444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Brazil agricultural crops market stands as one of the most significant agricultural powerhouses in the global economy, representing a cornerstone of both domestic food security and international trade dynamics. Brazil’s agricultural sector encompasses a diverse portfolio of crops including soybeans, corn, sugarcane, coffee, cotton, and various fruits and vegetables that collectively contribute to the nation’s economic stability and growth trajectory.

Market dynamics within Brazil’s agricultural landscape are characterized by advanced farming technologies, extensive arable land availability, and favorable climatic conditions that support year-round cultivation across different regions. The sector demonstrates remarkable resilience and adaptability, with productivity improvements reaching approximately 3.2% annually through the adoption of precision agriculture and sustainable farming practices.

Geographic advantages position Brazil as a leading agricultural exporter, with the country’s vast territory spanning multiple climate zones that enable diverse crop production. The integration of modern agricultural techniques with traditional farming knowledge has resulted in enhanced crop yields and improved quality standards that meet international market requirements.

Investment flows into Brazil’s agricultural infrastructure continue to strengthen the market foundation, supporting technological advancement and supply chain optimization. The sector’s contribution to national GDP remains substantial, while employment generation across rural communities underscores the social and economic importance of agricultural crop production in Brazil’s development strategy.

The Brazil agricultural crops market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and commercialization of various agricultural commodities cultivated within Brazilian territory. This market includes both food crops for domestic consumption and export-oriented commodities that serve global supply chains.

Agricultural crops in the Brazilian context span multiple categories including staple grains, oilseeds, fiber crops, fruits, vegetables, and specialty crops that cater to diverse market segments. The market structure incorporates smallholder farmers, medium-scale operations, and large agribusiness enterprises that collectively contribute to the nation’s agricultural output and economic performance.

Market participants range from individual farmers and cooperatives to multinational corporations involved in seed production, agricultural inputs, processing, and distribution activities. The interconnected nature of this market creates value chains that extend from farm-level production to end-consumer delivery, encompassing various stakeholders including financial institutions, technology providers, and logistics companies.

Brazil’s agricultural crops market demonstrates exceptional growth potential driven by increasing global food demand, technological innovation, and sustainable farming practices. The market benefits from Brazil’s position as a major agricultural exporter, with export revenues contributing significantly to the national trade balance and foreign exchange earnings.

Key performance indicators reveal strong market fundamentals, with crop productivity improvements averaging 4.1% annually across major commodities. The adoption of digital agriculture technologies and precision farming techniques continues to enhance operational efficiency while reducing environmental impact through optimized resource utilization.

Market diversification strategies have expanded beyond traditional crops to include specialty products and value-added agricultural commodities that command premium pricing in international markets. This diversification approach strengthens market resilience and creates new revenue opportunities for agricultural producers across different scales of operation.

Investment attraction remains robust, with both domestic and international capital flowing into agricultural infrastructure, research and development, and supply chain enhancement projects. The market’s growth trajectory is supported by favorable government policies, infrastructure development initiatives, and increasing private sector participation in agricultural innovation.

Strategic insights into Brazil’s agricultural crops market reveal several critical factors that shape market dynamics and future growth prospects:

Primary drivers propelling Brazil’s agricultural crops market growth encompass both domestic and international factors that create favorable conditions for sector expansion and development.

Global food demand continues to increase driven by population growth, rising incomes, and changing dietary preferences in emerging markets. This demand growth creates substantial opportunities for Brazilian agricultural exports, particularly in protein-rich crops and specialty commodities that align with evolving consumer preferences.

Technological advancement in agricultural production methods enables farmers to achieve higher yields while optimizing resource utilization. The integration of digital technologies, biotechnology, and precision agriculture tools supports productivity improvements that enhance market competitiveness and profitability across different crop categories.

Infrastructure development initiatives including transportation networks, storage facilities, and processing capabilities strengthen the agricultural value chain and reduce operational costs. These infrastructure investments improve market access for rural producers and enhance the overall efficiency of agricultural commodity flows from production areas to consumption centers.

Government support through agricultural policies, research funding, and rural development programs creates an enabling environment for sector growth. Policy initiatives focused on agricultural innovation, export promotion, and farmer support contribute to market expansion and competitiveness enhancement.

Climate advantages inherent to Brazil’s geographic location provide favorable growing conditions for diverse crop varieties throughout the year. The availability of multiple growing seasons and diverse agro-ecological zones enables crop diversification and production optimization strategies that maximize land utilization and market opportunities.

Market constraints affecting Brazil’s agricultural crops sector include various challenges that require strategic attention and mitigation measures to ensure sustained growth and development.

Environmental concerns related to deforestation, water usage, and biodiversity conservation create regulatory pressures and market access challenges for agricultural producers. International buyers increasingly demand sustainability certifications and environmental compliance, which may require additional investments and operational modifications.

Infrastructure limitations in certain regions, particularly regarding transportation and storage facilities, constrain market access and increase post-harvest losses. These infrastructure gaps affect supply chain efficiency and limit the ability of farmers to capitalize on market opportunities, particularly in remote agricultural areas.

Climate variability and extreme weather events pose production risks that can significantly impact crop yields and quality. Drought conditions, excessive rainfall, and temperature fluctuations create production uncertainties that affect market stability and farmer income security.

Input cost volatility including fertilizers, seeds, and agricultural chemicals affects production economics and farmer profitability. Price fluctuations in essential agricultural inputs can impact production decisions and overall market competitiveness, particularly for smallholder farmers with limited financial resources.

Trade policy uncertainties and international market access restrictions can affect export opportunities and market stability. Changes in trade agreements, tariff structures, and phytosanitary requirements create market uncertainties that influence investment decisions and long-term planning strategies.

Emerging opportunities within Brazil’s agricultural crops market present significant potential for growth, innovation, and value creation across various market segments and stakeholder categories.

Organic agriculture represents a rapidly expanding market segment with demand growth exceeding 12% annually in key export markets. The development of organic production systems and certification processes creates premium pricing opportunities for agricultural producers willing to adopt sustainable farming practices.

Precision agriculture technologies offer substantial opportunities for productivity improvement and cost reduction through optimized input application and enhanced crop monitoring capabilities. The adoption of smart farming solutions enables data-driven decision making that improves operational efficiency and environmental performance.

Value-added processing opportunities allow agricultural producers to capture higher margins through product differentiation and market positioning strategies. Development of processing capabilities for specialty crops and niche market products creates new revenue streams and reduces dependence on commodity price fluctuations.

Export market diversification presents opportunities to reduce market concentration risks and access new consumer segments with different product preferences and quality requirements. Developing relationships with emerging markets and specialty product segments can enhance market stability and growth potential.

Sustainable agriculture practices and carbon credit opportunities create additional revenue streams while addressing environmental concerns. Implementation of regenerative farming practices and participation in carbon offset programs provide financial incentives for environmental stewardship activities.

Market dynamics within Brazil’s agricultural crops sector reflect complex interactions between supply and demand factors, technological developments, and policy influences that shape market behavior and growth patterns.

Supply-side dynamics are influenced by land availability, technological adoption rates, and production efficiency improvements that determine overall market capacity and competitiveness. The expansion of cultivated areas and yield improvements contribute to supply growth, while production costs and input availability affect supply economics.

Demand-side factors include domestic consumption patterns, export market requirements, and industrial demand for agricultural commodities as raw materials. Growing biofuel demand and food processing industry expansion create additional market outlets that support price stability and growth opportunities.

Price dynamics reflect global commodity market trends, currency fluctuations, and local supply-demand balances that influence farmer income and investment decisions. Market volatility management through risk mitigation strategies and price stabilization mechanisms supports market stability and planning certainty.

Competitive dynamics involve both domestic competition among producers and international competition in export markets. Quality differentiation, cost competitiveness, and market positioning strategies determine competitive advantages and market share distribution among different market participants.

According to MarkWide Research analysis, market dynamics indicate increasing integration between traditional agriculture and digital technologies, with technology adoption rates reaching approximately 28% annually among medium and large-scale agricultural operations.

Research methodology employed in analyzing Brazil’s agricultural crops market incorporates comprehensive data collection and analysis techniques that ensure accurate market assessment and reliable insights for stakeholders and decision-makers.

Primary research activities include structured interviews with agricultural producers, agribusiness executives, government officials, and industry experts to gather firsthand insights into market conditions, challenges, and opportunities. Field surveys and farm-level assessments provide detailed information about production practices, technology adoption, and market participation patterns.

Secondary research encompasses analysis of government statistics, industry reports, academic publications, and international trade data to establish market baselines and identify trends. Data triangulation methods ensure information accuracy and reliability through cross-verification of multiple data sources and analytical approaches.

Quantitative analysis techniques include statistical modeling, trend analysis, and forecasting methods that project market developments and identify key performance indicators. Market segmentation analysis provides detailed insights into different crop categories, regional variations, and stakeholder group characteristics.

Qualitative assessment methods incorporate expert opinions, stakeholder perspectives, and market observation techniques that provide contextual understanding of market dynamics and strategic implications. Scenario analysis and sensitivity testing evaluate potential market outcomes under different conditions and assumptions.

Regional analysis of Brazil’s agricultural crops market reveals significant variations in production patterns, crop specialization, and market development across different geographic areas within the country.

Center-West Region dominates agricultural production with approximately 47% market share in major commodity crops, particularly soybeans and corn. This region benefits from favorable climate conditions, advanced farming technologies, and well-developed agricultural infrastructure that supports large-scale commercial farming operations.

South Region contributes significantly to agricultural diversity with strong production in soybeans, corn, wheat, and specialty crops. The region’s cooperative system and technology adoption rates create competitive advantages in productivity and market access, while family farming operations contribute to agricultural employment and rural development.

Northeast Region specializes in tropical and semi-arid crops including fruits, cotton, and irrigated agriculture that serves both domestic and export markets. Irrigation development and drought-resistant crop varieties support agricultural expansion in areas previously considered unsuitable for intensive farming.

Southeast Region combines traditional agricultural areas with proximity to major consumption centers and processing facilities. The region’s agricultural diversity includes sugarcane, coffee, citrus, and vegetables that serve both domestic markets and export opportunities.

North Region represents emerging agricultural frontiers with expanding production areas and increasing investment in agricultural infrastructure. Sustainable development initiatives and environmental compliance requirements shape agricultural expansion patterns in this region.

Competitive landscape within Brazil’s agricultural crops market encompasses diverse participants ranging from smallholder farmers to multinational agribusiness corporations that collectively shape market dynamics and development patterns.

Market concentration varies by crop category and regional market, with some segments dominated by large agribusiness companies while others maintain significant participation from medium-scale producers and cooperative organizations. Vertical integration strategies and supply chain control create competitive advantages for major market participants.

Market segmentation of Brazil’s agricultural crops market provides detailed analysis of different product categories, production systems, and market channels that serve diverse consumer needs and commercial applications.

By Crop Type:

By Production System:

Category-wise analysis reveals distinct market characteristics, growth patterns, and strategic considerations for different agricultural crop segments within Brazil’s diverse agricultural landscape.

Grain Crops Category: Soybeans and corn represent the largest market segments with export orientation and strong global demand fundamentals. These crops benefit from established supply chains, processing infrastructure, and international market relationships that support stable growth and investment attraction.

Specialty Crops Category: Coffee, fruits, and vegetables command premium pricing and offer value differentiation opportunities through quality enhancement and market positioning strategies. These crops require specialized production knowledge and marketing approaches that create barriers to entry and competitive advantages.

Industrial Crops Category: Sugarcane and cotton serve specific industrial applications with integrated processing requirements and established value chains. These crops benefit from domestic processing capacity and export market development that supports sector growth and employment generation.

Food Security Crops: Rice, beans, and other staple crops primarily serve domestic consumption needs with government policy support and price stabilization mechanisms. These crops contribute to food security objectives while providing income opportunities for smallholder farmers.

Emerging Categories: Organic crops, specialty grains, and functional foods represent growing market segments with premium pricing potential and consumer demand growth. These categories require specialized production systems and certification processes that create market differentiation opportunities.

Industry participants and stakeholders in Brazil’s agricultural crops market realize substantial benefits through participation in this dynamic and growing sector that offers multiple value creation opportunities.

For Agricultural Producers:

For Agribusiness Companies:

For Government and Society:

SWOT Analysis of Brazil’s agricultural crops market provides comprehensive assessment of internal strengths and weaknesses alongside external opportunities and threats that influence market development and strategic planning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Brazil’s agricultural crops sector reflect evolving consumer preferences, technological advancements, and sustainability requirements that influence production practices and market strategies.

Digital Agriculture Adoption: Integration of precision farming technologies, satellite monitoring, and data analytics is transforming agricultural production methods and decision-making processes. Farmers increasingly utilize digital tools for crop monitoring, input optimization, and yield prediction that enhance operational efficiency and environmental performance.

Sustainability Focus: Growing emphasis on sustainable farming practices and environmental stewardship drives adoption of regenerative agriculture, carbon sequestration, and biodiversity conservation measures. Market demand for sustainably produced agricultural commodities creates premium pricing opportunities and competitive advantages.

Value Chain Integration: Vertical integration strategies and supply chain optimization initiatives strengthen market positioning and improve profitability through enhanced control over production, processing, and distribution activities. Strategic partnerships and collaborative arrangements create synergies and risk-sharing opportunities.

Export Market Diversification: Expansion into new international markets and product differentiation strategies reduce market concentration risks and capture premium pricing opportunities. Development of specialty products and niche market segments creates additional revenue streams and competitive advantages.

Climate Adaptation: Development of climate-resilient varieties and adaptive farming practices ensures production stability under changing environmental conditions. Investment in drought-resistant crops and water-efficient irrigation systems supports long-term sustainability and risk mitigation.

Industry developments within Brazil’s agricultural crops market reflect ongoing innovation, investment, and strategic initiatives that shape sector evolution and competitive dynamics.

Technology Partnerships: Collaboration between agricultural technology companies and research institutions accelerates innovation development and technology transfer to farming operations. These partnerships focus on developing solutions for productivity improvement, sustainability enhancement, and operational efficiency optimization.

Infrastructure Investments: Major infrastructure development projects including transportation networks, storage facilities, and processing plants strengthen agricultural value chains and reduce operational costs. Government and private sector investments in rural infrastructure support market access and competitiveness improvement.

Sustainability Initiatives: Implementation of sustainable agriculture programs and certification systems addresses environmental concerns and market access requirements. Industry-wide initiatives focus on reducing environmental impact while maintaining productivity and profitability standards.

Market Access Expansion: Development of new trade relationships and export market opportunities diversifies revenue sources and reduces market concentration risks. Trade promotion activities and quality certification programs support international market penetration and brand development.

Research and Development: Increased investment in agricultural research and variety development creates competitive advantages through improved crop genetics and production technologies. Public-private partnerships in research activities accelerate innovation and technology commercialization processes.

Strategic recommendations for stakeholders in Brazil’s agricultural crops market focus on leveraging opportunities while addressing challenges to ensure sustainable growth and competitive positioning.

For Agricultural Producers: Diversification strategies should emphasize crop rotation systems and specialty crop development that reduce market risks and capture premium pricing opportunities. Investment in precision agriculture technologies and sustainable farming practices enhances long-term competitiveness and environmental compliance.

For Agribusiness Companies: Vertical integration opportunities and supply chain optimization initiatives create competitive advantages through enhanced control over production and distribution processes. Strategic partnerships with technology providers and research institutions accelerate innovation adoption and market development.

For Government Policy: Infrastructure development priorities should focus on rural connectivity and storage capacity expansion that reduces post-harvest losses and improves market access for smallholder farmers. Policy support for research and development activities strengthens sector competitiveness and innovation capacity.

For Investors: Investment opportunities in agricultural technology, processing infrastructure, and sustainable agriculture initiatives offer attractive returns while supporting sector development. Focus on companies with strong sustainability credentials and technology integration capabilities provides long-term value creation potential.

MWR analysis suggests that stakeholders should prioritize sustainability integration and technology adoption strategies that align with evolving market requirements and consumer preferences while maintaining operational efficiency and profitability standards.

Future outlook for Brazil’s agricultural crops market indicates continued growth and development driven by global food demand, technological advancement, and sustainability requirements that create both opportunities and challenges for market participants.

Production Growth: Agricultural production is projected to expand through productivity improvements and sustainable intensification practices rather than extensive land use expansion. Technology adoption and improved farming practices are expected to drive yield increases of approximately 2.8% annually across major crop categories.

Market Diversification: Export market expansion and product differentiation strategies will reduce dependence on traditional commodity markets while capturing premium pricing opportunities in specialty and value-added product segments. Development of new market relationships and trade partnerships supports revenue diversification and risk mitigation.

Sustainability Integration: Environmental stewardship and climate adaptation measures will become increasingly important for market access and competitive positioning. Implementation of sustainable agriculture practices and carbon sequestration initiatives creates additional revenue opportunities while addressing environmental concerns.

Technology Transformation: Digital agriculture and precision farming technologies will continue transforming production methods and supply chain management practices. Integration of artificial intelligence, robotics, and biotechnology creates opportunities for significant productivity improvements and cost reductions.

Investment Attraction: Continued investment in agricultural infrastructure, research and development, and technology innovation supports sector modernization and competitiveness enhancement. Public-private partnerships and international investment flows strengthen market development and growth potential with investment growth projected at 6.2% annually over the forecast period.

Brazil’s agricultural crops market represents a dynamic and strategically important sector that combines natural advantages with technological innovation and market expertise to maintain global leadership in agricultural production and trade. The market’s diverse crop portfolio, advanced production systems, and strong export orientation create substantial opportunities for continued growth and development.

Market fundamentals remain robust, supported by favorable climate conditions, extensive arable land resources, and well-developed agricultural infrastructure that enables efficient production and distribution of diverse agricultural commodities. The sector’s contribution to economic growth, employment generation, and food security underscores its critical importance to Brazil’s national development strategy.

Strategic positioning for future success requires continued focus on sustainability integration, technology adoption, and market diversification that addresses evolving consumer preferences and regulatory requirements while maintaining competitive advantages in global markets. The emphasis on sustainable agriculture practices and environmental stewardship creates opportunities for premium market positioning and long-term value creation.

Investment opportunities across the agricultural value chain, from production technologies to processing infrastructure and market development initiatives, offer attractive returns while supporting sector modernization and growth. The integration of digital technologies and precision agriculture solutions enhances operational efficiency and environmental performance, creating competitive advantages for forward-thinking market participants.

The Brazil agricultural crops market is well-positioned to capitalize on global food demand growth, technological advancement opportunities, and sustainability requirements that shape the future of agricultural production and trade, ensuring continued leadership in the global agricultural economy.

What is Brazil Agricultural Crops?

Brazil Agricultural Crops refer to the various types of crops cultivated in Brazil, including soybeans, corn, sugarcane, and coffee. These crops play a significant role in the country’s economy and agricultural landscape.

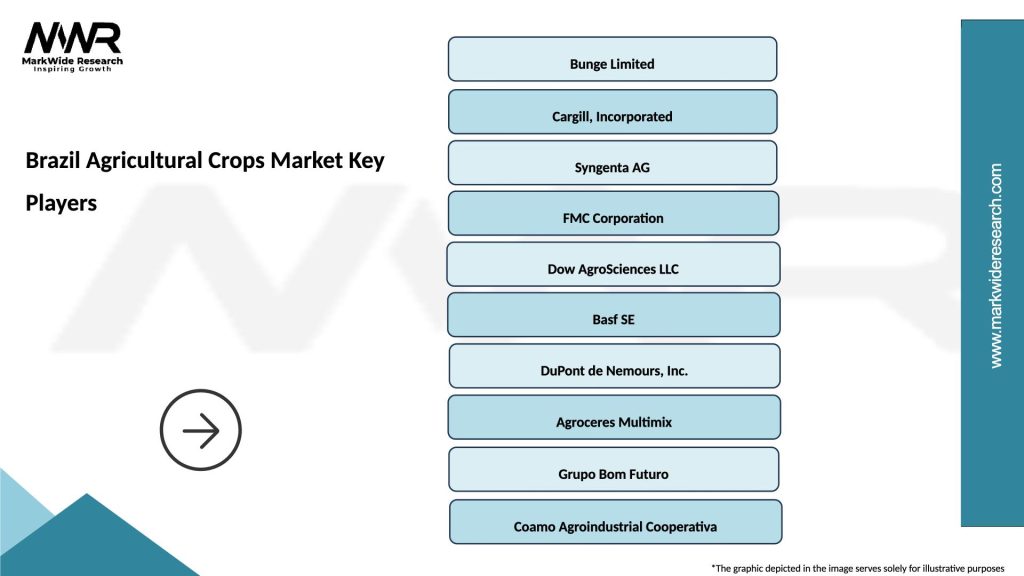

What are the key players in the Brazil Agricultural Crops Market?

Key players in the Brazil Agricultural Crops Market include companies like Bunge Limited, Cargill, and ADM. These companies are involved in various aspects of crop production, processing, and distribution, among others.

What are the growth factors driving the Brazil Agricultural Crops Market?

The Brazil Agricultural Crops Market is driven by factors such as increasing global demand for food, advancements in agricultural technology, and favorable climatic conditions for crop production. Additionally, the expansion of export markets contributes to growth.

What challenges does the Brazil Agricultural Crops Market face?

The Brazil Agricultural Crops Market faces challenges such as fluctuating commodity prices, environmental concerns, and regulatory hurdles. These factors can impact farmers’ profitability and sustainability practices.

What opportunities exist in the Brazil Agricultural Crops Market?

Opportunities in the Brazil Agricultural Crops Market include the potential for organic farming, the adoption of precision agriculture technologies, and the growing interest in sustainable practices. These trends can enhance productivity and market reach.

What trends are shaping the Brazil Agricultural Crops Market?

Trends in the Brazil Agricultural Crops Market include the increasing use of genetically modified organisms (GMOs), the rise of agroecological practices, and the integration of digital farming solutions. These innovations aim to improve crop yields and sustainability.

Brazil Agricultural Crops Market

| Segmentation Details | Description |

|---|---|

| Product Type | Soybeans, Corn, Sugarcane, Coffee |

| End Use | Food, Feed, Biofuel, Industrial |

| Trait | Genetically Modified, Organic, Conventional, Hybrid |

| Distribution Channel | Direct Sales, Wholesalers, Retailers, Exporters |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Brazil Agricultural Crops Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at