444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China automated material handling market represents one of the most dynamic and rapidly evolving sectors within the global industrial automation landscape. This comprehensive market encompasses sophisticated systems designed to move, store, control, and protect materials throughout manufacturing, warehousing, and distribution processes without direct human intervention. China’s industrial transformation has positioned the nation as a global leader in adopting and implementing advanced material handling technologies, driven by the country’s massive manufacturing base and ambitious Industry 4.0 initiatives.

Market dynamics in China reflect the nation’s strategic focus on automation and digitalization across key industries including automotive, electronics, pharmaceuticals, food and beverage, and e-commerce. The market demonstrates remarkable growth momentum, with adoption rates accelerating at 12.5% annually as manufacturers seek to enhance operational efficiency and reduce labor dependency. Government initiatives such as “Made in China 2025” have significantly accelerated investment in automated material handling solutions, creating a robust ecosystem for technological advancement and market expansion.

Regional distribution across China shows concentrated development in major industrial hubs, with the Yangtze River Delta, Pearl River Delta, and Bohai Economic Rim accounting for approximately 75% of market activity. These regions benefit from established manufacturing infrastructure, skilled workforce availability, and proximity to major ports and transportation networks. The market’s evolution reflects China’s transition from labor-intensive manufacturing to high-tech, automated production systems that can compete globally while addressing domestic labor cost increases and demographic shifts.

The China automated material handling market refers to the comprehensive ecosystem of technologies, systems, and solutions designed to automate the movement, storage, control, and protection of materials, goods, and products throughout various stages of manufacturing, warehousing, and distribution processes within Chinese industrial operations. This market encompasses a wide range of equipment including automated guided vehicles (AGVs), conveyor systems, robotic systems, automated storage and retrieval systems (AS/RS), sortation systems, and warehouse management software integrated to create seamless material flow operations.

Automated material handling systems in China represent sophisticated integration of mechanical, electrical, and software components that work together to minimize human intervention while maximizing efficiency, accuracy, and safety in material movement operations. These systems are characterized by their ability to handle diverse materials ranging from raw components to finished products, adapt to varying production requirements, and integrate with existing manufacturing execution systems and enterprise resource planning platforms.

China’s automated material handling market stands at the forefront of global industrial automation, driven by the nation’s commitment to manufacturing excellence and technological innovation. The market encompasses diverse segments including automotive manufacturing, electronics assembly, pharmaceutical production, food processing, and rapidly expanding e-commerce fulfillment operations. Key growth drivers include rising labor costs, increasing demand for operational efficiency, stringent quality requirements, and government support for industrial automation initiatives.

Market penetration varies significantly across industries, with automotive and electronics sectors leading adoption at rates exceeding 68% implementation among major manufacturers. The e-commerce segment represents the fastest-growing application area, with companies investing heavily in automated fulfillment centers to meet consumer expectations for rapid delivery. Technology advancement focuses on artificial intelligence integration, Internet of Things connectivity, and predictive maintenance capabilities that enhance system reliability and operational intelligence.

Competitive dynamics feature both international technology leaders and emerging domestic players, creating a diverse ecosystem that drives innovation and cost optimization. The market benefits from China’s strong manufacturing base, extensive supply chain networks, and growing emphasis on sustainable production practices that automated systems help achieve through improved resource utilization and waste reduction.

Strategic market insights reveal several critical trends shaping the China automated material handling landscape:

Primary market drivers propelling China’s automated material handling sector reflect both economic necessities and strategic opportunities. Labor cost escalation represents the most significant driver, with manufacturing wages increasing at rates that make automation investments increasingly attractive. Companies face growing pressure to maintain competitiveness while managing rising operational costs, making automated material handling systems essential for long-term sustainability.

Government policy support through initiatives like “Made in China 2025” provides substantial momentum for automation adoption. These policies include financial incentives, tax benefits, and strategic guidance that encourage manufacturers to invest in advanced material handling technologies. Industrial upgrading requirements mandate that companies modernize their operations to meet environmental standards and efficiency targets, driving systematic adoption of automated solutions.

E-commerce expansion creates unprecedented demand for sophisticated material handling systems capable of managing high-volume, diverse product flows with exceptional speed and accuracy. The sector’s growth, accelerating at 18.2% annually, requires automated sortation, picking, and packaging systems that can handle millions of orders daily while maintaining cost-effectiveness and delivery speed expectations.

Quality and safety requirements in industries such as pharmaceuticals, food processing, and electronics manufacturing necessitate automated systems that ensure consistent handling procedures, reduce contamination risks, and maintain traceability throughout the supply chain. These requirements create sustained demand for specialized material handling solutions designed to meet stringent regulatory standards.

Market restraints present significant challenges that influence adoption patterns and implementation strategies across China’s automated material handling sector. High initial investment costs represent the primary barrier for many manufacturers, particularly small and medium enterprises that may lack the capital resources required for comprehensive automation projects. These costs include not only equipment procurement but also installation, integration, training, and ongoing maintenance expenses that can strain operational budgets.

Technical complexity associated with integrating automated material handling systems into existing manufacturing operations creates implementation challenges. Many facilities require extensive modifications to accommodate new equipment, while ensuring compatibility with legacy systems demands specialized expertise that may not be readily available. System integration difficulties can lead to extended implementation timelines and unexpected costs that discourage potential adopters.

Skilled workforce limitations constrain market growth as automated systems require technicians and engineers capable of operating, maintaining, and optimizing complex equipment. The shortage of qualified personnel creates bottlenecks in system deployment and ongoing operations, while training existing workers requires time and resources that many companies struggle to allocate effectively.

Technological obsolescence concerns influence purchasing decisions as rapid advancement in automation technologies creates uncertainty about long-term system viability. Companies worry about investing in solutions that may become outdated quickly, leading to delayed decision-making and preference for proven technologies over innovative alternatives that might offer superior performance.

Emerging opportunities within China’s automated material handling market reflect evolving industrial requirements and technological capabilities. Smart manufacturing integration presents substantial growth potential as companies seek to create fully connected production environments where material handling systems communicate seamlessly with manufacturing execution systems, quality control equipment, and enterprise resource planning platforms. This integration enables real-time optimization and predictive analytics that enhance overall operational efficiency.

Artificial intelligence applications offer transformative opportunities for material handling optimization through machine learning algorithms that can predict maintenance requirements, optimize routing decisions, and adapt to changing operational conditions automatically. AI-powered systems can achieve efficiency improvements of 25-30% compared to traditional automated solutions, creating compelling value propositions for manufacturers seeking competitive advantages.

Sustainability initiatives drive demand for energy-efficient material handling systems that reduce environmental impact while maintaining operational performance. Companies increasingly prioritize solutions that support carbon reduction goals, waste minimization, and resource conservation, creating opportunities for innovative technologies that deliver both environmental and economic benefits.

Small and medium enterprise adoption represents an underserved market segment with significant growth potential. As automation technologies become more affordable and modular, smaller manufacturers gain access to solutions previously available only to large corporations. This democratization of automation technology expands the addressable market substantially while driving innovation in cost-effective system design.

Market dynamics in China’s automated material handling sector reflect complex interactions between technological advancement, economic pressures, and strategic initiatives. Supply chain evolution drives fundamental changes in material handling requirements as companies adopt just-in-time manufacturing, lean production principles, and flexible manufacturing systems that demand responsive, adaptable automation solutions.

Competitive pressure from both domestic and international markets compels Chinese manufacturers to invest in automation technologies that enhance productivity, reduce costs, and improve quality consistency. Companies that fail to modernize their material handling operations risk losing market share to more efficient competitors, creating sustained demand for advanced automation solutions.

Technology convergence between material handling systems and broader industrial automation platforms creates synergistic effects that amplify system capabilities. Integration with robotics, artificial intelligence, and Internet of Things technologies enables material handling systems to operate with unprecedented intelligence and adaptability, achieving performance levels that justify substantial investments.

Regional development patterns influence market dynamics as different areas of China experience varying levels of industrial development and automation adoption. Coastal regions with established manufacturing bases lead in advanced system implementation, while inland areas present growth opportunities as industrial development expands and labor costs rise throughout the country.

Comprehensive research methodology employed in analyzing China’s automated material handling market combines quantitative data analysis with qualitative insights gathered from industry stakeholders, technology providers, and end-user organizations. Primary research includes structured interviews with key decision-makers across manufacturing, logistics, and technology sectors to understand adoption drivers, implementation challenges, and future requirements.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technology documentation to establish market sizing, competitive positioning, and trend identification. Data validation processes ensure accuracy through cross-referencing multiple sources and verification with industry experts who possess deep knowledge of China’s industrial automation landscape.

Market segmentation analysis utilizes both top-down and bottom-up approaches to identify growth opportunities across different industries, technologies, and regional markets. This methodology enables precise identification of market dynamics and provides reliable foundation for strategic recommendations and future projections.

Trend analysis incorporates historical data patterns, current market conditions, and forward-looking indicators to project market evolution and identify emerging opportunities. The methodology considers both cyclical and structural factors that influence market development, ensuring comprehensive understanding of long-term growth prospects.

Regional market distribution across China reveals distinct patterns of automated material handling adoption influenced by industrial concentration, economic development levels, and infrastructure capabilities. Eastern China dominates market activity with approximately 45% market share, driven by the Yangtze River Delta region’s advanced manufacturing base, including Shanghai, Jiangsu, and Zhejiang provinces. This region benefits from established automotive, electronics, and chemical industries that require sophisticated material handling solutions.

Southern China accounts for roughly 28% of market activity, centered in the Pearl River Delta region encompassing Guangdong province and surrounding areas. This region’s strength in electronics manufacturing, consumer goods production, and export-oriented industries drives substantial demand for automated material handling systems, particularly in high-volume assembly and packaging operations.

Northern China represents approximately 18% of market share, with Beijing, Tianjin, and surrounding Hebei province forming the Bohai Economic Rim. This region’s focus on heavy industry, automotive manufacturing, and logistics operations creates demand for robust material handling systems capable of managing large, heavy components and high-throughput operations.

Central and Western China collectively account for the remaining 9% of market activity, but represent the fastest-growing regions as industrial development expands inland. Government initiatives to promote balanced regional development drive manufacturing investment in these areas, creating emerging opportunities for material handling system providers willing to establish local presence and support capabilities.

Competitive landscape in China’s automated material handling market features diverse participants ranging from global technology leaders to innovative domestic companies. International players maintain strong positions through advanced technology offerings, established customer relationships, and comprehensive service capabilities that appeal to multinational manufacturers and large domestic enterprises.

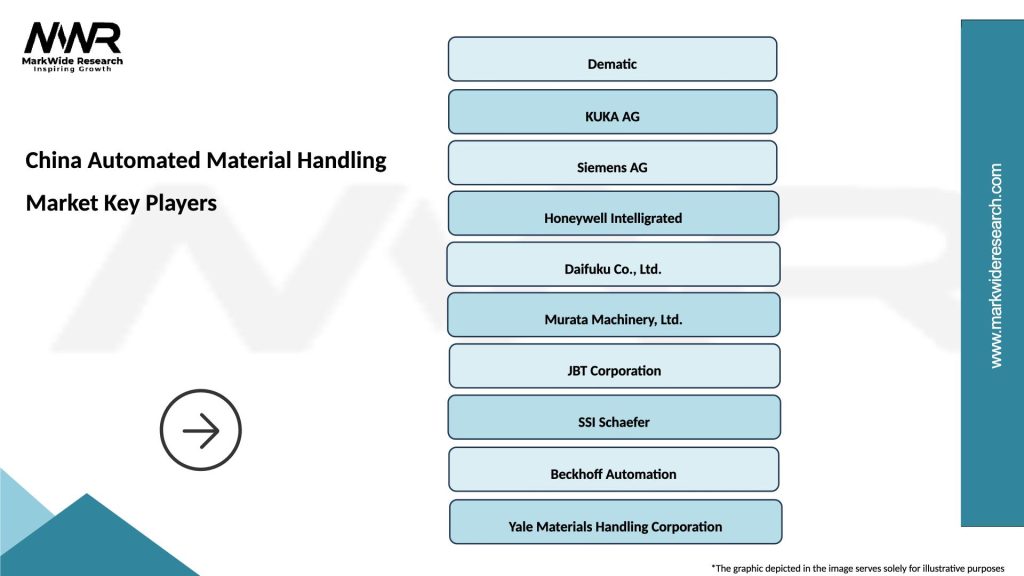

Key market participants include:

Domestic competitors increasingly challenge international players through cost-competitive offerings, local market knowledge, and rapid response capabilities. These companies benefit from government support, lower operational costs, and deep understanding of Chinese manufacturing requirements, enabling them to capture growing market share in price-sensitive segments.

Market segmentation analysis reveals distinct categories based on technology type, application industry, and system complexity. By Technology: The market encompasses automated guided vehicles (AGVs), conveyor systems, robotic systems, automated storage and retrieval systems (AS/RS), sortation systems, and warehouse management software, each serving specific operational requirements and offering unique value propositions.

By Application Industry:

By System Complexity: Market segments range from basic conveyor installations to comprehensive integrated automation systems that encompass entire facility operations. Simple systems serve cost-conscious customers with straightforward material movement requirements, while complex integrated solutions address sophisticated manufacturing environments requiring seamless coordination between multiple automated subsystems.

Automated Guided Vehicles (AGVs) represent one of the fastest-growing categories, with adoption rates increasing 22% annually as manufacturers seek flexible material transport solutions. These systems offer advantages in dynamic production environments where material flow patterns change frequently, providing adaptability that fixed conveyor systems cannot match. Advanced AGV systems incorporate artificial intelligence for route optimization and obstacle avoidance, enhancing operational efficiency and safety.

Conveyor Systems maintain the largest market share due to their versatility, reliability, and cost-effectiveness across diverse applications. Modern conveyor technologies integrate sensors, controls, and software that enable intelligent material routing and real-time performance monitoring. Modular conveyor designs allow for easy reconfiguration as production requirements evolve, providing long-term value for manufacturers facing changing market demands.

Robotic Material Handling systems demonstrate exceptional growth potential as robotic technologies become more sophisticated and cost-effective. These systems excel in applications requiring precision, flexibility, and integration with manufacturing processes. Collaborative robots enable safe human-robot interaction while maintaining high productivity levels, appealing to manufacturers seeking to enhance rather than replace human workers.

Automated Storage and Retrieval Systems address space optimization requirements in high-density storage applications. These systems achieve storage density improvements of 40-60% compared to traditional warehousing methods while providing faster retrieval times and improved inventory accuracy. AS/RS integration with warehouse management systems enables real-time inventory visibility and optimized storage allocation strategies.

Manufacturers realize substantial benefits from automated material handling systems including reduced labor costs, improved operational efficiency, enhanced product quality, and increased production capacity. Operational cost reductions typically range from 15-35% depending on system complexity and application requirements, while productivity improvements enable manufacturers to meet growing demand without proportional increases in facility size or workforce.

System Integrators benefit from growing market demand and opportunities to develop specialized expertise in emerging technologies. The complexity of modern material handling systems creates sustained demand for integration services, maintenance support, and system optimization consulting. Service revenue represents an increasingly important component of system integrator business models, providing recurring income streams and deeper customer relationships.

Technology Providers gain access to one of the world’s largest and most dynamic industrial markets, with opportunities to scale production, reduce costs, and accelerate innovation through collaboration with Chinese manufacturers. Local partnerships enable technology companies to adapt their offerings to specific Chinese market requirements while benefiting from cost-effective manufacturing and assembly capabilities.

End Users achieve competitive advantages through improved operational efficiency, enhanced product quality, reduced workplace injuries, and greater flexibility in responding to market changes. Return on investment for automated material handling systems typically occurs within 2-4 years, depending on labor cost savings, productivity improvements, and operational efficiency gains achieved through implementation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming China’s automated material handling market. AI-powered systems enable predictive maintenance, dynamic route optimization, and adaptive learning capabilities that continuously improve operational performance. Machine learning algorithms analyze historical data to predict equipment failures, optimize energy consumption, and enhance overall system efficiency, delivering value that justifies premium pricing for advanced solutions.

Internet of Things Connectivity creates opportunities for comprehensive system monitoring and optimization through real-time data collection and analysis. IoT-enabled material handling systems provide unprecedented visibility into operational performance, enabling proactive maintenance, energy optimization, and integration with broader smart factory initiatives. This connectivity supports remote monitoring and control capabilities that reduce operational costs while improving system reliability.

Collaborative Automation emerges as manufacturers seek solutions that enhance rather than replace human workers. Collaborative robots and human-machine interfaces enable safe interaction between automated systems and human operators, combining the precision and consistency of automation with human flexibility and problem-solving capabilities. This approach addresses labor concerns while maximizing operational efficiency.

Sustainability Focus drives demand for energy-efficient material handling systems that support environmental goals while reducing operational costs. Green automation technologies incorporate energy recovery systems, optimized motor controls, and intelligent power management that can reduce energy consumption by 20-30% compared to traditional systems, appealing to environmentally conscious manufacturers and cost-focused operations alike.

Recent industry developments demonstrate accelerating innovation and market expansion across China’s automated material handling sector. Major automotive manufacturers have announced substantial investments in automated assembly line systems, with several companies implementing comprehensive material handling automation that integrates with robotic assembly systems and quality control equipment. These projects showcase the potential for fully automated production environments that minimize human intervention while maximizing efficiency and quality consistency.

E-commerce giants continue expanding their automated fulfillment capabilities, with new distribution centers featuring advanced sortation systems, robotic picking technologies, and automated storage solutions capable of processing millions of orders daily. MarkWide Research analysis indicates these investments drive broader market adoption as other retailers seek to match service levels and operational efficiency achieved by industry leaders.

Technology partnerships between international automation companies and Chinese manufacturers create opportunities for knowledge transfer, cost optimization, and market expansion. These collaborations enable foreign companies to access China’s manufacturing capabilities while providing Chinese partners with advanced technology and global market access, fostering innovation and competitive improvement across the industry.

Government initiatives including smart manufacturing demonstration projects and automation subsidy programs provide practical support for companies investing in material handling automation. These programs reduce financial barriers while showcasing successful implementation examples that encourage broader market adoption and technology advancement.

Strategic recommendations for market participants emphasize the importance of developing comprehensive automation strategies that align with long-term business objectives rather than pursuing isolated system implementations. Successful companies should focus on creating integrated material handling ecosystems that support current operations while providing flexibility for future expansion and technology upgrades. This approach maximizes return on investment while minimizing disruption during implementation phases.

Technology selection should prioritize solutions that offer scalability, interoperability, and upgrade pathways rather than focusing solely on initial cost considerations. Future-ready systems incorporate open architecture designs, standard communication protocols, and modular components that enable gradual expansion and technology integration as requirements evolve and budgets allow for additional investment.

Partnership strategies with experienced system integrators and technology providers can significantly improve implementation success rates while reducing project risks. Collaborative relationships enable knowledge transfer, best practice sharing, and ongoing support that ensures optimal system performance throughout the equipment lifecycle. Companies should evaluate potential partners based on technical expertise, local support capabilities, and long-term commitment to the Chinese market.

Workforce development initiatives should accompany automation investments to ensure organizations possess the skills necessary for successful system operation and maintenance. Training programs that combine technical education with hands-on experience create internal capabilities that reduce dependence on external support while enabling continuous improvement and optimization of automated systems.

Future market prospects for China’s automated material handling sector remain exceptionally positive, driven by sustained industrial growth, technological advancement, and strategic government support. Market expansion is projected to continue at robust rates exceeding 11% annually through the next decade, supported by ongoing manufacturing sector modernization and emerging application areas including pharmaceutical production, food processing, and renewable energy manufacturing.

Technology evolution will focus on artificial intelligence integration, autonomous system capabilities, and seamless connectivity with broader industrial automation platforms. Next-generation systems will demonstrate unprecedented intelligence and adaptability, enabling real-time optimization based on changing operational conditions, predictive maintenance scheduling, and autonomous decision-making that minimizes human intervention while maximizing operational efficiency.

Market democratization through cost reduction and technology simplification will expand automation access to small and medium enterprises that previously could not justify investment in sophisticated material handling systems. Modular solutions and flexible financing options will enable broader market penetration while driving innovation in cost-effective system design and deployment methodologies.

Sustainability requirements will increasingly influence technology development and purchasing decisions as environmental regulations tighten and corporate responsibility initiatives gain prominence. Green automation technologies that deliver both environmental and economic benefits will command premium pricing while creating competitive advantages for early adopters who can demonstrate superior environmental performance alongside operational efficiency gains.

China’s automated material handling market represents a dynamic and rapidly evolving sector that offers substantial opportunities for technology providers, system integrators, and end-user organizations seeking competitive advantages through operational automation. The market’s growth trajectory reflects fundamental shifts in Chinese manufacturing toward higher value-added production, improved efficiency, and enhanced quality consistency that automated material handling systems enable.

Key success factors for market participants include developing comprehensive automation strategies, selecting scalable technology solutions, establishing strong partnership networks, and investing in workforce development initiatives that support successful system implementation and operation. Companies that approach automation as a strategic transformation rather than tactical improvement will achieve superior results and sustainable competitive advantages.

Market outlook remains highly positive, supported by continued industrial growth, government policy support, and technological advancement that expands automation capabilities while reducing implementation barriers. The convergence of artificial intelligence, Internet of Things connectivity, and advanced robotics creates unprecedented opportunities for intelligent material handling systems that deliver exceptional performance and value to Chinese manufacturers across diverse industry sectors.

What is Automated Material Handling?

Automated Material Handling refers to the use of technology to automate the movement, storage, and control of materials and products throughout the manufacturing, warehousing, and distribution processes.

What are the key players in the China Automated Material Handling Market?

Key players in the China Automated Material Handling Market include KION Group, Daifuku Co., Ltd., and SSI Schaefer, among others.

What are the main drivers of growth in the China Automated Material Handling Market?

The main drivers of growth in the China Automated Material Handling Market include the increasing demand for efficiency in logistics, the rise of e-commerce, and advancements in robotics and automation technologies.

What challenges does the China Automated Material Handling Market face?

Challenges in the China Automated Material Handling Market include high initial investment costs, the need for skilled labor to manage automated systems, and potential integration issues with existing processes.

What opportunities exist in the China Automated Material Handling Market?

Opportunities in the China Automated Material Handling Market include the expansion of smart factories, the growing adoption of Internet of Things (IoT) technologies, and the increasing focus on sustainability in supply chain operations.

What trends are shaping the China Automated Material Handling Market?

Trends shaping the China Automated Material Handling Market include the rise of autonomous mobile robots, the integration of artificial intelligence for predictive analytics, and the development of advanced warehouse management systems.

China Automated Material Handling Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Conveyor Systems, Robotic Arms, Sortation Systems |

| Technology | IoT Integration, AI Algorithms, Machine Learning, Vision Systems |

| End User | Manufacturing, E-commerce, Pharmaceuticals, Food & Beverage |

| Application | Warehouse Management, Order Fulfillment, Inventory Control, Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Automated Material Handling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at