444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The security in banking system market represents a critical segment of the financial technology landscape, encompassing comprehensive cybersecurity solutions, fraud prevention technologies, and risk management systems designed specifically for banking institutions. Financial institutions worldwide are experiencing unprecedented digital transformation, driving substantial demand for advanced security infrastructure that can protect against evolving cyber threats while maintaining operational efficiency.

Digital banking adoption has accelerated dramatically, with online banking penetration reaching 78% globally and mobile banking usage growing at 12.5% annually. This rapid digitization has created new attack vectors and vulnerabilities, making robust security frameworks essential for maintaining customer trust and regulatory compliance. Banking security solutions now encompass artificial intelligence-powered threat detection, biometric authentication systems, blockchain-based transaction verification, and real-time fraud monitoring capabilities.

Regulatory compliance continues to drive market expansion, with institutions investing heavily in security infrastructure to meet stringent requirements such as PCI DSS, GDPR, and emerging open banking regulations. The market demonstrates strong growth potential, with cybersecurity spending in the banking sector increasing at a compound annual growth rate of 9.2% as institutions prioritize digital security investments.

The security in banking system market refers to the comprehensive ecosystem of cybersecurity technologies, solutions, and services specifically designed to protect financial institutions from digital threats, ensure regulatory compliance, and maintain the integrity of banking operations across all channels.

Banking security systems encompass multiple layers of protection, including network security, endpoint protection, identity and access management, transaction monitoring, and data encryption technologies. These solutions work synergistically to create a robust defense framework that protects against both external cyber attacks and internal security breaches while enabling seamless customer experiences.

Modern banking security integrates advanced technologies such as machine learning algorithms for behavioral analysis, quantum encryption for data protection, and distributed ledger technologies for transaction verification. The market includes both traditional security vendors adapting their solutions for banking environments and specialized fintech companies developing innovative security technologies tailored to financial services requirements.

Market dynamics in the banking security sector are characterized by rapid technological evolution, increasing regulatory pressures, and growing sophistication of cyber threats. Financial institutions are transitioning from reactive security approaches to proactive, intelligence-driven security frameworks that can anticipate and prevent potential attacks before they impact operations.

Key market drivers include the exponential growth in digital banking transactions, with contactless payments increasing by 41% year-over-year and creating new security challenges. The rise of open banking initiatives has introduced additional complexity, requiring banks to secure API ecosystems while maintaining interoperability with third-party service providers.

Technology adoption trends show significant investment in artificial intelligence and machine learning capabilities, with 85% of major banks implementing AI-powered fraud detection systems. Cloud-based security solutions are gaining traction, offering scalability and cost-effectiveness while addressing the challenges of hybrid banking infrastructures.

Competitive landscape features a mix of established cybersecurity giants, specialized banking security providers, and emerging fintech innovators. Strategic partnerships between traditional banks and technology companies are becoming increasingly common as institutions seek to leverage cutting-edge security innovations while maintaining operational stability.

Critical market insights reveal several transformative trends shaping the banking security landscape:

Digital transformation acceleration serves as the primary catalyst for banking security market growth. The shift toward digital-first banking models has created unprecedented security requirements, with institutions needing to protect multiple touchpoints including mobile applications, web portals, ATM networks, and emerging channels such as voice banking and IoT devices.

Regulatory compliance mandates continue to drive substantial security investments. New regulations such as PSD2 in Europe, Open Banking standards globally, and evolving data protection laws require banks to implement sophisticated security controls while maintaining system interoperability. Compliance costs now represent approximately 15% of total IT budgets for major banking institutions.

Cyber threat sophistication is escalating rapidly, with attackers employing advanced techniques including AI-powered attacks, supply chain compromises, and social engineering campaigns specifically targeting financial institutions. The average cost of a data breach in banking has increased significantly, making proactive security investments more cost-effective than reactive incident response.

Customer expectations for seamless yet secure banking experiences are driving innovation in security technologies. Banks must balance robust protection with user convenience, leading to investments in invisible security solutions such as behavioral biometrics and risk-based authentication that enhance security without impacting user experience.

Implementation complexity represents a significant challenge for banking security adoption. Legacy banking systems often require extensive integration work to accommodate modern security solutions, creating technical debt and operational risks during transition periods. Many institutions struggle with the complexity of managing multiple security vendors and ensuring seamless interoperability across diverse technology stacks.

Cost considerations continue to constrain market growth, particularly for smaller financial institutions with limited IT budgets. Advanced security technologies require substantial upfront investments and ongoing operational expenses, making it challenging for community banks and credit unions to implement enterprise-grade security solutions.

Skills shortage in cybersecurity professionals poses a critical constraint, with the banking sector competing for limited talent in an increasingly competitive market. The specialized nature of banking security requirements makes it difficult to find professionals with both cybersecurity expertise and deep understanding of financial services regulations and operations.

Regulatory uncertainty in emerging markets and evolving compliance requirements create hesitation among some institutions regarding security technology investments. Rapid changes in regulatory frameworks can make long-term security planning challenging, particularly for multinational banks operating across multiple jurisdictions with varying requirements.

Emerging market expansion presents substantial growth opportunities as developing economies undergo rapid banking digitization. Countries in Asia-Pacific, Latin America, and Africa are experiencing accelerated adoption of digital banking services, creating demand for comprehensive security solutions tailored to local regulatory requirements and infrastructure constraints.

Artificial intelligence integration offers significant potential for next-generation banking security solutions. AI-powered threat detection, automated incident response, and predictive security analytics represent high-growth segments with the potential to transform how banks approach cybersecurity management and threat prevention.

Open banking ecosystems are creating new opportunities for specialized security providers. The need to secure API ecosystems, manage third-party risk, and ensure data privacy across interconnected financial services platforms is driving demand for innovative security architectures and governance frameworks.

Quantum computing preparation represents an emerging opportunity as banks begin investing in quantum-resistant security technologies. Early adoption of post-quantum cryptography and quantum key distribution systems positions security vendors to capture market share in this nascent but critical segment.

Technology evolution is fundamentally reshaping the banking security landscape, with cloud-native security solutions gaining prominence over traditional on-premises deployments. The shift toward microservices architectures and containerized applications is driving demand for security solutions that can provide granular protection and seamless scalability across distributed banking infrastructures.

Threat landscape evolution continues to influence market dynamics, with cybercriminals increasingly targeting financial institutions using sophisticated attack vectors. Ransomware attacks against banks have increased by 67% annually, driving urgent demand for advanced endpoint protection and backup recovery solutions specifically designed for financial services environments.

Partnership ecosystems are becoming increasingly important as banks seek to leverage specialized security expertise while maintaining operational control. Strategic alliances between traditional banks, cybersecurity vendors, and fintech companies are creating new market dynamics and accelerating innovation in banking-specific security solutions.

Customer behavior shifts toward digital-first banking are creating new security requirements and opportunities. The rise of embedded finance, buy-now-pay-later services, and cryptocurrency integration is expanding the attack surface that banks must protect, driving demand for comprehensive security platforms that can adapt to evolving business models.

Comprehensive market analysis employs a multi-faceted research approach combining primary research with banking security professionals, secondary analysis of industry reports and regulatory filings, and quantitative assessment of market trends and adoption patterns. The methodology ensures accurate representation of market dynamics across different geographical regions and banking segments.

Primary research activities include structured interviews with chief information security officers, IT directors, and compliance professionals at banking institutions of various sizes. Survey data collection from security vendors, system integrators, and consulting firms provides additional insights into market trends, technology adoption patterns, and competitive dynamics.

Secondary research sources encompass regulatory publications, industry association reports, vendor white papers, and academic research on banking cybersecurity trends. Financial analysis of publicly traded security companies and banking institutions provides quantitative insights into market growth patterns and investment priorities.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market insights. Regional market analysis incorporates local regulatory requirements, cultural factors, and economic conditions that influence banking security adoption patterns.

North America maintains market leadership in banking security adoption, driven by stringent regulatory requirements, advanced digital banking infrastructure, and high cybersecurity awareness among financial institutions. The region accounts for approximately 42% of global banking security investments, with particular strength in AI-powered fraud detection and advanced threat analytics solutions.

European markets demonstrate strong growth in banking security adoption, particularly following PSD2 implementation and GDPR compliance requirements. Open banking initiatives across the European Union are driving demand for API security solutions and third-party risk management platforms. Nordic countries lead in biometric authentication adoption with 89% implementation rates among major banks.

Asia-Pacific region represents the fastest-growing market for banking security solutions, with digital banking adoption accelerating rapidly across emerging economies. China and India are driving significant growth in mobile banking security solutions, while Singapore and Hong Kong serve as regional hubs for fintech security innovation.

Latin America shows increasing investment in banking security infrastructure as financial inclusion initiatives expand digital banking access. Brazil and Mexico lead regional adoption of advanced security technologies, with particular focus on mobile payment security and fraud prevention solutions tailored to local market conditions.

Market leadership is distributed among several categories of providers, each bringing distinct capabilities and market positioning:

Emerging competitors include specialized fintech security companies and regional providers offering innovative solutions tailored to specific banking segments. Strategic partnerships and acquisitions are reshaping the competitive landscape as established players seek to expand their banking security capabilities.

By Solution Type:

By Deployment Model:

By Bank Size:

Network Security Solutions continue to evolve toward software-defined approaches that can adapt to dynamic banking infrastructures. Next-generation firewalls with application-aware capabilities are becoming standard, with 73% of banks implementing advanced threat prevention features. Zero trust network architectures are gaining traction as banks seek to eliminate implicit trust assumptions in their security models.

Identity and Access Management represents the fastest-growing segment, driven by regulatory requirements for strong customer authentication and the need to manage complex user ecosystems including employees, customers, and third-party partners. Biometric authentication adoption is accelerating, with fingerprint recognition implemented by 81% of mobile banking applications.

Fraud Detection and Prevention solutions are incorporating advanced machine learning algorithms to improve accuracy and reduce false positives. Real-time transaction monitoring capabilities are becoming more sophisticated, with behavioral analytics helping banks identify suspicious activities while minimizing customer friction during legitimate transactions.

Data Protection Technologies are evolving to address new challenges such as quantum computing threats and privacy regulations. Homomorphic encryption and secure multi-party computation are emerging as next-generation technologies that enable secure data processing while maintaining privacy and compliance requirements.

Financial Institutions benefit from comprehensive security solutions that protect against cyber threats while enabling digital innovation. Advanced security technologies help banks reduce operational risk, maintain regulatory compliance, and build customer trust through demonstrated commitment to data protection and privacy.

Technology Vendors gain access to a high-value market with strong growth potential and recurring revenue opportunities. The banking sector’s willingness to invest in premium security solutions creates opportunities for vendors to develop specialized offerings with higher margins than general-purpose security products.

Customers benefit from enhanced security measures that protect their financial assets and personal information while enabling convenient digital banking experiences. Advanced authentication methods and fraud prevention systems provide peace of mind without compromising usability or accessibility.

Regulators benefit from improved industry security posture that reduces systemic risk and enhances financial system stability. Standardized security frameworks and automated compliance reporting capabilities help regulatory bodies monitor and enforce security requirements more effectively.

System Integrators find opportunities to provide specialized implementation and managed services for complex banking security deployments. The need for customization and integration expertise creates sustainable service revenue streams and long-term client relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming banking security through automated threat detection, behavioral analysis, and predictive security analytics. Machine learning algorithms are becoming more sophisticated in identifying subtle patterns that indicate potential security threats while reducing false positive rates that can impact operational efficiency.

Zero Trust Architecture adoption is accelerating as banks recognize the limitations of perimeter-based security models. This approach requires verification of every user, device, and transaction regardless of location, creating demand for comprehensive identity verification and continuous monitoring solutions.

Cloud Security Evolution reflects the banking industry’s gradual migration toward cloud-based infrastructure. Hybrid and multi-cloud security frameworks are becoming essential as banks seek to leverage cloud benefits while maintaining regulatory compliance and data sovereignty requirements.

Biometric Authentication Expansion is driven by the need for stronger security without compromising user experience. Multi-modal biometric systems combining fingerprint, facial recognition, and voice authentication are becoming standard for high-value transactions and sensitive account access.

Quantum-Resistant Cryptography preparation is beginning as banks anticipate future quantum computing threats to current encryption methods. Early adoption of post-quantum cryptographic algorithms positions institutions to maintain security effectiveness as quantum computing capabilities advance.

Strategic partnerships between traditional banks and fintech companies are accelerating security innovation. Recent collaborations focus on developing specialized solutions for emerging challenges such as cryptocurrency security, embedded finance protection, and cross-border payment security.

Regulatory initiatives continue to shape market development, with new guidelines for cloud security, third-party risk management, and operational resilience driving technology adoption. MarkWide Research analysis indicates that regulatory compliance requirements are influencing 68% of banking security investment decisions.

Acquisition activity in the banking security sector remains robust as established vendors seek to expand their capabilities and market reach. Recent acquisitions focus on specialized technologies such as API security, behavioral analytics, and quantum-resistant encryption solutions.

Technology standardization efforts are gaining momentum through industry consortiums and regulatory bodies working to establish common security frameworks. These initiatives aim to improve interoperability while maintaining high security standards across the banking ecosystem.

Investment prioritization should focus on solutions that address multiple security challenges simultaneously while providing clear return on investment through reduced risk exposure and operational efficiency gains. Banks should evaluate vendors based on their ability to integrate with existing infrastructure and adapt to evolving regulatory requirements.

Vendor selection criteria should emphasize proven banking industry experience, regulatory compliance expertise, and demonstrated ability to scale solutions across diverse banking operations. Long-term partnership potential and innovation roadmaps should be weighted heavily in evaluation processes.

Implementation strategies should adopt phased approaches that minimize operational disruption while building comprehensive security capabilities over time. Pilot programs and proof-of-concept deployments can help validate solution effectiveness before full-scale implementation.

Skills development initiatives should be prioritized to address the cybersecurity talent shortage. Banks should invest in training programs, partnerships with educational institutions, and knowledge transfer processes to build internal security expertise and reduce dependence on external resources.

Emerging technology preparation should include quantum-resistant cryptography planning, AI ethics frameworks, and cloud security governance structures. Early preparation for these technologies will provide competitive advantages and reduce future implementation risks.

Market evolution will be characterized by continued consolidation among security vendors and increasing specialization in banking-specific solutions. The next five years will see significant advancement in AI-powered security capabilities, with predictive threat intelligence becoming standard across major banking institutions.

Technology convergence will drive integration between security, compliance, and operational risk management platforms. Unified security operations centers will become more common as banks seek to streamline security management and improve incident response capabilities.

Regulatory development will continue to influence market direction, with new requirements for operational resilience, third-party risk management, and cross-border data protection driving technology adoption. MWR projections indicate that regulatory compliance will account for 35% of banking security spending by 2028.

Innovation acceleration will be driven by emerging technologies such as quantum computing, 5G networks, and edge computing. These technologies will create new security challenges and opportunities, requiring adaptive security architectures that can evolve with changing technological landscapes.

Market maturation will lead to more standardized security frameworks and improved interoperability between different security solutions. This evolution will reduce implementation complexity and enable banks to adopt best-of-breed approaches while maintaining integrated security postures.

The security in banking system market represents a critical and rapidly evolving sector that will continue to experience strong growth driven by digital transformation, regulatory requirements, and evolving cyber threats. Financial institutions worldwide are recognizing that robust security infrastructure is not just a compliance requirement but a competitive advantage that enables innovation while protecting stakeholder interests.

Market dynamics favor vendors that can demonstrate deep banking industry expertise, regulatory compliance capabilities, and innovative approaches to emerging security challenges. The shift toward AI-powered security solutions, zero trust architectures, and cloud-native platforms will create new opportunities for technology providers while requiring continuous adaptation to changing market conditions.

Future success in this market will depend on the ability to balance security effectiveness with operational efficiency, regulatory compliance with innovation enablement, and comprehensive protection with user experience optimization. Organizations that can navigate these complex requirements while maintaining cost-effectiveness will be well-positioned to capitalize on the substantial growth opportunities ahead in the banking security sector.

What is Security in Banking System?

Security in Banking System refers to the measures and protocols implemented to protect financial institutions from fraud, cyberattacks, and unauthorized access. This includes technologies like encryption, firewalls, and multi-factor authentication to safeguard sensitive customer data and transactions.

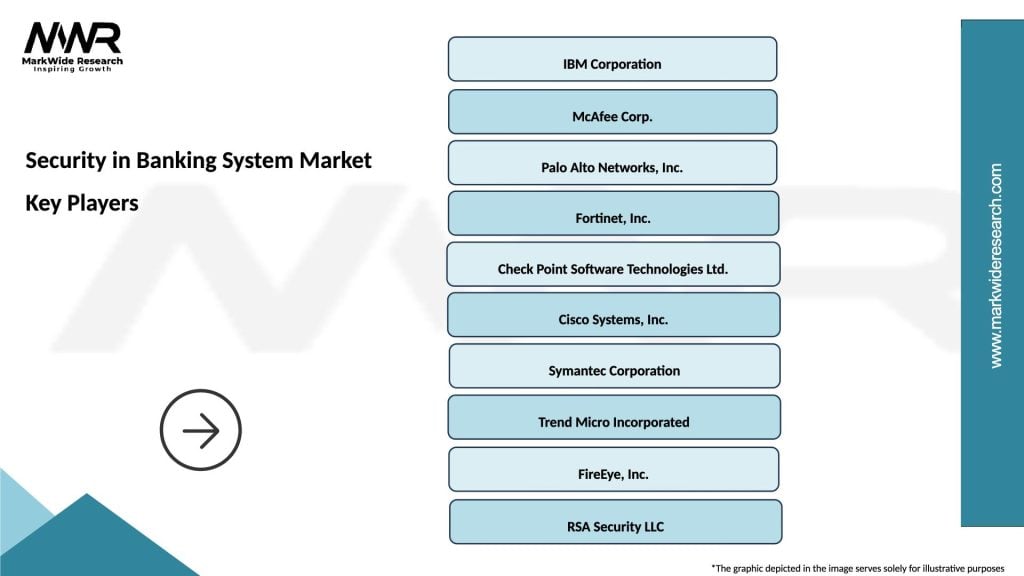

What are the key players in the Security in Banking System Market?

Key players in the Security in Banking System Market include companies like IBM, Cisco, and McAfee, which provide various security solutions tailored for financial institutions. These companies focus on developing advanced cybersecurity technologies and services to protect banking operations, among others.

What are the main drivers of growth in the Security in Banking System Market?

The main drivers of growth in the Security in Banking System Market include the increasing frequency of cyberattacks, the rising demand for secure online banking services, and regulatory requirements for data protection. Financial institutions are investing heavily in security solutions to mitigate risks and enhance customer trust.

What challenges does the Security in Banking System Market face?

The Security in Banking System Market faces challenges such as the evolving nature of cyber threats, the high cost of implementing advanced security measures, and the shortage of skilled cybersecurity professionals. These factors can hinder the ability of banks to effectively protect their systems.

What opportunities exist in the Security in Banking System Market?

Opportunities in the Security in Banking System Market include the growing adoption of artificial intelligence and machine learning for threat detection, the expansion of mobile banking, and the increasing focus on regulatory compliance. These trends present avenues for innovation and investment in security technologies.

What are the current trends in the Security in Banking System Market?

Current trends in the Security in Banking System Market include the integration of biometric authentication methods, the rise of cloud-based security solutions, and the emphasis on real-time monitoring and response systems. These innovations aim to enhance the overall security posture of banking institutions.

Security in Banking System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Firewalls, Intrusion Detection Systems, Encryption Solutions, Access Control Systems |

| End User | Commercial Banks, Investment Banks, Credit Unions, Online Banking Services |

| Technology | Biometric Authentication, Blockchain, AI-Based Security, Cloud Security |

| Service Type | Consulting, Managed Security Services, Incident Response, Compliance Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Security in Banking System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at