444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The tuna and algae omega-3 ingredient market represents a rapidly expanding sector within the global nutritional supplements and functional foods industry. This specialized market encompasses the production, processing, and distribution of omega-3 fatty acids derived from both traditional tuna sources and innovative algae-based alternatives. Market dynamics indicate substantial growth driven by increasing consumer awareness of cardiovascular health benefits and the rising demand for sustainable nutrition solutions.

Consumer preferences are shifting toward premium omega-3 ingredients that offer superior bioavailability and environmental sustainability. The market encompasses various product forms including concentrated oils, powders, and encapsulated formulations designed for dietary supplements, functional foods, and pharmaceutical applications. Growth projections suggest the market is expanding at a robust CAGR of 8.2%, driven by increasing health consciousness and regulatory support for omega-3 fortified products.

Technological advancements in extraction and purification processes have significantly improved the quality and concentration of omega-3 ingredients from both tuna and algae sources. The market benefits from growing scientific evidence supporting the health benefits of EPA and DHA fatty acids, particularly in cardiovascular health, cognitive function, and inflammatory response management. Regional adoption varies significantly, with North America and Europe leading in market penetration at approximately 65% combined market share.

The tuna and algae omega-3 ingredient market refers to the commercial sector focused on producing, processing, and supplying omega-3 fatty acids derived from tuna fish and marine algae for use in dietary supplements, functional foods, pharmaceuticals, and nutraceutical applications. This market encompasses both traditional fish-derived omega-3s and innovative plant-based alternatives that provide essential EPA and DHA fatty acids.

Key components of this market include the extraction and refinement of omega-3 fatty acids from tuna sources, cultivation and processing of omega-3 rich algae strains, and the development of various delivery formats for consumer and industrial applications. The market serves multiple end-use industries including dietary supplements, functional foods, infant nutrition, pharmaceutical formulations, and animal feed applications.

Market participants range from large-scale fish processing companies and algae cultivation facilities to specialized ingredient suppliers and contract manufacturers. The sector emphasizes quality control, sustainability practices, and regulatory compliance to meet growing consumer demands for clean-label, traceable omega-3 ingredients with proven health benefits.

Market leadership in the tuna and algae omega-3 ingredient sector is characterized by strong demand growth, technological innovation, and increasing focus on sustainable sourcing practices. The market demonstrates resilience and expansion potential driven by rising health awareness, aging demographics, and growing scientific validation of omega-3 health benefits across multiple therapeutic areas.

Key market drivers include increasing prevalence of cardiovascular diseases, growing consumer preference for natural health solutions, and expanding applications in functional foods and beverages. The market benefits from regulatory support with approximately 78% of developed markets having established health claims for omega-3 fatty acids, facilitating product marketing and consumer education initiatives.

Competitive dynamics favor companies with integrated supply chains, advanced processing capabilities, and strong research and development programs. The market shows particular strength in premium segments where consumers are willing to pay higher prices for superior quality, sustainability credentials, and enhanced bioavailability. Innovation trends focus on improving extraction efficiency, developing novel delivery systems, and creating hybrid products that combine multiple omega-3 sources.

Future prospects remain highly favorable with expanding applications in personalized nutrition, sports nutrition, and clinical nutrition segments. The market is expected to benefit from continued research into omega-3 benefits, improving manufacturing technologies, and growing consumer acceptance of algae-based alternatives as sustainable nutrition solutions.

Strategic insights reveal several critical factors shaping the tuna and algae omega-3 ingredient market landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary market drivers propelling growth in the tuna and algae omega-3 ingredient market stem from multiple interconnected factors that create sustained demand across various application segments. These drivers represent fundamental shifts in consumer behavior, healthcare trends, and regulatory environments that support long-term market expansion.

Health awareness trends constitute the most significant driver, with increasing consumer understanding of omega-3 benefits for cardiovascular health, brain function, and inflammatory response. The growing prevalence of lifestyle-related diseases and aging populations in developed markets create sustained demand for preventive nutrition solutions. Clinical evidence supporting omega-3 efficacy continues to strengthen, with recent studies showing significant cardiovascular risk reduction of up to 25% in regular omega-3 consumers.

Regulatory support provides another crucial driver through established health claims and quality standards that facilitate market development. Government initiatives promoting functional foods and dietary supplements create favorable operating environments for omega-3 ingredient suppliers. The market benefits from clear regulatory pathways for product approval and marketing claims validation.

Sustainability concerns increasingly drive consumer preference toward responsibly sourced omega-3 ingredients, particularly algae-based alternatives that offer environmental advantages over traditional fish-derived sources. This trend supports premium pricing and brand differentiation opportunities for companies investing in sustainable production methods and supply chain transparency.

Market restraints in the tuna and algae omega-3 ingredient sector present challenges that companies must navigate to maintain growth trajectories and market position. These constraints stem from various operational, regulatory, and market-specific factors that can impact profitability and expansion opportunities.

Cost pressures represent a primary restraint, particularly for algae-based omega-3 production which requires significant capital investment in cultivation facilities and processing equipment. High production costs can limit market penetration in price-sensitive segments and emerging markets where consumers have lower purchasing power. The complexity of maintaining consistent quality and yield in algae cultivation adds operational challenges and cost variability.

Supply chain volatility affects tuna-derived omega-3 ingredients through fluctuating fish prices, seasonal availability, and regulatory restrictions on fishing activities. Environmental factors including climate change and ocean pollution can impact both tuna populations and algae cultivation, creating supply security concerns for ingredient manufacturers and end-users.

Regulatory complexity varies significantly across global markets, creating compliance challenges for companies operating internationally. Different quality standards, labeling requirements, and health claim regulations can increase operational costs and limit market access. The evolving nature of regulations around novel ingredients, particularly algae-based products, can create uncertainty for investment decisions.

Consumer skepticism regarding algae-based alternatives and concerns about taste, odor, and efficacy compared to traditional fish-derived omega-3s can limit market acceptance and growth potential in certain consumer segments.

Emerging opportunities in the tuna and algae omega-3 ingredient market present significant potential for companies positioned to capitalize on evolving consumer preferences, technological advancements, and expanding application areas. These opportunities represent pathways for sustainable growth and competitive differentiation.

Personalized nutrition represents a transformative opportunity as consumers increasingly seek customized health solutions based on individual genetic profiles, health conditions, and lifestyle factors. The development of targeted omega-3 formulations for specific demographic groups, health conditions, or genetic variations offers premium pricing opportunities and enhanced customer loyalty.

Functional food integration provides substantial growth potential as food and beverage manufacturers seek to incorporate omega-3 ingredients into mainstream products. Opportunities exist in developing stable, taste-neutral omega-3 ingredients suitable for fortification of dairy products, baked goods, beverages, and snack foods. Market penetration in functional foods currently represents only 23% of total omega-3 applications, indicating significant expansion potential.

Emerging market expansion offers considerable growth opportunities, particularly in Asia-Pacific regions where rising disposable incomes, increasing health awareness, and growing middle-class populations create favorable conditions for premium nutrition products. The development of culturally appropriate products and distribution strategies can unlock substantial market potential.

Technology partnerships with pharmaceutical companies, research institutions, and biotechnology firms can accelerate innovation in delivery systems, bioavailability enhancement, and novel applications for omega-3 ingredients in therapeutic and clinical nutrition segments.

Market dynamics in the tuna and algae omega-3 ingredient sector reflect complex interactions between supply-side factors, demand trends, competitive forces, and external influences that shape market behavior and growth patterns. Understanding these dynamics is essential for strategic planning and market positioning.

Supply-demand equilibrium shows increasing tension as demand growth outpaces traditional supply expansion, particularly for high-quality, sustainably sourced omega-3 ingredients. This imbalance supports price stability and encourages investment in alternative production methods, including advanced algae cultivation technologies and improved extraction processes. Capacity utilization across the industry averages approximately 82%, indicating healthy demand conditions.

Competitive intensity varies across market segments, with premium segments showing less price competition due to quality differentiation and brand loyalty factors. The market demonstrates increasing consolidation as larger players acquire specialized producers to integrate supply chains and expand technological capabilities. Innovation cycles are accelerating, with new product introductions increasing by approximately 15% annually over the past three years.

External factors including environmental regulations, sustainability certifications, and climate change impacts increasingly influence market dynamics. Companies with strong environmental credentials and sustainable sourcing practices gain competitive advantages through preferential customer relationships and premium pricing opportunities.

Technology adoption rates vary significantly across market participants, with leading companies investing heavily in advanced processing technologies, quality control systems, and supply chain optimization tools to maintain competitive positioning and operational efficiency.

Research methodology for analyzing the tuna and algae omega-3 ingredient market employs comprehensive primary and secondary research approaches to ensure accurate, reliable, and actionable market intelligence. The methodology combines quantitative analysis with qualitative insights to provide complete market understanding.

Primary research involves extensive interviews with industry executives, key opinion leaders, regulatory experts, and end-users across the omega-3 value chain. This includes structured discussions with ingredient suppliers, supplement manufacturers, food companies, and distribution partners to gather firsthand insights on market trends, challenges, and opportunities. Survey methodologies capture quantitative data on market preferences, purchasing patterns, and growth projections from representative industry samples.

Secondary research encompasses comprehensive analysis of industry reports, regulatory filings, patent databases, scientific literature, and trade publications to establish market baselines and validate primary research findings. This includes examination of company financial reports, product launches, strategic partnerships, and merger and acquisition activities that shape market dynamics.

Data validation processes ensure accuracy through triangulation of multiple sources, expert review panels, and statistical verification methods. The research methodology incorporates real-time market monitoring to capture emerging trends and adjust analysis based on current market conditions. Quality assurance protocols maintain research integrity through standardized data collection procedures and peer review processes.

Regional market dynamics in the tuna and algae omega-3 ingredient sector demonstrate significant variation in demand patterns, regulatory environments, and competitive landscapes across major geographic markets. This analysis provides insights into regional growth opportunities and market-specific strategies.

North America maintains market leadership with approximately 42% regional market share, driven by high consumer awareness of omega-3 benefits, established supplement culture, and favorable regulatory framework. The United States dominates regional consumption through strong demand in dietary supplements, functional foods, and clinical nutrition applications. Canada shows particular strength in sustainable sourcing initiatives and algae-based omega-3 development, supported by government research funding and environmental regulations.

Europe represents the second-largest regional market with 23% market share, characterized by stringent quality standards, sustainability focus, and growing demand for plant-based alternatives. Nordic countries lead in per-capita consumption due to traditional fish consumption patterns and health-conscious populations. The European Union’s regulatory framework supports market development through clear health claims and quality standards.

Asia-Pacific emerges as the fastest-growing regional market, expanding at approximately 12.5% CAGR, driven by rising disposable incomes, increasing health awareness, and growing middle-class populations. Japan and South Korea lead regional adoption through established supplement markets and aging populations, while China and India present significant growth opportunities despite current low penetration rates.

Latin America and Middle East & Africa represent emerging opportunities with growing health consciousness and expanding distribution networks, though market development remains in early stages compared to established regions.

Competitive landscape in the tuna and algae omega-3 ingredient market features a diverse mix of established players, innovative startups, and integrated suppliers competing across various market segments and geographic regions. The market structure reflects ongoing consolidation trends and increasing focus on vertical integration.

Market leaders include several key companies that have established strong positions through technological innovation, supply chain integration, and strategic partnerships:

Competitive strategies focus on product differentiation through quality enhancement, sustainability credentials, and technological innovation. Companies increasingly invest in research and development to create proprietary extraction methods, improve bioavailability, and develop novel delivery systems that provide competitive advantages.

Market segmentation in the tuna and algae omega-3 ingredient sector reveals distinct categories based on source type, application, form, and end-use industry. This segmentation analysis provides insights into market dynamics and growth opportunities across different product categories.

By Source Type:

By Application:

By Form:

Category-wise analysis reveals distinct performance patterns and growth trajectories across different segments of the tuna and algae omega-3 ingredient market. These insights highlight opportunities for targeted strategies and resource allocation.

Premium Concentrate Category demonstrates the strongest growth momentum, driven by consumer willingness to pay higher prices for superior quality and potency. This category benefits from concentration levels exceeding 80% EPA/DHA and commands premium pricing through enhanced bioavailability and reduced dosage requirements. Market penetration in this category reaches approximately 35% in developed markets, with significant expansion potential in emerging regions.

Sustainable Sourcing Category shows accelerating growth as environmental consciousness influences purchasing decisions. Products with third-party sustainability certifications demonstrate price premiums of 15-25% compared to conventional alternatives, indicating strong consumer value perception for environmental responsibility. This category particularly resonates with younger demographics and health-conscious consumers.

Functional Food Integration Category represents significant untapped potential with current penetration rates below optimal levels. Successful products in this category require specialized formulation expertise to address taste, stability, and processing challenges while maintaining omega-3 efficacy. Innovation success rates in functional food applications average approximately 68% for companies with dedicated food science capabilities.

Clinical Nutrition Category offers the highest value proposition through specialized formulations for specific health conditions and therapeutic applications. This category benefits from strong scientific validation and healthcare professional recommendations, supporting premium pricing and customer loyalty.

Industry participants in the tuna and algae omega-3 ingredient market realize multiple strategic and operational benefits through participation in this growing sector. These benefits extend across the value chain from raw material suppliers to end-product manufacturers and distributors.

Revenue Growth Opportunities: The expanding market provides multiple avenues for revenue enhancement through new product development, market expansion, and premium positioning strategies. Companies benefit from growing consumer demand, expanding applications, and favorable pricing trends that support sustainable profitability and business growth.

Technological Advancement: Participation in the omega-3 market drives innovation in extraction technologies, purification methods, and delivery systems that can provide competitive advantages and intellectual property assets. These technological capabilities often have applications beyond omega-3 ingredients, creating additional value opportunities.

Sustainability Leadership: Companies investing in sustainable omega-3 production, particularly algae-based alternatives, position themselves as environmental leaders and attract environmentally conscious consumers, investors, and business partners. This positioning supports brand differentiation and premium pricing strategies.

Strategic Partnerships: The omega-3 market facilitates valuable partnerships with research institutions, healthcare organizations, and complementary industry players that can accelerate innovation, expand market access, and enhance competitive positioning.

Regulatory Advantages: Established players benefit from regulatory expertise and compliance capabilities that create barriers to entry for new competitors while facilitating expansion into new markets and applications with favorable regulatory environments.

Market Intelligence: Active participation provides valuable insights into consumer trends, regulatory developments, and competitive dynamics that inform strategic decision-making and identify emerging opportunities before they become widely recognized.

SWOT analysis provides comprehensive evaluation of the tuna and algae omega-3 ingredient market’s strategic position, highlighting internal capabilities and external factors that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the tuna and algae omega-3 ingredient sector reflect evolving consumer preferences, technological developments, and industry dynamics that influence strategic planning and investment decisions. These trends provide insights into future market direction and opportunity areas.

Sustainability Integration emerges as a dominant trend with consumers increasingly prioritizing environmentally responsible products. This trend drives investment in algae-based omega-3 production, sustainable fishing practices, and circular economy approaches to ingredient manufacturing. Companies demonstrating strong sustainability credentials gain competitive advantages through brand differentiation and consumer loyalty.

Personalization Movement reflects growing consumer interest in customized nutrition solutions based on individual health profiles, genetic factors, and lifestyle characteristics. This trend creates opportunities for targeted omega-3 formulations and precision nutrition applications that command premium pricing and enhance customer engagement.

Clean Label Demand influences product development toward simpler, more transparent ingredient lists with minimal processing and artificial additives. This trend favors natural extraction methods, organic certifications, and clear sourcing information that resonate with health-conscious consumers seeking authentic nutrition solutions.

Technology Convergence combines omega-3 ingredients with advanced delivery systems, nanotechnology, and bioavailability enhancement techniques to improve efficacy and consumer experience. This trend drives innovation in encapsulation technologies, sustained-release formulations, and combination products that optimize health benefits.

Functional Food Integration expands beyond traditional supplements into mainstream food and beverage products, creating new market opportunities and consumer touchpoints. This trend requires specialized ingredient forms that maintain stability and palatability in various food applications while delivering meaningful omega-3 content.

Industry developments in the tuna and algae omega-3 ingredient market reflect dynamic changes in technology, regulation, and competitive landscape that shape market evolution and strategic opportunities. Recent developments highlight key trends and future directions.

Technological Breakthroughs include advanced algae cultivation systems that significantly improve yield and reduce production costs. Several companies have developed proprietary fermentation technologies that enhance omega-3 concentration and purity while reducing environmental impact. These innovations support market expansion and improved profitability for algae-based omega-3 producers.

Strategic Partnerships between ingredient suppliers and pharmaceutical companies accelerate development of prescription omega-3 medications and clinical nutrition products. These collaborations leverage complementary expertise and resources to address specific therapeutic applications and regulatory requirements for medical-grade omega-3 ingredients.

Regulatory Advancements include expanded health claim approvals and updated quality standards that facilitate market development and consumer confidence. Recent regulatory developments support omega-3 use in infant nutrition, functional foods, and clinical applications, creating new market opportunities and revenue streams.

Sustainability Initiatives encompass industry-wide efforts to improve environmental responsibility through sustainable sourcing certifications, carbon footprint reduction, and circular economy practices. These initiatives respond to consumer demands and regulatory pressures while creating competitive differentiation opportunities.

Market Consolidation activities include strategic acquisitions and joint ventures that reshape competitive dynamics and create integrated supply chains. Recent transactions focus on combining complementary technologies, expanding geographic reach, and achieving operational synergies that enhance market position and profitability.

Strategic recommendations for success in the tuna and algae omega-3 ingredient market emphasize the importance of differentiation, sustainability, and innovation to capture growth opportunities and maintain competitive advantage. MarkWide Research analysis suggests several key strategic priorities for market participants.

Investment in Sustainability represents a critical success factor as environmental considerations increasingly influence purchasing decisions. Companies should prioritize sustainable sourcing practices, environmental certifications, and transparent supply chain management to meet evolving consumer expectations and regulatory requirements. This investment supports premium positioning and long-term market viability.

Technology Development should focus on improving extraction efficiency, enhancing bioavailability, and developing novel delivery systems that provide competitive advantages. Companies investing in proprietary technologies and intellectual property assets position themselves for sustained competitive advantage and premium pricing opportunities.

Market Diversification across applications and geographic regions reduces risk and captures growth opportunities in emerging segments. Companies should explore opportunities in functional foods, clinical nutrition, and personalized health solutions while expanding presence in high-growth emerging markets.

Quality Leadership through superior product quality, consistency, and safety standards creates competitive differentiation and supports premium pricing. Investment in quality control systems, analytical capabilities, and regulatory compliance enhances market position and customer confidence.

Strategic Partnerships with complementary companies, research institutions, and distribution partners can accelerate market access, technology development, and competitive positioning while sharing risks and resources for mutual benefit.

Future market prospects for the tuna and algae omega-3 ingredient sector remain highly favorable, supported by fundamental growth drivers including aging demographics, increasing health awareness, and expanding scientific validation of omega-3 benefits. Long-term projections indicate sustained growth across multiple market segments and geographic regions.

Technology evolution will continue driving market development through improved production efficiency, enhanced product quality, and novel applications that expand market opportunities. Advances in biotechnology, particularly in algae cultivation and genetic optimization, promise to reduce production costs and improve sustainability profiles. Innovation cycles are expected to accelerate, with breakthrough technologies emerging at approximately 18-month intervals over the next five years.

Market expansion into emerging economies presents significant growth potential as rising disposable incomes and health consciousness create favorable conditions for omega-3 product adoption. Penetration rates in developing markets currently average only 12% of developed market levels, indicating substantial expansion opportunities for companies with appropriate market entry strategies.

Regulatory development will likely support continued market growth through expanded health claims, quality standards, and safety guidelines that facilitate consumer confidence and product innovation. The regulatory environment is expected to become more favorable for novel omega-3 sources and applications, particularly in clinical nutrition and functional foods.

Sustainability requirements will increasingly influence market dynamics, with environmentally responsible products gaining market share and premium positioning. Companies investing in sustainable practices and transparent supply chains are positioned to benefit from this trend through enhanced brand value and consumer loyalty.

Market analysis reveals that the tuna and algae omega-3 ingredient market represents a dynamic and rapidly growing sector with substantial opportunities for companies positioned to capitalize on evolving consumer preferences, technological advancements, and expanding applications. The market demonstrates strong fundamentals supported by increasing health awareness, scientific validation, and regulatory support that create favorable conditions for sustained growth.

Key success factors include investment in sustainability, technology innovation, quality leadership, and strategic market positioning that differentiate companies in an increasingly competitive landscape. The market rewards companies that demonstrate environmental responsibility, superior product quality, and innovative solutions that address evolving consumer needs and regulatory requirements.

Future prospects remain highly favorable with multiple growth drivers supporting market expansion across geographic regions and application segments. The convergence of health trends, sustainability focus, and technological advancement creates a compelling investment opportunity for companies with appropriate strategic positioning and operational capabilities. MWR projections indicate continued market evolution toward premium, sustainable, and scientifically validated omega-3 ingredients that deliver superior value to consumers and stakeholders throughout the value chain.

What is Tuna and Algae Omega-3 Ingredient?

Tuna and Algae Omega-3 Ingredient refers to the nutritional components derived from tuna fish and algae, which are rich in omega-3 fatty acids. These ingredients are commonly used in dietary supplements, functional foods, and animal feed due to their health benefits.

What are the key players in the Tuna and Algae Omega-3 Ingredient Market?

Key players in the Tuna and Algae Omega-3 Ingredient Market include DSM Nutritional Products, BASF SE, and Omega Protein Corporation, among others. These companies are involved in the production and distribution of omega-3 ingredients for various applications.

What are the growth factors driving the Tuna and Algae Omega-3 Ingredient Market?

The growth of the Tuna and Algae Omega-3 Ingredient Market is driven by increasing consumer awareness of health benefits associated with omega-3 fatty acids, rising demand for dietary supplements, and the growing popularity of plant-based alternatives.

What challenges does the Tuna and Algae Omega-3 Ingredient Market face?

The Tuna and Algae Omega-3 Ingredient Market faces challenges such as sustainability concerns regarding overfishing of tuna, regulatory hurdles in ingredient sourcing, and competition from synthetic omega-3 alternatives.

What opportunities exist in the Tuna and Algae Omega-3 Ingredient Market?

Opportunities in the Tuna and Algae Omega-3 Ingredient Market include the development of innovative products targeting specific health benefits, expansion into emerging markets, and increasing collaborations between food manufacturers and ingredient suppliers.

What trends are shaping the Tuna and Algae Omega-3 Ingredient Market?

Trends shaping the Tuna and Algae Omega-3 Ingredient Market include a shift towards sustainable sourcing practices, the rise of plant-based omega-3 products, and growing interest in personalized nutrition solutions.

Tuna and Algae Omega-3 Ingredient Market

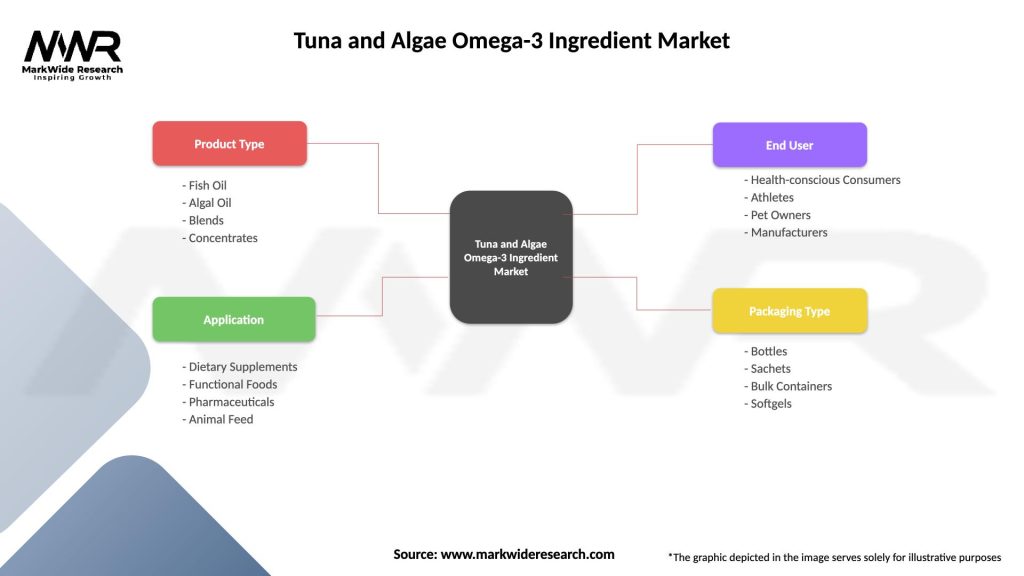

| Segmentation Details | Description |

|---|---|

| Product Type | Fish Oil, Algal Oil, Blends, Concentrates |

| Application | Dietary Supplements, Functional Foods, Pharmaceuticals, Animal Feed |

| End User | Health-conscious Consumers, Athletes, Pet Owners, Manufacturers |

| Packaging Type | Bottles, Sachets, Bulk Containers, Softgels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Tuna and Algae Omega-3 Ingredient Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at