444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America continuous glucose monitoring devices market represents a rapidly evolving healthcare technology sector that is transforming diabetes management across the continent. This dynamic market encompasses advanced medical devices designed to provide real-time glucose level monitoring for diabetic patients, offering unprecedented convenience and accuracy in blood sugar management. The region’s growing diabetes prevalence, combined with increasing healthcare awareness and technological adoption, has created a robust foundation for continuous glucose monitoring (CGM) device expansion.

Market dynamics in South America reflect a significant shift toward preventive healthcare and patient-centric monitoring solutions. The adoption rate of CGM devices has accelerated by approximately 23% annually across major South American markets, driven by improved healthcare infrastructure and rising disposable incomes. Countries like Brazil, Argentina, and Colombia are leading this transformation, with healthcare systems increasingly recognizing the long-term cost benefits of continuous monitoring over traditional finger-stick methods.

Technological advancement continues to drive market evolution, with next-generation CGM devices offering enhanced accuracy, extended wear time, and smartphone integration capabilities. The integration of artificial intelligence and predictive analytics has further elevated the value proposition of these devices, enabling proactive diabetes management and reducing the risk of severe hypoglycemic or hyperglycemic episodes.

The South America continuous glucose monitoring devices market refers to the comprehensive ecosystem of medical devices, technologies, and services designed to provide continuous, real-time monitoring of blood glucose levels in diabetic patients across South American countries. These sophisticated devices utilize advanced sensor technology to measure glucose concentrations in interstitial fluid, providing users with immediate feedback on their blood sugar levels without the need for frequent finger-stick blood tests.

CGM devices represent a paradigm shift from reactive to proactive diabetes management, enabling patients to make informed decisions about their diet, exercise, and medication timing based on real-time glucose trends. The market encompasses various device categories, including real-time CGM systems, flash glucose monitoring devices, and integrated insulin pump systems with continuous monitoring capabilities.

Healthcare transformation through continuous glucose monitoring extends beyond individual patient benefits to encompass broader healthcare system improvements, including reduced emergency room visits, better long-term diabetes outcomes, and enhanced quality of life for millions of South American diabetes patients.

Market leadership in South America’s continuous glucose monitoring devices sector is characterized by rapid technological adoption and expanding healthcare accessibility. The region demonstrates exceptional growth potential, with diabetes prevalence rates increasing by approximately 18% over the past five years, creating substantial demand for advanced monitoring solutions. This growth trajectory positions South America as an emerging market with significant opportunities for both established medical device manufacturers and innovative technology companies.

Key market drivers include rising diabetes awareness campaigns, government healthcare initiatives, and increasing insurance coverage for CGM devices. The market benefits from a growing middle class with enhanced purchasing power and a healthcare system that increasingly prioritizes preventive care over reactive treatment approaches. Additionally, the region’s young, tech-savvy population demonstrates high acceptance rates for digital health solutions and connected medical devices.

Competitive landscape features a mix of global medical device leaders and emerging regional players, with innovation focusing on affordability, accuracy, and user experience. The market’s evolution reflects broader healthcare digitization trends, with CGM devices serving as gateway products for comprehensive diabetes management ecosystems that include mobile applications, cloud-based data analytics, and telemedicine integration.

Strategic market insights reveal several critical factors shaping the South America continuous glucose monitoring devices landscape:

Market penetration varies significantly across South American countries, with Brazil and Argentina leading adoption rates while smaller markets like Paraguay and Uruguay show emerging potential. The diversity in healthcare systems, economic conditions, and regulatory frameworks across the region creates both challenges and opportunities for market participants.

Primary market drivers propelling the South America continuous glucose monitoring devices market include the escalating diabetes epidemic, technological advancement, and evolving healthcare paradigms. The region’s diabetes prevalence has reached critical levels, with approximately 9.4% of the adult population affected by the condition, creating substantial demand for effective monitoring solutions.

Healthcare system evolution represents another significant driver, as governments and private healthcare providers increasingly recognize the long-term cost benefits of preventive diabetes management. The shift from episodic care to continuous health monitoring aligns with global healthcare trends and supports CGM device adoption across diverse patient populations.

Technological innovation continues to drive market expansion through improved device accuracy, extended sensor life, and enhanced user experience. Modern CGM devices offer features such as smartphone connectivity, predictive alerts, and integration with insulin delivery systems, making them increasingly attractive to both patients and healthcare providers.

Economic factors also contribute significantly to market growth, including rising disposable incomes, expanding insurance coverage, and government healthcare initiatives. Many South American countries have implemented diabetes management programs that include CGM device subsidies or coverage, reducing financial barriers to adoption.

Social awareness campaigns and healthcare education initiatives have elevated diabetes awareness across the region, leading to earlier diagnosis and proactive management approaches. This increased awareness translates directly into higher demand for advanced monitoring technologies and comprehensive diabetes care solutions.

Significant market restraints challenge the growth trajectory of continuous glucose monitoring devices in South America, primarily centered around cost considerations and healthcare infrastructure limitations. The high initial cost of CGM devices and ongoing sensor replacement expenses create substantial barriers for many patients, particularly in countries with limited healthcare coverage or lower average incomes.

Healthcare infrastructure disparities across the region present additional challenges, with rural and remote areas often lacking adequate healthcare provider training and technical support for CGM devices. This geographic inequality limits market penetration and creates uneven adoption patterns across different population segments.

Regulatory complexity varies significantly between South American countries, with some markets featuring lengthy approval processes and stringent import requirements that delay product launches and increase market entry costs. These regulatory barriers can discourage innovation and limit patient access to the latest CGM technologies.

Cultural factors and traditional healthcare practices sometimes conflict with continuous monitoring approaches, particularly among older patient populations who may prefer familiar blood glucose testing methods. Overcoming these cultural barriers requires extensive patient education and healthcare provider advocacy.

Technical challenges include concerns about device accuracy, sensor adhesion in humid climates, and connectivity issues in areas with limited internet infrastructure. These technical limitations can impact user satisfaction and long-term device adoption rates across diverse geographic and climatic conditions.

Substantial market opportunities exist within the South America continuous glucose monitoring devices sector, driven by untapped patient populations, technological advancement potential, and evolving healthcare policies. The region’s large undiagnosed diabetes population represents a significant opportunity for market expansion as healthcare screening programs improve and diabetes awareness increases.

Digital health integration presents exceptional opportunities for CGM device manufacturers to develop comprehensive diabetes management ecosystems. The integration of artificial intelligence, machine learning, and predictive analytics with continuous glucose monitoring creates possibilities for personalized treatment recommendations and improved patient outcomes.

Partnership opportunities with local healthcare providers, government health programs, and insurance companies offer pathways for expanded market access and reduced patient costs. These strategic alliances can facilitate device adoption while addressing affordability concerns through innovative financing models and coverage programs.

Emerging market segments include pediatric diabetes management, gestational diabetes monitoring, and pre-diabetes prevention programs. These specialized applications require tailored device features and support services, creating opportunities for product differentiation and market expansion.

Telemedicine integration opportunities have accelerated following the global health crisis, with CGM devices serving as essential components of remote patient monitoring programs. This trend creates new revenue streams and expands the addressable market beyond traditional clinical settings to include home-based and community health programs.

Complex market dynamics shape the South America continuous glucose monitoring devices landscape through the interplay of technological innovation, healthcare policy evolution, and changing patient expectations. The market demonstrates cyclical patterns influenced by economic conditions, regulatory changes, and competitive pressures that create both challenges and opportunities for industry participants.

Supply chain dynamics play a crucial role in market development, with manufacturers navigating import regulations, distribution networks, and local partnership requirements. The COVID-19 pandemic highlighted supply chain vulnerabilities while simultaneously accelerating digital health adoption and remote monitoring acceptance.

Competitive dynamics feature intense rivalry among established medical device companies and emerging technology firms, driving continuous innovation in device accuracy, user experience, and cost-effectiveness. This competition benefits patients through improved product offerings and competitive pricing strategies.

Regulatory dynamics continue evolving as South American health authorities adapt to rapid technological advancement and increasing patient demand for innovative medical devices. Harmonization efforts between countries aim to streamline approval processes while maintaining safety and efficacy standards.

Economic dynamics influence market growth through currency fluctuations, healthcare spending patterns, and government policy changes. The region’s economic diversity creates varied market conditions that require flexible business strategies and localized approaches to succeed across different countries and market segments.

Comprehensive research methodology employed in analyzing the South America continuous glucose monitoring devices market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability. The research approach combines quantitative market analysis with qualitative insights from industry experts, healthcare providers, and patient advocacy groups.

Primary research activities include structured interviews with key market participants, including medical device manufacturers, healthcare providers, regulatory officials, and patient organizations. These interviews provide firsthand insights into market trends, challenges, and opportunities that complement secondary data sources.

Secondary research encompasses analysis of government health statistics, medical literature, industry reports, and regulatory filings to establish market baselines and identify growth patterns. This research foundation supports trend analysis and market projection development across multiple time horizons.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and statistical verification techniques. The methodology incorporates bias reduction strategies and confidence interval calculations to enhance research reliability and credibility.

Market modeling techniques utilize advanced analytical tools to project market growth, segment performance, and competitive dynamics. These models incorporate various scenarios and sensitivity analyses to account for market uncertainties and provide robust forecasting capabilities for strategic decision-making.

Regional market analysis reveals significant variation in continuous glucose monitoring device adoption across South American countries, with Brazil commanding approximately 45% of the regional market share due to its large population, advanced healthcare infrastructure, and strong economic foundation. The Brazilian market benefits from established medical device distribution networks and increasing insurance coverage for diabetes management technologies.

Argentina represents the second-largest market with approximately 22% regional market share, driven by high diabetes prevalence rates and a well-developed private healthcare sector. The country’s medical device regulatory framework supports innovation while maintaining safety standards, creating favorable conditions for CGM device adoption.

Colombia and Chile emerge as high-growth markets, each capturing approximately 8-10% of regional market share respectively. Both countries demonstrate strong healthcare system development and increasing middle-class populations with enhanced purchasing power for advanced medical technologies.

Peru and Ecuador represent emerging opportunities with growing healthcare awareness and improving economic conditions. These markets show potential for significant growth as healthcare infrastructure develops and diabetes awareness campaigns expand reach into previously underserved populations.

Smaller markets including Uruguay, Paraguay, and Bolivia demonstrate nascent but promising adoption patterns, particularly in urban centers where healthcare access and economic conditions support advanced medical device utilization. These markets require tailored approaches that address local healthcare delivery models and economic constraints.

Competitive landscape analysis reveals a dynamic market environment featuring established global medical device leaders alongside emerging regional players and innovative technology companies. The market structure reflects ongoing consolidation trends while maintaining space for specialized niche players and disruptive technologies.

Market leaders include:

Competitive strategies focus on product differentiation through accuracy improvements, user experience enhancement, and cost reduction initiatives. Companies invest heavily in clinical research, regulatory compliance, and local partnership development to establish market presence and drive adoption.

Innovation trends include artificial intelligence integration, predictive analytics capabilities, and seamless connectivity with digital health ecosystems. These technological advancements create competitive advantages while addressing evolving patient needs and healthcare provider requirements.

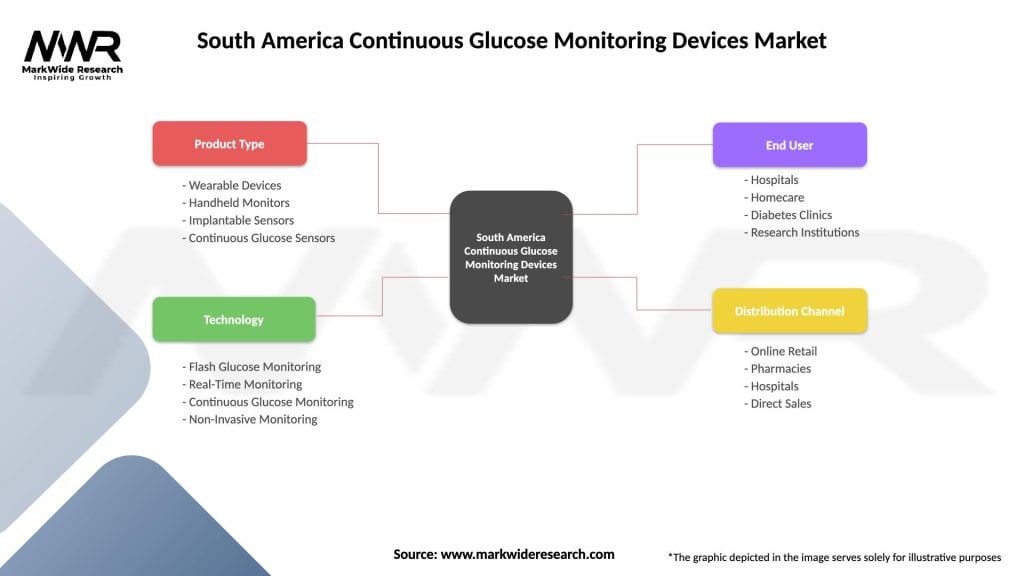

Market segmentation analysis provides detailed insights into the diverse components and applications within the South America continuous glucose monitoring devices market, enabling targeted strategies and specialized product development approaches.

By Product Type:

By Application:

By End User:

By Age Group:

Real-time CGM systems dominate the premium market segment, offering continuous glucose monitoring with immediate alerts and comprehensive data analytics. These devices appeal to patients requiring intensive diabetes management and healthcare providers seeking detailed patient monitoring capabilities. The category benefits from strong clinical evidence and insurance coverage in many South American markets.

Flash glucose monitoring represents the fastest-growing category, providing an accessible entry point for patients transitioning from traditional blood glucose testing. The scanning-based approach offers convenience without the complexity of continuous alarms, making it particularly attractive to newly diagnosed patients and those with less intensive monitoring needs.

Integrated systems combining CGM with insulin delivery represent the most advanced category, targeting patients with complex diabetes management requirements. These systems offer automated insulin adjustment based on glucose trends, representing the future of diabetes care technology and commanding premium pricing in the market.

Pediatric-focused devices constitute a specialized category requiring unique design considerations, including smaller sensors, child-friendly interfaces, and parental monitoring capabilities. This category demonstrates strong growth potential as diabetes diagnosis rates increase among younger populations across South America.

Professional-use CGM systems serve healthcare providers with temporary monitoring solutions for diagnosis and treatment optimization. These devices offer high accuracy and detailed reporting capabilities, supporting clinical decision-making and patient education initiatives in hospital and clinic settings.

Industry participants in the South America continuous glucose monitoring devices market realize substantial benefits through market expansion opportunities, technological innovation platforms, and strategic partnership potential. Medical device manufacturers gain access to a large, underserved patient population with growing healthcare awareness and improving economic conditions.

Healthcare providers benefit from improved patient outcomes, reduced emergency interventions, and enhanced diabetes management capabilities. CGM devices enable proactive care approaches, better patient engagement, and comprehensive data collection that supports evidence-based treatment decisions and long-term patient relationship development.

Patients experience transformative benefits including improved quality of life, better glucose control, and reduced diabetes-related complications. The convenience of continuous monitoring eliminates frequent finger-stick testing while providing actionable insights for diet, exercise, and medication management decisions.

Healthcare systems realize cost savings through reduced hospitalizations, emergency room visits, and long-term diabetes complications. The preventive approach enabled by continuous glucose monitoring aligns with healthcare sustainability goals and population health management objectives.

Technology partners including software developers, data analytics companies, and digital health platforms benefit from integration opportunities and expanding market applications. The CGM ecosystem creates multiple revenue streams and partnership possibilities across the healthcare technology landscape.

Investors and stakeholders gain exposure to a high-growth healthcare technology sector with strong demographic tailwinds and increasing market acceptance. The market offers attractive returns through both established companies and emerging innovation opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration emerges as the dominant trend reshaping the continuous glucose monitoring landscape, with devices increasingly serving as data collection points for comprehensive diabetes management ecosystems. This integration enables personalized treatment recommendations, predictive analytics, and seamless communication between patients and healthcare providers.

Artificial intelligence adoption accelerates across CGM applications, with machine learning algorithms providing predictive glucose alerts, pattern recognition, and automated insulin dosing recommendations. These AI-powered features enhance device value while reducing the burden of diabetes management on patients and caregivers.

Miniaturization and wearability trends focus on developing smaller, more comfortable devices with extended sensor life and improved adhesion properties. These advances address key user concerns while expanding the addressable market to include patients who previously found CGM devices too intrusive or uncomfortable.

Connectivity expansion encompasses integration with smartphones, smartwatches, and other connected devices, creating seamless user experiences and comprehensive health monitoring capabilities. This trend aligns with broader digital health adoption patterns and consumer expectations for integrated technology solutions.

Personalization and customization trends enable tailored glucose monitoring experiences based on individual patient needs, lifestyle factors, and clinical requirements. This approach improves user satisfaction while optimizing clinical outcomes through more relevant and actionable monitoring data.

Affordability initiatives include value-based pricing models, insurance coverage expansion, and government subsidy programs aimed at improving CGM accessibility across diverse socioeconomic populations. These trends address key market barriers while expanding the potential user base significantly.

Regulatory approvals for next-generation CGM devices have accelerated across South American markets, with health authorities streamlining approval processes while maintaining safety standards. Recent approvals include extended-wear sensors, pediatric indications, and integration with automated insulin delivery systems.

Strategic partnerships between international manufacturers and local healthcare providers have expanded market access and improved patient support services. These collaborations often include training programs, patient education initiatives, and innovative financing solutions that address regional market needs.

Technology launches featuring improved accuracy, extended sensor life, and enhanced connectivity have strengthened competitive positioning for leading manufacturers. Recent innovations include sensors with 14-day wear time and accuracy improvements reaching 95% correlation with laboratory glucose measurements.

Investment activities in the region include manufacturing facility development, distribution network expansion, and research and development centers focused on addressing South American market requirements. These investments demonstrate long-term commitment to regional market development and local capability building.

Clinical research initiatives conducted across multiple South American countries provide evidence supporting CGM effectiveness in diverse patient populations and healthcare settings. This research strengthens the clinical foundation for device adoption and supports reimbursement discussions with healthcare payers.

Digital health platform integrations have expanded CGM utility beyond glucose monitoring to include comprehensive diabetes management, telemedicine consultations, and population health analytics. These developments position CGM devices as central components of broader healthcare technology ecosystems.

Market entry strategies should prioritize partnerships with established local distributors and healthcare providers to navigate regulatory requirements and build market presence effectively. MarkWide Research analysis indicates that successful market entry requires understanding of local healthcare delivery models and patient preferences that vary significantly across South American countries.

Product development focus should emphasize affordability, ease of use, and climate adaptability to address regional market requirements. Devices designed for humid environments with simplified user interfaces and competitive pricing will achieve higher adoption rates across diverse patient populations.

Investment priorities should include local manufacturing capabilities, distribution infrastructure, and patient education programs that support long-term market development. These investments create competitive advantages while demonstrating commitment to regional market success.

Partnership opportunities with government health programs, insurance providers, and patient advocacy organizations can accelerate market penetration while addressing affordability concerns. These strategic alliances create sustainable growth platforms and improve patient access to advanced diabetes management technologies.

Innovation strategies should incorporate artificial intelligence, predictive analytics, and telemedicine integration to differentiate products and create comprehensive diabetes management solutions. These technological advances align with healthcare digitization trends while providing tangible patient benefits.

Market expansion approaches should target underserved segments including pediatric patients, Type 2 diabetes populations, and rural communities through specialized products and delivery models. These segments represent significant growth opportunities with less competitive intensity than traditional markets.

Long-term market prospects for South America continuous glucose monitoring devices remain exceptionally positive, driven by demographic trends, technological advancement, and healthcare system evolution. The market is projected to experience robust growth with adoption rates increasing by approximately 25-30% annually over the next five years as awareness expands and affordability improves.

Technology evolution will continue driving market transformation through next-generation sensors with extended wear time, improved accuracy, and seamless integration with digital health platforms. MWR projections indicate that artificial intelligence integration will become standard across CGM devices, enabling predictive glucose management and personalized treatment recommendations.

Market expansion will encompass new patient segments including pre-diabetes monitoring, gestational diabetes management, and pediatric applications as clinical evidence supports broader CGM utilization. These emerging applications will significantly expand the addressable market while creating new revenue opportunities for industry participants.

Healthcare integration trends will position CGM devices as central components of comprehensive diabetes care ecosystems, including telemedicine platforms, electronic health records, and population health management systems. This integration creates sustainable competitive advantages while improving patient outcomes and healthcare efficiency.

Regulatory harmonization efforts across South American countries will streamline market access and reduce compliance costs, facilitating faster innovation adoption and improved patient access to advanced diabetes management technologies. These regulatory improvements will benefit both manufacturers and patients through reduced barriers and enhanced safety standards.

Economic development across the region will continue supporting market growth through expanded healthcare coverage, increased disposable incomes, and improved healthcare infrastructure. The growing middle class represents a substantial opportunity for premium diabetes management solutions and comprehensive care programs.

The South America continuous glucose monitoring devices market represents a transformative healthcare technology sector with exceptional growth potential and significant patient impact opportunities. The convergence of rising diabetes prevalence, technological advancement, and improving healthcare access creates a compelling foundation for sustained market expansion and innovation.

Market dynamics reflect a maturing industry with established leaders and emerging innovators competing to serve diverse patient populations across varied economic and healthcare environments. The successful navigation of regulatory requirements, cultural considerations, and economic constraints will determine long-term success in this dynamic market landscape.

Strategic opportunities abound for companies willing to invest in local partnerships, product adaptation, and patient education initiatives that address regional market needs. The emphasis on affordability, ease of use, and comprehensive support services will differentiate successful market participants from those pursuing generic global strategies.

Future success in the South America continuous glucose monitoring devices market will require balancing innovation with accessibility, ensuring that advanced diabetes management technologies reach the patients who need them most. This balance will drive sustainable growth while contributing to improved health outcomes across the continent’s diverse populations and healthcare systems.

What is Continuous Glucose Monitoring Devices?

Continuous Glucose Monitoring Devices are medical devices that provide real-time measurements of glucose levels in the body, primarily used by individuals with diabetes to manage their condition effectively.

What are the key players in the South America Continuous Glucose Monitoring Devices Market?

Key players in the South America Continuous Glucose Monitoring Devices Market include Abbott Laboratories, Dexcom, Medtronic, and Roche, among others.

What are the growth factors driving the South America Continuous Glucose Monitoring Devices Market?

The growth of the South America Continuous Glucose Monitoring Devices Market is driven by the increasing prevalence of diabetes, advancements in technology, and rising awareness about diabetes management among patients.

What challenges does the South America Continuous Glucose Monitoring Devices Market face?

Challenges in the South America Continuous Glucose Monitoring Devices Market include high costs of devices, limited access to healthcare in certain regions, and regulatory hurdles that can delay product approvals.

What opportunities exist in the South America Continuous Glucose Monitoring Devices Market?

Opportunities in the South America Continuous Glucose Monitoring Devices Market include the potential for innovative product development, increasing investment in healthcare infrastructure, and growing demand for personalized diabetes management solutions.

What trends are shaping the South America Continuous Glucose Monitoring Devices Market?

Trends in the South America Continuous Glucose Monitoring Devices Market include the integration of digital health technologies, the rise of mobile health applications, and a shift towards more user-friendly and accurate monitoring devices.

South America Continuous Glucose Monitoring Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Handheld Monitors, Implantable Sensors, Continuous Glucose Sensors |

| Technology | Flash Glucose Monitoring, Real-Time Monitoring, Continuous Glucose Monitoring, Non-Invasive Monitoring |

| End User | Hospitals, Homecare, Diabetes Clinics, Research Institutions |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Continuous Glucose Monitoring Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at