444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The cloud and data center transformation market represents a pivotal shift in how organizations manage, store, and process their digital infrastructure. This rapidly evolving sector encompasses the comprehensive modernization of traditional data centers through cloud adoption, virtualization technologies, and advanced automation solutions. Market dynamics indicate substantial growth driven by increasing digital transformation initiatives across industries worldwide.

Organizations globally are experiencing unprecedented pressure to modernize their IT infrastructure to support remote work, digital services, and data-intensive applications. The transformation involves migrating from legacy systems to cloud-native architectures, implementing hybrid cloud solutions, and adopting software-defined infrastructure. According to MarkWide Research analysis, the sector is experiencing robust expansion with a projected CAGR of 12.5% through the forecast period.

Key transformation drivers include the need for enhanced scalability, improved operational efficiency, and reduced infrastructure costs. Organizations are increasingly adopting multi-cloud strategies, edge computing solutions, and containerization technologies to optimize their digital operations. The market encompasses various segments including infrastructure-as-a-service, platform-as-a-service, and software-as-a-service solutions that collectively enable comprehensive data center modernization.

The cloud and data center transformation market refers to the comprehensive ecosystem of technologies, services, and solutions that enable organizations to modernize their IT infrastructure by transitioning from traditional on-premises data centers to cloud-based, hybrid, or edge computing environments. This transformation encompasses the strategic migration of workloads, applications, and data storage systems to more flexible, scalable, and cost-effective cloud platforms.

Transformation initiatives typically involve multiple phases including assessment and planning, migration strategy development, implementation of cloud-native technologies, and ongoing optimization. The process requires specialized expertise in areas such as cloud architecture design, security implementation, data migration, and performance monitoring. Organizations undertaking these transformations often work with specialized service providers who offer consulting, implementation, and managed services to ensure successful outcomes.

Modern data center transformation extends beyond simple cloud migration to include the adoption of emerging technologies such as artificial intelligence, machine learning, and automation tools that enhance operational efficiency and reduce manual intervention requirements.

The cloud and data center transformation market is experiencing unprecedented growth as organizations worldwide accelerate their digital transformation initiatives. This comprehensive market encompasses infrastructure modernization, cloud migration services, hybrid cloud solutions, and advanced data center technologies that enable businesses to achieve greater agility, scalability, and operational efficiency.

Market expansion is primarily driven by increasing demand for remote work capabilities, growing data volumes, and the need for enhanced cybersecurity measures. Organizations across various industries are investing heavily in cloud transformation to reduce operational costs while improving service delivery and customer experience. Enterprise adoption rates have increased by 68% over the past two years, reflecting the critical importance of infrastructure modernization.

Key market segments include public cloud services, private cloud solutions, hybrid cloud platforms, and edge computing infrastructure. The market also encompasses specialized services such as cloud consulting, migration planning, security implementation, and ongoing managed services. Regional analysis reveals strong growth across North America, Europe, and Asia-Pacific, with emerging markets showing particularly rapid adoption rates.

Competitive landscape features established technology giants alongside innovative startups offering specialized transformation solutions. The market continues to evolve with new service models, pricing strategies, and technological innovations that address specific industry requirements and regulatory compliance needs.

Strategic market insights reveal several critical trends shaping the cloud and data center transformation landscape:

These insights demonstrate the market’s evolution toward more sophisticated, integrated solutions that address complex organizational requirements while maintaining focus on security, efficiency, and scalability.

Digital transformation acceleration serves as the primary driver for cloud and data center transformation adoption. Organizations across industries recognize the critical need to modernize their IT infrastructure to remain competitive in an increasingly digital marketplace. Remote work requirements have particularly intensified this need, with companies requiring scalable, secure, and accessible infrastructure solutions.

Cost optimization pressures continue to drive transformation initiatives as organizations seek to reduce capital expenditures associated with traditional data center operations. Cloud transformation enables organizations to shift from capital-intensive infrastructure investments to more flexible operational expenditure models. Operational efficiency gains of up to 45% are commonly achieved through successful transformation initiatives.

Scalability requirements represent another significant driver, particularly for organizations experiencing rapid growth or seasonal demand fluctuations. Cloud-based infrastructure provides the elasticity needed to scale resources up or down based on actual requirements, eliminating the need for over-provisioning traditional hardware.

Enhanced security capabilities offered by modern cloud platforms drive adoption among security-conscious organizations. Advanced threat detection, automated security updates, and compliance management tools provide superior protection compared to many traditional on-premises solutions. Regulatory compliance requirements also necessitate infrastructure modernization to meet evolving data protection and privacy standards.

Implementation complexity remains a significant restraint for many organizations considering cloud and data center transformation. The process requires careful planning, specialized expertise, and substantial coordination across multiple departments and stakeholders. Legacy system integration challenges often create additional complexity and potential delays in transformation timelines.

Security concerns continue to inhibit adoption among organizations with highly sensitive data or strict regulatory requirements. Despite advances in cloud security, some organizations remain hesitant to migrate critical workloads to external cloud environments. Data sovereignty requirements in certain industries and regions create additional constraints on cloud adoption strategies.

Skills shortage in cloud technologies and transformation expertise creates bottlenecks for organizations attempting to execute transformation initiatives. The rapid evolution of cloud technologies requires continuous learning and adaptation, which can strain existing IT teams. Training and certification costs add to the overall investment required for successful transformation.

Vendor lock-in concerns discourage some organizations from committing to specific cloud platforms or transformation approaches. The complexity of migrating between different cloud environments can create long-term dependencies that limit future flexibility and negotiating power.

Emerging technologies integration presents substantial opportunities for market expansion. The convergence of artificial intelligence, machine learning, and cloud infrastructure creates new possibilities for intelligent automation and predictive analytics. AI-driven optimization can improve resource utilization by 35% while reducing operational costs and enhancing performance.

Edge computing expansion offers significant growth potential as organizations seek to process data closer to its source. The proliferation of IoT devices and real-time applications drives demand for edge infrastructure that complements traditional cloud services. 5G network deployment further accelerates edge computing adoption by enabling new use cases and applications.

Industry-specific solutions represent a growing opportunity for specialized transformation services. Healthcare, financial services, manufacturing, and government sectors have unique requirements that create demand for tailored transformation approaches. Compliance automation tools and industry-specific security frameworks provide additional value propositions.

Small and medium enterprise adoption presents an underserved market segment with significant growth potential. As cloud services become more accessible and affordable, smaller organizations can benefit from enterprise-grade infrastructure capabilities previously available only to large corporations. Simplified deployment models and managed services reduce the complexity barrier for SME adoption.

Market dynamics in the cloud and data center transformation sector are characterized by rapid technological evolution and shifting customer expectations. The interplay between supply and demand factors creates a complex ecosystem where innovation drives competitive advantage while customer requirements shape service development priorities.

Technology convergence continues to reshape market dynamics as previously distinct categories merge into integrated solutions. The combination of cloud services, data analytics, artificial intelligence, and cybersecurity creates comprehensive platforms that address multiple organizational needs simultaneously. Platform consolidation trends indicate that 78% of organizations prefer integrated solutions over point products.

Competitive pressure intensifies as traditional IT vendors compete with cloud-native companies and new market entrants. This competition drives innovation while reducing costs for end customers. Partnership strategies become increasingly important as no single vendor can address all transformation requirements independently.

Customer sophistication continues to increase as organizations gain experience with cloud technologies and develop more nuanced requirements. This evolution drives demand for specialized services, customized solutions, and advanced capabilities that go beyond basic infrastructure migration. Outcome-based pricing models gain traction as customers seek to align costs with business value rather than resource consumption.

Comprehensive research methodology employed for this market analysis combines primary and secondary research approaches to ensure accuracy and depth of insights. The methodology encompasses quantitative data collection, qualitative analysis, and expert validation to provide a holistic view of market dynamics and trends.

Primary research activities include structured interviews with industry executives, technology leaders, and end-user organizations across various sectors. Survey data collection from IT decision-makers provides quantitative insights into adoption patterns, spending priorities, and future planning initiatives. Expert panels comprising industry analysts and technology specialists validate findings and provide additional context.

Secondary research involves analysis of industry reports, company financial statements, technology vendor announcements, and regulatory documentation. Market data aggregation from multiple sources ensures comprehensive coverage of market segments and geographic regions. Trend analysis incorporates historical data patterns to identify emerging opportunities and potential challenges.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review of preliminary findings. Quality assurance measures ensure data accuracy and reliability while maintaining objectivity in analysis and interpretation.

North America maintains its position as the largest regional market for cloud and data center transformation, driven by early technology adoption and substantial enterprise investment in digital transformation initiatives. The region benefits from mature cloud infrastructure, extensive service provider networks, and favorable regulatory environments that support innovation. Market share in North America represents approximately 42% of global adoption.

Europe demonstrates strong growth momentum with increasing focus on data sovereignty and regulatory compliance driving transformation initiatives. The implementation of GDPR and other privacy regulations creates demand for specialized cloud solutions that address compliance requirements. Nordic countries lead European adoption rates due to advanced digital infrastructure and government support for technology innovation.

Asia-Pacific represents the fastest-growing regional market with rapid digitalization across emerging economies driving substantial demand for transformation services. Countries such as China, India, and Southeast Asian nations show particularly strong growth rates as organizations modernize their infrastructure to support expanding digital economies. Growth rates in the region exceed 18% annually.

Latin America and Middle East & Africa show emerging growth potential as organizations in these regions begin large-scale digital transformation initiatives. Government digitalization programs and increasing foreign investment in technology infrastructure create opportunities for market expansion.

The competitive landscape features a diverse ecosystem of technology vendors, service providers, and specialized consultants offering various transformation solutions and services. Market leadership positions vary across different segments and geographic regions.

Competitive strategies focus on differentiation through specialized industry solutions, enhanced security capabilities, and comprehensive managed services. Partnership alliances become increasingly important as organizations seek integrated solutions that combine multiple vendor capabilities.

Market segmentation reveals distinct categories based on deployment models, service types, organization sizes, and industry verticals, each with unique characteristics and growth patterns.

By Deployment Model:

By Service Type:

By Organization Size:

Infrastructure-as-a-Service (IaaS) represents the foundational category enabling organizations to replace physical hardware with virtualized computing resources. This segment shows consistent growth as organizations seek to reduce capital expenditures while maintaining control over their computing environments. Adoption rates for IaaS solutions have increased by 52% among enterprise customers over the past year.

Platform-as-a-Service (PaaS) demonstrates strong growth driven by application modernization initiatives and developer productivity requirements. Organizations increasingly adopt PaaS solutions to accelerate application development while reducing infrastructure management overhead. Container platforms and serverless computing models within this category show particularly rapid adoption.

Software-as-a-Service (SaaS) continues to expand across various business functions, from customer relationship management to enterprise resource planning. The category benefits from user familiarity and reduced implementation complexity compared to traditional software deployment models. Integration capabilities become increasingly important as organizations adopt multiple SaaS solutions.

Professional Services represent a critical category supporting successful transformation initiatives through consulting, implementation, and ongoing management services. This segment shows strong growth as organizations seek expertise to navigate complex transformation challenges and optimize their cloud investments.

Technology Vendors benefit from expanding market opportunities and recurring revenue models associated with cloud services. The transformation market enables vendors to develop deeper customer relationships through comprehensive solution portfolios and ongoing service delivery. Revenue predictability improves through subscription-based models and long-term service contracts.

Service Providers gain access to high-value consulting and implementation opportunities that leverage their expertise and industry knowledge. The complexity of transformation initiatives creates demand for specialized services that command premium pricing. Partnership opportunities with technology vendors provide additional revenue streams and competitive differentiation.

End-User Organizations achieve multiple benefits including reduced infrastructure costs, improved operational efficiency, enhanced scalability, and access to advanced technologies. Time-to-market improvements enable faster product development and service delivery. Risk reduction through improved disaster recovery and security capabilities provides additional value.

Investors and Stakeholders benefit from the market’s strong growth prospects and the strategic importance of digital transformation across industries. The recurring revenue nature of cloud services provides stable, predictable returns while the innovation potential creates opportunities for substantial value creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid and Multi-Cloud Strategies dominate current market trends as organizations seek to optimize their infrastructure across multiple platforms and providers. This approach enables organizations to leverage the best capabilities from different vendors while avoiding single-vendor dependency. MWR data indicates that 85% of enterprises now employ multi-cloud strategies.

Edge Computing Integration represents a significant trend driven by IoT proliferation and real-time processing requirements. Organizations increasingly deploy edge infrastructure to reduce latency and improve performance for critical applications. Edge deployment is expected to complement rather than replace centralized cloud infrastructure.

Artificial Intelligence and Machine Learning integration into transformation initiatives enables intelligent automation and predictive analytics capabilities. AI-powered tools optimize resource allocation, predict maintenance requirements, and enhance security monitoring. Automation adoption reduces operational overhead by 40% on average.

Sustainability Focus becomes increasingly important as organizations seek to reduce their environmental impact through efficient cloud infrastructure. Green data center technologies and renewable energy adoption drive vendor selection decisions. Carbon footprint reduction becomes a key transformation objective alongside cost and performance optimization.

Zero-Trust Security Models gain widespread adoption as organizations recognize the limitations of traditional perimeter-based security approaches. This trend drives demand for comprehensive security solutions that verify every access request regardless of location or user credentials.

Major cloud providers continue to expand their global infrastructure footprint with new data center regions and edge computing locations. These investments improve service availability and reduce latency for customers worldwide while addressing data sovereignty requirements in various jurisdictions.

Strategic acquisitions reshape the competitive landscape as established technology companies acquire specialized startups and innovative solutions. These transactions accelerate capability development and market expansion while providing exit opportunities for emerging companies.

Partnership announcements between cloud providers, system integrators, and technology vendors create comprehensive solution ecosystems. These alliances enable customers to access integrated solutions while reducing implementation complexity and vendor management overhead.

Regulatory developments in data protection and privacy continue to influence market dynamics, particularly in Europe and other regions with strict data governance requirements. Compliance automation tools and specialized services emerge to address these evolving requirements.

Open source initiatives gain momentum as organizations seek to avoid vendor lock-in while maintaining flexibility in their technology choices. Container orchestration platforms and cloud-native technologies benefit from strong open source community support.

Organizations considering transformation should develop comprehensive strategies that align with their business objectives and risk tolerance. Phased implementation approaches reduce complexity while enabling learning and adjustment throughout the transformation process. Starting with non-critical workloads allows organizations to gain experience before migrating mission-critical applications.

Investment in skills development represents a critical success factor for transformation initiatives. Organizations should prioritize training existing staff while also recruiting specialized talent to support transformation objectives. Partnership strategies with experienced service providers can supplement internal capabilities during transition periods.

Security considerations must be integrated throughout the transformation planning and implementation process rather than addressed as an afterthought. Zero-trust architectures and comprehensive monitoring capabilities provide robust protection for cloud-based infrastructure and applications.

Vendor selection decisions should consider long-term strategic alignment rather than focusing solely on initial costs or technical capabilities. Multi-cloud strategies provide flexibility and negotiating leverage while reducing dependency risks associated with single-vendor approaches.

Performance monitoring and optimization require ongoing attention to ensure transformation investments deliver expected benefits. Regular assessment of costs, performance, and business outcomes enables continuous improvement and optimization of cloud infrastructure investments.

Market growth prospects remain robust as digital transformation continues to accelerate across industries and geographic regions. The increasing sophistication of cloud technologies and the growing availability of specialized services will drive continued adoption and market expansion. Compound annual growth rates are projected to maintain double-digit levels through the next five years.

Technology evolution will focus on increased automation, artificial intelligence integration, and enhanced security capabilities. Serverless computing and event-driven architectures will become more prevalent as organizations seek to optimize costs and improve operational efficiency. Quantum computing integration may emerge as a differentiating factor for advanced applications.

Industry consolidation is expected to continue as larger technology companies acquire specialized capabilities and smaller vendors seek scale advantages through partnerships or acquisitions. This consolidation will create more comprehensive solution portfolios while potentially reducing the number of independent vendors.

Regulatory evolution will continue to shape market dynamics, particularly regarding data protection, privacy, and cross-border data transfers. Organizations will need to maintain flexibility in their transformation strategies to adapt to changing regulatory requirements.

Emerging market expansion presents significant growth opportunities as developing economies invest in digital infrastructure and organizations in these regions begin large-scale transformation initiatives. Government digitalization programs will drive additional demand for transformation services and solutions.

The cloud and data center transformation market represents a fundamental shift in how organizations approach IT infrastructure and digital operations. This comprehensive analysis reveals a dynamic, rapidly growing market driven by digital transformation imperatives, cost optimization requirements, and the need for enhanced operational agility.

Market fundamentals remain strong with widespread recognition of transformation necessity across industries and regions. The convergence of cloud technologies, artificial intelligence, and edge computing creates new opportunities for innovation and value creation. Growth trajectories indicate sustained expansion with emerging markets and small-to-medium enterprises representing significant untapped potential.

Success factors for market participants include comprehensive solution portfolios, specialized industry expertise, and strong partnership ecosystems. Organizations must balance innovation with reliability while addressing evolving security and compliance requirements. Strategic positioning requires understanding of regional dynamics, regulatory environments, and customer sophistication levels.

Future market evolution will be characterized by increased automation, enhanced integration capabilities, and growing emphasis on sustainability and environmental responsibility. The cloud and data center transformation market will continue to serve as a critical enabler of digital business strategies while creating substantial value for technology vendors, service providers, and end-user organizations worldwide.

What is Cloud and Data Center Transformation?

Cloud and Data Center Transformation refers to the process of modernizing and optimizing data center operations through cloud technologies. This includes the adoption of cloud computing, virtualization, and automation to enhance efficiency, scalability, and flexibility in IT infrastructure.

What are the key players in the Cloud and Data Center Transformation Market?

Key players in the Cloud and Data Center Transformation Market include Amazon Web Services, Microsoft Azure, Google Cloud, and IBM, among others. These companies provide a range of services such as cloud storage, computing power, and data management solutions.

What are the main drivers of growth in the Cloud and Data Center Transformation Market?

The main drivers of growth in the Cloud and Data Center Transformation Market include the increasing demand for scalable IT solutions, the need for cost reduction in data management, and the rising adoption of hybrid cloud environments. Additionally, businesses are seeking enhanced data security and compliance capabilities.

What challenges does the Cloud and Data Center Transformation Market face?

Challenges in the Cloud and Data Center Transformation Market include data security concerns, the complexity of migrating legacy systems to cloud environments, and potential downtime during the transition. Organizations also face difficulties in managing multi-cloud strategies effectively.

What opportunities exist in the Cloud and Data Center Transformation Market?

Opportunities in the Cloud and Data Center Transformation Market include the growing trend of edge computing, which allows for faster data processing closer to the source. Additionally, advancements in artificial intelligence and machine learning can enhance data analytics capabilities within transformed data centers.

What trends are shaping the Cloud and Data Center Transformation Market?

Trends shaping the Cloud and Data Center Transformation Market include the increasing adoption of serverless computing, the rise of containerization technologies, and a focus on sustainability in data center operations. Organizations are also prioritizing automation to improve operational efficiency.

Cloud and Data Center Transformation Market

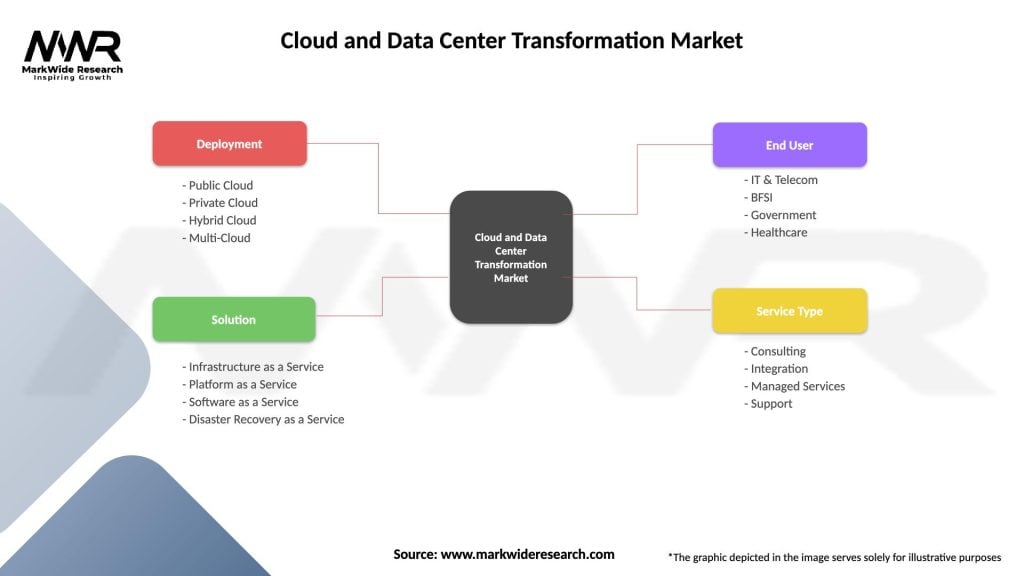

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Infrastructure as a Service, Platform as a Service, Software as a Service, Disaster Recovery as a Service |

| End User | IT & Telecom, BFSI, Government, Healthcare |

| Service Type | Consulting, Integration, Managed Services, Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Cloud and Data Center Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at