444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC automated material handling and storage systems market represents one of the most dynamic and rapidly evolving sectors in the global industrial automation landscape. This comprehensive market encompasses sophisticated technologies designed to streamline warehouse operations, manufacturing processes, and distribution networks across the Asia-Pacific region. Market dynamics indicate robust growth driven by increasing industrialization, e-commerce expansion, and the urgent need for operational efficiency improvements across diverse industries.

Regional characteristics of the APAC market demonstrate significant diversity, with countries like China, Japan, South Korea, India, and Australia leading adoption initiatives. The market experiences particularly strong momentum in manufacturing-intensive economies where automated material handling systems provide critical competitive advantages. Growth projections suggest the market will expand at a compound annual growth rate of 8.2% through the forecast period, reflecting sustained investment in automation technologies.

Technology integration across the region showcases varying levels of sophistication, from basic conveyor systems to advanced robotic solutions incorporating artificial intelligence and machine learning capabilities. The market benefits from strong government support for Industry 4.0 initiatives, particularly in developed economies, while emerging markets focus on foundational automation infrastructure development.

The APAC automated material handling and storage systems market refers to the comprehensive ecosystem of technologies, equipment, and solutions designed to automate the movement, storage, control, and protection of materials and products throughout manufacturing, warehousing, and distribution processes across Asia-Pacific countries. This market encompasses both hardware components and software systems that work together to optimize supply chain operations.

Core components include automated storage and retrieval systems, conveyor systems, robotic solutions, warehouse management software, and integrated control systems. These technologies enable organizations to reduce manual labor requirements, improve accuracy, enhance safety standards, and achieve significant operational cost reductions while increasing throughput capacity.

Market scope extends across multiple industries including automotive, electronics, pharmaceuticals, food and beverage, retail, and logistics. The systems range from simple mechanized solutions to complex integrated platforms that leverage advanced technologies such as IoT sensors, predictive analytics, and autonomous mobile robots.

Market leadership in the APAC automated material handling and storage systems sector is characterized by strong regional growth momentum and increasing technology adoption across diverse industrial segments. The market demonstrates exceptional resilience and expansion potential, driven by fundamental shifts in manufacturing practices and supply chain optimization requirements.

Key growth drivers include rapid e-commerce expansion, which accounts for approximately 35% of market demand growth, along with manufacturing sector modernization initiatives and labor cost optimization strategies. The region’s position as a global manufacturing hub creates sustained demand for advanced automation solutions that can enhance productivity and maintain competitive advantages.

Technology trends reveal increasing integration of artificial intelligence, machine learning, and IoT capabilities within traditional material handling systems. This technological evolution enables predictive maintenance, real-time optimization, and enhanced decision-making capabilities that deliver measurable operational improvements.

Regional dynamics show China maintaining the largest market share at approximately 42% of total APAC demand, followed by Japan, India, and South Korea. Each market demonstrates unique characteristics based on industrial focus, labor costs, and government policy support for automation initiatives.

Strategic insights reveal several critical factors shaping the APAC automated material handling and storage systems market landscape. These insights provide essential understanding for stakeholders evaluating market opportunities and investment decisions.

Market maturity varies significantly across APAC countries, with developed markets focusing on advanced integration while emerging economies prioritize foundational automation infrastructure. This diversity creates opportunities for solution providers to offer scalable technologies that can evolve with market development.

Primary market drivers propelling growth in the APAC automated material handling and storage systems market reflect fundamental economic and technological shifts across the region. These drivers create sustained demand for automation solutions and support long-term market expansion.

E-commerce expansion represents the most significant growth driver, with online retail penetration increasing rapidly across all APAC markets. The demand for faster order fulfillment, accurate inventory management, and cost-effective distribution creates immediate needs for automated warehouse solutions. Fulfillment centers require sophisticated material handling systems to process increasing order volumes while maintaining service quality standards.

Manufacturing competitiveness pressures drive automation adoption as companies seek to maintain cost advantages while improving product quality and production flexibility. Labor cost inflation in developed APAC markets makes automation investments increasingly attractive, with payback periods shortening as technology costs decrease and capabilities expand.

Government initiatives supporting Industry 4.0 transformation provide policy frameworks and financial incentives that accelerate automation adoption. Countries like Singapore, South Korea, and Japan offer comprehensive support programs that reduce implementation barriers and encourage technology investment.

Supply chain optimization requirements following global disruptions emphasize the importance of resilient, flexible operations. Automated systems provide the agility and reliability needed to adapt to changing market conditions while maintaining operational continuity.

Implementation challenges present significant restraints that can limit market growth and adoption rates across the APAC automated material handling and storage systems market. Understanding these constraints is essential for developing effective market entry and expansion strategies.

High capital investment requirements create barriers for small and medium enterprises, particularly in emerging markets where access to financing may be limited. The complexity of calculating return on investment and justifying large upfront costs can delay or prevent automation projects, especially when immediate benefits are not clearly demonstrated.

Technical complexity and integration challenges pose significant obstacles for organizations with limited technical expertise. System integration with existing infrastructure often requires specialized knowledge and can result in extended implementation timelines and cost overruns. Legacy system compatibility issues further complicate adoption decisions.

Skills shortage in automation technologies limits implementation success across many APAC markets. The lack of qualified technicians, engineers, and operators capable of managing sophisticated automated systems creates operational risks and increases long-term maintenance costs.

Cultural resistance to automation in some markets, particularly concerning job displacement concerns, can create implementation challenges. Change management requirements and workforce transition considerations add complexity to automation projects and may require extensive stakeholder engagement efforts.

Emerging opportunities within the APAC automated material handling and storage systems market present substantial potential for growth and innovation. These opportunities reflect evolving market needs and technological capabilities that create new avenues for business development.

Small and medium enterprise automation represents a significant untapped opportunity, as affordable, scalable solutions become available. Cloud-based systems and modular automation platforms enable smaller organizations to access advanced capabilities without prohibitive upfront investments, expanding the addressable market substantially.

Sustainability integration creates opportunities for energy-efficient automation solutions that help organizations meet environmental goals while improving operational efficiency. Green automation technologies that reduce energy consumption and waste generation align with increasing corporate sustainability commitments across the region.

Industry-specific solutions offer opportunities for specialized automation platforms tailored to unique sector requirements. Industries such as pharmaceuticals, food processing, and electronics manufacturing require customized approaches that address specific regulatory, safety, and operational needs.

Service and maintenance markets present recurring revenue opportunities as the installed base of automated systems grows. Predictive maintenance services, remote monitoring capabilities, and performance optimization consulting create valuable ongoing relationships with customers while ensuring system reliability and performance.

Market dynamics in the APAC automated material handling and storage systems sector reflect complex interactions between technological advancement, economic development, and changing business requirements. These dynamics shape competitive landscapes and influence strategic decision-making across the value chain.

Technology evolution continues to accelerate, with artificial intelligence and machine learning integration enabling more sophisticated automation capabilities. Predictive analytics and real-time optimization features provide competitive advantages that justify investment in advanced systems. The convergence of IoT, robotics, and data analytics creates new possibilities for operational excellence.

Competitive intensity increases as both international and regional players expand their presence across APAC markets. Market consolidation trends emerge as larger companies acquire specialized technology providers to enhance their solution portfolios and geographic coverage. This consolidation creates opportunities for innovation while potentially limiting supplier diversity.

Customer expectations evolve toward integrated solutions that provide comprehensive automation capabilities rather than standalone components. Solution integration becomes a key differentiator as customers seek partners who can deliver end-to-end automation platforms with seamless operation and unified management interfaces.

Regulatory environments across APAC countries continue to develop frameworks that support automation adoption while addressing safety, security, and employment considerations. Standards harmonization efforts facilitate cross-border technology deployment and reduce compliance complexity for multinational implementations.

Research approach for analyzing the APAC automated material handling and storage systems market employs comprehensive methodologies that ensure accurate, reliable, and actionable insights. The methodology combines quantitative analysis with qualitative research to provide a complete market understanding.

Primary research activities include extensive interviews with industry executives, technology providers, end-users, and market experts across key APAC countries. These interviews provide insights into market trends, competitive dynamics, customer requirements, and future development directions that cannot be captured through secondary sources alone.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, trade association data, and academic research. This comprehensive review ensures broad market coverage and validates findings from primary research activities.

Data validation processes include triangulation of findings across multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability. Market modeling techniques incorporate economic indicators, industry growth patterns, and technology adoption curves to develop robust market projections and scenario analyses.

Regional analysis methodology accounts for significant variations in market development, regulatory environments, and economic conditions across APAC countries. Country-specific research ensures that regional insights accurately reflect local market dynamics and opportunities.

Regional market characteristics across the APAC automated material handling and storage systems market demonstrate significant diversity in development levels, adoption patterns, and growth trajectories. Understanding these regional variations is essential for effective market strategy development and resource allocation.

China dominates the regional market with approximately 42% market share, driven by massive manufacturing capacity and rapid e-commerce growth. The country’s focus on manufacturing automation and smart factory initiatives creates sustained demand for advanced material handling solutions. Government support through Made in China 2025 and other industrial policies accelerates adoption across multiple sectors.

Japan maintains a strong position with 18% market share, characterized by high technology adoption and focus on precision automation. The country’s aging workforce and labor shortage challenges drive automation investment, while advanced manufacturing capabilities support sophisticated system requirements. Innovation leadership in robotics and automation technologies provides competitive advantages for Japanese companies.

India represents the fastest-growing market with 12% current share but exceptional growth potential driven by manufacturing expansion and digital transformation initiatives. Make in India programs and increasing foreign investment create opportunities for automation adoption across diverse industries. The large domestic market and cost-competitive manufacturing environment support sustained growth.

South Korea accounts for 10% market share with high technology adoption rates and strong government support for Industry 4.0 initiatives. The country’s advanced electronics and automotive industries drive demand for sophisticated automation solutions, while smart factory programs accelerate implementation across manufacturing sectors.

Australia and Southeast Asian markets collectively represent 18% market share with varying development levels and growth opportunities. These markets benefit from increasing industrialization, foreign investment, and government initiatives supporting automation adoption in key industries.

Competitive dynamics in the APAC automated material handling and storage systems market reflect a diverse ecosystem of international technology leaders, regional specialists, and emerging innovators. The competitive landscape continues to evolve as companies expand their geographic presence and solution capabilities.

Market positioning strategies vary significantly, with some companies focusing on comprehensive integrated solutions while others specialize in specific technologies or industry segments. Innovation capabilities and local market knowledge increasingly determine competitive success as customers demand more sophisticated and customized automation solutions.

Strategic partnerships and acquisitions continue to reshape the competitive landscape as companies seek to expand their technology capabilities and geographic reach. Local partnerships become particularly important for international companies seeking to establish strong positions in emerging APAC markets.

Market segmentation analysis reveals diverse categories within the APAC automated material handling and storage systems market, each with distinct characteristics, growth patterns, and customer requirements. Understanding these segments enables targeted strategy development and resource allocation optimization.

By Technology:

By Application:

By End-User Industry:

Technology category analysis provides detailed insights into specific segments within the APAC automated material handling and storage systems market, revealing unique growth drivers, challenges, and opportunities for each category.

Automated Storage and Retrieval Systems demonstrate the highest growth potential, driven by increasing warehouse density requirements and labor cost optimization needs. These systems provide space utilization improvements of up to 60% compared to traditional storage methods while reducing operational costs and improving accuracy. Technology advancement in this category focuses on AI-powered optimization and predictive maintenance capabilities.

Robotic Systems experience rapid adoption across manufacturing and warehouse applications, with collaborative robots gaining particular traction due to their flexibility and safety features. The category benefits from decreasing technology costs and improving capabilities that make robotic solutions accessible to smaller organizations. Integration capabilities with existing systems become increasingly important for market success.

Conveyor Systems maintain steady growth as foundational automation technology, with innovation focusing on modular designs and intelligent routing capabilities. The category serves as an entry point for automation adoption, particularly in emerging markets where organizations begin their automation journey with basic material handling improvements.

Warehouse Management Systems evolve toward comprehensive platforms that integrate with IoT devices and provide real-time optimization capabilities. Cloud-based solutions gain traction as they reduce implementation complexity and provide scalable functionality that grows with business requirements.

Stakeholder benefits from the APAC automated material handling and storage systems market extend across the entire value chain, creating value for technology providers, end-users, and supporting service organizations. Understanding these benefits helps stakeholders optimize their market participation strategies.

For Technology Providers:

For End-User Organizations:

For System Integrators:

Strategic analysis of the APAC automated material handling and storage systems market reveals key strengths, weaknesses, opportunities, and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the APAC automated material handling and storage systems market reflect technological advancement, changing customer requirements, and evolving business models that shape future market development and competitive strategies.

Artificial Intelligence Integration represents the most significant trend, with AI-powered systems providing predictive analytics, real-time optimization, and autonomous decision-making capabilities. Machine learning algorithms enable systems to continuously improve performance and adapt to changing operational conditions without manual intervention.

Cloud-Based Solutions gain momentum as organizations seek scalable, cost-effective automation platforms that reduce infrastructure requirements and provide flexible deployment options. Software-as-a-Service models enable smaller organizations to access advanced capabilities while reducing upfront investment requirements.

Collaborative Robotics expansion continues as safety improvements and cost reductions make collaborative robots accessible across diverse applications. Human-robot collaboration becomes increasingly sophisticated, enabling flexible automation that combines human expertise with robotic precision and consistency.

Sustainability Integration emerges as a key trend, with organizations prioritizing energy-efficient automation solutions that support environmental goals. Green automation technologies that reduce energy consumption and waste generation align with corporate sustainability commitments and regulatory requirements.

Modular System Design becomes increasingly important as organizations seek flexible automation solutions that can evolve with changing business requirements. Scalable platforms enable phased implementation and future expansion without complete system replacement.

Industry developments across the APAC automated material handling and storage systems market demonstrate accelerating innovation, strategic partnerships, and market expansion activities that influence competitive dynamics and future growth trajectories.

Technology Partnerships between automation providers and software companies create integrated solutions that combine hardware capabilities with advanced analytics and optimization software. These partnerships enable comprehensive automation platforms that address end-to-end operational requirements.

Acquisition Activities continue as larger companies acquire specialized technology providers to expand their solution portfolios and geographic coverage. Market consolidation trends create opportunities for innovation while potentially reducing supplier diversity in certain market segments.

Government Initiatives across APAC countries provide policy frameworks and financial support for automation adoption. Smart manufacturing programs in countries like Singapore, South Korea, and Japan accelerate technology deployment and create favorable market conditions for automation providers.

Research and Development investments focus on next-generation technologies including autonomous mobile robots, AI-powered optimization systems, and IoT-enabled predictive maintenance platforms. Innovation centers established across the region support technology development and market-specific solution customization.

Industry Collaboration initiatives bring together technology providers, end-users, and research institutions to develop industry standards and best practices. Standards development efforts facilitate technology interoperability and reduce implementation complexity for end-users.

Strategic recommendations for stakeholders in the APAC automated material handling and storage systems market focus on optimizing market participation, managing risks, and capitalizing on emerging opportunities for sustainable growth and competitive advantage.

For Technology Providers: Focus on developing scalable solutions that can serve both large enterprises and smaller organizations with varying automation requirements. Invest in local partnerships and service capabilities to provide comprehensive support throughout the customer lifecycle. Innovation investment should prioritize AI integration and sustainability features that align with market trends and customer priorities.

For End-Users: Develop comprehensive automation strategies that align with long-term business objectives rather than pursuing isolated technology implementations. Invest in workforce development and change management to ensure successful automation adoption. Pilot programs can help validate technology benefits and build organizational confidence before large-scale deployments.

For Investors: Focus on companies with strong technology differentiation and established market presence in high-growth APAC markets. Consider the importance of local market knowledge and service capabilities when evaluating investment opportunities. Market timing considerations should account for varying development levels across different APAC countries.

For System Integrators: Develop specialized expertise in high-growth industry segments and emerging technologies to differentiate service offerings. Build strategic partnerships with technology providers to access advanced solutions and training resources. Focus on developing recurring revenue streams through maintenance and optimization services.

Future projections for the APAC automated material handling and storage systems market indicate sustained growth momentum driven by technological advancement, economic development, and evolving business requirements across the region. MarkWide Research analysis suggests the market will continue expanding at robust rates through the forecast period.

Technology evolution will accelerate with increasing integration of artificial intelligence, machine learning, and IoT capabilities that enable more sophisticated automation solutions. Autonomous systems will become more prevalent as technology costs decrease and capabilities improve, making advanced automation accessible to a broader range of organizations.

Market expansion will be driven by continued industrialization in emerging APAC markets and increasing automation adoption among small and medium enterprises. E-commerce growth will sustain demand for warehouse automation solutions, while manufacturing competitiveness pressures will drive factory automation investments.

Geographic development patterns suggest that emerging markets will experience the highest growth rates as they build foundational automation infrastructure, while developed markets will focus on advanced integration and optimization capabilities. Cross-border collaboration will increase as companies seek to leverage regional expertise and cost advantages.

Industry transformation will continue as automation becomes integral to business operations rather than optional enhancement. Organizations that successfully integrate automation capabilities will gain significant competitive advantages in efficiency, quality, and customer service delivery.

Market assessment of the APAC automated material handling and storage systems sector reveals a dynamic, rapidly evolving market with substantial growth potential and diverse opportunities for stakeholders across the value chain. The market benefits from strong fundamental drivers including industrialization, e-commerce expansion, and government support for automation adoption.

Regional diversity creates opportunities for different approaches and solutions, with developed markets focusing on advanced integration while emerging economies build foundational automation infrastructure. This diversity requires nuanced strategies that account for varying market conditions, customer requirements, and competitive dynamics across different APAC countries.

Technology advancement continues to reshape market possibilities, with AI integration, robotics evolution, and IoT capabilities creating new opportunities for operational excellence and competitive differentiation. Organizations that successfully leverage these technological capabilities will be well-positioned for sustained success in the evolving market landscape.

Success factors for market participants include technology innovation, local market expertise, comprehensive service capabilities, and strategic partnerships that enable effective market penetration and customer relationship development. The APAC automated material handling and storage systems market represents a compelling opportunity for stakeholders who can navigate its complexity while delivering value to customers seeking operational transformation through automation technologies.

What is Automated Material Handling and Storage Systems?

Automated Material Handling and Storage Systems refer to technologies and equipment used to automate the movement, storage, and control of materials in various industries. These systems enhance efficiency, reduce labor costs, and improve safety in warehouses and manufacturing facilities.

What are the key players in the APAC Automated Material Handling and Storage Systems Market?

Key players in the APAC Automated Material Handling and Storage Systems Market include Daifuku Co., Ltd., KION Group AG, and SSI Schaefer. These companies are known for their innovative solutions and extensive product offerings in automated storage and retrieval systems, conveyor systems, and robotics, among others.

What are the main drivers of growth in the APAC Automated Material Handling and Storage Systems Market?

The main drivers of growth in the APAC Automated Material Handling and Storage Systems Market include the increasing demand for efficiency in supply chain operations, the rise of e-commerce, and advancements in robotics and automation technologies. These factors are pushing companies to adopt automated solutions to enhance productivity.

What challenges does the APAC Automated Material Handling and Storage Systems Market face?

Challenges in the APAC Automated Material Handling and Storage Systems Market include high initial investment costs, the complexity of system integration, and the need for skilled labor to operate and maintain these systems. Additionally, rapid technological changes can make it difficult for companies to keep up.

What opportunities exist in the APAC Automated Material Handling and Storage Systems Market?

Opportunities in the APAC Automated Material Handling and Storage Systems Market include the growing adoption of Industry Four Point Zero technologies, the expansion of smart warehouses, and the increasing focus on sustainability in logistics. These trends are likely to drive innovation and investment in automated solutions.

What trends are shaping the APAC Automated Material Handling and Storage Systems Market?

Trends shaping the APAC Automated Material Handling and Storage Systems Market include the integration of artificial intelligence and machine learning for predictive analytics, the rise of autonomous mobile robots, and the development of IoT-enabled systems for real-time monitoring. These innovations are transforming how materials are handled and stored.

APAC Automated Material Handling and Storage Systems Market

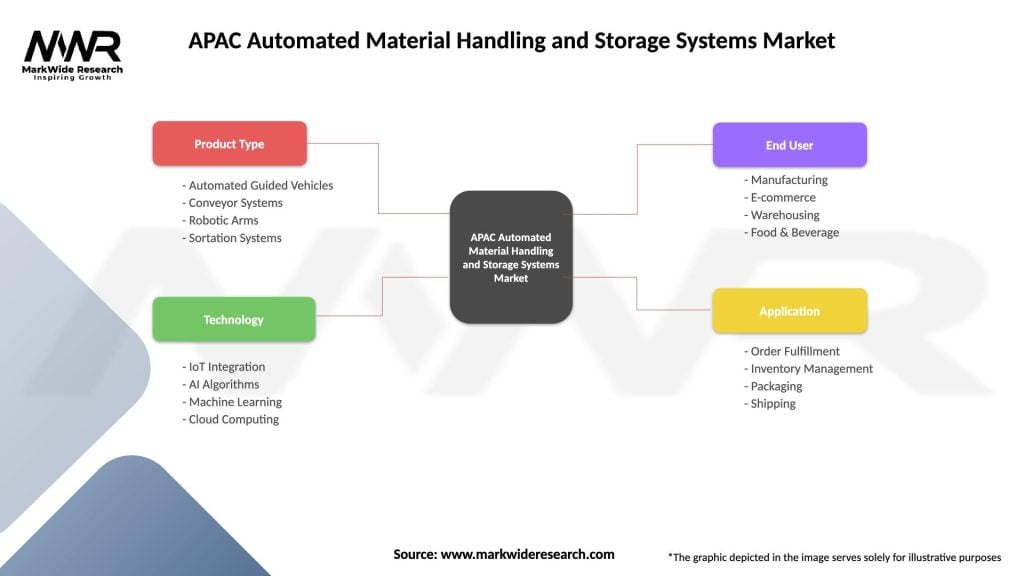

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Conveyor Systems, Robotic Arms, Sortation Systems |

| Technology | IoT Integration, AI Algorithms, Machine Learning, Cloud Computing |

| End User | Manufacturing, E-commerce, Warehousing, Food & Beverage |

| Application | Order Fulfillment, Inventory Management, Packaging, Shipping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Automated Material Handling and Storage Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at