444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China ICU patient monitor market represents a critical segment of the country’s healthcare technology landscape, experiencing unprecedented growth driven by healthcare infrastructure modernization and increasing demand for advanced critical care monitoring solutions. ICU patient monitors serve as essential medical devices that continuously track vital signs and physiological parameters of critically ill patients in intensive care units across Chinese hospitals and healthcare facilities.

Market dynamics indicate robust expansion fueled by government healthcare reforms, aging population demographics, and rising prevalence of chronic diseases requiring intensive monitoring. The market encompasses various monitoring technologies including multi-parameter monitors, cardiac monitors, respiratory monitors, and neurological monitoring systems designed to enhance patient safety and clinical outcomes in critical care environments.

Healthcare digitization initiatives across China have accelerated adoption of sophisticated monitoring solutions, with hospitals increasingly investing in smart monitoring systems that integrate artificial intelligence and data analytics capabilities. The market growth trajectory reflects a compound annual growth rate of 8.2%, positioning China as a significant regional hub for ICU monitoring technology advancement.

Regional distribution shows concentrated demand in tier-one cities including Beijing, Shanghai, and Guangzhou, while expanding penetration in tier-two and tier-three cities demonstrates broadening market accessibility. Public hospitals represent the largest customer segment, accounting for approximately 72% of market adoption, followed by private healthcare facilities and specialty critical care centers.

The China ICU patient monitor market refers to the comprehensive ecosystem of medical monitoring devices, systems, and technologies specifically designed for continuous surveillance of critically ill patients within intensive care units across Chinese healthcare facilities. These sophisticated monitoring solutions provide real-time tracking of vital physiological parameters including heart rate, blood pressure, oxygen saturation, respiratory rate, and various other critical indicators essential for patient care management.

ICU patient monitors encompass a broad range of medical devices from basic bedside monitors to advanced multi-parameter systems capable of integrating with hospital information systems and electronic health records. The market includes both invasive monitoring equipment for direct physiological measurement and non-invasive monitoring solutions that provide continuous patient assessment without direct contact with internal body systems.

Market scope extends beyond hardware to include software platforms, connectivity solutions, data management systems, and associated services that support comprehensive critical care monitoring workflows. These integrated solutions enable healthcare professionals to make informed clinical decisions, improve patient outcomes, and optimize resource utilization within intensive care environments.

China’s ICU patient monitor market demonstrates exceptional growth potential driven by healthcare system modernization, demographic shifts, and technological advancement in critical care monitoring. The market landscape reflects increasing demand for sophisticated monitoring solutions that enhance patient safety, improve clinical efficiency, and support evidence-based medical decision-making in intensive care settings.

Key market drivers include government healthcare investment initiatives, rising chronic disease prevalence, and growing emphasis on patient safety standards across Chinese hospitals. Technology adoption rates show accelerating integration of artificial intelligence, machine learning, and predictive analytics capabilities within monitoring systems, with AI-enabled monitors experiencing 15.3% adoption growth annually.

Competitive dynamics feature both international medical device manufacturers and domestic Chinese companies competing for market share through innovation, pricing strategies, and localized service offerings. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding product portfolios and strengthening distribution networks across China’s diverse healthcare landscape.

Future outlook suggests continued market expansion supported by ongoing healthcare infrastructure development, increasing ICU capacity, and evolving patient monitoring requirements. Regulatory environment improvements and standardization initiatives provide favorable conditions for market growth and technology adoption across various healthcare facility types.

Market intelligence reveals several critical insights shaping the China ICU patient monitor market trajectory and competitive landscape:

Market segmentation analysis indicates multi-parameter monitors dominate with 58% market share, while specialized cardiac and respiratory monitors show strong growth potential in niche applications.

Healthcare infrastructure modernization serves as the primary catalyst driving China’s ICU patient monitor market expansion. Government initiatives promoting smart hospital development and digital healthcare transformation create substantial demand for advanced monitoring technologies that enhance critical care capabilities and patient outcomes.

Demographic transitions significantly impact market growth, with China’s aging population requiring increased intensive care services and continuous monitoring solutions. Chronic disease prevalence continues rising, particularly cardiovascular conditions, respiratory disorders, and diabetes complications that necessitate sophisticated ICU monitoring capabilities for effective patient management.

Quality improvement initiatives across Chinese hospitals drive adoption of advanced monitoring systems that support evidence-based care protocols and clinical decision-making processes. Patient safety standards increasingly emphasize continuous monitoring requirements, creating mandatory demand for reliable, accurate monitoring equipment in intensive care environments.

Technology advancement enables development of more sophisticated, user-friendly monitoring solutions that integrate seamlessly with hospital workflows and information systems. Artificial intelligence integration provides predictive analytics capabilities that help healthcare providers identify potential complications early and optimize treatment interventions.

Healthcare investment from both government and private sectors supports expansion of ICU capacity and modernization of existing critical care facilities. Medical tourism growth in China creates additional demand for world-class monitoring equipment that meets international standards and patient expectations.

High implementation costs represent a significant barrier for many healthcare facilities, particularly smaller hospitals and rural medical centers with limited capital budgets. Initial investment requirements for comprehensive monitoring systems, including hardware, software, training, and ongoing maintenance, can strain healthcare facility finances and delay adoption decisions.

Technical complexity associated with advanced monitoring systems creates challenges for healthcare staff training and system integration. Skill gaps among medical personnel regarding sophisticated monitoring technology operation and interpretation can limit effective utilization and return on investment for healthcare facilities.

Regulatory compliance requirements impose additional costs and complexity for both manufacturers and healthcare providers. Certification processes for medical devices in China can be lengthy and expensive, potentially delaying market entry for innovative monitoring solutions and limiting product availability.

Maintenance and support challenges particularly affect facilities in remote or underserved areas where technical expertise and service infrastructure may be limited. Equipment downtime due to maintenance issues or technical failures can significantly impact patient care quality and hospital operational efficiency.

Data security concerns regarding patient information protection and cybersecurity threats create hesitation among healthcare providers considering connected monitoring solutions. Integration difficulties with existing hospital information systems can complicate implementation and reduce operational efficiency benefits.

Rural healthcare expansion presents substantial opportunities for ICU patient monitor market growth as government initiatives focus on improving medical care accessibility in underserved regions. Telemedicine integration with monitoring systems enables remote patient supervision and expert consultation, expanding market reach beyond traditional hospital boundaries.

Artificial intelligence advancement creates opportunities for developing predictive monitoring solutions that can anticipate patient deterioration and optimize clinical interventions. Machine learning algorithms integrated with monitoring systems offer potential for personalized patient care and improved clinical outcomes through data-driven insights.

Home healthcare growth opens new market segments for portable and user-friendly monitoring devices that enable patient care outside traditional hospital settings. Chronic disease management programs increasingly incorporate remote monitoring capabilities, expanding the addressable market for ICU-grade monitoring technology.

Public-private partnerships in healthcare infrastructure development create opportunities for innovative financing models and technology deployment strategies. Medical device leasing and service-based business models can make advanced monitoring technology more accessible to resource-constrained healthcare facilities.

Export potential for Chinese-manufactured monitoring systems to other developing markets represents significant growth opportunities for domestic manufacturers. Technology transfer initiatives and international collaboration can accelerate innovation and market expansion beyond China’s borders.

Supply chain dynamics in the China ICU patient monitor market reflect complex interactions between international manufacturers, domestic producers, and healthcare providers seeking optimal monitoring solutions. Component sourcing challenges and global supply chain disruptions have prompted increased focus on local manufacturing capabilities and supply chain resilience.

Competitive intensity continues escalating as both established medical device companies and emerging technology firms compete for market share through innovation, pricing strategies, and service differentiation. Market consolidation trends indicate strategic acquisitions and partnerships aimed at strengthening product portfolios and distribution networks.

Technology evolution drives rapid product development cycles, with manufacturers investing heavily in research and development to maintain competitive advantages. Customer expectations increasingly demand integrated solutions that combine monitoring hardware, software platforms, and comprehensive support services.

Regulatory landscape changes influence market dynamics through evolving standards, certification requirements, and quality assurance protocols. Government procurement policies favor domestic manufacturers in certain segments while maintaining quality and performance standards for critical care applications.

Economic factors including healthcare spending patterns, reimbursement policies, and budget allocation priorities significantly impact purchasing decisions and market growth trajectories. Currency fluctuations and trade policies affect pricing strategies for imported monitoring equipment and components.

Market research methodology employed for analyzing the China ICU patient monitor market incorporates comprehensive primary and secondary research approaches to ensure data accuracy and market insight reliability. Primary research activities include structured interviews with healthcare administrators, clinical professionals, and medical device procurement specialists across various hospital types and geographic regions.

Secondary research sources encompass government healthcare statistics, industry association reports, medical device manufacturer data, and academic publications related to critical care monitoring technology. Data triangulation methods validate findings across multiple sources to ensure research credibility and minimize potential bias in market analysis.

Quantitative analysis utilizes statistical modeling techniques to project market trends, growth rates, and segmentation patterns based on historical data and current market indicators. Qualitative assessment incorporates expert opinions, industry insights, and stakeholder perspectives to provide context and depth to numerical findings.

Market sizing methodology employs bottom-up and top-down approaches to validate market estimates and ensure consistency across different analytical perspectives. Forecasting models consider multiple scenarios including optimistic, conservative, and most likely growth trajectories based on various market drivers and constraints.

Data collection protocols ensure compliance with research ethics standards and maintain confidentiality of proprietary information while gathering comprehensive market intelligence for analysis and reporting purposes.

Eastern China dominates the ICU patient monitor market with major metropolitan areas including Shanghai, Beijing, and Guangzhou accounting for approximately 45% of total market demand. Healthcare infrastructure density in these regions supports adoption of advanced monitoring technologies, with tier-one hospitals leading implementation of sophisticated multi-parameter monitoring systems.

Southern China demonstrates strong growth potential driven by economic development and healthcare investment in cities like Shenzhen, Dongguan, and Foshan. Manufacturing hub presence in this region creates opportunities for local production and supply chain optimization, potentially reducing costs and improving market accessibility.

Central China shows emerging market characteristics with increasing healthcare spending and infrastructure development in cities such as Wuhan, Changsha, and Zhengzhou. Government healthcare initiatives targeting regional development create demand for modern monitoring equipment in newly constructed and upgraded medical facilities.

Western China represents an underserved market with significant growth potential as government policies promote healthcare accessibility and quality improvement in remote regions. Telemedicine integration with monitoring systems becomes particularly valuable in these areas where specialist medical expertise may be limited.

Northern China benefits from proximity to Beijing’s healthcare policy center and established medical device distribution networks. Regional market share distribution shows 28% concentration in northern provinces, with strong demand from both public and private healthcare facilities.

Market leadership in China’s ICU patient monitor sector features a diverse mix of international medical device manufacturers and domestic Chinese companies competing through innovation, pricing, and service strategies. Competitive positioning varies significantly across different market segments and customer types.

Competitive strategies increasingly emphasize value-based selling, comprehensive service packages, and long-term partnership development with healthcare providers. Market differentiation occurs through technology innovation, clinical evidence generation, and customized solutions addressing specific customer requirements.

Product segmentation within the China ICU patient monitor market reflects diverse monitoring requirements and clinical applications across different healthcare settings and patient populations.

By Product Type:

By Technology:

By End User:

Multi-parameter monitors dominate market demand due to their versatility and comprehensive monitoring capabilities, accounting for approximately 58% of total market volume. These systems provide integrated monitoring of vital signs including ECG, blood pressure, oxygen saturation, and temperature, making them essential equipment for general ICU applications.

Cardiac monitoring systems represent a specialized high-value segment driven by increasing cardiovascular disease prevalence and advanced cardiac care requirements. Technology advancement in this category focuses on arrhythmia detection, ST-segment analysis, and integration with cardiac intervention procedures.

Wireless monitoring solutions experience rapid growth as hospitals seek to improve patient comfort and mobility while maintaining continuous monitoring capabilities. Adoption rates for wireless systems show 18.5% annual growth, particularly in progressive healthcare facilities prioritizing patient experience and operational flexibility.

Portable monitoring devices gain traction in emergency medical services and inter-facility patient transport applications. Market demand for portable solutions reflects increasing emphasis on continuity of care and monitoring capability during patient transfers between medical facilities.

Central monitoring stations become increasingly sophisticated with advanced alarm management, data analytics, and integration capabilities. Healthcare efficiency improvements through centralized monitoring enable better staff utilization and enhanced patient surveillance across multiple ICU beds simultaneously.

Healthcare providers benefit significantly from advanced ICU patient monitoring systems through improved patient safety, enhanced clinical decision-making capabilities, and optimized resource utilization. Real-time monitoring enables early detection of patient deterioration, potentially reducing mortality rates and improving overall clinical outcomes in intensive care settings.

Clinical staff experience enhanced workflow efficiency through integrated monitoring systems that provide comprehensive patient data, automated alarm management, and seamless integration with electronic health records. Documentation accuracy improves through automated data capture, reducing manual recording errors and administrative burden on nursing staff.

Hospital administrators realize operational benefits including improved bed utilization, reduced length of stay, and enhanced quality metrics that support accreditation and regulatory compliance. Cost optimization occurs through better resource allocation, reduced complications, and improved staff productivity enabled by advanced monitoring technology.

Patients and families benefit from enhanced safety, improved care quality, and better communication regarding patient status through advanced monitoring capabilities. Patient comfort increases with wireless monitoring solutions that allow greater mobility while maintaining continuous surveillance.

Medical device manufacturers gain market opportunities through innovation, technology advancement, and partnership development with healthcare providers. Service revenue streams expand through maintenance contracts, training programs, and ongoing technical support services that create long-term customer relationships.

Government healthcare systems achieve policy objectives including improved healthcare quality, better resource utilization, and enhanced patient safety standards through widespread adoption of advanced monitoring technology across public healthcare facilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the most significant trend transforming ICU patient monitoring, with AI-powered systems providing predictive analytics, automated alarm management, and clinical decision support capabilities. Machine learning algorithms analyze patient data patterns to identify potential complications before they become critical, enabling proactive interventions and improved patient outcomes.

Wireless connectivity expansion continues reshaping monitoring system design and deployment strategies, with healthcare facilities increasingly adopting wireless monitoring solutions that enhance patient mobility and reduce infrastructure complexity. Bluetooth and Wi-Fi integration enables seamless data transmission and real-time monitoring without physical connection constraints.

Cloud-based data management gains momentum as hospitals seek scalable, secure solutions for storing and analyzing large volumes of patient monitoring data. Cloud platforms enable advanced analytics, remote monitoring capabilities, and improved data accessibility for clinical decision-making and quality improvement initiatives.

Interoperability standardization becomes increasingly important as healthcare providers demand monitoring systems that integrate seamlessly with existing hospital information systems and electronic health records. HL7 FHIR standards and other interoperability protocols drive product development and vendor selection criteria.

Miniaturization and portability trends focus on developing compact, lightweight monitoring devices that maintain clinical accuracy while improving patient comfort and mobility. Wearable monitoring technology expands monitoring capabilities beyond traditional bedside equipment to continuous, unobtrusive patient surveillance.

Cybersecurity enhancement becomes critical as connected monitoring systems require robust protection against potential security threats and data breaches. Encryption protocols and security frameworks ensure patient data protection while maintaining system functionality and connectivity benefits.

Regulatory framework evolution significantly impacts the China ICU patient monitor market through updated medical device approval processes and quality standards. National Medical Products Administration implements streamlined approval procedures for innovative monitoring technologies while maintaining rigorous safety and efficacy requirements.

Strategic partnerships between international manufacturers and Chinese healthcare providers accelerate technology transfer and market penetration. Joint ventures and collaboration agreements enable knowledge sharing, local manufacturing development, and customized solution development for Chinese market requirements.

Technology innovation initiatives focus on developing next-generation monitoring systems incorporating artificial intelligence, advanced sensors, and enhanced connectivity features. Research and development investments by both domestic and international companies drive continuous product improvement and market competitiveness.

Healthcare infrastructure projects including new hospital construction and existing facility upgrades create substantial demand for modern monitoring equipment. Government investment programs support healthcare facility development in underserved regions, expanding market opportunities for monitoring system manufacturers.

Digital health integration initiatives promote adoption of connected monitoring solutions that support telemedicine, remote consultation, and integrated care delivery models. MarkWide Research analysis indicates increasing emphasis on monitoring systems that enable comprehensive digital health ecosystems and data-driven care optimization.

Quality improvement programs across Chinese hospitals drive demand for advanced monitoring capabilities that support evidence-based care protocols and clinical outcome measurement. Accreditation requirements increasingly emphasize continuous monitoring capabilities and patient safety standards.

Market entry strategies for new participants should focus on differentiated value propositions that address specific unmet needs in the Chinese healthcare market. Localization efforts including Chinese language interfaces, local technical support, and customized clinical workflows can significantly improve market acceptance and competitive positioning.

Investment priorities should emphasize artificial intelligence capabilities, wireless connectivity, and interoperability features that align with evolving healthcare provider requirements. Technology roadmaps must consider both current market needs and future trends including home healthcare expansion and remote monitoring applications.

Partnership development with established Chinese distributors, healthcare providers, and technology companies can accelerate market penetration and reduce entry barriers. Strategic alliances enable access to local market knowledge, regulatory expertise, and established customer relationships essential for successful market development.

Pricing strategies must balance competitive positioning with profitability requirements, considering diverse customer segments ranging from premium tier-one hospitals to cost-sensitive rural healthcare facilities. Value-based pricing models that demonstrate clear return on investment and clinical benefits can justify premium positioning for advanced monitoring solutions.

Service differentiation through comprehensive training programs, technical support, and maintenance services can create competitive advantages and customer loyalty. MWR analysis suggests that service quality often influences purchasing decisions as much as product features and pricing considerations.

Regulatory compliance preparation should begin early in product development processes to ensure timely market entry and avoid costly delays. Quality management systems must meet both Chinese regulatory requirements and international standards to support potential export opportunities.

Market trajectory for China’s ICU patient monitor sector indicates sustained growth driven by healthcare modernization, demographic trends, and technology advancement. Long-term projections suggest continued expansion with annual growth rates exceeding 8% through the next decade, supported by government healthcare investment and increasing demand for advanced critical care capabilities.

Technology evolution will likely focus on artificial intelligence integration, predictive analytics, and enhanced connectivity features that transform monitoring from reactive to proactive patient care. Next-generation systems may incorporate advanced sensors, machine learning algorithms, and automated intervention capabilities that revolutionize intensive care medicine.

Market consolidation trends suggest potential merger and acquisition activity as companies seek to strengthen product portfolios, expand geographic reach, and achieve economies of scale. Strategic partnerships between technology companies and healthcare providers may become more common to accelerate innovation and market development.

Geographic expansion will likely extend monitoring technology adoption to smaller cities and rural areas as healthcare infrastructure development continues. Telemedicine integration with monitoring systems may enable expert care delivery to remote locations, expanding the effective market reach for advanced monitoring solutions.

Regulatory environment evolution may streamline approval processes for innovative monitoring technologies while maintaining safety and efficacy standards. International harmonization of medical device standards could facilitate global market expansion for Chinese manufacturers and technology transfer initiatives.

MarkWide Research forecasts indicate emerging opportunities in home healthcare monitoring, chronic disease management, and preventive care applications that extend beyond traditional ICU settings. Market diversification into these adjacent segments may provide additional growth avenues for monitoring system manufacturers and healthcare technology companies.

The China ICU patient monitor market represents a dynamic and rapidly evolving sector within the country’s healthcare technology landscape, characterized by strong growth potential, technological innovation, and increasing demand for advanced critical care monitoring solutions. Market fundamentals including demographic trends, healthcare infrastructure development, and government policy support create favorable conditions for sustained expansion and investment opportunities.

Competitive dynamics reflect a diverse ecosystem of international and domestic manufacturers competing through innovation, pricing strategies, and service differentiation. Technology advancement particularly in artificial intelligence, wireless connectivity, and data analytics capabilities drives product development and market evolution toward more sophisticated, integrated monitoring solutions.

Future prospects indicate continued market growth supported by healthcare modernization initiatives, expanding ICU capacity, and evolving patient monitoring requirements across diverse healthcare settings. Strategic opportunities exist for companies that can effectively address market needs through innovative products, comprehensive services, and strategic partnerships with healthcare providers and technology partners.

The China ICU patient monitor market will likely continue serving as a critical component of the country’s healthcare system transformation, enabling improved patient outcomes, enhanced clinical efficiency, and better resource utilization across intensive care environments nationwide.

What is ICU Patient Monitor?

ICU Patient Monitor refers to medical devices used in intensive care units to continuously monitor patients’ vital signs, including heart rate, blood pressure, oxygen saturation, and respiratory rate. These monitors are essential for providing real-time data to healthcare professionals for critical patient management.

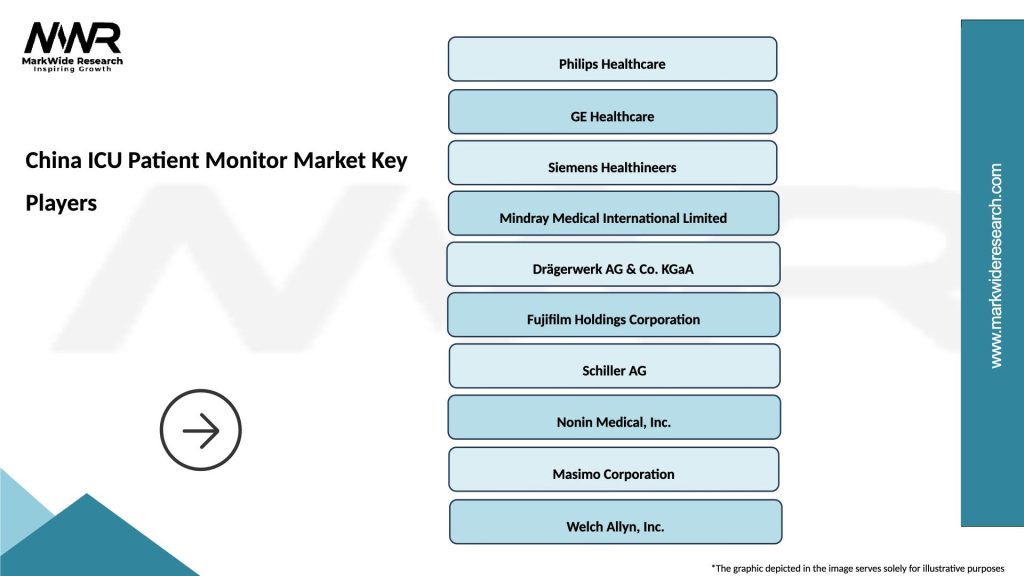

What are the key players in the China ICU Patient Monitor Market?

Key players in the China ICU Patient Monitor Market include Philips Healthcare, GE Healthcare, and Siemens Healthineers, among others. These companies are known for their innovative monitoring solutions and significant market presence.

What are the growth factors driving the China ICU Patient Monitor Market?

The China ICU Patient Monitor Market is driven by factors such as the increasing prevalence of chronic diseases, the growing elderly population, and advancements in monitoring technology. Additionally, the rising demand for efficient healthcare services contributes to market growth.

What challenges does the China ICU Patient Monitor Market face?

The China ICU Patient Monitor Market faces challenges such as high costs of advanced monitoring systems and the need for skilled personnel to operate these devices. Furthermore, regulatory hurdles can also impact market entry for new technologies.

What opportunities exist in the China ICU Patient Monitor Market?

Opportunities in the China ICU Patient Monitor Market include the development of portable and wireless monitoring devices, which enhance patient mobility and comfort. Additionally, the integration of artificial intelligence in monitoring systems presents significant potential for improved patient outcomes.

What trends are shaping the China ICU Patient Monitor Market?

Trends shaping the China ICU Patient Monitor Market include the increasing adoption of telemedicine and remote monitoring solutions, driven by the need for continuous patient care. Moreover, the focus on patient-centric care is leading to innovations in user-friendly interfaces and data analytics.

China ICU Patient Monitor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Monitors, Bedside Monitors, Multiparameter Monitors, Central Station Monitors |

| Technology | Wireless Monitoring, Invasive Monitoring, Non-invasive Monitoring, Telemetry Systems |

| End User | Hospitals, Emergency Care Centers, Home Care, Specialty Clinics |

| Application | Cardiac Monitoring, Respiratory Monitoring, Neurological Monitoring, Patient Safety |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China ICU Patient Monitor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at