring sophisticated animal health management to maintain productivity and meet international quality standards. Population dynamics and rising income levels continue to drive increased protein consumption, necessitating expanded and more efficient animal production systems.

Government policy support represents a crucial driver, with initiatives focused on food safety, agricultural modernization, and rural development creating favorable conditions for market growth. The National Rural Revitalization Strategy emphasizes sustainable agricultural practices and technological advancement, directly benefiting animal health market participants. Regulatory harmonization with international standards is opening new opportunities for product registration and market access, particularly for innovative biologics and advanced therapeutics.

Technological advancement serves as a significant growth catalyst, with digitalization enabling more precise health monitoring, early disease detection, and optimized treatment protocols. The integration of artificial intelligence and IoT technologies in livestock management is creating demand for compatible animal health solutions. Consumer awareness regarding food safety and animal welfare continues to expand, driving demand for higher-quality animal health products and services across all market segments.

Market constraints affecting China’s animal health sector include regulatory complexities, pricing pressures, and infrastructure limitations that can impede optimal market development. Regulatory approval processes for new products remain lengthy and resource-intensive, particularly for innovative biologics and novel therapeutic approaches. The evolving regulatory landscape, while ultimately beneficial, creates short-term uncertainties that can delay product launches and market entry strategies.

Cost sensitivity among agricultural producers, particularly smaller-scale operations, limits adoption of premium animal health solutions despite their proven benefits. Price competition from generic products and local manufacturers creates margin pressure for international companies, requiring careful balance between affordability and innovation. Distribution challenges in rural areas continue to limit market penetration, with logistics infrastructure requiring continued investment and development.

Technical expertise gaps in certain regions affect optimal product utilization and treatment outcomes. Veterinary service availability remains uneven across different provinces, with rural areas often lacking adequate professional support for advanced animal health programs. Counterfeit products and quality control issues in some market segments undermine consumer confidence and create unfair competition for legitimate manufacturers. Environmental regulations are becoming increasingly stringent, requiring additional investment in sustainable production and disposal practices.

Emerging opportunities in China’s animal health market reflect the sector’s dynamic evolution and the country’s commitment to agricultural modernization. The companion animal segment presents exceptional growth potential, with pet ownership rates increasing rapidly in urban areas and pet healthcare spending showing strong upward trends. Aquaculture applications offer significant expansion opportunities, given China’s dominant position in global fish and seafood production.

Digital health solutions represent a transformative opportunity, with smart farming technologies, remote monitoring systems, and data analytics platforms gaining traction among progressive agricultural operations. The integration of precision medicine approaches in veterinary care is creating demand for personalized treatment protocols and targeted therapeutic interventions. Preventive healthcare programs are expanding beyond traditional vaccination to include comprehensive wellness management systems.

Export market development offers substantial growth potential as Chinese animal health companies gain international recognition and regulatory approvals. Research and development partnerships between domestic and international companies are creating opportunities for innovative product development tailored to local market needs. Sustainability initiatives are driving demand for environmentally friendly products and production methods, creating niches for specialized solutions. Professional education and training services represent growing opportunities as the industry seeks to enhance technical expertise and best practice adoption.

Market dynamics in China’s animal health sector reflect complex interactions between supply and demand factors, regulatory influences, and technological innovations. Supply chain evolution is characterized by increasing sophistication in manufacturing capabilities, quality control systems, and distribution networks. Domestic manufacturers are investing heavily in research and development, with R&D spending increasing by approximately 15% annually among leading companies.

Demand patterns show significant variation across different animal species and geographic regions. The swine sector remains the largest demand driver, accounting for approximately 42% of total market consumption, while companion animal applications are experiencing the fastest growth rates. Seasonal fluctuations in demand align with breeding cycles, disease outbreaks, and agricultural calendars, requiring sophisticated inventory management and production planning.

Competitive intensity is increasing as both domestic and international players expand their market presence through strategic investments, partnerships, and acquisitions. Innovation cycles are accelerating, with new product introductions becoming more frequent and technologically advanced. Price dynamics reflect ongoing tension between cost pressures and the need for continued innovation investment. Regulatory changes continue to influence market access, product positioning, and competitive advantages, requiring adaptive strategies from all market participants.

Research approach for analyzing China’s animal health market employs comprehensive methodologies combining primary and secondary research techniques to ensure accurate and actionable market intelligence. Primary research involves extensive interviews with industry stakeholders including manufacturers, distributors, veterinary professionals, agricultural producers, and regulatory officials to capture real-time market insights and emerging trends.

Data collection methods include structured surveys, in-depth interviews, focus group discussions, and field observations across multiple provinces and market segments. Secondary research encompasses analysis of government statistics, industry reports, academic publications, and company financial statements to establish market baselines and validate primary findings. Market sizing utilizes multiple approaches including top-down analysis from agricultural production data and bottom-up calculations from product consumption patterns.

Quality assurance measures include data triangulation, expert validation, and cross-verification of key findings across multiple sources. Regional analysis covers major agricultural provinces and urban centers to capture geographic variations in market development and opportunity distribution. Temporal analysis examines historical trends, current market conditions, and future projections to provide comprehensive market understanding. Competitive intelligence gathering involves systematic monitoring of company activities, product launches, and strategic initiatives across the competitive landscape.

Regional market dynamics across China reveal significant variations in animal health market development, adoption patterns, and growth opportunities. Eastern provinces including Jiangsu, Zhejiang, and Guangdong lead in market sophistication and adoption rates, benefiting from higher economic development, advanced agricultural practices, and better veterinary infrastructure. These regions account for approximately 38% of total market consumption despite representing a smaller portion of total agricultural land.

Northern regions including Heilongjiang, Jilin, and Inner Mongolia demonstrate strong growth in livestock applications, particularly in dairy and beef cattle operations. The Northeast agricultural belt shows increasing adoption of modern animal health practices, driven by large-scale farming operations and government modernization initiatives. Central provinces such as Henan, Hubei, and Hunan maintain significant market presence due to their role as major agricultural production centers.

Western regions present emerging opportunities with government development programs supporting agricultural modernization and rural economic growth. Sichuan province leads western market development, particularly in swine production applications. Urban centers across all regions drive companion animal market growth, with cities like Beijing, Shanghai, and Shenzhen showing premium product adoption rates exceeding 55%. Rural-urban disparities in market development continue to narrow as infrastructure improvements and economic development reach more remote areas.

Competitive structure in China’s animal health market features a diverse mix of international pharmaceutical giants, domestic manufacturers, and specialized regional players. Market leadership is distributed among several key categories, with different companies dominating specific therapeutic areas and animal species applications. The competitive environment continues to evolve through strategic partnerships, acquisitions, and new market entrants seeking to capitalize on growth opportunities.

Market segmentation analysis reveals distinct patterns across multiple dimensions including product type, animal species, application method, and end-user categories. Product segmentation shows pharmaceuticals maintaining the largest market share, followed by vaccines, feed additives, and diagnostic products. Each segment demonstrates unique growth characteristics and competitive dynamics influenced by regulatory requirements, technological advancement, and market demand patterns.

By Product Type:

By Animal Type:

Pharmaceutical category maintains market dominance through consistent demand for therapeutic interventions across all animal species. Antibiotic usage patterns are evolving in response to regulatory changes and resistance concerns, driving development of alternative therapeutic approaches. Anti-parasitic products show strong growth due to increasing awareness of parasite-related productivity losses and welfare concerns.

Vaccine segment demonstrates exceptional growth potential, with adoption rates increasing by 22% annually in commercial livestock operations. Combination vaccines are gaining popularity due to convenience and cost-effectiveness, while autogenous vaccines address specific regional disease challenges. Companion animal vaccines show premium pricing acceptance and growing market penetration in urban areas.

Feed additive category reflects the industry’s shift toward preventive healthcare and performance optimization. Probiotic products are experiencing rapid adoption as alternatives to antibiotic growth promoters. Enzyme supplements gain traction for improving feed efficiency and reducing environmental impact. Functional additives targeting specific health outcomes are creating new market niches and premium pricing opportunities.

Diagnostic segment represents the fastest-growing category, driven by precision farming adoption and early disease detection requirements. Point-of-care testing solutions are expanding market reach to smaller operations and remote locations. Digital diagnostic platforms integrating with farm management systems are creating new business models and value propositions.

Industry participants in China’s animal health market enjoy numerous strategic advantages stemming from the sector’s robust growth trajectory and supportive market conditions. Manufacturers benefit from expanding market demand, improving profit margins, and opportunities for product innovation and differentiation. The market’s size and growth rate provide sustainable revenue streams while supporting continued investment in research and development activities.

Agricultural producers gain access to advanced animal health solutions that improve productivity, reduce mortality rates, and enhance product quality. Livestock farmers report productivity improvements of 18-25% when implementing comprehensive animal health programs. Cost savings from preventive healthcare approaches often exceed initial investment costs within the first production cycle, creating strong economic incentives for adoption.

Veterinary professionals benefit from expanding service opportunities, access to advanced diagnostic tools, and professional development resources. Distribution partners enjoy growing market demand, expanding product portfolios, and opportunities for geographic expansion. Regulatory authorities benefit from improved food safety outcomes, reduced disease outbreaks, and enhanced agricultural productivity supporting national food security objectives.

Consumers ultimately benefit from safer food products, reduced antibiotic residues, and improved animal welfare standards. Pet owners gain access to advanced veterinary care options and preventive healthcare programs that extend pet lifespans and improve quality of life. Export markets benefit from improved product quality and safety standards that enhance China’s reputation as a reliable agricultural product supplier.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the most significant trend reshaping China’s animal health market, with smart farming technologies, IoT sensors, and data analytics platforms becoming integral to modern animal health management. Precision livestock farming approaches are gaining widespread adoption, enabling more targeted and effective health interventions while reducing overall treatment costs and environmental impact.

Preventive healthcare focus continues to intensify, with market participants shifting from reactive treatment approaches to comprehensive wellness programs. Vaccination programs are expanding beyond traditional requirements to include optional immunizations that provide competitive advantages in productivity and product quality. Nutritional health solutions are increasingly integrated with traditional pharmaceutical approaches to create holistic animal health programs.

Sustainability initiatives are driving product development toward environmentally friendly formulations, reduced packaging waste, and lower carbon footprint manufacturing processes. Antibiotic alternatives including probiotics, prebiotics, and immunomodulators are experiencing rapid growth as regulatory pressure and consumer preferences shift toward residue-free animal products. Personalized medicine approaches are emerging in companion animal care, with genetic testing and individualized treatment protocols gaining acceptance among pet owners.

Consolidation trends in the competitive landscape are creating larger, more capable market participants through strategic mergers, acquisitions, and partnerships. Vertical integration strategies are becoming more common as companies seek to control supply chains and improve profit margins. International collaboration between Chinese and foreign companies is accelerating technology transfer and market development initiatives.

Recent industry developments highlight the dynamic nature of China’s animal health market and the rapid pace of innovation and investment across all market segments. Regulatory modernization initiatives have streamlined approval processes for certain product categories while maintaining rigorous safety and efficacy standards. MarkWide Research analysis indicates that regulatory approval timelines have improved by approximately 25% over the past two years for priority product categories.

Manufacturing expansion projects by both domestic and international companies demonstrate confidence in long-term market growth prospects. Several major pharmaceutical companies have announced significant capacity expansions and new facility construction projects totaling substantial investments in production capabilities. Technology partnerships between animal health companies and digital agriculture platforms are creating integrated solutions that address multiple aspects of farm management.

Product innovation continues at an accelerated pace, with new vaccine formulations, novel therapeutic compounds, and advanced diagnostic tools receiving regulatory approval and market introduction. Companion animal segment developments include specialized oncology treatments, advanced surgical procedures, and premium nutritional products targeting specific health conditions. Research collaborations between universities, government institutions, and private companies are advancing scientific understanding and practical applications of animal health technologies.

Market access improvements through enhanced distribution networks, digital marketing platforms, and direct-to-farm sales channels are expanding product availability and customer reach. Professional education programs are improving veterinary expertise and best practice adoption across different regions and market segments.

Strategic recommendations for market participants emphasize the importance of adapting to rapidly evolving market conditions while maintaining focus on long-term growth opportunities. Product portfolio diversification across multiple animal species and therapeutic categories reduces market risk and captures broader growth opportunities. Companies should prioritize innovation investment in high-growth segments including companion animal care, digital health solutions, and sustainable product formulations.

Market entry strategies should emphasize local partnerships, regulatory expertise, and distribution network development to navigate complex market dynamics successfully. Pricing strategies must balance affordability requirements with innovation investment needs, potentially through tiered product offerings targeting different market segments. Quality assurance and brand building initiatives are essential for establishing market credibility and differentiation from lower-quality competitors.

Technology integration should be prioritized to capture opportunities in precision farming, digital health monitoring, and data-driven decision support systems. Sustainability initiatives will become increasingly important for market access and competitive positioning as environmental regulations and consumer preferences continue evolving. Professional relationship building with veterinary professionals, agricultural extension services, and industry associations creates valuable market intelligence and promotional opportunities.

Geographic expansion strategies should focus on underserved regions with improving infrastructure and growing agricultural sophistication. Regulatory compliance capabilities must be continuously enhanced to navigate evolving requirements and maintain market access across all product categories.

Future market prospects for China’s animal health sector appear exceptionally favorable, supported by fundamental growth drivers that are expected to remain strong over the coming decade. Market expansion is projected to continue at a robust pace exceeding 8% annually, driven by continued agricultural modernization, rising protein consumption, and expanding companion animal ownership. MWR projections indicate that technological innovation will play an increasingly central role in market development and competitive differentiation.

Emerging technologies including artificial intelligence, blockchain applications, and advanced biotechnology are expected to create new market categories and business models. Gene therapy and personalized medicine approaches may revolutionize treatment protocols for both production animals and pets. Preventive healthcare adoption is expected to accelerate, with comprehensive wellness programs becoming standard practice across all animal categories.

Regulatory evolution will likely continue toward greater harmonization with international standards while maintaining focus on food safety and environmental protection. Market consolidation trends are expected to continue, creating larger, more capable market participants with enhanced research and development capabilities. Export opportunities for Chinese animal health companies are projected to expand significantly as product quality and international recognition improve.

Sustainability requirements will become increasingly important, driving innovation in environmentally friendly products and production processes. Digital transformation will accelerate, with smart farming technologies becoming ubiquitous in commercial agricultural operations. Consumer awareness and demand for high-quality animal products will continue supporting premium animal health solutions across all market segments.

China’s animal health market represents one of the most compelling growth opportunities in the global veterinary industry, characterized by strong fundamental drivers, supportive government policies, and continuous innovation across all market segments. The market’s evolution from a primarily reactive treatment-focused sector to a comprehensive animal wellness industry reflects broader changes in agricultural practices, consumer expectations, and regulatory requirements.

Market participants who successfully navigate the complex regulatory environment, invest in appropriate technologies, and develop strong local partnerships are well-positioned to capture substantial growth opportunities. The sector’s future development will be shaped by continued technological advancement, sustainability initiatives, and the ongoing modernization of China’s agricultural sector. Strategic focus on innovation, quality, and customer relationships will determine competitive success in this dynamic and rapidly evolving market environment.

Long-term prospects remain highly favorable, supported by China’s commitment to food security, agricultural modernization, and animal welfare improvement. The China animal health market will continue serving as a critical component of the country’s agricultural infrastructure while contributing to global food safety and animal welfare standards. Market participants who align their strategies with these fundamental trends and maintain focus on customer value creation are positioned for sustained success in this exceptional growth market.

What is Animal Health?

Animal health refers to the overall well-being of animals, encompassing their physical, mental, and social health. It includes the prevention, diagnosis, and treatment of diseases in livestock and pets, as well as the management of their nutrition and welfare.

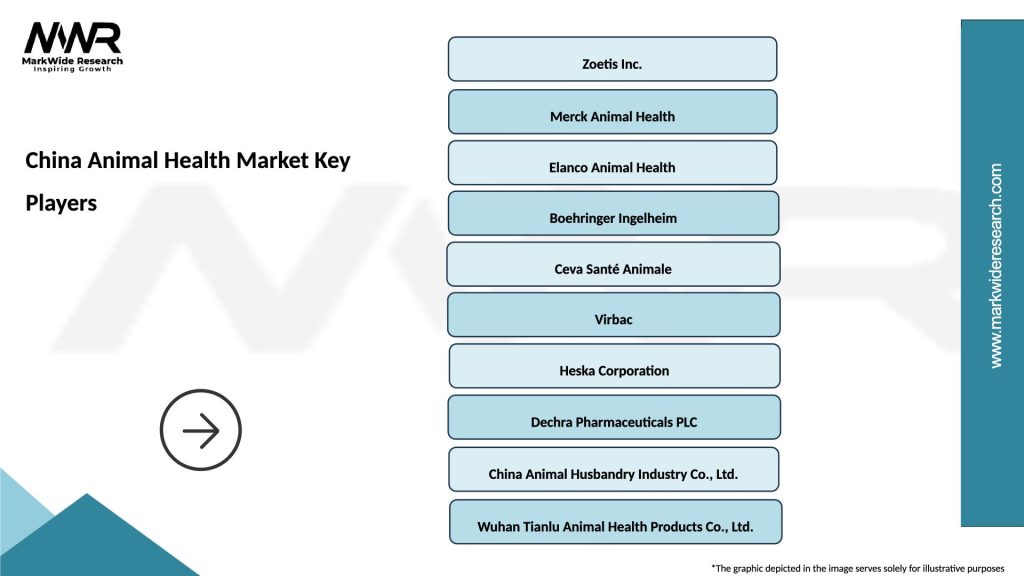

What are the key companies in the China Animal Health Market?

Key companies in the China Animal Health Market include Zoetis, Merck Animal Health, and Bayer Animal Health, among others. These companies are involved in the development of vaccines, pharmaceuticals, and nutritional products for various animal species.

What are the growth factors driving the China Animal Health Market?

The growth of the China Animal Health Market is driven by increasing livestock production, rising pet ownership, and growing awareness of animal diseases. Additionally, advancements in veterinary medicine and technology are contributing to market expansion.

What challenges does the China Animal Health Market face?

The China Animal Health Market faces challenges such as regulatory hurdles, the high cost of veterinary services, and the prevalence of counterfeit products. These factors can hinder market growth and affect the quality of animal health care.

What opportunities exist in the China Animal Health Market?

Opportunities in the China Animal Health Market include the increasing demand for organic and natural animal products, advancements in biotechnology, and the expansion of e-commerce platforms for veterinary products. These trends are likely to shape the future of the market.

What trends are emerging in the China Animal Health Market?

Emerging trends in the China Animal Health Market include the rise of telemedicine for veterinary services, the integration of digital health solutions, and a focus on preventive care. These innovations are transforming how animal health services are delivered.

China Animal Health Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vaccines, Pharmaceuticals, Feed Additives, Diagnostics |

| End User | Veterinary Clinics, Livestock Farms, Research Institutions, Pet Owners |

| Delivery Mode | Injectable, Oral, Topical, Inhalation |

| Application | Preventive Care, Treatment, Diagnostics, Nutritional Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Animal Health Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at