444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia water enhancers market represents a dynamic and rapidly evolving segment within the broader beverage industry, characterized by increasing consumer demand for healthier hydration alternatives. Water enhancers have gained significant traction among Australian consumers seeking to transform plain water into flavorful, nutritious beverages without the high sugar content typically associated with traditional soft drinks. The market encompasses liquid concentrates, powder mixes, and effervescent tablets designed to enhance water’s taste, nutritional profile, and functional benefits.

Market dynamics indicate robust growth driven by health-conscious consumer behavior, with adoption rates increasing by approximately 12.5% annually across major Australian metropolitan areas. The sector benefits from rising awareness about hydration importance, particularly among fitness enthusiasts, working professionals, and health-focused demographics. Premium positioning of water enhancers as convenient, portable solutions for on-the-go hydration has resonated strongly with busy Australian lifestyles.

Innovation trends within the market focus on natural ingredients, organic formulations, and functional additives such as vitamins, minerals, electrolytes, and botanical extracts. Australian consumers demonstrate strong preference for products featuring native ingredients like lemon myrtle, finger lime, and kakadu plum, creating opportunities for locally-inspired flavor profiles. The market’s growth trajectory reflects broader shifts toward preventive health measures and personalized nutrition solutions.

The Australia water enhancers market refers to the commercial ecosystem encompassing the production, distribution, and consumption of liquid and powder additives designed to improve water’s taste, nutritional content, and functional properties. These products enable consumers to customize their hydration experience by adding flavors, vitamins, minerals, caffeine, or other beneficial compounds to plain water, creating personalized beverages that align with individual health goals and taste preferences.

Water enhancers typically come in concentrated liquid drops, powder sachets, or effervescent tablets that dissolve quickly in water, offering convenience and portability for active lifestyles. The market includes various product categories ranging from simple flavor enhancers to complex formulations containing electrolytes for sports recovery, vitamins for immune support, or natural extracts for wellness benefits. This segment bridges the gap between plain water and traditional flavored beverages, providing a healthier alternative with customizable intensity levels.

Australia’s water enhancers market demonstrates exceptional growth potential, driven by evolving consumer preferences toward healthier hydration solutions and increasing awareness of sugar reduction benefits. The market landscape features diverse product offerings spanning flavor enhancement, nutritional supplementation, and functional wellness categories, catering to varied consumer needs across different demographic segments.

Key market drivers include rising health consciousness, with approximately 68% of Australian consumers actively seeking sugar-free beverage alternatives, and growing demand for convenient, portable hydration solutions. The fitness and wellness trend significantly influences market expansion, particularly among millennials and Gen Z consumers who prioritize functional beverages supporting active lifestyles.

Competitive dynamics reveal a mix of international brands and emerging local players, with innovation focusing on natural ingredients, sustainable packaging, and unique Australian flavor profiles. Distribution channels span traditional retail, online platforms, and specialty health stores, with e-commerce showing particularly strong growth rates of approximately 15.3% annually. The market’s future outlook remains positive, supported by continued health trend momentum and expanding product innovation.

Consumer behavior analysis reveals several critical insights shaping the Australia water enhancers market landscape:

Health consciousness trends serve as the primary catalyst driving Australia’s water enhancers market expansion. Increasing awareness of sugar-related health risks has prompted consumers to seek alternatives to traditional soft drinks and flavored beverages. The growing prevalence of diabetes and obesity concerns motivates health-conscious Australians to adopt low-calorie, sugar-free hydration solutions that don’t compromise on taste or satisfaction.

Lifestyle factors significantly influence market growth, particularly the rise of fitness culture and active living trends across Australian demographics. Busy professional schedules create demand for convenient, portable hydration solutions that can be easily incorporated into daily routines. The increasing popularity of gym memberships, outdoor activities, and sports participation drives demand for functional water enhancers containing electrolytes and performance-supporting ingredients.

Innovation in formulations continues to attract new consumer segments through specialized products targeting specific health goals. The development of water enhancers with added vitamins, minerals, probiotics, and adaptogens appeals to consumers interested in functional nutrition. Natural ingredient trends drive demand for products featuring organic flavors, plant-based additives, and sustainably sourced components that align with environmental values.

Marketing and awareness campaigns by leading brands have successfully educated consumers about water enhancer benefits, contributing to market expansion. Social media influence and fitness influencer endorsements have particularly impacted younger demographics, creating viral trends around hydration optimization and healthy lifestyle choices.

Price sensitivity represents a significant challenge for market expansion, particularly among price-conscious consumer segments who view water enhancers as non-essential purchases. The premium pricing of many products compared to traditional beverages creates barriers for widespread adoption, especially during economic uncertainty periods when consumers prioritize essential spending categories.

Artificial ingredient concerns continue to limit market penetration among health-conscious consumers who scrutinize product labels for synthetic additives, preservatives, and artificial sweeteners. Despite industry efforts to develop natural alternatives, consumer skepticism about processed food products affects purchasing decisions, particularly among organic and clean-eating advocates.

Taste preferences and flavor satisfaction challenges impact repeat purchase rates, as individual taste preferences vary significantly across consumer segments. Some consumers find artificial flavoring unsatisfactory compared to natural fruit juices or traditional beverages, leading to trial without sustained adoption patterns.

Regulatory considerations surrounding health claims and ingredient approvals create compliance complexities for manufacturers, potentially limiting innovation speed and market entry for new products. Competition from alternatives such as flavored sparkling water, kombucha, and natural fruit infusions provides consumers with numerous hydration options, intensifying market competition and potentially limiting water enhancer market share growth.

Product innovation opportunities abound in developing specialized formulations targeting specific consumer needs and health goals. The growing interest in personalized nutrition creates potential for customizable water enhancer products that allow consumers to adjust flavor intensity, nutritional content, and functional benefits according to individual preferences and health objectives.

Native Australian ingredients present unique positioning opportunities for brands seeking to differentiate products through local authenticity and cultural connection. Incorporating indigenous botanicals, native fruits, and traditional Australian flavors can create compelling brand stories while supporting local agriculture and sustainable sourcing practices.

E-commerce expansion offers significant growth potential, particularly through subscription models and direct-to-consumer sales channels. The convenience of regular delivery services appeals to loyal customers while providing brands with valuable consumer data and relationship-building opportunities. Digital marketing strategies can effectively target specific demographics through social media platforms and influencer partnerships.

Corporate wellness programs represent an emerging opportunity as employers increasingly focus on employee health and productivity. Partnerships with fitness centers, corporate offices, and healthcare providers can create new distribution channels while positioning water enhancers as wellness solutions rather than simple beverage alternatives.

Supply chain dynamics within the Australia water enhancers market reflect both global ingredient sourcing and local manufacturing capabilities. International suppliers provide specialized ingredients like natural flavors, vitamins, and functional additives, while local manufacturers focus on packaging, quality control, and distribution efficiency. The market benefits from Australia’s strong regulatory framework ensuring product safety and quality standards.

Consumer purchasing patterns demonstrate seasonal variations, with higher consumption during summer months and increased demand for electrolyte-enhanced products during peak fitness seasons. Retail dynamics show growing importance of online channels, with approximately 28% of purchases now occurring through e-commerce platforms, reflecting changing shopping behaviors and convenience preferences.

Competitive dynamics feature intense innovation cycles as brands compete through unique formulations, packaging innovations, and marketing strategies. The market supports both established international brands and emerging local companies, creating a diverse competitive landscape that benefits consumers through variety and competitive pricing.

Regulatory dynamics influence product development through food safety standards, labeling requirements, and health claim regulations. The Therapeutic Goods Administration (TGA) oversight ensures consumer protection while creating compliance frameworks that shape product innovation and market entry strategies.

Comprehensive market analysis for the Australia water enhancers market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct consumer surveys, focus groups, and in-depth interviews with key market participants including manufacturers, distributors, and retail partners to gather firsthand insights about market trends, consumer preferences, and industry challenges.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary findings. Data triangulation methods ensure consistency across multiple sources while identifying potential discrepancies or emerging trends not captured through single research approaches.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing retail sales data, distribution channel information, and consumer consumption patterns to establish accurate market parameters. Qualitative analysis focuses on understanding consumer motivations, brand perceptions, and purchase decision factors through behavioral research and psychographic profiling.

Industry expert consultations provide specialized insights into technical aspects, regulatory considerations, and future market developments. The research methodology ensures comprehensive coverage of market dynamics while maintaining objectivity and analytical rigor throughout the investigation process.

New South Wales dominates the Australia water enhancers market, representing approximately 35% of national consumption, driven by Sydney’s large population and high health consciousness levels among urban consumers. The state benefits from strong retail infrastructure, diverse distribution channels, and early adoption of health and wellness trends that support water enhancer market growth.

Victoria accounts for roughly 28% of market share, with Melbourne’s coffee culture and active lifestyle trends creating favorable conditions for functional beverage adoption. The state’s strong fitness industry and health-conscious demographic profile contribute to sustained demand for water enhancers, particularly products targeting sports nutrition and wellness applications.

Queensland represents approximately 22% of the market, benefiting from warm climate conditions that increase hydration needs and outdoor activity levels. The state’s tourism industry and beach culture create seasonal demand spikes, while growing urban populations in Brisbane and Gold Coast drive year-round consumption growth.

Western Australia and South Australia collectively account for the remaining market share, with Perth and Adelaide showing strong growth potential driven by increasing health awareness and expanding retail presence. These regions demonstrate particular interest in natural and organic water enhancer formulations, reflecting local consumer preferences for clean-label products.

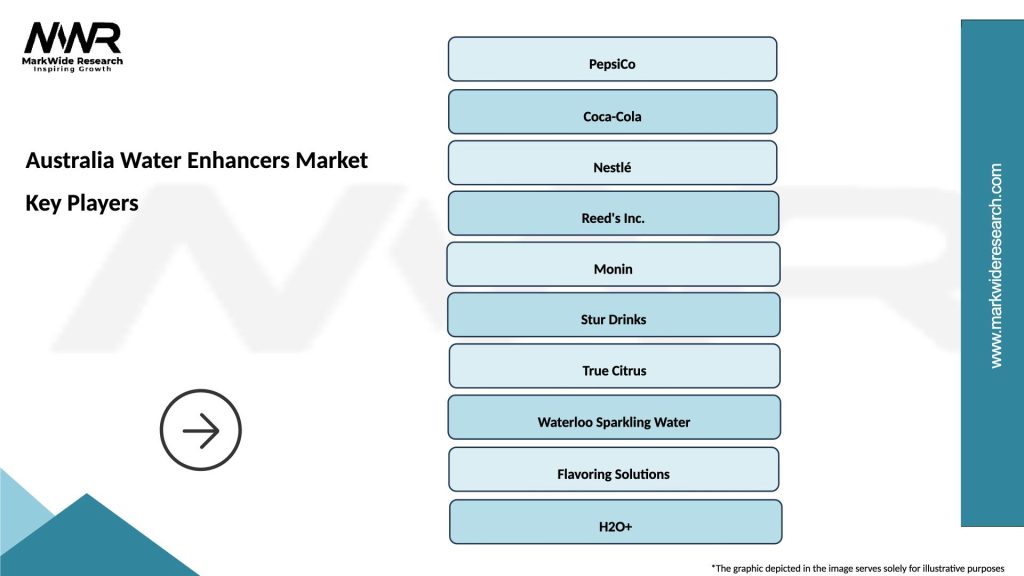

Market leadership in Australia’s water enhancers sector features a diverse mix of international brands and emerging local players, each competing through unique value propositions and targeted marketing strategies:

Competitive strategies emphasize product differentiation through natural ingredients, functional benefits, and innovative packaging solutions. Brands invest heavily in digital marketing, influencer partnerships, and sampling programs to build consumer awareness and trial rates. Innovation cycles focus on developing unique flavor combinations, improving nutritional profiles, and enhancing convenience features to maintain competitive advantages in the dynamic market environment.

By Product Type:

By Flavor Category:

By Functionality:

Liquid concentrates represent the largest segment within Australia’s water enhancers market, accounting for approximately 45% of total sales volume. These products appeal to consumers through convenience, precise dosing control, and immediate flavor release upon mixing. The segment benefits from established brand presence and extensive retail distribution across major supermarket chains and convenience stores.

Powder sachets demonstrate strong growth potential, particularly among travelers, office workers, and fitness enthusiasts who value portability and single-serve convenience. This segment shows approximately 18% annual growth driven by increasing demand for on-the-go hydration solutions and workplace wellness programs.

Functional formulations containing vitamins, minerals, or electrolytes command premium pricing while attracting health-conscious consumers seeking additional nutritional benefits beyond basic flavor enhancement. The sports nutrition subcategory shows particular strength, supported by Australia’s active lifestyle culture and growing fitness industry participation rates.

Natural and organic variants represent the fastest-growing category segment, reflecting consumer preferences for clean-label products and sustainable ingredients. These products typically achieve higher profit margins while appealing to environmentally conscious demographics willing to pay premium prices for perceived quality and health benefits.

Manufacturers benefit from the water enhancers market through several key advantages including relatively low production costs compared to traditional beverages, extended shelf life reducing inventory risks, and opportunities for premium positioning through functional ingredient additions. The concentrated nature of products enables efficient shipping and storage, reducing logistics costs while maximizing profit margins.

Retailers gain from water enhancers through high-margin product categories that require minimal refrigeration space and demonstrate strong inventory turnover rates. The products’ compact size allows for efficient shelf space utilization while appealing to health-conscious consumers who typically exhibit higher overall basket values and shopping frequency.

Consumers receive significant value through cost-effective hydration solutions that provide flavor variety without the high sugar content and calories associated with traditional soft drinks. The convenience factor enables better hydration habits while supporting health and wellness goals through customizable nutritional benefits.

Health professionals can recommend water enhancers as tools for encouraging adequate hydration among patients who struggle with plain water consumption, particularly those with diabetes or weight management goals who benefit from low-calorie flavor alternatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient integration represents the most significant trend shaping Australia’s water enhancers market, with consumers increasingly demanding products featuring organic flavors, plant-based sweeteners, and botanical extracts. This trend drives innovation toward cleaner formulations while creating opportunities for premium positioning and higher profit margins.

Functional nutrition focus continues gaining momentum as consumers seek products delivering specific health benefits beyond basic hydration and flavor enhancement. Adaptogenic ingredients, probiotics, and targeted vitamin combinations appeal to health-conscious demographics interested in preventive wellness and performance optimization.

Sustainability initiatives influence product development and packaging decisions, with brands investing in recyclable materials, reduced plastic usage, and carbon-neutral manufacturing processes. MarkWide Research indicates that approximately 42% of consumers consider environmental impact when selecting water enhancer products, driving industry-wide sustainability improvements.

Personalization trends emerge through customizable flavor intensity options, individual health goal targeting, and subscription services offering personalized product selections. Digital platforms enable brands to collect consumer preference data while providing tailored recommendations and automated reordering capabilities.

Social media influence significantly impacts brand awareness and consumer trial rates, particularly among younger demographics who discover products through influencer content and peer recommendations on platforms like Instagram and TikTok.

Product innovation accelerates across the Australia water enhancers market with manufacturers launching specialized formulations targeting specific consumer needs and occasions. Recent developments include caffeine-free energy boosters using natural stimulants, sleep-supporting formulations with melatonin and calming herbs, and immune-boosting varieties featuring vitamin C and zinc combinations.

Packaging innovations focus on sustainability and convenience improvements, including biodegradable sachets, refillable concentrate bottles, and portion-control dispensing systems that reduce waste while enhancing user experience. Smart packaging technologies incorporating QR codes provide consumers with detailed nutritional information and usage suggestions.

Distribution channel expansion includes partnerships with fitness centers, corporate offices, and healthcare facilities to reach consumers in relevant consumption contexts. Online subscription services gain traction, offering convenience and cost savings while providing brands with valuable consumer data and relationship-building opportunities.

Regulatory developments influence product formulations and marketing claims, with increased scrutiny on health benefit assertions and ingredient safety standards. Industry collaboration with regulatory bodies ensures compliance while supporting innovation within approved guidelines.

Strategic partnerships between water enhancer brands and complementary companies create cross-promotional opportunities and expanded market reach through shared distribution networks and co-marketing initiatives.

Market entry strategies should prioritize differentiation through unique value propositions, whether focusing on natural ingredients, specific health benefits, or innovative delivery formats. New entrants benefit from targeting underserved consumer segments or geographic regions with tailored product offerings that address local preferences and needs.

Investment priorities should emphasize research and development capabilities for creating innovative formulations that meet evolving consumer demands for natural, functional, and sustainable products. MWR analysis suggests that companies investing in clean-label formulations achieve approximately 23% higher profit margins compared to conventional products.

Distribution strategy optimization requires balanced approaches combining traditional retail presence with growing online channels and direct-to-consumer sales opportunities. Brands should invest in e-commerce capabilities while maintaining strong relationships with key retail partners for maximum market coverage.

Marketing focus should emphasize education about product benefits, usage occasions, and health advantages through digital channels that effectively reach target demographics. Influencer partnerships and user-generated content strategies prove particularly effective for building brand awareness and consumer trust.

Sustainability integration becomes increasingly important for long-term market success, requiring investments in eco-friendly packaging, sustainable sourcing practices, and transparent supply chain communications that resonate with environmentally conscious consumers.

Growth trajectory for Australia’s water enhancers market remains positive, supported by sustained health and wellness trends, increasing consumer awareness of hydration importance, and continued innovation in product formulations and delivery methods. The market benefits from demographic shifts toward health-conscious consumption patterns and growing acceptance of functional beverages as lifestyle essentials.

Technology integration will likely influence future market development through smart packaging solutions, personalized nutrition platforms, and data-driven product recommendations that enhance consumer experience while providing brands with valuable insights for product development and marketing optimization.

Market expansion opportunities include development of specialized products for specific demographic segments, geographic expansion into underserved regions, and creation of new consumption occasions through innovative marketing and product positioning strategies. MarkWide Research projects continued market growth with increasing penetration rates across all major Australian metropolitan areas.

Regulatory evolution may influence market dynamics through updated health claim guidelines, ingredient approval processes, and sustainability requirements that shape product development priorities and competitive positioning strategies. Industry adaptation to regulatory changes will determine long-term success factors.

Consumer behavior evolution toward greater health consciousness, environmental awareness, and convenience preferences will continue driving market innovation and growth opportunities for brands that successfully align with these trends while delivering superior value propositions.

Australia’s water enhancers market demonstrates robust growth potential driven by fundamental shifts in consumer behavior toward healthier hydration alternatives and functional beverage solutions. The market benefits from strong demographic trends, increasing health consciousness, and growing demand for convenient, portable products that support active lifestyles and wellness goals.

Key success factors for market participants include innovation in natural formulations, effective distribution channel management, and strategic positioning that resonates with health-conscious consumers seeking alternatives to traditional high-sugar beverages. The competitive landscape offers opportunities for both established brands and new entrants willing to invest in differentiated value propositions and consumer education initiatives.

Future market development will likely be shaped by continued emphasis on natural ingredients, functional nutrition benefits, and sustainability considerations that align with evolving consumer values and preferences. Brands that successfully navigate these trends while maintaining product quality, convenience, and competitive pricing will be well-positioned for sustained growth in Australia’s dynamic water enhancers market.

What is Water Enhancers?

Water enhancers are concentrated liquid or powdered products designed to improve the taste and nutritional profile of water. They often contain flavorings, vitamins, and minerals, catering to health-conscious consumers seeking hydration alternatives.

What are the key players in the Australia Water Enhancers Market?

Key players in the Australia Water Enhancers Market include brands like Mio, Stur, and Hydrant, which offer a variety of flavor options and formulations. These companies focus on appealing to health-conscious consumers and expanding their product lines, among others.

What are the growth factors driving the Australia Water Enhancers Market?

The Australia Water Enhancers Market is driven by increasing health awareness among consumers, a growing demand for flavored water alternatives, and the rise of on-the-go hydration solutions. Additionally, the trend towards low-calorie and sugar-free products is influencing market growth.

What challenges does the Australia Water Enhancers Market face?

Challenges in the Australia Water Enhancers Market include competition from traditional beverages, regulatory scrutiny over health claims, and consumer skepticism regarding artificial ingredients. These factors can hinder market penetration and growth.

What opportunities exist in the Australia Water Enhancers Market?

Opportunities in the Australia Water Enhancers Market include the potential for product innovation, such as organic and natural formulations, and expanding distribution channels through e-commerce. Additionally, targeting specific consumer segments, like athletes and busy professionals, can enhance market reach.

What trends are shaping the Australia Water Enhancers Market?

Trends in the Australia Water Enhancers Market include the increasing popularity of functional beverages that offer health benefits, the rise of eco-friendly packaging, and the incorporation of unique flavors and ingredients. These trends reflect changing consumer preferences towards healthier and more sustainable options.

Australia Water Enhancers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Enhancers, Powder Enhancers, Concentrated Drops, Flavor Infusions |

| End User | Households, Fitness Centers, Restaurants, Beverage Manufacturers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Specialty Shops |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia Water Enhancers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at