444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan gluten-free foods and beverages market represents a rapidly evolving segment within the country’s health-conscious consumer landscape. Market dynamics indicate significant growth potential driven by increasing awareness of celiac disease, gluten sensitivity, and lifestyle-driven dietary choices. The Japanese market demonstrates unique characteristics compared to Western counterparts, with traditional rice-based cuisine naturally aligning with gluten-free preferences while modern processed foods create new opportunities for specialized products.

Consumer adoption rates have shown remarkable acceleration, with approximately 12% annual growth in gluten-free product consumption across major metropolitan areas. Retail expansion has been particularly notable in Tokyo, Osaka, and other urban centers where health-conscious consumers actively seek alternatives to conventional wheat-based products. The market encompasses diverse product categories including rice-based alternatives, specialty flours, gluten-free beverages, and traditional Japanese foods reformulated for gluten-sensitive consumers.

Manufacturing innovation has emerged as a key differentiator, with Japanese companies leveraging advanced food technology to create products that maintain traditional taste profiles while ensuring gluten-free compliance. Supply chain development has strengthened significantly, with dedicated production facilities and specialized distribution networks supporting market expansion across both urban and rural regions.

The Japan gluten-free foods and beverages market refers to the commercial ecosystem encompassing all food and beverage products specifically manufactured, processed, or certified to contain less than 20 parts per million of gluten proteins, catering to Japanese consumers with celiac disease, gluten sensitivity, or lifestyle preferences for gluten-free diets.

Product classification within this market includes naturally gluten-free items such as rice, vegetables, and fruits, as well as specially manufactured alternatives to traditional wheat-based products. Regulatory compliance follows both international standards and Japan-specific food safety requirements, ensuring products meet strict quality and labeling standards for gluten-free certification.

Market participants range from traditional Japanese food manufacturers adapting existing products to specialized international brands entering the Japanese market. Distribution channels include specialty health food stores, major supermarket chains, convenience stores, and increasingly popular online platforms catering to health-conscious consumers seeking gluten-free alternatives.

Strategic market positioning reveals the Japan gluten-free foods and beverages market as an emerging high-growth segment within the broader health and wellness food industry. Consumer behavior analysis indicates shifting dietary preferences driven by health awareness, medical necessity, and lifestyle choices, with urban populations leading adoption trends.

Key growth drivers include increasing diagnosis rates of celiac disease and gluten sensitivity, rising health consciousness among Japanese consumers, and growing availability of high-quality gluten-free alternatives. Market penetration rates show approximately 8% of Japanese households regularly purchasing gluten-free products, with higher concentrations in metropolitan areas.

Competitive landscape dynamics feature both domestic manufacturers leveraging traditional rice-based expertise and international brands introducing proven gluten-free formulations adapted for Japanese tastes. Innovation trends focus on maintaining authentic Japanese flavors while ensuring gluten-free compliance, creating unique market opportunities for companies successfully bridging traditional and modern dietary requirements.

Future market trajectory suggests continued expansion driven by demographic trends, increasing health awareness, and improved product availability across diverse retail channels. Investment activity has intensified as companies recognize the long-term potential of this specialized but growing market segment.

Consumer demographic analysis reveals distinct patterns in gluten-free product adoption across Japan’s diverse population segments. Primary consumers include individuals with diagnosed celiac disease or gluten sensitivity, health-conscious urban professionals, and families with children experiencing dietary restrictions.

Health awareness expansion serves as the primary catalyst driving Japan’s gluten-free foods and beverages market growth. Medical research dissemination has increased public understanding of celiac disease, gluten sensitivity, and related health conditions, leading to higher diagnosis rates and subsequent demand for gluten-free alternatives.

Demographic shifts contribute significantly to market expansion, with aging populations experiencing increased digestive sensitivities and younger generations prioritizing preventive health measures. Urbanization trends support market growth through concentrated consumer bases with higher disposable income and greater access to specialized products.

Retail infrastructure development has enhanced product accessibility, with major supermarket chains dedicating shelf space to gluten-free products and specialty stores expanding their offerings. E-commerce growth has particularly benefited rural consumers previously unable to access diverse gluten-free options, with online sales showing robust growth rates exceeding traditional retail channels.

Manufacturing innovation continues driving market expansion through improved product quality, taste, and variety. Technology advancement enables Japanese manufacturers to create gluten-free versions of traditional foods while maintaining authentic flavors and textures that appeal to local consumers.

Government support through food safety regulations and labeling requirements has increased consumer confidence in gluten-free products. Healthcare system recognition of gluten-related disorders has led to better diagnosis rates and medical recommendations for gluten-free diets, creating sustained demand growth.

Premium pricing challenges represent a significant barrier to widespread market adoption, with gluten-free products typically commanding higher prices than conventional alternatives. Cost sensitivity among Japanese consumers, particularly in rural areas and among older demographics, limits market penetration for non-essential gluten-free products.

Limited product variety compared to Western markets constrains consumer choice and satisfaction. Taste and texture differences between gluten-free alternatives and traditional products create acceptance challenges, particularly for consumers accustomed to specific textures in Japanese cuisine.

Supply chain complexities increase costs and limit availability, especially for imported gluten-free ingredients and specialized manufacturing equipment. Cross-contamination concerns require dedicated production facilities and strict quality control measures, adding operational complexity and costs for manufacturers.

Consumer education gaps persist regarding gluten-free diets, product identification, and health benefits. Cultural resistance to dietary changes, particularly among traditional consumers, slows adoption rates in certain demographic segments and geographic regions.

Regulatory compliance costs for gluten-free certification and labeling requirements create barriers for smaller manufacturers. Distribution challenges in rural areas limit product availability and increase logistics costs, constraining market expansion beyond urban centers.

Product innovation opportunities abound in adapting traditional Japanese foods for gluten-free markets while maintaining authentic taste profiles. Rice-based alternatives present particular potential given Japan’s rice cultivation expertise and consumer familiarity with rice-based products across various food categories.

Export market potential exists for Japanese gluten-free products, particularly rice-based items and traditional foods adapted for international gluten-free markets. Technology transfer opportunities enable Japanese food processing expertise to create innovative gluten-free solutions for both domestic and international markets.

Partnership opportunities with healthcare providers, nutritionists, and wellness centers can drive market education and product adoption. Corporate wellness programs represent untapped channels for bulk sales and employee health initiatives focused on dietary accommodation.

E-commerce expansion offers significant growth potential, particularly for reaching rural consumers and providing convenient access to diverse product ranges. Subscription services and direct-to-consumer models can build customer loyalty while providing predictable revenue streams for manufacturers.

Premium positioning opportunities exist for high-quality, artisanal gluten-free products targeting affluent urban consumers willing to pay premium prices for superior taste and quality. Functional food integration combining gluten-free properties with additional health benefits can create differentiated product offerings.

Competitive intensity has increased significantly as both domestic and international players recognize market potential and invest in product development and distribution capabilities. Market consolidation trends show larger food manufacturers acquiring specialized gluten-free brands to expand their health-focused product portfolios.

Innovation cycles have accelerated, with companies continuously developing new products to meet evolving consumer preferences and dietary requirements. Technology adoption in manufacturing processes has improved product quality while reducing costs, making gluten-free options more accessible to price-sensitive consumers.

Consumer behavior evolution shows increasing sophistication in product selection, with buyers becoming more knowledgeable about ingredients, certifications, and nutritional benefits. Brand differentiation has become crucial as market maturity increases and consumers develop stronger preferences for specific product attributes.

Supply chain optimization efforts focus on reducing costs and improving product availability across diverse geographic markets. Regulatory environment changes continue shaping market dynamics through updated labeling requirements and certification standards that affect product development and marketing strategies.

Seasonal demand patterns influence inventory management and production planning, with certain products experiencing higher demand during specific periods aligned with traditional Japanese dietary customs and health-focused seasons.

Primary research methodology encompasses comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus groups across major Japanese metropolitan areas. Data collection strategies include both quantitative and qualitative approaches to capture market trends, consumer preferences, and industry dynamics affecting the gluten-free foods and beverages sector.

Secondary research sources include government statistics, industry reports, trade publications, and academic studies related to gluten-free markets and Japanese consumer behavior. Market analysis techniques combine statistical modeling with trend analysis to project future market developments and identify emerging opportunities.

Industry expert consultations provide insights into manufacturing processes, regulatory requirements, and competitive strategies within the Japanese gluten-free market. Retail channel analysis examines distribution patterns, pricing strategies, and consumer purchasing behavior across different retail formats.

Geographic coverage includes major urban centers, suburban areas, and rural regions to capture diverse market dynamics and consumer preferences across Japan’s varied demographic landscape. Temporal analysis tracks market evolution over multiple years to identify sustained trends versus temporary fluctuations.

Validation processes ensure data accuracy through cross-referencing multiple sources and conducting follow-up research to confirm key findings and market projections.

Tokyo metropolitan area dominates the Japanese gluten-free foods and beverages market, accounting for approximately 40% of national consumption. Consumer sophistication in Tokyo drives demand for diverse product categories and premium offerings, with health-conscious urban professionals leading adoption trends.

Osaka and Kansai region represents the second-largest market segment, with strong growth in both retail and food service channels. Regional preferences show particular interest in traditional Japanese foods adapted for gluten-free diets, reflecting cultural food preferences combined with health consciousness.

Nagoya and central Japan demonstrate steady market growth driven by industrial workforce populations and increasing health awareness. Distribution infrastructure in this region has improved significantly, with major retailers expanding gluten-free product selections to meet growing demand.

Northern regions including Sendai show emerging market potential with growing awareness of gluten-related health issues. Rural market penetration remains limited but shows improvement through e-commerce channels and regional retail chain expansion.

Southern regions and Kyushu present unique opportunities combining traditional food culture with modern health trends. Regional specialization in certain agricultural products creates opportunities for locally-sourced gluten-free ingredients and products.

Market concentration patterns reveal approximately 75% of market activity concentrated in major metropolitan areas, with rural regions representing emerging growth opportunities as product availability and consumer awareness increase.

Market leadership is distributed among several key players combining domestic Japanese companies with international gluten-free specialists. Competitive positioning varies by product category, with some companies focusing on traditional Japanese foods while others emphasize Western-style gluten-free alternatives.

Competitive strategies emphasize product quality, taste authenticity, and health benefits rather than price competition. Innovation focus centers on maintaining traditional Japanese flavors while ensuring gluten-free compliance, creating unique market positioning opportunities.

Market entry barriers include regulatory compliance costs, distribution network development, and consumer education requirements. Strategic partnerships between domestic and international companies have become common approaches to market entry and expansion.

Product category segmentation reveals distinct market dynamics across different food and beverage types within the Japanese gluten-free market. Consumer preferences vary significantly by product category, with traditional Japanese foods showing higher acceptance rates than Western alternatives.

By Product Type:

By Distribution Channel:

By Consumer Type:

Rice-based products represent the most successful category within Japan’s gluten-free market, leveraging traditional Japanese rice cultivation expertise and consumer familiarity. Market performance in this category shows consistent growth with high consumer acceptance rates and expanding product variety.

Noodle alternatives present significant opportunities as Japanese cuisine heavily features wheat-based noodles in popular dishes. Innovation challenges focus on replicating traditional textures and flavors while maintaining gluten-free compliance, with rice and alternative grain noodles showing promising market reception.

Bakery products face greater challenges due to gluten’s crucial role in traditional baking processes. Consumer acceptance varies significantly, with success depending on taste and texture quality compared to conventional alternatives. Premium positioning has proven effective for high-quality bakery items targeting health-conscious urban consumers.

Beverage categories show strong growth potential, particularly gluten-free beer and traditional Japanese drinks reformulated for gluten-sensitive consumers. Market differentiation opportunities exist in combining gluten-free properties with functional health benefits appealing to wellness-focused consumers.

Condiment and seasoning categories represent essential market segments with consistent demand from consumers requiring complete dietary compliance. Brand loyalty tends to be strong in these categories due to the importance of maintaining authentic flavors in Japanese cooking.

Manufacturers benefit from accessing a growing market segment with relatively limited competition and opportunities for premium pricing. Product differentiation opportunities allow companies to establish strong brand positions while serving underserved consumer needs.

Retailers gain from offering specialized products that attract health-conscious consumers and increase customer loyalty. Market positioning as health-focused retailers can drive traffic and improve overall store performance through expanded product categories.

Consumers receive improved quality of life through access to safe, enjoyable food options that accommodate their dietary restrictions without sacrificing taste or cultural food preferences. Health outcomes improve for individuals with gluten-related disorders through better product availability and variety.

Healthcare providers benefit from improved patient compliance with gluten-free dietary recommendations due to better product availability and quality. Treatment effectiveness increases when patients can maintain gluten-free diets without significant lifestyle disruption.

Agricultural stakeholders find new market opportunities for alternative grains and rice varieties specifically suited for gluten-free food production. Supply chain participants benefit from specialized distribution and logistics opportunities serving this growing market segment.

Food service operators can differentiate their offerings and attract new customer segments by providing gluten-free menu options. Market expansion opportunities exist for restaurants and cafes willing to invest in gluten-free food preparation capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends show consumers increasingly willing to pay higher prices for superior taste, quality, and authentic Japanese flavors in gluten-free products. Brand positioning strategies emphasize artisanal production methods and traditional ingredients adapted for gluten-free compliance.

Functional food integration combines gluten-free properties with additional health benefits such as probiotics, enhanced nutrition, or traditional Japanese medicinal ingredients. Consumer appeal increases when products offer multiple health advantages beyond gluten-free compliance.

Convenience-focused innovation addresses busy urban lifestyles through ready-to-eat gluten-free meals, portable snacks, and quick-preparation products. Packaging innovation emphasizes portion control, freshness preservation, and clear gluten-free labeling for consumer confidence.

Sustainability consciousness influences product development with emphasis on environmentally friendly packaging, local ingredient sourcing, and reduced food waste. Corporate responsibility initiatives resonate with health-conscious consumers who value environmental stewardship alongside personal health.

Digital engagement strategies utilize social media, mobile apps, and online communities to educate consumers and build brand loyalty. Content marketing focuses on recipes, health information, and lifestyle integration to support consumer adoption and retention.

Personalization trends show growing interest in customized gluten-free products tailored to individual taste preferences, dietary restrictions, and health goals. Technology integration enables more precise product matching and personalized nutrition recommendations.

Manufacturing facility expansion has accelerated as companies invest in dedicated gluten-free production lines to prevent cross-contamination and meet growing demand. Technology upgrades focus on improving product quality while reducing production costs through automation and process optimization.

Regulatory framework evolution includes updated labeling requirements and certification standards that enhance consumer confidence while creating compliance challenges for manufacturers. Government initiatives support market development through food safety guidelines and health awareness campaigns.

Strategic partnerships between domestic and international companies have increased, combining Japanese market knowledge with global gluten-free expertise. Acquisition activity shows larger food companies purchasing specialized gluten-free brands to expand their health-focused product portfolios.

Research and development investments focus on ingredient innovation, taste improvement, and cost reduction technologies. University collaborations advance scientific understanding of gluten-free food science and consumer health benefits.

Retail channel expansion includes major supermarket chains dedicating increased shelf space to gluten-free products and convenience stores adding grab-and-go options. E-commerce platform development has improved online shopping experiences and delivery capabilities for gluten-free products.

International market exploration shows Japanese companies beginning to export gluten-free products, particularly rice-based items, to health-conscious consumers in other Asian markets and Western countries seeking authentic Japanese alternatives.

Market entry strategies should prioritize product quality and taste authenticity over aggressive pricing, as Japanese consumers demonstrate willingness to pay premiums for superior gluten-free alternatives. MarkWide Research analysis indicates that companies succeeding in this market focus on maintaining traditional flavors while ensuring strict gluten-free compliance.

Distribution strategy recommendations emphasize multi-channel approaches combining traditional retail with e-commerce platforms to reach diverse consumer segments. Rural market penetration requires innovative distribution solutions and consumer education initiatives to build awareness and accessibility.

Product development priorities should focus on categories with highest consumer acceptance, particularly rice-based products and traditional Japanese foods adapted for gluten-free diets. Innovation investments in taste and texture improvement yield better returns than extensive product line expansion.

Partnership opportunities with healthcare providers, nutritionists, and wellness centers can accelerate market education and consumer adoption. Corporate wellness programs represent underutilized channels for bulk sales and employee health initiatives.

Brand positioning strategies should emphasize health benefits, quality assurance, and cultural authenticity rather than competing primarily on price. Consumer education initiatives remain crucial for market expansion, particularly in regions with limited gluten-free awareness.

Investment timing considerations favor early market entry while competition remains limited and consumer awareness continues growing. Long-term market potential justifies significant upfront investments in manufacturing capabilities and brand development.

Market trajectory projections indicate sustained growth driven by increasing health consciousness, aging population dietary needs, and improved product availability. Consumer adoption rates are expected to accelerate as product quality improves and prices become more accessible through economies of scale.

Technology advancement impacts will continue improving product quality while reducing manufacturing costs, making gluten-free options more competitive with conventional alternatives. Innovation cycles will likely accelerate as competition intensifies and consumer expectations increase.

Demographic trends support long-term market expansion, with younger generations showing higher acceptance of dietary alternatives and older populations experiencing increased digestive sensitivities. Urbanization patterns will continue concentrating market demand in metropolitan areas while e-commerce expands rural access.

Regulatory environment evolution may include stricter labeling requirements and certification standards that could increase compliance costs but enhance consumer confidence. Government health initiatives may provide additional support for gluten-free market development through awareness campaigns and healthcare integration.

International market integration presents opportunities for Japanese companies to export gluten-free products while foreign brands may increase their presence in Japan. MWR projections suggest the market will experience continued expansion with annual growth rates potentially reaching double digits in certain product categories.

Supply chain optimization will become increasingly important as market scale enables more efficient distribution and inventory management. Sustainability considerations will likely influence future product development and packaging decisions as environmental consciousness grows among health-focused consumers.

The Japan gluten-free foods and beverages market represents a compelling growth opportunity within the broader health and wellness food sector. Market fundamentals remain strong, supported by increasing health awareness, demographic trends favoring dietary alternatives, and improving product quality and availability.

Competitive advantages exist for companies that successfully combine traditional Japanese food expertise with modern gluten-free manufacturing capabilities. Consumer acceptance continues growing as products better replicate traditional tastes and textures while maintaining strict gluten-free compliance.

Strategic success factors include quality-focused product development, multi-channel distribution strategies, and comprehensive consumer education initiatives. Market expansion potential remains significant, particularly in rural areas and emerging product categories that leverage Japan’s traditional food culture.

Long-term market prospects appear favorable, with demographic trends, health consciousness, and technological advancement supporting sustained growth. Investment opportunities exist for companies willing to commit to quality, innovation, and patient market development in this specialized but expanding sector of Japan’s food and beverage industry.

What is Gluten-Free Foods & Beverages?

Gluten-Free Foods & Beverages refer to products that do not contain gluten, a protein found in wheat, barley, and rye. These products cater to individuals with celiac disease or gluten sensitivity, offering a variety of options such as gluten-free grains, snacks, and beverages.

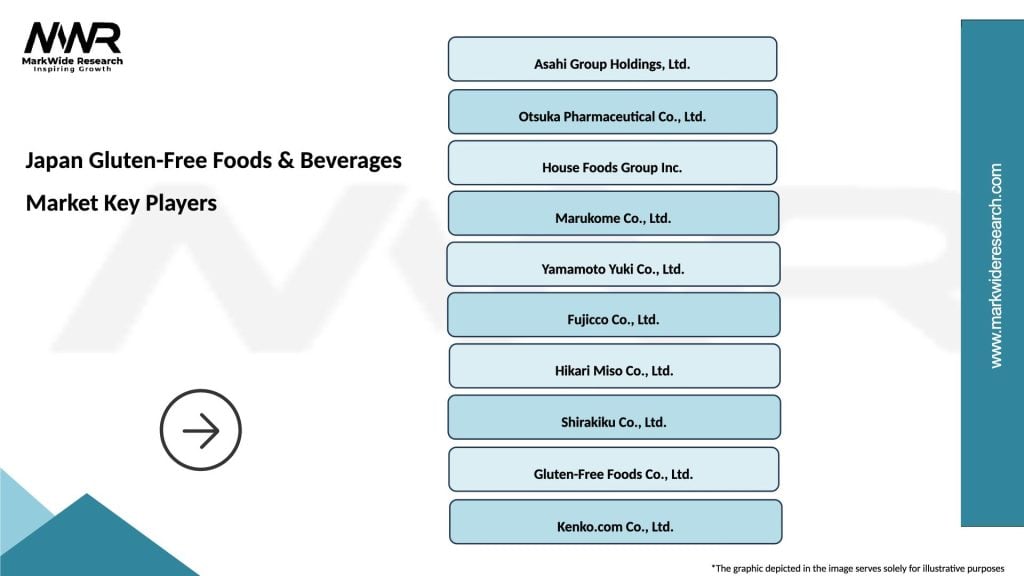

What are the key players in the Japan Gluten-Free Foods & Beverages Market?

Key players in the Japan Gluten-Free Foods & Beverages Market include companies like Otsuka Pharmaceutical, Asahi Group Holdings, and Kikkoman Corporation, among others. These companies are known for their innovative gluten-free product lines and commitment to quality.

What are the growth factors driving the Japan Gluten-Free Foods & Beverages Market?

The growth of the Japan Gluten-Free Foods & Beverages Market is driven by increasing health awareness among consumers, a rise in the number of diagnosed gluten-related disorders, and a growing demand for healthier food options. Additionally, the expansion of retail channels is facilitating greater access to gluten-free products.

What challenges does the Japan Gluten-Free Foods & Beverages Market face?

The Japan Gluten-Free Foods & Beverages Market faces challenges such as the higher cost of gluten-free ingredients and potential cross-contamination during production. Additionally, consumer skepticism regarding the health benefits of gluten-free diets can hinder market growth.

What opportunities exist in the Japan Gluten-Free Foods & Beverages Market?

Opportunities in the Japan Gluten-Free Foods & Beverages Market include the potential for product innovation, such as the development of new gluten-free snacks and beverages. There is also a growing trend towards organic and natural gluten-free products, appealing to health-conscious consumers.

What trends are shaping the Japan Gluten-Free Foods & Beverages Market?

Trends shaping the Japan Gluten-Free Foods & Beverages Market include the increasing popularity of plant-based diets, the rise of online grocery shopping, and the introduction of gluten-free options in mainstream restaurants. These trends reflect a broader shift towards healthier eating habits among consumers.

Japan Gluten-Free Foods & Beverages Market

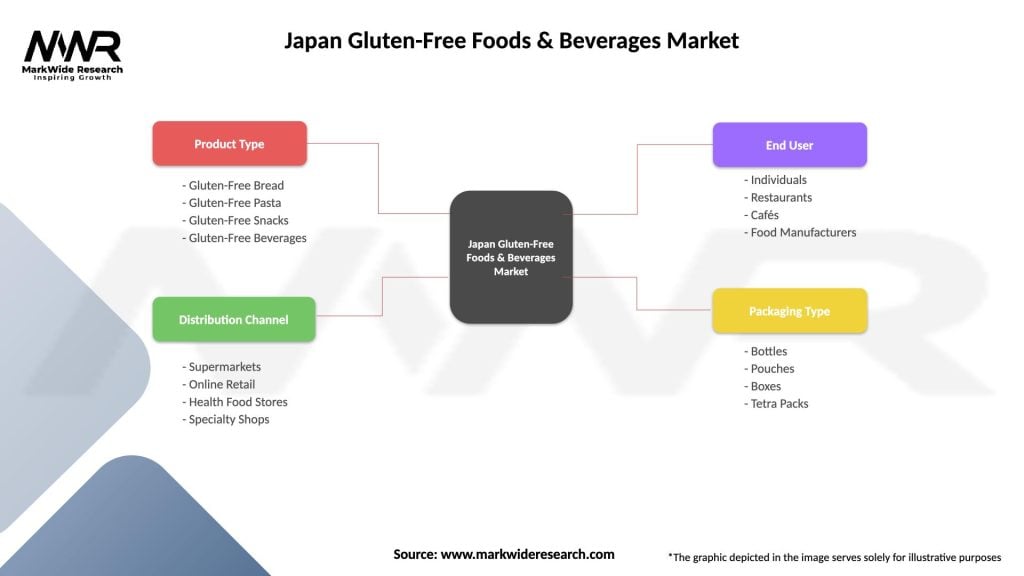

| Segmentation Details | Description |

|---|---|

| Product Type | Gluten-Free Bread, Gluten-Free Pasta, Gluten-Free Snacks, Gluten-Free Beverages |

| Distribution Channel | Supermarkets, Online Retail, Health Food Stores, Specialty Shops |

| End User | Individuals, Restaurants, Cafés, Food Manufacturers |

| Packaging Type | Bottles, Pouches, Boxes, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Gluten-Free Foods & Beverages Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at