444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam agricultural tractors market represents a dynamic and rapidly evolving sector within Southeast Asia’s agricultural machinery landscape. As Vietnam continues its agricultural modernization journey, the demand for efficient farming equipment has surged significantly. The market demonstrates robust growth potential, driven by government initiatives promoting mechanization and the increasing adoption of modern farming practices across the country’s diverse agricultural regions.

Agricultural mechanization in Vietnam has gained tremendous momentum, with tractor adoption rates increasing by approximately 12% annually over recent years. The market encompasses various tractor categories, from compact utility tractors suitable for small-scale farming to high-horsepower machines designed for large agricultural operations. Rice cultivation, being the dominant agricultural activity, significantly influences tractor specifications and market demand patterns.

Regional distribution shows concentrated demand in the Mekong Delta region, which accounts for approximately 45% of total tractor sales nationwide. The Red River Delta and Central Highlands regions also contribute substantially to market growth. Government subsidies and favorable financing schemes have accelerated adoption rates, particularly among smallholder farmers who traditionally relied on manual labor and water buffalo for field operations.

The Vietnam agricultural tractors market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of agricultural tractors specifically designed for Vietnamese farming conditions. This market includes various tractor types ranging from compact two-wheel tractors to sophisticated four-wheel drive machines equipped with advanced technology features.

Market scope extends beyond mere equipment sales to include after-sales services, spare parts distribution, financing solutions, and technical support systems. The market serves diverse agricultural segments including rice farming, vegetable cultivation, fruit orchards, and livestock operations. Mechanization levels vary significantly across regions, with some areas achieving 70% mechanization rates while others remain predominantly manual.

Technological integration has become increasingly important, with modern tractors featuring GPS guidance systems, precision farming capabilities, and fuel-efficient engines. The market also encompasses the growing segment of electric and hybrid tractors, reflecting Vietnam’s commitment to sustainable agricultural practices and environmental conservation.

Vietnam’s agricultural tractors market demonstrates exceptional growth momentum, driven by comprehensive government support and increasing farmer awareness of mechanization benefits. The market has experienced consistent expansion, with adoption rates accelerating particularly in rice-producing regions where mechanization directly impacts productivity and labor efficiency.

Key market drivers include government subsidies covering up to 25% of tractor purchase costs, rural credit programs, and agricultural cooperatives facilitating shared equipment ownership. The market structure shows increasing consolidation, with established international brands competing alongside emerging domestic manufacturers. Technology advancement remains a critical differentiator, with smart farming features becoming standard expectations rather than premium options.

Market challenges include fragmented land ownership patterns, varying soil conditions across regions, and the need for extensive dealer networks to provide adequate after-sales support. Despite these challenges, the market outlook remains highly positive, supported by Vietnam’s agricultural export ambitions and the ongoing rural development initiatives. Future growth is expected to be driven by precision agriculture adoption and sustainable farming practices.

Market dynamics reveal several critical insights that shape the Vietnam agricultural tractors landscape. The following key insights provide comprehensive understanding of market behavior and growth patterns:

Government policy support serves as the primary catalyst driving Vietnam’s agricultural tractors market expansion. The national agricultural mechanization strategy includes substantial subsidies, tax incentives, and preferential loan programs specifically designed to accelerate tractor adoption among farming communities. Rural development initiatives have allocated significant resources to modernize agricultural practices and improve farm productivity.

Labor shortage challenges in rural areas have created urgent demand for mechanization solutions. As younger generations migrate to urban centers for employment opportunities, remaining farmers face increasing pressure to adopt labor-saving technologies. Tractor mechanization addresses this challenge by enabling fewer workers to manage larger agricultural areas more efficiently.

Economic factors contribute significantly to market growth, including rising agricultural commodity prices that improve farmer income levels and investment capacity. Export market opportunities for Vietnamese agricultural products have increased farmer willingness to invest in productivity-enhancing equipment. Additionally, improved rural infrastructure and road connectivity have made tractor transportation and servicing more feasible across previously inaccessible regions.

Technological advancement in tractor design has made modern equipment more suitable for Vietnamese farming conditions. Features like compact designs for small fields, fuel efficiency improvements, and multi-functional capabilities have increased tractor appeal among traditional farmers who previously relied on manual methods.

Land fragmentation presents the most significant challenge to tractor market expansion in Vietnam. The average farm size remains relatively small, making large tractor investments economically challenging for individual farmers. Ownership patterns characterized by numerous small plots scattered across different locations complicate mechanization decisions and reduce equipment utilization efficiency.

High initial investment costs continue to limit tractor accessibility despite government subsidies. Many farmers struggle with the substantial upfront capital requirements, particularly when considering additional costs for implements, maintenance, and operator training. Financial constraints are particularly acute among smallholder farmers who represent the majority of Vietnam’s agricultural workforce.

Infrastructure limitations in remote agricultural areas restrict tractor deployment and servicing capabilities. Poor road conditions, limited electricity access, and inadequate storage facilities create operational challenges that discourage tractor adoption. Service network gaps in rural regions result in extended downtime when repairs are needed, reducing overall equipment reliability and farmer confidence.

Technical knowledge barriers among traditional farmers slow adoption rates, as many lack experience with mechanized equipment operation and maintenance. Training programs remain insufficient to meet growing demand for skilled tractor operators, creating bottlenecks in effective equipment utilization.

Precision agriculture adoption presents substantial growth opportunities as Vietnamese farmers increasingly recognize the benefits of data-driven farming practices. Smart tractor technologies incorporating GPS guidance, variable rate application systems, and automated field mapping capabilities offer significant productivity improvements that justify premium pricing.

Cooperative farming models are expanding rapidly, creating opportunities for shared tractor ownership and custom farming services. Equipment sharing programs enable multiple farmers to access advanced machinery while distributing costs, making high-end tractors economically viable for smaller operations. This trend opens new business models for manufacturers and dealers.

Export market development for Vietnamese agricultural products drives demand for higher quality and more consistent crop production, necessitating advanced mechanization. International certification requirements for agricultural exports often mandate specific farming practices that require modern tractor capabilities, creating premium market segments.

Sustainable farming initiatives supported by government policies and international development programs create opportunities for eco-friendly tractor technologies. Electric and hybrid tractors align with Vietnam’s environmental goals while offering long-term operational cost advantages. MarkWide Research indicates that sustainable agriculture practices are gaining traction among progressive farmers seeking competitive advantages.

Supply chain dynamics in Vietnam’s agricultural tractors market reflect the complex interplay between international manufacturers, local distributors, and end-user farmers. Import dependencies create vulnerability to global supply chain disruptions and currency fluctuations, while simultaneously providing access to advanced technologies and competitive pricing from established manufacturers.

Competitive intensity has increased significantly as both international and domestic players vie for market share. Price competition remains fierce, particularly in the mid-range tractor segments where multiple brands offer similar specifications. However, differentiation through service quality, financing options, and technology features provides opportunities for premium positioning.

Seasonal fluctuations create distinct demand patterns that influence inventory management and sales strategies. Peak seasons coinciding with planting and harvesting periods generate concentrated demand, while off-seasons require alternative revenue streams through maintenance services and spare parts sales.

Technology evolution continuously reshapes market dynamics, with rapid advancement in automation, connectivity, and precision agriculture capabilities. Digital integration is becoming increasingly important, with farmers expecting tractors to interface with farm management software and mobile applications for comprehensive operational control.

Primary research methodology employed comprehensive field studies across Vietnam’s major agricultural regions, including direct interviews with farmers, dealers, and industry stakeholders. Survey techniques captured quantitative data on tractor ownership patterns, usage frequencies, and purchase decision factors from representative farmer samples across different farm sizes and crop types.

Secondary research incorporated extensive analysis of government statistics, industry reports, and trade association data to establish market baselines and trend patterns. Data triangulation methods ensured accuracy by cross-referencing multiple information sources and validating findings through expert consultations with agricultural machinery specialists.

Regional analysis involved detailed examination of provincial-level data to identify geographic variations in tractor adoption rates, brand preferences, and market penetration levels. Demographic segmentation considered factors such as farm size, crop type, farmer age, and education levels to understand market heterogeneity.

Technology assessment included evaluation of current and emerging tractor technologies, their applicability to Vietnamese farming conditions, and adoption timelines. Market modeling incorporated economic indicators, policy impacts, and technological trends to project future market scenarios and growth trajectories.

Mekong Delta region dominates Vietnam’s agricultural tractors market, accounting for approximately 45% of total sales volume. The region’s extensive rice cultivation areas, flat terrain, and established irrigation infrastructure create ideal conditions for tractor deployment. Can Tho and An Giang provinces lead in mechanization rates, with some areas achieving over 80% tractor adoption for rice farming operations.

Red River Delta represents the second-largest market segment, characterized by intensive agriculture and high population density. Mechanization challenges in this region include smaller average farm sizes and more fragmented land ownership patterns. However, government initiatives promoting cooperative farming have increased tractor accessibility and utilization efficiency.

Central Highlands show growing tractor demand driven by coffee and rubber plantations requiring specialized equipment for crop maintenance and harvesting support. Terrain variations in this region demand tractors with enhanced maneuverability and slope-handling capabilities, creating niche market opportunities for specialized manufacturers.

Northern mountainous regions present unique challenges due to steep terrain and limited infrastructure, resulting in lower mechanization rates but growing interest in compact, versatile tractors suitable for diverse agricultural applications. Government support programs specifically target these regions to reduce agricultural development disparities.

Market leadership in Vietnam’s agricultural tractors sector is distributed among several established international brands and emerging domestic players. The competitive environment reflects diverse strategies ranging from premium technology positioning to cost-effective solutions targeting price-sensitive segments.

By Power Range: The Vietnam agricultural tractors market demonstrates clear segmentation patterns based on horsepower categories, reflecting diverse farming requirements and economic considerations across different agricultural segments.

By Application: Agricultural applications drive distinct tractor specifications and market demand patterns across Vietnam’s diverse farming landscape.

By Drive Type: Technical specifications reflect varying terrain conditions and operational requirements across Vietnam’s agricultural regions.

Two-wheel tractors maintain significant market presence, particularly in regions with small farm sizes and intensive cultivation practices. These compact machines offer affordability and versatility, serving multiple functions from land preparation to transportation. Market penetration of two-wheel tractors remains high in vegetable-growing regions where precision and maneuverability outweigh raw power requirements.

Four-wheel tractors represent the fastest-growing segment, driven by increasing farm consolidation and mechanization of rice cultivation. Technology integration in four-wheel tractors includes GPS guidance systems, automated steering, and precision application capabilities that significantly improve operational efficiency and crop yields.

Specialty tractors designed for specific crops or operations show emerging growth potential. Orchard tractors with narrow profiles and low centers of gravity cater to fruit cultivation needs, while high-clearance tractors serve specialty crop applications requiring elevated ground clearance for mature plant navigation.

Electric tractors represent an emerging category with growing interest among environmentally conscious farmers and operations near urban areas. Battery technology improvements and government incentives for clean energy adoption are expected to accelerate electric tractor market development, though current adoption remains limited by range and charging infrastructure constraints.

Farmers benefit significantly from tractor adoption through increased productivity, reduced labor requirements, and improved crop quality. Operational efficiency improvements enable farmers to cultivate larger areas with fewer workers, addressing rural labor shortages while increasing income potential. Precision agriculture capabilities help optimize input usage, reducing costs and environmental impact.

Manufacturers gain access to a rapidly expanding market with strong government support and increasing mechanization awareness. Local assembly opportunities provide cost advantages and closer customer relationships, while technology transfer requirements create long-term competitive positioning benefits.

Dealers and distributors benefit from recurring revenue streams through after-sales services, spare parts, and financing services. Service networks become increasingly valuable as tractor populations grow, creating sustainable business models beyond initial equipment sales.

Government stakeholders achieve agricultural modernization objectives through increased productivity, food security improvements, and rural economic development. Export competitiveness of Vietnamese agricultural products improves through mechanization-enabled quality and consistency enhancements.

Financial institutions find growing opportunities in agricultural equipment financing, supported by government guarantee programs and improving farmer creditworthiness. MarkWide Research analysis indicates that agricultural lending portfolios show strong performance metrics due to mechanization-driven productivity improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the dominant trend reshaping Vietnam’s agricultural tractors market. Smart farming technologies including IoT sensors, GPS guidance systems, and data analytics platforms are becoming standard features rather than premium options. Farmers increasingly expect tractors to integrate seamlessly with farm management software and mobile applications for comprehensive operational control.

Sustainability focus drives growing interest in fuel-efficient engines, electric powertrains, and precision application systems that reduce environmental impact. Carbon footprint reduction initiatives supported by government policies and international buyers create market demand for eco-friendly tractor technologies. Renewable energy integration through solar charging systems for electric tractors represents an emerging trend.

Service-oriented business models are transforming traditional equipment sales approaches. Equipment-as-a-Service offerings provide farmers access to advanced tractors without large capital investments, while manufacturers benefit from recurring revenue streams and closer customer relationships. Predictive maintenance services using telematics data help prevent breakdowns and optimize equipment performance.

Customization demand increases as farmers seek tractors specifically adapted to local conditions and crop requirements. Modular designs enable configuration flexibility, while local assembly operations allow manufacturers to incorporate region-specific modifications and reduce costs through proximity to end markets.

Manufacturing localization initiatives have accelerated, with several international brands establishing assembly operations in Vietnam. THACO Industries expanded its agricultural machinery production capabilities, while foreign manufacturers increasingly partner with local companies to meet growing demand and benefit from preferential trade policies.

Technology partnerships between tractor manufacturers and precision agriculture companies have proliferated, creating integrated solutions that combine hardware and software capabilities. Digital platform development enables farmers to access equipment monitoring, maintenance scheduling, and operational optimization tools through unified interfaces.

Financial innovation has introduced new equipment financing models, including lease-to-own programs, seasonal payment structures, and cooperative purchasing arrangements. Fintech companies are entering agricultural equipment financing, leveraging alternative credit assessment methods and digital platforms to serve previously underserved farmer segments.

Training program expansion addresses the growing need for skilled tractor operators and maintenance technicians. Vocational schools and manufacturer training centers have increased capacity to support mechanization growth, while mobile training units bring education directly to farming communities in remote areas.

Market entry strategies should prioritize comprehensive dealer network development and after-sales service capabilities, as these factors significantly influence farmer purchase decisions. Local partnerships with established agricultural equipment distributors provide market access advantages and cultural understanding essential for success in Vietnam’s diverse regional markets.

Product development focus should emphasize adaptability to Vietnamese farming conditions, including compact designs for small fields, fuel efficiency for cost-conscious farmers, and durability for intensive usage patterns. Technology integration should balance advanced capabilities with user-friendly interfaces suitable for farmers with varying technical expertise levels.

Financing solutions represent critical success factors, with manufacturers and dealers needing to offer flexible payment terms, seasonal adjustment options, and cooperative purchasing programs. Government subsidy alignment ensures maximum customer benefit while simplifying administrative processes for both farmers and dealers.

Service network investment should prioritize rural area coverage and mobile service capabilities to address geographic challenges in equipment maintenance and repair. MWR analysis suggests that service quality often determines long-term brand loyalty more than initial purchase price considerations.

Market growth trajectory remains highly positive, supported by continued government mechanization initiatives and increasing agricultural export opportunities. Adoption rates are expected to accelerate as younger farmers embrace technology and cooperative farming models expand access to advanced equipment. Regional expansion will likely extend mechanization benefits to previously underserved mountainous and remote areas.

Technology evolution will drive market premiumization, with autonomous tractors, artificial intelligence integration, and advanced precision agriculture capabilities becoming mainstream within the next decade. Electric tractor adoption is projected to grow significantly as battery technology improves and charging infrastructure develops, particularly in areas with reliable electricity access.

Market consolidation may occur as successful brands expand market share while smaller players struggle with service network requirements and technology investment demands. Local manufacturing capabilities are expected to increase, reducing import dependency and improving cost competitiveness for established brands.

Sustainability requirements will increasingly influence purchase decisions, with farmers seeking equipment that meets environmental standards required for export markets. Carbon credit programs and sustainable agriculture certifications may create additional incentives for adopting eco-friendly tractor technologies, further accelerating market transformation toward environmentally responsible mechanization solutions.

Vietnam’s agricultural tractors market stands at a pivotal transformation point, characterized by robust growth potential and evolving farmer expectations. The convergence of government support, technological advancement, and agricultural modernization needs creates an exceptionally favorable environment for market expansion. Mechanization trends indicate sustained growth momentum, with adoption rates accelerating across all major agricultural regions.

Success factors in this dynamic market include comprehensive service networks, flexible financing solutions, and products specifically adapted to Vietnamese farming conditions. Technology integration will increasingly differentiate market leaders from followers, while sustainability considerations become essential for long-term competitiveness. The market’s future belongs to companies that can effectively balance advanced capabilities with affordability and reliability.

Strategic opportunities abound for manufacturers, dealers, and service providers willing to invest in understanding local market nuances and building lasting relationships with farming communities. MarkWide Research projects continued strong performance for stakeholders who prioritize farmer needs, technological innovation, and comprehensive support systems in their market approach strategies.

What is Agricultural Tractors?

Agricultural tractors are powerful vehicles designed primarily for agricultural tasks such as plowing, tilling, and planting. They play a crucial role in modern farming by enhancing productivity and efficiency in various agricultural operations.

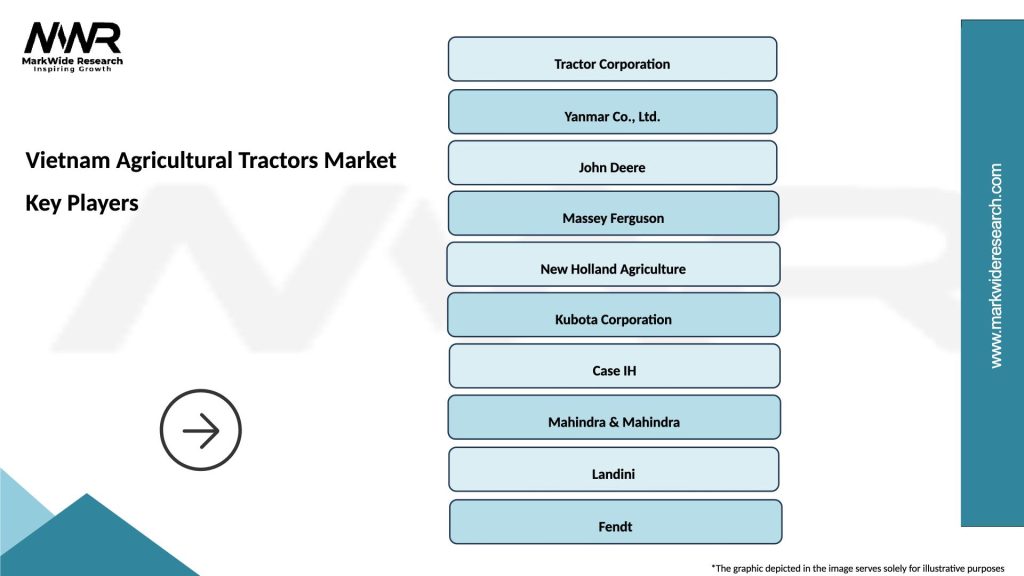

What are the key players in the Vietnam Agricultural Tractors Market?

Key players in the Vietnam Agricultural Tractors Market include companies like John Deere, Kubota, and Yanmar, which are known for their innovative tractor solutions. These companies compete on technology, efficiency, and customer service, among others.

What are the growth factors driving the Vietnam Agricultural Tractors Market?

The Vietnam Agricultural Tractors Market is driven by factors such as the increasing demand for mechanization in agriculture, rising labor costs, and government initiatives to promote modern farming techniques. These elements contribute to the growing adoption of tractors in various agricultural sectors.

What challenges does the Vietnam Agricultural Tractors Market face?

Challenges in the Vietnam Agricultural Tractors Market include limited access to financing for small farmers, fluctuating commodity prices, and the need for skilled operators. These factors can hinder the widespread adoption of tractors in rural areas.

What opportunities exist in the Vietnam Agricultural Tractors Market?

Opportunities in the Vietnam Agricultural Tractors Market include the potential for technological advancements such as precision farming and automation. Additionally, increasing foreign investment in agriculture presents avenues for growth and innovation.

What trends are shaping the Vietnam Agricultural Tractors Market?

Trends in the Vietnam Agricultural Tractors Market include the rise of electric and hybrid tractors, advancements in smart farming technologies, and a growing focus on sustainability. These trends are influencing how tractors are designed and utilized in modern agriculture.

Vietnam Agricultural Tractors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Compact Tractors, Utility Tractors, Row Crop Tractors, Orchard Tractors |

| Technology | Hydraulic Systems, GPS Guidance, Autonomous Tractors, Electric Powertrains |

| End User | Farmers, Agricultural Cooperatives, Government Agencies, Contractors |

| Fuel Type | Diesel, Gasoline, Biofuel, Electric |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Agricultural Tractors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at